10 Best Enterprise Risk Management Software Providers Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

There are so many different risk management solutions that selecting the best one can be tricky. You want to ensure your business can proactively address potential threats to its objectives, operations, and reputation - and need the right tool for your team. I've got you covered! In this post, I leverage my personal experience consulting CEOs of large companies and being exposed to many different enterprise platforms to review this curated list of the best enterprise risk management solutions.

What is Enterprise Risk Management Software?

Enterprise risk management solutions refer to integrated tools and processes that help organizations identify, assess, and manage risks effectively.

These solutions enable businesses to establish a risk-aware culture, align risk management with strategic goals, and enhance decision-making in the face of uncertainty.

The specific feature set of each ERM software might vary somewhat, depending on the tool’s scope and target audience. However, you can expect to see features such as risk assessment tools, risk identification and monitoring, incident tracking, compliance management, and reporting.

Overview Of The Best Enterprise Risk Management Software

Based on a combination of functionality, features, integrations, value, and usability, here’s what I think are the best ERM software tools of 2024.

Deel is a comprehensive global people platform that simplifies global HR and compliance management for companies looking to expand around the world with speed and ease.

Why I picked Deel: As an enterprise risk management solution, Deel is unique because it focuses on risk management in the context of global employment. It extends beyond worldwide payroll processing to include legal compliance and financial reporting across diverse regulatory environments.

Deel has a comprehensive compliance database that is updated in real-time to ensure companies remain consistent with local labor laws and tax regulations, proactively mitigating risks associated with global employment.

Deel Standout Features and Integrations:

Standout features include localized contract generation, with the help of experts, tailored to meet the specific legal requirements of each country.

Additionally, Deel's payroll management system reduces the financial risks associated with currency fluctuations and cross-border payments.

Integrations include Hibob, Netsuite, Okta, OneLogin, Quickbooks, Ashby, BambooHR, Expensify, Greenhouse, SCIM, Xero, Workday, and Workable. It also has an API for custom integrations.

Pros and cons

Pros:

- Simplifies the process of hiring employees in different countries

- Provides assistance with visas and other related services

- Compliance with local laws

Cons:

- Potential learning curve for new users

- No mobile app

Hyperproof is a compliance-focused risk management platform with support for firms aligning with multiple compliance frameworks. It encompasses security, risk, and compliance.

Why I picked Hyperproof: I selected Hyperproof because it has substantial automation features that can free up valuable time for teams.

Hyperproof Standout Features and Integrations:

Standout features include automated evidence collection and automated task management to help speed up workflows. It can also test control effectiveness by running automated risk impact assessments.

I also like that Hyperproof has 70+ framework templates to start from and that it helps firms align strategy with recognized frameworks including SOC 2, ISO, and NIST CSF.

Integrations include Slack, ZenDesk, Salesforce, Gusto, and GitHub.

Pros and cons

Pros:

- Collaboration features

- Very easy integrations

- Substantial automation for faster workflows

Cons:

- Lacking in third-party risk management features

Mitratech's Alyne is an integrated Governance, Risk, and Compliance (GRC) software solution that provides a comprehensive platform for enterprise risk management.

Why I picked Mitratech: The platform provides continuous risk monitoring and management capabilities, featuring a web-enabled and mobile-responsive design, dynamic dashboards and reports, scalable risk assessments, and ready-to-go templates. Mitratech aims to offer a comprehensive view of an organization's risk and compliance profile, enabling users to understand and assess risk, implement compliance requirements, and leverage analytics for informed decision-making.

Overall, Mitratech takes an agile approach to risk management with real-time risk assessments, third-party risk management, and policy management, helping organizations make quick decisions and pivot where needed.

Mitratech Standout Features and Integrations:

Standout features include no-code workflow automation and scalable risk assessments. Both these features allow users to build out workflows without technical expertise while still aligning with growing risk management operations.

The platform also offers thousands of ready-to-go templates mapped to regulations and controls, powerful enterprise integrations, and multi-language capabilities to support global operations.

Integrations include Black Kite, SecurityScorecard, DocuSign, Salesforce, and more.

Pros and cons

Pros:

- No-code workflow automations

- Mappings to relevant laws, regulations, and industry standards

- AI-enabled capabilities for GRC

Cons:

- Integration with other applications may require additional resources

- Learning curve for new users

ManageEngine Log360 is an SIEM solution designed to help organizations manage and mitigate security threats across on-premises, cloud, and hybrid environments.

Why I picked ManageEngine Log360: It integrates SIEM capabilities with advanced threat detection, machine learning-based anomaly detection, and compliance management, providing a thorough and proactive risk management framework. This integration ensures that organizations can effectively monitor and respond to potential risks, enhancing their overall security posture and compliance with industry regulations.

ManageEngine Log360 Standout Features and Integrations:

Standout features include its user and entity behavior analytics (UEBA), which detects unusual behavior patterns that might indicate potential risks. Another critical feature is its forensic analysis capabilities, enabling detailed investigation of security incidents to understand the root cause.

The software also includes incident management, which streamlines the process of tracking and resolving security incidents.

Integrations include Microsoft Active Directory, Office 365, Google Workspace, AWS, Azure, Salesforce, Box, ServiceNow, Jira, Slack, IBM QRadar, Splunk, SolarWinds, Palo Alto Networks, Fortinet, Cisco, and Sophos.

Pros and cons

Pros:

- Compliance with legal regulations

- Comes with numerous pre-configured reports

- Effective in managing and analyzing logs

Cons:

- Requires regular maintenance and updates

- Complex setup and configuration

Corporater offers an integrated business management platform for governance, performance, risk, and compliance (GPRC) solutions. It covers a wide range of risk management capabilities, including third-party risks, project and portfolio risks, IT risks, and operational risk management.

Why I picked Corporater: I chose Corporater for its holistic platform, which seamlessly integrates governance, risk, and compliance (GRC) with performance management. It allows organizations to create a digital twin of their operations, providing real-time insights and data-driven decision-making. The platform offers customizable dashboards, risk assessment and mitigation tools, compliance tracking, and performance analytics. This holistic approach ensures that all aspects of enterprise risk and performance are managed efficiently

Corporater Standout Features and Integrations:

Standout features include a process engine, data automation, data modeling, AI integration with GRC, performance data, forms and surveys for data collection and validation, and support for EU taxonomies for digital risk libraries.

Additionally, the reporting engine automatically combines data and insights into different reports. Risks can also be quantitatively assessed, and the software supports internal controls for compliance.

Integrations include but not limited to Excel, CSV, SQL, Web-Services, Amazon AWS, and Power BI.

Pros and cons

Pros:

- Comprehensive tools for risk assessment and mitigation

- Customizable dashboards

- Advanced analytics

Cons:

- Lack of automation capabilities

- May come with a learning curve

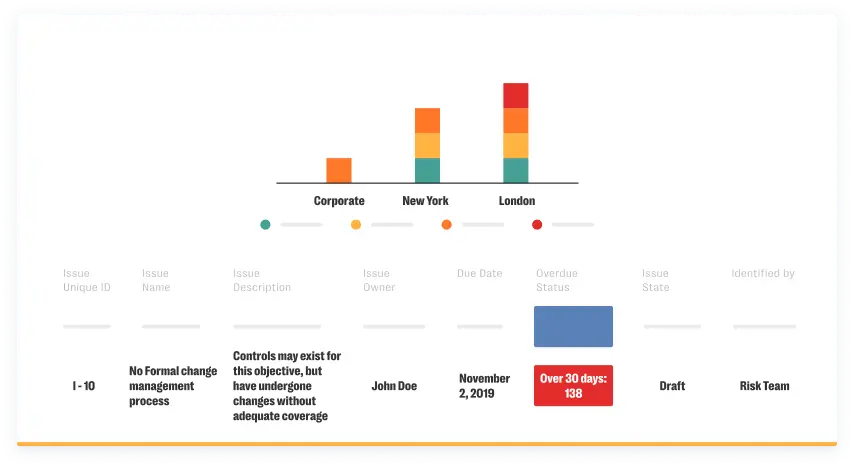

Resolver is an ERM tool with an equal focus on risk and controls. Its automated workflows help teams identify organizational risks more effectively.

Why I picked Resolver: I selected Resolver primarily because of its automated workflows for risk management (and auditing) teams. For instance, Resolver automatically transfers data in from different business systems (like your ERP), eliminating manual data entry work. The tool can also be configured to set up automated reminders for workflow due dates and overdue thresholds.

Overall, Resolver helps teams automate different stages of an organization’s risk identification, management, and mitigation processes.

Resolver Standout Features and Integrations:

Standout features include automated workflow management and comprehensive risk registers.

I like how both of these features combine to help teams collaborate and automate as much as possible — Resolver will be particularly helpful for large firms with separate risk management, compliance, and internal auditing teams.

Integrations include custom integrations via core API, Webhook, and Workato.

Pros and cons

Pros:

- Extensive risk mitigation features

- ISO 31000 and COSO ERM compliant

- Great collaboration and automation features

Cons:

- Integrations could be simpler

MetricStream is a GRC (governance, risk, and compliance) software company, and its Cyber GRC platform is an active cyber risk management platform designed to help automate and enhance cyber security, governance, risk, and compliance processes.

Cyber GRC is solely dedicated to helping firms strengthen and protect their digital infrastructure. For general risk management, MetricStream has a separate Business GRC product line.

Why I picked MetricStream Cyber GRC: While most ERM systems incorporate some level of cyber risk management, I selected Cyber GRC because it’s a 100% cyber/IT dedicated risk management platform.

MetricStream Standout Features and Integrations:

Standout features include IT and cyber risk management functionality, following the latest industry standards (NIST/ISO).

Given the focus on cybersecurity, I appreciate that MetricStream uses a closed-loop process of investigation, response strategy, and remediation to help organizations ensure compliance with changing regulatory environments.

I also really like MetricStream’s Cyber Risk Quantification, it lets you quantify your organization’s exposure to cyber risks into an exact dollar amount.

Integrations include security tools, vulnerability scanners, regulatory content providers, and more via MetricStream APIs.

Pros and cons

Pros:

- Flexible integrations via custom APIs

- Digital regulation and reporting compliance support

- Extensive cybersecurity and IT risk mitigation tools

Cons:

- Solely cyber-focused

Essential ERM modules can be used independently or in combination with Essential Strategic Planning for greater versatility.

Why I picked Essential ERM: I selected Essential ERM for companies that need a flexible ERM solution, as it accommodates multiple risk frameworks and allows you to decide which audit methodology to use.

Essential ERM Standout Features and Integrations:

Standout features include risk voting, which helps teams reduce groupthink and generate more accurate, crowdsourced risk ratings.

I also like that Essential ERM encourages collaboration and open discussion among team members. Admins can easily manage contributors and set permission limits, and team members can add labels for organizations and tag supervisors or co-workers. Every contribution is tracked in a real-time change log, which helps managers oversee workflows.

Integrations include custom integrations via APIs.

Pros and cons

Pros:

- Free 14-day trial

- Modular deployment for customizable feature sets (and costs)

- Affordable pricing for smaller teams

Cons:

- Limited feature set compared to my top picks

Oracle Risk Management and Compliance is a module of the Oracle Fusion Cloud ERP software suite. For firms already using this ERP — or looking for a new enterprise resource planning software — Oracle’s solutions are a good fit.

Why I picked Oracle Risk Management and Compliance: I selected Oracle Risk Management and Compliance because it’s fully integrated with Oracle’s cloud ERP solution, one of the most popular ERPs on the market. Many enterprise-level firms already use this ERP, and team members may already be familiar with the software. And it’s a useful module for large firms facing regulatory pressure, as it simplifies financial reporting via automated SOX compliance and audit workflows.

Oracle Standout Features and Integrations:

Standout features include user access control to Oracle ERP financial data to help firms monitor user activity and ensure regulatory compliance. The software also uses AI to continuously monitor user behavior, helping firms identify internal security and compliance risks.

I like that this module is built into Oracle’s ERP platform and that its automation features help to speed up financial reporting requirements.

Integrations include other Oracle software and various third-party SaaS tools.

Pros and cons

Pros:

- Data security and user access controls

- No additional cost for firms using Oracle Fusion Cloud ERP

- Easy to use (for existing Oracle ERP users)

Cons:

- Not usable without Oracle Cloud ERP access

- Limited feature set (primarily focused on user access controls and security)

Archer is an integrated risk management solution for large firms. The breadth and depth of the tool make it well-suited to multinational companies and those in heavily regulated industries.

Why I picked Archer: I selected Archer because it can be successfully deployed in large-scale firms facing complex risk management scenarios.

Archer Standout Features and Integrations:

Standout features include internal risk management and mitigation tools. The common risk language and rating scales help identify and address risks organization-wide.

Archer also integrates workflows and tools for third-party governance, ESG management, operational resilience, IT risk management, and regulatory/corporate compliance management.

I like how Archer can help you analyze the internal control environments of your third-party service providers to make sure your organization isn’t exposed to an unacceptable level of risk.

Integrations include data sourcing via direct data imports, data feeds, and Archer API.

Pros and cons

Pros:

- Customizable

- Vendor and third-party service provider risk assessments

- Includes ESG and IT security tools

Cons:

- Lacking in no-code integrations

| Tools | Price | |

|---|---|---|

| Deel | Flat rate user pricing, with a free version for businesses with up to 200 people | Website |

| Hyperproof | Pricing upon request | Website |

| Mitratech | Pricing upon request | Website |

| ManageEngine Log360 | Pricing upon request | Website |

| Corporater | Pricing upon request | Website |

| Resolver | Pricing upon request | Website |

| MetricStream | Pricing upon request | Website |

| Essential ERM | From $299 per month per user | Website |

| Oracle Risk Management and Compliance | Pricing upon request | Website |

| Archer | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther ERM Software Options

Didn’t find the right tool for your firm? These alternative enterprise risk management software providers might be worth considering:

Selection Criteria for Enterprise Risk Management Software

These are the primary selection criteria I used when narrowing down this list of the best ERM solutions on the market.

Core Functionality

At its core, ERM software should enable your organization to:

- identify potential risks to revenue, profitability, reputation, and market share

- determine mitigation strategies for those risks

- monitor compliance with internal policies and external rules and regulations

- facilitate SWOT analysis to identify strengths, weaknesses, opportunities, and threats to the organization

- ensure the company is interacting appropriately with customers

- mitigate security risks and fraud

- assist internal audit departments

Key Features

Beyond a software’s core functionality, these are some key features to look out for in enterprise risk management tools:

- Compliance management: Compliance management encompasses industry and security standards plus governmental, corporate, and regulatory policies. Software should help firms assess existing corporate systems, audit for compliance, and monitor systems over time to ensure ongoing compliance.

- Monitoring and oversight: ERM software should provide monitoring and oversight capabilities for both internal and external processes and standards. It should allow top-down oversight at a glance, as well as auditing drill-down into individual practices, policies, and teams.

- Financial reporting accuracy: ERM software should provide some insight into a firm’s financial reporting accuracy as it relates to regulatory and legal standards.

- Third-party risk management: Enterprise risk management software should help to monitor, assess, and mitigate third-party risk (risk associated with external vendors, contractors, and service providers). As much as possible, these tools should help firms align third-party policy and performance with the firm’s own internal policy and standards.

- Incident response: Software should aid teams in implementing incident response policy, as well as monitoring outcomes and analyzing long-term trends.

- Audit management: Tools should also allow managers to audit existing processes, policies, incident response performance, and other factors to improve upon existing processes (and produce reports for stakeholders).

- Policy management: A firm’s internal policies are the backbone of a good enterprise risk management strategy, and software can help draft, revise, publish, and monitor these policies.

- IT governance and security: Software should allow for accurate assessment, monitoring, and evaluation of IT security and vulnerabilities. Some firms may opt to use a dedicated IT security software or external service in addition to ERM software.

- External standards and compliance: Finally, software should help firms align internal policies and strategies with recognized international standards, including ISO 31000 and COSO ERM.

Usability

The best ERM software should be user-friendly enough for internal teams to utilize effectively without requiring external consultants. While many ERM tools do have relatively steep learning curves, many tools also offer online training and onboarding materials for new clients.

Along with user-friendliness, good ERM tools should allow for efficient report creation to share findings with non-technical staff, including managers and C-suite executives.

Integrations

ERM platforms should provide at least basic integration support with external sources of data. Enterprise risk management platforms don’t necessarily integrate directly with ERP systems and other common enterprise tools. However, most support custom integrations via API or other tools — and all should allow for the manual uploading of external data.

People Also Ask

Still have questions about ERP systems? Check out my answers to some frequently asked questions below.

What is the most used ERM framework?

There are two common ERM frameworks/standards that many firms follow. These are ISO 31000 and COSO ERM. Both of these frameworks attempt to standardize corporate risk management best practices across industries and geographies.

Firms may customize their own risk management approaches, but these frameworks are often used as a starting point.

What are the types of risks addressed by ERM software?

Theoretically, ERM software can help firms prepare for any potential risk to their business. That said, the most common risk management approaches focus on the following risk factors:

- Strategic risks, which are risks created by (or affected by) business strategy decisions.

- Hazard risks, which are risks that pose significant threat to life, property, or the environment.

- Financial risks, which are risks directly related to a company’s finances.

- Operational risks, which are risks caused by failed business processes or policies.

How do you set up enterprise risk management systems?

Enterprise risk management systems may be deployed on-premise or via cloud-based solutions. On-premise setups may offer more internal control over security infrastructure, but they are typically slower and often more costly to launch.

In any case, ERM systems should be set up with a firm’s standards, compliance requirements, and stated goals in mind.

How much does enterprise risk management software cost?

The majority of ERM systems are customizable based on a firm’s needs, and costs scale to the size of the company and the number of users/employees. With that said, most ERM software is costly — think several thousand dollars per month at a minimum.

Summary

ERM software can increase efficiencies in internal compliance, risk management, and auditing processes. But it’s important to choose a solution that is appropriate for your use case — and ideally, one that fits in well with your existing software stack. The options listed above are the best enterprise risk management solutions on the market today.

For more business insights and the latest tech industry news, sign up for The CFO Club newsletter for resources and advice from financial leaders.