10 Best Merchant Account Services Shortlist

Here's my pick of the 10 best software from the 21 tools reviewed.

Your business needs a new merchant account, but there are too many similar services on the market and it’s not always obvious from looking at a provider’s website whether its services will suit your needs. You know you want to increase revenue through expanded payment options, improve customer satisfaction, and streamline financial reporting, but need the right provider for it. I've got you! That’s why I’ve researched, summarized and categorized the offerings from ten of the best providers to help you quickly compare options and find the best merchant account services for your business today.

What Are Merchant Account Services?

Merchant account services refer to financial services that enable businesses to accept electronic payments from customers, whether through debit cards, credit cards, or other payment types. These services include the setup of merchant accounts, processing transactions, and ensuring the secure transfer of funds from the customer to the merchant, facilitating the purchase of goods or services.

These services play a crucial role in enabling businesses to enhance security in payment processing, adapt to the digital economy and meet the diverse payment preferences of their customers.

Overview Of The 10 Best Merchant Account Services

Here’s a detailed assessment of every merchant account I chose for the top list, along with an explanation of what I think it does best and which type of business it suits. I’ve also included information on each account’s integration and pricing.

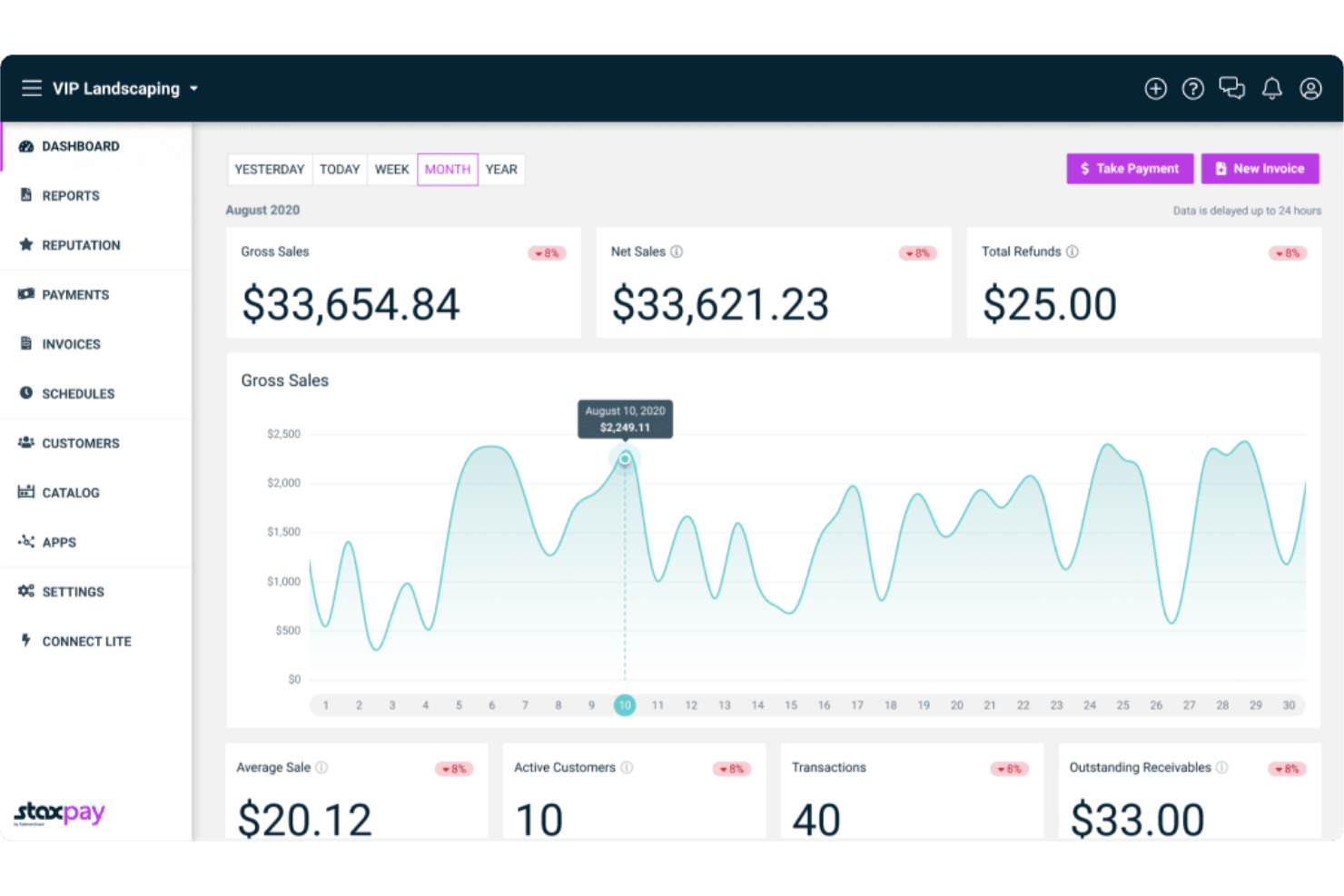

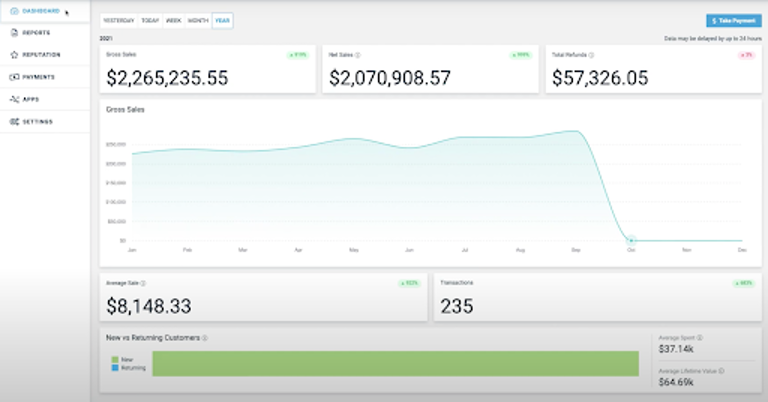

Stax Pay is a valuable payment processing platform designed to support businesses and SaaS platforms with cost-effective payment solutions. It features automated subscription billing to help manage recurring payments and reduce late or failed transactions. Additionally, Stax Pay supports compliant surcharging, allowing businesses to pass on credit card processing fees to customers while adhering to industry standards.

Why I chose Stax Pay: Stax Pay is an all-in-one platform that not only simplifies payment processing but also provides a range of capabilities such as surcharging, equipment, lending, mobile payments, and e-commerce solutions. This breadth of services, combined with a commitment to transparency and customer support, positions Stax Pay as a versatile and reliable partner for businesses seeking merchant account services.

Stax Pay also offers up to 40% savings on payment processing fees to assist businesses in managing their transactions efficiently.

Stax Pay Standout Features and Integrations

Features include payment processing, invoicing, inventory management, recurring billing, customer management, financial reporting, multi-location support, and customizable digital receipts. The platform also provides advanced security features, integration capabilities with various business tools, and real-time transaction monitoring.

Integrations include Slack, Zapier, Microsoft Office, Google Suite, and CRMs. Additionally, Stax Pay allows for easy integration of payment processing capabilities into software and mobile apps with comprehensive mobile software development kits in Javascript and Python, and a language-agnostic RESTful API.

Pros and cons

Pros:

- Flat-rate subscription pricing

- Easy integration across multiple systems

- Advanced security features

Cons:

- Higher cost for lower-volume merchants

- Limited international support

Payment Depot is a highly-rated merchant account provider, owned by Stax. Its membership-style offering helps customers save on fees, but its credit card processing capabilities are where I think the company really shines.

Why I picked Payment Depot: If you’re a B2B business that processes a lot of credit card payments, I think you’ll love Payment Depot’s offering. It uses a payment gateway called PayTrace, which automatically fills data fields required to get level II and level III rates on business cards. Combine this with Payment Depot’s flat membership fee, and it’s a solid offering. As long as you don’t want a load of cutting-edge features, I think you’ll find Payment Depot hard to beat.

Payment Depot Standout Features and Integrations

Features aren’t quite as bountiful with Payment Depot as other providers in this list, if I’m honest. What you see is what you get. One feature I think brick-and-mortar merchants might love, however, is the wide range of POS equipment, courtesy of Clover, that Payment Depot provides.

Integrations include most major e-commerce platforms like Shopify and Magento, as well as Quickbooks, Revel, NCR, and Authorize.net.

Pros and cons

Pros:

- No cancellation fees

- Great customer service

- No hidden fees

Cons:

- Not cost-effective at low volumes

- No additional payment services like invoices

Helcim is a suite of payment solutions that help businesses take payments online and in-store. They offer many of the same features as other merchant account services on this list, but what sets Helcim apart is their pricing. There are no monthly fees and you get the lowest interchange rate for every transaction.

Why I picked Helcim: I think the company offers exceptional value for money, plain and simple. Helcim uses an “interchange plus” pricing model, which means the cost for each transaction fluctuates based on the underlying interchange rate. So when payments are processed at a lower interchange rate, your business gets the savings, not Helcim. I also think businesses will appreciate the fact that the company decreases its margin the more payments you process with them.

Helcim’s pricing structure also means you don’t have to pay a monthly subscription to access the platform. I like that point-of-sale software, online checkouts, and virtual terminals are all available for free.

Helcim Standout Features and Integrations

Features like an online checkout, card reader, and virtual terminal are just a small part of Helcim’s appeal in my view. I think what really sets the company apart from other businesses in my list is its pricing, as discussed above, and its customer service—who you can contact by phone, email, or social media.

Integrations let you connect Helcim with a range of third-party tools. These are split into three groups: accounting services (like QuickBooks), shopping carts (like Magento), and billing systems (like Great Exposure).

Pros and cons

Pros:

- All-inclusive platform

- No monthly fees

- Very low transaction rates

Cons:

- Not suitable for high-risk businesses

- Forecasting costs can be difficult

CardX by Stax is a payment processing tool that allows businesses to accept credit card payments at 0% cost, ensuring compliance with surcharging regulations. It offers online, in-office, and in-person payment processing solutions, enabling businesses to keep 100% of their credit card sales while automatically adhering to all rules and regulations.

Why I picked CardX by Stax: CardX by Stax stands out for its seamless surcharging compliance and automated compliance, making it easy for businesses to accept credit cards at 0% cost. This makes it the best choice for businesses looking for a payment processing solution that is fully compliant and allows them to keep all of their sales revenue.

Additionally, CardX by Stax provides secure payment options for online, in-office, and in-person transactions, and ensure compliance with all rules and regulations. Their automated compliance and cost-saving features make them a leader in surcharge compliance for businesses and government and educational institutions.

CardX by Stax Standout Features and Integrations

Features include transparent pricing, no hidden fees, compliance with surcharging regulations, easy integration, enhanced convenience, efficiency for businesses, customer support, real-time reporting, secure transactions, and fraud prevention tools.

Integrations include Stax Pay, Stax Connect, Stax Bill, Stax Processing, and Click to Pay.

Pros and cons

Pros:

- Integrations with several POS systems

- Advanced reporting tools for transaction insights

- Customizable surcharge rules

Cons:

- Potential integration challenges with less common payment systems

- Limited international support

Merchant One is a full-service credit card processing provider with a focus on custom solutions. The company provides a range of payment solutions, but every package is tailored to merchants.

Why I picked Merchant One: I think the company’s flexibility is unrivaled. You don’t need to buy specific hardware to use Merchant One’s payment gateway service, for instance. That’s because the company provides a range of advanced API and SDK-based features that allow you to deploy Merchant One’s software on your existing terminals. I like that you aren’t left to figure this out on your own, either. The company provides integration examples, an integration guide, and API documentation.

Merchant One Standout Features and Integrations

Features include the merchant gateway service I have described above for card not present and online transactions. I think merchants will also appreciate that Merchant One provides several credit card terminals, as well as a range of Clover products, all pre-loaded with its software. iPhone and Android card readers are also available.

Integrations are possible through Merchant One’s API, meaning you can connect the company’s software to any existing POS hardware.

Pros and cons

Pros:

- Excellent customer support

- No setup fee

- Highly customizable solution

Cons:

- Can be expensive

- Long-term contract

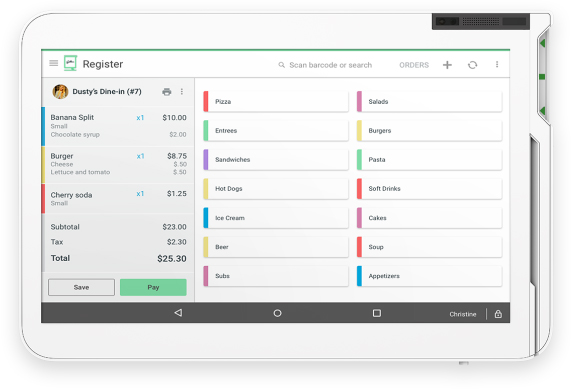

Square is a comprehensive payment solution that provides hardware and software to physical and online businesses. It can act as your store’s POS, help you create a website, manage your inventory, and report sales figures.

Why I picked Square: You’ve probably seen Square POS hardware when shopping locally. The more I learn about Square, the less I’m surprised. I think they are a popular choice for these kinds of stores for several reasons. Firstly, they offer affordable hardware that brick-and-mortar stores rely on to take payments in person. They don’t charge expensive leasing fees, either, and there is no fee to return the hardware.

Another thing I like about Square is that it provides several software solutions that help store owners manage their businesses. That includes an online store builder, a payment processing solution, payroll services, and inventory management. In the same way that Stripe is an all-in-one solution for digital business, Square is the only solution most physical retail outlets need.

Square Standout Features and Integrations

Features that I think make Square ideal for brick-and-mortar stores include a range of POS hardware suitable for any budget, business-focused software, like inventory management and appointment booking tools, and an online store builder. I also love that you can manage everything from a single app

Integrations are available from the Square App Marketplace. These include native integrations with popular business tools, like QuickBooks, WooCommerce, Jotform, and TrustPilot Reviews.

Pros and cons

Pros:

- Easy-to-use online store builder

- No hardware leasing or return fees

- Huge range of hardware

Cons:

- A lack of customer support

- Not the most cost-effective option

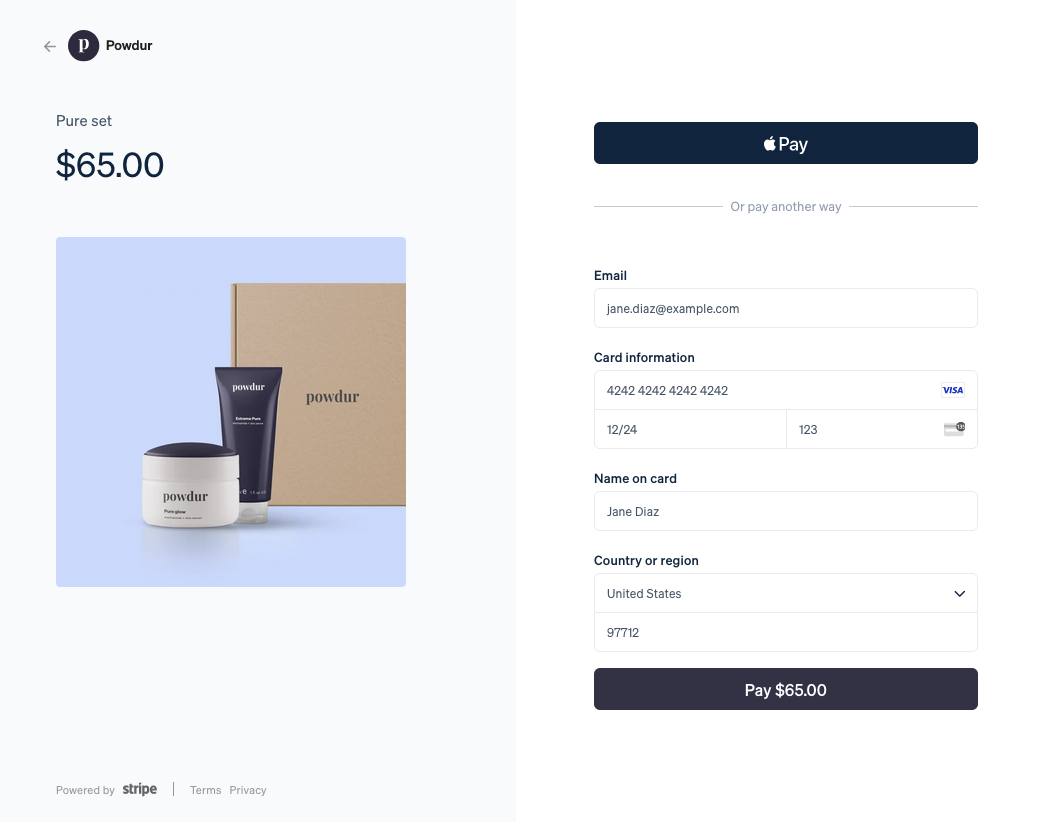

Stripe is a global payments platform that provides software and APIs to help businesses take payments. Like Stax, it offers a range of additional features such as invoicing terminal solutions, but it's particularly geared towards online businesses.

Why I picked Stripe: Speed and simplicity. That’s the two words that come to mind when I think of Stripe Checkout. It’s probably the easiest tool in my list to use to create a hosted checkout page, integrate it with your website platform, and start taking payments. I love that you don’t need to know how to code to get started, either. But if you are more technically minded, then you can use Stripe Elements to design your own payment flow. It’s basically got something for everyone.

It’s pretty common for online businesses to serve a global audience, which is another reason to choose Stripe. The platform supports over 135 currencies, as well as localized options like Alipay.

Stripe Standout Features and Integrations

Features that I think set Stripe apart from other tools in my list include its suite of pre-built payment products. This includes a checkout page, recurring billing functionality, and payment links, as well as payment processing. If you’re a developer, then you’ll love that Stripe makes it easy to build your own payment tools with access to APIs and low-code solutions.

Integrations are available with dozens of business tools, including e-commerce platforms like BigCommerce, bookkeeping software like Bench Accounting, and data platforms like Databox.

Pros and cons

Pros:

- Secure transactions

- Flexibility to build custom systems

- Huge range of payment tools

Cons:

- Expensive processing rates

- User Interface can be confusing

Skyflow delivers data privacy vaults, like the kind pioneered by Apple and Netflix, to merchants through an API. It’s straightforward for developers to integrate the platform into your online checkout and your store will become PCI-compliant almost immediately.

Why I picked Skyflow: Few merchant accounts take data privacy as seriously as Skyflow from what I’ve seen. While you’ll still need to use a payment provider like Stripe, Skyflow ensures all payments are processed in a secure and PCI-compliant manner. I like that Skyflow is easy to integrate into your checkout process, too. The main functionality is delivered by API, but there are client-side SDKs for iOS, Android, and JavaScript, too.

Skyflow Standout Features and Integrations

Features that I think set Skyflow apart from others center on privacy. The Skyflow Fintech Vault connects to your online store via an API and removes any sensitive payment data from your environment. Everything is offloaded to Skyflow, meaning you become almost instantly PCI compliant. But it doesn’t stop there. I also like that Polymorphic Encryption means data is encrypted at rest and in transit, while the company’s Advanced Data Governance Engine ensures PCI requirements are met. Skyflow also takes a zero-trust approach to data privacy, meaning every access request is never trusted and always verified.

Integrations include a number of pre-built solutions for payment processors, including Stripe, Visa, Experian, Plaid, and Alloy. You can even use the platform to build your own integrations.

Pros and cons

Pros:

- Fast PCI compliance

- API connection

- Privacy-first solution

Cons:

- May require help from developers to install

- Not a standalone solution

Dharma Merchant Services offers a comprehensive merchant services account, with low rates and good customer service. But it’s their approach to surcharging that sets them apart from competitors and makes them an ideal choice for businesses like restaurants that handle a large amount of credit card payments.

Why I picked Dharma Merchant Services: I love that the company offers a surcharge service, which lets you pass on all of a credit card’s processing fees to the customer — something few other providers in this list do. I think it’s one of the easiest ways a company can reduce costs and improve revenue—as long as your customers are happy to pay it. What’s more, the company also offers “interchange plus” pricing, with flat, fixed margins and no monthly fee.

Dharma Merchant Services Standout Features and Integrations

Features are what you’d expect from a decent all-round provider. I like that the company offers multiple payment solutions that incorporate its surcharge capabilities, including a virtual terminal, mobile payment processing software, and online payment links. I’m also a fan of the reporting dashboard that offers a range of pre-built reports and means retailers can start understanding their businesses from day one.

Integrations include most POS hardware systems and MX Merchant.

Pros and cons

Pros:

- No long-term contracts

- Low fees

- Surcharging features

Cons:

- Not suitable for businesses processing less than $10,000 per month

- Not suitable for high-risk businesses

Flagship Merchant Services isn’t flashy and doesn’t have the best website, in my opinion. But it has the best approach to customer service, and all of the services most small and medium-sized businesses will ever need.

Why I picked Flagship Merchant Services: The company’s commitment to customer service puts it above a lot of other options on this list. If it’s your first time buying a merchant account, Flagship Merchant Services can guide you through the process. Unlike most of the other merchants on this list, you can call them up and speak to a sales rep. You also qualify for free equipment when you open an account and the company promises the best processing rates guaranteed—two great selling points for cash-strapped startups.

Flagship Merchant Services Standout Features and Integrations

Features include everything a first-time retailer needs to start accepting payments, in my view. This includes a free Clover Mini Point-of-Sale or EMV Certified Terminal, e-commerce credit card processing, and fraud prevention services. I like the fact that the offering can scale with you. For example, once you’ve found your feet as a retailer, Flagship Merchant Services also offers API access, so you can customize your checkout flow.

Integrations focus on Clover’s payment processing offering. Flagship’s ecommerce offering Quiq, has API access you can use to integrate with other software solutions.

Pros and cons

Pros:

- Same-day funding

- Broad range of payment solutions

- Free and easy account setup

Cons:

- Few native integrations

- Lack of transparency on pricing

| Tools | Price | |

|---|---|---|

| Stax Pay | From $99/month | Website |

| Payment Depot | From $79/month | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| CardX by Stax | From $29/month | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Square | From $36/month plus 2.9% + $0.30 per transaction | Website |

| Stripe | From 2.9% + 0.30 per transaction | Website |

| Skyflow | Pricing upon request | Website |

| Dharma Merchant Services | From $25/month and 0.15% + 8¢ | Website |

| Flagship Merchant Services | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Merchant Account Services

If you don’t find what you’re looking for in the list above, try one of these merchant account services that are worth checking out.

Selection Criteria For Merchant Account Services

Finding the best merchant account services provided from the hundreds of options isn’t easy—you wouldn’t be reading this article otherwise. So how did I shortlist the merchant account providers above?

Here’s what I evaluated:

Core Functionality

The first thing I analyzed was whether merchant account services had the core functionality a business would expect. These are the basic features the solutions needed to have to make my shortlist:

- Allow customers to make online and in-person payments

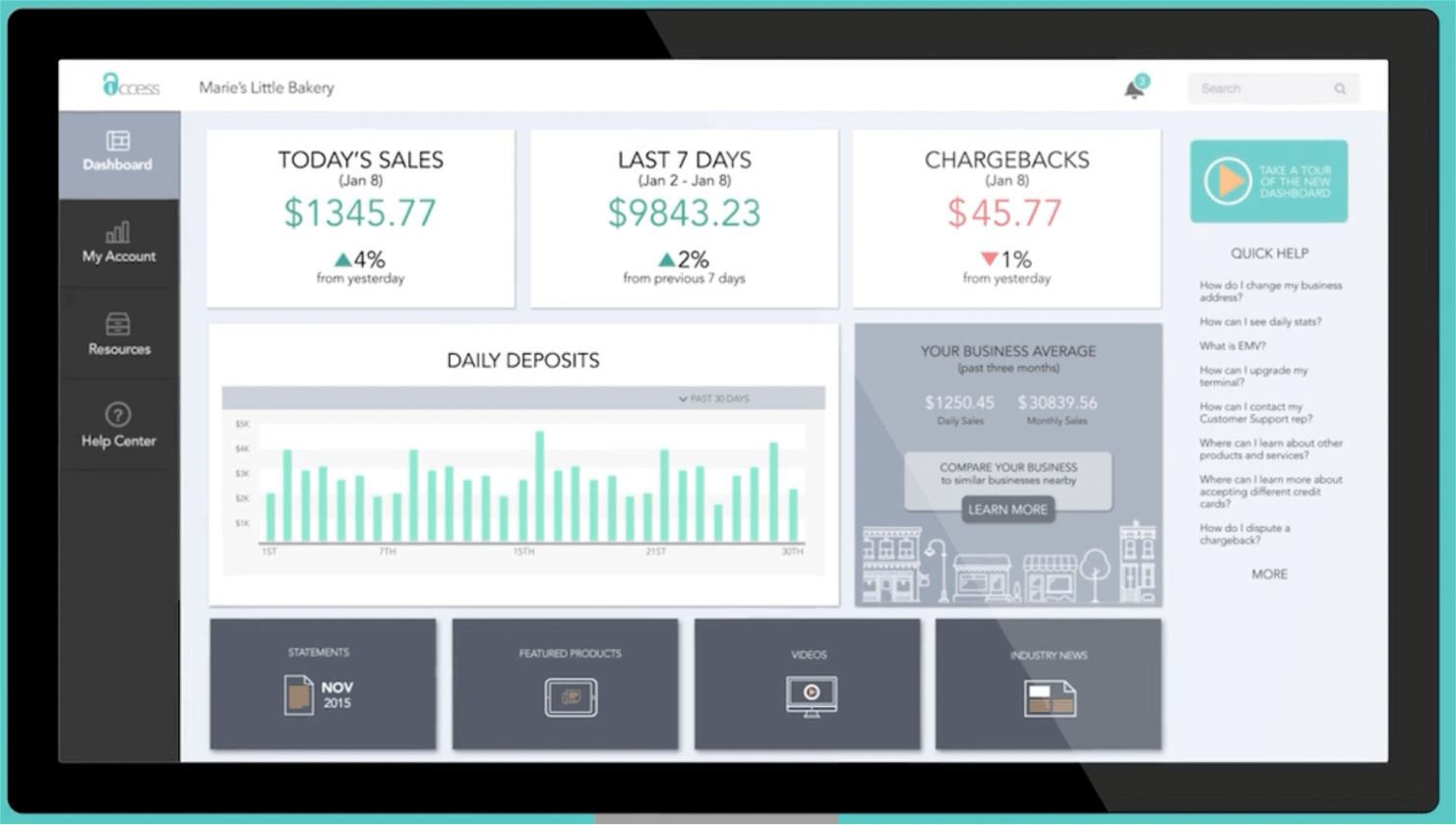

- Allow businesses to manage payments through an online dashboard

- Send business funds within five working days or less

Key Features

To be able to deliver the core functionality I’ve highlighted above, many of the merchant accounts had the following key features:

- Payment processing: merchant accounts should let businesses accept a variety of payment methods online and in-person

- Fraud prevention tools: many merchant accounts provide businesses with a range of tools and services that prevent financial fraud like chargebacks

- Online checkout integration: merchant accounts work best when they integrate with a retailer’s existing website. That being said, some merchant accounts give retailers the tools to build their own websites from scratch.

- Reporting and analytics: retailers need real-time payment reports and dashboards to understand cash flow and create accurate financial forecasts.

- Customer support: technical issues need to be resolved fast to stop them from impacting a retailer’s revenue.

Usability

Payment systems are complex enough without you having to waste time working out how to host a checkout page or get to grips with a merchant’s dashboard. That’s why I’ve prioritized merchant accounts that are easy to use.

Almost all of these services have clean, intuitive interfaces. Many have excellent support capabilities, too.

Integrations

While many of the merchant account services I’ve listed offer “all-in-one” solutions, they still need to integrate with other financial tools like online bookkeeping software. As such, I’ve chosen merchant accounts that natively integrate with these platforms.

Fees

I’ve provided merchant accounts with a wide range of pricing models. Some merchants may prefer to pay a percentage fee per transaction. Others may prefer a flat monthly fee. Percentage fees range from 1.9% to 2.9% per transaction. Monthly fees tend to range from $13.95 to $99 per month. Be aware that companies charging smaller monthly rates may also charge additional fees per transaction.

People Also Ask

Still have questions about finding the best merchant accounts services for your business? My frequently asked questions section below may help.

How easy is it to open a merchant services account?

Opening a merchant services account should be a relatively straightforward process. As long as you have basic information about your business, you should be able to open an account online.

How do merchant account services work?

Merchant account services allow businesses to take debit cards, credit cards, and other payments from customers. Many of the merchant account services on my list process transactions without involving an intermediary, transferring funds from the customers account to their own for a small fee. Those funds are then transferred to your business account.

How much does a merchant account cost?

Merchant accounts charge fees in several different ways. Some charge a percentage fee on each transaction, while others charge a flat fee per month.

Will my business qualify for a merchant account?

The vast majority of businesses will qualify for a merchant account. Even high risk businesses, like adult and CBD brands, can use specialist services to qualify for a merchant account.

What payment types will my merchant account accept?

The payment types your merchant account will accept will depend on the provider. That being said, almost all merchant accounts will accept credit and debit cards, and mobile payments like Apple Pay and Google Pay.

Did You Find What You Were Looking For?

I hope you found what you were looking for in my list of merchant account services.

It’s hard to prescribe a specific service when everyone’s business needs are different, but I’ve done my best to categorize merchant accounts by their use case.

If you need more in-depth advice on financial software or corporate finance in general, sign up for our newsletter.