10 Best POS Software For Small Business Shortlist

Here's my pick of the 10 best software from the 25 tools reviewed.

There are seemingly countless point-of-sale solutions available, so figuring out which one is best for you is tough. You want to streamline the checkout process, manage inventory, and generate sales reports but need to figure out which tool is the best for the job. I've got you! In this post I make things simple, leveraging my experience managing my own business and having used dozens of different tools to bring you this curated list of the best POS software for small business.

What Is POS software for small business?

Small business POS software refers to digital solutions used by smaller enterprises to process transactions, manage inventory, and generate reports, providing them with the tools needed to conduct sales efficiently. Therefore, they typically include features like transaction processing, inventory management, sales reporting, employee management, and customer relationship management.

A POS system provides a financial controller with up-to-date information on revenue generation and inventory that they can monitor and analyze to assess the overall cost structure and profitability of sales channels.

Overviews Of The 10 Best POS Software For Small Business

Below, you’ll find overviews of my top POS software picks. Each overview contains a summary of standout features, integrations, available pricing details, and some notable pros and cons.

KORONA POS is a cloud-based point-of-sale system designed to cater to a wide range of business types, including retail stores, wineries, event spaces, and more. Known for its versatility and robust feature set, Korona POS offers an intuitive interface that simplifies the sales process for both employees and managers.

Why I picked KORONA POS: One of the key reasons Korona POS stands out for small businesses is its scalability and ease of use. The system is designed to grow with your business, offering seamless integration with various hardware and software tools. Additionally, Korona POS offers robust inventory management features that help small business owners keep track of stock levels in real time, reducing the risk of overstocking or stockouts. The system's customer relationship management (CRM) tools also enable businesses to maintain strong customer relationships.

KORONA POS Standout Features and Integrations

Standout features include detailed and customizable reporting tools, allowing businesses to generate comprehensive reports on sales, inventory, and customer behavior. Furthermore, its integrated payment processing supports a variety of payment methods, including credit cards, mobile payments, and contactless transactions.

Integrations include QuickBooks, WooCommerce, Shopify, Magento, BigCommerce, Mailchimp, and various payment processors such as PayPal, Stripe, Worldpay, Authorize.Net, and CardConnect.

Pros and cons

Pros:

- Provides robust inventory management tools

- The system is highly customizable

- Supports multiple business locations

Cons:

- Lacks on-location installation support

- Each terminal incurs a separate cost

Stax Pay is a payment processing platform that provides businesses with integrated solutions, including payment acceptance, automated billing, and compliant surcharging. Its all-in-one POS and business management software allows for secure in-person and online payment processing, as well as the integration of necessary tools, like accounting software, within a single dashboard

Why I picked Stax Pay: I selected Stax Pay because it offers a unified business management platform that supports both in-person and online credit card payment processing. This all-in-one approach is ideal for small businesses looking to consolidate functions like invoicing, scheduling of recurring billing, payment tracking, and financial management. I also like that the platform offers robust analytics and reporting capabilities to monitor trends, refunds, and transaction history.

Stax Pay Standout Features and Integrations

Standout features include scheduled and automated payments, synchronized in-person and online transaction information, and integrated business tools. The platform also offers a compliant surcharging feature that allows businesses to pass on credit card processing fees to customers.

Additionally, Stax Pay offers a suite of POS capabilities for different payment scenarios, including SaaS platform integration, ACH payments, online and mobile payments, and in-person transactions.

Integrations include Slack, Zapier, Microsoft Office, Google Suite, and CRMs. You can also integrate payment processing capabilities into software and mobile apps with comprehensive mobile software development kits in Javascript and Python.

Pros and cons

Pros:

- All-in-one tools and point-of-sale solution

- Recurring billing and invoicing tools

- Cost-effective with potential savings on processing fees

Cons:

- Potential additional costs

- May not be best suited to low-volume businesses

Best for ecommerce, mobile, and physical payment terminals

Payment Depot is a merchant solutions provider that offers a POS system for ecommerce, mobile, and physical payment terminals. By focusing on transparent interchange pricing, it helps companies reduce the amount they spend on merchant service fees, making it a cost-saving solution for small and medium-sized businesses.

Why I picked Payment Depot: I selected Payment Depot because of its flexibility, which makes it a good option for businesses of different sizes and industries. It's suitable for small businesses in retail, services, restaurants and bars, healthcare, and more. A free payment gateway is available as well as virtual terminal capabilities provided through partnerships like SwipeSimple. These allow merchants to process payments online, via mobile, and over the phone without incurring additional gateway fees.

Payment Depot Standout Features and Integrations

Standout features include the membership-based pricing model for credit card processing, which offers tailored interchange+ pricing. The company is also recognized for its commitment to customer care, and has garnered positive feedback from clients who have experienced cost savings.

Integrations include Shopify, WooCommerce, BigCommerce, PrestaShop, and OpenCart. It also integrates with payment systems such as authorize.net and business management systems like Revel Systems.

Pros and cons

Pros:

- Cost-effective for businesses with high transaction volumes

- User interface is straightforward and intuitive

- Comprehensive equipment offerings

Cons:

- Limited to US-based, non-high-risk merchants

- Not ideal for low-volume businesses

Shopify POS is software that helps streamline business operations by unifying sales channels. By focusing on omnichannel solutions, Shopify helps deliver a more consistent customer experience.

Why I picked Shopify POS: I selected Shopify POS because it’s specially designed for omnichannel retailers. Customers and employees will have a predictable experience and workflow whether the order is an online, in-store, or ship-to-home order.

Standout features include real-time inventory monitoring so companies with multiple sales channels can ensure their most up-to-date inventory numbers are syncing across channels, helping avoid canceled transactions and surprise out-of-stock alerts.

I also like how Shopify’s real-time syncing also applies to customer data. It used to be difficult to analyze customer behavior when dealing with multiple sales channels—but Shopify makes it simpler by unifying customer data records across channels and automatically tagging transactions to a specific customer account based on factors like the credit card used.

Integrations include PayPal, Stripe, Authorize.Net, Square, QuickBooks, Xero, FreshBooks, Mailchimp, Klaviyo, Zendesk, Google Analytics, Metrilo, ShipStation, and Easyship.

Pros and cons

Pros:

- Competitive payment processing rates for high-volume businesses

- Customer relationship management and data-tracking features

- Precise inventory management and tracking (with omnichannel syncing)

Cons:

- Many features require two paid subscriptions: Shopify + POS Pro, which starts at $89/month

- No free tier ($39/month + processing fees is the cheapest option)

Lavu is a POS system designed specifically for restaurants, bars, and other food and beverage establishments. As a cloud-based solution, Lavu offers a comprehensive suite of tools that centralize various aspects of restaurant management, from order processing and inventory management to employee scheduling and CRM.

Why I picked Lavu: I particularly like Lavu's iPad POS system, which offers a seamless and user-friendly experience, allowing staff to take orders, process payments, and manage tables with ease. This mobility and flexibility are crucial for small businesses that need to maximize space and efficiency. Additionally, the iPad POS system supports multiple payment methods, ensures quick transactions, and integrates smoothly with other Lavu features, making it a powerful tool for any small restaurant or bar.

Lavu Standout Features and Integrations

Standout features include the order management system, allowing businesses to tailor menus and ordering processes. The inventory management feature helps track stock levels in real-time, and the employee management tools, such as scheduling and time tracking, help optimize staff productivity and monitor performance.

Integrations include Digital Pour, Marketman, CheddarSuite, Up'n Go, CheckPlease, OpenTable, Pepper, LoyaltyMatch, Restaurant365, Shogo, Quickbooks, Xero, ADP, DoorDash, Uber Eats, Grubhub, and more.

Pros and cons

Pros:

- Inventory management tools

- Reporting and analytics features

- Custom-built POS for restaurants

Cons:

- Not suitable for businesses outside the food and beverage industry

- Limited offline functionality

Epos Now is a provider of POS software designed to meet the of various business sizes, including small businesses. Offering a range of both hardware and software solutions, Epos Now aims to centralize operations for organizations in the retail and hospitality industries. The system is known for its user-friendly interface, extensive features, and cloud-based functionality.

Why I picked Epos Now: As a small business POS software, Epos Now stands out for its scalability, cloud-based nature, and feature-rich platform. The cloud-based system allows business owners to access real-time data from anywhere. This flexibility ensures that the software can grow alongside the business, adapting to increased demands. Other features that support small businesses include the ability to manage multiple locations, detailed sales and inventory reporting, and customizable user permissions.

Epos Now Standout Features and Integrations

Standout features include its customer relationship management (CRM) tools for tracking customer purchase histories and preferences, and its inventory management system for users to track stock levels, set up automatic reorder alerts, and manage suppliers efficiently. Additionally, Epos Now offers detailed analytics, providing insights into sales trends, employee schedules, and overall business health.

Integrations include WooCommerce, BigCommerce, Magento, PayPal, Stripe, Sage, Zapier, Google Analytics, Workforce.com, APO, Deputy, Deliveroo, Mr Yum, Hopt, QuickBooks, Xero, Mailchimp, Shopify, Appointedd, simpleERB, Worldpay, and more.

Pros and cons

Pros:

- Flexible and customizable software

- Good reporting features

- User-friendly interface

Cons:

- Initial setup can take time

- Occasional slow system performance

Helcim's POS software for small businesses is designed to facilitate the acceptance of payments through various channels, including in-store, online, and mobile transactions.

Why I picked Helcim: I selected Helcim because it emphasizes transparent pricing without long-term contracts or hidden fees. It also provides a secure environment for processing payments, adhering to industry-standard security protocols.

Helcim Standout Features and Integrations

Standout features include an integrated system that allows businesses to manage sales, track inventory, and process payments using a single platform. It includes invoicing, customer management, and reporting tools to help business owners keep track of their sales and customer interactions.

I also like how Helcim offers a suite of services such as merchant accounts, POS systems, card readers, and an online payment gateway, which are designed to support the transactional needs of businesses across different industries.

Integrations include Xero Payments, QuickBooks, Great Exposure, Foxy.io, and WooCommerce.

Pros and cons

Pros:

- Terminals and printers can be connected via USB or Bluetooth

- Excellent value for money

- Quick and easy application and approval processes

Cons:

- Lacks a manual or instructions

- Card terminal can be clunky for clients

Clover offers POS and small business management systems for all types of businesses—whether you need a countertop POS or a handheld device.

Why I Picked Clover: I selected Clover because of its high-quality hardware options. Clover has handheld, mobile, and countertop POS hardware, and multiple terminals and devices that you can easily link together to customize your system.

Clover Standout Features and Integrations:

Standout features include the ability to accept multiple payment options (all major credit cards, mobile payments, cash, and even check scanning). This makes it easy for customers and ensures you don’t miss any sales.

I also like that Clover has team management and scheduling features built into the POS software.

Integrations include QuickBooks by Commerce Sync, Thrive Inventory, Digital Loyalty, Time Clock, and Skipcart Delivery.

Pros and cons

Pros:

- 24/7 phone support

- Offline functionality

- Countertop, portable, and mobile POS devices

Cons:

- Expensive

- No free hardware

Merchant One is a payment processing service that offers businesses the ability to accept and manage credit card transactions.

Why I picked Merchant One: I selected Merchant One because it offers various tools designed to assist small business owners in managing day-to-day sales activities, tracking inventory levels, and understanding customer purchasing patterns. Merchant One's POS software is also part of a broader suite of services that includes merchant accounts and payment processing, aiming to provide a comprehensive system for small businesses to handle their financial transactions.

Merchant One Standout Features and Integrations

Standout features include competitive pricing structures, including interchange-plus pricing, which can provide businesses with transparency and potentially lower processing costs. This pricing model separates the interchange fees charged by card networks from the markup charged by the payment processor, allowing businesses to see the exact costs involved.

I also like how Merchant One supports a wide range of payment methods, including credit and debit cards, electronic checks, and mobile payments.

Integrations include First Data Corporation, Fifth Third Bank N.A., Maitre'D, Micros, Paytrace Gateway, Payeezy Gateway, Payflow Pro, Authorize.net, Aloha, and USAePay.

Pros and cons

Pros:

- Offers a variety of hardware options

- User-friendly interface

- Provides a mobile app for on-the-go payments

Cons:

- May not be suitable for low-volume businesses

- Limited transparency in contract terms

Lightspeed POS is a tool that optimizes the sales process by allowing you to manage multiple offline and online stores in one place. It’s particularly useful for ecommerce firms with multiple online sales channels.

Why I picked Lightspeed: I picked Lightspeed due to its intuitive omnichannel setup for retailers. You can use it to sell on Amazon, Facebook, Instagram, eBay, and Walmart—as well as on your own websites and physical store locations.

Standout features include automatic stock synchronization across channels and out-of-the-box support for sellers on Amazon and eBay. I think Lightspeed does a good job of unifying inventory levels, pricing, and promotions across internal channels and third-party platforms.

I was also impressed by Lightspeed’s retail analytics and reporting capabilities. There are over 50 pre-built reports that can shed light on sales volume, customer behavior, and pricing strategy. While not quite as capable as a dedicated business intelligence or corporate performance management software, Lightspeed has more advanced analytics than many competitors.

Integrations include iZettle, Mailchimp, Planday, Podium, SKU IQ, Vantiv, Homebase, Cloudbeds, Planday, Moneris, and Accumula.

Pros and cons

Pros:

- Data analytics

- 24/7 customer support

- All plans include a free register

Cons:

- Moderate learning curve

- Upgrades can get costly

| Tools | Price | |

|---|---|---|

| KORONA POS | Pricing upon request | Website |

| Stax Pay | From $99/month | Website |

| Payment Depot | From $79/month | Website |

| Shopify POS | Plans start at $31/month | Website |

| Lavu | From $59/month + payment processing | Website |

| ePOS | Pricing upon request | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Lightspeed | From $99 per month | Website |

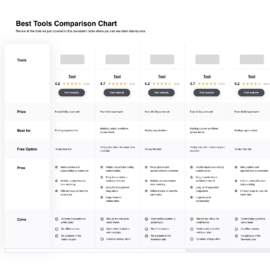

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther POS Software Options

There were some more tools I shortlisted during my research. They didn’t quite make the cut for my main list, but might still be worth investigating further.

Selection Criteria for Small Business POS Software

Here’s a short summary of the main selection criteria I used to develop this list.

Core Functionality

At its core, POS software should enable your business to:

- Build carts/orders: Team members should be able to easily scan items or add product SKUs manually. Ideally, this should be a quick and simple process, as many small businesses frequently hire new staff. And for food service firms, having the option to take digital orders directly at the table (using a tablet or other mobile device) is a big selling point.

- Calculate sales tax: POS software needs to be able to quickly and accurately calculate sales tax amounts on a state and local level (and federal, for options available in countries with a federal sales tax).

- Process payments: POS software should be able to accept and process credit card payments, including Visa, Mastercard, American Express, and Discover—as well as cash payments, gift cards, mobile wallets, and perhaps even pay-over-time providers.

- Track inventory: POS software should also provide at least basic inventory management features. When a sale is completed, internal inventory records should be updated automatically. Larger companies may wish to also use inventory management software.

Key Features

The features offered by POS systems can have a significant impact on your business. Some basic features to look out for include:

- Customer management features: It’s beneficial for POS systems to collect and compile customer data for the purposes of marketing and customer loyalty programs.

- Loyalty programs: POS systems should also have the capability (if desired) to implement customer loyalty programs, customer rewards, and gift card programs to encourage repeat business.

- Sales reporting and analytics: POS software should provide a bird’s-eye-view of metrics looking at revenue, daily sales volume, etc. Ideally, it should be able to compare factors like sales by location and daily sales vs. long-term averages.

- Employee management features: Many POS systems also include employee management features, like scheduling, time clocks, and even payroll (though many firms will also use external software for some of these workflows).

- Versatile deployment: Most POS systems these days are cloud-native, making them relatively easy to deploy in a variety of situations. Ideally, POS software should be able to be used on physical registers, tablets, smartphones, and other devices.

Usability

You’ll want a POS system that’s easy to use. Remember, POS platforms will likely be used by many employees—including those who are relatively new on the job. It’s great if a POS system is able to run several elements of your business, but it should be able to do so with relative ease of use.

Integrations

Integrations allow you to connect your POS system to other business software.

It’s particularly important to choose a POS system that integrates with your accounting system, along with whatever inventory systems or payroll software you’re using too.

Also, be sure your POS software supports your payment processing systems. Most POS platforms offer their own payment processing, but you may not necessarily want or need to switch over.

People Also Ask

Point-of-sale software prompts plenty of questions from small business owners and financial operations teams. Here are answers to some of the most common questions people have about POS software.

What are the different types of POS systems?

The common types of POS systems are:

- Cloud-based POS, with remote storage and access of information.

- Mobile POS, on devices like tablets or smartphones.

- Traditional POS, with hardware and software in a static physical location, including terminals and receipt printers.

How much does a POS system for a small business cost?

Most POS systems have a three-tiered cost structure that includes: the monthly costs, the hardware costs, and the payment processing fees.

Monthly costs can range from $0 to $500+ per month, hardware prices can range from $0 to $1,000+ per unit, and payment processing fees are typically between 2.4% + $0.09 per transaction to 3.5% + $0.30 per transaction.

Summary

After reading through this list, hopefully, you’re closer to finding the POS software that’s a good fit for your team.

For more business insights and the latest tech industry news, sign up for our newsletter for weekly tips and advice from financial leaders.