10 Best Credit Card Processing Companies Shortlist

Here's my pick of the 10 best software from the 23 tools reviewed.

With so many companies offering credit card processing, it's difficult to identify the best one. You know you want to ensure a seamless payment process, from authorizing transactions to transferring funds, but need to find the right tool. I've got you! In this post, I share a curated list of the best credit card processing companies that I reviewed after extensive research and blending my findings with my exposure to these types of services in large organizations.

What Are Credit Card Processing Companies?

Credit card processing companies are vendors that offer digital solutions that handle electronic payment transactions, specifically those involving credit and debit cards. Their software plays a crucial role in facilitating secure and timely processing of payments, contributing to a more streamlined and convenient payment experience for both businesses and customers.

Some features you can expect from their services are payment gateway integrations, point-of-sale compatibility, secure transaction processing, fraud detection, and reporting tools. Most processors also support mobile payment options, such as ACH, Apple Pay, Google Pay, and Venmo.

Overview Of The 10 Best Credit Card Processing Companies

Let’s dive into these credit card processing companies. I’ll cover key features, strengths, weaknesses, and pricing.

Stax Pay is an all-in-one payment processing platform that caters to businesses and SaaS platforms with a focus on transparent pricing and dedicated in-house support. The platform delivers integrated payment and recurring billing solutions, ensuring compliance and offering the ability to pass on credit card processing fees through surcharging.

Why I picked Stax Pay: Stax Pay distinguishes itself with its integrated payment and recurring billing solutions tailored for businesses. It stands out due to its commitment to industry-leading compliance, the ability to handle seamless surcharging, and the simplification of payment acceptance for its users.

What makes Stax Pay different is its transparent pricing structure and the availability of real people ready to provide support. This approach to pricing and customer service is particularly important for businesses that need clear cost structures and reliable assistance.

Stax Pay Standout Features and Integrations:

Features include payment processing, customized invoicing, subscription billing, a virtual terminal, robust analytics, customer management, a developer-friendly API, inventory tracking, and multi-location support. Stax Pay also provides next-day funding, omni-channel payment solutions, point of sale options, and seamless integration with various business tools and software.

Integrations include Slack, Zapier, Microsoft Office, Google Suite, and CRMs. Additional integrations include mobile software development kits in Javascript and Python and a language-agnostic RESTful API.

Pros and cons

Pros:

- Versatile feature set

- High degree of customizability

- Subscription-based pricing

Cons:

- Primarily for U.S. markets

- Complex functionalities and configurations

Shopify POS is a point-of-sale system designed to integrate both in-store and online sales, catering to the needs of omnichannel retail businesses. It assists retailers in managing business operations, tracking payments, inventory, and customer data, and offers insights that are crucial for maintaining inventory levels and understanding customer preferences.

Why I picked Shopify POS: This company shines in its ability to provide a cohesive experience for credit card processing, leveraging Shopify's robust e-commerce infrastructure to offer seamless integration and secure transactions. It also distinguishes itself with its capacity for omnichannel selling, providing a smooth checkout experience and linking in-store with online sales.

This robust and integrated system eases daily operations, monitors payments, inventory, and customer information, and delivers insights that aid in enhancing efficiency and revenue growth.

Shopify POS Standout Features and Integrations:

Features that make this company stand out include its online inventory management which gives you the flexibility to pivot inventory to other locations or online based on performance. I also like its POS smart grid, which keeps your most-used apps, discounts, and products at your fingertips to speed up checkout.

Integrations include QuickBooks, Xero, Mailchimp, Klaviyo, LoyaltyLion, Yotpo, ShipStation, DHL Express, UPS, and Canada Post.

Pros and cons

Pros:

- Extensive third-party app marketplace for additional functionalities

- Direct credit card processing with competitive rates

- Seamless integration with Shopify's e-commerce platform

Cons:

- Additional fees for using external payment gateways

- Limited to countries where Shopify Payments is available

- Primarily benefits Shopify users, less so for non-Shopify merchants

Payment Depot, a merchant services company, offers payment processing for in-person and online transactions. It accepts all major credit cards and digital wallets.

Why I picked Payment Depot: Like Stax, which acquired it in 2021, Payment Depot doesn’t mark up credit card interchange rates. What’s more, it doesn’t charge setup, cancellation, or chargeback fees.

Payment Depot Standout Features and Integrations:

Standout features include virtual terminals, standard terminals, smart terminals, and a mobile credit card swiper. And because Payment Depot is owned by Stax, it also doesn’t add a markup to interchange fees.

Integrations include Authorize.net, Magento, WooCommerce, BigCommerce, Quickbooks, Opencart, Zencart, and Shopify.

Pros and cons

Pros:

- Processes online wallets

- Range of hardware (+ virtual terminal)

- No setup, chargeback, or cancellation fees

Cons:

- High monthly fees

- Few support resources

CardX by Stax is a payment processing tool that allows businesses to accept credit card payments at 0% cost, ensuring compliance with surcharging regulations. It offers online, in-office, and in-person payment processing solutions, enabling businesses to keep 100% of their credit card sales while automatically adhering to all rules and regulations.

Why I picked CardX by Stax: CardX by Stax stands out for its seamless surcharging compliance and automated compliance, making it easy for businesses to accept credit cards at 0% cost. This makes it the best choice for businesses looking for a payment processing solution that is fully compliant and allows them to keep all of their sales revenue. Additionally, the software ensures compliance with surcharging regulations and provides detailed transaction insights, helping businesses manage their finances more effectively.

CardX by Stax Standout Features and Integrations:

Features include transparent pricing, no hidden fees, compliance with surcharging regulations, easy integration, enhanced convenience, efficiency for businesses, customer support, real-time reporting, secure transactions, and fraud prevention tools.

Integrations include Stax Pay, Stax Connect, Stax Bill, Stax Processing, and Click to Pay.

Pros and cons

Pros:

- Custom branding options

- Multi-platform capability

- Seamless refund process

Cons:

- Not ideal for low-volume transactions

- Initial learning curve

Square Online is a platform that allows businesses to create and manage an ecommerce website, accept payments, and handle orders both online and in-store. It offers a user-friendly website builder, options for domain and email setup, and integration with other Square products like Point of Sale, Customer Directory, and Loyalty programs.

Why I picked Square Online: One of the key reasons I picked Square Online is its intuitive setup and user-friendly interface, allowing businesses to quickly establish an online presence without needing extensive technical knowledge. The platform offers customizable templates and a drag-and-drop editor, making it easy to create a professional-looking online store in minutes.

Furthermore, the integration with Square's POS system ensures that inventory and sales data are synchronized across both online and offline channels, providing a unified and efficient way to manage business operations. The platform also has robust and secure payment processing capabilities. It accepts all major credit cards, Apple Pay, and Google Pay.

Square Online Standout Features and Integrations:

Standout features include order management and multi-location management for easy inventory tracking in one place. It also has built-in SEO tools, shipping and other fulfillment options, and a mobile-ready design. Square Online also provides built-in tools for managing and tracking orders, as well as advanced reporting features that give business owners valuable insights into their sales performance.

Integrations include QuickBooks, Xero, Bookkeep, Facebook Ads, Google Ads, Squarespace, Thrive Inventory, Wix, WooCommerce, and more.

Pros and cons

Pros:

- Advanced reporting capabilities

- Built-in inventory management

- Flexible POS system

Cons:

- Limited design themes

- Limited payment options on free plan

Helcim is a payment solution that also offers invoicing and recurring payments. They tout their fee and rate transparency and give small businesses the tools to build and grow a database of customers.

Why I picked Helcim: Much more than a credit card payment processor, Helcim can function as an out-of-the-box business infrastructure. While it may not have the most advanced features, the combination of processor, POS, CRM, and online store gives new business owners a suite of tools to work with.

Helcim Standout Features and Integrations:

Standout features include a built-in POS system, as well as tools for inventory management. You can even use Helcim to build an online store, creating a centralized shopping and payment experience.

Integrations include Quickbooks, Magento, WooCommerce, and Foxy.io. There are few pre-built integrations, although Helcim offers an API for customization.

Pros and cons

Pros:

- Customer database

- PCI Level 1 service provider

- Included POS and inventory tool

Cons:

- Expensive at low sales volume

- Many prohibited industries

Merchant One is a financial services provider that specializes in payment processing solutions for businesses of various sizes and industries. The company aims to support businesses with quick approval processes, 24/7 customer service, and a focus on security and compliance with industry standards.

Why I picked Merchant One: Merchant One offers a range of payment solutions that enable credit card processing companies to accept various forms of payments from their customers. The services include the ability to process credit and debit card transactions, electronic check acceptance, and mobile payment solutions.

Merchant One Standout Features and Integrations:

Standout features include merchant services such as account setup, customer support, and compliance with payment card industry data security standards (PCI DSS) to ensure secure transaction processing. Merchant One also provides next day funding, meaning that transactions can be settled and funds can be deposited into an account on the following business day.

Integrations include Authorize.net, USAePay, Aloha, Maitre'D, Payeezy Gateway, Payflow Pro, Micros, and Paytrace Gateway.

Pros and cons

Pros:

- Offers recurring billing support

- Supports NFC and EMV technology

- Provides a variety of credit card terminals

Cons:

- Some potential for hidden fees

- Limited information on contract terms

Clover is a point-of-sale system, but it’s owned by payment provider Fiserv. Some other processors, including Flagship Merchant Services, are resellers of Clover hardware. Along with credit cards, Clover accepts Google Pay and Apple Pay.

Why I picked Clover: For small businesses, cutting down on complexity can save tons of time and frustration. A combined payment processor and POS can help get businesses up and running quickly.

Clover Standout Features and Integrations:

Standout features include processing not only credit cards, debit cards, and digital wallets, but also Venmo and PayPal. You can even scan and submit paper checks.

Integrations include Shopify, Magento, BigCommerce, Yelp, Time Clock, Payroll, Xero, Quickbooks, and WooCommerce.

Pros and cons

Pros:

- Reporting tools

- 24/7 phone support

- Rapid deposit

Cons:

- Complex pricing

- No free options

Podium is a cloud-based technology company. Originally named RepDrive, the platform was initially focused on providing reputation and review management tools for businesses. They then added text-based marketing and web chat functionality. In 2020, Podium added payments to its repertoire of features.

Why I picked Podium: Many local trade businesses, like plumbers and electricians, rely on word of mouth and reputation to grow revenue. They also have to collect payment in the field. Podium is a powerful combination of mobile payments and review management.

Podium Standout Features and Integrations:

Standout features include the ability to collect payment by subscription or even financing. With their text-based marketing, Podium also enables professionals to keep in touch with customers, collect payments, and solicit reviews, all from a smartphone.

Integrations include Lightspeed, ActiveCampaign, Freshbooks, Copper, Housecall Pro, Hubspot, Mailchimp, Quickbooks, ServiceTitan, Shopify, Squarespace, and Thumbtack. Podium offers 150 integrations as well as a developer portal to build new ones.

Pros and cons

Pros:

- Text-based transactions

- Reputation management tools

- Numerous trade software integrations

Cons:

- Poor customer service

- High monthly fees

Stripe is a payment platform and credit card processor that supports transactions in 46 countries, although China isn’t one of them. Stripe also offers products for invoicing, billing, fraud detection, and identity verification. It supports all major credit cards, including American Express.

Why I picked Stripe: Stripe is a great choice for e-commerce and other businesses that collect payments primarily online. It accepts 135 currencies, helping even small businesses go international. Stripe is also praised for its APIs and documentation, allowing businesses to build Stripe into their website or app however they like.

Stripe Standout Features and Integrations:

Standout features include the option to sell subscriptions, an increasingly necessary feature for products and services alike. Stripe also allows you to create shareable payment links to streamline transactions on the go. Adaptive Acceptance uses machine learning to intelligently retry credit card payments when they fail.

Integrations include Capital One, Constant Contact, Mailchimp, Postmark, Hubspot Data Sync, DocuSign, Xero, and Varos. Stripe has more than 80 pre-built integrations and offers APIs for businesses with development resources.

Pros and cons

Pros:

- Customizable with APIs

- Subscription capabilities

- Wide range of payments

Cons:

- Too complex for small businesses

- Limited in-person transactions

| Tools | Price | |

|---|---|---|

| Stax Pay | From $99/month | Website |

| Shopify POS | Plans start at $31/month | Website |

| Payment Depot | From $79/month | Website |

| CardX by Stax | From $29/month | Website |

| Square Online | From $35/month and 2.9% + $0.30/transaction | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Podium | From $289/month | Website |

| Stripe | From 2.9% + 0.30 per transaction | Website |

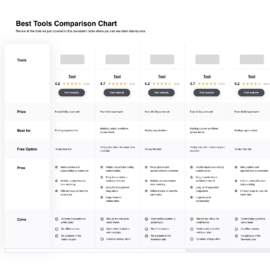

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Credit Card Processing Company Options

Along with my top picks, these are some other strong credit card processing options that didn’t make the list.

Selection Criteria For Credit Card Processing Companies

Here’s a breakdown of the main criteria I used to evaluate these credit card processors.

Core Functionality

First and foremost, I researched what credit cards and other payment methods each company processes. Why sign up with a processor that can’t take a major credit card, or can’t accept them from a mobile wallet? You need one that covers all your bases in taking card payments, whether that’s online, in person, or mobile, regardless of the card used.

Key Features

Along with the functionality above, here are some valuable features I looked for:

- Same-day and instant deposits

- Mobile payment processing

- Security and PCI compliance

- Reporting and analysis tools

- Point-of-sale functionality

- Inventory tracking

Pricing and Fees

Because most processors charge a combination of monthly fees and transaction fees, I considered which pricing structures made sense for different businesses. I also researched other costs, such as setup fees, cancellation fees, and chargeback fees, as well as whether contracts required a long-term commitment.

Hardware Needs and Compatibility

In order to process in-person payments, most processors require some type of hardware to read credit and debit cards as well as to house a POS system. I considered what types of hardware each company was compatible with. I prioritized processors with a range of hardware price points.

Customer Support

Finally, I evaluated what customer services each credit card processor provided. I considered both the number of channels (phone, live chat, etc.) and how the service was rated in user reviews.

People Also Ask

Still trying to make sense of credit card processing? Here are answers to some of the most common questions.

How much is a typical credit card processing fee?

A typical credit card processor will charge a fee of 1% – 4%. This includes processing fees, assessment fees, and interchange fees. While rates vary from one processor to another, they can also vary based on whether a transaction is online or in-person, as well as whether the customer is paying with a debit or credit card. Some processors charge a flat transaction fee (typically 5-50 cents) in combination with a percentage fee.

What is a payment service provider?

Payment service providers allow businesses to accept online payments by handling the behind-the-scenes process of moving money from a customer’s account to a business account. For businesses to accept online payments, they need a merchant account. A payment service provider operates one merchant account that is shared by multiple businesses.

Getting started with a payment service provider is usually faster and less expensive than using a merchant service provider. The drawbacks include transaction and volume limits and an increased risk of account freezes.

What is a merchant service provider?

Merchant service providers enable businesses to collect online payments by creating an individual merchant account for the business. When working with merchant service providers, the vetting and setup process takes longer than it would with a payment service provider. The upside is that you have more flexibility in negotiating rates, transaction volume, and operating fees.

What is the best credit card processor for a small business?

Even among small businesses, different industries and business models affect which credit card processor is best. Businesses should consider fees and processing rates, along with which channels they use for sales. A payment service provider, like Stripe, Square, or Stax, allows you to get started collecting payments quickly. Because it operates in 202 countries and supports more than 20 currencies and cryptocurrencies, PayPal is popular among small businesses with a global reach.

In the End, Your Unique Needs Determine the Best Credit Card Processing Provider

If it were as simple as picking the single best credit card processing company and recommending it to everyone, this article would be much shorter. But choosing the right credit card processor can actually be a complex, multi-faceted decision.

When comparing vendors, you should consider not just the cost of a single transaction, but the overall processing costs, as well as your sales volume and channels. And, like any other technology, your processor needs to integrate with your other tools, be they hardware or software.

While different businesses have different needs, this list narrows down the field so you can focus on what matters to you.

Don’t miss out on the latest financial trends and tactics by subscribing to our weekly newsletter, tailored for executives and professionals.