More than 80% of small businesses fail because of cash flow problems. The first step towards tackling them is a concrete understanding of cash flow and cash flow statements.

Here’s how to understand the basics of - and prepare your - own cash flow statement, as well as some ways to extract juicy insights from your statement.

What is a Cash Flow Statement?

A cash flow statement is a financial document outlining your business’s sources of cash (like revenue, sale of assets, or raising capital) and uses of cash (like operating expenses, purchase of assets, or repaying capital).

It’s one of the three financial statements companies prepare in compliance with GAAP (Generally Accepted Accounting Principles).

Components

Cash flow statements are divided into three parts:

- Cash flow from operating activities: Cash flows from business operations, such as the sale of inventory, collection of accounts receivable, and payment to creditors.

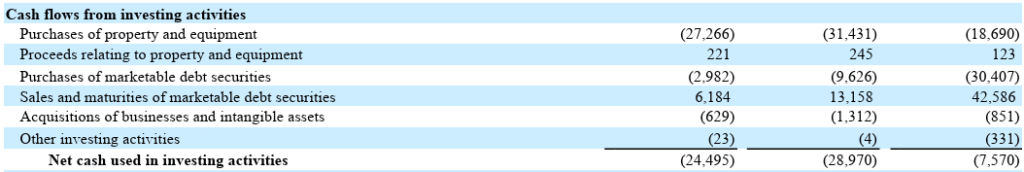

- Cash flow from investing activities: Cash flows from the sale or purchase of assets like land and marketable securities.

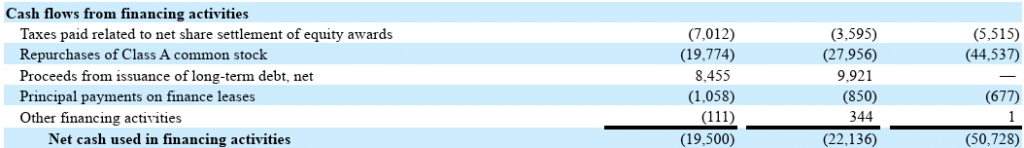

- Cash flow from financing activities: Cash flows from financing activities, such as issuing stock or repaying debt.

Preparation Methods

There are two methods to prepare a cash flow statement. The only difference between the two methods is the way transactions are presented under the cash flow from operating activities:

- Direct method: The direct method involves listing the cash flows from operating activities to find the net cash generated or used from operating activities.

- Indirect method: The indirect method involves reconciling the net income with net cash flow from operating activities.

According to ASC 230-10-45-29, companies must provide a reconciliation of net income to net cash flow from operating activities regardless of whether they use the direct or indirect method. This is why most companies use the indirect method of preparing a cash flow statement, and that’s the method we’ll use in our examples.

Statement of Cash Flow’s Purpose

While cash is important for all businesses, it’s especially crucial for a high-growth business. If you’re in a high growth phase, your business needs plenty of resources—more employees, better infrastructure, office space—and all of these require cash.

Monitoring the company’s cash flow helps you prepare for a potential cash crunch. You can take action to maintain liquidity so you don’t have to hit pause on growth if your customers are late on their payments.

A cash flow statement adds context to your profitability. Suppose your current revenue is $1 million with a 90% net margin.

You’re smiling as you gaze at your income statement… Then turn the page to your cash flow statement telling you that 50% of your revenue ($500,000) hasn’t been received in cash. This 50% is supposed to come from your biggest client and if they go out of business, you’re out of $500,000. Suddenly, you’re worried.

The reason why your income statement and cash flow statement can tell a different story is because of the accrual basis of accounting - aka the standard practice in modern accounting. Because of this practice, cash flow statements matter a lot.

How to Create a Cash Flow Statement

Most accounting software can generate a cash flow statement for you, but preparing yourself can give you a clearer understanding of the mechanics—which will, in turn, help you derive more insights from your statement.

Before You Begin

The first thing you need before you read a cash flow statement is a basic understanding of financial statements, accounting rules for double-entry bookkeeping, and entry-level accounting concepts.

Next, you need your net income figure (available on the income statement) and opening cash balance (available on your balance sheet). Finally, you need to understand the format of a cash flow statement prepared using the indirect method.

As mentioned before, all items in the statement fall under three headings: operating, investing, and financing activities.

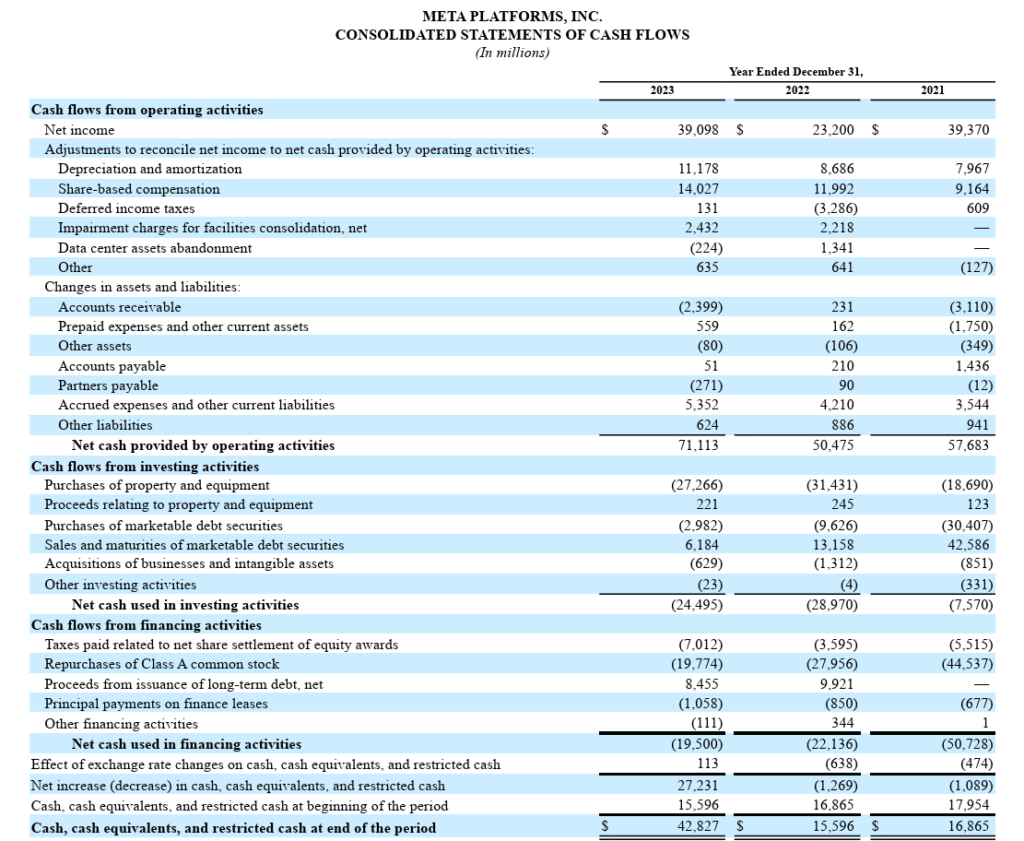

Here’s Meta’s cash flow statement as an example:

All of these figures are available on the income statement (if it’s an income, gain, expense, or loss) or balance sheet (if it’s an asset, liability, or shareholder’s equity line item).

Simply add three headings in your cash flow statement (cash flow from operating, investing, and financing activities) and list cash transactions as explained in the next section.

1. Calculate Cash Flow from Operating Activities

The first category to add to a cash flow statement is cash flows from operating activities. Since we’re using the indirect method, the first item you’ll add under this category is net income.

Here’s how you can calculate cash flow from operating activities:

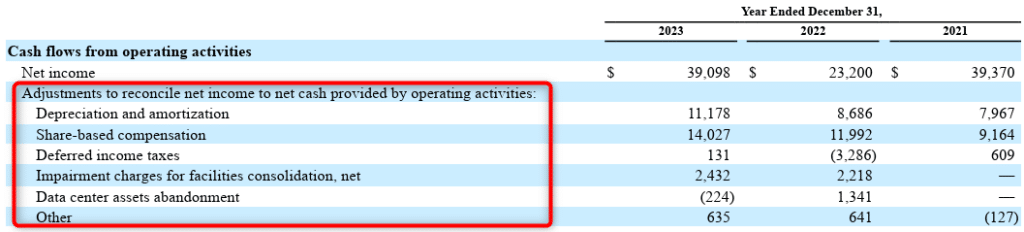

Step 1: Adjustments for Non-cash Transactions

Non-cash expenses (expenses that don’t involve cash outflow) like depreciation and amortization must be added back to the net income.

Non-cash gains like profit on the sale of a fixed asset must be reduced from the net income because the full amount of cash received from the sale (which includes the gain) is included under the head cash flow from investing activities. Scan the income statement to find all non-cash items.

Expenses recognized but not paid, such as deferred income tax expense, must be added back into the net income figure. Deferred expenses are available on the asset side of your balance sheet.

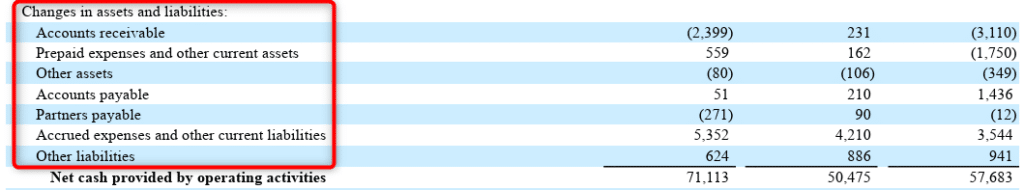

Step 2: Adjustments for Changes in Working Capital

Next, you need to make adjustments for transactions like collection from debtors, payment to creditors, and prepaid expenses.

You might need to put some effort into determining whether to add or subtract a working capital line item, but it becomes second nature over time. In the meantime, here’s a rule you can follow:

- Adjustment for changes in current assets: If the balance of a current asset (other than cash) increases, subtract the increased amount when calculating cash flow from operating activities, and vice versa.

- Adjustment for changes in current liabilities: If the balance of a current liability increases, add the amount of increase when calculating cash flow from operating activities, and vice versa.

For example, if the accounts receivable balance increases by $5,000 by the end of an accounting period, subtract $5,000 under cash flow from operating activities. Similarly, if the balance of accounts payable increases by $5,000, add it to the cash flow from operating activities.

After you’ve added all the line items, sum up the figures to calculate the net cash flow from the operating section.

If this number is negative, you have a serious problem because it indicates your company’s operations aren’t currently cash-positive. If this wasn’t intentional (or expected), your priority needs to be getting back in the black here.

2. Calculate Cash Flow from Investing Activities

Examples of investing activities include:

- Sale or purchase of land and building

- Sale or purchase of marketable securities

- Sale or purchase of intangible assets

- Divestiture or acquisition of businesses

Determining if cash is flowing in or out is pretty easy. For example, capital expenditures require a cash payment, which means cash flows out. When you sell an asset, cash flows in.

Remember the gains we subtracted from the sale of assets under cash flow from operating activities? That gets added back here because the sale proceeds of an asset include the cost as well as the gain on the sale of the asset.

3. Calculate Cash Flow from Financing Activities

Examples of items under this heading include:

- Issuance of equity or debt capital (or adding capital yourself if you’re a sole proprietor)

- Repayment of equity or debt capital

- Capital lease obligations

- Payment of dividends

It’s fairly easy to understand how cash moves in this category as well. If you raise capital, whether equity or debt, cash flows in. Cash flows out when you make capital lease payments or pay dividends.

Note that interest payments on debt don't appear under this section. In fact, it doesn’t appear anywhere on the cash flow statement when using the indirect method because it’s already factored into your net income.

However, if you haven’t paid the interest, it appears as a current liability on your balance sheet. The unpaid interest amount is added under adjustments in working capital in the operating activities section of the cash flow statement.

4. Calculate Ending Balance

To calculate the ending balance, sum up the net cash flow for all categories and add the opening cash balance.

You may need to adjust for exchange rate fluctuations if you have cash or cash equivalents in a foreign currency like Meta does.

What to Look for in a Cash Flow Statement

Here are examples of how you can use the information in the cash flow to manage cash and financial health:

Investigate Negative Cash Flow

Young companies and those in high-growth periods often have negative cash flows. Most of the cash flows in through financing activities and is spent on buying assets, hiring employees, and developing the product.

If you’re cash flow negative, investigate the reason. If you’re investing in assets and are about to run out of cash, consider raising more capital or delaying capital expenditures. If you’re losing cash in operations, potential reasons could include an unfavorable cost structure or large interest payments.

In any case, you should aim to move towards positive net cash flow over time if you want to stay in business.

Dig Deeper Into Positive Cash Flow

Positive net cash flow can sometimes be deceptive. Companies can achieve positive cash flow by selling assets or taking on unreasonable financial leverage, even when they’re bleeding cash through their operations.

If you’re not a young company and you see a negative cash flow from operations, you have a reason to worry, even if the cumulative net cash flow is positive.

More Insights With Free Cash Flow (FCF)

There are two types of free cash flow: free cash flow to the firm (FCFF) and free cash flow to equity (FCFE).

FCFF

FCFF tells you how much cash your business generates from operations after accounting for capital expenditures. The formula is:

FCFF = Cash from Operating Activities - Capital Expenditure

There are multiple ways to calculate FCFF but this is the simplest way using your cash flow statement.

The idea is to understand the business’s ability to generate cash after spending on operations and capital assets—two vital things for keeping the business going.

FCFE

FCFE tells you the amount of cash available to the company’s shareholders after all expenses, capital expenditures, and debts are accounted for. The formula for FCFE is:

FCFE = Cash from Operating Activities - Capital Expenditure + Net Debt Issued

Net debt measures a company’s ability to pay off debts under the assumption that they’re due immediately. The formula is:

Net Debt = Short-Term Debt + Long-Term Debt - Cash and Cash Equivalents

Companies use FCFE to pay dividends, stock repurchases, or growth.

Understanding Cash is Critical

Cash keeps the business going. Just looking at net income and smiling all the way home can turn into a disaster—and history shows that it usually does.

Ready to compound your abilities as a finance leader? Subscribe to our newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.