Best Financial Reporting Software Shortlist

Here are the financial reporting solutions I’ve examined and selected to cover in this article:

Our one-on-one guidance will help you find the perfect fit.

Maybe it's just me, but financial reporting is quite possibly one of my least favorite things about working in a financial function — I feel like it's the grown-up equivalent of getting your school attendance signed off by a parent. You might see it more favorably, but I'm over here thanking my lucky stars that financial reporting software exists.

Rather than spending my time sifting through mountains of data and hoping I didn't fat-finger an extra zero into the balance sheet, the software creates, analyzes, and distributes financial reports at whim, keeping everyone in the loop.

The only problem? There's just too much tech out there.

I went through the most popular financial reporting software options to find you the best tool for 2025. Let's get into it.

Why Trust Our Financial Software Reviews

My team and I have been testing and reviewing financial software since 2023. As current — or, ahem, historical — financial operators ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Costs & Pricing for Financial Reporting Software

To kick things off, I collected pricing information about each tool. Here’s how they stack up, cost-wise:

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for vendor payout data | Free demo available | Pricing upon request | Website | |

| 2 | Best for real-time spend pattern visibility | Free demo available | From $8/user/month (billed annually) | Website | |

| 3 | Best for financial forecasting | Free demo available | Pricing upon request | Website | |

| 4 | Best for Excel-powered financial reporting | Free demo + product tour available | Pricing upon request | Website | |

| 5 | Best for startups | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 6 | Best for presentation-ready reports | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 7 | Best for lease accounting reporting | Free demo available | Pricing upon request | Website | |

| 8 | Best for complex reporting | Free demo available | Available upon request | Website | |

| 9 | Best on a small budget | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 10 | Best for small businesses | 30-day free trial available | From $10/month | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Reviews of the Best Financial Reporting Software for 2025

Here are the best financial management reporting software tools on the market going into 2025. I’ll go through the pros and cons of each tool, their features, and their ideal use cases.

Payouts.com is a specialized platform that supports businesses in automating and managing financial operations like payouts, vendor relationships, and invoicing. It caters particularly to companies in the affiliate marketing, influencer economy, and digital advertising spaces by integrating seamlessly with tracking systems like Tune, Affise, and CJ Affiliate.

Why I picked Payouts: Its payout automation capabilities allow businesses to manage large-scale payments efficiently, ensuring that creators, influencers, and partners are paid on time without errors. By integrating directly with tracking systems such as Tune and Affise, it provides a consolidated view of all transactions, giving you precise financial data to work with. This financial data is supported by real-time dashboards and custom reporting capabilities. Additionally, automatic invoice matching eliminates the need for manual reconciliation. By automating this process, Payouts reduces errors and speeds up the accounts payable workflow.

Standout Features and Integrations

Standout features include advanced data synchronization that ensures your financial systems and the Payouts platform are always aligned, providing real-time accuracy in reporting. The platform also offers efficient one-click payment execution, allowing you to pay anyone, anywhere, with minimal effort. Additionally, Payouts.com supports diverse payment options, including traditional bank transfers, eWallets, and cryptocurrencies.

Integrations include PayPal, Venmo, Payoneer, impact.com, CJ Affiliate, Everflow, Zelle, Priority, Tune, System1, and NetSuite.

Pros and cons

Pros:

- Supports scaling operations

- Multiple payout methods

- Comprehensive automation of accounts payable processes

Cons:

- May not integrate with all existing systems

- May require time to fully customize

Rippling Spend is a tool designed to help businesses get a handle on spending by providing a centralized place for managing expenses, corporate cards, and budgets. With it, you can set up automated controls to ensure spending stays within your company’s guidelines.

Why I picked Rippling Spend: When it comes to financial reporting, Rippling Spend gives you solid tools to track and categorize every expense. You'll get detailed, real-time visibility into all spending activity, helping you understand exactly where your money is going. Its automated expense approvals reduce manual effort while ensuring compliance. Plus, its reporting features break down expenses by department, project, or employee, so you can quickly generate reports and gain insights into patterns that affect your financial decisions.

Standout Features and Integrations

Standout features include the ability to set up dynamic policy controls to prevent unauthorized spending before it happens. You can also manage employee reimbursements directly through the platform, ensuring everything is documented and handled efficiently. Additionally, Rippling Spend integrates corporate card management, giving you control over card usage while offering visibility into transactions in real-time.

Integrations include Slack, Google Workspace, Office 365, AWS, Zoom, Dropbox, and Salesforce.

Pros and cons

Pros:

- Dynamic policy enforcement helps prevent unauthorized spending

- Detailed reports for departments, projects, and employees

- Expense tracking helps with budgeting decisions

Cons:

- May offer more features than required for smaller operations

- Lacks advanced forecasting features

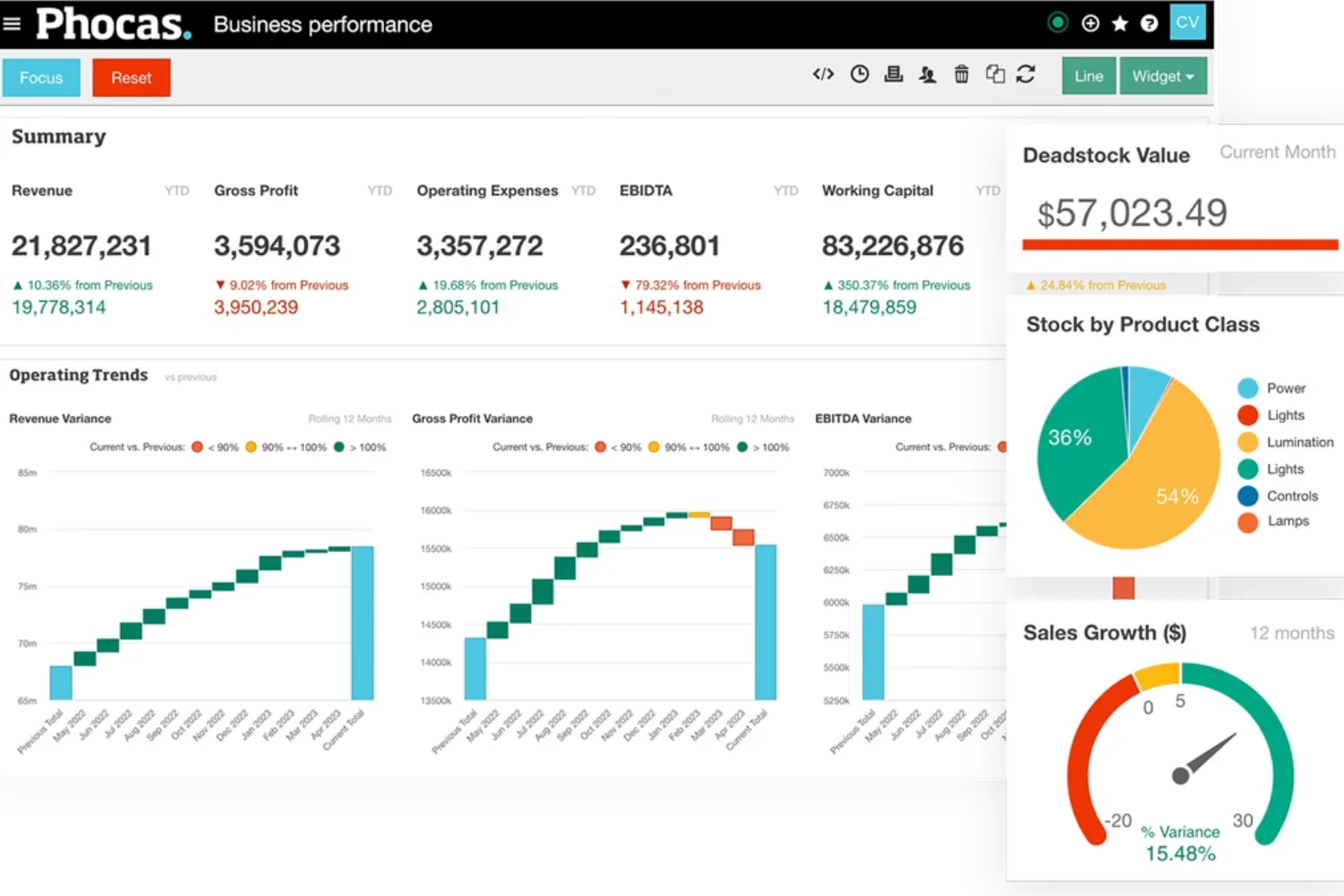

Phocas is a business intelligence and financial analysis software designed to provide organizations with comprehensive data analytics, visualization, and reporting capabilities. It's specifically tailored for businesses seeking to enhance their data-driven decision-making processes as it integrates with various data sources, including ERP systems, CRM software, and other databases.

Why I picked Phocas: I chose Phocas because it offers customizable financial statements, including balance sheets, profit and loss statements, and cash flow reports, which can be tailored to meet the specific needs of any organization. The platform's ability to generate real-time financial reports ensures that businesses always have up-to-date information at their fingertips. Additionally, Phocas offers features for financial forecasting, allowing users to create detailed predictions based on historical data and trend analysis.

Standout Features and Integrations

Standout features include collaborative tools that enable users to share reports and dashboards with team members, data visualization tools to transform complex financial data into intuitive charts, graphs, and dashboards, and an AI feature that allows users to ask questions and receive relevant insights and reports quickly.

Integrations include Oracle, QAD, MAM Software, Khaos Control, SYSPRO, Retail Express, Sympac, Microsoft, Acumatica, Xero, Epicor, IFS, Sage, Accolent, MYOB, Enapps, Kerridge, SAP, Datafile, Netsuite, and more.

Pros and cons

Pros:

- Forecasting capabilities

- Real-time data and analytics

- Extensive customizations for reports and dashboards

Cons:

- Learning curve for new users wanting to maximize the features

- Set up and configuration can be time consuming

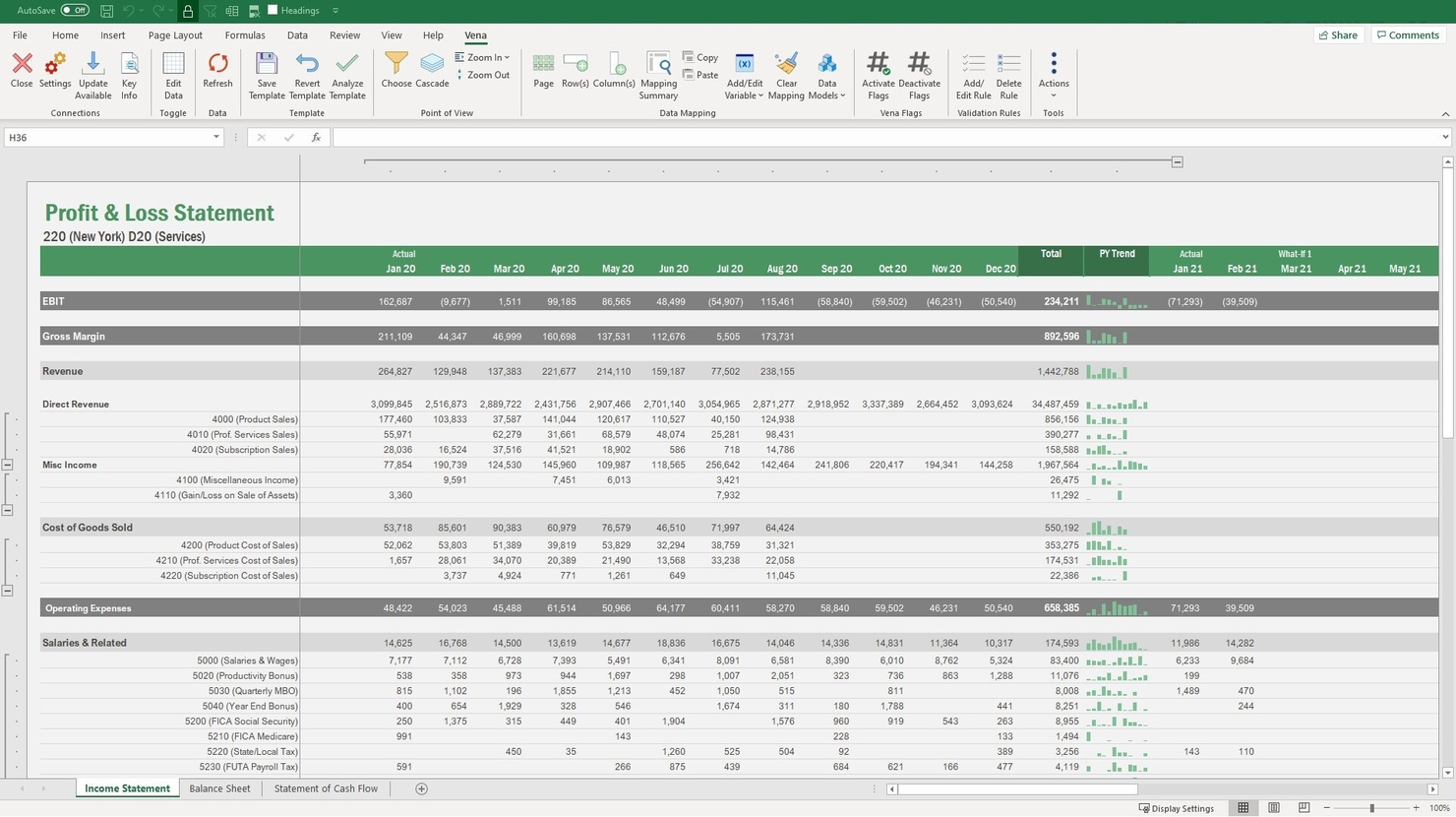

Vena is a flexible financial planning and analysis (FP&A) platform that automates key financial consolidation and reporting processes. It features a native Excel interface as well as integrations with Microsoft Power BI and PowerPoint, making it easy to adopt for most finance teams.

Why I picked Vena: I chose Vena for its easy-to-use Excel interface, custom reporting, and dashboard features, and ability to quickly integrate and consolidate data from ERP/GL, CRM, and HRIS systems. Additionally, as a financial reporting software, Vena provides robust planning and analysis features that include artificial intelligence for insightful financial data analysis, support for financial planning tasks, and data modeling capabilities for forecasting and scenario analysis.

Standout Features and Integrations

Standout features include audit trails, variance analysis, workflow management, scenario modeling, automated reconciliations, real-time dashboards, ad-hoc reporting, and collaboration tools.

Integrations include QuickBooks, Salesforce, Sage Intacct, Oracle, SAP, NetSuite, Microsoft Dynamics 365 Business Central, Dropbox, OneDrive, SFTP, and SharePoint. Custom integrations are available through Vena API.

Pros and cons

Pros:

- Usually quick to implement

- Preconfigured templates and reports

- Leverages familiar Excel interface

Cons:

- No mobile app

- Some compatibility issues with Mac

Xero is a popular accounting platform used by businesses of all sizes across many different industries.

Why I picked Xero: I added Xero to my list because it’s extremely easy to use and offers all the necessary financial reporting tools for small businesses and startups.

Standout Features and Integrations

Standout features include automated reconciliations, bank balance projections, AI-powered cash flow predictions, and customizable financial reports that allow users to easily reorder, add, and delete different columns as needed.

Xero supports multiple currencies and unlimited clients and users. They also have extensive support and online tutorials available, making it easy to learn the platform and accounting features.

Integrations include Shopify, HubSpot, MailChimp, Float, Accelo, and many more. Xero integrates with over 1,000 apps.

Pros and cons

Pros:

- Affordable

- Includes invoicing tools and automated receipt capture

- Unlimited users supported on all plans

Cons:

- Multiple currencies only available on the highest plan

- Limited features on entry-level plan

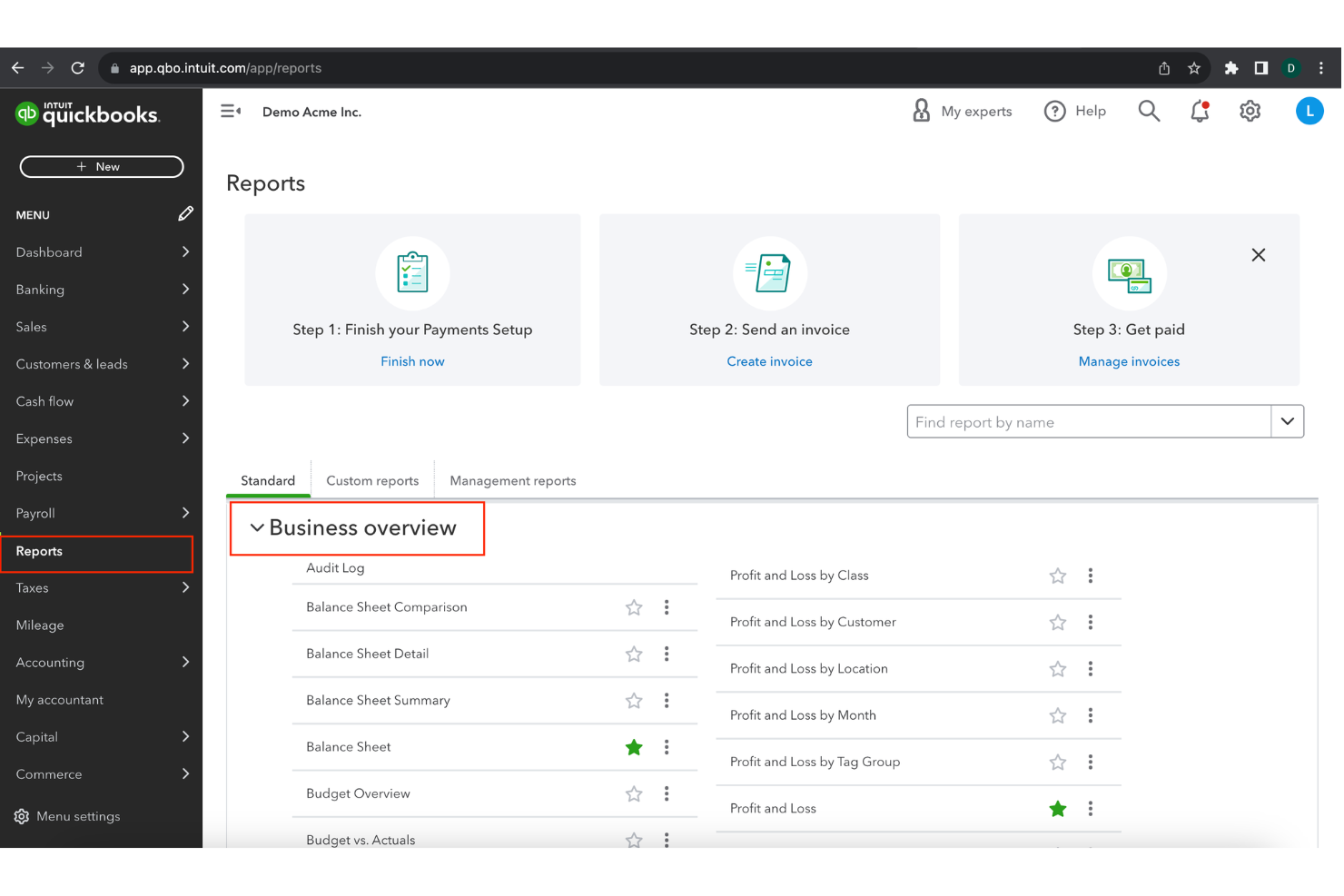

QuickBooks Online is a cloud-based accounting software tailored for small to midsize businesses, offering a wide range of financial management tools such as invoicing, expense tracking, payroll management, and tax preparation.

Why I picked QuickBooks Online: It provides presentation-ready reports that can be tailored to meet the specific needs of stakeholders, which is crucial for precision in financial presentations. These reports are supported by real-time insights available through financial statements and a revenue streams dashboard, offering a dynamic view of the company's financial health. The ability to monitor cash flow trends and create personalized dashboards for key performance indicators (KPIs) also drives informed, data-driven decisions.

Standout Features and Integrations

Standout features include automated invoicing and bill payments, reducing time spent on routine tasks, and tools for collaboration and data management. Other features include project profitability tracking and inventory management, which are vital for businesses handling both products and services.

Integrations include Amazon Business, PayPal, Square, Etsy, eBay, Shopify, Google Sheets, Salesforce, Stripe, HubSpot, and Mailchimp.

Pros and cons

Pros:

- Compatible with a wide range of apps

- Good for scaling businesses

- Users can tailor financial reports to meet specific business needs

Cons:

- Potential for errors in general ledger due to auto-population issues

- Bank feed rules can lead to errors

Spacebase is a modern lease accounting and management solution designed to help businesses efficiently handle their portfolios. It offers tools for managing leases, ensuring compliance with accounting standards, and streamlining reporting processes.

Why I picked Spacebase: I chose Spacebase for its ability to simplify compliance with accounting standards such as ASC 842 and IFRS 16. The platform provides guided checklists to classify leases as operating, finance, or short-term, helping your team adhere to regulatory requirements without hassle. This feature ensures that your financial reports are accurate and compliant, reducing the risk of errors during audits. You can also build tailored reports and exports to access the specific data your team needs. This flexibility allows for detailed financial analysis and supports informed decision-making.

Standout Features and Integrations

Standout features include a centralized dashboard that offers a comprehensive overview of your lease portfolio, displaying critical dates, rent obligations, and portfolio metrics. Automated alerts and notifications ensure you never miss important dates or payments by highlighting them prominently on the dashboard. Additionally, the lease notes system aggregates user comments and updates, facilitating communication among team members regarding lease actions or changes.

Integrations include Workday, NetSuite, Tableau, Okta, OneLogin, and Oracle Cloud Financials.

Pros and cons

Pros:

- Custom reporting features allow tailored financial analysis

- Ensures compliance with lease accounting standards like ASC 84

- Effective tracking and management of rent, leases, and important real estate files

Cons:

- No mobile app

- Could offer more native integration options

Workiva is a financial reporting tool with convenient document collaboration features. It’s a great platform for data visualization and creating customized views and ad hoc reports.

Why I picked Workiva: I chose Workiva because it allows for customized financial reporting for organizations of all sizes.

Standout Features and Integrations

Standout features include automations designed to streamline data collection and financial reporting processes across your organization.

Workiva’s automations help to improve the timeliness and accuracy of internal and external financial reports, including budget-to-actual variance reports, management reporting, internal controls, capital market transactions, and environmental, social, and governance (ESG) reporting.

I think the tools that help teams monitor business KPIs and debt covenant compliance seem particularly useful.

Integrations include Workday, Sage Intacct, Netsuite, Google Drive, QuickBooks, Tableau, Planful, and SAP.

Pros and cons

Pros:

- Available via web and Android app

- Automated ESG reporting

- User-friendly interface

- Comprehensive reporting features

Cons:

- No phone or live support

- No mobile application for iOS

Freshbooks is accounting software that’s very affordable and easy to use, which I think is ideal for small businesses, freelancers, and solopreneurs.

Why I picked Freshbooks: I added Freshbooks to my list because it’s a great all-around solution for small businesses and freelancers who don’t need the complex financial reporting software that makes up most of this list.

Standout Features and Integrations

Standout features include annual and interim financial statements, bank account synchronization, and detailed tax reporting.

In addition to the basic financial reporting functionality, I like that Freshbooks also gives you tools for invoicing, client management, payments, and expense management.

Integrations include Hubspot, QuickBooks, Google Sheets, PayPal, Gmail, WooCommerce, Square, and Shopify.

Pros and cons

Pros:

- Customizable invoices and email templates

- Connects with your bank for easy reconciliation

- Easy-to-use

Cons:

- No full audit trail

- Limits on billable clients

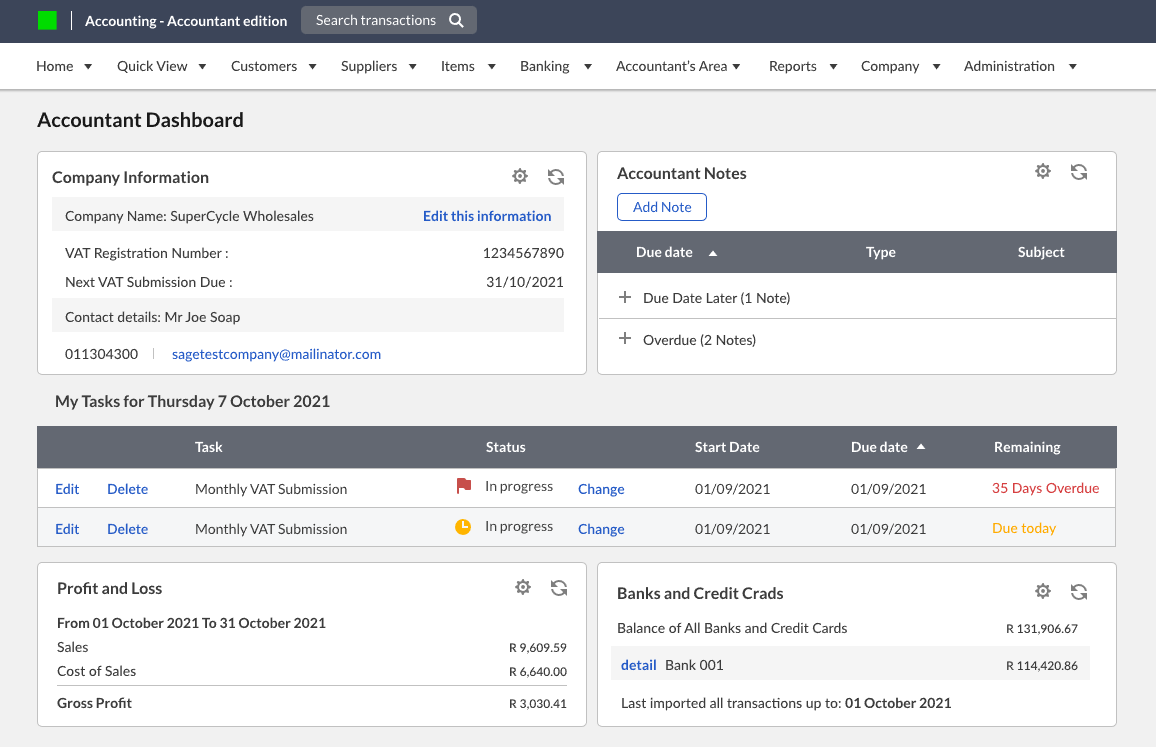

Sage Business Cloud Accounting only costs $10 a month, but it has all your basic financial reporting needs covered.

Why I picked Sage Business Cloud Accounting: I picked Sage Business Cloud Accounting because it’s an affordable cloud-based financial reporting tool that seems like it would be a great fit for small teams and startups.

Standout Features and Integrations

Standout features include full audit trails, cash flow management and forecasting, automated tax reporting tools, and inventory tracking.

I like Sage’s library of user support and training videos, and all of the other educational resources available for users, like Sage University and the Customer Learning Curriculum.

Integrations include Netcash, HubSpot, Monday.com, Salesforce, Shopify, Gmail, Excel, Stripe, and PayPal.

Pros and cons

Pros:

- Customer Learning Curriculum

- Mobile app

- Supports multiple currencies

Cons:

- API is not user-friendly

- Limited features with basic plan

Other Financial Reporting Software Options

Here are some more financial reporting tools that didn’t make the top 12 but are still worth checking out.

- Tipalti

For large organizations

- insightsoftware

For custom reporting

- Xledger

For complex ERP needs

- Tagetik

Comprehensive solution

- Cube

For growing teams

- LicenceOne

For SaaS spend optimization

- Spreadsheet Server

For live data reports

- Budgyt

For simple projects

- Abacum

For teams with 100-500 users

- Sage Intacct

For ease of use

Related Finance and Accounting Software Reviews

In the market for some other finance and accounting software as well? Check out these reviews:

- Forecasting Software

- Billing Software

- Expense Tracking Software

- Payroll Services

- Retail POS Systems

- Inventory Management Software

Selection Criteria For Financial Management Reporting Software

Selecting financial reporting software involves evaluating its functionality and how well it meets specific use cases. The criteria relate to the needs and pain points of software buyers, ensuring the tool is suitable for its intended use.

Here's what I thought mattered most:

Core Financial Reporting Software Functionality: 25% of Total Weighting Score

- Generating financial statements

- Budgeting and forecasting

- Compliance and audit support

- Consolidation of financial data

- Real-time financial analysis

Additional Standout Features: 25% of Total Weighting Score

- Advanced data visualization tools

- Integration with other business systems (e.g., ERP, CRM)

- Customizable reporting templates

- AI-driven insights and predictive analytics

- Mobile accessibility for on-the-go reporting

Usability: 10% of Total Weighting Score

- Intuitive user interface

- Drag-and-drop report builders

- Customizable dashboards

- Role-based access control

- Minimal learning curve

Onboarding: 10% of Total Weighting Score

- Availability of training videos and tutorials

- Interactive product tours

- Pre-built templates for quick setup

- Chatbots for instant support

- Webinars for in-depth training

Customer Support: 10% of Total Weighting Score

- 24/7 availability

- Multiple support channels (phone, email, chat)

- Dedicated account managers

- Comprehensive knowledge base

- Fast response times

Value For Money: 10% of Total Weighting Score

- Competitive pricing models

- Transparent pricing structure

- Flexible subscription plans

- Cost-benefit analysis

- Discounts for long-term commitments

Customer Reviews: 10% of Total Weighting Score

- Overall satisfaction ratings

- Commonly reported issues

- Praise for specific features

- Feedback on customer support

- User testimonials and case studies

How to Choose Financial Reporting Software

As you work through this list, don't get caught up in the marketing of it all. Keep your organization, and yourself, in mind, considering:

- Functionality: Ensure the software meets your specific financial reporting needs, including budgeting, forecasting, and analysis capabilities. For example, if your organization requires detailed budget management and predictive analytics, look for software that offers these features.

- Integration: Look for software that integrates (well) with existing tools like Microsoft Excel and Power BI. This is crucial for data management and reporting, as it allows for smoother data flow and reduces the need for manual data entry.

- Scalability: Choose a solution that can grow with your organization and handle increasing data volumes. If you're part of a rapidly expanding company, you'd best look for software that can scale up to accommodate more users and larger datasets without compromising performance.

- User Experience: The software should be user-friendly to facilitate collaboration among your teams. A complex interface can hinder productivity, so look for solutions with intuitive navigation, pre-built templates, and customizable reports to make the user experience more efficient.

- Security: Prioritize software with robust security features to protect sensitive financial data. This is especially important for organizations handling confidential information — such as those in healthcare or government — as strong security measures help prevent data breaches and ensure compliance with regulatory standards.

Financial Reporting Software Trends in 2025

Financial reporting software is evolving in many of the same ways as other financial software, though there are few unique things to pay attention to. Here are some key trends financial reporting software saw in 2025.

AI and Machine Learning Integration

AI and machine learning are being integrated into financial reporting software. These technologies help automate data analysis and provide predictive insights. This trend is important for improving decision-making accuracy.

Real-Time Data Processing

Real-time data processing is becoming a standard feature. It allows businesses to access up-to-the-minute financial information. This is crucial for timely decision-making and maintaining a competitive edge.

Blockchain for Enhanced Security

Blockchain technology is being adopted for financial reporting. It offers enhanced security and transparency in financial transactions. This trend is significant for reducing fraud and ensuring data integrity.

Cloud-Based Solutions

Cloud-based financial reporting solutions are on the rise. They offer scalability and remote access to financial data. This is particularly important for businesses with distributed teams.

Customizable Dashboards

Customizable dashboards are gaining popularity. They allow users to tailor their financial reports to specific needs. This trend is valuable for providing personalized insights and improving user experience.

What is Financial Reporting Software?

Financial reporting software is a digital tool that centralizes financial data, automates reporting processes, and enhances the accuracy and consistency of financial information, contributing to effective communication and reporting.

Key features such as report customization, data visualization, collaboration tools, and compliance functionalities simplify the preparation of financial statements, support regulatory requirements, and enable users to generate insightful reports for informed decision-making.

Features Of Financial Reporting Software

When choosing financial reporting software, it is essential to understand the key features that will help streamline your financial processes and ensure accurate reporting. The right software can make a significant difference in how efficiently and effectively you manage your financial data. Here are the most important features to look for in financial reporting software:

- User-Friendly Interface: A simple and intuitive interface ensures that users can navigate the software easily, reducing the learning curve and increasing productivity.

- Customizable Reports: The ability to customize reports allows you to tailor the financial data to meet specific business needs, providing more relevant insights.

- Real-Time Data Access: Access to real-time data ensures that you are always working with the most current information, which is crucial for making timely decisions.

- Integration Capabilities: Seamless integration with other business systems, such as ERP and CRM, ensures that data flows smoothly across different platforms, reducing the risk of errors.

- Automated Processes: Automation of routine tasks, such as data entry and report generation, saves time and reduces the likelihood of human error.

- Security Features: Robust security measures protect sensitive financial data from unauthorized access and breaches, ensuring compliance with regulatory requirements.

- Scalability: The software should be able to grow with your business, accommodating increasing amounts of data and more complex reporting needs as your company expands.

- Collaboration Tools: Features that facilitate collaboration, such as shared access and real-time updates, enable team members to work together more effectively.

- Mobile Access: The ability to access the software from mobile devices ensures that you can manage your financial data on the go, providing flexibility and convenience.

- Customer Support: Reliable customer support ensures that any issues or questions are addressed promptly, minimizing downtime and disruptions to your financial processes.

Choosing financial reporting software with these features will help ensure that your financial management is efficient, accurate, and adaptable to your business's evolving needs. By focusing on these key aspects, you can make a more informed decision and select a solution that best fits your requirements.

Benefits Of Financial Reporting Software

In today's fast-paced business environment, financial reporting software has become an essential tool for organizations looking to streamline their financial processes and gain a competitive edge. This software offers a range of benefits that can significantly enhance the efficiency and accuracy of financial management. Below are five primary benefits of financial reporting software for users and organizations.

- Improved Accuracy: Financial reporting software reduces the risk of human error by automating calculations and data entry, ensuring that financial reports are accurate and reliable.

- Time Efficiency: By automating repetitive tasks and streamlining data collection, financial reporting software saves valuable time for finance teams, allowing them to focus on more strategic activities.

- Enhanced Data Analysis: The software provides advanced analytical tools that enable users to gain deeper insights into financial data, helping organizations make informed decisions based on comprehensive analysis.

- Regulatory Compliance: Financial reporting software helps organizations stay compliant with regulatory requirements by automatically updating to reflect changes in financial reporting standards and providing audit trails.

- Real-Time Reporting: With real-time data processing capabilities, financial reporting software allows users to generate up-to-date financial reports quickly, facilitating timely decision-making and improving overall business agility.

Investing in financial reporting software can transform the way organizations manage their finances, leading to increased accuracy, efficiency, and compliance. By leveraging the advanced features of this software, businesses can gain valuable insights and make more informed decisions, ultimately driving growth and success.

Costs And Pricing Of Financial Reporting Software

This section provides an estimate of average financial reporting software plans and costs. The pricing varies based on the plan type and the features offered.

| Plan Type | Average Price (per month) | Common Features |

|---|---|---|

| Free | ... it's free! | Basic income/expense tracking, invoicing, limited reporting capabilities |

| Personal | $10 - 50 | Income/expense tracking, invoicing, basic financial statements, limited users |

| Business | $50 - 150 | Multi-user access, recurring invoicing, expense reporting automation, payroll |

| Enterprise | $150+ | Customizable fields, automated reporting, project costing, advanced integrations |

People Also Ask

Here are my answers to some common questions people have about financial reporting software.

Can you use Excel for financial reporting?

You can, and many businesses certainly do, but unless your business is very small or simple, or you have an Excel genius on staff, it’s going to be time-consuming. If you want any sort of forecasting, reconciliation, visualization, or data integration, you’re looking for software or at least a plug-in.

What are the three required financial statements?

The big three required financial statements are a balance sheet, income statement, and cash flow statement. You want software that can produce these just for their usefulness, but if your company has (or wants) investors or is on the market to be sold, you need to be able to produce these.

How to Choose Financial Reporting Software

As you work through this list, don’t get caught up in the marketing of it all. Keep your organization, and yourself, in mind, considering:

-

- Functionality: Ensure the software meets your specific financial reporting needs, including budgeting, forecasting, and analysis capabilities. For example, if your organization requires detailed budget management and predictive analytics, look for software that offers these features.

-

- Integration: Look for software that integrates (well) with existing tools like Microsoft Excel and Power BI. This is crucial for data management and reporting, as it allows for smoother data flow and reduces the need for manual data entry.

-

- Scalability: Choose a solution that can grow with your organization and handle increasing data volumes. If you’re part of a rapidly expanding company, you’d best look for software that can scale up to accommodate more users and larger datasets without compromising performance.

-

- User Experience: The software should be user-friendly to facilitate collaboration among your teams. A complex interface can hinder productivity, so look for solutions with intuitive navigation, pre-built templates, and customizable reports to make the user experience more efficient.

-

- Security: Prioritize software with robust security features to protect sensitive financial data. This is especially important for organizations handling confidential information — such as those in healthcare or government — as strong security measures help prevent data breaches and ensure compliance with regulatory standards.

What features should I look for in financial reporting software?

In addition to interactive dashboards, look for live reporting, data visualization, flexibility for customizations, and integration with a range of software apps and platforms.

Security is also important. Financial reporting software needs to protect sensitive business information, especially if it’s a cloud-based or otherwise internet-connected option. Security features should include user access controls and permissions—people who only need the budget shouldn’t be able to go rooting around in vendor payment data and so on.

How does financial reporting software help?

Financial reporting software automates data collection, generates financial reports, and helps finance teams analyze your company’s historical financial data to more accurately predict future trends.

Financial reporting software helps internal users by preparing annual budgets and producing ad-hoc financial reports to analyze performance across departments. It’s also crucial for providing up to date financial statements to external users, including regulators, auditors, lenders, and stockholders.

Quality financial reporting software gives company executives greater visibility into business performance, and streamlines the financial reporting process to produce financial statements and custom reports with greater accuracy and efficiency than manual processes allow.

How to Choose Financial Reporting Software

As you work through this list, don’t get caught up in the marketing of it all. Keep your organization, and yourself, in mind, considering:

-

- Functionality: Ensure the software meets your specific financial reporting needs, including budgeting, forecasting, and analysis capabilities. For example, if your organization requires detailed budget management and predictive analytics, look for software that offers these features.

-

- Integration: Look for software that integrates (well) with existing tools like Microsoft Excel and Power BI. This is crucial for data management and reporting, as it allows for smoother data flow and reduces the need for manual data entry.

-

- Scalability: Choose a solution that can grow with your organization and handle increasing data volumes. If you’re part of a rapidly expanding company, you’d best look for software that can scale up to accommodate more users and larger datasets without compromising performance.

-

- User Experience: The software should be user-friendly to facilitate collaboration among your teams. A complex interface can hinder productivity, so look for solutions with intuitive navigation, pre-built templates, and customizable reports to make the user experience more efficient.

-

- Security: Prioritize software with robust security features to protect sensitive financial data. This is especially important for organizations handling confidential information — such as those in healthcare or government — as strong security measures help prevent data breaches and ensure compliance with regulatory standards.

Subscribe For More Fintech Insights

I can't choose your business's financial statement software for you, but I hope this information helps make the decision as easy as possible.

Want to keep your finger on the pulse of financial technology? Get insights from industry-leading operators?

Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.