The accounting cycle is how transactions end up in your financial statements. For example, when a customer pays their subscription, you don’t directly add that to the revenue in your income statement. It goes through the journal, general ledger, and then to the financial statements.

In this article, I explain how a transaction is first recorded in your books and the consequent accounting cycle steps that culminate in a transaction being reflected in your income statement or balance sheet.

What is the Accounting Cycle?

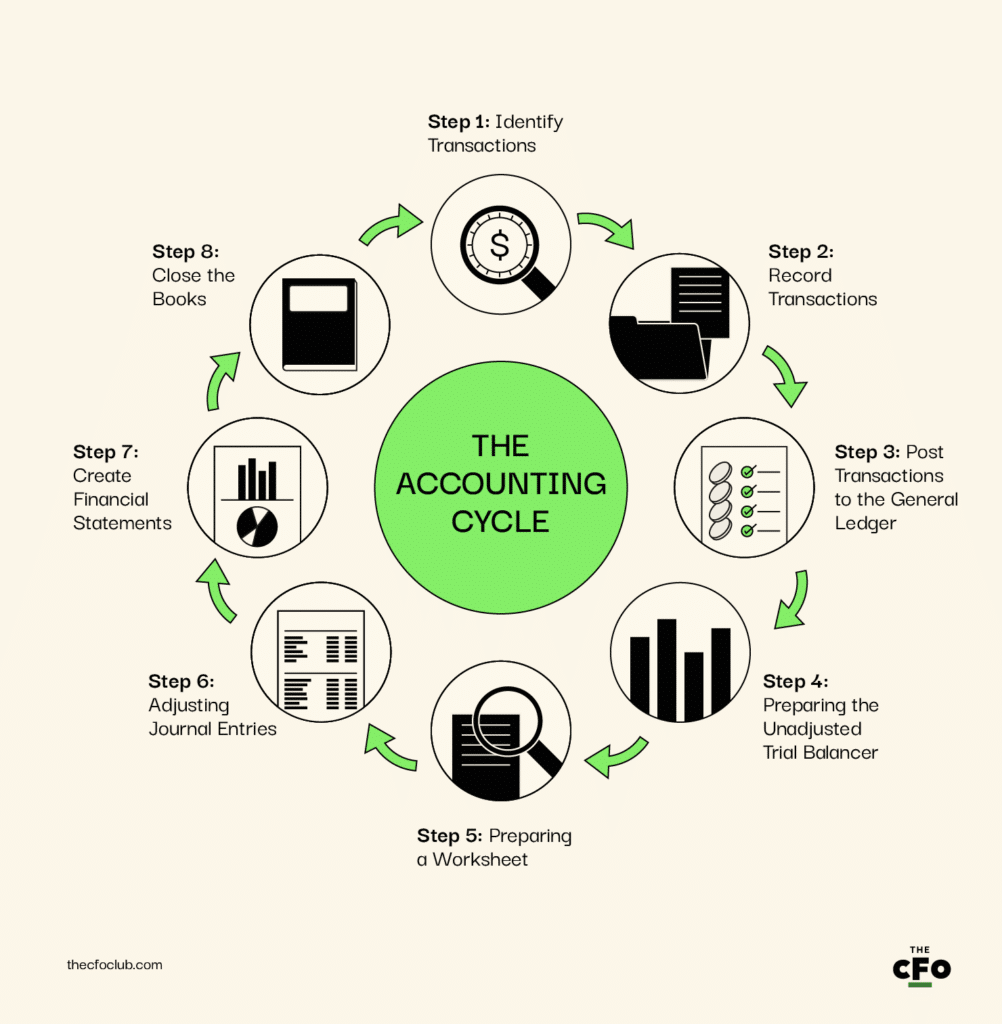

The accounting cycle is an eight-step process businesses use to record a company’s financial transactions, from when the transaction occurs to closing the company’s accounts.

The time a company takes to complete the accounting cycle varies depending on various factors. For example, companies that use automated accounting software and companies using continuous financial close can complete the accounting cycle faster than companies that use manual processes and a hard close approach.

The Accounting Cycle’s Purpose

The primary purpose of the accounting cycle is to provide a systematic framework to record a company’s financial transactions.

The framework offers bookkeepers and accountants the chance to verify the recorded transactions for uniformity and accuracy, both of which are critical compliance parameters.

For example, one of the steps in the accounting cycle involves creating a trial balance. A trial balance helps verify the arithmetical accuracy of recorded transactions. If the debits don’t equal the credits, the bookkeeper might have recorded one of the figures incorrectly.

The Accounting Cycle’s 8 Steps

The process starts with recording individual transactions and ends with creating a summary (financial statements) of the company’s financial affairs during a specific period.

Financial accounting software can execute many of the steps in the accounting cycle automatically. However, understanding how the process works is critical so you can intervene when needed.

Remember that you don’t have to implement the accounting cycle as-is. You can modify it to fit your company’s business model and accounting processes. With that foundation set, let’s talk about the eight accounting cycle steps in detail.

Step 1: Identify Transactions

The first step in the accounting cycle is identifying business transactions. You can use various technological systems to identify transactions. Companies use internal controls to ensure all transactions are identified and recorded accurately. Invoice numbers are an example of such internal controls.

CRM (Customer Relationship Management), ERP (Enterprise Resource Planning), and other technological systems can help identify transactions related to sales, expenses, loans, withdrawals, and more.

For example, when a customer pays $500 to start an annual subscription, it marks the beginning of the accounting cycle.

Step 2: Record Transactions

The second step is to journalize the transactions you identified in step one.

When you record transactions in the journal depends on whether you use cash or accrual accounting. If you use accrual accounting, you’ll need to match revenue and expenses.

According to double-entry accounting, all transactions impact two or more subledger accounts, with equal debits and credits.

For example, when you generate an invoice for a $500 subscription fee, you credit the revenue subledger and debit the AR subledger:

| Account | Debit | Credit |

| Revenue | $500 | - |

| Accounts Receivable | - | $500 |

Step 3: Post Transactions to the General Ledger

The general ledger (GL) is a master record of all transactions categorized into specific categories such as cost of goods sold (COGS), accounts payable, accounts receivable, cash, and more.

Almost all companies use accounting software, so posting transactions to GL is less of a concern now than in the past. Accounting software automatically posts transactions into the GL in real time.

Step 4: Prepare the Unadjusted Trial Balance

A trial balance helps check the arithmetical accuracy of recorded transactions. The trial balance is essentially a list of accounts along with their debit and credit amounts.

It’s prepared at the end of the accounting period. But if you use accounting software, you won’t need to prepare the trial balance manually.

If the debits and credits aren’t equal, you could’ve:

- Entered the wrong amount in one of the journal entries, or

- Mixed up the accounts that should be debited and credited

Accounting software can help avoid the hassle of correcting these errors because it checks the amounts and whether debits and credits are equal when you post journal entries.

Step 5: Prepare a Worksheet

A worksheet is where you adjust the “unadjusted” trial balance if needed. If the trial balance reveals errors, the worksheet can help identify the reason for it.

Preparing a worksheet involves aggregating the debits and credits made during the current accounting period into a spreadsheet. If the debits and credits don’t match, you’ll need to make the necessary adjusting entries to prepare the adjusted trial balance.

For example, if the bookkeeper had debited cash by $100 and credited customer A’s account by $1,000, the credit and debit balances wouldn’t match. The bookkeeper will need to change the amount in the journal entry or pass an adjusting entry to fix the error.

Step 6: Adjust Journal Entries

Once you recognize an error, you’ll need to correct the figures in your accounting system or pass an additional journal entry.

You’ll also need to pass additional journal entries to accrue expenses that aren’t recorded in the accounts payable account, or expenses incurred after the accounts payable was posted to the GL but before the end of the accounting period.

For example, when the bookkeeper notices that the cash account was debited by $100 instead of $1,000, the bookkeeper must pass an adjusting entry for $900 to correct the balance in the cash account.

Step 7: Create Financial Statements

Financial statements are reports that summarize the company’s financial performance and position during a specific time frame. Companies prepare three financial statements:

- Income statement: The income statement is a performance report showing your company’s profitability. It helps business owners and stakeholders understand the company’s cost structure, which helps identify opportunities to improve profitability.

- Balance sheet: The balance sheet is a summary of the shareholders’ equity as well as the company’s assets and liabilities. It lists the debit (assets) and credit balances (equity and liabilities) of all of the company’s accounts. Think of the balance sheet as a snapshot of the company’s financial position on a specific date.

- Cash flow statement: The statement of cash flows is a summary of transactions that impact cash. It shows the cash inflows, outflows, and the net change in the company’s cash position. Cash flow is a critical statement to assess a company’s financial health, maintain liquidity, and understand if and where your business is losing excess cash.

Step 8: Close the Books

Closing the books involves resetting temporary accounts to a zero balance. These are the accounts you see on the income statement. Balance sheet accounts aren’t closed—that’s why they appear in the “balance” sheet.

For example, you must pass closing entries to close all revenue and expense accounts. The net income is transferred to retained earnings (a permanent account) that appears in the balance sheet in the shareholders’ equity section with the following entry:

| Account | Debit | Credit |

| Net income | $200,000 | - |

| Retained earnings | - | $200,000 |

Once you close the accounts, you’re ready to restart the accounting cycle for the next fiscal year. Note that closing the accounts isn’t necessary in a soft close.

Optimizing Your Accounting Cycle

Performing all eight steps in the accounting cycle can be time-consuming. There’s also a higher chance of human error—when you’re recording and transferring thousands of transactions in your books, it’s possible you’ll mistype a transaction amount or skip a transaction.

Accounting software can help optimize the accounting cycle. Even as a small business, investing in accounting software makes sense because it automates almost all steps in the accounting cycle.

You can integrate accounting software with your sales system. When you make a sale, the accounting software automatically adds the transaction to the revenue account and updates the income statement. You can also link your ERP and other systems so the accounting software can record and monitor expenses.

The software auto-generates financial statements so you can directly close your books at the end of the reporting period. This saves plenty of money you’d have spent on maintaining books and correcting errors. Of course, you might need to get your financial statements audited by a CPA if you’re a public company.

Difference Between the Accounting Cycle and Budget Cycle

The primary difference between the accounting and budget cycle is the time frame under consideration.

The accounting cycle focuses on recording and summarizing the financial activities that occur during the year.

On the other hand, the budget cycle uses the financial information compiled by the accounting cycle process to forecast revenue, expenses, cash position, and more over the next accounting period.

Record, Report, Repeat

The accounting cycle provides a framework for recording transactions and checking them for accuracy before they make it to the financial statements.

Accuracy is critical because you’ll use the financial information generated by the accounting cycle to analyze transactions and financial performance. It’s even more important for companies that need to report financial information to the SEC (Securities and Exchange Commission).

Most companies today use accounting software for improved accuracy and faster accounting. While you’ll need to invest some money upfront in purchasing and implementing accounting software, the long-term benefits significantly outweigh the costs.

Like this article? Subscribe to The CFO Club’s newsletter and receive weekly articles in your inbox.