In this interest-rate environment, executives and investors alike are being forced to make tough decisions about where to put their money. When weighing options, an effective valuation method is essential.

One popular method used to estimate the value of potential investment opportunities is the discounted cash flow, or DCF, model.

But what is the DCF model, and how can you apply it to your investment decisions?

What is the Discounted Cash Flow model?

The discounted cash flow (DCF) model is a valuation method used to determine what a series of future cash flows is worth today. DCF models are used to value companies, projects, investments, and anything else that has a series of cash flows attached to it.

All valuation methods can be placed into one of the following categories:

- Market approach: based on comparable public company transactions

- Income approach: based on cash flow forecasts

- Cost approach: based on net asset values (sometimes called asset-based approach)

The discounted cash flow model falls under the income approach; which discounts future amounts (income, expenses, or other cash flows) and converts them into a single current value (net present value).

As its name suggests, the discounted cash flow model can only be used to value income-producing assets.

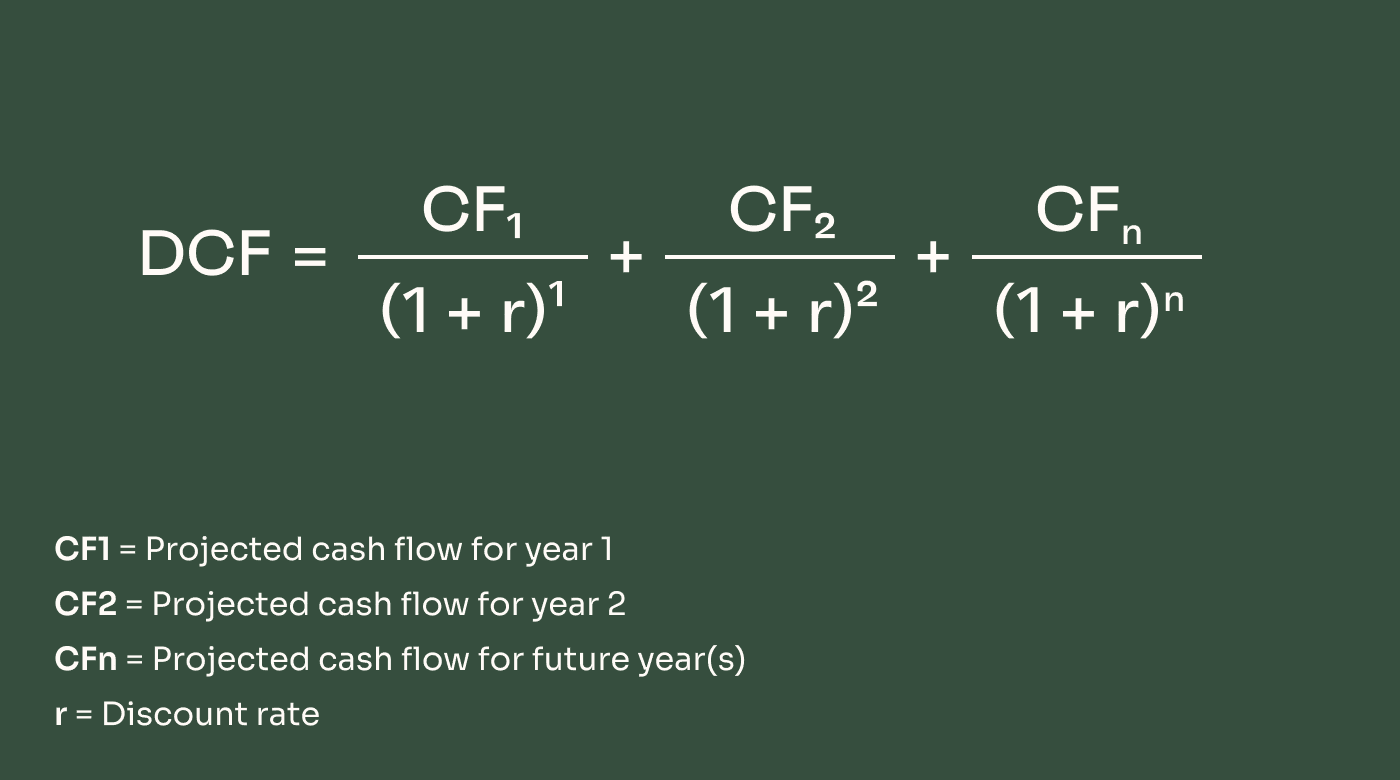

To discount the value of expected future cash flows to the present day, DCF models use a discount rate. The discount rate adjusts for potential risk (more on that later) and the time value of money—since $1 today is more valuable than $1 tomorrow.

When Can You Use the DCF Model?

The beauty of the DCF model is it can look at two projects—with two completely different income streams—and give you a single (comparable) value for each one.

As mentioned, the DCF model can be used to evaluate any investment or project expected to generate future cash flows that can be reasonably estimated. That’s pretty broad, so I’ll go over some specific scenarios.

To Value a Company

Discounted cash flow models are used to value companies, which could come in handy when:

- Selling your company: Owners and equity stakeholders could use a DCF model to determine a fair asking price before selling a company.

- Buying a company: In mergers and acquisitions, DCF modeling is often used to determine the value of the target company—and to evaluate whether the investment is worthwhile.

- Taking a company public: DCF modeling might be used to determine a company’s authorized number of shares and their par value in preparation for an initial public offering (IPO).

To Value a Bond, Stock, or Other Investment Opportunity

The DCF model is also used to analyze potential investments. It’s a popular tool among all types of investors and can be used when:

- Buying a stock: Many valuation methods exist for equity investors, but DCF modeling is often used by investors and fund managers to identify undervalued assets. DCF valuations can also serve as a sanity check when analyzing current market prices of publicly-traded stocks.

- Pricing bonds: Bond investors can apply the DCF model to determine the net present value of a bond based on its coupon rate, payment frequency, and maturity date.

- Comparing investment opportunities: Really, DCF modeling can be used to evaluate any income-generating asset. As such, companies (or individuals) with limited capital often utilize DCF models to choose between two mutually-exclusive investment options.

Hedge funds and asset managers rely heavily on DCF models to compare potential investment opportunities in real estate, public equity, and private equity markets.

To Inform Capital Budgeting Decisions

The DCF model can also be used by firms deciding where (or whether) to allocate capital. For instance, a firm may use DCF if they are:

- Considering expanding capacity: When expanding capacity, firms may apply DCF models to weigh the expected cost of funding the expansion against the current value of the future cash flows it is expected to generate.

- Considering launching a new product: Firms doing market research into new products or services may conduct DCF modeling using estimated cash flows to determine the potential benefit of a new product launch (and the opportunity cost of skipping over others).

For instance, a SaaS company considering rolling out an auxiliary product offering for existing customers might use the DCF model to estimate the financial value of investing in that product vs looking at acquisition targets.

- Making other capital allocation and budgeting decisions: All firms must make decisions about where and when to deploy capital. To make the best decision, they need some way to identify the most profitable option. And since DCF models provide an effective and efficient way to determine a project’s value—they're often used to inform capital allocation and budgeting decisions.

What Inputs Are Needed in a DCF Model?

Using the DCF model doesn’t need to be complicated, but it helps to understand the basics first. These are the primary inputs needed to run a discounted cash flow model.

Forecast Period

The forecast period is the length of time being examined when utilizing the valuation method. Different periods can be used, but the general range is between 5 to 10 years.

If a project or investment has defined start and end dates, those will determine the forecast period.

Free Cash Flow

DCF model valuations are based on projected free cash flow (FCF). Free cash flow represents the cash flows earned by a company or asset after deducting related operating expenses.

For instance, if expanding production is expected to produce an annual cash inflow of $800,000, with a $300,000 cash outflow in operating costs, then the free cash flow is $500,000.

Growth Rate

In order to project the current year’s free cash flow into future periods, you need to apply an appropriate growth rate.

For instance, if a project is expected to produce $1 million in FCF in the first year and grow at an estimated 5% annually, the FCF in the next year would be $1,050,000 ($1M times 1.05).

Discount Rate

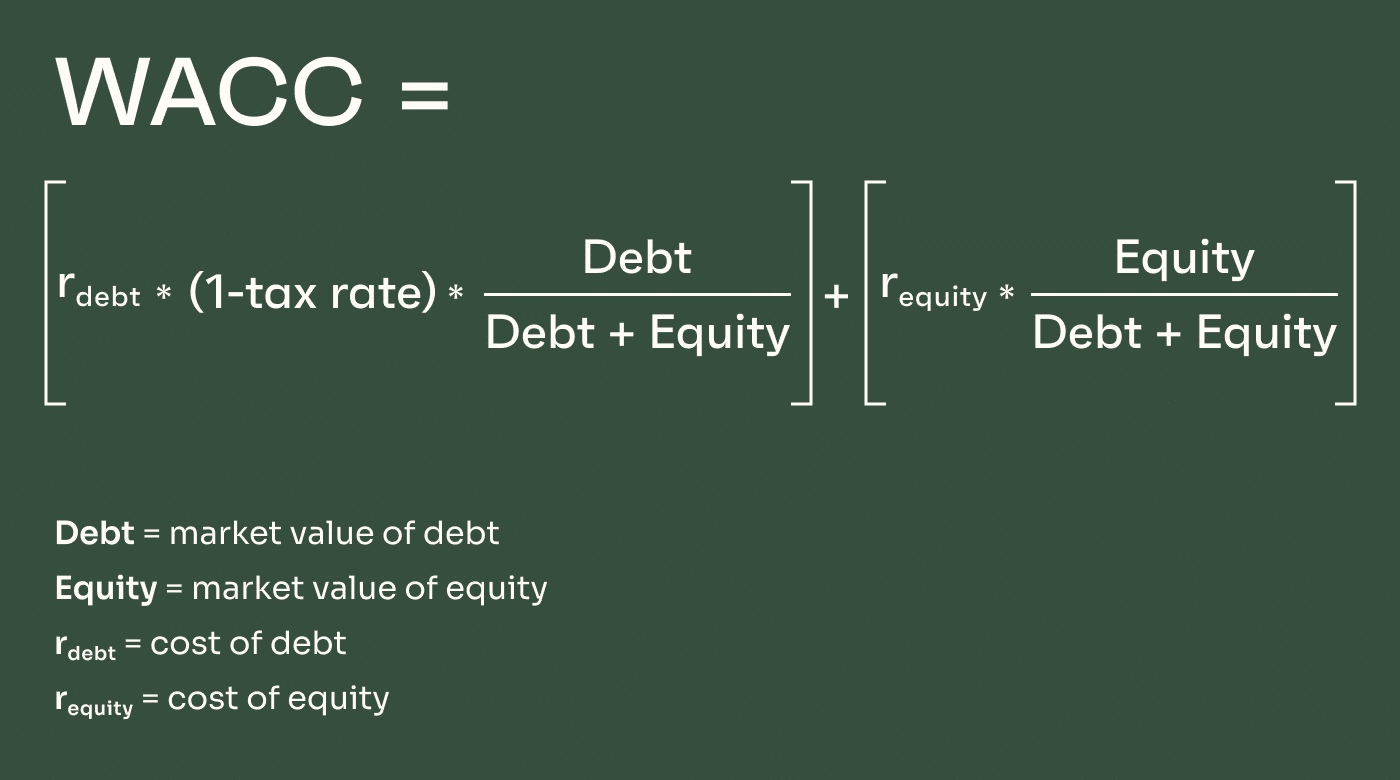

The discount rate is used to discount future cash flows back to their present value. The most common way to do this is to use a company’s weighted average cost of capital (WACC) as the starting point.

For debt-funded companies, WACC may simply be the average cost of servicing that debt. For equity-funded companies, it’s the average cost of equity (or the expected/demanded return by shareholders). For companies that use a mix of debt and equity funding, WACC is a weighted average cost of both types of capital.

Terminal Value

Terminal value is the estimated value of an asset after the forecast period. If using the popular Gordon Growth Model calculation (more on this later), terminal value assumes that the asset or project will grow at a set growth rate in perpetuity.

Terminal value can also be calculated based on the assumption that an asset or business will be sold. This method uses the exit multiple to determine terminal value based on a multiple of free cash flows (e.g., 10x).

How to Build a DCF Model

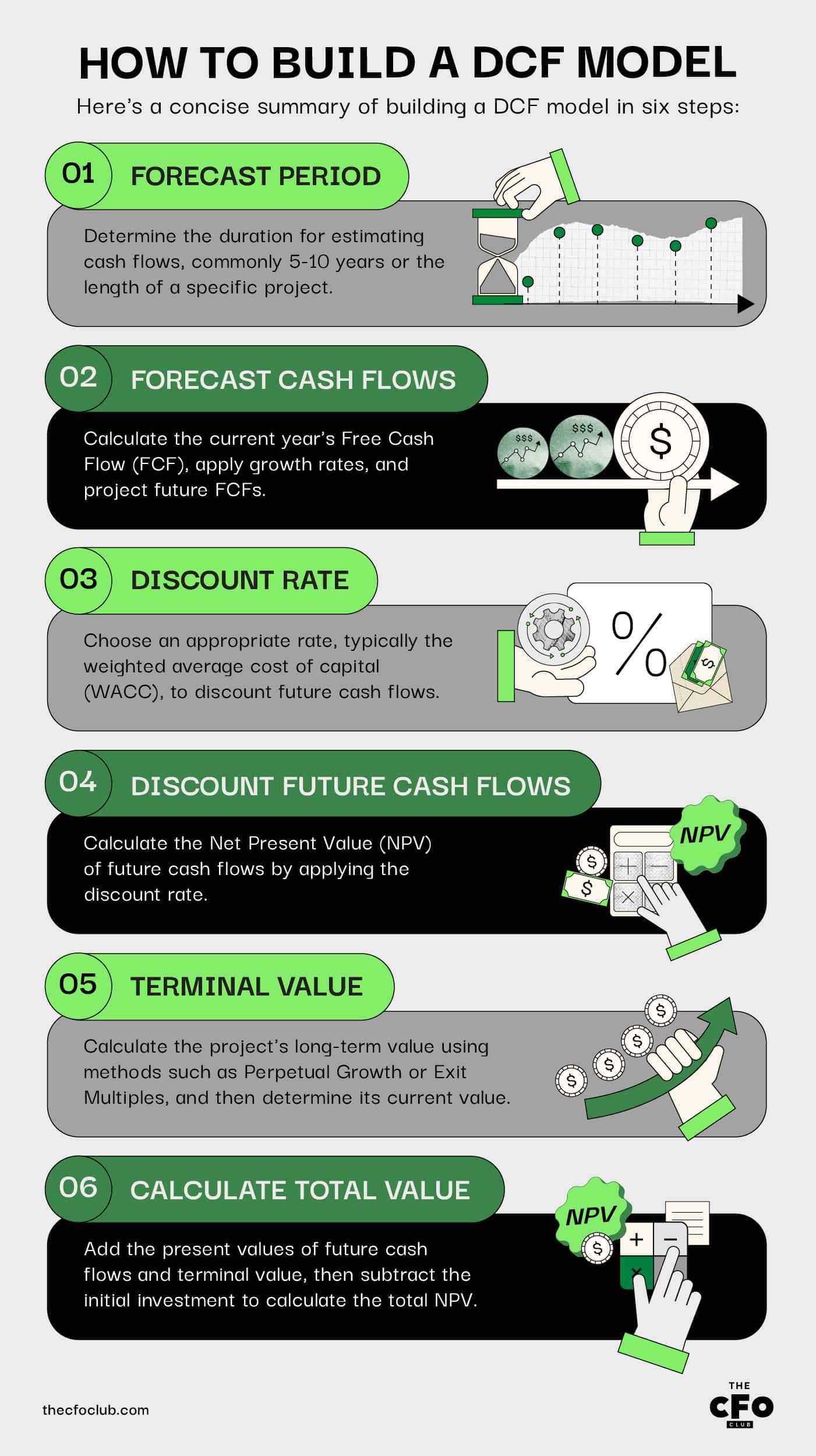

Utilizing discounted cash flow to evaluate the value of a project or investment doesn’t need to be complicated. This 6-step method is all you need.

Keep in mind that several of these steps can be expedited by using Microsoft Excel or another software with similar capabilities.

Step 1: Determine the Forecast Period

The forecast period refers to the length of time that you can reasonably estimate the cash flows from a project. It’s common to use 5-10 years.

For projects with a defined end date, it’s more common to use the length of the project as the forecast period. For instance, if a firm is investing resources in order to meet the needs of a 3-year contract, they would use a 3-year forecast period.

Step 2: Forecast Future Cash Flows

Next comes forecasting future cash flows (FCF). There are a few sub-steps here:

Calculate FCF for the Current Year

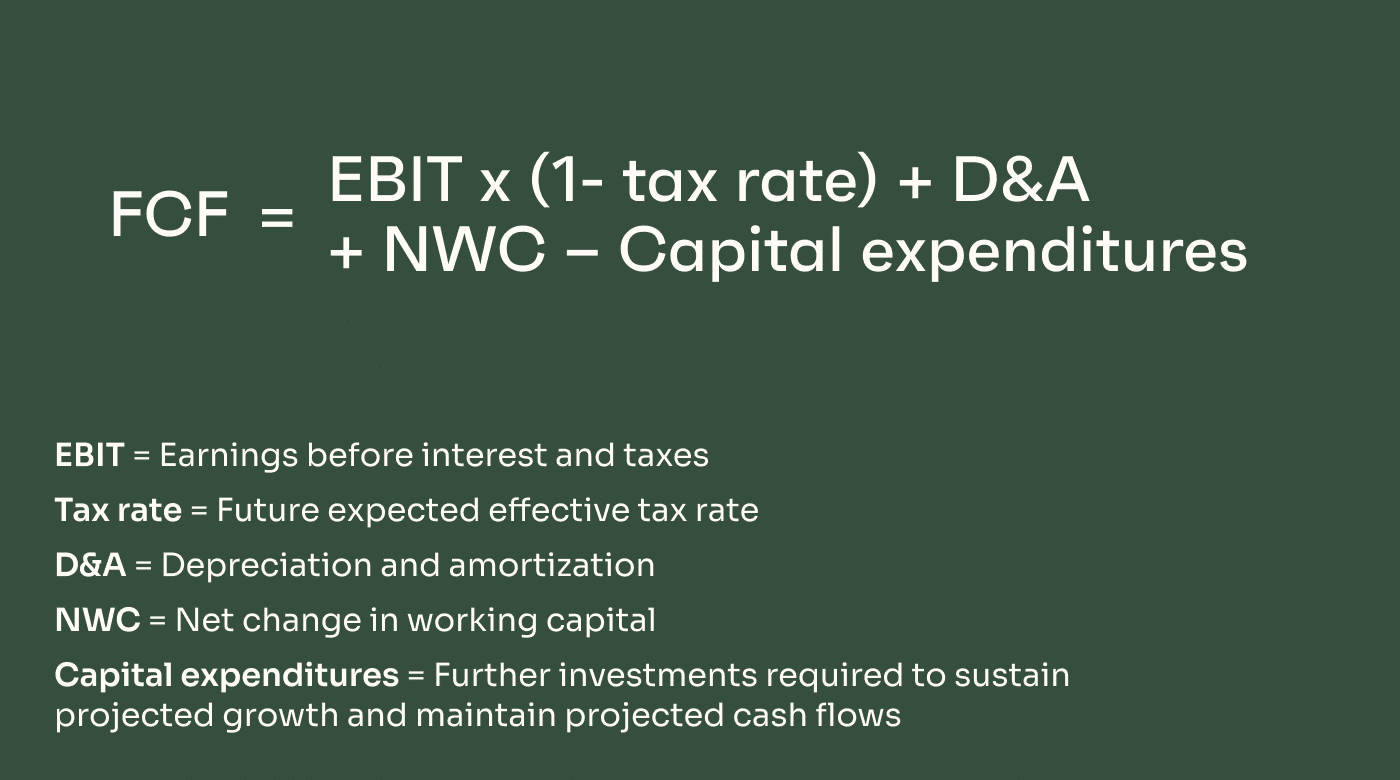

Current-year FCF can be calculated based on the following formula:

FCF = EBIT x (1- tax rate) + D&A – Change in working capital – Capital expenditures

Remember to calculate FCF only from this particular project/investment, not from your entire business.

Depending on the type of project, some guesswork may be necessary here. It’s wise to use relatively conservative estimates and lean on past data from launches of similar projects or investments, where possible.

Apply an Appropriate Growth Rate

Next, apply an estimated growth rate, if needed.

Some DCF models don’t require a growth rate, such as in the case of a fixed contract or another project with clearly defined cash flows (e.g. $1M in the first two years, then $1.75M for the remaining contract term).

In other cases, you may have to estimate growth based on comparables in your industry.

FCF calculations assume a consistent growth rate, which obviously is not always realistic. That said, if you expect variable growth, it’s best to err on the side of caution and go with the lower end of the range; however, the most accurate answer is always best.

For many industries, growth rates can be expected to accelerate in the short to medium term before leveling off.

In the SaaS industry, growth rates tend to be higher closer to launch, when the annual rate of return (ARR) is relatively low. For instance, SaaS firms with an ARR of under $1 million had a median growth rate of around 100%, compared to just 40% for firms with ARR in the $3 to $5 million range.

Forecast FCF for Future Years (Current-Year FCF x Growth Rate)

Free cash flow in future years will be higher than current-year estimates, assuming growth rates trend as projected.

To find FCF for future years, simply multiply the FCF from the previous year by the expected growth rate.

For example, if a project is expected to produce FCFs of $1 million in the first year and grow at a rate of 5%, the FCF for the second year would be $1.05M.

Step 3: Choose an Appropriate Discount Rate

The discount rate is crucial to the DCF model because it discounts future cash flows to their value today.

For company valuation purposes and potentially for capital deployment projects, as well, the standard discount rate is the weighted average cost of capital (WACC).

By including a debt element and an equity element, the WACC formula considers a company's two main sources of capital. The formula is as follows:

For solely debt-funded companies, WACC is mostly influenced by borrowing costs (which means it's also at the mercy of inflation and changing interest rates). For equity-funded firms, the cost of equity is largely based on investor demand and expectations of return. For companies with hybrid funding, WACC takes a weighted average of the two.

The WACC is the base layer of the discount rate. For the discount rate to reflect company-specific risk factors and other market risks, certain risk premiums are added on top of the WACC to “build up” the discount rate. Discount rates often include risk premiums for:

- Market risk: captures overall equity market risk; this typically ranges from 4% to 7% for most companies.

- Company size: smaller companies don’t have easy access to large amounts of capital, and are generally considered higher risk.

- Company-specific risk: considers risk related to certain characteristics of a company, for example:

- customer concentration

- product diversification

- competitive environment

- R&D investment

- earnings volatility

- reliance upon “key person(s)”

Step 4: Discount Future Cash Flows to Their Present Value

Next up is finding the net present value (NPV) of the future cash flows.

To do this, take the future FCFs from Step 2 and multiply them by the discount rate found in Step 3. This will give you the NPV of cash flows from each year. You can then add each year’s NPV together to find the total NPV of the project or investment.

Step 5: Calculate the Present Value of the Terminal Value

Next is to find the terminal value of the project, then find the present value of that terminal value. I swear it isn't as complicated as it sounds.

Terminal value is the value beyond the forecast period, and there are two different methods used to calculate it.

Perpetual Growth Method

The perpetual growth method, also known as the Gordon Growth Model, assumes cash flows will continue to grow at a constant rate after the forecast period.

So, if the assumed growth rate during the forecast period was 9%, then the perpetual growth rate would also be 9%.

The formula for the perpetual growth method is as follows:

TV = (FCFn x (1 + g)) / (WACC – g)

Calculating terminal values in this way is more common in academic circles. In industry and investment, calculating terminal values based on exit multiples is more common.

Exit Multiples

Finding terminal value based on exit multiple assumes that the business or project will be sold after the forecast period—or simply allows a firm to determine the estimated value of the asset if they were to sell it at that time.

In this case, the formula is as follows:

TV = Financial Metric (usually EBITDA) x Trading Multiple (such as 10x)

This formula uses a fixed trading multiple, which is a function of expected investor demand. Finding an appropriate multiple usually involves comparisons to similar companies that have exited and/or gone through funding rounds at similar growth stages, in similar market conditions. Industry average valuation multiples can also be used in a pinch—but keep in mind that these multiples tend to shift over time with investor demand, risk appetite, and the interest rate environment.

Step 6: Calculate the Project/Company Value

Bringing it all together, you can now calculate the net present value of the project, company, or investment being considered.

To do this, add the present value of future cash flows within the forecast period (from Step 4) to the present value of the calculated terminal value (from Step 5).

Then, subtract the initial investment amount from this final value. If the figure is positive, the investment is worth considering. If it’s negative, the investment is a net loss when adjusted for the time value of money.

Example Calculations for the DCF Model

Taking everything above, I’ll walk through a simplified example to illustrate the discounted cash flow model. This is highly simplified—DCF modeling is best done in Excel or another software for more complex metrics.

A SaaS firm is investing $3 million in a project to launch a new paid upgrade feature to an existing offering. The firm chooses a 5-year forecast period as a reasonable length to accurately forecast returns.

Assumptions:

- 12% discount rate

- Year 1 free cash flows are expected to be $850,000

- 5% annual growth rate

- Terminal value is not considered

The firm is considering whether or not the capital expenditure is worthwhile. It chooses to use the DCF model to calculate the investment’s potential.

Given the 5% annual growth rate, projected free cash flows during the forecast period are:

Free cash flows:

| Year | Cash Flow |

|---|---|

| Year 1 | $850,000 |

| Year 2 | $892,500 |

| Year 3 | $937,125 |

| Year 4 | $983,981 |

| Year 5 | $1,033,180 |

| Total | $4,696,786 |

Next, the firm discounts those amounts back to their present values using a discount rate of 12%.

Discounted free cash flows:

| Year | Cash Flow |

|---|---|

| Year 1 | $758,929 |

| Year 2 | $711,496 |

| Year 3 | $667,027 |

| Year 4 | $625,338 |

| Year 5 | $586,254 |

| Total | $3,349,043 |

So the future free cash flows the product is expected to generate over the next 5 years are worth $3,349,043 today. After subtracting the $3 million initial cost of the product launch, the net present value is around $350 thousand.

Discounted FCF: $3,349,043

Initial cost: ($3,000,000)

Net Present Value: $349,043

DCF Limitations

The discounted cash flow model can be very useful in helping companies and investors decide where to deploy capital. But it’s not a perfect system—here are the drawbacks.

Depends on Accurate Forecasting

DCF modeling is built on future cash flows, which must be estimated in most cases. As such, it relies heavily on the accuracy of these estimates.

While there are some situations in which future cash flows are more or less set in stone, these are relatively rare. In most business capital deployment decisions, firms must estimate cash flows first, then use these figures to calculate DCF valuation.

Particularly for longer forecast periods, even a relatively small “miss” in estimates can create big discrepancies in an investment’s projected value and its true value.

Sensitive to Chosen Discount Rate

Another key component of the DCF model is the discount rate. And firms are free to set their own discount rates when doing these calculations.

A standard discount rate is the weighted average cost of capital (WACC), which is relatively easy to calculate. That said, the cost of capital can potentially change over time.

Other discount rates may be more applicable to certain business scenarios, but determining the right one can be tricky—and it can have a huge impact on DCF calculations.

Terminal Value Can Fluctuate

Terminal value is another crucial component of DCF models. And yet, the terminal value of a project can be somewhat fuzzy and certainly subject to change.

If using the Gordon Growth Model, terminal value assumes constant rates of growth—which are obviously rare in reality.

And when using the exit multiple approach, one must make assumptions about valuation and investor sentiment many years in the future.

As we all know, investor sentiment and market conditions can change dramatically, especially when the cost of capital shifts.

For instance, SaaS valuation multiples dropped a whopping 75% year-over-year in 2022. A company planning an exit back in, say, 2018 would certainly not have expected that—and yet, that shift can dramatically change the math on discounted cash flow analysis.

Software Solutions for DCF Modeling

Firms and individuals conducting discounted cash flow analysis can benefit from the use of software.

In many cases, this may simply be Microsoft Excel. The popular software can handle DCF modeling with relative ease, and you can find plenty of templates and models online.

Even if you don’t have dedicated forecasting software, you may find that DCF functionality is already built into some of your existing systems, such as ERP systems.

Plenty of specialized software exists, too. For instance, Rockport VAL is a valuation computing software specifically for commercial real estate.

There are a lot of new machine learning and AI-powered FP&A tools out there that might be worth looking into as well.

The Bottom Line on Discounted Cash Flow Modeling

The discounted cash flow model is used to determine the value of an investment today based on estimates of how much money it should generate in the future—and adjusted for the time value of money (or the cost of capital).

Want to compound your skills in the world of finance? Subscribe to The CFO Club newsletter to join a supportive community of finance executives. The CFO Club is built by financial leaders, for financial leaders. Join today.