Best Invoicing Software Shortlist

Here’s my pick of the 10 best software from the 22 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

You want to create, send, and manage invoices efficiently, but you aren't sure which tool is best. You’re not alone! The demand for such software has created a huge market, which can make choosing the right invoicing software both time-consuming and challenging.

In this post, I'll share my personal experiences with various invoicing tools and highlight my top picks for the best invoicing software. Overall, my goal is to simplify your search by highlighting each tool's standout features and ideal use cases to help you find the best fit for your team’s needs.

Why Trust Our Software Reviews

We’ve been testing and reviewing financial management software since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Invoicing Software Summary

| Tools | Price | |

|---|---|---|

| Xero | From $15/month (billed annually) | Website |

| Zoho Invoice | From $9/month (billed annually). | Website |

| Wave | From $14/user/month | Website |

| Keap | From $249/user/month (billed annually) | Website |

| Billdu Ltd. | From $4.99/user/month (billed annually) | Website |

| Square Invoices | Pricing upon request | Website |

| Sage Accounting | From $19/month | Website |

| Zervant | From $7/user/month (billed annually) | Website |

| Hiveage | From $19/user/month | Website |

| Invoicely | From $9/user/month (billed annually) | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Invoicing Software

As you work through your unique software selection process, keep the following points in mind:

- System Integrations: When choosing invoicing software, be sure that it integrates smoothly with your existing ERP and accounting systems. This interoperability can help you maintain a smooth workflow and avoid manual data entry, which can be error-prone and time-consuming.

- Scalability and Customization Options: Look for solutions with customization options, such as personalized invoice templates and flexible delivery methods. This helps ensure that your software can adapt as your business expands without needing a complete overhaul.

- Data Security and Compliance: Invoicing software handles sensitive financial data, so security and compliance features are essential. Choose software that adheres to high data protection standards and complies with regulations like GDPR for European businesses or PCI DSS for credit card transactions. This protects your business from data breaches and helps build trust with your clients by safeguarding their information.

- Customer Support and Training: Even the best software can have challenges, so reliable customer support is essential. Choose invoicing software with multiple support channels like email, phone, and live chat, as well as comprehensive training resources such as tutorials, webinars, and knowledge base articles.

- Total Cost of Ownership: When choosing invoicing software, it is important to consider the total cost of ownership, not just the initial price. This includes subscription fees, payment processing fees, implementation costs, and ongoing support and training expenses.

Best Invoicing Software Reviews

Here, I provide a detailed summary and analysis for each invoicing software. Each review will cover the pros and cons, features, and best use cases for each tool.

Xero is a cloud-based accounting software designed for small businesses, accountants, and bookkeepers, providing a wide range of financial management tools. It supports multiple currencies and international transactions, making it ideal for global business operations.

Why I Picked Xero: I chose Xero for its powerful accounting features that cater to small and medium-sized businesses globally. Xero allows users to handle international transactions in over 160 currencies with real-time exchange rates and automatic currency conversions, making it perfect for businesses operating globally. Furthermore, Xero offers several compliance features, such as tax management tools that support multiple tax rates and jurisdictions, simplifying tax calculations and submissions for businesses operating in different countries.

Standout features & integrations:

Features include invoicing, expense tracking, bank connections, payroll management, inventory management, and real-time financial reporting and analytics.

Integrations include PayPal, Stripe, Square, HubSpot, Shopify, Gusto, Expensify, Bill.com, Vend, and Receipt Bank.

Pros and cons

Pros:

- Extensive integrations

- Supports multiple currencies

- Comprehensive accounting features

Cons:

- Limited customer support options

- Steep learning curve for new users

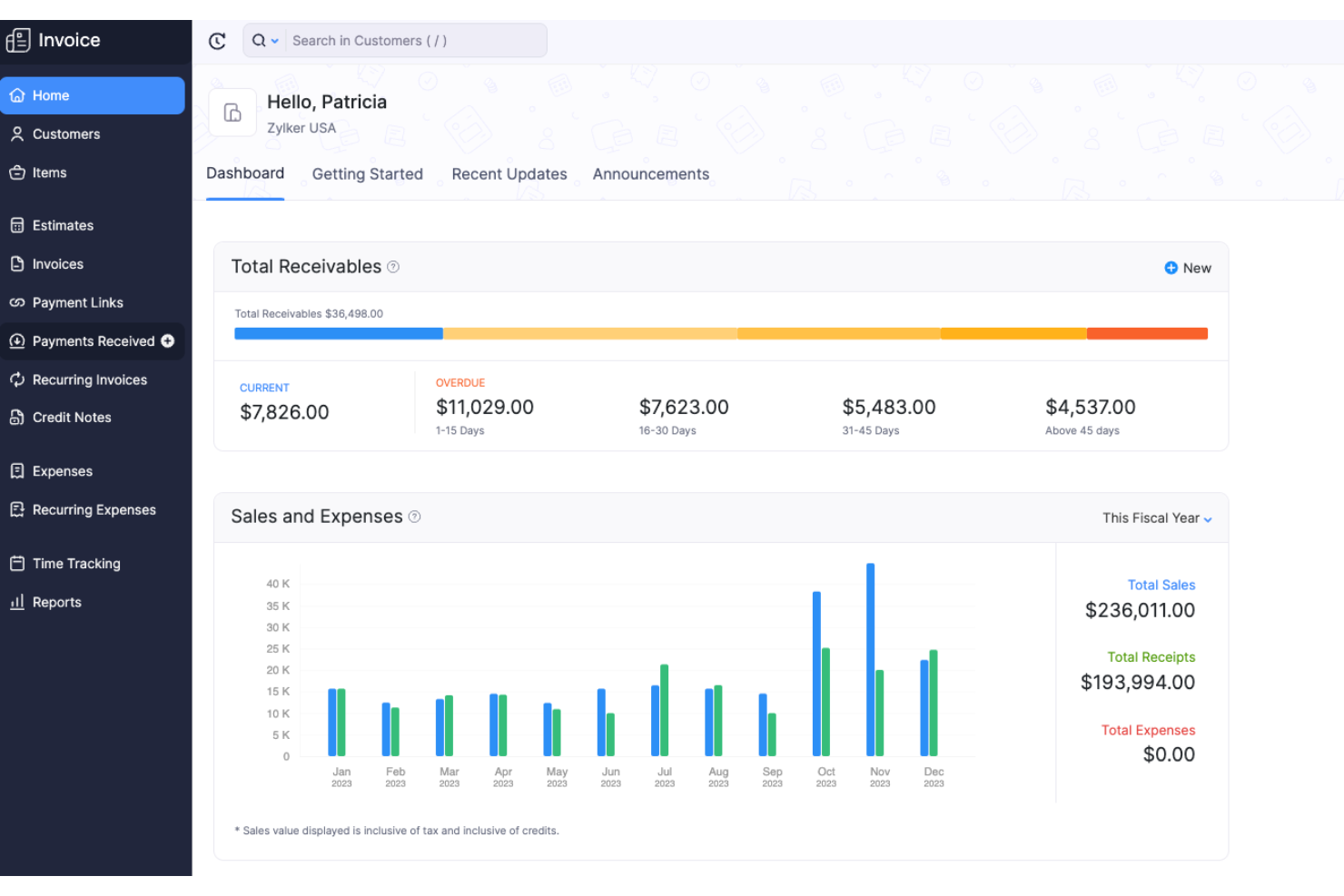

Zoho Invoice is a free online invoice management software designed for small businesses. It offers customizable invoice creation, online and offline payment options, time and expense tracking, payment reminders, customer portals, and reports.

Why I Picked Zoho Invoice: I chose Zoho Invoice for its comprehensive features tailored to small businesses and freelancers. The platform’s time-tracking feature particularly sets it apart, making it perfect for businesses that bill by the hour. This feature integrates time logs into invoices for accurate billing. It also supports multiple timers for tracking different tasks simultaneously and allows for customization of invoices, making it easy to include time entries and project details tailored to client requirements.

Standout features & integrations:

Features include customizable invoice templates, time tracking, expense tracking, automated payment reminders, a customer portal for clients to view and pay invoices, and detailed financial reports to track business performance.

Integrations include Zoho Books, Zoho CRM, Zoho Projects, PayPal, Stripe, G Suite, Office 365, Slack, Dropbox, and OneDrive.

Pros and cons

Pros:

- Customizable templates

- Time tracking included

- Free forever

Cons:

- No phone support

- Limited advanced features

Wave is free invoicing software for small businesses, allowing them to create and send invoices, track payments, and manage expenses. It helps simplify billing processes and helps businesses maintain financial organization overall.

Why I Picked Wave: I chose Wave for its unique combination of free invoicing and integrated accounting features. This integration automatically syncs invoices with accounting records, ensuring that all financial data is automatically updated and reducing manual entry and errors. Additionally, Wave's platform provides real-time financial insights, helping businesses to stay on top of their financial health effortlessly. As such, Wave is ideal for small businesses and freelancers that need efficient, cost-free invoicing and accounting.

Standout features & integrations:

Features include recurring billing, automatic payment reminders, mobile invoicing, instant notifications for invoice status changes, and online payment options.

Integrations include Google Sheets, PayPal, Etsy, HubSpot CRM, Zapier, and Shoeboxed.

Pros and cons

Pros:

- Mobile invoicing app

- Recurring billing

- Free accounting integration

Cons:

- No advanced reporting

- Limited customer support

Keap is a comprehensive business management tool designed to help small businesses with customer relationship management (CRM) and automation. It offers features such as small business automation, marketing automation, sales automation, and lifecycle automation.

Why I Picked Keap: Keap's CRM allows small businesses to manage customer interactions, segment contacts, and run personalized communication campaigns. I like that its in-platform invoicing features enable users to send quotes, invoices, and receipts, and manage payments through integrations with various payment processors like PayPal, Stripe, and WePay. Furthermore, the platform's automation capabilities help eliminate manual tasks, such as sending follow-up emails and recording new leads.

Standout features & integrations:

Features include appointment scheduling, dynamic form creation, lead capture, pipeline management, marketing and sales automation, contact management, and sales reporting.

Integrations include PlusThis, AdEspresso, BigCommerce, AppointmentCare, Bonjoro, Gmail, Jotform, Outlook, ScheduleOnce, WordPress, Wistia, and Zapier. Keap also has an open API for custom integrations.

Pros and cons

Pros:

- Extensive customization options

- Robust CRM features

- Good automation tools

Cons:

- UI could be improved

- May be expensive for those on a tighter budget

Billdu is a versatile invoicing software tailored for small businesses, providing invoicing, estimates, payment processing, and expense tracking. It also offers online booking, an online store, and a website widget, enhancing appointment management and customer engagement.

Why I Picked Billdu: I chose Billdu for its unique combination of invoicing and online booking features, which can be essential for small businesses that need an integrated solution for managing financial transactions and customer appointments. It allows clients to book appointments directly through the platform, which automatically generates invoices based on the booked services. Billdu simplifies scheduling and managing appointments alongside invoicing, including real-time updates and reminders, making it ideal for small businesses.

Standout features & integrations:

Features include invoicing, estimates, fast payments, expense tracking, online booking, online store, and instant website creation.

Integrations include PayPal, Stripe, QuickBooks, Google Calendar, Google Drive, Dropbox, Mailchimp, Slack, Authorize.net, and Trello.

Pros and cons

Pros:

- Expense tracking

- Integrated online booking

- Comprehensive invoicing features

Cons:

- Lacks advanced accounting features

- Limited customization options

Square Invoices is a comprehensive invoicing software that helps businesses streamline their invoicing and payment processes. It is best for accepting diverse payment methods, including credit cards, Apple Pay, Google Pay, ACH bank transfers, and Cash App Pay.

Why I Picked Square Invoices: I chose Square Invoices for its versatility in accepting various payment methods, which is essential for businesses offering multiple payment options. Customers can pay online directly through the invoice or in person using a mobile card reader. Additionally, Square allows users to set up recurring payments and store customer card information for future transactions. This sets it apart from other invoicing tools by providing flexibility and convenience in payment processing.

Standout features & integrations:

Features include digital invoicing, real-time tracking, automatic payment reminders, saving and charging cards on file, milestone-based payment schedules, and custom invoice templates.

Integrations include QuickBooks Online, Xero, Google Calendar, Google Sheets, WooCommerce, Wix, BigCommerce, Magento, Shopify, and Mailchimp.

Pros and cons

Pros:

- Custom invoice templates

- Real-time tracking

- Diverse payment methods

Cons:

- Higher processing fees

- Limited multi-currency support

Sage Accounting offers an extensive suite of business management tools tailored for small to medium-sized enterprises. It excels in providing a comprehensive solution that integrates accounting, payroll, and business management functionalities.

Why I Picked Sage Accounting: I chose Sage Accounting for its comprehensive business management approach. Sage Accounting is best for comprehensive business management because it offers features beyond invoicing, including advanced financial management, payroll, and inventory control. It also offers excellent invoicing features, including invoice tracking, which enables users to see the status of each invoice, and multi-currency invoicing, which ensures that invoices are accurately converted and recorded in the relevant currency.

Standout features & integrations:

Features include advanced financial reporting, automated bank reconciliation, and comprehensive payroll management. It also offers inventory management and job costing functionalities.

Integrations include Microsoft 365, Stripe, PayPal, AutoEntry, OneDrive, Excel, Word, PowerPoint, Teams, SharePoint, and MileIQ.

Pros and cons

Pros:

- Robust payroll features

- Advanced financial reporting

- Comprehensive business management

Cons:

- Limited to desktop installation

- Complex setup

Zervant is invoicing software for sole traders and small businesses, offering e-invoicing, quotes, time tracking, a mobile app, payment reminders, and payments. Part of Ageras, it is praised for its simplicity, multilingual support, and free account option, providing a fast and intuitive invoicing experience for entrepreneurs.

Why I Picked Zervant: I chose Zervant for its variety of features tailored to small businesses and sole traders. It especially stands out for its simplicity and efficiency, making invoicing easy without unnecessary add-ons. In particular, Zervant is best for automated recurring invoices, which save businesses significant time by automatically generating and sending invoices to customers at regular intervals. This automation helps ensure consistent cash flow and reduces the manual effort involved in billing repetitive invoices.

Standout features & integrations:

Features include automated recurring invoices, multiple delivery formats, invoice status tracking, and a free mobile app.

Integrations include PayPal, Stripe, GoCardless, and QuickBooks.

Pros and cons

Pros:

- Multiple delivery formats

- Free mobile app

- Automated recurring invoices

Cons:

- Limited customer support options

- No built-in accounting

Hiveage is a cloud-based invoicing software designed for small businesses, freelancers, and agencies. It is best for simple invoicing with multiple payment gateways because it offers over a dozen popular online payment gateways, allowing users to accept credit card payments easily.

Why I Picked Hiveage: I chose Hiveage for its simplicity and effectiveness in managing finances, customers, and teams. Users can send professional, branded invoices quickly and easily, including custom logos and business details. The platform also supports recurring billing, enabling automatic charges and sending of invoices at regular intervals. Overall, Hiveage’s user-friendly interface and support for multiple payment gateways make it ideal for small businesses and freelancers seeking a straightforward invoicing solution.

Standout features & integrations:

Features include invoice creation, estimates, multiple payment gateways, financial reports, recurring billing, and team management.

Integrations include PayPal, Stripe, Authorize.Net, Braintree, WePay, 2Checkout, Mollie, Razorpay, QuickBooks Online, and Xero.

Pros and cons

Pros:

- Recurring billing

- User-friendly interface

- Multiple payment gateways

Cons:

- Limited reporting tools

- No built-in accounting features

Invoicely is a free online invoicing platform designed for small businesses. It offers unlimited mobile invoicing, allowing users to create and send invoices from any iOS or Android device.

Why I Picked Invoicely: I chose Invoicely for its mobile invoicing capabilities. This ability to create and send invoices from mobile devices makes it an excellent choice for businesses that operate on-the-go. The platform also supports real-time synchronization, ensuring that all data is updated across devices instantly. Additionally, Invoicely provides the ability to track expenses, manage clients, and accept payments directly through the mobile app, making it a comprehensive tool for mobile business management.

Standout features & integrations:

Features include customizable business reports, online payment acceptance, time, expense, and mileage tracking, and the ability to create invoices, bills, and estimates in under 60 seconds.

Integrations include PayPal, Stripe, Authorize.Net, WePay, Mollie, Braintree, and PayLane.

Pros and cons

Pros:

- Online payment acceptance

- Customizable business reports

- Unlimited mobile invoicing

Cons:

- No integrated accounting features

- Limited customer support

Other Invoicing Software

Below is a list of additional invoicing software that did not make it to the top list, but are definitely still worth checking out.

- InvoiceNinja

Best for freelancers needing expense tracking

- Paymo

Best for invoicing with project management

- FreshBooks

Best for user-friendly invoicing and accounting

- Stripe

Best for online payment processing

- Tipalti

Best for global mass payments

- Procurify

Best for procurement and spend management

- Jobber

Best for field service businesses

- QuickBooks

Best for comprehensive financial management

- Soluno

Best for legal practice management

- Notch

Best for food and beverage industry

- HighRadius

Best for accounts receivable automation

- Houzz Pro

Best for home renovation professionals

Related Financial Management Software Reviews

If you still haven't found what you're looking for here, check out these tools closely related to tax software that we've tested and evaluated.

- Accounting Software

- POS Systems

- Billing Software

- Payroll Services

- Best Merchant Services

- Expense Report Software

Selection Criteria for Invoicing Software

Selecting invoicing software involves carefully evaluating each tool’s overall functionality and how well it is able to meet the user’s specific needs. Throughout my career, I have personally tried and researched these tools to gain insights into the essential features and user experience aspects that matter most. As such, I have developed a set of selection criteria that I believe are essential to the selection process.

I have compiled a list of my selection criteria here, with each weighted to reflect its importance to my overall decision.

Core Functionality (25% of total weighting score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Generating and sending invoices

- Tracking payments and due dates

- Managing client information

- Automating recurring invoices

- Integrating with accounting software

Additional Standout Features (25% of total weighting score): To help further narrow down the competition, I also looked for unique features, such as:

- Customizable invoice templates

- Multi-currency support

- Mobile app availability

- Advanced reporting and analytics

- Integration with payment gateways

Usability (10% of total weighting score): To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Easy navigation

- Minimal learning curve

- Drag-and-drop functionality

- Clear and concise dashboard

Onboarding (10% of total weighting score): To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Chatbots for instant help

- Webinars for in-depth learning

- Pre-built templates for quick setup

Customer Support (10% of total weighting score): To assess each software provider’s customer support services, I considered the following:

- 24/7 availability

- Multiple support channels (email, phone, chat)

- Fast response times

- Knowledgeable support staff

- Comprehensive help center

Value For Money (10% of total weighting score): To evaluate the value for money of each platform, I considered the following:

- Competitive pricing

- Transparent pricing structure

- Free trial availability

- Flexible subscription plans

- Discounts for annual payments

Customer Reviews (10% of total weighting score): To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction ratings

- Feedback on ease of use

- Comments on customer support quality

- Reviews on feature effectiveness

- User testimonials on value for money

Trends in Invoicing Software for 2024

As businesses adapt to changing technology, invoicing software is advancing to meet new demands and shape the future of invoicing, making it more efficient and accessible for companies of all sizes. Here are some key trends to watch:

- AI-Powered Automation: AI is increasingly being used to automate invoicing processes. This reduces human error and speeds up payment cycles, resulting in more accurate and timely invoicing.

- Blockchain Integration: Blockchain technology is increasingly being integrated into invoicing software to ensure secure and transparent transactions. This is essential for industries requiring high levels of data integrity.

- Mobile Invoicing: Mobile invoicing is also on the rise, as it allows businesses to send and manage invoices on the go. This flexibility can be essential for small businesses and freelancers.

- Subscription Billing: Subscription billing features are also becoming more common, as they help businesses manage recurring payments efficiently.

- Customizable Templates: Customizable invoice templates are gaining popularity. They allow businesses to maintain brand consistency, which is important for professional presentation and client trust.

What is Invoicing Software?

Invoicing software automates the creation, sending, and management of invoices for businesses. It is commonly used by freelancers, small business owners, and large enterprises to streamline billing and ensure timely payments. Key features include invoice creation, client management, payment tracking, and reporting, enabling users to generate professional invoices, manage client information, track payment statuses, and analyze financial data efficiently.

Features of Invoicing Software

When choosing invoicing software, it's essential to look for features that enhance efficiency, accuracy, and financial management. Here are some key features to consider while you search for the right tool for you:

- Automated Invoice Generation: This feature allows the software to create invoices automatically, saving time and reducing errors. It ensures that invoices are generated promptly and accurately, which is vital for maintaining cash flow.

- Customizable Invoice Templates: Customizable templates enable businesses to create professional-looking invoices that reflect their brand. This helps users to maintain a consistent and professional image.

- Fast Payment Processing and Automated Reminders: The ability to process payments quickly and send automated reminders for overdue payments ensures that businesses receive payments on time, improving cash flow.

- Expense Tracking: Effective expense tracking can help businesses monitor and categorize their expenses, providing better financial oversight and aiding in budgeting.

- Integration with Accounting Software: Seamless integration with accounting software ensures that all financial data flows smoothly between systems, reducing manual data entry and potential errors.

- Multiple Payment Gateways: Supporting various payment gateways offers flexibility in how customers can pay their invoices, enhancing customer satisfaction and speeding up the payment process.

- Tax Compliance and Calculation: This feature ensures that invoices are compliant with tax regulations and assists with accurate tax calculations, reducing the risk of errors and ensuring regulatory compliance.

- Mobile Accessibility: Mobile accessibility allows users to manage their invoicing and financial tasks on the go, ensuring that business owners can stay connected with their financial activities anywhere, anytime.

- Data Security and Backup: Vigorous data security and backup features protect sensitive financial information from breaches and ensure that data is regularly backed up to prevent loss.

- Real-Time Financial Reporting: Real-time financial reporting provides immediate insights into a business's financial status, allowing for quick decision-making based on the latest data.

Benefits of Invoicing Software

Leveraging invoicing software can be important for businesses of all sizes, as it can help streamline billing and ensure accuracy and efficiency. By automating invoicing, businesses can save time, reduce errors, and improve cash flow. Here are several key benefits of using invoicing software:

- Time Savings: Automating the invoicing process reduces the time spent on manual data entry and allows businesses to focus on more critical tasks.

- Improved Accuracy: Invoicing software minimizes human errors by automatically calculating totals, taxes, and discounts, ensuring that invoices are accurate and professional.

- Enhanced Cash Flow: Invoicing software helps businesses get paid faster and maintain a healthy cash flow by sending invoices promptly and offering multiple payment options.

- Better Organization: Invoicing software provides a centralized system for managing invoices, making it easier to track payments, manage customer information, and generate financial reports.

- Professional Appearance: Customizable templates and branding options allow businesses to create professional-looking invoices that reflect their brand identity, enhancing their credibility with clients.

Investing in invoicing software can greatly enhance the efficiency and effectiveness of your billing process, leading to overall better financial management and customer satisfaction.

Costs & Pricing of Invoicing Software

One of the most important aspects of selecting invoicing software is understanding the different pricing plans available. After all, it’s essential to be aware of your options to avoid paying for unnecessary features or overpaying for standard ones.

With so many tools available, plans and prices can vary widely. However, pricing plans for invoicing software generally fall into common categories.

Below is a table summarizing the plan types, average prices, and common features of popular invoicing software:

Plan Comparison Table for Invoicing Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic invoicing, limited clients, basic reporting, client portal |

| Basic Plan | $7 - $15 per month | Unlimited invoices, multiple users, basic customization, client management |

| Standard Plan | $19 - $30 per month | Advanced customization, recurring invoices, multiple payment gateways, reporting |

| Premium Plan | $39 - $60 per month | Full customization, project management, time tracking, advanced reporting |

| Enterprise Plan | $78 - $200 per month | Comprehensive accounting features, inventory management, unlimited clients |

When choosing an invoicing software plan, it is important to consider the size of your business, the number of clients you manage, and the specific features you need. Free plans are suitable for freelancers or very small businesses, while premium and enterprise plans offer advanced features for growing businesses with more complex needs. The right plan should offer the features you need at a price that fits your budget.

Invoicing Software FAQs

Here are some commonly asked questions I’ve received about invoicing software:

Is cloud-based invoicing software better than desktop-based?

Cloud-based invoicing software offers several advantages over desktop-based solutions, including accessibility from any device with an internet connection, automatic updates, and data backup. It also allows for real-time collaboration with team members and clients. However, desktop-based software may be preferred for businesses with specific security or offline access requirements.

Can invoicing software integrate with my existing accounting tools?

Many invoicing software options offer integrations with popular accounting tools such as QuickBooks, Xero, and FreshBooks. These integrations help streamline financial management by automatically syncing invoice data, reducing manual entry, and minimizing errors.

How does invoicing software handle taxes?

Invoicing software typically includes features for tax calculation and management. It can automatically apply the correct tax rates based on your location and the type of goods or services provided. Some software also generates tax reports, making it easier to file returns and stay compliant with tax regulations.

Is it possible to send invoices in multiple currencies?

Yes, many invoicing software solutions support multi-currency invoicing. This feature is particularly useful for businesses that operate internationally or have clients in different countries. It allows you to create and send invoices in the client’s preferred currency, helping to avoid conversion issues and delays in payment.

Can I set up recurring invoices with invoicing software?

Most invoicing software includes the ability to set up recurring invoices. This feature is ideal for businesses with subscription-based services or regular clients. You can schedule invoices to be sent automatically at specified intervals, saving time and ensuring consistent cash flow.

How secure is my data with invoicing software?

Invoicing software providers typically implement security measures to protect your data. These measures may include encryption, secure servers, and regular security audits. It’s important to choose a reputable provider and review their security policies to ensure your data is safe.

What kind of customer support is available for invoicing software?

Customer support varies by provider, but most invoicing software companies offer multiple support channels, including email, phone, and live chat. Some also provide extensive online resources such as FAQs, tutorials, and user forums. It’s important to choose a provider with reliable and accessible support to assist you with any issues that may arise.

Is there mobile access or an app available for the invoicing software?

Many invoicing software solutions offer mobile apps or web-based access, enabling you to create and manage invoices on the go from your smartphone or tablet.

What Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.