An expense report includes a list of items your employees paid for on your behalf. It’s a simple document that lists an employee’s expenses, but the approval process can be cumbersome and expensive.

Let’s put that into perspective with numbers using data from the Global Business Travel Association:

- Processing just one expense report costs an average of $58.

- 19% of expense reports have errors.

- You’ll need to spend an average of 18 minutes of your time and $52 per report to fix errors in one expense report.

A streamlined expense reporting process can save you plenty of money (and a couple of headaches, too).

Here are the basics of an expense report and some of my tips on managing expense reports at scale.

The Basics of an Expense Report

Writing expense reports isn’t complex—it’s a list of expenses.

The difficult part is monitoring reimbursement policy violations, checking and approving expenses at scale, and speeding up expense report processing.

Before we touch on these issues, let’s quickly get the basics out of the way.

What is an Expense Report?

An expense report is a summary of reimbursable expenses incurred by your employees.

Money spent by employees on a meal during a business trip, fuel when driving the company car, or office supplies appears on an expense report.

Of course, your expense reimbursement policy dictates which expenses are reimbursable.

Finance teams ask employees for expense reports to:

- Track expenses: Expense reports make tracking expenses easier, especially if you have access to expense tracking software that uses OCR (optical character recognition). OCR can scan expense reports and input this data into your accounting system, saving you a ton of time.

- Reimburse approved expenses: Determine that all of the included expenses are reimbursable as per your policy. You still need to check for violations, though.

- Financial control: Expense reporting systems with built-in analytics can help analyze spending patterns and flag anomalies. If an employee has spent money on lavish dinners when traveling for business, you’d want to find out sooner rather than later.

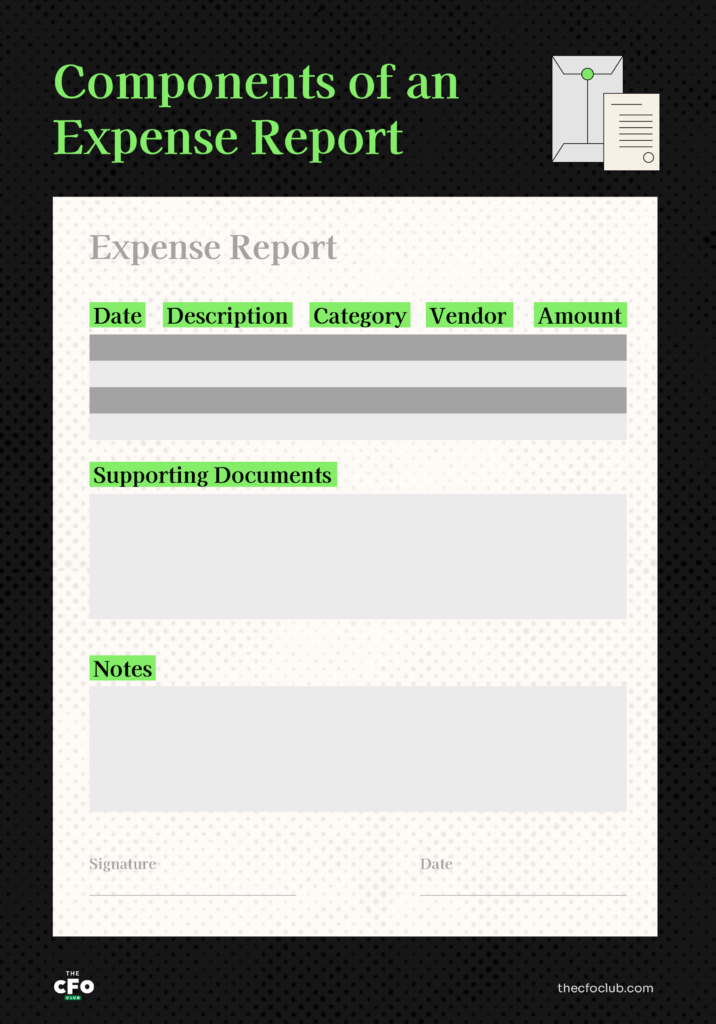

Components of an Expense Report

Here’s what a typical expense report includes:

- Date: The date of the expense.

- Expense description: Description of what the money was spent on.

- Expense category: Expense categories could include travel, meals, fuel, and more. Calculate a category-specific subtotal and a grand total for all expenses.

- Vendor: The name of the vendor. This section is even more important if your company policy requires buying from specific vendors.

- Amount: Amount of the expense.

- Client or project: The client or project for which the expense was incurred.

- Supporting documents: Receipt, invoice, or credit card statement to validate the expense.

- Notes: Any additional information goes here.

When processing expense reports, pay attention to IRS deductibility rules.

For example, Section 1.274-5(c)(2)(iii)(B) states that the IRS only considers documentary evidence adequate when it includes information about the amount, date, place, and description of the expenditure.

So when using a hotel receipt to claim a tax deduction, it should include the name, location, date, and separate amounts for charges such as lodging, meals, or anything else.

Importance in the Tech Industry

Expense reports aren’t just about reimbursements. They’re a window into your company’s spending behavior that helps you make data-backed decisions—whether contained within accounting software or sitting on a spreadsheet in Excel.

Let’s dive a little deeper into how expense reports offer value beyond their primary purpose.

Role in Financial Tracking

Expense reports tell you how much your employees spend, where they’re spending, and which one of your expense categories needs greater control.

You can use expense report data as real-time input for budgeting and expense categorization to make smarter decisions.

Budgeting

Budgeting involves projecting expenses for future periods. If your software team spent $10,000 during their trip to the SaaStr annual event, you could budget for $15,000 for the following year (assuming your team will grow a bit and inflation will cause prices to rise).

If they only spent $7,000 but you had budgeted for $10,000, you could divert some of those funds elsewhere.

Data from expense reports helps identify variances too. If you had a budget of $10,000 for the sales team and they incurred a $16,000 expense, there’s a $6,000 adverse variance that’s worth investigating.

Expense Categorization

What are employees spending the most on during business travel? What are the sales team’s mobile phone bills and would switching to VoIP software be cheaper?

This information is available only when you have a category-wise breakdown of employee expenses.

Employees can select categories when creating an expense report, and expense reporting software can automatically create a view that shows categorized expenses.

Even if you’re a small business owner, software has value. It can automate the process so you can use your human resources (aka time and energy) on other, more important tasks without additional operating leverage.

Real-time Reporting

Real-time reporting offers your team value in multiple ways, especially when you’re an early-stage startup or a small business strapped for cash. Here are examples of how real-time reporting helps:

- Greater financial visibility: Real-time reporting gives you immediate insights into spending patterns. It allows you to monitor the amount of money each department is spending and where.

- Budget control: You can monitor spending limits. If an employee is about to reach their spending threshold for a specific category, you can proactively take steps to help them stay within the budget.

- Optimize cash flow: If overspending seems inevitable, real-time reporting will ensure you have enough time to arrange for more cash before it dries up.

- Efficient expense management: Real-time reporting helps minimize errors and fast-track reimbursement by reducing the time between an expense’s occurrence and reporting.

The CFO’s Guide To Effective Expense Reporting

A standardized procedure streamlines your expense report workflow. You need to standardize three elements of the expense reporting workflow to make it more effective: submissions, reviews, and disbursement.

Within these three elements, there are various other factors to consider. For example, you can make submissions easier by investing in expense-tracking software. However, you still need to review reports to ensure they comply with your expense policy before you can approve reimbursements.

Let’s talk about how you can set up an effective expense report workflow.

How to Set Up an Expense Report Workflow

Here’s a four-step process to set up an expense report workflow:

Step 1: Communicate Expense Policy

Communicating your expense policy can make all parts of your workflow easier.

Address all the potential questions your employees may have regarding reimbursable expenses, approved vendors, spending limits, the method of spending, and other relevant aspects of your policy.

Once you’ve written down a clear process and updated it to address questions employees have had, you should store it somewhere accessible and direct new employees to learn it. If more questions arise in the future, you simply need to update your policy document to address them.

When everyone is clear about the policy, you’ll see fewer errors and violations in expense reports which, in turn, will allow you to review expense reports faster.

Step 2: Create an Expense Report Template

Templates make it easier for employees to request reimbursement.

You don’t necessarily have to create a template manually. Many expense management software solutions include built-in templates, and you can find more online. Employees just need to fill in the details and hit the submit button.

When an employee submits a report, the software notifies the person in charge of reviewing it.

Alternatively, you can manually create a template using Microsoft Excel. Add columns for all the details you want in expense reports—date, time, amount, category, what have you.

Some expense management solutions eliminate the need to create reports altogether. In fact, that’s the approach large enterprises take to expense management.

Mark Hawkins, Director of Operations at Puma, shares in a Zoho case study how he loves that Zoho Expense can scan receipts and automatically populate expense reports.

“The fact that the mobile app will take a scanned receipt, gather relevant data, and populate all or most of the fields you need to populate is a huge time-saver.”

Step 3: Determine the Approval Hierarchy and Sequence

Define levels of approval based on the amount and types of expenses.

It’s okay for the immediate supervisor to approve small expenses. However, larger expenses should go to the department head or senior management for approval.

You have two specifics to define here:

- Expenses that require separate approval: Define the criteria for expenses that the immediate supervisor can’t approve. You could require special approvals for expenses that exceed a certain amount, belong to a specific category, or are paid to a new vendor.

- Sequence of approval: If the immediate supervisor can’t approve an expense, who should they involve for review? Determine the approvers based on the organization’s hierarchy, and give yourself the final authority.

Step 4: Automate Reimbursements

Manual reimbursements can be a time hog.

They’re also impractical if you’re processing thousands of invoices per month—can you picture yourself calculating reimbursement amounts and looking for policy violations on a thousand invoices? Probably not.

Configure the expense management software to automatically disburse payments once they’re approved. If you use an accounts payable automation system, see if you can integrate it with the expense management solution. You’ll save time and your employees will appreciate quick disbursal.

Best Practices for Expense Approval

Implementing an automated expense reporting workflow is only half the battle. Following these best practices is vital to your workflow’s success:

- Clear expense policy: Make sure your expense policy is extensive and clear. Outline which expenses are reimbursable, what the spending limit is for each expense category, the document(s) required as proof, the approval process, and the timeline from submission to approval.

- Timely submission and approval: Encourage employees to submit expense reports promptly after incurring expenses. Similarly, your team should review and approve expenses and reimburse employees as quickly as possible.

- Documentation: Require supporting documentation for all expenses. Checks should be in place to authenticate the document’s validity.

- Mobile-friendly software: Use mobile-friendly expense tracking apps to allow employees to add expenses to an expense report on the go. With most software, employees can even submit reports using the mobile app and get them approved within minutes.

- Segregation of duties: Segregate the duties to approve and audit expense reports among two employees. It’s a crucial internal control that helps prevent fraud.

Advanced Tips For Scaling Companies

As your company grows and you hire more people, you’ll process more expense reports. Managing and approving expense reports at scale can quickly become overwhelming for the finance department.

If you’re in a similar situation or heading there, I’ve got tips for you.

Automate Expense Reporting

Easy, right? Just let the software take care of expense reports.

Solutions like SAP Concur give you more control and visibility over expenses while streamlining your workflow—you can enforce and modify spending policies, auto-capture documentation, and integrate it with your accounting system.

Of course, there are plenty of options to choose from, such as Pleo, Expensify, and Fyle.

AI has made managing expense reports far less time-consuming. AI systems can automatically categorize expenses and flag violations.

However, you still need to audit auto-approved expense reports every once in a while for due diligence.

Frauds are a major problem. I’ve heard of employees claiming the most absurd expenses—my favorite is the chicken statue with a top hat. Even Jim Harrick has falsified receipts on his expense reports.

The good news: AI software can detect anomalies in expense reports.

Take Yokoy for example. The AI-powered tool automates almost all parts of your expense management workflow and helps prevent fraud by letting you place individual spending limits, matching card payments with expenses to find duplicates, and detecting expense policy breaches in real-time.

Automated systems offer a great productivity boost, but there are a few things to be mindful of:

- Human oversight is important. Automated systems aren’t 100% effective at detecting anomalies and thus, you need to review things manually sometimes. Aim to strike a balance between automation and human oversight—schedule periodic reviews to make sure employees aren’t sneaking non-business expenses into their expense reports.

- Complex solutions aren’t a solution. Software solutions with a complex interface have low buy-in. Not only will your employees be reluctant to use these solutions, but you’ll have to pay a premium price for them too. Not to mention the possibility of employees making errors when using the solution wrong.

- Integrating with legacy systems is tricky. Modern solutions may or may not integrate with legacy systems, which can lead to data silos. If your expense management software doesn’t integrate with your accounting software, you’ll have to migrate expense data manually into your accounting system. And that would just suck.

Use Data Analytics

AI expense management software also generates insightful reports in real-time to help you make smarter decisions, which you can analyze to identify bottlenecks and room for improvement.

Here are some analytics techniques you can use for deriving insights from expense report data:

- Predictive modeling: It’s a model that uses historical data to forecast future expenses using machine learning algorithms and regression analysis. For example, a predictive model can predict future trip costs using data on trip duration, location, mode of travel, type of event, and past expenses.

- Anomaly detection: Anomaly detection involves identifying outliers in spending patterns. Statistical models or machine learning algorithms like clustering or isolation forests help build anomaly detectors that scan reports as they come in. When any data point in the report breaches the model’s thresholds and parameters, it alerts your team.

- Scenario planning: It’s exactly what it sounds like—scenario planning involves simulating probable expense scenarios to evaluate their impact on your budget and bottom line. For example, if you’re considering partnering with a hotel chain to reduce accommodation expenses, you could run a simulation using the hotel’s discounted pricing data across your most frequently visited destinations.

CFO FAQs: Dig Deeper into Expense Reports

What are the tax implications of improper expense reporting?

Improperly reported expenses can lead to disallowed deductions and increase your taxable income. It can also lead to errors in calculating sales tax remittances. Authorities may levy fines or decide to audit your business to check for more errors, sales tax compliance, and tax evasion.

How can I integrate expense reports into my broader financial strategy?

Here’s how you can integrate expense reports into your overarching financial strategy:

- Review expenses and analyze if they help your business generate more revenue, reduce costs, or increase profitability.

- Use expense reports to predict expenses when budgeting for the next period.

- Study expense reports to find areas where employees overspent and come up with a strategy to control those costs.

- Use expense reports to understand the impact of various expense categories on your business and make data-backed decisions.

- Information in the expense report can tell you if your policies need a change. Use expense report data to see if your spending limits need a revision or if you can negotiate better deals with a different vendor.

Signing Off The Report

Streamlining your expense report workflow goes a long way—it helps employees quickly get their money back and saves your team plenty of time. Plus, expense reports are a goldmine of information. Analyzing monthly expense reports can help you find cost drivers and opportunities to reduce cash outflow.

Want more such insights? Subscribe to our weekly newsletter built for financial professionals in the tech space, to receive these insights directly in your inbox.