10 Best Billing Software Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

There are so many different billing tools on the market that choosing the best one for you can be tricky. You want to streamline the process of generating invoices, managing payments, and tracking financial transactions - and need the right tool for your team. I've got you covered! In this post, I leverage my personal experience with budgeting and billing-related activities with large teams to share my picks of the best billing software.

What is Billing Software?

Billing software refers to tools that handle the creation, management, and processing of invoices for goods or services provided by a business. Key features that make this possible include invoice creation, payment processing, recurring billing, expense tracking, and reporting – simplifying billing processes, reducing errors, and providing better control over financial transactions.

Overall, billing software automates billing tasks, improves accuracy, and enhances the overall efficiency of financial operations.

Overviews Of The 10 Best Billing Software

Here’s my assessment of each billing software that I chose to include on this list and what I think it does best.

Stax Bill is a powerful billing software designed to automate the complexities of subscription management and recurring billing for a wide range of businesses. By providing a comprehensive platform, it allows companies to enhance their billing processes, improve revenue collection, and enhance customer satisfaction.

Why I picked Stax Bill: The platform’s robust automated invoicing and subscription capabilities ensure that businesses can handle a high volume of recurring invoices efficiently, reducing manual errors and saving valuable time. Its ASC 606-compliant revenue recognition feature helps businesses adhere to financial reporting standards while its advanced dunning management system and credit card retry schedules help minimize the incidence of failed payments. Overall, this helps ensure a steady revenue flow.

Stax Bill Standout Features and Integrations:

Features include customizable invoicing, real-time analytics and reporting, multi-currency support, tax management, discount and promotion management, payment gateway integration, customer account hierarchy, self-service portals, usage-based billing, flexible pricing models, invoice templates, subscription lifecycle management, and detailed customer insights.

Integrations include QuickBooks, Xero, Salesforce, HubSpot, NetSuite, Intacct, Avalara, Authorize.net, Braintree, Stripe, and PayPal.

Pros and cons

Pros:

- Automates recurring invoicing and payments

- ASC 606-compliant revenue recognition

- Dunning management capabilities

Cons:

- No free version available

- May be expensive for small businesses

Stax Pay is an all-in-one platform that offers secure, multi-method payments for businesses. It simplifies payment processes and provides transparent pricing, making it a suitable choice for businesses looking for a secure and comprehensive payment solution.

Why I picked Stax Pay: Stax Pay's transparent pricing model aligns with the need for a straightforward and comprehensive payment processing solution. In judging its capabilities, what makes Stax Pay stand out is its ability to accept multiple payment types and the seamless integration of necessary tools within a single dashboard, which is critical for efficient business management.

Stax Pay Standout Features and Integrations:

Features include quick and easy payment acceptance, automated billing, and seamless surcharging with industry-leading compliance. Stax Pay offers subscription billing, surcharging programs, and additional resources such as insights, API documentation, and support knowledgebase.

Integrations include Slack, Zapier, Microsoft Office, Google Suite, and CRMs. Stax Pay also supports comprehensive mobile software development kits in Javascript and Python, and a language-agnostic RESTful API.

Pros and cons

Pros:

- In-depth reporting for financial management and strategic planning

- User-friendly interface

- Customizable invoices and receipts

Cons:

- Features sets can be limited

- Primarily U.S.-based

Online Check Writer is a simple and secure way for businesses to pay and get paid. The software supports ACH payments, direct deposits, checks, and debit and credit card payments as well.

Why I picked Online Check Writer: I like that it offers a free way to send and receive payments, with reasonable transaction fees.

Online Check Writer Standout Features and Integrations:

Features include a mobile app that allows you to accept payments and print checks.

In my opinion, Online Check Writer’s transaction fees are reasonable at 1% on their free plan, up to a maximum of $5, which is lower than other services like PayPal. This has all of the basic AP and AR features businesses need to send and receive payments.

Integrations include QuickBooks, Xero, Gusto, Zoho Payroll, BILL, and Zapier.

Pros and cons

Pros:

- Mobile app

- Easy to learn and use

- Accepts multiple payment methods

Cons:

- Minimum spend amount per month on paid plans

- Limited customizations

Chargebee is a popular billing software with a focus on subscription-based or recurring billing. I think it would probably be a good fit for fast-growing SaaS and eCommerce businesses.

Why I picked Chargebee: I feel like this software will make it easier for businesses to manage and collect subscription-based payments from their customers. It simplifies the process of onboarding customers, as well as upgrading, downgrading, or canceling subscription plans.

Chargebee Standout Features and Integrations:

Features include support for a wide range of billing models. I saw that Chargebee supports everything from one-time charges up to more complex subscription plans with tiered pricing.

Chargebee has tools to assist with invoicing and payment collection through a secure payment gateway. It also supports dunning management, meaning it will automatically retry in the event of a failed payment.

Integrations include Sage Intacct, QuickBooks, Xero, Netsuite, Salesforce, Hubspot, Microsoft Dynamics, Zoho CRM, Mailchimp, Slack, and dozens more, plus other 3rd party software integrations through Zapier.

Pros and cons

Pros:

- Developer-friendly APIs

- Lots of integrations

- Designed for subscription-based business models

Cons:

- Limited reporting and analytics

- Steep learning curve

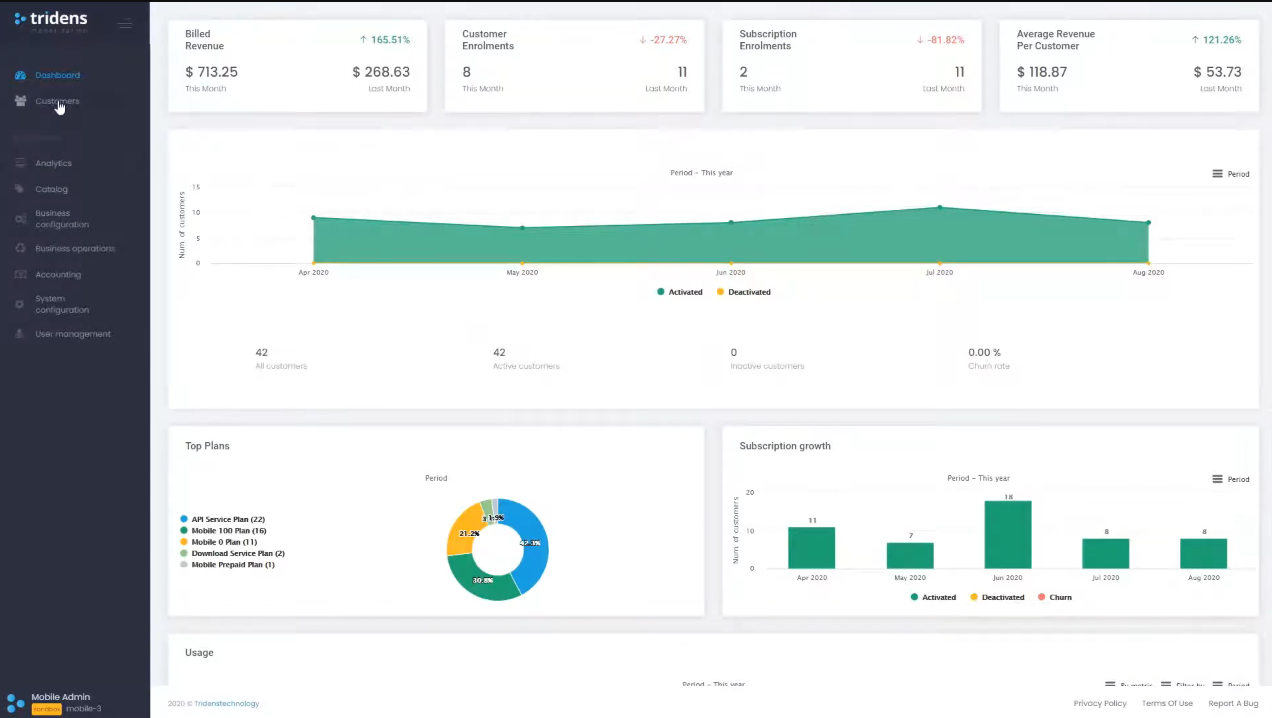

Most billing software is only designed to invoice customers for standard line items or one-time charges. Tridens Monetization is unique in that it also allows for usage-based billing.

Why I picked Tridens Monetization: Tridens looks to me like it’s been specifically designed for the telecommunications, energy, and utility industries. I think companies that need to bill customers for usage of electricity or natural gas will find Tridens can make their processes much more convenient. I can see it also being applicable to subscription-based services from media or SaaS companies.

Tridens Monetization Standout Features and Integrations:

Features include flexible pricing and monetization models. Triden’s ability here is what really stands out to me.

Triden’s customer web and mobile apps let your customers view their account balance and usage and pay their bills online. I was also impressed by the amount of analytics and reporting tools Tridens offers, including custom dashboards and customizable reports.

Integrations include Netsuite, SAP, Microsoft Dynamics, Salesforce, Stripe, Paypal, and SureTax.

Pros and cons

Pros:

- Intuitive interface and dashboards

- Customer mobile app and online portal

- Supports complex pricing and billing

Cons:

- Initial setup & implementation is complex

- Tridens takes 1% of billed revenue (on top of base fees)

BILL (formerly Bill.com) is a cloud-based software and billing platform. It can help you to digitize your accounts payable, accounts receivable, and other financial processes in your business and to make them run more efficiently.

Why I picked BILL: I like that BILL stores everything in the cloud and reduces paper-based processes. Plus, you don’t need to install software on specific machines or keep it updated. I would normally be concerned about security with cloud-based billing software. However, BILL keeps all payment processing in-house and uses bank-level encryption and secure data center facilities with more than one physical location for full redundancy.

BILL Standout Features and Integrations:

Features include support for multiple payment options, including ACH (automated clearing house), virtual cards, and online payment reminders.

I like that BILL provides flexibility for billing customers and accepting payments, even internationally. BILL also has approval workflows for managing bills and payments more efficiently. Plus, it leaves behind a clean audit trail of all transactions.

BILL’s real-time reporting on cash inflows and outflows help companies monitor their financial health. The forecasting tools seem like they'd be helpful for strategic planning, too.

Integrations include Netsuite, Sage, Xero, QuickBooks, SAP, Freshbooks, and Hubdoc.

Pros and cons

Pros:

- Supports 130+ countries and currencies

- Integrates with most accounting software

- Customizable invoices

Cons:

- Learning curve for new users

- Limited features for businesses with complex needs

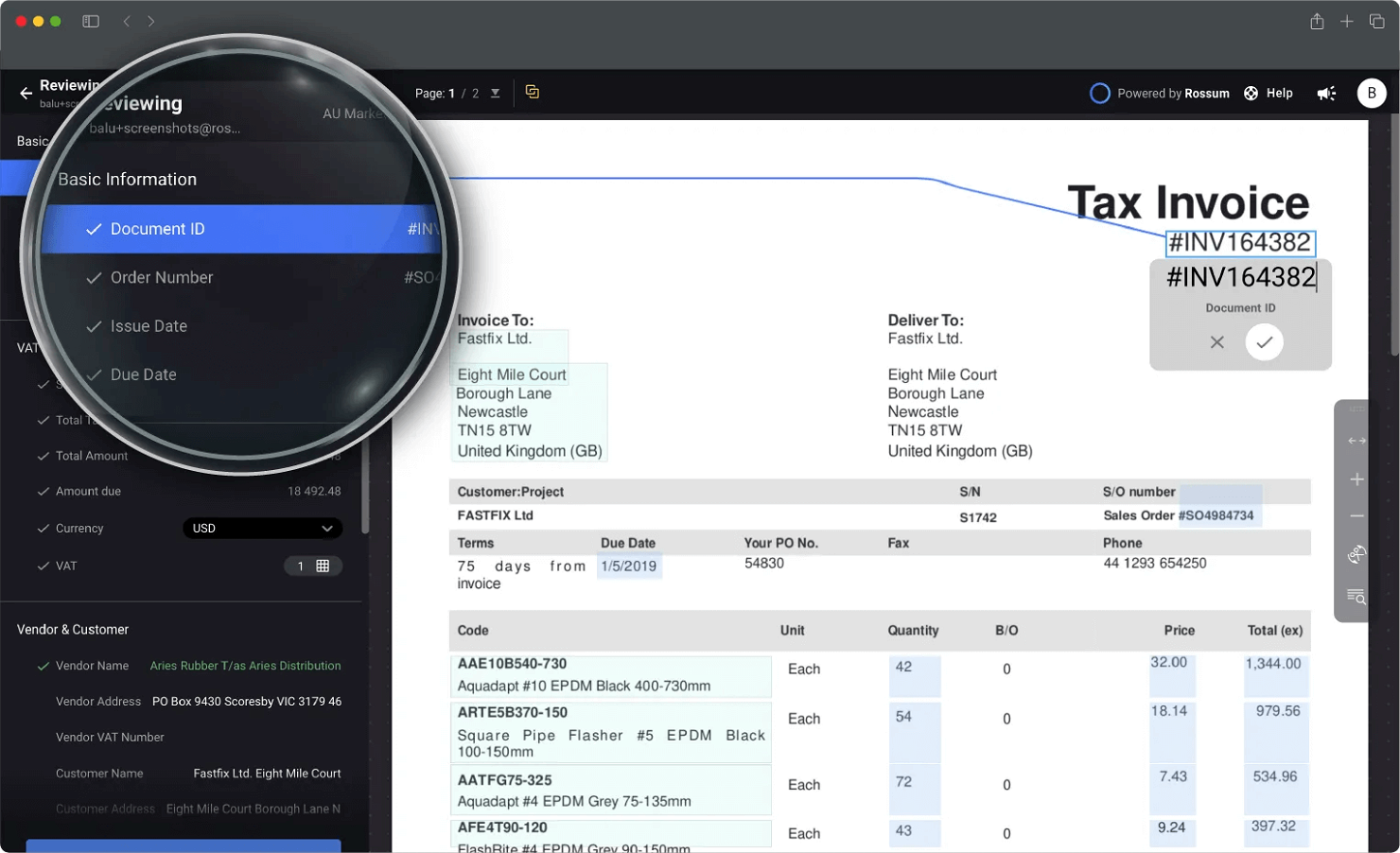

Rossum is an AI-powered document processing software. It helps businesses to extract data from documents like purchase orders, invoices, and receipts.

Why I picked Rossum: Rossum uses optical character recognition (OCR) to help quickly extract data from scanned documents. What I think sets Rossum apart is its machine-learning algorithms and AI technology. This means the software continually gets better, faster, and more accurate at processing documents over time as it gets to know the document formatting of your particular vendors and customers.

Although Rossum itself isn’t a billing software, it natively integrates with the most popular choices and pays for itself if you consider the time saved in the billing process.

Rossum Standout Features and Integrations:

Features include the ability to greatly reduce manual data capture. Rossum claims their software can save you 82% of the time on document validation. Rossum seems quite good at reading business documents like a human, and it adapts well to changes in document style, layout, and formatting.

Overall, I think it could help companies save a lot of time spent validating and entering billing data.

I also like how Rossum’s analytics and reporting features can help with troubleshooting.

Integrations include BILL, QuickBooks, Freshbooks, Xero, SAP, NetSuite, Zoho Books, Coupa, and Dropbox.

Pros and cons

Pros:

- Adaptable AI improves over time

- OCR data validation

- User-friendly interface

Cons:

- Visit WebsiteOpens new window

- Limited application scope (requires separate billing software)

- Pricing details aren’t transparent

Xledger is a cloud-based financial management system designed to provide businesses with a range of accounting and financial tools. It aims to automate a significant portion of accounting and financial tasks.

Why I picked Xledger: As a billing software, Xledger automates complex intercompany transactions, reducing administrative burdens and minimizing errors. Its support for multiple currencies and local financial regulations makes it ideal for global operations and managing multi-entity operations. Its centralized system also supports real-time analytics and reporting, enabling immediate visibility into the financial performance of each entity.

Xledger Standout Features and Integrations:

Features include project accounting to manage project costing, billing, and tracking of project financial performance. The software also offers budgeting and forecasting to aid financial planning and analysis.

Furthermore, Xleder's automated accounts payable and receivable manage the inflow and outflow of cash related to customer invoices and vendor bills to help improve overall workflow.

Integrations include GoldFinch, Salesforce, Microsoft Dynamics CRM, JPMorgan Chase Bank, Chase Credit Card, Harvest, Magento, and more.

Pros and cons

Pros:

- Provides workflow collaboration

- Includes multi-currency capabilities

- Offers real-time reporting

Cons:

- User interface can be more intuitive

- Limited customization options

Scoro is a business management software with a particular focus on service businesses.

Why I picked Scoro: Scoro can help service businesses stay organized and keep everything in one place. In addition to billing, it also has solutions for project management, customer relationship management, and financial reporting

Scoro Standout Features and Integrations:

Features include the ability to control your billing and expense lifecycle, from providing quotes to collecting payment on invoices. By having sales, delivery, and financial information in one platform, you can get a better idea of how a business is performing.

I think Scoro’s drag-and-drop planner and Kanban task board help plan and prioritize work and manage time more efficiently.

Integrations include Google Calendar and Google Drive, Microsoft Exchange, Dropbox, Jira, QuickBooks, Xero, Stripe, Hubspot, Asana, Expensify, Trello, and dozens of other applications.

Pros and cons

Pros:

- Data sharing between different teams

- Visually intuitive interface

- Integrates with many popular tools

Cons:

- Many features locked behind higher-level plans

- No single-user plan (Minimum five users)

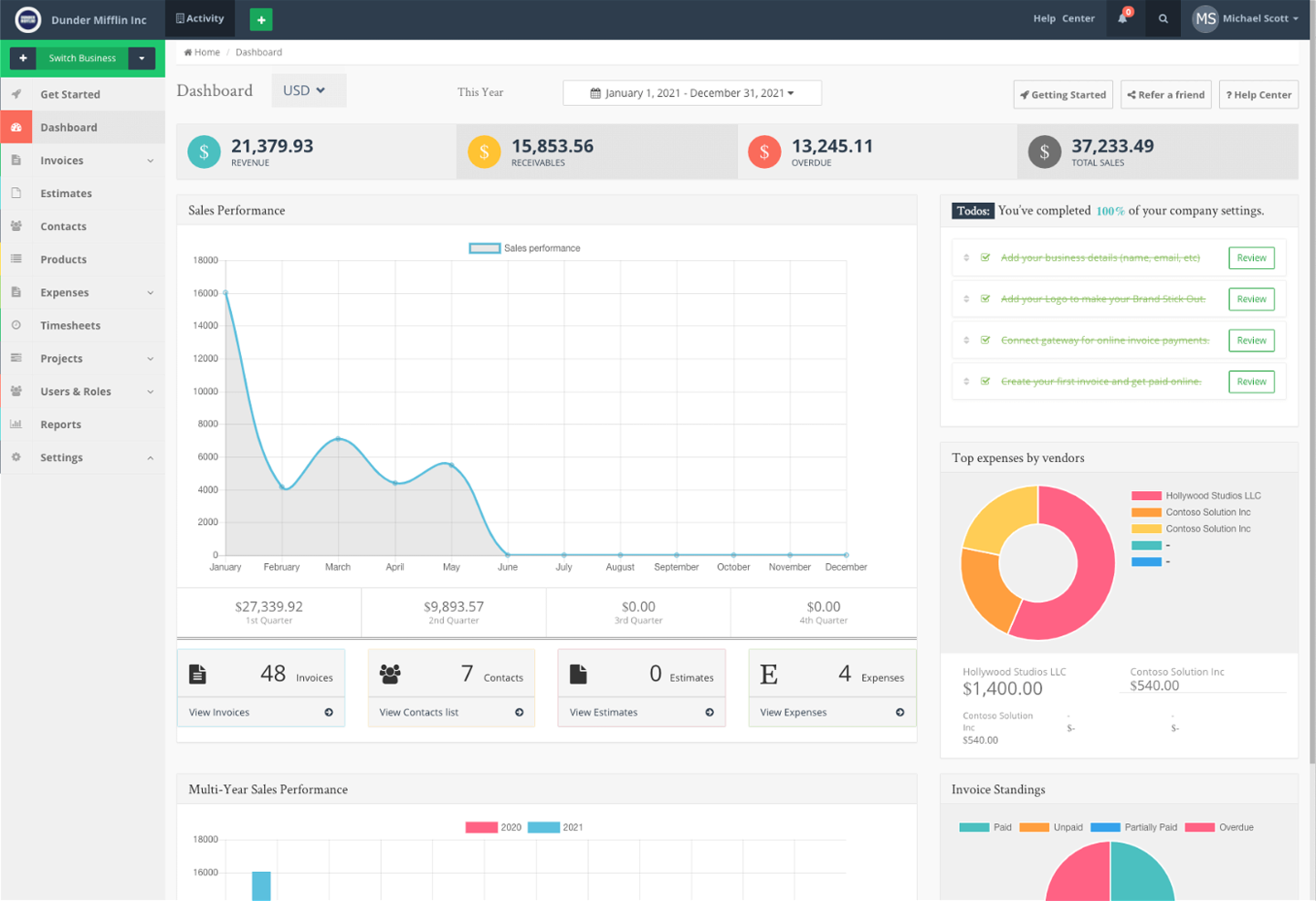

VatPay is a billing software that allows you to generate invoices in any language or currency. The company also has a strong focus on project management and time-tracking features.

Why I picked VatPay: I liked that VatPay supports multiple currencies. If your company’s doing business with clients and customers in other countries,

VatPay lets you specify the currency you wish to receive your payment in. Customers can pay directly from your invoice or through a client portal using VISA, Mastercard, AMEX, or Apple Pay.

VatPay Standout Features and Integrations:

Features include being compatible with mobile, tablet, or desktop. Its time-tracking and project management tools allow you to invite your employees, contractors, or even clients to collaborate on projects.

I like how your customer invoices, account statements, and credit memos can be customized with your business logo and theme.

VatPay can also generate insightful reports to help you understand where your money is coming from and where it’s going.

Integrations include Stripe, PayPal, Chase, Google Suite, Authorize.net, and Office 365.

Pros and cons

Pros:

- Mobile app

- Integrates with popular payment gateways

- Customized invoices

Cons:

- Not designed for large companies (100+ users)

- Expensive compared to similar options

| Tools | Price | |

|---|---|---|

| Stax Bill | From $199/month. | Website |

| Stax Pay | From $99/month | Website |

| Online Check Writer | From $49.99/month | Website |

| Chargebee | From $249/month | Website |

| Tridens Monetization | Pricing upon request | Website |

| BILL | From $45/user/month | Website |

| Rossum | Pricing upon request | Website |

| Xledger | Pricing upon request | Website |

| Scoro | From $30/user/month (billed annually) | Website |

| VatPay | From $249/month | Website |

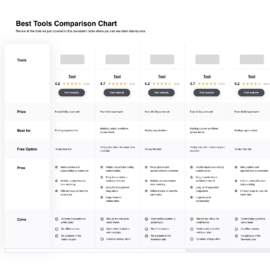

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

Here are some more billing tools that I shortlisted during my research. They didn’t make it into my top 10, but they’re still worth checking out.

Selection Criteria For Billing Software

Here’s a short summary of the main selection and evaluation criteria I used to develop my list of the best billing software for this article:

Core Functionality

It’s not worth calling it billing software if it can’t handle invoicing, billing automation, payment tracking, cash flow and customer management, and reporting and analytics.

Key Features

With those minimums handled, here are some features considered in picking out the best:

- Invoice templates: Allows you to create professional-looking invoices tailored to your business's branding and style with help from customizable templates.

- Automated invoicing: Enables you to set up recurring invoices for subscriptions, memberships, or regular services, automating those invoices at specified intervals.

- Payment gateway integration: Facilitates secure and convenient online payment processing, allowing customers to pay invoices easily via Paypal, Stripe, or other popular gateways.

- Customer portal: Provides customers with a dedicated platform to view and manage their invoices, payment history, and account details, enhancing transparency and self-service capabilities.

- Multi-currency support: Allows you to create invoices and process payments in different currencies, accommodating international customers and simplifying global transactions.

- Payment reminders: Reduces late or missed payments with automated payment reminders and notifications to customers.

- Financial reports: Provides insights into revenue, outstanding balances, payment history, and other financial metrics.

- Tax calculation and compliance: Incorporates tax calculation functions to apply appropriate taxes based on jurisdiction, ensuring compliance with tax regulations.

- Data security: Prioritizes data security by employing encryption protocols, secure server infrastructure, and compliance with industry standards to protect sensitive customer information.

- Mobile accessibility: Offers mobile applications or responsive web interfaces, enabling you to access and manage billing functions on the go through smartphones or tablets.

Usability

I prioritized billing software with modern and visually-intuitive interfaces and features, as well as easy-to-navigate menus. I understand every software will have a learning curve, but it shouldn’t take weeks before your staff is comfortable billing customers with new software.

Integrations

Billing software should integrate with accounting systems like QuickBooks, Xero, or NetSuite. If the software can’t take payments by itself, it should work with payment gateways like Stripe and PayPal. Billing software should allow for automatic synchronization of billing data, streamlining financial management, and reducing manual data entry.

People Also Ask

Here are some answers to common questions that I may not have covered above.

How much does billing software cost?

Billing software can range from free to hundreds of dollars per month. It will mostly depend on the size of your company and how many users you’ll have.

Basic accounting software to cover the needs of a small business will likely cost less than $20 per month.

On the other hand, an ERP for a large corporation may cost hundreds of dollars per month.

Is there any free billing software?

Yes. From my list above, Chargebee, GetCost, and Online Check Writer all have free plans available, although features in free plans are often limited.

Is there a difference between billing and accounts receivable software?

There is a lot of overlap, and I would consider billing software to be almost a subset of accounts receivable software. Billing software is specifically focused on sending invoices and getting paid. Accounts receivable software includes broader features to keep track of what you’re owed and to age accounts.

Conclusion

Ultimately, the billing software that’s right for you will depend on the specifics of your company. The industry you’re in and the size of your business will have a large impact on which option makes the most sense for you. But I hope after reading my analysis above, you have a good idea of which one likely makes the most sense for your context.

To get the latest tech news and insights from top financial leaders, be sure to sign up for our weekly newsletter.