Understanding Financial Statements: A university degree helps in understanding how financial statements work and provide a comprehensive financial picture.

Knowledge of Accounting Concepts: Preparing financial statements requires a working knowledge of accounting concepts like double-entry accounting, accrual basis accounting, and the accounting cycle.

I got a university degree to learn how financial statements work and how those numbers come together to give you a comprehensive financial picture.

After all, preparing financial statements requires a working knowledge of accounting concepts like double-entry accounting, accrual basis accounting, and the accounting cycle.

But there’s good news.

Rather than taking on years of study, you can read this 15-minute guide to preparing financial statements—aka the income statement, statement of changes in equity, balance sheet, and cash flow statement—instead.

Financial Statements Overview

Financial statements are the business world's equivalent of a medical check-up. They offer a comprehensive overview of an organization's financial condition, including details about its profitability, cash flow, and overall worth.

There are four types of financial statements, each with a unique purpose:

- Income statement: An income statement is a summary of your company’s financial performance. It shows the revenue, expenses (including taxes), and profit your company generated over a specific accounting period.

- Statement of changes in equity: The statement of changes in equity (SOCE) - also known as the statement of retained earnings or statement of owners’ equity - gives a detailed account of how shareholders’ equity has changed over time. Equity can change for various reasons, such as adding or withdrawing capital and paying dividends.

- Balance sheet: The balance sheet shows what the company owns (assets), owes (liabilities), and the stake held by shareholders (equity). Think of it as a snapshot of your company’s financial condition on a given day.

- Cash flow statement: The cash flow statement summarizes cash inflow and outflow. This statement is especially important for startups since many of them go out of business due to their inability to manage cash effectively. Even if you’re profitable, you can run out of cash—profit generated during a year does not equal cash generated during a year.

Each one of these documents gives stakeholders such as investors, creditors, employees—even competitors—valuable insights about where a business stands financially.

Why Are Financial Statements Important?

Financial statements provide easy-to-understand, standardized insights into your company’s financial performance, capital structure, and cash flow. Stakeholders need this information to:

- Make informed decisions: The financial data in financial statements can guide strategic decisions. For example, the income statement shows revenue growth and operating income—two key elements you need to evaluate if you’re considering dropping a product line.

- Raise capital: When raising new equity or debt capital, lenders and investors will need to look at your capital structure, profitability, and other details from your financial statements.

- Comparative analysis: Financial statements help you compare your business’s performance with industry benchmarks, such as seeing how your gross margin compares to your closest competitors.

- Compliance: Filing financial statements with regulatory bodies like the Securities and Exchange Commission (SEC) is compulsory for some types of companies, like publicly traded companies and private companies with public debt.

The Process Of Preparing Financial Statements

When preparing financial statements, you have two options:

- Use accounting software to handle almost every part of the process. These accounting systems automatically update financial statements in real time when you record day-to-day transactions, making statement preparation easy.

- Prepare your statements manually. I’ll walk through how to do this in the next section of this article.

You may see large companies prepare financial statements following GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

While there is a difference in the accounting standards between GAAP and IFRS, the purpose of each financial statement remains the same.

Step 1: Prepare a Trial Balance

A trial balance is a summary of open accounts in your books. Here’s how to prepare a trial balance:

1. Record Transactions

Recording transactions is the gateway through which all the information needed to prepare financial statements flows. Sales, purchases, returns—every transaction impacts your financial statements.

The old-school method was to record these transactions in a journal; however, using accounting software means you can just enter transaction details into the accounting system - the system takes care of the rest.

2. Post Journal Entries to Sub-Ledger Accounts

The next step is to post journal entries to sub-ledger accounts, which are accounts that record details and provide more context than the overarching general ledger. Sales transactions are posted to the sales ledger, credit sales are recorded in the accounts receivable ledger, and so on - you get the idea.

The sub-ledger accounts are then aggregated into five general ledger categories (income, expenses, assets, liabilities, and equity).

3. Adjusting Entries

You may need to post adjusting entries before you start closing your accounts. Adjusting entries are generally for unrecognized income or expenses for the period. Here’s an example to help you understand what I mean.

Suppose your company lent $20,000 to a friend’s company, ABC Corp., on December 1, 2023. According to the agreement, interest is due every 12 months and the rate is 4% per annum.

You prepared financial statements on December 31, 2023. In the process, you recorded the $20,000 loan as an asset for your company, but what about the $66.67 interest outstanding for December [($20,000 x 4%) / 12]?

The interest would be an adjusting entry:

| Account | Debit | Credit |

| ABC Corp. interest receivable A/C (current asset) | $66.67 | - |

| Interest income A/C (income) | - | $66.67 |

4. Adjusted Trial Balance

A trial balance helps check the arithmetic accuracy of accounts. Remember that the trial balance doesn’t find other types of errors such as amounts posted in the wrong account.

All debits have corresponding credits - of equal amounts - according to double-entry accounting. For this reason, a trial balance is built to check if the debits and credits are equal; if the total debit and credit amounts are different, you’ll need to check for arithmetic errors.

To create a trial balance, you just need to list the balances of all accounts in your books and sum up the debit and credit balances. Accounting software would do this for you automatically.

Step 2: Prepare the Income Statement

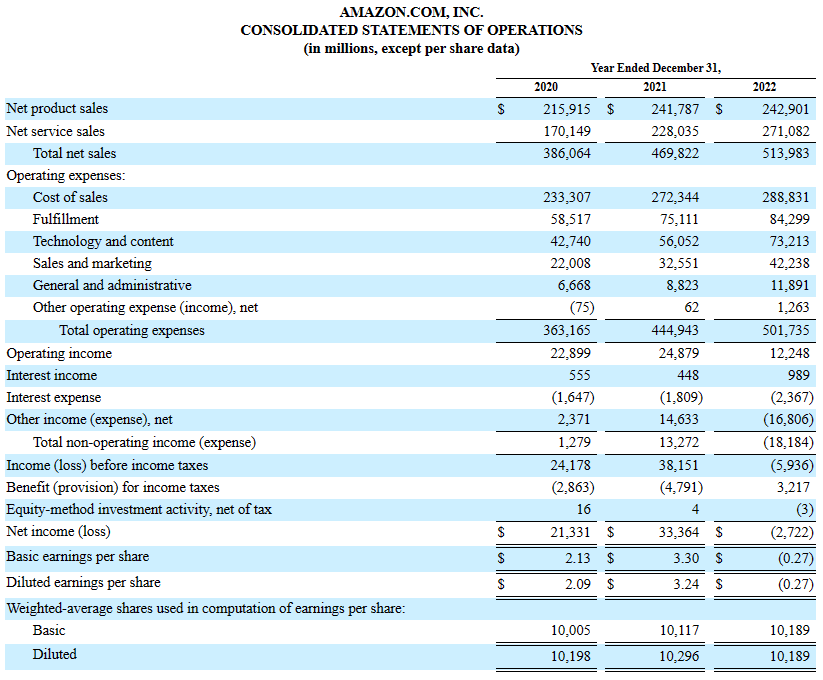

Let’s look at Amazon’s financial statements to help give context to each of these as I explain them, starting with the income statement.

As I mentioned before, when preparing financial statements manually, you’ll want to start with the income statement. The sequence doesn’t matter when you use an accounting system.

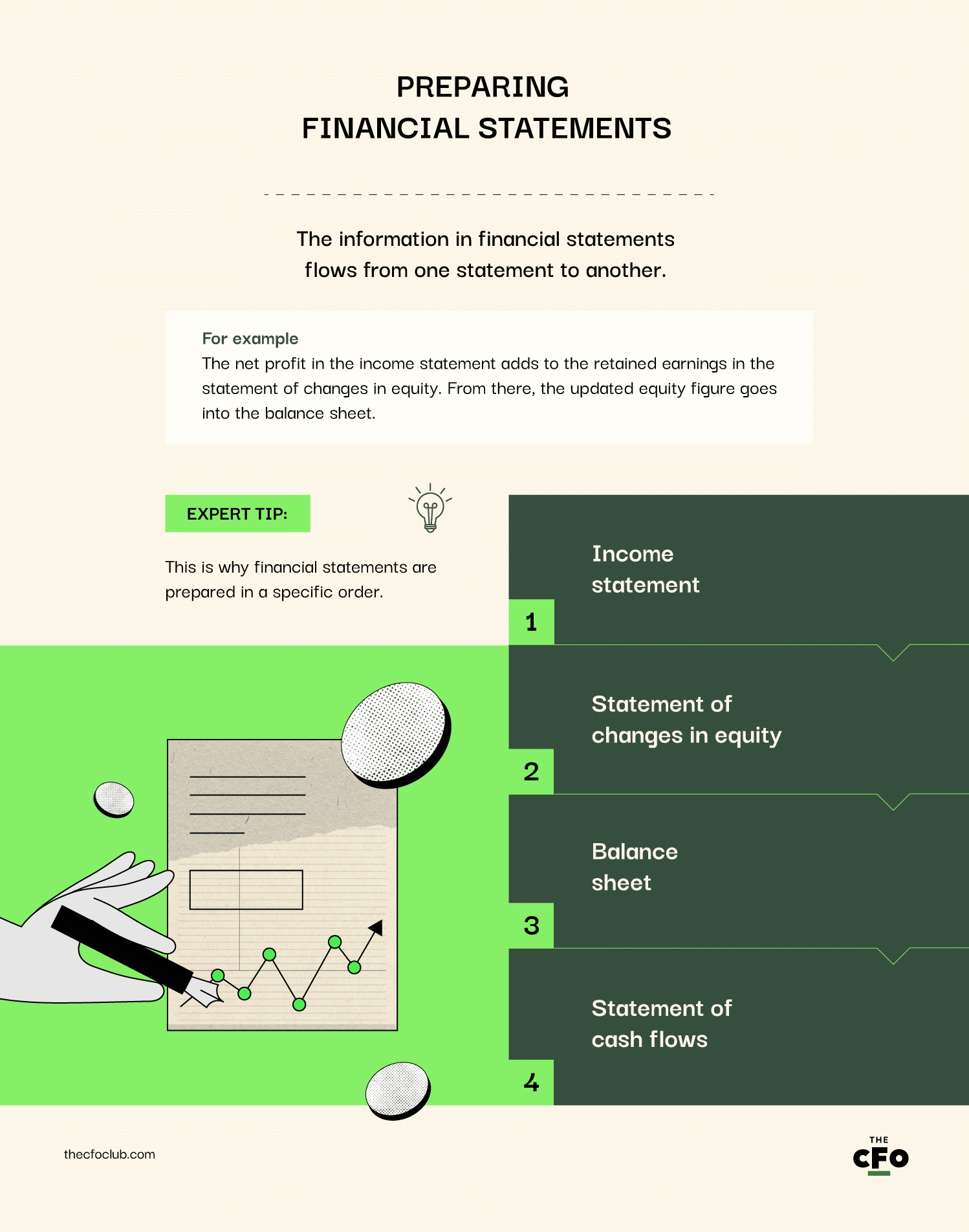

The reason? The net income calculated at the end of the income statement is added to retained earnings, which is required to complete the statement of changes in equity. And the equity figure is needed to complete the balance sheet.

If you do this out of order, you’ll have a lot of repeated work.

1. Start with Revenue

Sum up all the sales during the period, net of returns. Don’t add any other types of income here, such as income from rent or interest—that’s not revenue.

2. Subtract Expenses

Once you’ve added revenue to the top line:

- Subtract the cost of sales (or cost of goods sold) from revenue to compute the gross profit.

- Subtract selling, general, and administrative expenses (or operating expenses) from the gross profit to compute the operating income.

- Add non-operating income (like interest and gains on financial instruments) and subtract non-operating losses to compute income before taxes.

- Subtract income tax to calculate the net income.

Step 3: Prepare the Statement of Changes in Equity

Your SOCE starts with the opening balance in the shareholders’ equity (the total of common and preferred stock) from the beginning of the period (ie, what was on last year’s SOCE).

Then make the following adjustments in the SOCE:

1. Add Retained Earnings

Retained earnings are the portion of net income the company doesn’t distribute as dividends.

To calculate retained earnings:

- Subtract the dividends distributed (debit them to the retained earnings account)

- Add net income to the retained earnings account (credit net income or debit net loss to the retained earnings account)

Once you have the closing balance for the retained earnings account, add it to the opening balance of owners’ equity.

2. Add/Subtract Other Comprehensive Income/Losses

Other comprehensive income refers to gains and losses that don’t appear on the income statement because the company hasn’t realized them yet.

For example, if the company revalues an asset and it’s worth less, it’s the company's loss. However, the loss is only realized when the company sells that asset.

Items like foreign currency translation adjustments and changes in pension liabilities appear here.

3. Record Changes in Capital

If the company has issued new shares, add them here. If the company repurchases shares, subtract them from here.

4. Calculate Closing Balance

Calculate the closing balance in stockholders’ equity and input this figure into the balance sheet.

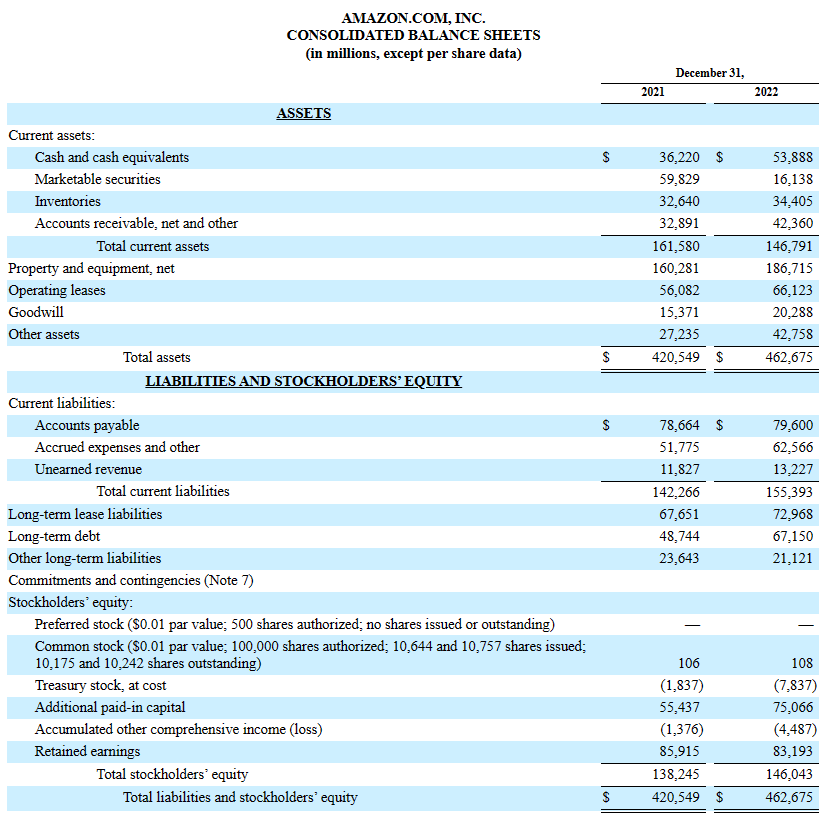

Step 3: Prepare the Balance Sheet

I have good news.

You don’t have to compute most of the items in the balance sheet. This statement simply lists the balances of your accounts, which you would have calculated before preparing your trial balance.

1. Assets

Assets appear on the left side of the balance sheet. Balances of fixed asset accounts like land, current asset accounts like cash, and intangible asset accounts like goodwill appear here.

2. Liabilities

Liabilities are money the company owes. Balances of current liabilities like accounts payable and long-term liabilities like bonds appear here.

3. Shareholders’ Equity (Business Net Worth)

Shareholders’ equity is money that belongs to the company’s owners (equity shareholders) and preference shareholders.

Here’s a more intuitive way to look at it: Shareholders’ equity is the difference between assets (what the company owns) and liabilities (what the company owes).

The equity figure calculated when preparing the statement of changes in equity goes in this section.

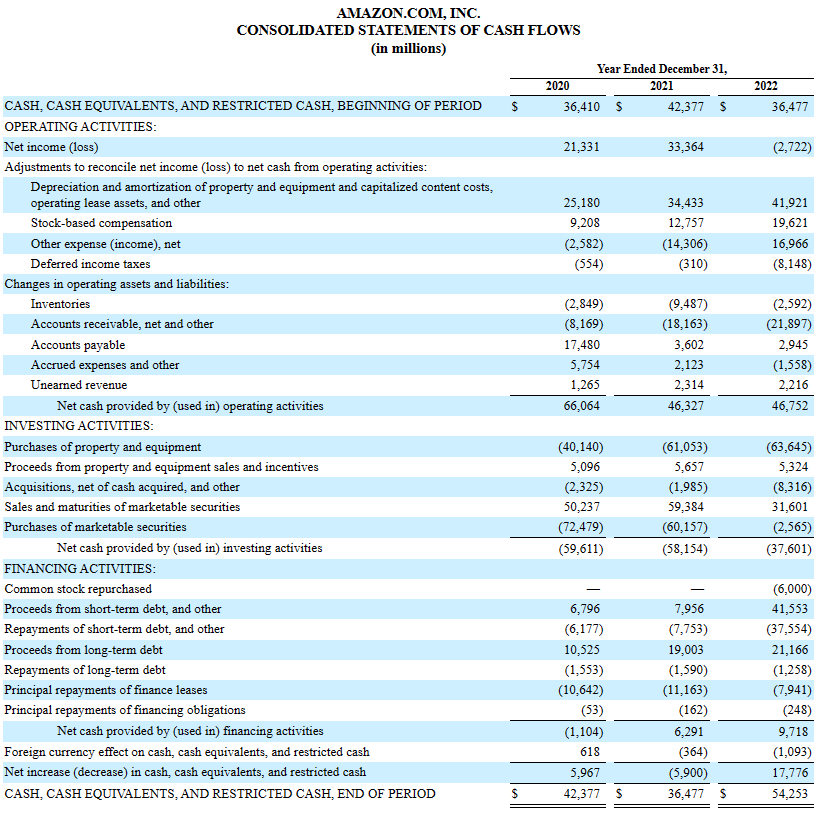

Step 4: Prepare the Cash Flow Statement

Cash flow gives you insights into your business’s sources and uses of cash. Maintaining a healthy cash balance - aka, enough but not too much - is mission-critical.

For most startups, the problem is running out of cash. Monitoring the cash flow statement helps predict cash flow issues and prepare for them before they turn into a major problem.

The process of preparing a cash flow statement depends on whether you’re using the direct or indirect method.

However, both types of cash flow statements have three categories, which I’ll explain below. Summing up the cash inflows and outflows from these categories gives you the net cash inflow or outflow during the reporting period.

1. Cash Flow from Operating Activities

Cash flow from operating activities is the sum of cash inflow and outflow from activities like collection from debtors, payment to creditors, and taxes paid.

If you’re using the indirect method of preparing the cash flow statement, non-cash items like depreciation and amortization will also appear here.

2. Cash Flow from Investing Activities

Cash flow from investing activities includes cash received from the sale of securities and cash paid to buy new assets like land and equipment, among other things.

There are additional line items in this section as well if you’re using the indirect method. You’ll need to subtract gains and add back losses on the sale of assets.

3. Cash Flow from Financing Activities

This section includes activities like raising new capital, paying off debt, and paying dividends.

Using the indirect method? Subtract gains related to financing, like interest received, and add back financing expenses or losses, like interest paid.

The Bottom Line

Grasping all of this information can be overwhelming if you haven’t studied accounting, so here’s a recap:

- The income statement tells you if your business is profitable, so you can make decisions related to pricing, cost structure, or discontinuing a product line.

- The statement of changes in equity lets interested parties know how ownership has changed over the period and whether money has been paid out to these owners.

- The balance sheet summarizes your financial position. If you have too much debt in an industry with shrinking profit margins and low growth, the business might lose its ability to service the debt over time.

- And, finally, the cash flow statement tells you how efficiently you’re generating and using cash. If your business doesn’t generate enough cash, how will you pay salaries, debt installments, or accounts payable?

You just need to understand what each financial statement tells you and where the information in those statements comes from. Accounting software takes care of all the mechanical tasks like preparing the trial balance, calculating the net income, and drawing the statement of cash flows.

Ready to compound your abilities as a finance leader? Subscribe to our newsletter for expert advice, guides, and recommendations from the finance leaders shaping the tech industry.