Creating an expense report takes time — time that would be better spent working on strategy, being creative, or doing just about anything else. To address this, I’ve put together a resource-packed guide for creating a simple expense report, with templates to boot.

I’ve covered two ways to create an expense report:

- Using Excel or Google Sheets

- Using expense report software

You don’t have to create reports from scratch in either case—software solutions typically offer their own built-in layouts, and I’ve shared some templates to use as a starting point if you want to sidestep the software.

With that said, let’s get into it.

The Traditional Approach To Expense Reporting

The traditional approach to expense reporting involved wrangling receipts and filling out forms.

Teams spend hours meticulously documenting every meal, cab ride, and conference fee, only to have it disappear into some bureaucratic black hole.

To top it all off, paper-based records are prone to errors, if they get remembered at all.

It’s easy to see how the traditional approach, while well intended, deserves to be left behind in the history books.

Benefits Of Modernizing Expense Reporting

Modern companies use software to create and track expense reports, because it’s:

1. More Efficient

Inserting data into software is far easier than carrying receipts and manually recording the data in paper-based records.

This simplicity translates into efficiency, allowing your team to process a significantly higher volume of expense reports during a given time period.

2. Better for Transparency

You can configure permissions so that everyone who needs access to expense reports has it, ensuring financial transparency and minimizing bureaucracy.

It also offers you and your team complete visibility over expenses—delayed visibility is a major problem across organizations. As Adriana Carpenter, the CFO at Emburse, explains:

“Companies are having challenges getting visibility into the spend their employees are making. It could be a while before [finance teams] see that spend, and that’s problematic.”

3. Modifiable in Real-Time

You can view expenses and reimbursement status in real time using expense reporting software, ensuring you’re always making decisions with up-to-date information.

This gives you real-time visibility into your business’s financials, exposing cost-saving opportunities while you can still do something about them. Plus, having this information in advance makes your financial close process much easier, when that time rolls around.

4. Tax Benefits

As I’m sure you’re aware, many business-related expenses are tax-deductible. Claiming a deduction for common business expenses, including travel, meals, entertainment, and office supplies, can lower your tax liability, provided you have the right documents (such as receipts and invoices as evidence).

Companies may also be able to recover sales tax in some jurisdictions. Remember, accuracy is more important than speed—inaccurate or incomplete expense reporting increases the risk of tax audits or results in compliance issues.

Key Features Of A Simple Expense Report

While it’s best to use software, it’s not always possible to invest in one, especially if you’re a cash-strapped startup or have few employees.

If now doesn’t seem like a great time to invest in expense reporting software, a simple expense report template created using Microsoft Excel or Google Sheets works fine—it’s not perfect, but still a much better method of reporting expenses than paper-based records.

A simple expense report is almost always just an itemized list of expenses with basic information like the employee’s name and report submission date. That may be overly simplistic.

Instead, focus on building an expense report that’s still simple, but also provides all the necessary information. Here are three key features of an expense report that make it simple and useful:

Intentional Layout

Build a clean and organized layout. Use consistent formatting and spacing to avoid clutter. A clean layout along with clearly labeled fields reduces the possibility of missed information.

Just Enough Detail

Add just enough detail—you want all the relevant information without clutter.

Clutter makes the report look overwhelming, increasing chances of errors and making approval tedious. For example, you should add a field for “food” expenses instead of asking employees to list every meal separately. If the line item looks abnormally high, that’s when you go check out the attached receipts.

Clear Guidelines

Provide clear guidelines, but only where necessary. For example, if your employees frequently travel abroad for business, your travel expense report should offer guidelines as to which exchange rate should be used for conversion and remind them to factor in applicable currency conversion charges.

Creating An Expense Report With Software

Creating a simple report is fairly easy with software. Here’s a step-by-step guide to creating your first simple expense report:

- Choose expense reporting software: The first step is... make it easy for yourself by choosing good expense reporting software. I've covered what to look for in the next section of this article.

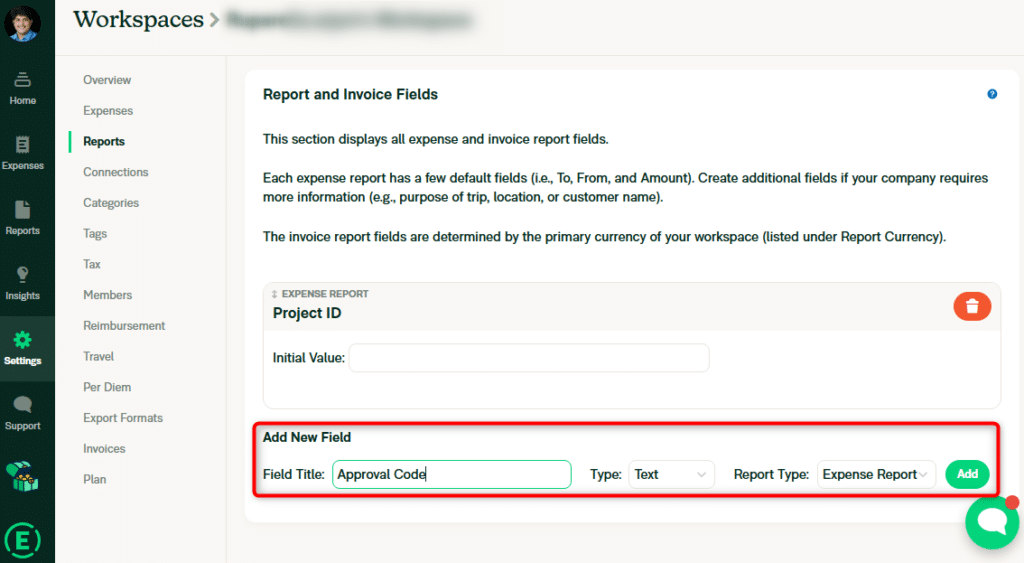

- Select a template: The specific layout of your expense report depends on the software you choose. Solutions with more customization options will let you further simplify or add complexity to the default template. For example, Expensify’s default template includes three fields (To, From, and Amount), but you can add custom fields as per your preference:

- Configure the software: Configure the software according to your preferences. All solutions offer configuration options, but they vary based on the solution’s complexity.

- Advanced tools like SAP Concur allow you to configure approval workflows to match your company’s hierarchy and policies.

- Beginner-friendly solutions like Expensify offer options like the ability to automatically submit expense reports at your preferred frequency:

Once you’ve configured your system to your liking, you can request employees to start using it to submit expense reports.

Evaluating Tools For Expense Reporting

Before you get into the weeds, filter the list of tools based on your budget.

Top expense reporting tools offer an extensive feature set, but may be too costly. On the other hand, inexpensive tools can lack advanced features.

Once you’ve narrowed your options down based on price range, the next step is to find a tool that offers the most value. For this, you need to compare the features of the tools you’re evaluating. Here are some features to look for:

- Mobile app: A mobile app allows employees to scan and submit receipts as soon as they receive them. This minimizes the possibility of errors and ensures the employee doesn’t forget to claim reimbursement for that expenditure.

- Credit card import: You get monthly statements for a corporate credit card, but you still need to populate that information into your expense reporting tool. The ability to import transaction data from your statement eliminates the need for mundane data entry work.

- GL coding: General Ledger (GL) codes are unique alphanumeric codes assigned to all general ledger accounts. By attaching GL codes to types of expenses, you can have your software automatically post expenses to relevant general ledger accounts, starting you on the process of automating expense reports altogether.

- Tax tracking: Built-in tax tracking helps track sales tax and tax-deductible expenses, making tax season significantly less stressful. Instead of going through each receipt when it’s time for taxes, let software track those figures so you can focus on tasks that require human touch.

- Integrations: Integrations help sync data across systems. Your expense reporting software may need to collect data from multiple sources, like your accounting software, then signify your payroll system to trigger automated payments based on the total reimbursement calculated for all approved employee expense reports.

Most decent solutions offer these features, but you should also look for features and capabilities that your business needs.

Free Expense Report Templates

There are various expense report templates available online, to make the zero to one process a lot simpler. Just take these templates and adjust them to create what you need. For example, you can add a subtotal field for each expense category or add a separate column for taxes so it’s easier to track them.

Here are some of the best ones, whether you’re running a company, in a company, or out on your own:

- Free templates by Smartsheet:

- Free templates by Clockify:

- Free templates by Coefficient:

- Business expense report template by Zoho

- Expense report template by HubSpot

Training Your Team On Expense Reporting

Effectively training your team for effective expense reporting makes the process much easier. Here are some ways you can train your team over time:

- Clear guidelines and policies: Start by establishing clear expense reporting guidelines and policies. Make sure all employees are aware of reimbursable expenses, documents required to claim reimbursement, spending limits, and the approval processes.

- Offer training sessions: Train employees to use your expense reporting software effectively. Educate them about the importance of accurate documentation and complying with company policies. Hands-on demonstrations and practice exercises are a great way to reinforce learning.

- Lead by example: Set an example for your employees by adhering to reporting policies and demonstrating responsible spending habits. Employees are more likely to follow their leader’s footsteps than instructions.

- Feedback and support: Offer feedback and support while employees navigate your new expense reporting policy. Encourage questions, provide guidance, and proactively address potential challenges they may encounter.

Expense Reporting, Simplified

Expense reporting software automates a large portion of the expense reporting process. It simplifies reporting for employees, gives you access to real-time expense data, and minimizes the risk of error. If you’re not ready to invest in software, Microsoft Excel or Google Sheets are a good place to start.

Ready to compound your abilities as a finance leader? Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.