You might have heard that only half of small businesses survive the first 5 years, but did you know that over 80% of businesses fail due to cash flow problems?

While understanding your balance sheet won't solve all of your problems, it'll help you catch them with enough time to make a difference.

Balance Sheet Basics

The balance sheet is a templated financial statement that illustrates a business’s worth. This is also sometimes referred to as the book value. Balance sheets are used:

- By business owners to understand the overall financial position of the business and make strategic spending, saving, and growth decisions

- By investors and lenders to understand the financial health and stability of a business when evaluating it for potential investment or credit

- By team members in accounting, leadership, and other departments to inform decision-making about processes, business goals, or spending

Although the balance sheet is a powerful financial tool, it isn’t a stand-alone tool for every accounting need. It doesn’t show the actual market value of a company, for example, or detail profits, losses, cash flows, and other critical financial factors. This is why lenders and investors typically want to see multiple financial statements, including balance sheets and income statements, when considering a business for credit or investment.

Balance sheets can be created in Excel manually. However, best practices are typically to use templates and reporting mechanisms within accounting software. These tools automate balance sheet creation, reducing error risks associated with transferring data manually.

What is an Accounting Balance Sheet

A balance sheet is an accounting statement that captures a snapshot of business assets, liabilities, and shareholder equity.

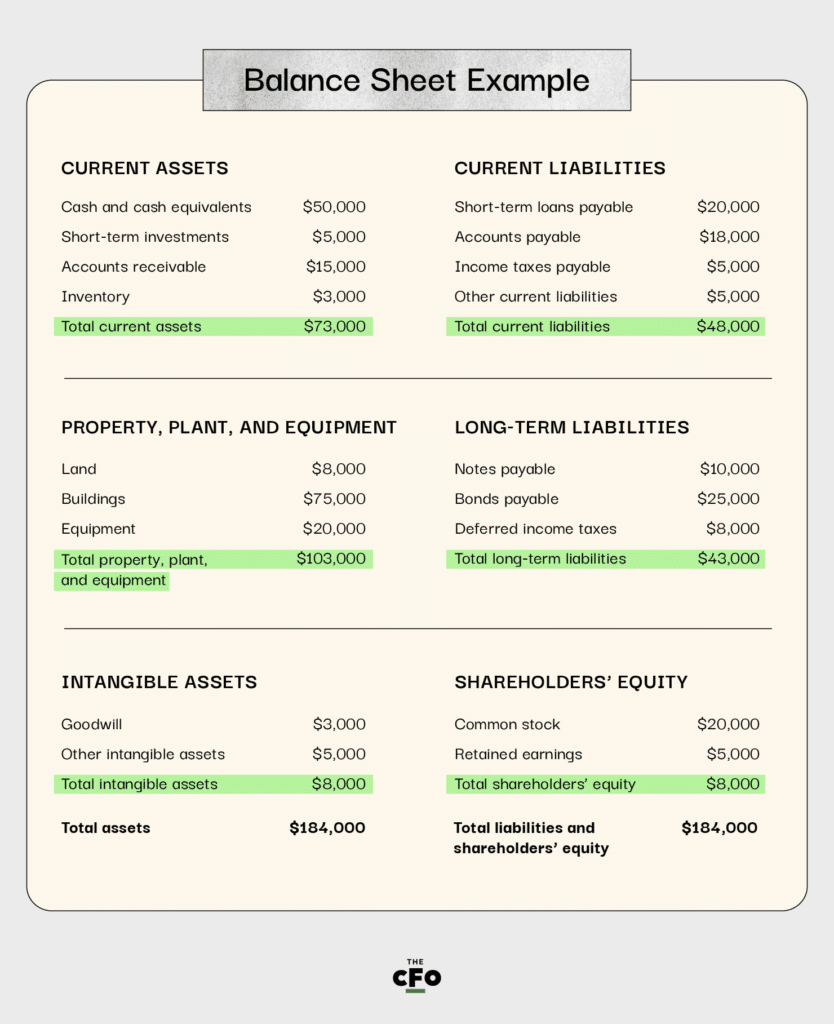

On one side of the balance sheet, you find what the company owns. This includes:

- Current assets, such as cash and cash equivalents

- Long-term assets, such as land and equipment

- Intangible assets, such as goodwill and intellectual property

On the other side of the balance sheet, you find what the company owes and how much owners have invested. What the company owes — its liabilities — include:

- Current liabilities, such as short-term loans, accounts payable, and income taxes

- Long-term liabilities, such as bonds payable and mortgages

Under the shareholder equity section, you’ll find common stock, retained earnings, and other stockholder equity.

Balancing Your Balance Sheet

As you may have guessed, your company’s balance sheet should always balance. The accounting equation for a balance sheet is:

Assets = Liabilities + Shareholders’ Equity

This means that each side of the equation should equal the same total number; total all the assets on one side of the balance sheet and then total all the liabilities plus shareholders’ equity on the other side. If they aren't equal, it's likely there's a mistake in reporting. Check that all the numbers are correct and nothing's been left out from the balance sheet equation. You may also need to ensure that you're reporting the correct assets and liabilities for the period captured on the balance sheets.

Here's a very basic balance sheet example:

Using This Tool to Understand Your Financial Position

You should use the balance sheet to understand your company’s financial position at a given point in time. It's a snapshot, which means it's good for that particular moment or period. Balance sheets are typically created monthly or quarterly for this reason.

While the balance sheet doesn't help you understand how money flows in and out of your business — that would require a cash flow statement — it does help you understand factors such as liquidity and solvency.

Liquidity

Liquidity refers to how many liquid assets you have access to. Liquid assets are cash, cash equivalents, or anything that can be converted quickly and easily to cash.

The formula for liquidity is called the current ratio:

Current ratio = current assets / current liabilities

Since both of those figures are readily available on a balance sheet, you can quickly get a current ratio from that statement. In fact, most balance sheets usually include the calculation for convenience. Benchmark current ratios differ by industry, but a good number is often considered to be 1.5 to 3.

Solvency

Solvency refers to the company's ability to meet its debts, both short-term and long-term. The formula for the solvency ratio is:

Solvency ratio = (Net Income + Depreciation) / All liabilities

Detailed balance sheets typically have all of the information required for this formula. In general, solvency ratios should be 1.5 or higher to indicate a company is able to meet its obligations and still have a bit of breathing room.

Assets and Your Balance Sheet

Assets refer to what a business owns. They have monetary value, and that value can be used to support business processes or meet debt obligations. The Asset portion of the balance sheet must account for total assets, including intangible assets, such as goodwill.

Current Assets

Current assets are those that the company will likely use within the next 12 months. They include cash and cash equivalents (used to fund business operations and pay short-term debts), as well as accounts receivable.

Long-Term Assets

A company’s assets also include items that may be used for years, such as property, plant, and equipment. This might include land, equipment that experiences depreciation, and intellectual property, such as patents or copyrights for software programs.

Liabilities and Your Balance Sheet

Liabilities refer to the financial obligations that a business has. The liabilities section of the balance sheet must account for total liabilities owed by the company, including both current and long-term debts.

Current Liabilities

Current liabilities, or short-term liabilities, are those that will come due within 12 months of the date on the balance sheet. Examples include accounts payable, such as a monthly invoice for cloud storage, as well as credit card debt, operating expenses, and certain taxes.

Long-term Liabilities

Non-current liabilities, or long-term debts, are those that will come due more than 12 months after the date on the balance sheet. They can include long-term notes and bank debt.

In many cases, a debt must be broken up into both categories. For example, let's say an app development company purchased an office building to house its operations. It must make 12 monthly payments on a mortgage within the next year; those payments might be listed under current liabilities. The remaining part of the mortgage would be listed as long-term debt.

Shareholder’s Equity and Your Balance Sheet

The equity section of the balance sheet records how much owners have invested in the business. This is an important part of the balance sheet because it reflects the value that the company owes to shareholders and other equity investors.

Owner’s Equity

Owner's equity refers to how much value the owners of the business have invested in it. Shareholder equity refers to how much value the shareholders have invested. The main difference between the two is how the business is owned or held.

To understand the difference, consider an example. An individual comes up with a SaaS business idea and decides to bootstrap the startup. This means the person backs the business with his or her own funds at first. If the owner invests $100,000 in the first year and takes out $50,000 in pay, his or her owner equity is $50,000 for the first year.

Now imagine that software service takes off and the owner wants to grow the business. They seek venture capital from investors. Now there are shareholders. Say the investors put in $200,000 and haven't taken any dividends out of it yet. The shareholder equity is $200,000.

Retained Earnings

Retained earnings refer to the amount of earnings the business retains to reinvest for growth or support cash-on-hand. To arrive at this figure, you take the net income minus the dividends for any given period.

For example, say a business has a net income of $100,000 for the month. It may distribute $50,000 of those profits among owners and shareholders and keep $50,000 to invest back into the company.

When a business has retained earnings, it has financial options for growth, increasing stock value, or making capital investments. Retained earnings are often reported as a ratio of retained earnings to assets. While a 1:1 ratio is ideal, it's not typically possible in many industries. Thus, the benchmark is to get as close to a 1:1 ratio as possible or simply to have a retained earnings ratio that's higher than the average for your industry.

Deficit

If the company doesn't have enough income within a period to meet its debt obligations and cover shareholder liabilities, it has negative retained earnings. That's called a deficit. It's important to monitor any deficit on the balance sheet because a deficit often means the business is dipping into cash reserves or borrowing money to cover liabilities. While this is possible to maintain for a short period, running a deficit over long periods is a sign of poor financial health for a business.

How to Most Effectively Utilize a Balance Sheet

Start with a template to make balance sheet creation simple. Whenever possible, use bookkeeping software to create balance sheets automatically, as this reduces the chance of errors. Business owners should review balance sheets and related financial ratios periodically to understand the overall health of their business. Reviewing your balance sheet monthly, for example, ensures there are no surprises if you decide to sell your business, apply for a business loan, or seek venture capital funding.

All set with your balance sheet and ready to move on to other important accounting matters for your business? Check out our other articles on accounting to learn more.