10 Best Cheap Payroll Services Shortlist

Here's my pick of the 10 best software from the 19 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

With so many different payroll services available, figuring out which ones offer the best services for a low cost can be tricky. You know you want someone to handle the accurate and timely processing of employee wages, taxes, and other withholdings on behalf of businesses but need to figure out which tool best fits your budget. I've got you! In this post I'll help make your choice easy, sharing the results of my extensive research of dozens of providers with my picks of the best cheap payroll services.

What is a Payroll Service?

Payroll services refer to outsourced solutions that manage various aspects of payroll processing for businesses. These services typically encompass tasks such as calculating employee wages, handling tax deductions, and generating payroll reports. These services allow companies to focus on their core activities while ensuring accurate and compliant payroll operations.

The main benefits of payroll services include time savings, reduced risk of errors and compliance issues, enhanced data security, and improved accuracy in tax filings.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payroll compliance | Free demo available | Flat rate user pricing, with a free version for businesses with up to 200 people | Website | |

| 2 | Best for automatic tax filing | 90-day free trial | Pricing upon request | Website | |

| 3 | Best for mobile access | 30-day free trial | From $40/month + $6/user/month | Website | |

| 4 | Best for paying global contractors | Free demo available | From $25 - $199/user/month | Website | |

| 5 | Best for US-based businesses | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 6 | Best for integrations | Free demo available | From $40/month + $6/user/month | Website | |

| 7 | Best for retail and restaurants | Not available | From $6/user/month + $35/month base fee | Website | |

| 8 | Best for automated payroll processing | 30-day free trial + free plan available | From $19/month plus $3/employee/month | Website | |

| 9 | Best for detailed reporting | 14-day free trial | From $10/user/month | Website | |

| 10 | Best for chat-based setup and support | 3-month free trial | From $39/month + $5/month/employee | Website |

Overviews Of The 10 Best Cheap Payroll Services

Below are my evaluations of the best cheap payroll services available on the market. Each features a summary of its key features, an overview of why I selected it, a screenshot of the solution, and details about trials and pricing.

Deel offers a comprehensive global workforce management solution, including a payroll platform and services. The tool and services are available in 150 countries, helping businesses of all sizes and industries scale their workforce globally while staying compliant.

Why I picked Deel: You can hire and pay both employees and contract workers using Deel, and manage your payroll through the software. If you want to hire international workers without the challenges of local employment laws and complex tax systems, this is a good solution to outsource and ensure compliance.

Deel Standout Features and Integrations:

Standout features are primarily in the fact that local experts work in-house for Deel, and run payroll for their clients in the areas where their staff operates. This provides peace of mind, knowing that someone familiar with taxes and laws of the county in which your employees work is handling their payroll.

Integrations include Quickbooks, Xero, Netsuite, Workday, Workable, Expensify, Greenhouse, Hibob, BambooHR, Ashby, OneLogin, and Okta.

Pros and cons

Pros:

- Off-cycle payroll available

- 24/7 online support

- 10+ payment options for clients

Cons:

- Limited customization options

- Some add-ons have confusing additional fees

RUN by ADP is a comprehensive payroll and HR software solution designed to simplify payroll processing and human resource management for small businesses of up to 49 employees.

Why I picked RUN by ADP: I like that RUN by ADP offers automatic payroll and tax filing. This service automatically calculates, deducts, pays, and files payroll taxes, which significantly reduces the administrative burden on small business owners. Additionally, RUN by ADP offers a convenient, mobile-friendly employee self-service portal so employees can access their information anytime, anywhere.

RUN by ADP Standout Features and Integrations:

Standout features include direct deposit, HR compliance support, time and attendance tracking, garnishment payment services, retirement plan services, workers' compensation management, and payroll and tax reports. The platform also includes AI-powered error detection to help avoid costly mistakes by flagging potential errors before they happen.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Employee self-service portal

- Robust mobile app

- Customizable, in-depth reporting options

Cons:

- Most HR functions are only available on higher-tier plans

- Initial setup can be complex

For payroll on the go, OnPay is my top choice. The mobile app is highly reliable and efficient, providing complete functionally and full access to the platform. Plus, it streamlines payroll and benefits administration, all with a lower learning curve and exceptional customer service.

Why I picked OnPay: I chose OnPay due to its highly capable mobile app, which exceeds what you’d typically find among cheap payroll services.

Plus, I like how OnPay offers specialized payroll services for specific industries and gives you access to an in-house insurance broker to make medical, dental, and vision plans accessible to small businesses.

OnPay Standout Features and Integrations:

Features include comprehensive but user-friendly payroll services and compliance management for all 50 states. There are also foundational HR tools available, including personnel file management, onboarding workflows, document storage, e-signature tools, and PTO tracking.

Integrations include Deputy, Guideline, Magnify, Mineral, PosterElite, QuickBooks, When I Work, Vestwell, and Xero.

Pros and cons

Pros:

- Reputation for excellent customer service

- Access to in-house insurance brokers, simplifying benefits selection for small businesses

- Highly capable mobile app for payroll management while on the go

Cons:

- Not designed for companies with multinational payroll needs

- Limited automation capabilities

Remofirst provides advanced payroll services including payments for global employer of record (EOR) hires, international payroll, and compliance support. Their most affordable payment service is available for paying international contractors at $25/contractor/month. Their main payroll pricing starts at $199/month.

Why I picked Remofirst: I included Remofirst in this list because it addresses the intricacies of managing global payments, including employment through EOR agreements. Their EOR service, though more expensive, includes compliance monitoring for local labor laws within 180 countries. They also offer tools to ensure your contractors are not misclassified, so you can avoid costly fines or penalties in different jurisdictions.

Remofirst Standout Features and Integrations:

Features include tools to pay global contractors, manage contracts, process contractor expenses, and track contractor availability through an integrated time-off tracking and calendar function. They also offer payroll services for full-time employees, as well as background checks, and services to help international employees obtain work permits or visas.

Integrations include Google Workspace, Microsoft Office 365, Slack, and Zoom. An API is also available to support custom integrations, as well.

Pros and cons

Pros:

- Customizable to different organizational needs

- Suitable for small to medium-sized businesses

- Employee vs contractor misclassification tools are helpful

Cons:

- Limited flexibility in certain features

- Affordability is limited to contractor-only plan

Patriot Payroll is an online payroll service tailored for small to medium-sized businesses in the United States. It provides a straightforward platform that simplifies payroll management, making it accessible for business owners who need to handle payroll efficiently and accurately without breaking the bank.

Why I picked Patriot Payroll: I like that it offers essential features such as automatic tax calculations, direct deposit, and an employee portal at an affordable price. Its full-service option, which includes federal, state, and local tax filings, ensures compliance without adding significant costs, making it an economical choice for small to medium-sized businesses.

Patriot Payroll Standout Features and Integrations:

Standout features include customizable pay rates, which allow businesses to tailor pay structures to individual employees, and time-off accruals, which help manage employee leave effectively. Furthermore, its payroll reports provide comprehensive insights into payroll data, helping businesses make informed financial decisions.

Integrations include QuickBooks, TSheets, Gusto, Square, FreshBooks, Xero, accounting software, time and attendance systems, and human resources management systems.

Pros and cons

Pros:

- Variety of built-in reports

- Includes features for managing electronic documents

- Unlimited payroll runs

Cons:

- The initial setup requires a lot of manual data entry

- No international payroll options

Gusto integrates with over 180 different platforms and services, and it works well for small businesses and large organizations alike. Along with comprehensive payroll features, Gusto works as an overall personnel management solution, handling taxes, time-tracking, and benefits administration.

Why I picked Gusto: I selected Gusto due to its high number of integration options, which far exceeds what you find with most cheap payroll services. Additionally, it offers automated payroll, tax document creation, and tax filings, which are advanced capabilities beyond what most would expect at this price point.

Gusto Standout Features and Integrations:

Features include automated payroll, taxes, and fillings, reducing workloads significantly.

Gusto has a wide array of capabilities that goes beyond things like direct deposit, debit card-based employee payments, and other things you’d normally expect from a standard payroll service.

I was especially impressed by the automatic adjustments Gusto will make to employee wages to comply with FLSA Tip Credit minimum wage requirements. Plus it can handle unlimited off-cycle payroll, flexible payment schedules, garnishment tools, and contractor payments.

Integrations include AttendanceBot, Betterment at Work, Bonusly, Bookkeeper360, Checkr, ClockShark, Connecteam, Deputy, DocuSign, eBillity, Expensify, Freshbooks, Guideline, Homebase, Hubstaff, Hyperproof, JazzHR, OnlineCheckWriter, Paperclip, QuickBooks, Relay, Sage Accounting, Salesforce, Tableau, Vestwell, VIVAHR, and Xero.

Pros and cons

Pros:

- Accommodates contractor payroll

- User-friendly, intuitive design with a reduced learning curve

- 180+ integrations available

Cons:

- Only supports US payments

- Benefits options only available at higher price tiers

Square Payroll is a user-friendly solution that works well for retailers and restaurants that already use Square POS, offering a cloud-based, mobile-friendly option for handling basic payroll needs with a few extras.

Why I picked Square Payroll: I selected Square Payroll for the ease of integration with Square POS, making it a standout choice for retailers and restaurants that rely on Square.

Additionally, you get a lot of bang for your buck with features like automated tax filings, instant payment through Square balances or checking accounts, and tip and commission tracking.

Square Payroll Standout Features and Integrations:

Features include instant payments to employees from a Square Checking account or Square balance, and the integration with Square POS allows time-tracking information to transition to the payroll features.

Square Payroll has a companion app, plus it offers automatic tax calculation and filing and tracks tips and commissions. I really like that Square can help calculate and automate most healthcare, retirement, and workers’ compensation insurance amounts too.

Integrations include QuickBooks, Square POS, and Square Team Management.

Pros and cons

Pros:

- Works for employees and contractors

- Automated tax filing

- Integrates with Square POS

Cons:

- Benefits administration features are limited

- Limited reporting capabilities

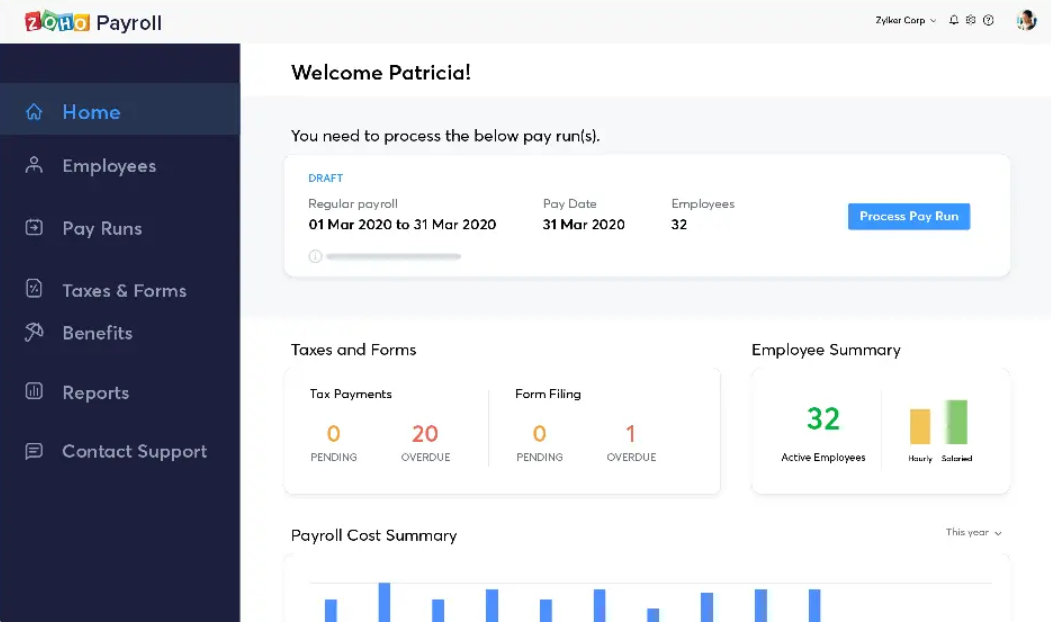

Zoho Payroll is an end-to-end payroll solution that harnesses automation to make payroll simpler for small businesses.

Why I picked Zoho Payroll: I picked Zoho Payroll since it’s one of the lower-cost options that harnesses automation effectively to minimize the time spent managing payroll. All you have to do is enter payment information for employees, and it will use any recorded hours to handle the calculations for you.

Zoho Payroll Standout Features and Integrations:

Features include automatic payroll calculations that work for both hourly and salaried employees, as well as the ability to run separate bonus payrolls.

In my opinion, it’s well worth the $19/month base price when you consider you also get benefits administration tools, digital pay stubs with direct deposit options, comprehensive payroll reports, and an employee self-service portal accessible through the web or a companion iOS app.

Integrations include Zoho People and Zoho Books.

Pros and cons

Pros:

- Multiple pay schedules available to align processing with your company’s needs

- Add pay runs as needed to account for bonuses or special pay

- Automated payroll calculations for simplicity

Cons:

- Only available in select states

- Limited integrations

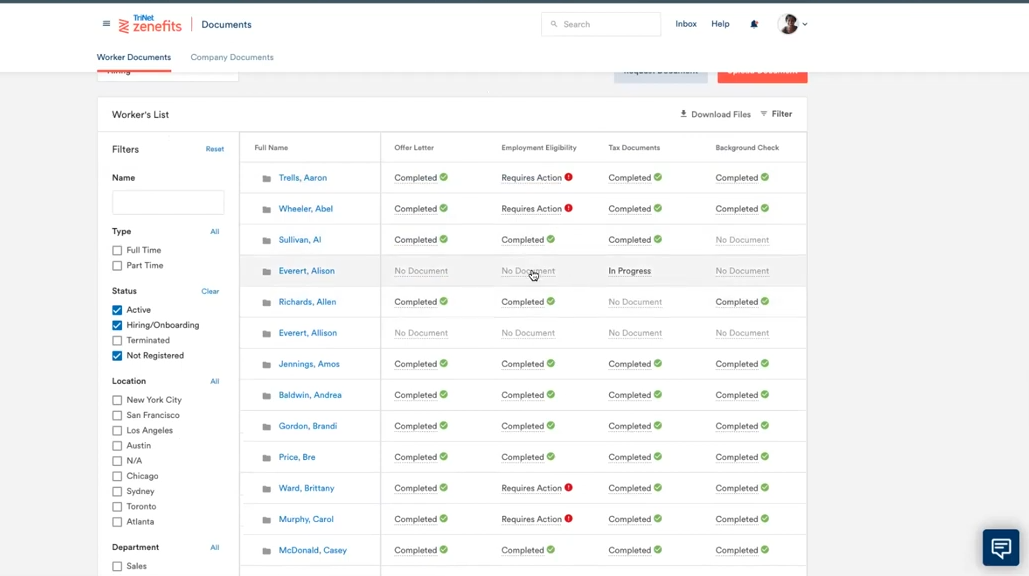

Zenefits is a comprehensive HR platform with payroll features that offers in-depth HR analytics and reporting to simplify information tracking and employee management.

Why I picked Zenefits: I chose Zenefits because it offers more customizable reporting options and analytics features than you usually get with a low-cost payroll service. Additionally, its payroll and benefits administration tools—while functioning as an add-on—are similarly top-notch and cover both in a single platform.

Zenefits Standout Features and Integrations:

Features include unlimited payrolls, direct deposit, and mobile payments, as well as the ability to set up different pay schedules for various employees.

I really like that analytics, PTO tracking, benefits administration, scheduling, and other employee management tools are also part of the base package.

Integrations include Asana, Betterment, BreezyHR, Deputy, Expensify, Greenhouse, Guideline, Lever, QuickBooks, Salesforce, and Xero.

Pros and cons

Pros:

- Automated HR and payroll tools

- Capable mobile app with self-service options for employees

- Detailed HR analytics

Cons:

- Not ideal for small businesses due to registered user requirements

- Payroll feature is an add-on, not a base feature

Roll by ADP uses a chat-based approach to set up and manage payroll, dramatically reducing the need for any degree of tech-savviness.

Why I picked Roll by ADP: I chose Roll by ADP mainly because of the value for the price, as it offers features like instant or next-day direct deposit, automated tax filing, and raise, bonus, and garnishment management.

The chat-based interface for payroll setup and support also makes it a solid choice for anyone who’s intimidated by the technical side of using a payroll solution, as the conversational approach is highly user-friendly.

Roll by ADP Standout Features and Integrations:

Features include automatic calculations for wages and withholdings, as well as automated tax filing at the federal, state, and local levels. Roll by ADP also simplifies the issuing of raises and bonuses, as well as managing garnishments, using a chat-based approach to instruct the platform.

Integrations include Plaid and QuickBooks.

Pros and cons

Pros:

- Instant and next-day direct deposit

- Mobile-app centric for managing payroll on the go

- Harnesses chat features to make support and setup feel like a conversation

Cons:

- Benefits administration options are limited

- Limited integrations

Other Cheap Payroll Service Options

I’ve included a few more options that didn’t make my top 12 for cheap payroll services but are still worth exploring:

- Justworks Payroll

For payroll with time tracking

- SurePayroll

For same-day payroll

- Payroll4Free

Free payroll service for small companies

- QuickBooks Payroll

For user-friendliness

- Paycor

For tailored HR management

- Humi

For Canadian companies

- Oyster HR

For local labor law compliance

- Remote

For global teams

- Trolley

For paying contractors and on-demand workers

Selection Criteria For Cheap Payroll Services

If you’re wondering how I selected the best cheap payroll services on this list, I personally evaluated dozens of available options. Additionally, I drew from my past experience to separate the comprehensive-but-affordable solutions from the rest of the pack. Here’s where I focused along the way:

Core Functionality

First, I evaluated various popular payroll services to ensure they included the necessary core functionality. Here are the points that a solution needed to provide to make the list:

- Automatic payroll calculations

- Modern employee payment options

- Tax withholding

- Online or cloud-based access

- Integration with popular accounting solutions

Key Features

Payroll services need features that support—and preferably simplify—core functionality and key operations. Here are some features I consider essential in an affordable payroll service solution:

- Direct deposit: When it comes to modern employee payment options, direct deposit is the most critical component. It allows you to send their pay straight to their bank account, eliminating the need for paper checks.

- Tax form creation: Handling your tax obligations requires specific forms, so I focused on cheap payroll services that at least offered the basics, such as W-2s and 1099s.

- Multiple pay schedules: The ability to assign different pay schedules to specific employees or groups limits the need for manual intervention, which I consider critical.

Value for Price

How much value you get for the price you pay is another critical factor I considered.

Among free solutions, the priority was basic payroll functionality, including issuing pay to employees and 1099-contractors, simple reporting options, and some low-level analytics.

For low-cost options, the criteria expanded to include more advanced features, like HR and benefits management, employee self-service options, and unlimited payroll runs.

Usability

During my evaluations, I favored tools that offer a positive user experience with simpler implementations. Even though avoiding a learning curve entirely isn’t typically possible, user-friendly options that support varying degrees of tech-savviness streamline implementation, ensuring your payroll team isn’t stuck training for weeks on end to make use of the solution.

Integrations

I chose cheap payroll service solutions that offered some opportunities for integrations. My focus was on those that at least integrated with popular accounting or HR platforms, though I’ve listed out the key integrations for each solution to help you narrow down your options quickly.

People Also Ask

Still trying to get a grip on payroll? Here are some answers to frequently asked questions that can help:

What are the typical payroll costs?

Payroll costs fall into two categories. First, you have the cost of salaries and benefits, as well as employer-paid payroll taxes and worker-related insurance, such as unemployment and workers’ compensation.

Second, you have payroll administration expenses. Usually, these include the cost of any payroll services or software you use to streamline your process. Typically, these run between $15 and $200 per month for the base service, as well as $5 to $10 per employee per month.

How do I simplify my payroll process?

Generally, there are a few strategies that simplify payroll processes for businesses. First, find a payroll service that uses automation. Those allow for a set-it-and-forget-it approach, eliminating redundant tasks.

Favoring electronic tax forms and filing, along with direct deposit, also simplifies the process. Finally, integrations can eliminate redundant data entry across your various solutions, which not only saves time but can reduce error rates since the process is less manual.

How much can I expect to pay for a payroll service?

The cost of payroll services can run the gamut. More expensive options start around $200 per month, and you’ll often have to pay an additional monthly fee of between $5 and $10 per employee.

Usually, a solution qualifies as a “cheap” payroll service if the monthly fee is at or below $40 per month and the per-employee monthly cost is $5 or less.

Some cheap payroll services don’t charge per-employee monthly fees if your payroll size is under a specific number of employees, which functionally offsets a higher service fee, so it’s critical to factor that into the equation.

Other Financial Software Reviews

If you’re interested in learning about software designed for other financial aspects of your organization, check out these reviews:

Best Statistical Analysis Software For 2024

Best Point Of Sale Systems for 2024

Best Accounts Payable Automation Software Solutions for 2024

Conclusion

Correcting even a single payroll error costs an average of $291. Plus, it puts companies at risk of fines and noncompliance penalties. In 2022, the IRS collected more than $13.6 billion in fines from businesses that made payroll mistakes.

Cheap payroll service solutions make your internal payroll processes less complex administratively. Plus, they can help ensure that tax withholding, employee payments, and compliance needs are handled correctly, reducing your chances of encountering additional costs or penalty fees.

I hope my breakdown of the top cheap payroll services above helped you find your ideal fit.

Subscribe to our newsletter for more solutions, strategies, and tips from top thinkers and financial leaders.