As CFO of a B2B SaaS company, you likely know that monitoring and managing churn rates are one of the most crucial aspects of your role.

Churn directly impacts your bottom line, performance, and overall financial health. CFOs should analyze churn to assess revenue stability, forecast future growth, and identify areas for improvement.

But, did you know that average churn rates at a SaaS company or startup can vary wildly depending on lifecycle stage and industry?

In this guide, I take a deep dive into what churn rates are, the different types of churn, influencing factors, industry benchmarks, formulas, and metrics to track as well as actionable strategies to reduce your churn rate in 2024 and beyond.

Definition of SaaS Churn Rate

Churn rate refers to the percentage of customers or subscribers who cancel or stop using a SaaS product over a specific period of time. It is a key metric that helps measure customer attrition, and it indicates the number of customers lost and the overall health of a SaaS business.

Difference between Customer Churn and Revenue Churn

Customer churn and revenue churn are interconnected. Customer-based churn refers to customers lost, while revenue churn calculates the revenue lost due to customer churn in a given period. Both metrics provide valuable insights, but they offer different perspectives.

Customer churn helps CFOs understand the impact on customer base, customer acquisition costs (CAC), and the overall customer retention strategy. It is a valuable metric for evaluating customer satisfaction, product-market fit, and the effectiveness of customer success initiatives.

Revenue churn, on the other hand, measures the financial impact of customer churn along with recurring revenue stream and overall profitability. It is especially relevant for forecasting the growth potential and sustainability of a SaaS business.

Monitoring and addressing both customer churn and revenue churn is crucial for a CFO to gain insights into the financial health of a SaaS company. Additionally, both of these metrics help CFOs gain a comprehensive understanding of underlying factors driving churn, retention efforts, and to develop strategies for optimizing revenue and reducing customer attrition.

Monthly vs Annual Churn

Monthly churn rate refers to the amount of revenue lost on a monthly basis. This metric provides a granular view of the situation, which allows for timely monitoring and quick identification of changes and trends in customer attrition.

Not all SaaS companies need to focus on monthly churn. It is typically reserved for those with a shorter customer lifecycle or subscription duration, or when customers in the industry are prone to switching providers often. SaaS startups in fast-paced markets where customer preferences change frequently should track monthly churn so they can make swift adjustments as needed.

An annual churn rate, which is also known as annualized churn, calculates the percentage of customers or revenue lost in a full year. It gives a more stable and comprehensive view of churn over a longer time frame. Enterprise software and other B2B service providers with longer contract durations or customer lifecycles often rely on annual churn metrics to assess their customer churn rates more accurately. Ultimately, analyzing your annual churn rate helps in evaluating revenue stability and customer retention over an extended period.

When factoring which metric to measure for your SaaS business, consider the following:

Business Model and Customer Lifecycle

If your SaaS company operates on short-term subscriptions or has a faster customer turnover, monthly churn is most relevant. Annual churn is the most accurate to track customer attrition in businesses with long-term contracts or annual subscription models.

Growth Stage Businesses

The stage of your SaaS business can influence which churn metric to track. Early growth stage businesses may focus on monthly churn initially to identify areas for improvement. Established businesses are likely more focused on annual churn for trends and long-term revenue forecasts.

Customer Engagement and Behavior

How frequently do customers engage with your product or service? If customer engagement is seasonal or varies month-to-month, then monthly churn may not give you an accurate representation of how your business is doing over the long term, influencing your decisions with inaccurate data. If customer behavior is consistent over long periods of time, monthly churn would be better at identifying near-term issues.

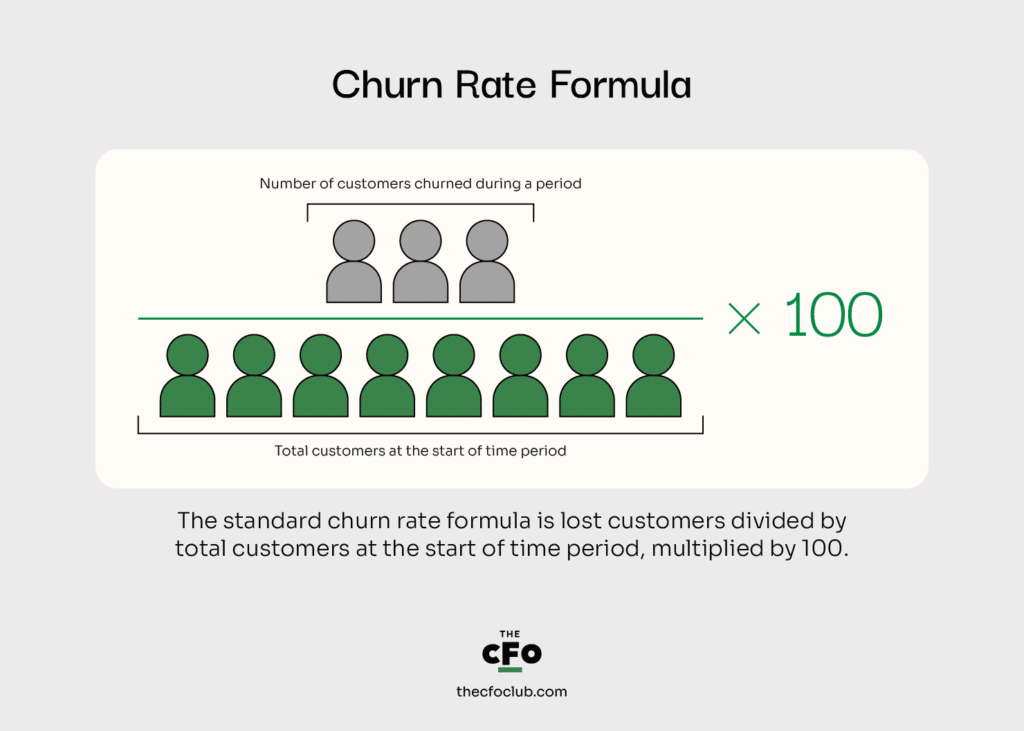

Churn Rate Formula

The standard churn rate formula is lost customers divided by total customers at the start of time period, multiplied by 100.

Additional SaaS Metrics to Track

CFOs should consider additional SaaS metrics and calculations to accurately assess the financial health of a SaaS company. Revenue churn rate, net revenue churn, or cohort-based churn analysis can give a CFO more nuanced insight into customer retention trends and the overall financial impact of churn.

Involuntary churn is another metric you can track which refers to a situation where customers are lost or churned without their intention or explicit decision. It typically occurs due to external factors, such as credit card expiration, failed payment attempts, or billing issues. You can track involuntary churn by analyzing failed payment reports, payment gateway information, and subscription metrics.

What’s a Good SaaS Churn Rate?

While there is no universally defined threshold for a good churn rate, the SaaS industry often aims for an annual customer churn rate of 5% or lower for established companies. What this means is that fewer than 5% of customers churn within a year, on average.

It may be helpful to know industry benchmarks when evaluating churn rates; however, you need to be specific about your comparisons. As churn can vary significantly across industries, it is imperative to research and benchmark against peers in the same sector. Studies and industry reports can provide valuable insights into typical churn rates for specific verticals, allowing SaaS companies to compare their performance.

Let’s look at a few common SaaS industries and their baseline churn rates.

Software Development and IT

In the software and IT industry, churn rates may vary based on the complexity of the software, customer needs, and competition. A good churn rate for these SaaS companies will fall somewhere between 3% and 5% annually for enterprises and 5-7% for small SaaS companies.

When there is less than 5% of churned customers in a given year it indicates strong customer retention.

However, if a software or IT company is targeting small to mid-size businesses (SMBs), the churn rate may skew higher due to the fact that these companies have evolving needs as their businesses are continuing to develop.

Marketing and Advertising

In the marketing and advertising landscape, what influences churn rates are industry trends, market saturation, and the changing needs of marketing professionals. Between 5% and 7% annually is considered a good churn rate for this industry. Though, some sub-sectors may experience higher churn due to rapidly evolving technology and intense competition.

Limitations of Comparing to Industry Standards

It is important for a CFO to take industry comparisons with a grain of salt. While it can be helpful to consider churn rate benchmarks, it can also be potentially misleading depending on the nuances, circumstances, and business context specific to the company.

For instance, it may not always be helpful when the circumstances are unique. Every SaaS company operates in a unique business environment and business model with distinct pricing models, customer segments, and offerings. Whether your business model is enterprise, self-serve, or freemium, it can significantly influence churn rates, skewing comparisons.

On the contrary, it can be helpful in providing a broader understanding of overall market trends and dynamics. Further, comparing churn rates with direct competitors in a similar target market may reveal strengths and weaknesses to inform strategic decision-making.

Factors Influencing SaaS Churn Rate

It is vital to understand the factors that can influence churn rate to effectively prevent and reduce churn. While we have mentioned a few influencing factors throughout this blog post, let’s take a closer look at three significant factors to consider.

Pricing

Pricing plays a notable role in customer retention. If a SaaS company’s pricing is perceived as too high or rigid, it can contribute to high churn rates. If some or many of your competitors have more affordable or flexible pricing, you can be sure your customers will likely explore them as an alternative option.

You can determine if this is an issue by conducting customer surveys that include pricing-related feedback, using customer exit surveys, and monitoring customer conversations online. Additionally, tracking specific insights such as customer acquisition costs (CAC) and customer lifetime value (LTV) can help you determine the financial impact of pricing on churn.

To improve pricing-related churn consider the following:

- Conduct market research and competitive analysis to ensure alignment with customer expectations and industry standards.

- Provide clear messaging about the value proposition and ROI to demonstrate its benefits and justify the pricing.

- Offer tiered pricing plans, freemium, or flexible billing options that cater to various customer segments.

Quality of Service

It goes without saying that quality of service will play a major role in churn. Poor quality service such as frequent bugs, inadequate features or performance issues directly impact the user experience, customer satisfaction, and retention. Customers in today’s competitive landscape will quickly seek alternative solutions if they feel frustrated with the lack of quality in your product.

Monitoring customer feedback, tracking product usage patterns, low product adoption rates, and analyzing IT support tickets can give you an indication that quality of service is an issue.

To enhance service quality and maintain low churn:

- Implement rigorous quality assurance processes to minimize bugs and other performance issues.

- Investing in regular product updates and feature enhancements based on customer feedback.

- Provide comprehensive onboarding and training resources to maximize the value and usage of your SaaS product.

Customer Support

Customers’ ability to receive the answers and support they need is a crucial element in reducing churn. A lack of customer support or unresponsiveness may lead to frustration, unresolved issues, a damaged reputation, and ultimately, increased churn.

Much like the factors mentioned above, customer support can be assessed with customer feedback and tracking support ticket response times. A high volume of unresolved support tickets can indicate if customer support is driving churn.

To enhance customer support:

- Develop a responsive and accessible support channel such as email, phone, or live chat to promptly address customer inquiries.

- Implement a ticketing system to monitor and manage requests.

- Train and empower support staff to be knowledgeable, empathetic, and with timely communication.

- Monitor support metrics such as response times, customer satisfaction ratings, and resolution time to identify areas for improvement.

Improving SaaS Churn Rate

On every CFO’s quest to improve churn rates, there are several effective strategies that can help you retain your customers.

Let’s explore some suggestions and strategies:

User Education

- Provide comprehensive onboarding with guided tutorials, documentation, and videos to help users understand the product’s features, benefits, and how to best use it.

- Conduct interactive training sessions and webinars where users can learn about functionality, best practices, and industry insights.

- Consider incorporating FAQs, in-app tips, or assistance in the UX design process.

Personalization

- Customize the user experience by leveraging user data to tailor it to individual preferences.

- Implement strategic upsell or cross-selling features such as upgrades based on behavior and needs.

- Personalize relevant messages or notifications based on activity to increase engagement.

Improved Communication

- Create processes for proactive customer support with live chat, email, or phone assistance to address concerns.

- Send automated emails to customers with personalized offers, updates, and product tips to keep them informed and engaged.

- Collect and act on user feedback through surveys and use insights to address pain points and improve product features and overall customer experience.

Brand-Building

- Foster a sense of community with your brand by creating online forums or user groups where users can connect, share experiences, and learn from each other on the customer journey.

- Engage in social media and content marketing initiatives to share industry insights, thought leadership, and success stories through blog posts, video, and social channels.

- Offer rewards and loyalty programs to recognize and incentivize with exclusive discounts, benefits, and early access to new features.

Time to Churn the Page

I hope this guide gave you a comprehensive overview of churn and how to improve the financial health of your SaaS company.

If you’re looking for a supportive community of finance professionals in the tech industry, you’ve come to the right place!

Subscribe to our newsletter to receive top tips and the latest insights from our collective experience in corporate finance here at the CFO Club.