10 Best Loan Origination Software Shortlist

Here's my pick of the 10 best software from the 18 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

If you’re here, chances are you’re tired of juggling spreadsheets, manual data entry, or waiting on approval bottlenecks that grind loan processing to a halt. Loan origination should be smooth and fast, but without the right software, it can feel like you’re just adding layers of complexity.

You need a tool that takes the guesswork out of compliance, reduces repetitive tasks, and helps your team make faster, smarter decisions. Using my experience with finance and accounting software, I tested and compared several of the top loan origination software available. From there, I compiled my results into detailed reviews to help you find the best software for your needs.

Why Trust Our Software Reviews

We’ve been testing and reviewing finance and accounting software since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & check out our software review methodology.

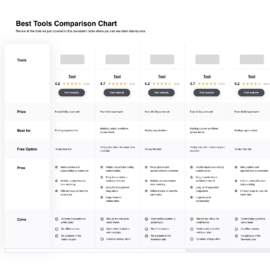

Best Loan Origination Software Summary

This comparison chart summarizes pricing details for my top loan origination solutions to help you find the best one for your budget and business needs.

| Tools | Price | |

|---|---|---|

| Floify | From $70/month (billed annually) | Website |

| Encompass | Pricing upon request | Website |

| Comarch | Pricing upon request | Website |

| Mortgage Automator | Pricing upon request | Website |

| DigiFi | Pricing upon request | Website |

| Finflux | Pricing upon request | Website |

| Finastra | Pricing upon request | Website |

| The Mortgage Office | Pricing upon request | Website |

| Fiserv | Pricing upon request | Website |

| LendingPad | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Loan Origination Software

It’s easy to get bogged down in long feature lists and complex pricing structures. To help you stay focused as you work through your unique software selection process, here’s a checklist of factors to keep in mind:

| Factor | What to Consider |

| Scalability | Will the software grow with your business needs? |

| Integrations | Does it connect with your existing systems? |

| Customizability | Can you tailor it to fit your team's processes? |

| Ease of Use | Is the software intuitive for your team to use? |

| Budget | Does it fit within your financial constraints? |

| Security Safeguards | Does it meet your security requirements? |

Best Loan Origination Software Reviews

Below are my detailed summaries of the best loan origination software that made it onto my shortlist. My reviews offer a detailed look at the key features, pros & cons, integrations, and ideal use cases of each tool to help you find the best one for you.

Floify is a mortgage automation and point-of-sale platform designed for mortgage professionals. It helps line up the loan origination process by automating document collection and verification.

Why I picked Floify: The platform is a great tool for its focused efficiency of document-handling processes. It helps keep both team and clients organized, ensuring everything stays on track. It is reliable and secure, providing peace of mind when dealing with sensitive information. Overall, it makes work much smoother and less prone to errors.

Standout features & integrations:

Features include automated reminders that help ensure timely document submissions, reducing delays in the loan process. The secure document portal allows borrowers to upload sensitive information safely. Custom checklists can be tailored to each loan, ensuring all required documents are collected.

Integrations include Encompass, Calyx Point, BytePro, LendingQB, Optimal Blue, Equifax, Plaid, CBCInnovis, MeridianLink, and Docusign.

Pros and cons

Pros:

- Reduces processing errors

- Automated reminders

- Excellent document management

Cons:

- Limited offline functionality

- Can feel complex initially

Encompass is a loan origination software designed for mortgage lenders, providing comprehensive tools for managing the entire loan lifecycle.

Why I picked Encompass: The software excels as an ideal choice for managing large-scale loan operations due to its comprehensive approach. It supports teams in navigating complex processes while maintaining efficiency and organization. This solution also adapts well to the needs of growing businesses, making it a reliable tool for long-term success.

Standout features & integrations:

Features include automated workflows that streamline loan processing, reducing manual errors and saving time. The platform's customizable reporting tools allow you to generate insights tailored to your needs. Advanced document management enhances how you organize and retrieve loan-related information.

Integrations include Salesforce, Microsoft Dynamics 365, Docusign, CoreLogic, Fannie Mae, Freddie Mac, Equifax, Experian, TransUnion, and Adobe Acrobat.

Pros and cons

Pros:

- Automated compliance checks

- Scales with business growth

- Comprehensive end-to-end solution

Cons:

- High learning curve

- Complex system setup

Comarch caters to financial institutions looking for flexible and scalable solutions. Its primary users include banks and credit unions that require a customizable system for managing loan applications and processing.

Why I picked Comarch: The software is a versatile platform that adapts to the evolving needs of businesses. It supports growth and ensures the system remains relevant as demands shift over time. This adaptability makes it a valuable tool for staying competitive in a dynamic market environment. Its ability to cater to different business sizes adds to its overall appeal.

Standout features & integrations:

Features include customizable modules that let you build a solution that fits your exact requirements. The software offers scalable options that grow with your business, providing long-term value. Advanced data analytics tools help your team make informed decisions based on real-time insights.

Integrations include Salesforce, Microsoft Dynamics 365, SAP, Oracle, FICO, Equifax, Experian, TransUnion, Adobe Acrobat, and Docusign.

Pros and cons

Pros:

- Advanced data analytics

- Easily scalable

- Modular architecture

Cons:

- High learning curve

- Initial setup complexity

Mortgage Automator is a loan origination and servicing software designed specifically for private lenders. It automates and manages the entire loan lifecycle, from application to discharge.

Why I picked Mortgage Automator: It stands out as an excellent option for those seeking a tailored solution. The system helps improve efficiency and accuracy, and keeps everyone in the loop, ensuring that your operations run smoothly. Its ability to support regulatory compliance provides peace of mind, making it a reliable choice for professionals in the lending space.

Standout features & integrations:

Features include automated document generation, which reduces the need for manual input and helps avoid errors. The system supports custom reporting, allowing you to tailor information to your specific needs. Compliance management tools provide peace of mind by ensuring your operations meet industry standards.

Integrations include Equifax, Filogix, D+H Expert, PCLender, Salesforce, Microsoft Dynamics 365, Xero, QuickBooks, and Zoho CRM.

Pros and cons

Pros:

- Supports full loan lifecycle

- Customizable reports

- Tailored for private lenders

Cons:

- Complex initial setup

- Higher starting price point

DigiFi utilizes AI to enhance decision-making processes for lenders and financial institutions. Its primary users are banks and lending companies.

Why I picked DigiFi: The software stands out due to its advanced approach to decision-making, offering a more modern solution compared to traditional systems. The use of AI adds significant value, particularly when it comes to assessing loan risks with greater accuracy. It also supports tailored processes to match unique business requirements, enhancing the effectiveness of lending strategies.

Standout features & integrations:

Features include predictive analytics that enhance risk assessment by providing data-driven insights. The software's customizable workflows allow you to adjust processes to meet unique business requirements. Real-time data updates ensure that your team has access to the latest information for decision-making.

Integrations include Salesforce, HubSpot, Microsoft Dynamics 365, Zoho CRM, QuickBooks, Xero, Plaid, Stripe, PayPal, and Experian.

Pros and cons

Pros:

- Customizable workflows

- Predictive analytics for risk

- AI-driven decision tools

Cons:

- Requires technical expertise

- Initial setup complexity

Finflux is tailored specifically for microfinance institutions. It offers a comprehensive solution for financial inclusion.

Why I picked Finflux: This software stands out as a valuable solution for organizations dedicated to empowering underserved communities through financial services. Its comprehensive approach to loan management supports a wide range of lending needs. Additionally, it enhances decision-making with valuable insights while also streamlining operations for more efficient processes.

Standout features & integrations:

Features include loan management tools that support various loan types, ensuring flexibility for your lending needs. The platform offers real-time analytics, which can enhance your decision-making processes. Mobile capabilities allow your team to operate efficiently in the field, improving data collection and access.

Integrations include Perfios, CreditMantri, CRIF High Mark, CIBIL, Equifax, Experian, and Karza, among others.

Pros and cons

Pros:

- Facilitates financial inclusion

- Mobile field operations

- Real-time analytics

Cons:

- Requires consistent internet

- Initial setup complexity

Finastra is designed for banks and financial institutions. It supports a wide range of lending products and serves a global user base, providing essential tools for loan processing, management, and compliance.

Why I picked Finastra: Its global reach and ability to handle diverse lending requirements make it a top choice for international institutions. The platform offers multi-currency and multi-language support, ensuring that your team can operate efficiently across borders. Its compliance features are also an asset as they help to meet regional and international regulations. Furthermore, the scalability of Finastra supports growing businesses effectively.

Standout features & integrations:

Features include multi-currency capabilities, which allow you to operate seamlessly across various markets. The software provides multi-language support, making it accessible to a diverse team. Compliance tools ensure you're meeting local and international regulations.

Integrations include Salesforce, Microsoft Dynamics 365, SAP, Oracle, AWS, Google Cloud, IBM Cloud, Equifax, Experian, and Dun & Bradstreet.

Pros and cons

Pros:

- Strong compliance features

- Scales with business growth

- Supports multi-currency transactions

Cons:

- Higher initial setup costs

- Complex implementation process

The Mortgage Office is a loan servicing software designed for mortgage lenders, providing tools to efficiently manage loan portfolios.

Why I picked The Mortgage Office: It’s a great solution for lenders seeking efficiency in managing their loan portfolios. It simplifies tasks and helps maintain organization in day-to-day operations. Its design ensures that essential information is always accessible, allowing for smoother workflows. Additionally, it supports staying up-to-date with regulatory standards without extra hassle.

Standout features & integrations:

Features include automated payment processing that minimizes manual errors and saves time for your team. The software's escrow management tools provide you with a comprehensive view of all relevant details. Compliance tracking helps ensure that your operations meet regulatory standards without extra effort.

Integrations include Microsoft Office, QuickBooks, Salesforce, Docusign, Adobe Acrobat, Wolters Kluwer, Equifax, Experian, TransUnion, and CoreLogic.

Pros and cons

Pros:

- Effective compliance tracking

- Automated payment processing

- Strong focus on loan servicing

Cons:

- Requires training for new users

- Complex initial setup

Fiserv is created for financial institutions, focusing on automating and managing the loan lifecycle. Its primary user base includes banks and credit unions that require efficient compliance management.

Why I picked Fiserv: It provides significant value for institutions that prioritize adherence to regulatory standards. Its emphasis on compliance ensures that financial institutions can operate with confidence, knowing they are staying aligned with necessary regulations. Based on my experience, this approach brings a sense of security and reliability to managing compliance-related tasks.

Standout features & integrations:

Features include automated workflows that simplify the loan processing steps, ensuring accuracy and speed. The platform provides real-time compliance checks, which keep your operations aligned with current regulations. Reporting tools are customizable, allowing you to generate insights tailored to your needs.

Integrations include Salesforce, Oracle, Microsoft Dynamics 365, SAP, Equifax, Experian, FICO, TransUnion, LexisNexis, and IBM.

Pros and cons

Pros:

- Reduces manual errors

- Automated workflows

- Strong compliance focus

Cons:

- May need extensive training

- Complex setup process

LendingPad is designed primarily for residential mortgage lending. It serves lenders, brokers, and processing centers, providing tools for loan management, compliance, and collaboration.

Why I picked LendingPad: Real-time updates and cross-department collaboration set LendingPad apart, enhancing decision-making processes and efficiency. Its built-in compliance tools ensure that your team stays aligned with industry regulations. The platform's cloud-based nature means you can access it from anywhere, facilitating remote work. The fast implementation allows you to get started quickly without extensive setup.

Standout features & integrations:

Features include tools for compliance, built-in real-time updates, and collaboration capabilities. Users can manage borrower information efficiently and send requests for documents directly through the software. The system also helps with balancing closing disclosures and calculating fees, making it easier to empower your team to handle complex tasks.

Integrations include Ellie Mae, Black Knight, Fannie Mae, Freddie Mac, CoreLogic, and CBCInnovis, and more.

Pros and cons

Pros:

- Collaborative features

- Real-time updates

- Cloud accessibility

Cons:

- Slight learning curve

- Initial interface complexity

Best Loan Origination Software Reviews

Below are my detailed summaries of the best loan origination software that made it onto my shortlist. My reviews offer a detailed look at the key features, pros & cons, integrations, and ideal use cases of each tool to help you find the best one for you.

Related Reviews

If you still haven’t found what you’re looking for here, check out these other tools that we’ve tested and evaluated:

Loan Origination Software Selection Criteria

When selecting the best loan origination software to include in this list, I considered common buyer needs and pain points like compliance management and integration requirements. I also used the following framework to keep my evaluation structured and fair:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage loan applications

- Track loan processing

- Handle document management

- Ensure compliance management

- Provide reporting and analytics

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Real-time collaboration tools

- AI-driven decision-making

- Customizable workflows

- Multi-currency support

- Advanced risk assessment tools

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Easy navigation

- Minimal learning curve

- Responsive design

- Clear and concise instructions

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Comprehensive templates

- Access to webinars

- Supportive chatbots

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 availability

- Multichannel support options

- Response time

- Quality of assistance

- Availability of self-help resources

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing

- Features offered for the cost

- Availability of different pricing tiers

- Transparency of pricing

- Return on investment

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- User satisfaction ratings

- Commonly mentioned benefits

- Reported issues

- Frequency of updates

- Overall recommendation rate

Trends in Loan Origination Software

In my research, I sourced countless product updates, press releases, and release logs from different loan origination software vendors. Here are some of the emerging trends I’m keeping an eye on:

- AI-driven underwriting: AI is being used to enhance underwriting processes by analyzing large data sets to predict creditworthiness. This trend allows lenders to make faster, more accurate decisions. Vendors like DigiFi are integrating AI-driven models to improve loan evaluations.

- Blockchain for security: Blockchain technology is being adopted for secure transaction recording and verification. This trend ensures data integrity and reduces fraud risk, which is crucial for maintaining trust in financial transactions. Some platforms are already exploring blockchain to enhance their security protocols.

- Cloud-native solutions: More vendors are offering cloud-native solutions, facilitating digital lending and improving scalability. This trend supports an evolving lending industry that requires commercial lending to have accessible systems that can grow with their business. Cloud-native platforms are becoming standard in the industry.

- Data-driven personalization: Customization based on data insights is becoming a key feature, allowing lenders to tailor products to individual borrower needs and overall customer experience. This trend helps enhance customer satisfaction and retention. Some vendors offer tools that use analytics to personalize loan offers.

- RegTech integration: Regulatory technology is being integrated to automate compliance processes, making it easier for lenders to adhere to regulations. This trend reduces the burden of manual compliance checks and minimizes errors. Many software providers are focusing on RegTech to ensure up-to-date compliance.

What is Loan Origination Software?

Loan origination software automates and manages the loan application and approval process. These tools are generally used by mortgage lenders, banks, real estate, and credit unions, providing value by increasing efficiency and accuracy in handling loans. Automated workflows, compliance checks, and data analytics help with improving decision-making, meeting regulations, and managing loan lifecycles effectively. Overall, these tools simplify the lending process, making it faster and more reliable for loan officers and financial bureaus.

Features of Loan Origination Software

When selecting loan origination software, keep an eye out for the following key features:

- Automated workflows: Streamlines the loan process by reducing manual tasks and increasing efficiency.

- Compliance management: Ensures that all transactions meet regulatory standards, minimizing the risk of non-compliance.

- Document management: Organizes and stores all loan-related documents in one place, making it easy to access and manage them.

- Data analytics: Provides insights into loan performance and borrower behavior, helping to make informed decisions.

- Customizable templates: Allows you to tailor documents and processes to fit specific business needs, enhancing flexibility.

- AI-driven decision-making: Uses artificial intelligence to evaluate loan applications, improving the accuracy of approval decisions.

- Escrow management: Handles the collection and disbursement of escrow funds, ensuring accurate and timely transactions.

- Real-time collaboration: Facilitates communication and coordination among team members, improving workflow and efficiency.

- Risk assessment tools: Evaluate potential risks associated with loans, helping to make informed lending decisions.

- Multi-currency support: Enables transactions in various currencies, supporting international operations.

Benefits of Loan Origination Software

Implementing loan origination software provides several benefits for your team and your business. Here are a few you can look forward to:

- Increased efficiency: Automated workflows reduce manual tasks, saving time and effort.

- Enhanced compliance: Built-in compliance management ensures adherence to regulations, reducing legal risks.

- Better decision-making: Data analytics and AI-driven tools provide insights that help make informed lending decisions.

- Improved organization: Document management keeps all loan-related files in one place, making them easy to access and manage.

- Flexibility: Customizable templates and workflows allow you to tailor processes to meet your specific business needs.

- Risk management: Risk assessment tools help evaluate potential loan risks, ensuring safer lending practices.

- Collaboration: Real-time collaboration features enhance team communication and coordination, improving overall workflow.

Costs and Pricing of Loan Origination Software

Selecting loan origination software requires an understanding of the various pricing models and plans available. Costs vary based on features, team size, add-ons, and more. The table below summarizes common plans, their average prices, and typical features included in loan origination software solutions:

Plan Comparison Table for Loan Origination Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0/user/month | Basic document management, limited analytics, and basic support. |

| Personal Plan | $20-$50/user/month | Document management, compliance checks, and basic reporting |

| Business Plan | $50-$100/user/month | Enhanced analytics, customizable templates, and team collaboration. |

| Enterprise Plan | $100-$200/user/month | Advanced risk assessment, full compliance management, and premium support. |

Loan Origination Software FAQs

Here are some answers to common questions about loan origination software:

How secure is loan origination software?

Loan origination software is generally secure, offering features like encryption and multi-factor authentication. These features protect sensitive borrower information from unauthorized access. Many systems are hosted on cloud platforms, providing an additional layer of security with regular updates and backups. You should still ensure your team follows best practices for data security.

Can loan origination software integrate with existing systems?

Yes, most loan origination software can integrate with existing systems like CRM and accounting software. These integrations help streamline processes and improve data flow between different applications. It’s important to check compatibility with your current systems before choosing a solution. You might need IT support to set up these integrations effectively.

How does loan origination software handle compliance?

Loan origination software includes compliance management features to ensure your operations meet regulatory standards. These features automate compliance checks and provide alerts for any discrepancies. This reduces the risk of non-compliance and helps maintain trust with clients. Make sure the software you choose stays updated with the latest regulations.

What kind of customer support is available for loan origination software?

Customer support varies by vendor but often includes options like chat, email, and phone support. Some vendors offer 24/7 support, while others have limited hours. It’s crucial to evaluate the level of support available, especially if your team needs assistance during critical times. Check if the vendor provides additional resources like user guides or training videos.

Is training required to use loan origination software?

Yes, training is usually required to use loan origination software effectively. Training helps your team understand the features and functionalities of the system. Many vendors offer training sessions, webinars, or video tutorials to assist with onboarding. Investing in training ensures that your team can maximize the software’s potential.

How customizable is loan origination software?

Loan origination software is often customizable, allowing you to tailor workflows and templates to fit your business needs. Customization helps align the software with your specific processes and requirements. However, the level of customization can vary, so it’s important to verify this feature with the vendor. Customization might require additional setup or support from your IT team.

What's Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.