10 Best ERP Accounting Software Providers Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

There are so many different ERP solutions on the market that selecting the best one can be tricky. You want to have a centralized platform to manage accounting processes, including general ledger, accounts payable, accounts receivable, and financial reporting, but need the right tool for the job. In this guide, I’ll use my experience with ERP tools as a former consultant and break down the best ERP accounting software tools to help you find the right solution for your team.

What is ERP Accounting Software?

ERP accounting software is a specialized module within an ERP system that focuses on centralizing and automating accounting processes. It includes features like financial reporting and analysis, budgeting, fixed asset management, and compliance tools to help you have better compliance with regulatory requirements, and enhanced visibility into the financial health of the organization.

In this guide, I focus on the best ERP and ERP-adjacent accounting software tools that bridge the gap between basic accounting tools and dedicated ERP systems.

Overview Of The Best ERP Accounting Software For 2024

I’ve narrowed the search down to the best based on my own experiences and the selection criteria I’ll detail further down this page.

Acumatica is a comprehensive cloud-based ERP (Enterprise Resource Planning) platform designed to support the diverse needs of modern businesses, integrating financials, CRM, and eCommerce functionalities.

Why I picked Acumatica: As ERP accounting software, Acumatica excels in delivering a unified solution for financial management, offering real-time insights, automation of financial processes, and scalability to support business growth. Being a cloud-born software, it integrates really well with other tools and systems and has a UI that helps intuitively navigate its features.

Acumatica Standout Features and Integrations:

Standout Features include real-time financial analytics, offering instant access to financial data and metrics that are crucial for strategic decision-making. Additionally, its modern pay-as-you-go, consumption-based licensing helps you scale as your needs change. A key aspect of Acumatica's offering is its integrated warehouse management system, which is built to facilitate efficient inventory management and control.

Integrations include Salesforce, Magento, Microsoft Office 365, BigCommerce, Shopify, Amazon, WooCommerce, HubSpot, Jira, and Slack.

Pros and cons

Pros:

- Customizable to fit specific business needs and workflows

- Scalable to support growth without the need for additional software

- Comprehensive integration of accounting with other business processes

Cons:

- May require training to fully leverage its capabilities

- The initial setup and customization can be complex and time-consuming

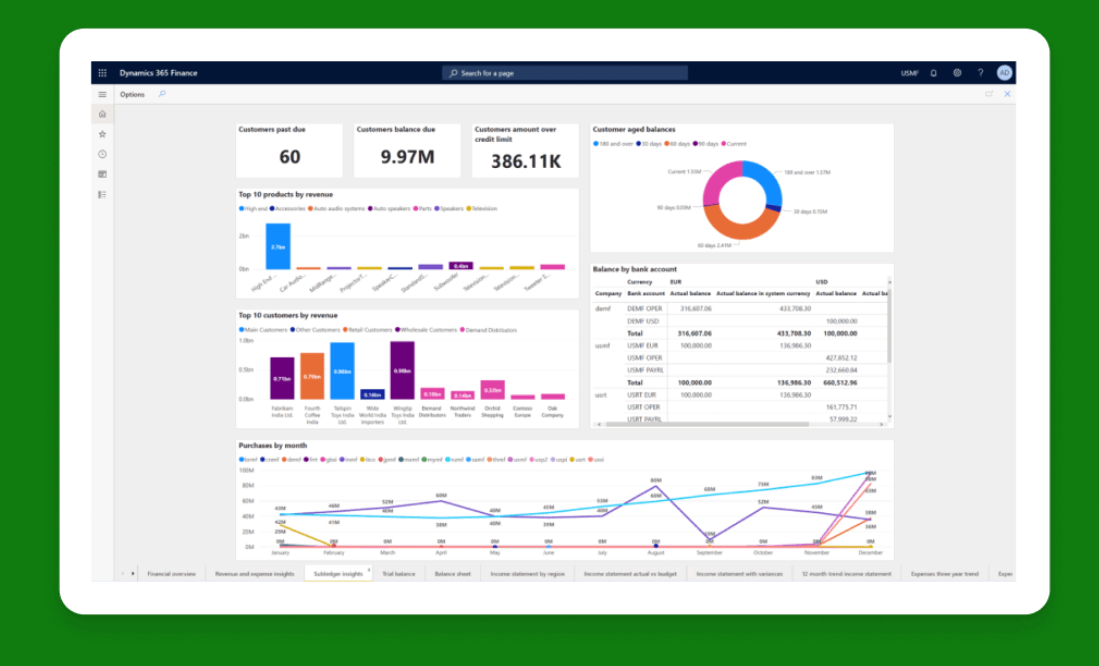

Microsoft Dynamics 365 Finance is part of a broader suite of software (Dynamics 365), but it’s available as a standalone product (you don’t have to bundle it with other 365 products). For this reason, it’s reasonably cost-effective — and the build-a-bundle options make it a pretty versatile choice for growing teams.

Why I picked Microsoft Dynamics 365 Finance: I selected Microsoft Dynamics 365 Finance for two main reasons. The first is its business intelligence insights, which enable accounting data to inform managerial decisions in real-time. The second is pure value: At $180 per month per user, it’s priced quite reasonably (particularly for small teams).

Microsoft Dynamics 365 Finance Standout Features and Integrations:

Standout features include AI-driven business intelligence (BI) insights. These features provide important insights into financial performance and operations and update in real-time as accounting data comes in.

I also appreciate the automation features if you spring for Dynamics 365 Finance. Touchless vendor invoicing frees up valuable time for AR teams, while rules-based collections automation improves cash.

Integrations include other tools in the Microsoft Dynamics 365 suite, as well as third-party applications including HubSpot and LinkedIn Sales Navigator.

Pros and cons

Pros:

- Can be used independently or bundled with other Dynamics 365 products

- Solid business intelligence features

- Transparent pricing with a low cost of entry

Cons:

- Steep learning curve

BlackLine is a dedicated accounting solution for mid-market and enterprise firms. It blends AR and AP automation with solid financial close management features.

Why I picked BlackLine: I selected BlackLine because it’s relatively simple to integrate with existing ERP systems. Like some others on this list, it’s NOT an ERP on its own — BlackLine is 100% accounting-focused. Think of it like an upgraded QuickBooks, with more advanced automation and intercompany financial management.

BlackLine Standout Features and Integrations:

Standout features include advanced financial close management and analytics, which help teams automate tedious workflows and focus on analysis rather than busy work. I also like BlackLine’s “continuous accounting” model. The software is designed to help teams spread out workflow consistently throughout the month and year (while automating significant portions).

Integrations include SAP, Oracle, Oracle NetSuite, and Microsoft Dynamics.

Pros and cons

Pros:

- Tax-effective intercompany accounting

- Integrates with most popular ERP systems

- Substantial automation features

Cons:

- Difficult onboarding for non-technical workers

- Not a dedicated ERP solution itself

SAP Business One is an enterprise resource planning software solution that’s targeted toward smaller firms. It’s relatively affordable compared to SAP’s full-featured ERP platform.

Why I picked SAP Business One: I selected SAP Business One because it’s accessible to small businesses — in terms of both affordability and user-friendliness.

SAP Business One Standout Features and Integrations:

Standout features include quick deployment, solid user-friendliness ratings, and an affordable price point. I like that all these factors make SAP Business One so accessible to startups and smaller companies, who may not be able to afford the high upfront investment for a more traditional ERP system.

Integrations include other SAP products.

Pros and cons

Pros:

- Dedicated ERP with accounting, financials, sales, CRM, and more

- Affordable price point

- Easy to use

Cons:

- Limited features compared to similar products

- Opaque pricing

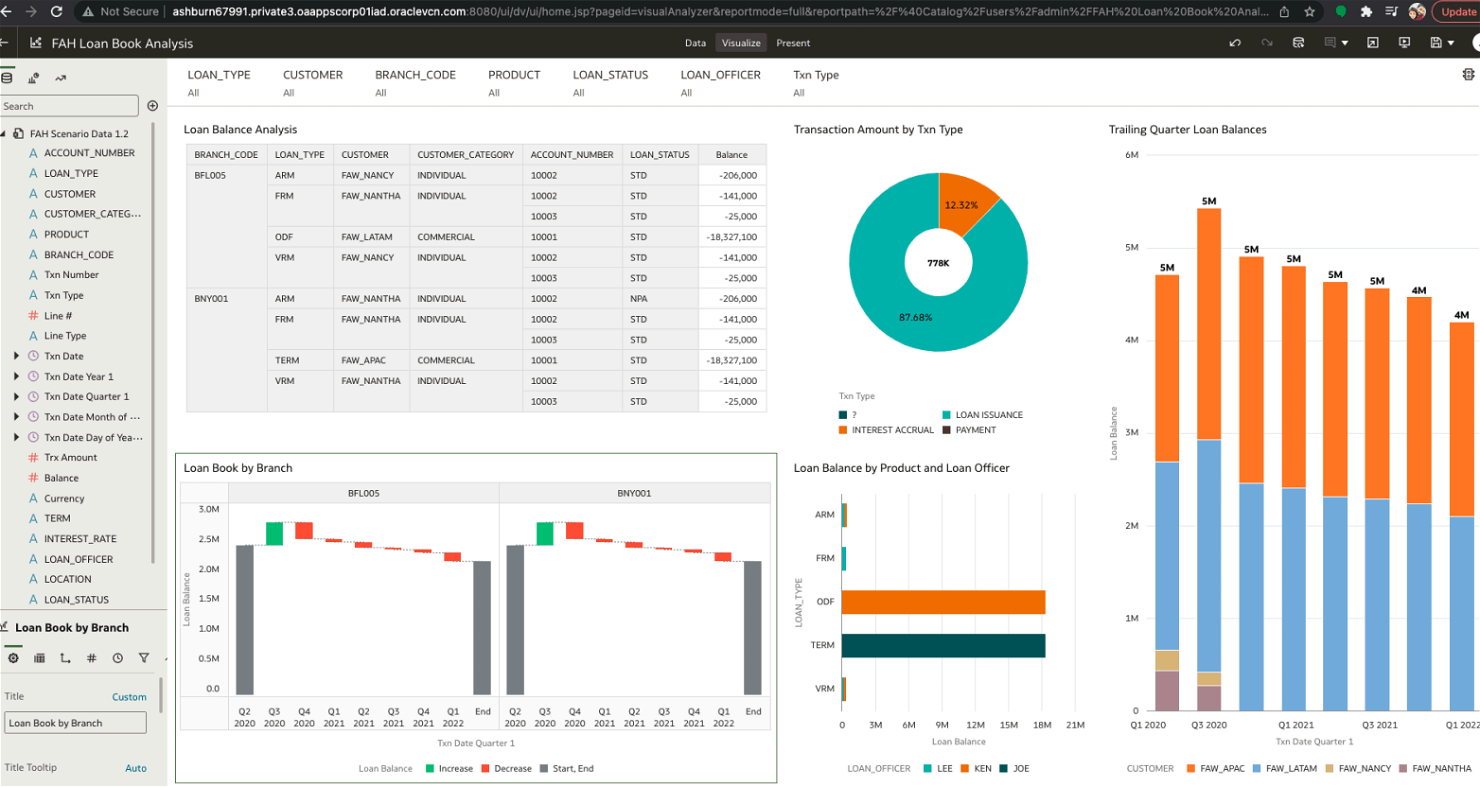

Oracle Enterprise Resource Planning (ERP) Cloud is a versatile ERP platform for mid-market and enterprise-level firms. It’s one of the more popular ERP systems on the market. As a fully cloud-based solution, it works well for global teams and remote-friendly workplaces.

Why I picked Oracle ERP Cloud: I selected Oracle ERP Cloud because it’s one of the most full-featured ERP systems on the market. And more specifically, for the purpose of this guide, it offers the Accounting Hub, a comprehensive accounting solution built into Oracle’s Financial Management ERP suite.

Oracle ERP Cloud Standout Features and Integrations:

Standout features include the Accounting Hub, Oracle’s in-built accounting solution. Accounting Hub serves as a centralized accounting engine and provides a continuous, touchless solution that draws in data from external sources — and keeps teams informed in real time.

I also really appreciate the versatility and sheer scope of Oracle ERP Cloud. Accounting Hub is merely one module within one application (Financial Management) within the entire ERP suite. Alongside this genuinely useful accounting platform, teams will find tools for project management, procurement, risk management, and supply chain management (among others).

Integrations include all Oracle Cloud products plus ADP Payroll, PeopleSoft, Zoom, and WorkForce Software.

Pros and cons

Pros:

- Cloud-based

- Advanced AI and machine learning capabilities

- Predictive analytics tools

Cons:

- Costly for smaller firms

- Steep learning curve

Infor Financials & Supply Management is a financial analytics and resource management platform for mid-sized and large firms.

Why I picked Infor Financials & Supply Management: I selected Infor Financials & Supply Management mostly because of its substantial procurement, inventory management, and supply chain management features.

Infor Financials & Supply Management Standout Features and Integrations:

Standout features include source-to-settle supply chain management features that help to identify cost-cutting measures by uncovering consolidation and cost-saving opportunities. I also like that Infor’s offering blends supply chain management functionality with a general ledger and robust accounting features (which often require two separate softwares).

Integrations include other Infor software tools.

Pros and cons

Pros:

- Industry-specific modules for manufacturing, distribution, and others

- Cloud-based

- Full-featured accounting and supply chain management

Cons:

- Not the most user-friendly interface

- Limited integrations

Sage 50cloud Accounting is a feature-rich accounting platform for small businesses. It’s not truly an ERP solution, but it does integrate well with other Sage products to build out a custom software suite that works for your company.

Why I picked Sage 50cloud Accounting: Again, I selected Sage 50cloud Accounting for two reasons. The first is its inventory management features, which are directly integrated with the accounting workflow and a must-have for firms selling physical goods. The second is its affordability.

Sage 50cloud Accounting Standout Features and Integrations:

Standout features include advanced inventory management for both retailers and manufacturers. Products are simple to enter, and Sage automatically creates journal entries whenever inventory moves. This cuts down on manual entries and the disconnect between inventory and accounting workflows.

I also really like the extensive selection of add-ons that can be used to customize the feature set of Sage 50cloud. Teams can add on payroll management, time tracking, automatic data entry, and others.

Integrations include Stripe, Credit Hound, Paya, VeriClock, and Zynk Workflow.

Pros and cons

Pros:

- Solid inventory management features

- Cost-effective for smaller companies

- Plenty of add-ons and expandable feature set options

Cons:

- Not a full-fledged ERP system

Multiview is a cloud ERP platform with a simple UI and a solid feature set. It’s best for mid-sized firms.

Why I picked Multiview: I selected Multiview because it has a good set of automation features to speed up routine accounting and business workflows.

Multiview Standout Features and Integrations:

Standout features include automated task and assignment routing to help speed up workflows (and tag the correct team members). I also like that Multiview includes time management and timesheet features (not all ERPs/accounting systems do).

Integrations include Avalara, Paylocity, MDI Solutions, and Cerner.

Pros and cons

Pros:

- Versatile feature set

- Relatively easy to use

- Automated accounting and managerial workflows

Cons:

- Simplistic UI

- Lacking in integrations

Xledger is a cloud-based ERP platform with features tailored for managing financials, HR, and project accounting. It consolidates multiple business functions into a unified system, enhancing the efficiency of processes and data flow throughout an organization. This software is designed to deliver instant insights, automate key business operations, and boost the decision-making skills of companies of diverse scales and sectors.

Why I picked Xledger: Xledger is ideal for multi-entity organizations with its ability to consolidate financial management across various business units. This real-time consolidation allows for the immediate generation of accurate financial reports without manual effort. Such streamlined processing is essential for timely and informed decision-making at the executive level.

Xledger Standout Features and Integrations:

The software excels in handling complex intercompany transactions and multi-currency operations, crucial for organizations operating internationally. Xledger automates these processes, ensuring consistency and compliance with accounting standards while reducing administrative burdens.

I also like that Xledger's cloud-based architecture offers the scalability required to adapt to growth and changes in structure without significant IT infrastructure investments. It features sophisticated access control and security measures, ensuring that sensitive financial data is accessible only to authorized personnel.

Integrations include Magento, Salesforce, JPMorgan Chase Bank, Microsoft Dynamics CRM, Harvest, Chase Credit Card, GoldFinch, and more.

Pros and cons

Pros:

- Automated day-to-day tasks

- Workflow collaboration

- Real-time reporting and business intelligence tools

Cons:

- Slight learning curve for new users

- Limited customization options for specific business needs

Accounting Seed is a cloud-based accounting solution that’s built on Salesforce. It provides general ledger and accounting workflows along with a 360-degree view of business performance with data automatically synchronized from Salesforce.

Why I picked Accounting Seed: I selected Accounting Seed because it’s specifically designed for Salesforce users.

Accounting Seed Standout Features and Integrations:

Standout features include a fully Salesforce native design. This means that firms can run their entire business from one platform and eliminate information silos. I also like that Accounting Seed supports multi-entity and multi-currency bookkeeping.

Integrations include Salesforce, Stripe, Plaid, and Yodlee.

Pros and cons

Pros:

- Good collaboration features

- Easy to use

- Salesforce native

Cons:

- Not a good fit for non-Salesforce users

- Not a full-fledged ERP system

| Tools | Price | |

|---|---|---|

| Acumatica | Pricing upon request | Website |

| Microsoft Dynamics 365 | From $70/user/month | Website |

| BlackLine | Pricing Upon Request | Website |

| SAP Business One | Pricing upon request | Website |

| Oracle ERP | Pricing upon request | Website |

| Infor | Pricing upon request | Website |

| Sage 50cloud | From $57.17/month for one-user plan, billed annually | Website |

| Multiview ERP | Pricing upon request | Website |

| Xledger | Pricing upon request | Website |

| Accounting Seed | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther ERP Accounting Options

Didn’t find the right fit for your firm? These alternative ERP accounting solutions might be worth considering:

Selection Criteria for ERP Accounting Software

These are the primary criteria I looked at when narrowing down this list of the best ERP accounting solutions.

Core Functionality

At its core, ERP accounting software should enable your firm to:

- Conduct routine financial management: ERP accounting tools should help firms manage cash flow, track fixed assets, automate bank reconciliations, customize financial reports, and conduct all daily, quarterly, and annual financial management tasks.

- Manage customer relationships and sales: ERP systems should also offer sales/marketing and customer relationship management features. Having sales data connected to ERP and accounting workflows can improve efficiency and accuracy, plus provide valuable data for projections and resource planning.

- View analytics and business intelligence: ERP accounting tools should also offer data analytics and business intelligence (BI) to help firms gain greater insights into the inner workings of their business.

And if you have physical inventory, two more must-haves:

- Manage purchasing and inventory: ERP systems should help firms manage physical inventory, handle purchasing and procurement workflows, and connect data to accounting and sales systems for greater visibility and resource management.

- Manage supply chains: ERP systems should also include functionality for at least the basics of supply chain management (SCM), although many firms will pair ERP systems with an external SCM tool.

Key Features

Key nice-to-haves in an ERP accounting solution include:

- Automation for bookkeeping and accounting processes: ERP accounting platforms should be able to automate certain bookkeeping, accounting, and AR/AP tasks. Automation doesn’t just save time — it can also reduce the risk of manual errors, plus provide real-time data to influence projections and BI dashboards to enable more nimble executive decision-making.

- Monitor budgets and forecasts: Beyond the basics of accounting, ERP accounting tools should help teams to build budgets, modify them to align with real-life data, and forecast sales, revenue, and expenses to create a more accurate picture of expected resource expenditures.

- Report customization and automation: ERP systems should be able to create detailed financial reports for internal teams and stakeholders alike. That said, tools that offer greater customization and automation features within reporting stand out as more useful. I also appreciate when tools include templating options as a starting point for report building.

- Financial management and planning: ERP systems should allow for efficient bi-directional comms and planning between accounting, finance, and executive teams. Real-world (and real-time) data should sync and update with projections, resource planning, and forecasting workflows for greater accuracy.

- Inventory and accounting integration: The value of an ERP system is that it provides a centralized source of truth across a firm’s entire operation, with everything syncing in real-time. For accounting teams, one of the most important integrations to consider is inventory and supply chain tools and how they interact with accounting workflows. This two-way connection helps teams align resources and plan ahead for seasonal shifts, promotions, and other variables that can influence supply and demand trends.

Usability

Legacy ERP systems are notorious for having steep learning curves, but modern cloud-based solutions are becoming more and more user-friendly. While functionality tops usability in the long run, software solutions should ideally be user-friendly enough for entire teams to use, not just for specialists or consultants.

On that note, keep in mind that the setup of these systems sometimes does require outside help in the form of onboarding teams (provided by the ERP vendor, sometimes for an additional fee) or external consultants (paid separately).

Integrations

Integrations can improve efficiency and accuracy by sharing data bidirectionally between diverse tools. A fully-featured ERP will already automatically integrate accounting functionality with tools for BI, sales, human resource planning, and others — but you’ll also want to consider other third-party tools that you may want to integrate into your tech stack.

People Also Ask

Below you can find answers to some frequently asked questions about ERP software.

Is QuickBooks an ERP software?

No, QuickBooks is a standard accounting software that does not offer ERP (enterprise resource planning) features. Accounting is one of the many features of ERP softwares — so while QuickBooks offers those accounting capabilities, it does not offer any of the other components of ERP systems.

Fortunately, QuickBooks is popular enough that it integrates well with many common ERP systems.

What is the difference between ERP software and accounting software?

ERP software provides a unified platform for managing all business operations, including accounting, sales and marketing, customer relationship management, and several other aspects. On the other hand, accounting software focuses solely on accounting and finance tasks.

How much does ERP accounting software cost?

ERP software usually carries significant cost. At a minimum, you’re looking at a few thousand dollars per month — possibly significantly more, depending on the number of users and the type of deployment (on-premise, cloud, etc.) ERP implementation can also be costly, with some providers charging upfront licensing and setup fees.

With that said, half of the tools on this list are not full-blown ERP solutions. The more accounting-specific tools, like BlackLine and Sage 50cloud Accounting, may be lower-cost. I included a mix of software solutions — with a wide range of cost levels — to accommodate a range of business types.

Do accountants use ERP software?

Accountants can benefit from using ERP software. ERP systems centralize most or all of a business’s data, including financials. And most ERP systems have full-fledged accounting solutions built in.

With that said, many accountants opt to use accounting-specific software, like QuickBooks or BlackLine. These tools are not full ERP systems, but they typically integrate well with ERPs from other vendors.

Summary

ERP accounting software handles more functions than traditional accounting solutions and can help growing firms centralize operations and improve efficiencies. But it’s vital to choose the right ERP system for your company — one that covers the features you need without breaking the bank.

The options listed above are the best ERP systems with accounting features, or the best not-technically-ERP-systems that get you most of the way there for a lot less financial outlay.

For more business and accounting insights, sign up for our newsletter for the latest tech news and industry insights from financial leaders.