The CFO's role over the last 10 years has been anything but stagnant.

Sure, the classic tasks of financial planning, managing financial reporting, and ensuring statutory compliance are still there. But that's like being served dinner on a plate - so normal that it would be weird if it was missing.

Nowadays, in the era of financial data, the CFO is tasked with making strategic, data-backed decisions that shape the company's direction.

But there's more to it than you'd think.

Overview of the CFO Role

The rapid progress in technology and the expanding responsibilities this brings mean CFOs must be ready to embrace change. For instance, you need to prepare yourself and your team for emerging demands like digitizing crucial day-to-day business functions and handling cybersecurity, alongside traditional finance tasks.

Most CFOs know it’s no longer enough to just focus on financial operations. Instead, as a tech CFO, it's essential to diversify your skills beyond finance, step up as a stronger leader, and reconsider your strategies for navigating external challenges and identifying fresh investment prospects. For example, a few areas where you could spend energy that goes beyond just finance include strategic leadership, building robust communication skills, leadership skills, organizational transformation, and performance management.

Financial Functions of the CFO

CFO responsibilities are twofold: first, they're the maestro of financial management, deftly conducting the finance team and accounting professionals who keep the company's operational functions going.

Secondly, they're the Chief Executive Officer’s (CEO) right hand and a strategic advisor to the rest of the C-suite like the Chief Operating Officer (COO) and the Chief Technology Officer (CTO).

Below are some of the core functions that make up the basic CFO job description.

Accounting and Financial Reporting

At the heart of a company's financial health, you'll find a collection of reports – balance sheets, profit and loss (P&L) statements, and cash flow statements.

These documents offer a clear picture of the company's fiscal state to all business partners and other key stakeholders. Whether you're a new CFO or it's your 100th time around the block, you have to ensure these statements are precise, complete, and in line with the Generally Accepted Accounting Principles (GAAP).

Although private companies are only required to file financial reports with the SEC if they have $10 million or more in assets and 500 or more shareholders, many businesses choose to create these statements anyway. This is done so that the information is available in case the company decides to seek a bank loan, venture capital, or other forms of funding.

Budgeting and Financial Forecasting

CFOs are not just responsible for reporting past events. They also predict future outcomes by creating financial forecasts. These forecasts are based on the company's historical performance, as well as internal and external factors that could impact revenue and expenses. The CFO consolidates all departmental forecasts to create profit projections for the CEO and shareholders.

Here are a few key factors that fall on the CFO’s plate.

Internal factors: These include things like sales trends, the cost of labor, and human resources expenses. In other words, the things happening inside your company.

External factors: These include things like the opportunity cost for your capital, changes in market demand, emerging competitors, and the steady march of technological progress.

Catalyst of Business Growth

CFOs are in charge of building the financial strategy and effectively using the dollars to make changes in the finance and accounting department and the company as a whole. They can prioritize plans for business improvement such as reducing costs, finding better deals, optimizing pricing strategies, and identifying efficient ways of operating that benefit the company.

Strategic Functions of a CFO

CFOs have the ability to propel a company forward beyond just analyzing spreadsheets and financial reports. They play a critical role in unlocking a business's full potential.

In addition to monitoring financial health, CFOs must identify initiatives that truly add value to the company, much like selecting the juiciest apples from a barrel. As the role of the CFO has evolved over time, they have become pace-setters, leading the charge in enhancing performance and organizational health.

Setting an Appropriate Baseline

A company's success and growth can be accurately measured only by comparing it to a meaningful starting point. This is where the finance function comes in.

For instance, let's assume a company's earnings have increased by $20 million. While this may seem like a success, it's only valid if you're not aware that the market grew at the same rate. Similarly, a 7% drop in earnings might seem like bad news, but only if you were unaware that without the company's joint efforts, earnings would have fallen by 20%. It's important to keep in mind that a company's performance within a given time frame can be affected by a variety of events and unrelated activities.

Usually, companies use the previous year's financials as a starting point, rather than relying on predictions or budgets that may not be accurate. However, last year's performance may not reflect the business's current momentum, which is the real measure of company performance and can be difficult to assess. Additionally, the company's performance next year may depend on broader industry trends.

As the CFO, you need to use your judgment and experience to decide what to include in your business projections. This becomes the starting point for measuring a company's performance, providing the rest of your team with a benchmarking context.

Create Long-Term Value Strategies

Managers frequently face the challenge of prioritizing initiatives that will have the largest impact, given their limited time and resources. It is common for good ideas to be missed while managers focus on less important initiatives.

For example, in a SaaS company, most managers may assume that increasing sales would solve their performance issues. However, if the product is not yet ready, it could lead to a higher churn rate. Meanwhile, they may overlook a significant increase in operating costs that could have a positive effect on the bottom line.

Let’s face it: people can get carried away with vanity metrics and unimportant targets. If your sales team is closing more revenue on a new product way easier than an old one, they’ll likely choose to prioritize the new product… but if the margins are dramatically worse, they’ll need someone to get them back on track with what matters. Your role forms an important line of defense here: You can monitor the org-wide numbers and ensure that projects don't cut investments in future performance in favor of today's numbers.

Additionally, you can check for non-cash improvements that appear on the profit-and-loss (P&L) statement but don't create value. Conversely, you can highlight cash improvements, such as reducing working capital, that add real value but don't affect the P&L.

Keep in mind that identifying valuable initiatives doesn't require you to hold things up and count every last penny. Businesses, especially startups, need to move quickly and prioritize getting things done… You just need to make sure they’re doing it intelligently.

Leading by Example

The CFO's role goes beyond explaining the value of initiatives to managers. Leading by example means showing the behavior you want others to follow.

It’s critical to ensure that your team performs well internally. When your department innovates and aims for the same goals as the rest of the organization, it adds to your credibility and influence.

For example, when you reduce costs and implement automation, the whole organization benefits. By making accounting systems easier to access and removing unnecessary layers of approval or reports, you can streamline processes and build momentum.

Additionally, practicing stronger spend management can quickly reduce costs throughout the organization, especially during times of financial constraint. For instance, you may lower the threshold at which purchases require approval, cancel company credit cards, or do something as simple as cancel subscriptions to services that are no longer adding value to the company.

As a CFO, you can help address resistance to change in the organization, given your practical knowledge of financial systems and controls. You can also provide an independent perspective in setting an appropriate level of control.

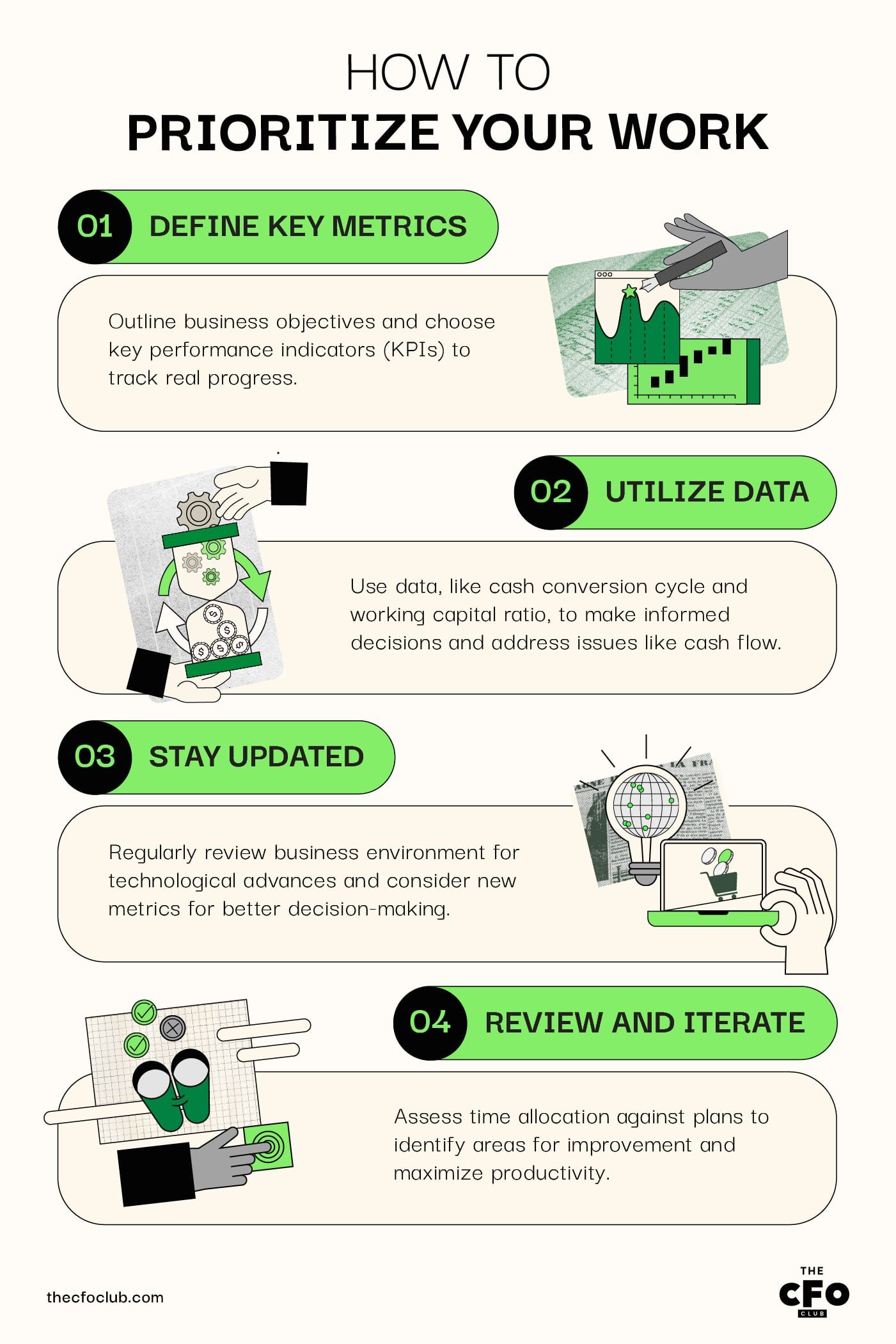

How to Prioritize Your Work

As companies grow, your work only gets harder. To do your job well and guide your company through challenges, you need to make plans that help you handle growth while also making sure you spend your time and effort on the most important things. Here are a few ways to do that.

- To track real progress, you need to pick the right things to measure. Start by outlining your business objectives, then use that to decide what metrics are most important (these are called "key performance indicators" or KPIs).

- Use data to make informed decisions. For example, if a company is experiencing cash flow issues, metrics such as the cash conversion cycle and working capital ratio can be used for decision-making to identify areas for improvement that help increase cash flow.

- Review your business environment and consider those findings in your business planning and strategic planning. For example, regularly check for technological advances and evaluate whether new metrics can provide insights into performance, helping you make better decisions.

- It's important to review how you spent your time compared to what was planned, much like the way you can learn from a post-mortem audit of a major investment or acquisition. Taking the time to review and iterate allows you to identify areas for improvement and better manage your time in the future while maximizing productivity.

The Evolving Role and Responsibilities of Today’s CFO

Top executives, including CFOs, acknowledge the value that finance chiefs bring to their companies. When it comes to the financial realm, there's a universal nod of approval that CFOs are not just involved but indispensable.

For the latest financial news, accounting and finance resources, and insights from financial leaders, be sure to sign up for our weekly newsletter.