Implementing new accounting software is a major undertaking for any business. Done right, it streamlines processes and unlocks powerful insights. But get it wrong, and you'll face disruptions, data issues, and frustrated employees.

All too often, businesses stumble through critical missteps like inadequate planning, poor data migration, and lack of training.

Here’s an 10-step accounting software implementation checklist to ensure a smooth, successful implementation.

Selecting an Implementation Methodology

So, you've chosen your accounting software. Congratulations! Now comes the critical part: getting it up and running smoothly. The way you approach this can make or break your implementation's success.

Let's explore the most popular methodologies that businesses like yours actually use:

- Agile Implementation: Break it down into bite-sized "sprints" focused on specific modules or functions. Go live with pieces quickly, test, and refine as you go. Flexible and offers quick wins, but requires close collaboration.

- Waterfall Implementation: The classic linear approach — plan, design, develop, test, deploy, maintain. Great for complex needs with rigid requirements, but changes mid-stream can be costly, and you'll wait longer to see results.

- Phased Rollout: Implement in stages, either by functionality — general ledger (GL), then accounts payable (AP), then accounts receivable (AR) — or by business unit. Lower risk, focused training, and you learn lessons for later phases. Ideal for larger organizations with complex accounting systems.

- Big Bang: Transition all users to the new system on a predetermined date. Efficient but intense — meticulous planning and comprehensive training are crucial.

- Parallel Adoption: Run the old and new systems side-by-side for a period. Allows a safety net for accuracy checks, but is resource-intensive and prolongs the transition.

Which Methodology is Right For You?

Consider your business's size, complexity, risk tolerance, and the urgency of your accounting needs. A startup might lean towards Agile for quick results, while a multinational with intricate reporting requirements might prefer Waterfall. A growing mid-sized company with diverse departments? The Phased Rollout could be your sweet spot.

Remember, these methodologies aren't mutually exclusive. You might use a Waterfall approach for your core setup, then switch to Agile to add new features. Or start with a Phased Rollout by location, but use Agile sprints within each phase.

The key is understanding each one’s pros and cons in order to craft an approach that's just right for your business.

Who’s Involved in Accounting Software Implementation?

Implementing accounting software is a broad transformation involving various organizational roles, not just a project for IT or finance. Key players include:

- Executive Sponsor: Often the CFO or COO, provides vision, secures resources, resolves blockages, and drives departmental buy-in.

- Project Manager: Manages the project implementation plan, timeline, budget, and team coordination, ensuring all parts mesh seamlessly.

- Accounting Team Lead: Bridges software technicalities with accounting realities, oversees system configuration, data migration, and user testing.

Other key players:

- IT Team: Manages technical setup and security.

- Vendor/Consultant: Offers software expertise and additional project management.

- Super Users: Departmental power users who facilitate training and support.

- HR and Payroll: Manages payroll modules and employee expenses.

- Sales and Operations: Handles order-to-cash processes.

- Legal Compliance: Ensures regulatory compliance.

- Change Management Lead: Oversees communication and adoption strategies.

Stakeholders to keep informed:

- CEO: Responsible for overall business performance.

- Board/Investors: Interested in ROI and risk.

- External Auditors: Depend on the system for reliable audits.

- Key Customers/Vendors: Affected by changes in billing or payments.

- All Employees: Impacted by financial accuracy and operational efficiency.

Each role is crucial to ensure the project's success, addressing both the strategic and practical aspects of the software's integration into the business.

How To Implement Accounting Software

Implementing accounting software — be it general, online, cloud-based, or another type entirely — is like building a house. You need a solid foundation, the right tools, and a clear blueprint.

Let's walk through each step, ensuring you don't just install software, but truly transform your accounting processes.

Step 0: Get Accounting Software

In case you don’t have a tool yet, our team has reviewed the best accounting software and determined that these are currently the best ones out there:

If you're switching from a different accounting tool, there's a slightly different process for you to follow.

1. Project Initiation and Planning: Define Your Requirements and Goals

This step is about getting crystal clear on what you need and why. It's the foundation for everything that follows. It's crucial to establish what you want the software to achieve for your business, whether it's improving financial reporting, streamlining processes, or enhancing compliance.

- Identify pain points in your current processes. Are you drowning in manual entries? Struggling with real-time reporting?

- List must-have features (like multi-currency support) and nice-to-haves (like AI-driven forecasting).

- Set measurable goals. For example, "Reduce month-end close time from 15 days to 5 days" or "Cut invoice processing costs by 30%."

- Involve key stakeholders. Your AR team might need customer aging reports, while your CEO wants a custom dashboard.

- Create a project charter that outlines the goals, scope, and limitations of the project.

- Set up a project management office (PMO) if necessary, to oversee the implementation.

2. Map and Optimize Your Processes

Don't just replicate your old processes in the new system. Use this opportunity to streamline.

- Document current workflows (as-is process maps).

- Identify bottlenecks and redundancies. Maybe three people are checking each invoice when only one would be necessary.

- Design optimized workflows (to-be process maps). Think automation, approvals, and audit trails.

- Validate with end-users. A process that looks good on paper might have hidden snags.

Example: A law firm mapped its billing process:

- As-Is: Lawyers tracked time in spreadsheets, emailed billing coordinators who manually created invoices in QuickBooks, and then partners reviewed every invoice, causing major delays.

- To-Be: In their new system, lawyers enter time directly, automated rules create draft invoices, and only high-value or exception invoices need partner review. Result? Invoices out 70% faster, improving cash flow.

3. Configure the Chart of Accounts (COA) and Reporting Structure

This is the blueprint of your financial house. Get it right, and reporting becomes a breeze.

- Start with your old chart of accounts, but don't just copy it. Use this as an opportunity to simplify.

- Ensure it supports both statutory and management reporting needs.

- Set up departments, cost centers, projects, or other dimensions for slicing and dicing data.

- Design your financial statements and key reports. Work backward to ensure your COA supports them.

Example: A non-profit, EduForAll, needed to track expenses by program, funding source, and location. Their COA used:

- 5 digits for natural accounts (e.g., 50400 for Office Supplies)

- 3 digits for programs (e.g., 101 for Literacy Program)

- 2 digits for funders (e.g., 05 for Gates Foundation)

- 2 digits for locations (e.g., 12 for Nairobi Office)

An expense like "50400-101-05-12" meant "Office Supplies for Literacy Program, funded by Gates Foundation, in Nairobi." This structure allowed EduForAll to quickly generate reports for each funder, optimize program costs, and manage location budgets effectively.

4. Plan and Execute Data Migration

This step is about bringing your history into your new home without dragging in the clutter.

- Decide what to migrate. Usually, you'll want open transactions, customer/vendor data, and at least a year of historical data.

- Clean your data. Fix customer duplicates, update outdated vendor info, reconcile open items.

- Map old data to new structures. Your old "Office Exp" account might map to several new accounts.

- Do a trial migration. Validate totals, spot-check details. Rinse and repeat until perfect.

- Plan cut-over carefully. You might need a brief 'quiet period' with no transactions; plan for it.

5. Customize and Integrate

Now, make the system truly yours and part of your broader business ecosystem.

- Customize cautiously. Out-of-the-box is great for upgrades and support. Only customize what gives real business value.

- Map out all required integrations: CRM, e-commerce, HRIS, banking, etc.

- Decide on real-time (APIs) vs. batch integrations. Real-time is great for inventory; batch might suffice for HRIS.

- Test integrations thoroughly. A hiccup between systems can cause major headaches.

6. Testing, Training, and Transition

You've built your new financial home. Now ensure it's sturdy and everyone knows how to find their way around it.

- Test everything. Unit tests (does this invoice workflow work?), integration tests (does Salesforce trigger billing?), and a full-cycle test (an order to cash to financial report).

- Train in phases. Start with a core team, then train-the-trainer, finally all users.

- Use real-life scenarios in training. "Here's how you'll handle the monthly client billing run."

- Plan go-live meticulously. Have a war room, an issue escalation process, and yes, get pizza.

- Post-go-live, have power users on each team to provide immediate support.

7. Post-Implementation Review and Stabilization

This is where many companies drop the ball, thinking the job is done once the system is live. But this is where you can really start leveraging your investment.

Before you pop the champagne, make sure your new system is truly stable and delivering as promised.

- Run a full month-end close. Compare this to your old process. Are you hitting those time and accuracy goals?

- Review KPIs weekly. Watch metrics like DSO, DPO, reconciliation exceptions, etc. They'll tell you if processes are working.

- Hold daily stand-ups for the first month. Quick check-ins catch issues early.

- Document all issues and resolutions. This becomes your playbook for future hiccups.

- Conduct a formal post-mortem. What went well? What didn't? Use lessons for future projects.

8. Compliance, Audits, and System Security

In today's regulatory environment, your system needs to be not just efficient, but bulletproof.

- Annual compliance review. SOX, GDPR, industry-specific regulations — make sure you're covered.

- Prep for audits year-round. Well-documented processes and clean audit trails make audits smoother.

- Regular security checks. Who has access to what? Are all integrations secure?

- Disaster recovery tests. Can you restore from backups? How much data might you lose?

9. Train, Retain, and Bring in New Blood

Your people are the heartbeat of your accounting system. Invest in them.

- Annual training refreshers. Cover new features and reinforce best practices.

- Send your team to user conferences. They'll learn from peers and come back energized.

- Cross-functional training. Your AR star might have great ideas for the GL team.

- When hiring, prioritize adaptability. You need folks who can grow with your evolving system.

10. Plan for Growth and Change

The only constant in business is change. Make your accounting system an enabler, not an obstacle.

- Annual scalability review. Will you outgrow your system or just need more licenses?

- Watch the business landscape. Expanding internationally? M&A on the horizon? Plan system changes early.

- Build a change request backlog. Small tweaks can wait, but track them for periodic update sprints.

- Stay strategic. Meet with the C-suite quarterly to align the system roadmap with business goals.

Implementing accounting software isn't a one-and-done project; it's an ongoing journey of optimization, insight, and growth. Keep refining!

How Long Implementation Takes

A rushed implementation can cost you far more in the long run than a few extra weeks spent getting it right. Let's break down the timelines.

The Variables: Factors Influencing Implementation Time

Before we talk weeks and months, understand that these factors can swing your timeline:

- Business Size and Complexity: A 10-person startup will move faster than a 1,000-employee multinational with six subsidiaries.

- Industry: Highly regulated sectors like healthcare or finance require more setup time for compliance.

- Customization Needs: Out-of-the-box is the fastest. Heavy customization? Add time.

- Data Migration: Simple trial balance, or years of transactional data? Big difference.

- Integrations: More integrations (CRM, e-commerce, etc.) mean more time.

- Team Bandwidth: A dedicated project team moves quicker than folks juggling daily tasks.

- Implementation Methodology: Agile can get parts live faster; Waterfall might take longer but go live all at once.

Typical Timeline Breakdown

- Project Planning (1-2 weeks): This initial phase includes defining the project scope, gathering requirements, and setting up the implementation team.

- Software Installation and System Configuration (2-6 weeks): Depending on the complexity, this phase involves installing the software, configuring it to suit business needs, and setting up user roles and permissions.

- Data Migration (1-4 weeks): The duration of this phase depends on the volume and cleanliness of the data being transferred. It includes data cleaning, mapping, and the actual migration, followed by validation to ensure accuracy.

- Testing (1-3 weeks): This critical phase involves running tests to ensure all aspects of the software work as expected and interact correctly with other systems.

- Training and Transition (2-4 weeks): Training end-users and supporting them as they transition to the new system. This phase is crucial for ensuring a smooth changeover and can vary in length based on the user's familiarity with new technology.

- Go-Live and Initial Support (1-2 weeks): The system goes live, and a support structure is put in place to handle any immediate issues.

Here's what you can generally expect depending on your business size

- Small Business (10–50 employees, single entity). Simple setup: 4–8 weeks

- Medium Business (50–500 employees, maybe a few entities). 3–6 months

- Large Enterprise (500+ employees, multi-entity, international): 6–12 months

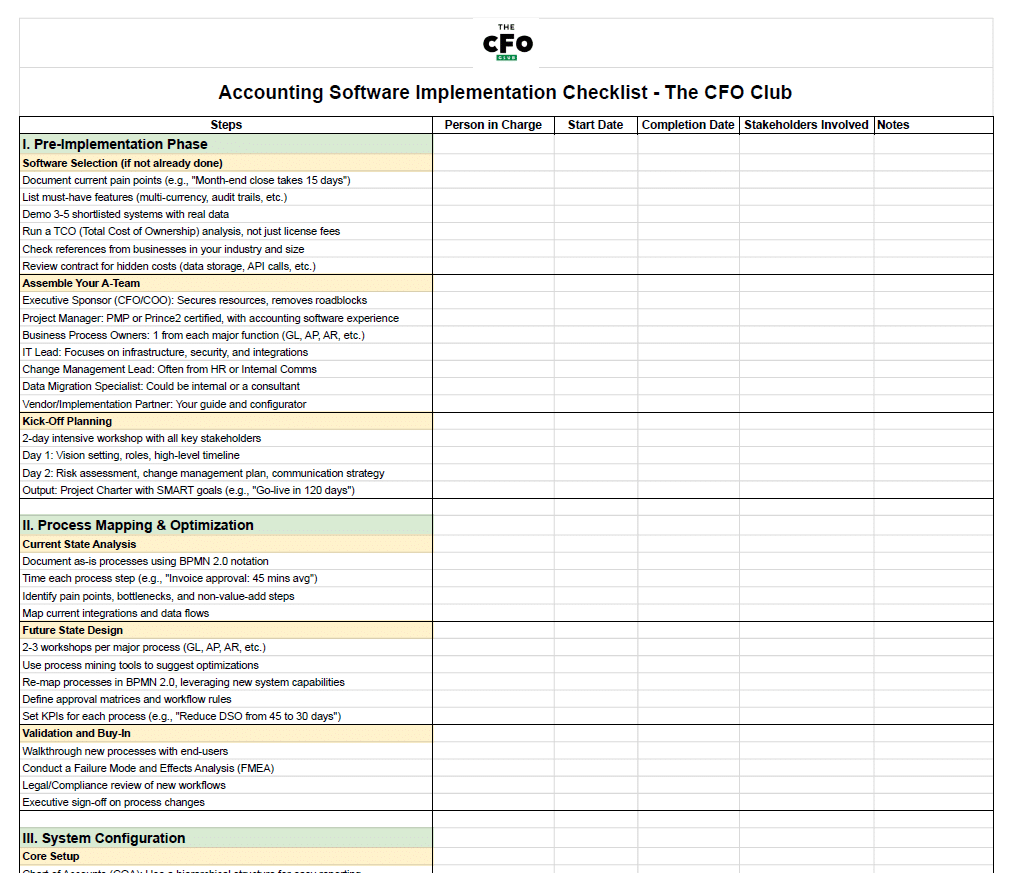

Download Your Accounting Software Implementation Checklist

You've got the knowledge. Now, let's make sure you can apply it systematically. This accounting software implementation checklist is your step-by-step companion through this journey.

This tool is designed to help you keep track of every important step, from initial planning through to the go-live phase, ensuring that no critical tasks are overlooked.

And the best part? It’s fully customizable. You can add, modify, or remove tasks to match your specific process.

7 Mistakes To Avoid When Implementing Accounting Software

Implementing accounting software can be complex and challenging. Here are some tips to avoid common mistakes and ensure a successful implementation:

1. Underestimating the Importance of Data Cleaning

Invest significant effort in cleaning your data before migration. Ensure that all data sets are free from duplicates, inaccuracies, and are fully updated.

This preparation reduces complications during the data migration phase and increases the overall efficiency of the new system.

2. Skipping Custom User Training

Don't just hand out generic manuals. Tailor your training to fit the various needs across your team. Use scenarios that mirror their daily tasks to make the new system feel familiar and easier to adopt.

3. Not Planning for Post-Go-Live Support

Be ready to tackle any issues head-on as soon as you go live.

Set up a solid support system with a help desk, user manuals, FAQs, and a squad of 'super-users' who can jump in fast. Proactive support cuts down on downtime and stress.

4. Failing to Set Realistic Timelines

Map out your project timeline with some wiggle room for the unexpected. Keep tabs on progress and make tweaks as needed.

A well-planned schedule avoids last-minute scrambles and makes sure every part of your project gets the attention it needs.

5. Overlooking the Need for Regular Updates and Feedback

Keep everyone in the loop with regular updates. Discuss how things are going, tackle any challenges, and adjust your plan based on real-time feedback. Open communication helps manage expectations and keeps everyone engaged and onboard.

6. Neglecting Change Management

Start managing change from day one.

- Communicate the benefits clearly — explain the 'Why' before the 'How'.

- Illustrate individual gains to encourage buy-in.

- Celebrate the wins along the way to build momentum and support.

Good change management can smooth out resistance and speed up adoption.

7. Too Many Cooks in the Kitchen

It’s great to have input, but too many stakeholders can turn decision-making into a real headache. Try to keep the circle tight. Include only those who need to be there — think key decision-makers and essential expertise. This keeps things moving smoothly and avoids the dreaded decision-making traffic jam.

Making Accounting Software Work for You

Implementing accounting software might seem daunting, but with the right steps and a keen eye for detail, it's totally manageable. Watch out for those sneaky pitfalls and embrace the process of fine-tuning your system to get the most out of it.

Looking for more handy tips like these? Subscribe to our free newsletter and grab our detailed checklist to keep everything on track. Let's get your accounting software up and running smoothly!