Want to know something crazy?

Businesses lose an average of 5% of their annual revenue to fraud. Considering how much time we all spend trying to get the best terms on our contracts, a blanket 5% haircut on your business’s revenue in exchange for absolutely nothing is ridiculous.

One of the lowest-hanging fruits for fraudsters is accounts payable.

In this article, I’ll explain what three-way invoice matching is, what’s involved, and how you can implement it efficiently and effectively.

What Is 3-Way Matching?

Three-way matching is the process of matching the invoice with the purchase order and Goods Received Note (GRN) to verify invoice details.

This approach compares various aspects, including the invoice amount, invoice number, and order quantities, with the corresponding purchase order (PO) and GRN.

Comparing details across three documents helps identify errors and fraudulent invoices. Of course, invoices often have minor errors because of rounding off or other legitimate reasons. As long as the invoice errors are within an acceptable tolerance level, you can approve them.

Why is 3-Way Matching Important for CFOs?

We’ve covered these already but, just to ensure anyone skimming this article knows what’s up, I’ll state them again. Three-way matching helps CFOs achieve three key objectives:

- Minimize fraud: Fraud can be a major concern that, when left unchecked, can have a massive impact on the bottom line. Three-way checking helps minimize the risk of fraudulent invoices by verifying each invoice twice. Once with the PO and again with the GRN.

- Manage cash flow: Timely payment of invoices is essential for effective cash flow management. By processing payments on or ahead of time, you can take advantage of early payment discounts.

- Fulfill internal control requirements: While three-way matching isn’t a legal mandate, it helps comply with relevant financial and tax regulations and maintain accurate financial records. Section 404 of the Sarbanes-Oxley Act requires assessing and reporting on the company’s effectiveness of Internal Control over Financial Reporting (ICFR). These internal controls must ensure the accuracy of financial transactions, which includes verifying invoices. So while invoice matching isn’t a direct requirement, it does help comply with regulations.

What are two-way and four-way matching in AP?

Two-way matching compares line items on the PO and invoice, but not the GRN. The AP clerk looks at the quantity and price in the PO and verifies that the vendor invoice has the same quantity and price. Essentially, two-way matching doesn’t verify that the product was actually delivered.

Four-way matching goes a step further than three-way matching by comparing invoices with inspection slips. An inspection slip shows the quantity of goods accepted after inspection. You’ll need to notify the vendor about products delivered in unacceptable condition so they can send a fresh delivery or adjust the total amount in the invoice.

Here’s a summary of the differences between the three matching processes:

| Document | Purchase Order | GRN | Vendor Invoice | Inspection Slip |

| 2-way matching | ✓ | - | ✓ | - |

| 3-way matching | ✓ | ✓ | ✓ | - |

| 4-way matching | ✓ | ✓ | ✓ | ✓ |

What's the difference between matching and reconciling?

Matching involves comparing two documents to find matches in the data. For example, three-way matching involves comparing the invoice with the PO and GRN to ensure all details are aligned.

On the other hand, reconciliation is the process of checking two data sets to see if they agree. A cash flow statement created using the indirect method is an excellent example of a reconciliation between the net profit and the cash flow.

The Three Components Of 3-Way Matching

Three-way matching hinges on three crucial components: the PO, GRN, and invoice. Reviewing all three documents helps you verify if the order was fulfilled as intended and if the invoice details are correct.

Here’s a bit more information on each of the three documents you need to look at:

Purchase Order (PO)

Your friends in the purchasing or procurement department issue the PO.

The PO authorizes the purchase of listed items and includes specifics like the quantity and price (as agreed with the supplier) of items. Each PO has a unique number that you can use to reference and track it.

Goods Received Note (GRN)

Also called a receiving report or delivery receipt, the GRN confirms that the receiving department has received the delivery. It contains information about the delivered items and states whether the delivery was full or partial.

Invoice

Typically, the supplier sends an invoice once you receive the delivery but this may vary depending on your relationship with them. The invoice includes details such as supplier contact details, a unique invoice number, applicable credits or discounts, the total amount due, and available payment methods.

3-Way Matching Process

Three-way matching is a straightforward (yet slightly time-consuming) process where the AP clerk compares three documents—PO, GRN, and invoice—to look for discrepancies and fraudulent or duplicate invoices.

Verifying vendor invoices includes three steps:

1. PO Verification

Confirm that the PO has all the order details required at the time of order placement, including the vendor’s name and address, items to order, and quantity and rate of those items.

2. Delivery Verification

Upon the shipment's arrival, the receiving department checks the condition of the goods and compares the quantity of goods received with the quantity specified in the PO. If everything checks out, they’ll issue a GRN confirming the delivery of goods and enter it into the inventory management software.

3. Invoice Matching

Match invoice details with the PO and GRN.

- Does the invoice’s total amount match that of the PO?

- Does the quantity invoiced match the quantity received as per the GRN?

- If the GRN indicates damage to certain items in the shipment, is the supplier's invoice adjusted accordingly?

Piece of cake, right? Well, this simple process can quickly become overwhelming when you receive thousands of deliveries every month.

You could always hire more clerks but there’s a smarter, more cost-effective way to make three-way matching scalable: AP automation software. Accounts payable automation helps scale three-way matching and minimizes the chances of human error.

Teams Involved In The 3-Way Matching Process

Three departments are involved in the three-way matching process:

- Purchasing department: The purchasing department issues the PO and ensures it has all the necessary details, such as the PO number and the item price and quantities.

- Receiving department: The receiving department receives deliveries, registers the new items in the inventory record, and issues a GRN.

- Finance or accounting department: The accounts payable team receives vendor invoices and cross-references them with the PO and GRN. If everything checks out, they clear the invoice.

Example Of 3-Way Matching

Let’s walk through an example of how three-way matching works. Suppose your software company requires 10 new monitors. The purchasing department has decided to place an order with company A.

The PO indicates a total value of $15,000 and includes details like the quantity and price of the ordered monitors, expected delivery date, and internal accounting codes.

Once company A delivers the monitors and sends an invoice, the AP clerk starts the verification process. The clerk checks whether the purchase was authorized through a PO, looking at the price, quantity, and company name to ensure it’s not a phony invoice.

Then the AP clerk cross-references the GRN to verify that 10 monitors were, in fact, delivered. Once satisfied, the clerk authorizes the payment.

Pros Of 3-Way Matching

Three-way matching offers the following benefits:

Prevent Fraud and Overpayment

I’ve mentioned this one a few times already, so you get it. Verifying the details across three distinct documents helps catch discrepancies that could lead to overpayment and identify fraudulent invoices. Three-way checking results is an efficient accounts payable process that protects your bottom line and cash flow.

Faster Payments

Three-way matching helps streamline legitimate vendor payments, especially when you use an AP automation tool. Faster payments help you build stronger supplier relationships, with 81% of payors believing that instant payments = better supplier relationships.

Faster payments can also potentially lead to improved credit terms, priority in orders, and early payment discounts.

Create an Audit Trail

Three-way matching requires you to store business documents (and be able to find them in a way that doesn’t make you want to pull your hair out). Having this system in place makes finding documents easier during an internal audit, speeding the whole thing up.

Cons Of 3-Way Matching

Everything good comes at a price; here are the disadvantages of 3-way matching:

Labor-Intensive

Three-way matching can be a lengthy and tedious process when you’re first setting it up. Longer processing times at the beginning could translate to delayed payments and stand in the way of building a good relationship with the supplier.

AP Automation is an easy solution for tackling the long manual matching process. The automated system takes care of everything, from matching details to the corresponding PO and GRN to making the payment. In case you couldn’t tell, I think automation is the way to go here; there’s no reason you should spend your time building a puzzle out of your business information if you don’t have to.

Not Ideal for Services

You can’t issue a GRN for services since they’re rendered on an ongoing basis. You’ll need a team member to audit the quality of service manually and inform the AP team so they can release the payment. Kind of a pain in the butt.

Doesn't Handle all Errors

Three-way matching takes care of errors in the invoice. It doesn’t account for other errors, like misplaced paperwork or misinterpreted agreement terms.

Plus, when you or your automated system detect errors, you’ll need to discuss the error with the purchasing and receiving department(s). This can further slow down the process, especially if teams are working at different locations.

With that said, there’s also a partial benefit here: catching these errors early helps you avoid bigger misunderstandings down the line if they go uncaught.

How To Implement 3-Way Matching

Manual three-way matching is labor-intensive; if you go into it without a plan, it can increase invoice processing times and act as a big bottleneck in your accounts payable workflow. Here’s how to implement three-way matching without letting it drag out your payment process:

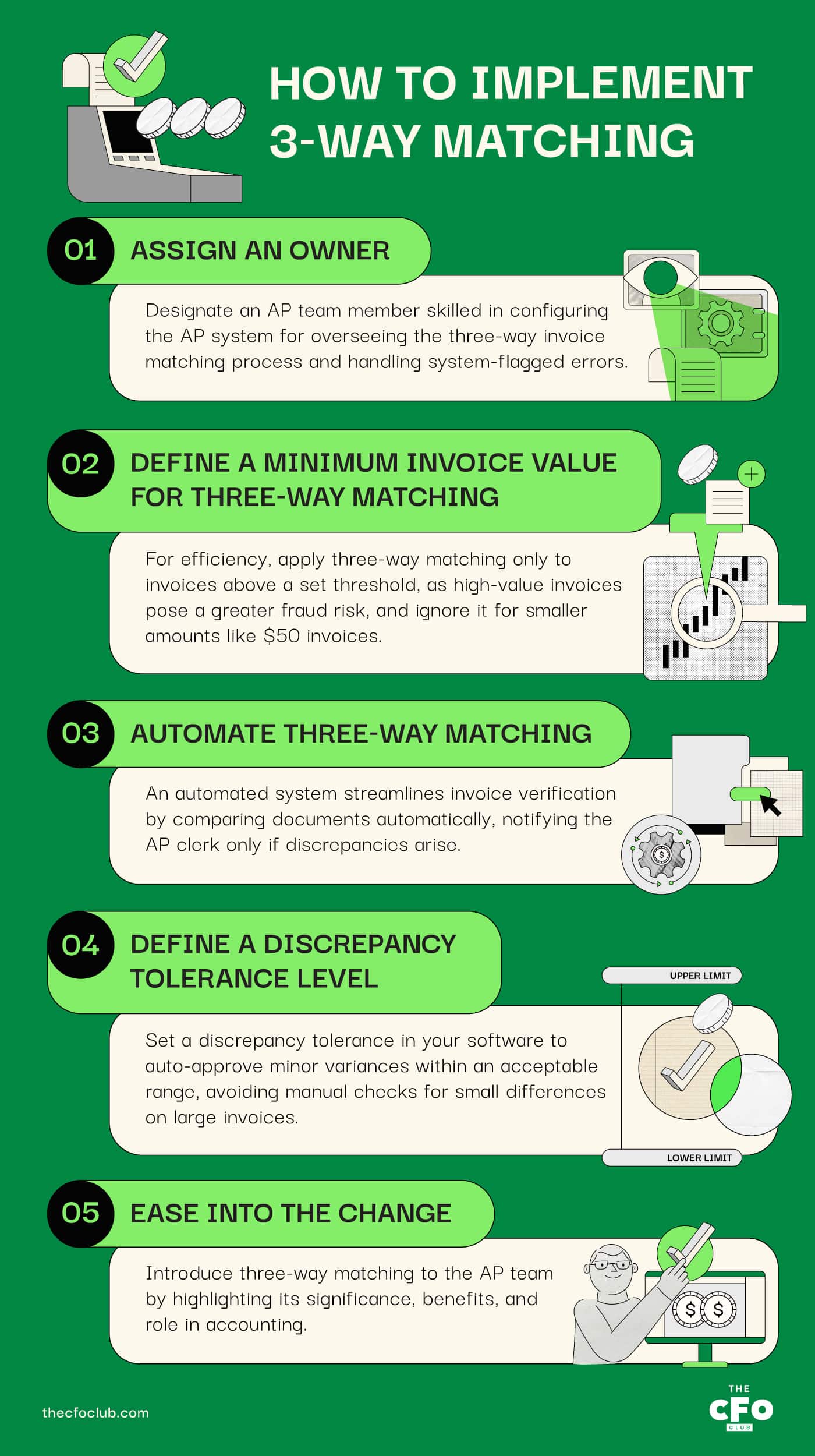

- Assign an owner: Identify a person who will oversee the three-way matching process. This should be someone on the AP team; preferably, someone who can configure the AP system to match invoices and address the errors flagged by the system.

- Define a minimum invoice value for three-way matching: It’s best not to bother with three-way matching for a $50 invoice. Reserve three-way matching for invoices over a certain dollar amount as high-value invoices generally carry a higher risk of fraud.

- Automate three-way matching: An automated system eliminates the need for an AP clerk to manually verify supplier invoices. The system compares the three documents without any manual effort. If there are discrepancies, the system notifies the AP clerk.

- Define a discrepancy tolerance level: If you’re using software, I recommend defining a tolerance level for discrepancies to allow the system to approve payments with minor discrepancies, as long as they’re within an acceptable range. This eliminates the need to look into minor discrepancies on high-value invoices. For example, the AP clerk shouldn’t have to spend time investigating a $10 difference in a $10,000 invoice.

- Ease into the change: Ease into implementing three-way matching by explaining to the AP team the importance of three-way matching, its benefits, and its role in the greater accounting process.

The Future Of 3-Way Matching

If your bingo card had me saying “AI” on it, be prepared to mark it off!

Right now, software is the best way to complete three-way matching; however, AI technologies will drive the future. AI is making software solutions more powerful across industries and, as they get smarter, they’ll save businesses plenty of money through even more increased efficiency, fraud reduction, and automated decisions.

For example, in 2019, a Honda employee defrauded the company out of $750,000 by creating multiple purchase orders. Honda could’ve prevented this with an AI-powered AP system and saved $750,000.

An AI-powered AP system can do more than just identify fraudulent invoices. For example, ML-based anomaly detection can monitor employees’ engagement with the AP process. The system flags malicious behavior so you can jump in before it’s too late.

You can also use technologies like fuzzy matching to detect invoices from fake companies.

“Fuzzy matching encompasses an umbrella of statistical techniques that compare and match approximately equal strings. These techniques employ statistical rules to arrive at a relative degree of truth on the similarity between two strings, in contrast to a Boolean approach, which uses a separate, hard-coded format for each task to provide a Yes/No answer.”

A system can use fuzzy matching to scan multiple repositories, look up the existing vendor database, and compare various documents to identify fake documents.

The result? Detecting fraud even in cases where a human could’ve missed it.

Prepare For the Future Today

Manual three-way checking is a 90s phenomenon. Modern businesses use software for error and fraud detection. AI is about to transform the AP process, but in the meantime, save time and improve security by implementing three-way checking today.

If you found this post helpful, subscribe to The CFO Club newsletter to receive more insights directly in your inbox.