Best Forecasting Software Providers Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Forecasting software gathers historical data about your business from your systems, then uses machine learning algorithms to find trends and give you the most likely outcomes for the future. The result? A massively improved ability to prepare for what's to come.

But finding the right solution? Well, that's the challenging part.

That's why I leveraged my knowledge in digital software to help you find the best forecasting software on the market. In this list, I included a few different types; some are simpler platforms intended for forecasting alone, while others are more versatile CPM or ERP platforms with built-in forecasting functionality.

However, all of them will be able to help ease the financial management stress. So, let's dig in.

Why Trust Our Financial Software Reviews

We have been testing and reviewing forecasting software since 2023. As a collection of software analysts and experienced financial operators, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases—including over 150 forecasting software solutions—and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our forecasting software review methodology.

Best Forecasting Software Summary

If you just want to see the options and head out of here, no worries. Here’s a quick overview of the tools I’ve covered, how much they cost (if available), and links to go check them out for yourself.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for expense forecasting | Free demo available | From $8/user/month (billed annually) | Website | |

| 2 | Best for cross-departmental forecasting | Free demo available | Pricing upon request | Website | |

| 3 | Best for Excel-powered financial forecasting | Free demo + product tour available | Pricing upon request | Website | |

| 4 | Best for agency profitability forecasts | 14-day free trial | From $9/month (billed annually) | Website | |

| 5 | Best spreadsheet-native forecasting tool | 14-day free trial | Pricing upon request | Website | |

| 6 | Best CPM software with forecasting | Free demo available | Pricing upon request | Website | |

| 7 | Best for advanced forecasting features | Free trial available | Pricing upon request | Website | |

| 8 | Best for business intelligence tools | 90-day free trial | From $36/user/month | Website | |

| 9 | Best for startups | Product demo available | From $20 per month | Website | |

| 10 | Best for ease of use | Free demo available | Pricing upon request | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Forecasting Software Reviews

I’ve summarized the main reasons for choosing each of these forecasting tools — all of them are good options, so I’ve focused my write-up on the features, integrations, and usability of each.

Rippling Spend is a comprehensive spend management solution designed to centralize and control all aspects of company expenditures.

Why I picked Rippling Spend: Rippling Spend offers an analytics-driven approach to expense planning. It provides real-time financial reporting and spend analytics, allowing your team to predict future costs based on historical data and current spending trends. Customizable dashboards also provide insights into department-level and company-wide expenses, making it easy to identify trends, anticipate financial risks, and adjust spending plans accordingly.

Rippling Spend Standout Features and Integrations:

Standout features include hiring scenarios, headcount planning, real-time budget tracking, AI-driven anomaly detection, automated expense categorization, role-based spending controls, predictive analytics, vendor payment automation, and transaction audit trails.

Integrations include Slack, Google, Zoom, Salesforce, Microsoft 365, Asana, Carta, PayPal, 1Password, Yubikey, Checkr, and Guideline.

Pros and cons

Pros:

- Automated spend tracking

- Strong analytics and reporting tools

- Real-time financial visibility

Cons:

- Some users find approval workflows complex

- Limited customization in forecasting reports

Phocas is a business intelligence and financial analysis platform that helps organizations make data-driven decisions. It provides tools for data analytics, visualization, and reporting.

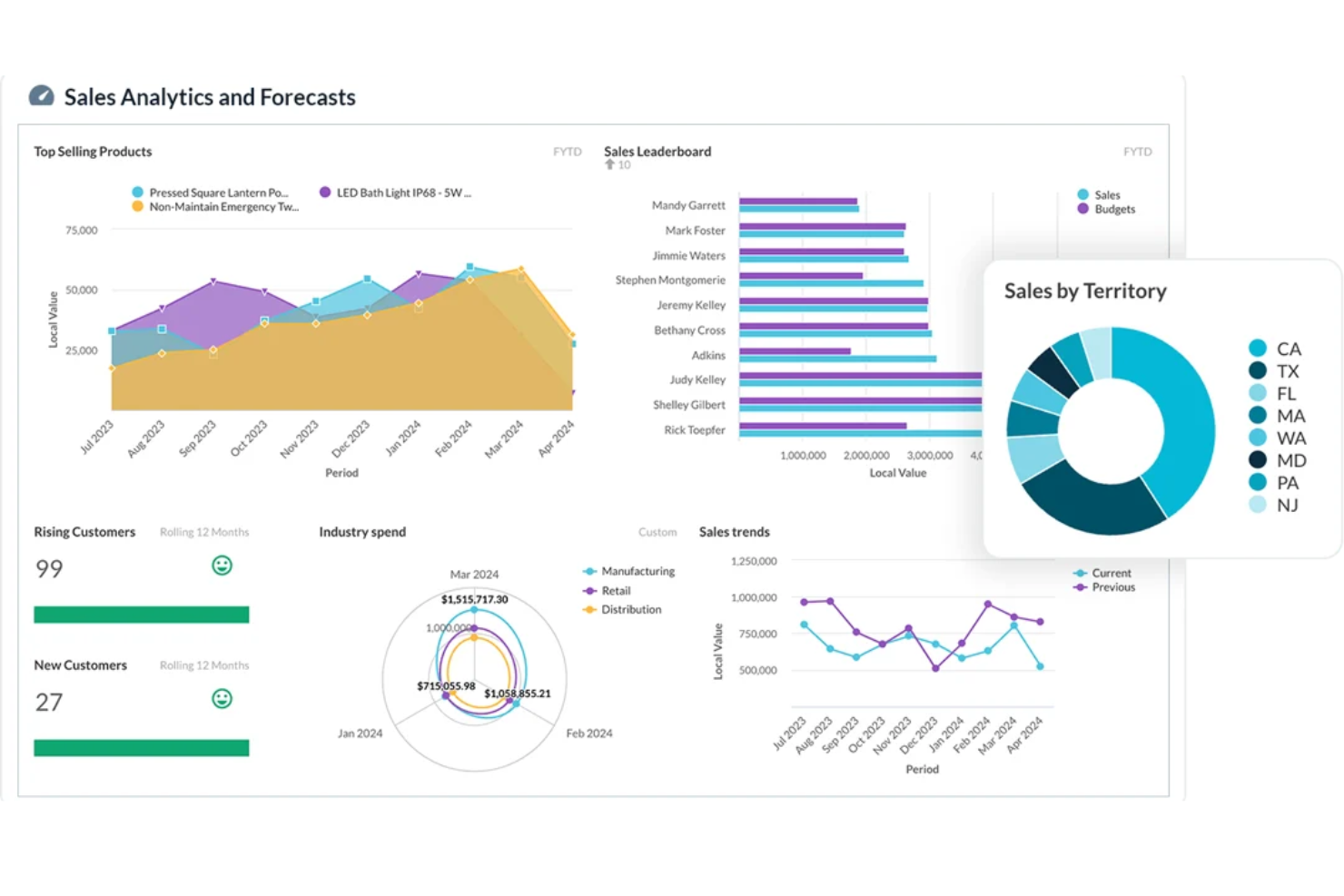

Why I picked Phocas: I like that Phocas has the ability to consolidate data across various departments and business functions, providing a more holistic view of current performance and trends for the future. Users can create specialized plans across sales, HR, and operations, with customizable forecasting reports and scenario modeling tools available to help visualize future revenue, prepare for customer demand, and model pricing strategies.

Phocas Standout Features and Integrations:

Standout features include customizable dashboards, CRM functionalities, rebate visibility, collaborative workflows, privacy compliance, and security controls.

I also like its Phocas AI feature, which allows less technical users to access data and reports by typing in a question and receiving a tailored response.

Integrations include Merlin, Microsoft, SYSPRO, Retail Express, Epicor, IFS, Sage, Accolent, Datafile, MYOB, Enapps, Kerridge, SAP, Sympac, Netsuite, Oracle, QAD, MAM Software, Jonas Metals Software, Acumatica, Xero, Khaos Control, and more.

Pros and cons

Pros:

- AI feature for quick insights

- Customizable dashboards and reports

- Forecasting functions for different departments

Cons:

- Access to lots of data can be overwhelming

- May take time to fully learn the software

Vena is an Excel-based platform for forecasting, budgeting, and financial reporting and analysis.

Why I picked Vena: I like that Vena builds on Excel's inherent capabilities, offering a dynamic integration that allows for sophisticated data modeling, analysis, and collaboration without abandoning the Excel environment that finance professionals are accustomed to.

Vena Standout Features and Integrations:

Standout features include flexible modeling, scenario analysis, automated data consolidation, intelligent dashboards, self-service analytics, customizable workflows, collaborative features, and an AI-powered planning assistant.

Integrations include Oracle, SAP, NetSuite, Sage Intacct, Salesforce, QuickBooks, Microsoft Dynamics 365 Business Central, Dropbox, OneDrive, SFTP, and SharePoint. You can also build custom integrations with Vena API.

Pros and cons

Pros:

- Sophisticated financial models and scenarios

- Familiar Microsoft Excel interface

- Usually quick to implement

Cons:

- No mobile app

- Mac compatibility issues

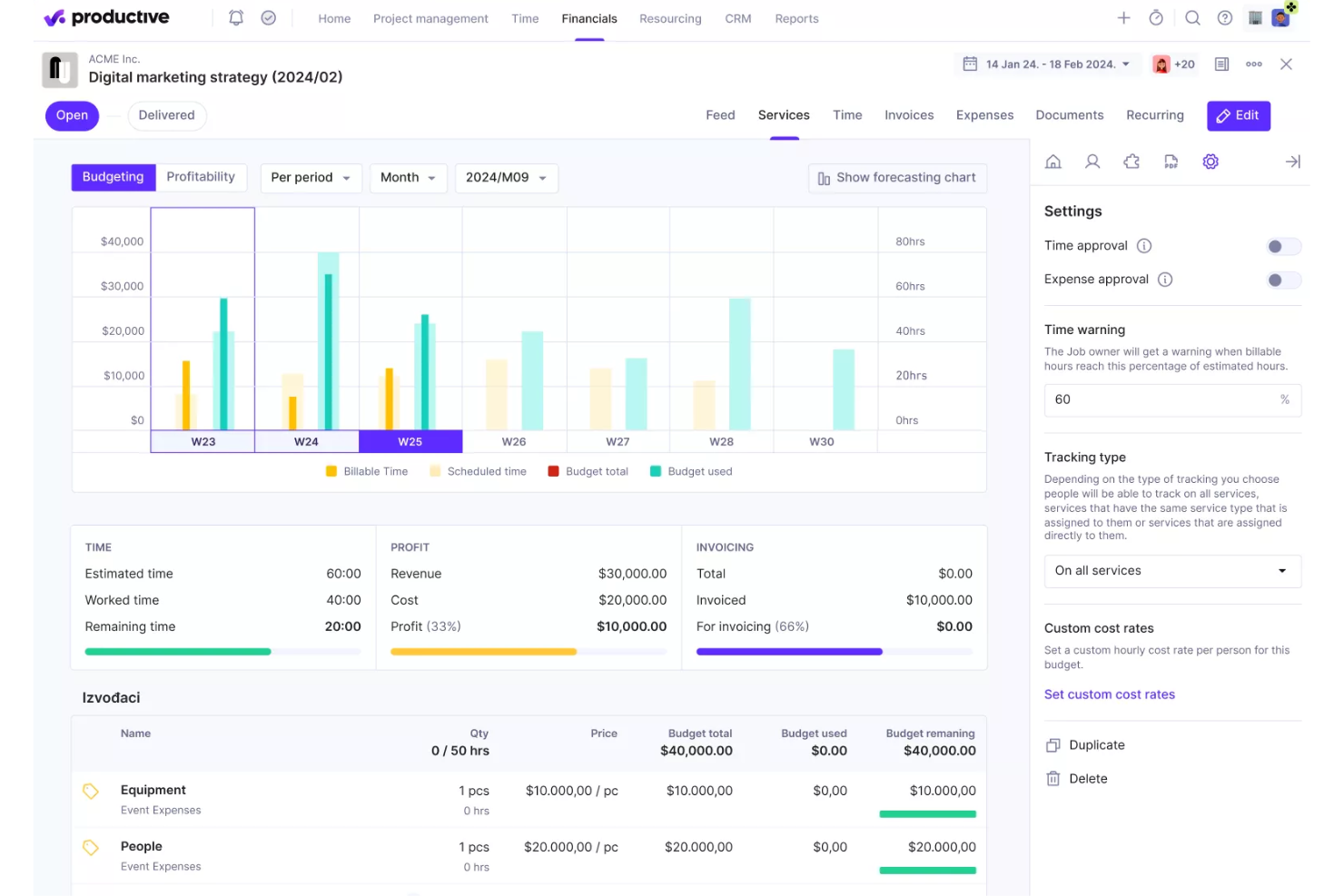

Productive is an all-in-one agency management system designed to assist businesses in managing their operations, projects, and financials.

Why I picked Productive: Productive allows users to create detailed forecasts by leveraging real-time data from multiple sources within the platform. The forecasting tool is integrated with budgeting and profitability modules, enabling users to predict financial outcomes with accuracy. Additionally, the workload feature helps manage resource allocation by forecasting team availability and workload.

Productive Standout Features and Integrations:

Standout features include advanced automation, time off management, project management, Gantt charts, sales CRM, workload management, invoicing, revenue recognition, purchase orders, AI features, customizable reporting, budgeting templates, and permission sets.

Integrations include Jira, Slack, QuickBooks, Xero, Google Calendar, Zapier, Rippling, Sage, BambooHR, and HubSpot.

Pros and cons

Pros:

- Good reporting and resource management capabilities

- Consolidates multiple functions into one platform

- Ability to track project profitability

Cons:

- Could benefit from more integrations

- Initial setup can be time-consuming

LiveFlow is a flexible financial reporting and forecasting tool that’s spreadsheet native, running right on top of popular applications, including Excel and Google Sheets.

Why I picked LiveFlow: I selected LiveFlow mostly for its spreadsheet-native design. It’s very easy to use and lets you turn your existing spreadsheets into live, scalable financial planning and analysis (FP&A) tools.

LiveFlow Standout Features and Integrations:

Standout features include custom dashboards that can automatically update with real-time data, plus in-sheet communication and collaboration features.

I also like that its budget vs. actual functionality is completely automated and always pulls the most recent data. You get access to a huge template library, too.

Integrations include Google Sheets, Microsoft Excel, Xero, and QuickBooks.

Pros and cons

Pros:

- Versatile platform with tons of pre-built templates

- Solid automation features

- Great cash flow forecasting

Cons:

- Limited integrations

Anaplan can be used for a wide variety of applications, but it’s primarily a corporate performance management (CPM) platform.

Why I picked Anaplan: I selected Anaplan because it does a great job of connecting sales planning and forecasting data with sales performance, giving teams the data they need to create targeted marketing strategies.

Anaplan also has solid demand forecasting features to help make your procurement and supply chain management processes more efficient.

Anaplan Standout Features and Integrations:

Standout features include sales planning (quotas, capacity plans, territory design, and account segmentation) that can tap into sales insights and analytics.

Anaplan’s Sales Performance Management application uses real-time data and AI-assisted projections to help you customize your marketing strategy based on different scenarios and demand drivers.

I think Anaplan’s predictive warnings are another feature worthy of mention. It’ll notify you of potential inventory gaps, low-stock items, excessive inventory, and other supply chain issues in time for you to actually do something about it.

Integrations include Microsoft Azure, Amazon Web Services (AWS), Google BigQuery, Excel, and more.

Pros and cons

Pros:

- Excellent reporting and analytics

- Advanced forecasting and analysis

- Extensive budgeting and planning features

Cons:

- Steep learning curve

- Implementation can take weeks

Workday Adaptive Planning is an enterprise performance management (EPM) software with a versatile feature set. It’s best used by mid-market and larger firms, as they can benefit most from its collaborative, cross-departmental features.

Why I picked Workday Adaptive Planning: I selected Workday primarily because of its advanced scenario planning and analysis tools. It’s a useful platform for running what-if scenarios, allowing you to forecast the financial and operational outcomes of various production and demand conditions

Workday Adaptive Planning Standout Features and Integrations:

Standout features include work-anywhere deployment for remote and geographically diverse teams, data and AI-driven financial planning, and predictive analysis.

I really like Workday’s advanced scenario modeling. It’s perfect if you’re needing to test new pricing, analyze marketing strategies, or plan for other contingencies.

Its interactive data visualizations are also great for sharing findings with stakeholders.

Integrations include the Workday software suite and over 600 third-party app integrations. Workday also offers custom integration support (for a fee).

Pros and cons

Pros:

- Excellent data visualization capabilities

- Cross-platform, access-anywhere workflows

- Includes reporting tools

Cons:

- Expensive

- Steep learning curve for new users

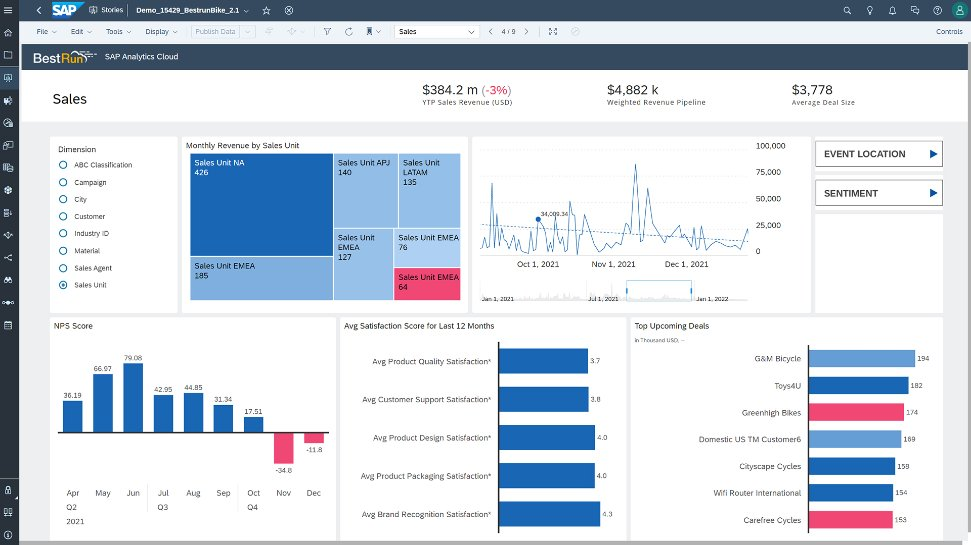

SAP Analytics Cloud is part of the SAP suite and offers cost-effective business intelligence (BI) solutions. It’s designed to help teams integrate real-time data, forecasts, and projections to make more informed business decisions.

Why I picked SAP Analytics Cloud: I selected SAP Analytics Cloud because it’s an affordable entry point into BI software, starting at $36 per user per month. However, many of the more advanced planning features are only included in the more expensive plans.

SAP Analytics Cloud Standout Features and Integrations:

Standout features include self-service data modeling, predictive forecasting, and extended scenario planning.

I appreciate how these features combine to enable teams to better understand—and prepare for—shifts in demand and changes in customer preferences.

And given the low-cost nature of this software, SAP Analytics Cloud is an affordable entry point into forecasting software for smaller teams.

Integrations include SAP suite tools, SQL, Google BigQuery, and more.

Pros and cons

Pros:

- Solid business intelligence tools at a low cost

- Module-based pricing via SAP suite lets you build your own package

- Competitive pricing with a free trial

Cons:

- Limited planning and forecasting features in the base package

- Steep learning curve

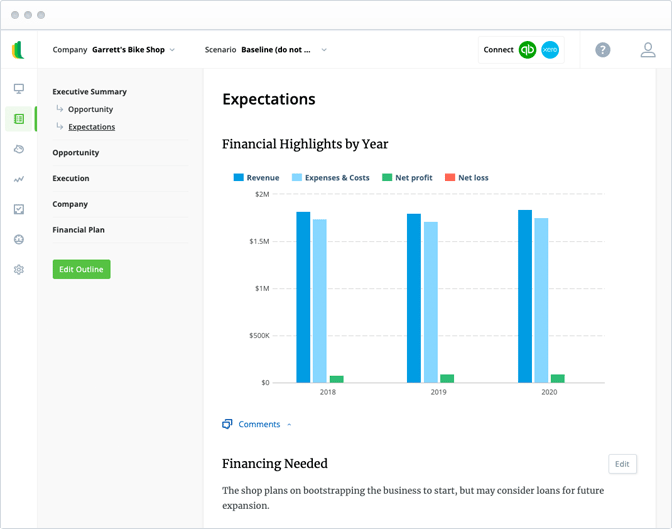

LivePlan is a unique software that’s best suited to new business operations. The software’s primary function is to help you build a business plan, complete with projected revenue and financial forecasting—and then to track actual business performance against those projected figures.

Why I picked LivePlan: I selected LivePlan because it’s cost-effective, easy to use, and specifically designed for new businesses.

Unlike many options on this list, LivePlan doesn’t require an extensive implementation period, nor does it require a big budget. Plus, the tool’s extensive business plan library makes it quite easy to get started.

LivePlan Standout Features and Integrations:

Standout features include a library of 500+ business plan templates, which are very helpful to get a new business off the ground. Plus, if you’re unsure about certain sections in your business plan, LivePlan gives you access to expert guidance.

Their templates also follow the Small Business Association-approved format, which may make it simpler to seek business funding.

LivePlan also makes it easy to project and forecast financial performance based on different scenarios, even for brand-new businesses without any historical sales data for the system to pull from. I also like that LivePlan lets business owners track their actual performance against both budgeted and projected amounts.

Although LivePlan doesn’t currently have any free trial offers available, they do offer a 35-day money-back guarantee—which, to me, means they at least stand behind their product.

Integrations include QuickBooks, Xero, and WinWeb. Exporting to Excel is easy, too.

Pros and cons

Pros:

- Profit and cashflow forecasting tools

- Pre-revenue forecasting features

- Easy business plan building using 500+ templates

Cons:

- Limited integrations

- Limited functionality for established businesses

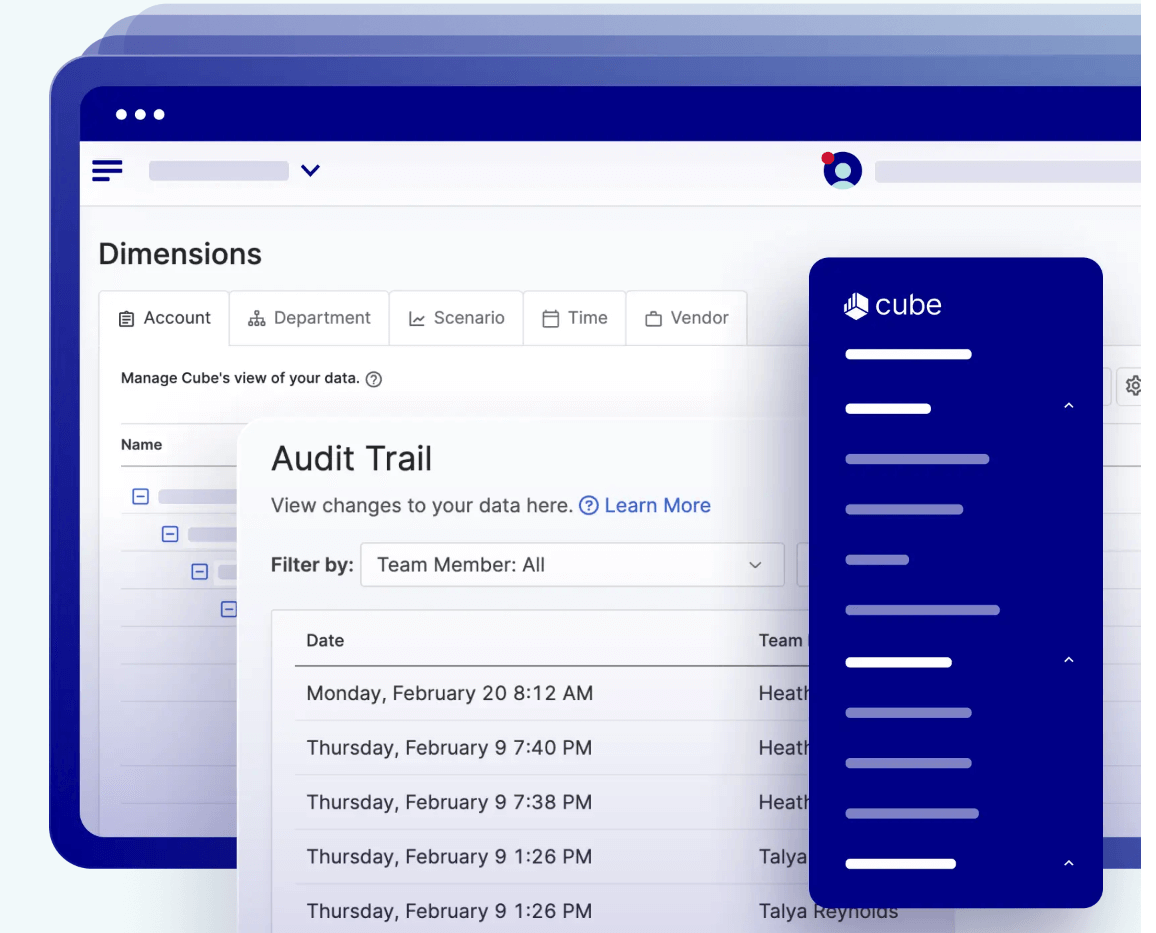

Cube is a financial planning and analysis (FP&A) software that’s spreadsheet-native. That means that it’s built to work alongside two common spreadsheet solutions (Microsoft Excel and Google Sheets).

Why I picked Cube: I selected Cube because it is the simplest to use due to its spreadsheet-native design. I also like that it has transparent pricing (from $1,250 per month), while most competitors have custom pricing that isn’t advertised upfront.

Cube Standout Features and Integrations:

Standout features include a spreadsheet-native design for both Sheets and Excel, which makes Cube simple to use, as well as useful operating expense planning and headcount planning features.

I really like how Cube’s spreadsheet-native design makes it simple to use, requiring minimal training and onboarding. The platform serves as a single source for comprehensive business data, which is drawn from integrated tools. It also has an impressive report builder that can help streamline your budgeting process.

Integrations include NetSuite, Sage, HubSpot, Salesforce, QuickBooks, and many more.

Pros and cons

Pros:

- Easy integrations with ERP, CRM, HRIS, accounting, and BI platforms

- User-friendly FP&A capabilities

- Very user-friendly

Cons:

- Multicurrency support limited to the more expensive plans

Other Forecasting Software Options

If you didn’t quite find the right tool for your organization, these alternative forecasting software providers might be worth a look:

- Pigment

For collaboration

- Mosaic Tech

For real-time data integration

- Zoho Finance Plus

Financial software suite with forecasting

- Salesforce Sales Cloud

For sales forecasting

- Jirav

Forecasting software with simple integrations

- Abacum

For teams with 100-500 users

- Sage Intacct

For detailed scenario models

- Bonsai Agency Software

For forecasting project profitability

- Float

For capacity and scheduling forecasting

- Jedox

For forecasting with performance management

Related Financial Software

If these forecasting tools didn't have the functionality you need, check out these other financially-focused business tools, that we've tested and evaluated:

- Accounting Software

- POS Systems

- Billing Software

- Financial Reporting Software

- Payroll Services

- Merchant Account Services

- Inventory Management Software

- Expense Report Software

Selection Criteria for the best Forecasting Tools

When selecting forecasting software, I look at functionality first — how well does the tool produce forecasts? In doing this, how much easier does it make users' lives?

I have personally tried and researched these tools to ensure they meet our standards, and established a set of criteria for judging them. Here's what we look at:

Core Forecasting Software Functionality - 25% of total weighting score

- Consolidating data from multiple sources

- Generating accurate financial forecasts

- Creating and comparing multiple scenarios

- Automating routine forecasting tasks

- Collaborating across different departments

Additional Standout Features - 25% of total weighting score

- Machine learning algorithms that improve forecast accuracy over time

- Real-time integration with ERP and CRM systems

- Scenario planning with advanced simulation capabilities

- Intuitive and customizable dashboards tailored to specific business needs

- Predictive modeling that leverages historical data trends

Usability - 10% of total weighting score

- Intuitive user interface that is easy to navigate

- Clear, visually appealing dashboard layouts

- Simple data input methods and streamlined workflows

- Drag-and-drop functionality for creating reports and scenarios

- Easy-to-access help and documentation within the platform

Onboarding - 10% of total weighting score

- Comprehensive training videos and tutorials

- Interactive product tours and guided onboarding sessions

- Availability of templates for quick setup

- Chatbots and live support for real-time assistance

- Webinars and ongoing training opportunities for users

Customer Support - 10% of total weighting score

- 24/7 customer support availability

- Multiple support channels (phone, email, chat)

- Responsive and knowledgeable support team

- Detailed and accessible knowledge base

- Community forums for peer-to-peer support

Value For Money - 10% of total weighting score

- Competitive pricing compared to similar tools

- Transparent pricing structures without hidden fees

- Various pricing tiers to fit different business sizes and needs

- Discounts for long-term commitments or bundled services

- Free trials or money-back guarantees to ensure satisfaction

Customer Reviews - 10% of total weighting score

- High overall satisfaction ratings from users

- Consistent positive feedback on core features

- Testimonials highlighting ease of use and effectiveness

- Reviews that mention reliable customer support

- Recognition for delivering good value for the cost

How to Choose Forecasting Software

I explain why I've chosen each forecasting solution in this list, but only you can decide on The One for your business. As you work through the software selection process, keep the following points in mind:

- Where it fits in your tech stack - If you're getting a standalone tool, it has to integrate with your existing systems, like your ERP or accounting platforms, to work properly. Clarify what tools are staying, what you can replace, and how it all connects together.

- What growth looks like for you - Changing software is an administrative headache; thus, the forecasting tool you choose should be able to grow and change in step with your business. If you're a fast-growing startup, put more emphasis here. If you're an established multinational, perhaps scalability is less important.

- What problem you're trying to solve - Be clear on the analytical capabilities you want to unlock, like predictive modeling and scenario planning. While all these forecasting tools will analyze past trends to predict future outcomes, some businesses will need advanced analytics to, say, help deal with market volatility, while others won't. Be clear on the camp you fall into.

- Who will need to use it - Who's going to be interacting with the software most? What's their level of digital fluency? These questions are going to help you understand how many licenses you'll need and just how complex the front-end can be before you get diminishing returns.

- How it would work within your organization - Consider each tool you shortlist alongside your workflows and delivery methodology. Evaluate what's currently working well, as well as the areas that are causing issues that need to be addressed. Then, see if they'd work together. Remember, every business is different — don’t assume that a tool will work for you just because it's popular.

Trends in Forecasting Software

In my research, I sourced countless product updates, press releases, and release logs from different accounting software for small businesses vendors. Here are some of the emerging trends I’m keeping an eye on:

Advanced Analytics and AI Integration

- Machine Learning and Predictive Modeling: Many forecasting tools are now incorporating advanced machine learning algorithms to enhance predictive accuracy. These models learn from historical data and improve over time, making your tools work better for you the longer you're using them. This has made a vendor's history of working with companies like yours more important in the analysis part of your journey.

- Real-Time Data Processing: The ability to process and analyze data in real-time has become a key feature. This allows businesses to make immediate decisions based on the latest financial data, improving responsiveness and strategic planning.

Enhanced User Experience

- Intuitive User Interfaces: User interfaces have become more user-friendly, with drag-and-drop functionalities and customizable dashboards. This trend reduces the learning curve and increases user adoption, enabling finance teams to leverage the software's full capabilities more quickly.

- Collaboration Tools: Modern forecasting software includes advanced collaboration features, such as real-time editing and sharing, which facilitate better communication across departments. This improves alignment and ensures that all stakeholders are informed and involved in the financial planning process.

Comprehensive Integration

- Seamless ERP and CRM Integration: There is a growing emphasis on the seamless integration of forecasting tools with ERP and CRM systems. This ensures a unified data environment, reducing the manual effort required to consolidate information from disparate sources. Unsurprising, considering the usefulness of forecasting tools relies on this data.

Advanced Scenario Planning

- Scenario Simulation and Analysis: Tools are increasingly offering robust scenario planning capabilities, allowing businesses to model and compare multiple financial scenarios. This helps in better preparing for uncertainties and making informed strategic decisions.

Automation and Efficiency

- Automated Forecasting Processes: Automation features are becoming more sophisticated, reducing the manual effort required for data entry and analysis. This increases efficiency and allows finance professionals to focus on higher-value tasks, like making decisions based on that data.

These trends indicate a clear shift towards more sophisticated forecasting solutions, without overcomplicating the user experience — in other words, making advanced analytics available to more people.

What is Forecasting Software?

Forecasting software, at its core, is a digital solution used to predict future trends or outcomes based on historical data and statistical models. It enables you to make more accurate predictions, identify potential opportunities or risks, and optimize planning processes.

Overall, it should be a tool that helps to plan proactively, using the most accurate data available.

But beyond that? It can do a lot more, like...

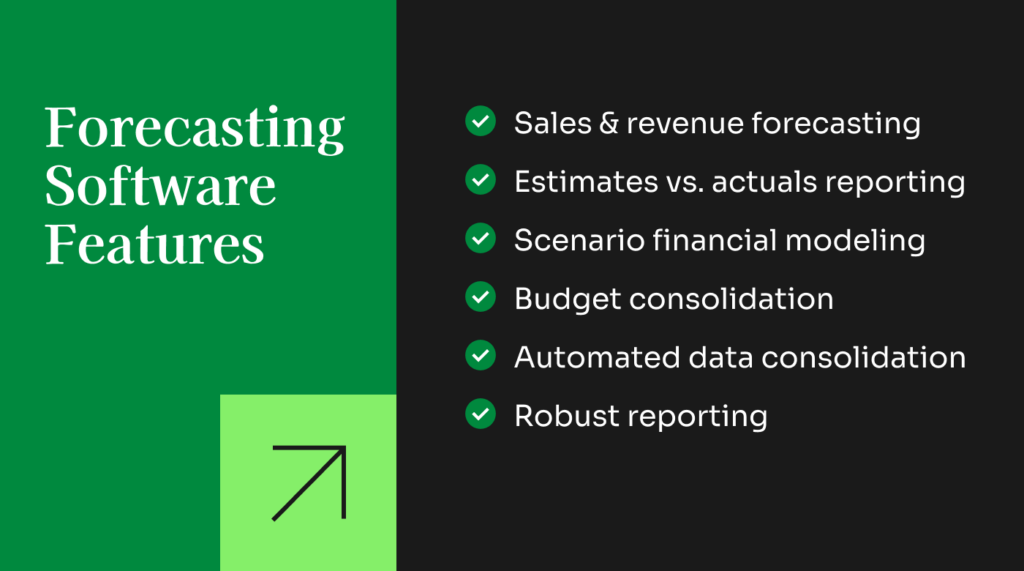

Key Features of Forecasting Tools

The right forecasting tool does more than create reports — it should be able to streamline workflows, enhance data accuracy, and improve strategic decision-making.

Here are the top features to consider:

- Data Integration: The software should seamlessly integrate with various data sources, ensuring a comprehensive view of financial information, which is crucial for accurate forecasting.

- Advanced Analytics: The inclusion of sophisticated analytics tools helps in generating more precise forecasts, allowing for better planning and resource allocation.

- Scenario Planning: The ability to model different scenarios helps prepare for potential challenges and opportunities, enabling more agile and informed decision-making.

- Automated Data Processing: Automation reduces the time and effort required for manual data entry, minimizes errors, and increases efficiency in the financial planning process.

- Predictive Modeling: Predictive models use historical data and machine learning to forecast future trends, enhancing the accuracy and reliability of financial projections.

- Budget Consolidation: Software should be able to consolidate budget, forecasting, and planning data into actionable information to be shared with internal teams. Most organizations typically consolidate on an annual basis, but greater insight can potentially be gained by using software to consolidate and prepare reports more efficiently — and more frequently.

- Variance Reports: Budgeting is a primary function of forecasting software, but the best tools also allow users to create variance reports. These compare budgets/projections to actual figures, which makes it easier to identify soft spots in forecasting and tweak future operations to better match budgeted figures.

- Machine Learning Integration: Incorporating machine learning algorithms enhances the tool's ability to learn from historical data and improve forecast accuracy over time, providing more reliable and actionable insights.

- Sales Forecasting & Production Scheduling: Software should be able to forecast sales estimates based on factors such as seasonal demand, pricing shifts, and historical trends. Additionally, it should have tools to help teams schedule production based on forecasted demand.

- Custom reporting: Forecasting tools should be able to export findings into user-friendly reports, which can be shared with internal (and potentially external) stakeholders. Ideally, reports should be intuitive and understandable for those without direct experience with the producing software solution.

Benefits of Forecasting Tools

Forecasting tools do more than simply tell you an outcome. By moving away from the spreadsheets and choosing a software solution, you can enjoy:

- Enhanced Accuracy: Using advanced algorithms and data integration, forecasting software improves the precision of financial projections, enabling businesses to make more informed decisions and reduce risks.

- Efficiency Gains: Automation of data processing and report generation saves time and reduces manual errors, allowing finance teams to focus on strategic analysis rather than repetitive tasks.

- Improved Strategic Planning: Scenario planning and predictive modeling provide insights into potential future outcomes, helping businesses prepare for various possibilities and make proactive adjustments.

- Better Collaboration: Integration with cloud services and collaboration tools ensures that all stakeholders have access to up-to-date information, fostering better communication and alignment across departments.

- Scalability and Flexibility: Forecasting software can scale with the growth of the business, accommodating increasing data volumes and complexity without compromising performance, ensuring continued relevance and utility.

Costs & Pricing for Forecasting Software

I included vendor-specific pricing above but, seeing as how much each tool's features can vary from the next, I wanted to put together a general pricing table for forecasting software, based on company size.

Here's a breakdown of the typical plan options and their pricing:

Plan Comparison Table for Forecasting Tools

| Plan Type | Average Price (/user/month) | Common Features | Best For | Integration Frequency |

|---|---|---|---|---|

| Free | $0 | - Basic forecasting tools - Limited data integration - Basic reporting capabilities | Startups and small businesses | Some standalone (intro plans), but often integrated into larger tools |

| Basic | $50 | - Standard forecasting models - Basic analytics - Integration with key data sources | Small to mid-sized businesses | Most often standalone |

| Professional | $150 | - Advanced analytics - Customizable dashboards - Scenario planning - Cloud integration | Growing businesses | Frequently integrated |

| Enterprise | $500+ | Full suite of advanced features - Machine learning - Real-time data processing - Dedicated support | Large enterprises | Most often integrated |

While changing software can be a real pain, changing tiers isn't as big of a deal. Businesses commonly change forecasting tool tiers as their needs evolve due to growth, increased data complexity, or the requirement for advanced features like machine learning and predictive modeling.

Transitions often occur during annual reviews, after significant growth phases, or when new ERP or CRM systems are implemented, which may have their own forecasting functionality.

What are the Different Types of Forecasting Software?

Forecasting software can take a few different forms. The primary categories are outlined below.

Budgeting and forecasting software focuses on financial details, covering revenue estimates, operating expense planning, and financial budgeting. Basic features in this realm may be included in accounting platforms, but many organizations could benefit from dedicated financial forecasting software.

Sales forecasting software focuses on the sales side of things and typically has more features for analyzing the effects of different marketing strategies (discounts, bundling, etc.). Sales forecasting tools are helpful in giving sales teams more accurate targets while also helping supply chain and production managers plan inventory levels and production targets accordingly.

Demand forecasting software focuses on the demand side of the equation, helping businesses optimize inventory levels, plan for shifts in seasonal demand, and track consumer trends and buyer behavior.

Capacity and workforce forecasting software focuses on labor, production capacity, and workflow planning while integrating projected demand and sales data. It’s useful for HR and executive teams to ensure their workforce can keep up with forecasted sales.

Enterprise resource planning (ERP) software offers a versatile feature set to centralize most or all of your operating and planning efforts. ERP platforms are the most expensive of the lot but also the most flexible in how they can be deployed and used.

Some software tools combine multiple focus areas, while others are dedicated to a specific feature set. The best forecasting tool for your team depends on your specific needs—as well as the size of the business, the industry, and other variables.

Forecasting Software FAQs

Below you’ll find my answers to some common questions people have about forecasting software.

What is financial forecasting?

Financial forecasting is a process businesses and organizations engage in to plan out future financial projections and how those projections might influence business decisions. Forecasting involves estimating future financial outcomes for a company, a division, or even a specific project or product.

Findings from financial forecasting procedures can be used in budgeting, tax planning, and valuation.

How does forecasting software assist finance teams?

Good forecasting software helps teams by automating parts of the forecasting process, including complex calculations based on multiple inputs and variables. Software can also help teams prepare detailed reports to share with stakeholders.

How much does forecasting software cost?

Forecasting software is a broad term that encompasses a few different types of software, and pricing can vary considerably.

Many companies opt for simple financial forecasting software, which is the cost-effective option. Pricing for basic forecasting software varies based on the number of users and the scope of features you need. You can expect to pay anywhere from $50 to several hundred dollars per month (and perhaps even more, for large teams).

Large organizations often opt for full-fledged enterprise resource planning (ERP) software, which is usually quite expensive (several thousand dollars per month).

What's Next?

To keep up to date with the latest trends in financial technology, subscribe to our free newsletter.