10 Best Accounting Software for Nonprofits Shortlist

Here's my pick of the 10 best software from the 16 tools reviewed.

There are seemingly countless accounting solutions available, so figuring out which one is best suited for a nonprofit is tough. You want to improve financial transparency, have efficient fund management, accurate tracking of donations and grants, and streamlined compliance reporting but need to figure out which tool is the best fit. I've got you! In this post I make things simple, leveraging my consulting experience and exposure to accounting software to bring you this shortlist of the best nonprofit accounting software.

What is nonprofit accounting software?

Nonprofit accounting software is a specialized financial management tool that encompasses tools and features that cater to fund accounting principles, donor management, and compliance reporting, allowing nonprofits to effectively manage their finances and demonstrate accountability.

The tool helps maintain accurate financial records, demonstrate transparency, and comply with accounting standards specific to the nonprofit sector.

Overview Of The 10 Best Accounting Software For Nonprofits

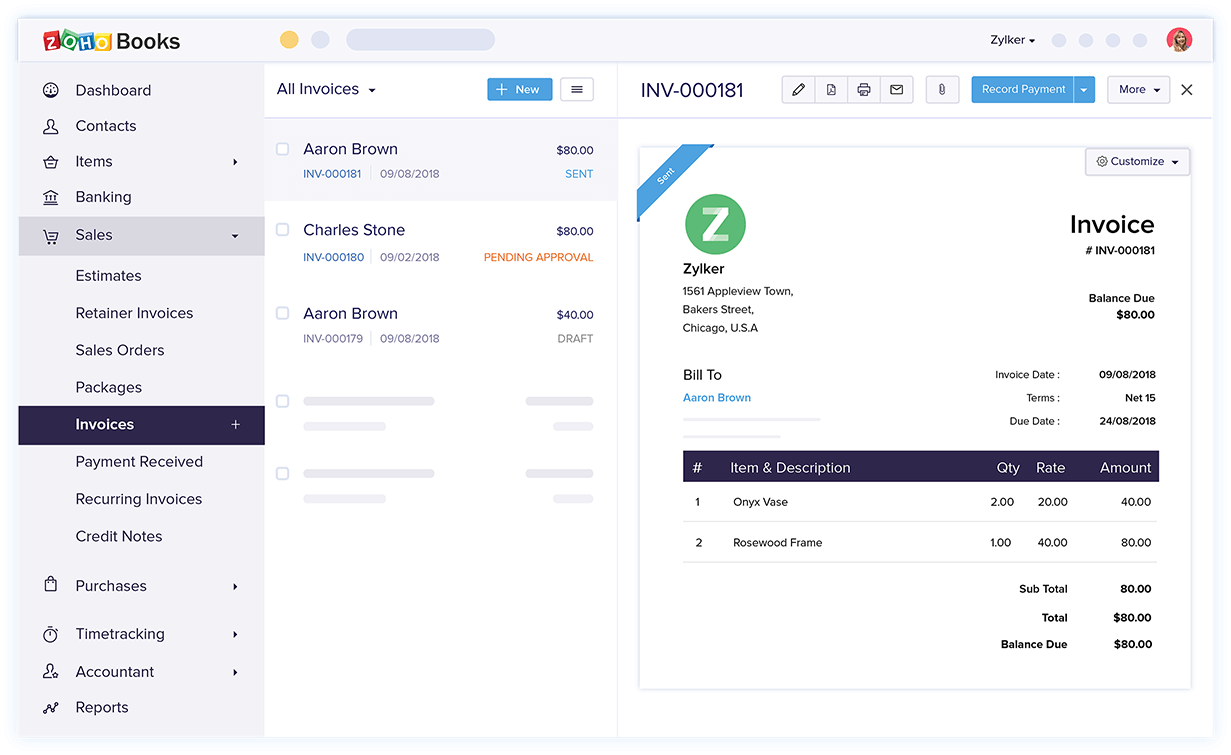

Zoho Books is an online accounting software designed for small businesses, providing features such as invoicing, expense tracking, and financial reporting. With its user-friendly interface and automation capabilities, Zoho Books helps businesses manage their finances efficiently. The platform is known for its affordability, accessibility, and integration with other Zoho products, making it a valuable solution for businesses looking to streamline their accounting processes and stay organized.

Why I picked Zoho Books: Zoho offers a full suite of cloud-based services for business and nonprofit organizations. If you’re looking for a one-stop shop for accounting and other key services, Zoho might be the best bet.

Zoho Books Standout Features and Integrations:

Standout features include Zoho Book’s ability to integrate with the company’s other services, including donor management, marketing, HR, legal services, and IT management, making it a potential one-stop shop for admin needs. On its own, the tool offers mileage and expense tracking, the ability to receive payments online and in person, and invoice management services. You can also use its automation tools to import statements from credit cards and bank accounts.

Integrations include other Zoho tools, along with PayPal, Stripe, WePay, and other payment tools.

Pros and cons

Pros:

- Free for organizations with annual revenues less than $50,000

- Free for small nonprofits

- Highly intuitive and easy to use with no experience

- Try the service out using a test account before you sign up

Cons:

- Few customization options

- Limited support

FreshBooks is a cloud-based accounting software designed for small businesses and self-employed professionals, offering features such as invoicing, expense tracking, and time tracking. With its user-friendly interface and automation capabilities, FreshBooks helps users manage their finances efficiently without the need for extensive accounting knowledge. The platform is known for its intuitive design, mobile accessibility, and robust reporting, making it a valuable solution for businesses looking to streamline their accounting processes and focus on growth.

Why I picked FreshBooks: FreshBooks is a low-cost option that comes with the tools that small nonprofits need, including expense tracking and the ability to accept payments.

FreshBooks Standout Features and Integrations:

Standout features include tracking restricted funds to ensure you don’t spend your nonprofit’s donations improperly. It also offers services like expense tracking, reporting tools, and time tracking to help manage your nonprofit. You can also use its invoicing tools and payment acceptance service to get paid if you provide work or a service for someone else.

Integrations include Hubspot, Gusto, Fundbox, Zapier, and more.

Pros and cons

Pros:

- Track restricted funds

- Long trial period

- Low cost

Cons:

- Monthly fee for each additional user

- Fewer features aimed specifically at nonprofits

Xledger is a cloud-based financial software that provides comprehensive solutions for finance, HR, and payroll management, aimed at streamlining business processes for organizations. It's designed to support various industries, including nonprofits, and is particularly noted for its real-time financial reporting, analytics capabilities, and scalability.

Why I picked Xledger: Xledger's automation accounting and financial tasks address the specific challenges faced by nonprofits, like limited resources. As a cloud-based system, Xledger allows nonprofit staff and volunteers to access financial data and tools from any location and on any device, with access to real-time insights to enhance transparency and accountability and build donor trust.

Xledger Standout Features and Integrations:

Standout features include project accounting to track financials on a project-by-project basis, budgeting and forecasting tools to aid financial planning, donor management tools, and automated workflows. It also supports all essential accounting functions such as managing accounts receivable and payable, processing orders and billing, and tracking time and expenses.

Integrations include Salesforce, Microsoft Dynamics CRM, Magento, GoldFinch, Harvest, JPMorgan Chase Bank, Chase Credit Card, and more.

Pros and cons

Pros:

- Donor management tools

- Real-time reporting

- Automation of day-to-day operations

Cons:

- Limited customization options

- Learning curve for new users

Aplos is an accounting software specifically designed for nonprofit organizations, offering comprehensive financial management tools to help nonprofits track donations, manage grants, and maintain compliance. Aplos empowers nonprofits to streamline their financial processes and demonstrate transparency to stakeholders. The platform is known for its user-friendly interface, affordability, and accessibility, making it a valuable solution for nonprofits of all sizes looking to manage their finances effectively and focus on their mission.

Why I picked Aplos: Aplos is a program that offers easy-to-use accounting tools without sacrificing functionality. It also has a powerful donor-management system to help you stay connected with donors.

Aplos Standout Features and Integrations:

Standout features include CRM tools that let you create donor profiles, track your communication and relationship history with them, make tailored appeals for donations, and track the pledges donors offer. The service also comes with fund accounting, donation tracking, online giving forms, reporting, and budgeting tools.

Integrations include many services, including Gusto, WePay, Church Community Builder, Bloomerang, PayPal, Sage Payroll, and more.

Pros and cons

Pros:

- Many integrations

- Intuitive and easy to use without sacrificing functionality

- Donor management tools

Cons:

- Some basic services require higher level of subscription

- High price

Wave is a free accounting software designed to meet the needs of small businesses, including freelancers, consultants, and startups. Wave helps businesses manage their finances efficiently without the need for extensive accounting knowledge. The platform is known for its user-friendly interface, affordability, and accessibility, making it a valuable solution for small businesses looking to streamline their financial processes and stay organized.

Why I picked Wave: If no one in your organization has accounting experience, Wave is one of the easiest-to-use tools on the market. You can set up an account and get running in just a few minutes.

Wave Standout Features and Integrations:

Standout features include connecting your account to an unlimited number of bank accounts and credit cards, invoicing, revenue and expense tracking, and financial reporting. If you have multiple nonprofits, Wave also makes it easy to manage multiple organizations with a single account.

Integrations include anything you can link with Zapier, although that may be somewhat more advanced.

Pros and cons

Pros:

- Free reporting and expense tracking

- Custom invoicing

- Completely free if you don’t use add-on services

Cons:

- Limited free support

- Restricted funds have to be tracked manually

Realm is a mobile database and synchronization platform designed to help developers build real-time, collaborative applications. Realm enables developers to create responsive and scalable mobile applications. The platform is known for its simplicity, performance, and cross-platform compatibility, making it a valuable solution for building modern mobile applications that require real-time data synchronization and collaboration features.

Why I picked Realm: Realm has a very specific focus on churches and other worship organizations. If you run a church, you’re likely to have better luck finding the features you need and getting support that understands your situation.

Realm Standout Features and Integrations:

Standout features include Realm’s app for pastors and congregants to help people stay connected to their church, register for events, volunteer, and donate, making this a uniquely helpful tool for churches. On the financial side, it offers financial dashboards, donor tracking and management, and donation acceptance tools.

Integrations: Realm is sold as an all-in-one platform.

Pros and cons

Pros:

- 24/7 support

- Easy to use

- Donor management and tracking capabilities

- Designed specifically for churches and worship organizations

Cons:

- Not applicable to all nonprofits

- Opaque pricing

- Limited features

Serenic Navigator is an integrated cloud-based Enterprise Resource Planning (ERP) solution designed for nonprofit organizations and government agencies. Serenic Navigator is known for its scalability, flexibility, and compliance with regulatory requirements, making it a valuable solution for nonprofits and government agencies looking to improve efficiency and transparency in their financial management processes.

Why I picked Serenic Navigator: Serenic Navigator is purpose-built with nonprofits and other similar organizations in mind. It offers key budgeting and financial tracking tools as well as other useful services.

Serenic Navigator Standout Features and Integrations:

Standout features include a variety of related services like IT and HR services that make it easy to get all your admin help from one place. The accounting tool in particular has reporting tools, core fund accounting, grant and award management, and easy-to-use budgeting tools.

Integrations include Sylogist’s other services, including IT management, web portals, and business apps.

Pros and cons

Pros:

- Financial tracking and budgeting tools

- Wide variety of add-on services

- Designed specifically for nonprofits

Cons:

- Works best if you buy multiple services, not just accounting

- Pricing is not transparent

Quicken is a personal finance management software developed by Intuit, offering tools for budgeting, expense tracking, and investment management.Quicken helps individuals manage their finances effectively. The platform is known for its user-friendly interface, robust reporting capabilities, and comprehensive financial tracking, making it a valuable tool for individuals looking to take control of their financial lives.

Why I picked Quicken: Quicken is a low-cost service that is designed largely for individuals tracking their finances, but it does offer a small business service that works well for small nonprofits with just one or two people involved.

Quicken Standout Features and Integrations:

Standout features included by Quicken make it easy to automate expense tracking using custom spending categories and to use that information with the service’s budgeting and forecasting tools. More advanced users can design custom reports and use what-if analysis to project their financial futures.

Integrations include bank and credit card accounts, and PayPal.

Pros and cons

Pros:

- Easy to use

- Cash flow reporting

- Low price, even for most advanced tiers

Cons:

- No product demo or free trial offering

- Limited features

ZipBooks is an accounting software tailored to meet the unique needs of nonprofits, providing robust financial management tools to help organizations track donations, grants, and expenses effectively. ZipBooks enables nonprofits to maintain accurate financial records and demonstrate transparency to stakeholders. The platform is known for its user-friendly interface, cloud-based accessibility, and affordability, making it a valuable solution for nonprofits seeking to manage their finances efficiently and focus on their mission.

Why I picked ZipBooks: If your nonprofit does a lot of invoicing, ZipBooks is easy to use and one of the cheapest ways to send and track invoices.

ZipBooks Standout Features and Integrations:

Standout features include unlimited invoices, making it one of the top free nonprofit accounting tools. You can accept major payment methods and access mobile accounting tools to track payments. It also has team management tools like time tracking.

Integrations include Google Drive, Square, PayPal, and major banks.

Pros and cons

Pros:

- Easy payment acceptance

- Higher levels of service are low cost

- Free service is suitable for many smaller nonprofits

Cons:

- Few integrations

- Limited support

NetSuite is a cloud-based enterprise resource planning (ERP) software suite designed to help businesses manage their core processes, including financials, CRM, inventory, and more, in one integrated platform. NetSuite provides a comprehensive solution for businesses of all sizes. The platform is known for its scalability, flexibility, and real-time visibility into business performance, making it a valuable solution for companies looking to streamline operations, improve efficiency, and drive growth.

Why I picked NetSuite: NetSuite is a highly modular program, giving you the flexibility to choose the tools and functionality that your nonprofit needs to succeed.

NetSuite Standout Features and Integrations:

Standout features of NetSuite’s cloud-based tools include a general ledger, cash management, tax compliance tools, as well as payment and donor management.

Integrations include a variety of other NetSuite services.

Pros and cons

Pros:

- Accounting and reporting tools

- Customizable pricing based on selected services

- Modular tool that lets you select the services you need and forgo the ones you don’t

Cons:

- The tool can be very complex

- Pricing lacks transparency

| Tools | Price | |

|---|---|---|

| Zoho Books | From $15/org/month | Website |

| FreshBooks | From $19/per/month | Website |

| Xledger | Pricing upon request | Website |

| Aplos | $29.50/account/month | Website |

| WAVE | From $16/user/month | Website |

| Realm | From $29 per month | Website |

| Serenic Navigator | Pricing upon request | Website |

| Quicken | From $3.99 per month | Website |

| ZipBooks | From $15/month (5 users) | Website |

| NetSuite | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

If you don’t feel any options on my list are the right fit for your organization, here are a few other nonprofit accounting tools to consider:

Selection Criteria For Non-Profit Accounting Tools

I looked at some of the best accounting programs on the market to compare their key features and see how well they serve the needs of nonprofits.

When comparing accounting programs for nonprofit organizations, I looked at the following criteria.

Core Functionality

Nonprofits need to accomplish many of the same bookkeeping tasks as businesses, tracking cash inflows and outflows and producing financial reports.

Any accounting tool for a nonprofit needs these basic bookkeeping options and some tools for nonprofits’ unique needs, like restricted fund tracking.

Key Features

Nonprofits have unique needs compared to businesses, so they should be looking for some specific features and tools.

For example, many nonprofit organizations rely on donations from people in their communities. Donor management is key to tracking these donations and working with people likely to make future donations.

Another key feature is the ability to track restricted funds. If a donor makes a gift with restrictions on how you can use the money, the last thing that you want is to spend that donation improperly or have it mixed with funds that you expect to rely on for other purposes.

Some also offer other unique functions, such as the ability to connect and communicate with volunteers. Nonprofits that rely on volunteers might appreciate being able to use the same app to find people who are willing to help out at different events.

I looked for accounting programs that offered donor management tools and other services focused on the unique needs of nonprofits.

Usability

It’s no secret that accounting can be a complicated topic. People spend years in higher education institutions to earn degrees that focus on it. It’s easy for that complexity to spill over into accounting software, leaving you with a tool that requires a textbook to understand.

Accounting software is there to help you manage your finances more easily. The best tools are intuitive and easy to pick up while still having all of the advanced features that you need. Extensive knowledge bases and how-to resources are also a big plus.

Integrations

Your nonprofit likely relies on a variety of programs and tools to handle different tasks. For example, you might use something like Paypal to accept donations.

Many accounting programs integrate with other financial services to make it easy to import data or track transactions. These integrations can save you a lot of time and help make it easier to track your organization’s finances.

Add-on services such as payroll services

Some accounting programs do more than just let you track your organization’s finances. They may try to serve as an all-in-one financial suite for your nonprofit. That can be a big plus if you’re looking for a single service that does it all.

I looked at accounting tools that have optional services, such as payroll or inventory management, that may help you run your nonprofit more efficiently.

Support

Sometimes, even the best accounting programs can have bugs or be a bit confusing to use. Should your software ever crash or freeze up on you, having reliable technical or customer support you can turn to is critical. I looked for software that has support that is easy to reach and has a reputation for being helpful.

People Also Ask

Here are some common questions and answers about nonprofit accounting software.

Why do nonprofits need accounting software?

Nonprofits need accounting software because it can help them keep track of their money and–crucially–the money they receive from donors. Though nonprofits are usually focused more on doing good and succeeding in their mission than they are on making money, it’s hard to accomplish the former without the latter.

Nonprofits need to keep an eye on where their funds are coming from and make sure they’re putting that money to the best use possible. Many nonprofit accounting tools also help with fundraising by offering donor management tools or ways to accept donations through multiple avenues.

What unique features should nonprofits look for when choosing account software?

Many accounting programs are targeted at for-profit businesses. Nonprofits are very different entities and need different features to keep track of the various donations, grants, and other funding they receive.

One important feature for nonprofits is restricted funds tracking. Some donations will have restrictions on how your organization is allowed to use the funds. A good nonprofit accounting tool can help track these restricted funds and ensure you don’t spend money improperly.

Donor management is also an important tool to look for in nonprofit accounting software. It can help you track the people you work with and who help fund your organization to give you the best chance of getting repeat donations.

What are other must-haves for nonprofit accounting software?

It’s important to look for nonprofit-specific functionality, like donor management and restricted funds, but the basics are equally important.

Any accounting tool should be able to produce a general ledger and chart of accounts for your nonprofit organization. These are essential for tracking your nonprofit’s finances and making sure it has the cash that it needs to pay the bills.

If your nonprofit sells goods or services or buys things from suppliers, invoicing tools and accounts payable tracking are also key. Also, be sure that the tool you select has reporting tools and an easy-to-read dashboard.

Are there free nonprofit accounting tools?

Yes, there are free accounting tools out there, many of which can be used by nonprofits. Keep in mind that, in many cases, you get what you pay for. These tools might be limited in functionality or force you to pay for a premium service to get full access to their functionality.

Some truly free options, such as open-source accounting software, may be hard to learn or have limited support.

It’s important to balance the benefit of using a free tool with the additional effort that is typically involved.

Is accounting software secure?

Whenever you’re working with important data, such as financial information or donor contact info, it’s important to consider security. You don’t want malicious actors to steal financial or personal information.

Before deciding on a software provider, check to make sure that the vendor is reputable and that it uses proper security measures.

Also, be sure to take some steps of your own, such as using a unique, complex password.

How do I choose the right accounting software for my nonprofit?

If you’re trying to choose the right accounting software for your nonprofit organization, you have to balance a few competing needs.

Of course, you want to choose a program that offers the basic bookkeeping tools that you want from accounting software. More advanced features, such as donor management, can be incredibly helpful, but you have to balance those desires with price. Depending on the size of your nonprofit, you may not have the funds to pay for expensive accounting tools.

Make a list of your needs and wants when it comes to bookkeeping and accounting features and use that to guide your search. Make a list of tools that fulfill all of your needs and note the wants that they satisfy. Then, compare their prices.

If the services offer free trials, take advantage of them. Trials are a great way to try out a service without having to commit. A trial period can give you a chance to figure out their learning curve and make sure they offer the features you need.

Finally, don’t forget to consider growth. If you’re a new nonprofit or on the smaller side, it’s tempting to choose the cheap option that works well for small organizations. If you’re hoping to grow, make sure that your accounting software can grow with you. Software that has multiple tiers of service can be a good fit for this.

Conclusion

Every nonprofit can benefit from having accounting software to fit its purpose. The right program will help you keep track of donations and make sure you’re putting your financial resources to proper use.

The right program can also further your nonprofit's mission by helping you spend less time and money on managing the organization’s finances and more on the people you’re trying to help.

If you want more financial management insight and advice, sign up for our newsletter to get resources and advice from leading experts.