Best International Payroll Services Shortlist

Here's my pick of the 10 best software from the 19 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

With so many international payroll services available, figuring out which is right for you is tough. You want to manage global payroll efficiently, but need to figure out which tool is best.

Using my extensive experience with various payroll software, I researched, tested, and reviewed several international payroll solutions to help teams find the top options on the market. Regardless of your industry or business size, I know that my reviews will lead you towards finding the ideal solution for your business.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software since 2023. As financial operators ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our accounting software review methodology.

Best International Payroll Services Summary

| Tools | Price | |

|---|---|---|

| Deel | Flat rate user pricing, with a free version for businesses with up to 200 people | Website |

| Globalization Partners | Pricing upon request | Website |

| IRIS Global Workforce Management | Pricing upon request | Website |

| SurePayroll | From $4/month/employee + $19.99/month base fee | Website |

| ADP | Pricing upon request | Website |

| Lano | From $325/month + $1,000 one-time setup fee | Website |

| Omnipresent | Pricing upon request | Website |

| Plane | From $19/employee/month | Website |

| Agile HRO | From $39/employee/month | Website |

| Velocity Global | Pricing upon request | Website |

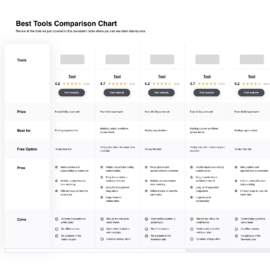

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose International Payroll Services

As you work through your own unique software selection process, keep the following points in mind:

- Global Reach and Experience: Ensure your chosen software has the capability to handle payroll in all the countries where you operate. For instance, software with established relationships with local payroll experts can offer advanced coverage, which is vital for businesses operating in multiple regions. This ensures compliance with local payroll-related legislation and smooth operations across borders.

- Data Security and Protection: Global payroll involves handling sensitive data across various jurisdictions, each with its own data protection laws like GDPR in the EU, LGPD in Brazil, and APPI in Japan. It’s essential to choose a software that understands and complies with these regulations to avoid legal issues and ensure the security of your payroll data.

- Integration Capabilities: The ability to integrate with existing HR and finance systems is important for seamless data flow and efficient operations. A global payroll solution should offer an open API for integration with various workforce management tools, ensuring that all systems work together harmoniously. This is particularly important for businesses that rely on multiple tools to manage their global workforce.

- Compliance and Legislative Updates: Staying compliant with ever-changing local laws is a significant challenge. A good payroll software should proactively keep up with legislative changes and implement necessary updates to ensure your business remains compliant. This minimizes the risk of financial penalties and reputational damage.

- Scalability and Flexibility: As your business grows, your payroll needs will evolve. Look for a provider that can scale with your business, adding new payroll countries and in-country providers easily. This ensures that your payroll system can support your expansion into new markets without significant disruptions.

By considering these factors, you can select an international payroll service that meets your business's unique needs and supports your global operations effectively.

Best International Payroll Services Reviews

This section provides an in-depth analysis and overview of each international payroll service. Below, I will walk through the pros and cons of each tool, their features, and their best use cases.

Deel offers an international payroll service that helps businesses manage their global workforce by providing a platform for easy and compliant payments to remote workers. It offers features such as compliance management, country-specific benefits, in-house visa support, and contract creation.

Why I picked Deel: I like that Deel has the ability to handle both employee and contractor payments, ensuring compliance with local regulations across over 150 countries. Deel also simplifies the onboarding process with automated contract generation and e-signature capabilities, reducing administrative burdens. Additionally, its built-in compliance features, such as localized contracts and automatic tax calculations, mitigate legal risks.

Standout features & integrations:

Features include global mobility support to facilitate transitions for employees relocating across borders, managing visas, work permits, and compliance. Deel also facilitates local filing with authorities, employee benefits and deductions, custom dashboards, and global reporting.

Integrations include Greenhouse, HiBob, Lever, NetSuite, Ashby, BambooHR, QuickBooks, Slack, Workday, Xero, and others.

Pros and cons

Pros:

- In-house visa support

- Ensure compliance with local labor laws

- Allows for hiring employees and contractors worldwide

Cons:

- Limited invoice customization

- No mobile app available

Globalization Partners is a global payroll provider and payments solution, allowing businesses to make accurate payments to their full-time team members and contractors in over 180 countries. It excels because it takes on all compliance responsibility as the legal EOR, allowing businesses to focus on other aspects of their operations.

Why I picked Globalization Partners: Globalization Partners stands out in the international payroll services market by offering advanced compliance solutions as the legal EOR. This makes it particularly effective for businesses looking to manage global employee payroll without the complexities of international compliance.

Standout features & integrations:

Features include global payroll and tax compliance, human resources management, international hiring and onboarding, employee benefits administration, legal and regulatory compliance, global mobility solutions, workforce analytics and reporting, multilingual support, and 24/7 customer service.

Integrations include Workday, SAP SuccessFactors, Oracle HCM, ADP, BambooHR, Namely, Gusto, QuickBooks, Xero, and NetSuite.

Pros and cons

Pros:

- Extensive global reach

- High payroll accuracy

- Comprehensive compliance solutions

Cons:

- Limited small business focus

- Potentially complex setup

IRIS Global Workforce Management offers a wide range of international payroll services, global payment solutions, international HR consulting, and global M&A services. They stand out due to their extensive service offerings and experience in managing all aspects of global workforce needs.

Why I picked IRIS Global Workforce Management: IRIS Global Workforce Management excels due to their ability to manage all aspects of global workforce needs, from recruiting and compliance to payroll and payments. Their expertise in handling complex global workforce challenges make it easier for businesses to operate across multiple countries. Additionally, IRIS's user-friendly interface and real-time data analytics enhance efficiency and decision-making for global workforce management.

Standout features & integrations:

Features include expert management of immigration documentation, employment law and compliance services, employee data, such as benefits and compensation services, secure payroll processing and calculation, international payments, and end-of-year reporting.

Integrations include SAP, Oracle, Workday, ADP, Ceridian, Ultimate Software, Kronos, BambooHR, Sage, and Xero.

Pros and cons

Pros:

- Expert compliance management

- Extensive global coverage

- Comprehensive service offerings

Cons:

- Limited small business focus

- Potentially complex setup

SurePayroll is an online payroll service provided by Paychex, designed to simplify payroll for small businesses. It handles payroll processing, tax calculations, and offers additional HR services.

Why I picked SurePayroll: SurePayroll handles all payroll-related tasks, including tax calculations and filings, which is vital for small business owners who need to save time and reduce errors. Its user-friendly interface and advanced support ensure that even businesses with limited payroll experience can manage their payroll efficiently and accurately. Additionally, SurePayroll's reliable compliance features help small businesses stay up-to-date with tax regulations and avoid costly penalties.

Standout features & integrations:

Features include free direct deposit, automated tax calculations and filings, and the ability to run payroll from any device. It also provides additional services like HR management and health insurance.

Integrations include QuickBooks, Xero, FreshBooks, Sage, Gusto, ADP, Paychex, BambooHR, Zenefits, and TSheets.

Pros and cons

Pros:

- Mobile access

- Comprehensive tax handling

- Easy to use

Cons:

- Additional cost for some features

- Limited international features

ADP offers a wide range of payroll and HR services designed to meet the needs of businesses of all sizes. It provides teams with several tools and services that streamline payroll processing and human capital management.

Why I picked ADP: ADP integrates payroll, HR, and compliance services into a single platform, making it easier for businesses to manage their workforce efficiently. It stands out in the realm of payroll and HR solutions due to its extensive range of services and advanced technology for businesses of all sizes, making a versatile software solution.

Standout features & integrations:

Features include automated payroll processing, tax filing, benefits administration, compliance management, advanced reporting and analytics, employee self-service portals, and mobile access.

Integrations include QuickBooks, Xero, Microsoft Dynamics, Oracle, SAP, Workday, Salesforce, BambooHR, Slack, and Google Workspace.

Pros and cons

Pros:

- Strong compliance support

- Scalable for all business sizes

- Comprehensive service offerings

Cons:

- Limited customization options

- Complex setup process

Lano is a global payroll consolidation and employer of record (EOR) platform. It unifies payroll data from multiple systems into one platform, simplifying global payroll management.

Why I picked Lano: Lano unifies global payroll data, which stands out in the crowded payroll services market. Its platform consolidates payroll data from various systems, making it easier to manage and analyze. This feature is particularly useful for companies operating in multiple countries, as it reduces complexity and enhances data accuracy.

Standout features & integrations:

Features include global payroll services, global payments, contractor management, hiring in over 170 countries, and a centralized hub for payroll data.

Integrations include HiBob, Workday, Personio, Sage, Zoho People, Lucca, BambooHR, Xero, QuickBooks, and SAP.

Pros and cons

Pros:

- Reduces payroll errors

- Supports 170+ countries

- Unifies payroll data

Cons:

- Complex initial setup

- Limited free resources

Omnipresent offers an advanced global payroll solution that simplifies paying international employees. It ensures compliance with local labor laws in over 165 countries, making it best for hassle-free global payroll services.

Why I picked Omnipresent: Omnipresent simplifies the complexities of global payroll management. Unlike other tools, Omnipresent stands out for its extensive coverage in over 165 countries and its dedicated international payroll team. Additionally, it offers seamless integration and real-time reporting, making it easier for companies to manage their global workforce efficiently and accurately.

Standout features & integrations:

Features include multi pay-cycle management, local currency payments, and simplified invoicing. It also ensures compliance with local data protection laws and manages variable compensation components like bonuses and commissions.

Integrations include QuickBooks, Xero, BambooHR, Workday, SAP SuccessFactors, ADP, Gusto, Rippling, Zenefits, and Paychex.

Pros and cons

Pros:

- Local currency payments

- Dedicated payroll team

- Covers 165+ countries

Cons:

- Requires annual billing

- Limited self-service options

Plane is a payroll platform that enables businesses to run payroll for their entire team, including domestic W2 employees, international employees, and global contractors in over 240 countries. The platform aims to provide an equitable payroll experience for all employees, regardless of their location.

Why I picked Plane: Plane streamlines payroll processes for both domestic and international teams, making it a standout tool in the realm of payroll services. Its unified platform eliminates the chaos of managing multiple systems, ensuring a seamless payroll experience across 240+ countries. This makes it the best choice for businesses looking to unify their domestic and international payroll operations.

Standout features & integrations:

Features include the ability to run payroll for contractors and employees in different countries simultaneously, automatic and manual payment options, and direct payments into international bank accounts without the need for third-party services. The platform also supports local currency payments in 70+ countries without markups or fees.

Integrations include QuickBooks, Xero, Gusto, BambooHR, Workday, ADP, Paychex, Rippling, Zenefits, and TriNet.

Pros and cons

Pros:

- Local currency support

- Direct international payments

- Unified payroll platform

Cons:

- Potential integration complexity

- Limited manual payment options

Agile HRO is an advanced global employment platform that empowers businesses to manage their international teams seamlessly. It’s best for businesses looking for a strong solution to manage their global workforce efficiently and compliantly.

Why I picked Agile HRO: Agile HRO is an innovative and compliant platform that stands out in the global employment space. The platform's ability to manage various aspects of global employment, from payroll, EOR, mobility, recruitment, and HR consulting, makes it a versatile choice for businesses of all types.

Standout features & integrations:

Features include a cloud-based platform, real-time data analytics, employee self-service portal, payroll management, benefits administration, compliance management, talent acquisition, performance management, time and attendance tracking, and customizable reporting.

Integrations include SAP SuccessFactors, Workday, Oracle Cloud, Microsoft Dynamics 365, ADP, Kronos, BambooHR, Gusto, Dayforce, and PeopleSoft.

Pros and cons

Pros:

- Real-time currency conversion

- Ensures local compliance

- Comprehensive global employment solutions

Cons:

- Limited information on specific integrations

- May require customization for specific needs

Velocity Global offers an advanced suite of international payroll and HR services for businesses looking to manage their global workforce. It allows for streamlined and efficient payment processes, ensuring compliance across multiple countries.

Why I picked Velocity Global: Velocity Global comes with strong multi-country payroll compliance capabilities. The platform stands out for its ability to handle complex international payroll requirements, making it easier for businesses to manage global payroll without the risk of non-compliance. Its advanced approach to navigating local laws and reducing payroll errors makes it a top choice for international employers.

Standout features & integrations:

Features include automated payroll processing, real-time reporting, statutory benefit enrollment, adaptable payment methods, and unmatched customer support.

Integrations include Oracle HCM, Workday, SAP SuccessFactors, ADP, BambooHR, QuickBooks, Xero, NetSuite, Gusto, and Rippling.

Pros and cons

Pros:

- Real-time reporting

- Automated payroll processing

- Comprehensive compliance support

Cons:

- Limited to businesses with legal entities

- May require setup time

Other International Payroll Services

Below is a list of additional international payroll services that I shortlisted. While they didn’t make the top 10, they’re still valuable and worth further research.

- Wise

Best for cost-effective international payments

- Multiplier

Best for borderless hiring and compliance

- Rippling

Best for integrated payroll and IT management

- Borderless AI

Best for seamless cross-border hiring

- Remote

Best for comprehensive HR solutions

- Papaya Global

Best for automated compliance and payroll

- Transformify

Best for diversity hiring and payroll

- Skaud

Best for scalable global workforce management

- Oyster

Best for managing global teams efficiently

Related Financial Software Reviews

If you still haven't found what you're looking for here, check out these closely related tools and services that we've tested and evaluated.

- ERP Software

- POS Systems

- Billing Software

- Payroll Services (best overall)

- Forecasting Software

- Merchant Account Services

- Expense Report Software

International Payroll Services Selection Criteria

The criteria for choosing an international payroll services software should directly address buyer needs and common pain points, ensuring that the software serves its intended purpose effectively. As an expert who has personally tried and researched these tools, here are the requirements I use when evaluating software:

Core Functionality - 25% of total weighting score

- Compliance with international tax laws

- Multi-currency support

- Automated payroll processing

- Employee self-service portals

- Integration with HR and accounting systems

Additional Standout Features - 25% of total weighting score

- Identifying unique features and functionality not offered by the competition

- Tools leveraging new and innovative features

- Exploring and testing for functionality that goes above and beyond generic international payroll services

Usability - 10% of total weighting score

- Evaluating power and complexity vs ease of use

- Interface design aesthetic

- Intuitive navigation

- Customizable dashboards

Onboarding - 10% of total weighting score

- Quick, simple, and easy onboarding

- Availability of training videos, templates, interactive product tours, chatbots, webinars

- Evaluating the post-purchase stage, migration to the tool, and start realizing the value

Customer Support - 10% of total weighting score

- Availability of 24/7 support

- Multi-language support

- Dedicated account managers

- Response time and resolution effectiveness

Value For Money - 10% of total weighting score

- Competitive pricing

- Transparent pricing models

- Cost vs. feature set

- ROI potential

Customer Reviews - 10% of total weighting score

- Overall satisfaction ratings

- Feedback on ease of use

- Comments on customer support quality

- Insights on feature effectiveness and reliability

Trends for International Payroll Services

International payroll services are evolving rapidly. Here are some key trends to watch for in the coming years:

- AI and Machine Learning Integration: AI and machine learning are being integrated into payroll systems to automate complex calculations and compliance checks. This reduces errors, saves time, and provides predictive analytics for better decision-making.

- Blockchain for Payroll Security: Blockchain technology is being used to enhance the security and transparency of payroll transactions. It ensures data integrity and reduces the risk of fraud. This is vital for maintaining trust in international transactions.

- Cloud-Based Payroll Solutions: Cloud-based payroll solutions offer scalability and accessibility from anywhere in the world. They simplify updates and maintenance, which is particularly beneficial for companies with a global workforce.

- Real-Time Payment Processing: Real-time payment processing allows employees to receive their wages instantly. This improves employee satisfaction and financial well-being, and also helps companies manage cash flow more effectively.

- Compliance Automation: Compliance automation tools are becoming essential for managing the complex regulations of different countries. These tools automatically update to reflect new laws and regulations, minimizing the risk of non-compliance and associated penalties.

As companies expand globally, leveraging advanced payroll technologies and staying abreast of regulatory changes will be crucial in ensuring seamless and efficient payroll operations. Embracing these trends will not only streamline processes but also enhance the overall employee experience, positioning organizations for sustained success in the global market.

What is International Payroll Services?

Software for international payroll services is a specialized tool designed to manage and streamline payroll processes for companies with a global workforce. It handles complexities such as multi-currency payroll calculations, diverse tax regulations, and compliance with local labor laws in different countries.

Features of International Payroll Services

When managing a global workforce, choosing the right international payroll service is important. Here are the most important features to look for in international payroll services software:

- Compliance Management: This feature ensures adherence to local tax laws and labor regulations, significantly reducing the risk of legal issues and potential fines. It helps businesses maintain a compliant payroll process across multiple jurisdictions, providing peace of mind and operational stability.

- Multi-Currency Support: With the ability to make payments in various currencies, this feature is essential for managing a global workforce. It simplifies multinational payroll processing by accommodating different monetary systems, enhancing accuracy and reducing the complexity of currency conversions.

- Automated Payroll Processing: By automating payroll calculations and disbursements, this feature saves considerable time and reduces the likelihood of human errors. It ensures timely and precise payslips for international contractors, local entities, and global employees, enhancing overall operational efficiency.

- Employee Self-Service Portal: This portal empowers employees to access their payroll information anytime, improving transparency and boosting satisfaction. It reduces administrative workload by allowing employees to handle basic payroll-related tasks independently.

- Integration with HR Systems: Seamless data flow between payroll and HR systems is facilitated, improving overall efficiency. This integration ensures that payroll processes are synchronized with HR records, reducing discrepancies and streamlining administrative tasks.

- Tax Filing Services: This feature manages tax filings and deductions accurately, ensuring compliance with local tax laws. It alleviates the burden of complex tax regulations and helps avoid penalties by ensuring timely and precise tax submissions.

- Customizable Reporting: Detailed and customizable reports are provided, aiding in financial planning and strategic decision-making. This allows businesses to generate specific reports tailored to their needs, offering valuable insights into payroll expenditures and trends.

- Data Security: Protecting sensitive payroll data from breaches is crucial for maintaining confidentiality and compliance with data protection laws. This ensures that employee information is securely stored and managed, mitigating the risk of data breaches.

- Scalability: The ability to adapt to the growing needs of your business supports expansion into new markets without disrupting payroll processes. This ensures that the software can handle increasing complexities as the business grows and diversifies.

- Customer Support: Reliable support is offered to address any payroll-related issues promptly, ensuring smooth operations. This provides businesses with access to expert assistance whenever needed, minimizing downtime and resolving problems efficiently.

From ensuring compliance and multi-currency support to providing robust security and scalability, these features streamline payroll operations and enhance overall efficiency. By leveraging these capabilities, businesses can focus on growth and employee satisfaction, confident in their ability to navigate complex international payroll landscapes.

Benefits of International Payroll Services

Managing payroll for a global workforce can be a complex and time-consuming task, but with an international payroll service provider, the process is simplified. Here are some of the added benefits an international payroll services software can offer:

- Compliance Management: International payroll services ensure that your business adheres to the diverse tax regulations and labor laws of each country where you operate, reducing the risk of legal issues and penalties.

- Cost Savings: By automating payroll processes and reducing the need for in-house payroll staff, international payroll services can significantly cut down on administrative costs and minimize errors that could lead to financial penalties.

- Efficiency and Time Savings: These services automate many of the manual tasks associated with payroll, such as tax calculations and compliance reporting, freeing up time for your HR team to focus on more strategic activities.

- Scalability: As your business grows, international payroll services can easily scale to accommodate an increasing number of employees and new geographic locations, ensuring seamless payroll management during periods of rapid expansion.

- Employee Satisfaction: Ensuring timely and accurate payments in local currencies helps maintain employee satisfaction and trust, which is important for retaining top talent in a competitive global market.

International payroll services offer a comprehensive solution to the challenges of managing a global workforce. By ensuring compliance, reducing costs, saving time, and enhancing employee satisfaction, these services enable businesses to focus on their core operations and growth strategies.

Costs & Pricing of International Payroll Services

International payroll services offer a range of plans to cater to different business needs. These plans vary in terms of features, pricing, and the level of support provided. Below is a detailed table summarizing the common plan types, their average prices, and the features they typically include.

Plan Comparison Table for International Payroll Services

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic international payroll processing, but limited to a small number of employees or contractors. |

| Basic Plan | $39/month + $5/employee | Payroll processing, direct deposit, tax filing, and employee self-service portal. |

| Standard Plan | $50/month + $8/employee | All Basic features + benefits administration, and compliance monitoring. |

| Premium Plan | $75/month + $10/employee | All Standard features + advanced reporting, and a dedicated account manager. |

| Enterprise Plan | Custom pricing | All Premium features + custom integrations, global HR support, and immigration services. |

When choosing an international payroll service, consider the specific needs of your business, the number of employees, and the level of support required. Each plan offers different features and pricing, so it's essential to evaluate which plan aligns best with your business goals and budget.

International Payroll Services FAQs

Here are some frequently asked questions I receive about international payroll services software:

How do international payroll services handle different currencies?

International payroll services typically use advanced software to manage currency conversions. They ensure that employees are paid in their local currency, while also providing accurate financial reporting for the business in its home currency. This helps in maintaining consistency and transparency in financial records.

What compliance issues do international payroll services address?

These services address various compliance issues, including local tax laws, labor regulations, social security contributions, and reporting requirements. They stay updated with changes in legislation to ensure that the business remains compliant and avoids legal penalties.

Can international payroll services integrate with existing HR systems?

Yes, many international payroll services offer integration with existing HR systems. This allows for seamless data transfer between payroll and HR functions, reducing the need for manual data entry and minimizing the risk of errors.

How do international payroll services ensure data security?

International payroll services implement robust data security measures, including encryption, secure data storage, and regular security audits. They comply with international data protection regulations, such as GDPR, to ensure that sensitive employee information is protected.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.