10 Best Retail POS System Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

There are so many different retail POS solutions on the market that deciding on the best can be tricky. You want to automate many aspects of transaction recording, eliminate manual errors, and make informed decisions about cash reserves, credit terms, and overall liquidity but need the right tool for your retail operation. I've got you covered! In this post, I use my personal experience having researched and compared dozens of retail point-of-sale systems to share with you the best retail POS system on the market.

What is a Retail POS System?

Retail POS systems are tools used in retail stores to optimize the retail experience by automating processes, reducing errors, and providing real-time insights into sales and inventory. They normally boast features like transaction processing, inventory management, barcode scanning, sales reporting, and integration with other business systems.

These systems have both the hardware (cash registers, card readers, and computers or smart devices like iPads) and the software required to execute retail sales transactions - improving inventory management, reducing manual data entry and saving time for a financial controller.

Overview Of The Best Retail POS Systems

Below, you’ll find detailed reviews of the top point-of-sale (POS) systems for retailers. Each section provides a summary of the key features, available integrations, and some notable pros and cons.

KORONA POS is a comprehensive point of sale system tailored for the retail industry, offering a cloud-based solution that combines ease of use with powerful functionality. Designed to accommodate businesses of all sizes, KORONA POS provides a user-friendly interface that simplifies the checkout process, making it quick and efficient for both employees and customers.

Why I Picked KORONA POS: I like its focus on real-time inventory tracking. This feature ensures that retailers can monitor their stock levels accurately and in real-time, reducing the risk of overstocking or stockouts. Additionally, KORONA POS offers automated inventory reordering, detailed sales reporting, and comprehensive inventory management tools that streamline the entire inventory process.

KORONA POS Standout Features & Integrations

Key features include multi-location support allows retailers to manage multiple stores from a single platform, ensuring consistent operations across all locations. It also has employee management features that enable the tracking of staff performance and scheduling.

Integrations include QuickBooks, WooCommerce, Shopify, Magento, BigCommerce, Mailchimp, and various payment processors such as PayPal, Stripe, Worldpay, Authorize.Net, and CardConnect.

Pros and cons

Pros:

- Advanced inventory management

- Multi-location support

- Customizable POS layout

Cons:

- Reports could be more customizable

- Lacks on-location installation support

Stax Pay is an all-in-one business management platform that simplifies payment processes for businesses, offering secure in-person and online credit card payment processing. Its transparent pricing model ensures cost visibility for informed decision-making, making it the best choice for businesses looking for clarity and simplicity in their payment solutions.

Why I Picked Stax Pay: Stax Pay provides omni-channel support, enabling businesses to accept payments seamlessly across multiple channels—online, in-store, and mobile. This cohesive experience helps businesses manage transactions and customer interactions in a unified manner, enhancing customer satisfaction and operational efficiency.

Stax Pay Standout Features & Integrations

Key features include flexible payment options (credit card, ACH, and eCheck), advanced invoicing, recurring billing, and customizable payment plans. The platform also provides detailed reporting and analytics, integrated fraud prevention, and a user-friendly dashboard for managing transactions.

Integrations include popular accounting software like QuickBooks and Xero, customer relationship management (CRM) systems such as Salesforce and HubSpot, and ecommerce platforms like Shopify and WooCommerce. Additionally, Stax Pay connects with payment gateways like Authorize.net and Stripe, as well as marketing tools like Mailchimp and Constant Contact.

Pros and cons

Pros:

- Seamless integration with popular tools

- Advanced invoicing capabilities

- Flexible payment options

Cons:

- Limited support for international transactions

- Slight learning curve for new users

Best for high-volume ecommerce, mobile, and physical transactions

Payment Depot is a merchant solutions provider that functions for ecommerce, mobile, and physical payment terminals alike. It stands out for its unique interchange pricing structure, which can help high-volume retail companies save on service fees.

Why I picked Payment Depot: This provider's free payment gateway and virtual terminal capabilities provided through partnerships like SwipeSimple allow merchants to process payments online, via mobile, and over the phone without incurring additional gateway fees. This is super beneficial for high-volume retailers, especially those with both online and in-store shopping options. In fact, you can process payments online, via mobile, and over the phone without incurring additional gateway fees.

Payment Depot Standout Features and Integrations

Standout features include the membership-based pricing model for credit card processing, which offers tailored interchange+ pricing. The company is also recognized for its commitment to customer care, and has garnered positive feedback from clients who have experienced cost savings.

Integrations include Shopify, WooCommerce, BigCommerce, PrestaShop, and OpenCart. It also integrates with payment systems such as authorize.net and business management systems like Revel Systems..

Pros and cons

Pros:

- User interface is straightforward and intuitive

- Comprehensive equipment offerings

- Cost-effective for businesses with high transaction volumes

Cons:

- Limited to US-based, non-high-risk merchants

- Not ideal for low-volume businesses

Shopify POS is a retail POS system that’s designed for retailers with omnichannel sales.

Why I picked Shopify POS: I selected Shopify POS mostly because it’s beneficial for omnichannel retailers. Plus, it’s really easy to use retailers that are already familiar with Shopify.

Shopify Standout Features and Integrations:

Standout features include company-wide discounts (online and offline) and tools to schedule and manage local deliveries and pick-up orders.

Their customer data management system helps keep customer data in sync across online and in-person sales.

In my opinion, Shopify is also one of the more intuitive platforms on the market—for both retailers and consumers.

Integrations include PayPal, Stripe, Square, Authorize.Net, QuickBooks, Xero, FreshBooks, Mailchimp, Klaviyo, Zendesk, Google Analytics, Metrilo, ShipStation, and Easyship.

Pros and cons

Pros:

- Inventory management tools

- No per-transaction fee for in-person transactions (many competitors charge $0.10-$0.30 per transaction)

- Intuitive and user-friendly interface

Cons:

- Shopify and POS Pro subscriptions are required for full functionality

- Limited offline functionality

Epos Now is a comprehensive POS software system designed to facilitate various business operations, including transaction processing, inventory management, and customer relationship management. It integrates with other software such as accounting and e-commerce platforms, allowing for seamless data synchronization and automation of business processes.

Why I Picked Epos Now: I like that Epos Now has a feature set tailored specifically for retail environments. The platform had inventory management, allowing retailers to track stock levels in real-time, set reorder points, and manage supplier relationships. Additionally, its sales management capabilities provide detailed insights into sales trends and customer preferences. The scalability of Epos Now is another significant advantage, as it can grow alongside the business, accommodating expanding inventory and increasing transaction volumes.

Epos Now Standout Features & Integrations

Key features include out-of-stock alerts, purchase order management, reports and analytics, mobile compatibility, staff management, and support for different payment methods, including credit and debit cards, mobile payments, and online orders. It also offers omnichannel selling and various hardware options.

Integrations include Deputy, Deliveroo, Mr Yum, Hopt, QuickBooks, Xero, Mailchimp, Shopify, Appointedd, simpleERB, WooCommerce, BigCommerce, Magento, PayPal, Stripe, Sage, Zapier, Google Analytics, Workforce.com, APO, Worldpay, and more.

Pros and cons

Pros:

- User-friendly interface

- Good customization options

- Detailed reporting on various metrics

Cons:

- Occasional slow system performance

- May take time to set up

Helcim is a payment processing service that offers a suite of tools for businesses to accept and manage payments.

Why I picked Helcim: I selected Helcim because it provides a cost-effective solution with a suite of features that cater to various payment processing needs, including point-of-sale and invoicing.

Standout features include the tool's transparent Interchange Plus pricing model, absence of monthly fees, and the provision of free tools such as a rate comparison and invoice generator.

I also like that Helcim's POS software integrates with inventory management tools, allowing retailers to track stock levels, manage product information, and generate sales reports. Additionally, the system offers customer management features that enable retailers to store customer information and purchase history, which can be used for marketing and loyalty programs.

Integrations include QuickBooks, Xero, WooCommerce, Shopify, Foxy.io, and Great Exposure.

Pros and cons

Pros:

- Provides excellent customer support

- Includes reporting and analytics tools

- No long-term contracts

Cons:

- Limited support for high-risk industries

- Fees for chargebacks

Merchant One is a payment processing service that offers various solutions for businesses to accept credit and debit card payments.

Why I picked Merchant One: I selected Merchant One for this list because it emphasizes direct service without intermediaries, offering next-day funding and a retail swipe system aimed at efficient transaction processing at the point of sale.

Standout features include omni-channel capabilities, allowing businesses to accept payments across multiple channels seamlessly. Whether it's in-store, online, mobile, or through virtual terminals, Merchant One provides the necessary tools and infrastructure to enable a unified payment experience.

I also like Merchant One's robust security measures. This includes encryption technology, tokenization, and compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements to protect sensitive customer data.

Integrations include Aloha, Micros, Maitre'D, Payflow Pro, Payeezy Gateway, USAePay, and Paytrace Gateway.

Pros and cons

Pros:

- Easy-to-use software for transaction management

- Offers 24/7 customer support

- Provides a strong payment gateway with fraud protection

Cons:

- Customer service limited to email and phone

- Three-year contract required

Clover is a popular POS that offers a range of hardware options, from ultra-basic smartphone setups to more comprehensive retail POS systems.

Why I Picked Clover: I selected Clover because of its versatility and its build-to-suit style. You can customize both the selection of devices used as well as the features you want to pay for (via Clover’s own functionality as well as third-party add-ons).

Standout features include the ability to accept and scan physical checks, as well as contactless payments.

I also like Clover’s extensive app marketplace, which can be used to expand functionality. These are essentially native integrations into the Clover POS system that allow you to add workflows for selling online, bookkeeping, and customer loyalty support.

Integrations include True Group, Abreeze Technology, LoyalZoo, Thrive Inventory, Melio, DirectSource, Solupay, Infuse, and MiPoint.

Pros and cons

Pros:

- Mix-and-match device compatibility

- Offline payment processing

- Multiple hardware options

Cons:

- Higher fees than some competitors

- No free hardware

Lightspeed POS is a retail POS system that offers a centralized place to manage sales, suppliers, and multiple channels.

Why I picked Lightspeed: I selected Lightspeed because of its personalized approach to customer support. Each Lightspeed client is paired with a dedicated advisor to help with onboarding as well as ongoing support.

Standout features include an open API for custom integrations in addition to native integrations.

I also like Lightspeed’s reporting features, which help management teams drill down into sales stats and other performance metrics.

Integrations include Mailchimp, iZettle, Cloudbeds, Homebase, Movi2go, Planday, Moneris, Seatninja, Accumula, Mews, Bike Index, QuoteMachine, UEAT, Wisk, Pointy, and Booxi.

Pros and cons

Pros:

- 24/7 support, plus a dedicated account manager

- Customer loyalty programs and omnichannel rewards

- Free register

Cons:

- Relatively high monthly fees

- Advanced features only available on higher tiers

Square is one of the most popular point-of-sale systems on the market. Their Square for Retail POS includes tools for inventory management, sales, payment processing, and some basic staffing and scheduling features as well.

Why I Picked Square: I selected Square because it’s a versatile all-in-one platform that’s easy to scale to your needs.

Standout features include inventory and fulfillment management, which helps track inventory levels. I like that you can set alerts to notify you when stock levels are getting low.

Plus, Square’s retail POS flows sync perfectly with the e-commerce platform, allowing omnichannel operations. For instance, stores selling online can offer shipping or in-store pickup—and both in-person and online transactions will automatically update stock levels in Square’s inventory management system.

I appreciate the built-in staffing functionality, so you don’t need separate scheduling and staffing software.

Integrations include Shopify, WooCommerce, Magento, BigCommerce, QuickBooks, FreshBooks, Xero, Mailchimp, TouchBistro, Upserve, Vend, and Toast.

Pros and cons

Pros:

- Inventory tracking tools

- Offline functionality

- Free base plan (just pay transaction fees)

Cons:

- Add-ons can get expensive

- Mediocre customer support

| Tools | Price | |

|---|---|---|

| KORONA POS | Pricing upon request | Website |

| Stax Pay | From $99/month | Website |

| Payment Depot | From $79/month | Website |

| Shopify POS | Plans start at $31/month | Website |

| ePOS | Pricing upon request | Website |

| Helcim | From 0.50% + $0.25 per transaction | Website |

| Merchant One | From $13.95 plus 0.29% + 1.55% per transaction | Website |

| Clover | From 2.3% + $0.1 per transaction | Website |

| Lightspeed | From $99 per month | Website |

| Square | From $36/month plus 2.9% + $0.30 per transaction | Website |

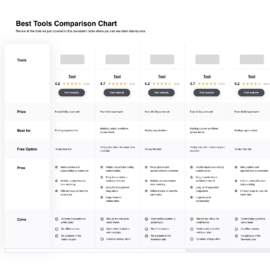

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

While they didn’t quite make my top 10 during my research process, I found some additional tools that are worth checking out.

Selection Criteria For Retail POS Systems

Below is a summary of the criteria for selecting the best retail POS systems.

Core Functionality

On a basic level, a retail POS system should enable your business to:

- Build carts/orders: Your team members should be able to easily scan items (or search for them using SKUs or keywords), add items to the cart, and start the checkout process.

- Calculate and collect sales tax: A crucial feature of POS systems is the accurate calculation and collection of state and local sales taxes.

- Process payments: POS software should enable workers to close out transactions by processing payments. At a minimum, POS systems should be able to accept Visa, MasterCard, Discover, and American Express (as well as cash). Nice-to-haves include mobile wallet payments and perhaps even check scanning.

- Track inventory levels: While some retailers can benefit from dedicated inventory management software, POS systems should at the very least be able to track basic inventory levels.

Key Features

The features that a POS system offers can significantly impact the way you do business and the way customers and employees interact with your technology stack. Here are some beneficial features to look for:

- Rewards programs: Having customer loyalty programs built into your POS system is a big selling point, in my opinion. Loyalty programs can help increase customer engagement and encourage repeat purchases.

- Customer data management: POS systems should collect (and analyze) customer data. Ideally, the POS should be able to identify customers based on the payment card they use and sync in-store purchase data with any available data from e-commerce transactions.

- Workforce management: Some POS systems offer features like employee scheduling, timesheets, and even payroll support.

- Reporting & analytics: Beyond processing payments, a good POS system should also help you drill down into data to monitor performance, revenue metrics, and other KPIs.

Usability

When selecting a POS system, it’s wise to prioritize user-friendliness. Given the relatively high turnover rates in the retail industry, it makes sense to opt for a system that's easy to learn.

While employee user-friendliness is perhaps the most important, it’s also a good idea to consider the customer experience and ease of use there.

Integrations

It also makes sense for you to prioritize integrations when making your selection. By connecting your POS with your other crucial business software—like accounting, ERP, CRM, etc—you'll be able to synchronize data in real-time.

Value for Money

Your choice of POS systems can make a significant difference to your bottom line. While the monthly fees are important to pay attention to, the crucial component for most firms is the payment processing fees. These can range from 1.8% on the low end to up to 2.9%.

People Also Ask

Still have questions? Here are the answers to some of the most frequently asked questions about retail POS systems.

What hardware is needed for a POS system?

The hardware required for a POS system can vary depending on the type of business, its size, and its operations. However, the principal elements usually include a computer or tablet, a barcode scanner, a receipt printer, a cash register (in some cases), a payment terminal, a digital scale (if necessary), and a router or WiFi connection.

How much does a POS system cost?

There are three cost components to consider:

- Hardware costs: This can rangeTheCFOClub Newsletter from $0 (use your smartphone) to several thousand dollars for full retail systems. Some vendors also lease hardware on a monthly basis (think $30-$100+ per month).

- Monthly costs: This can range from $0 with free plans to several hundred dollars per month. This cost goes to the POS system provider and does not include payment processing fees.

- Payment processing costs: These are the fees you pay when a customer swipes their card (there are typically no fees for cash payments). This fee ranges from around 0.3% to 3% or more, depending on the vendor, transaction volume, and card type (debit vs. credit, etc.)

Summary

There are a lot of POS systems for retailers to choose between. I hope this article helps you find the best POS system for your retail business.

Want more business and finance resources and advice? Sign up for our weekly newsletter for the latest tech industry news and business insights from financial leaders.