Let’s face it—taxes aren’t the most thrilling topic for most people, but mastering them can make a world of difference for your career, business, or even your peace of mind.

Whether you’re an accounting pro, a small business owner, or someone who just wants to tackle tax season like a champ, the right tax course can save you time, money, and a ton of headaches.

In this article, I’ve rounded up the 11 best tax courses to take in 2025, designed to fit a variety of needs and expertise levels. From mastering complex corporate tax laws to understanding personal tax deductions, these courses are packed with actionable insights and strategies to make taxes less of a chore and more of a skillset. Let's dive in a little further.

Overview Of The Best Tax Courses

1. Income Tax Course (H&R Block)

This course covers basic tax preparation and provides the foundation to prepare a tax return. Participants cannot miss more than four sessions to meet attendance requirements, which may vary by state.

- Who It’s For: Individuals interested in starting a career in tax preparation

- Topics Covered:

- Tax theory

- Step-by-step tax preparation

- Tax terminology

- Wages and income

- Capital assets

- Depreciation

- Itemized deductions

- Deduction and credits

- Online, In-Person, or Both?: Both

- Exam Required?: Yes

- Hours Of Instruction: 6 hours per week

- Eligibility Requirements:

- Must be 18 years old and

- A high school graduate or equivalent degree

- Price:

- In most states: $149

- Minnesota: $99

- Take The Course: H&R Block

2. Comprehensive Tax Course (The Income Tax School)

This course provides in-depth training for those looking to understand tax preparation from start to finish. The interactive course covers federal tax laws and real-world scenarios to help students gain the skills needed to prepare individual tax returns.

- Who It’s For: Those looking to become professional tax preparers

- Topics Covered:

- Filing status

- Income types

- Deductions and credits

- Taxable vs. non-taxable income

- Basic to advanced tax calculations

- Preparing Form 1040

- Tax laws and updates

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 3 to 6 months

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: From $497.00

- Take The Course: The Income Tax School

3. Chartered Tax Professional Certificate Program (CPA Training Center)

This program offers comprehensive training for individuals aiming to master individual and business tax preparation. It consists of a series of courses that progressively build advanced tax knowledge, equipping students to handle complex tax returns.

- Who It’s For: Those seeking to become certified tax professionals or advance their tax preparation skills

- Topics Covered:

- Federal income tax preparation

- Small business tax returns

- Corporate tax returns

- Advanced deductions and credits

- IRS ethics and compliance

- Practical application of tax knowledge

- Tax law updates and changes

- Online, In-Person, or Both?: Online

- Exam Required?: Yes

- Duration: 18 months

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $1,874

- Take The Course: CPA Training Center

4. Federal Income Tax Course (National Tax Training School)

This course provides foundational training in federal income tax preparation, focusing on the essential knowledge and tax software needed to file accurate tax returns for individuals. It covers core tax concepts and regulations to ensure students understand the federal tax system.

- Who It’s For: Individuals new to tax preparation who want to gain a solid understanding of federal income taxes

- Topics Covered:

- Filing requirements

- Taxable and non-taxable income

- Deductions and credits

- Tax forms and schedules

- Tax law updates

- Tax planning

- FICA FUTA payroll taxes

- Sale or exchange property

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 8 weeks or 12 months

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price:

- Full tuition: $895 (can be paid in 3 monthly instalments)

- Registration fee: $125

- Take The Course: National Tax Training School

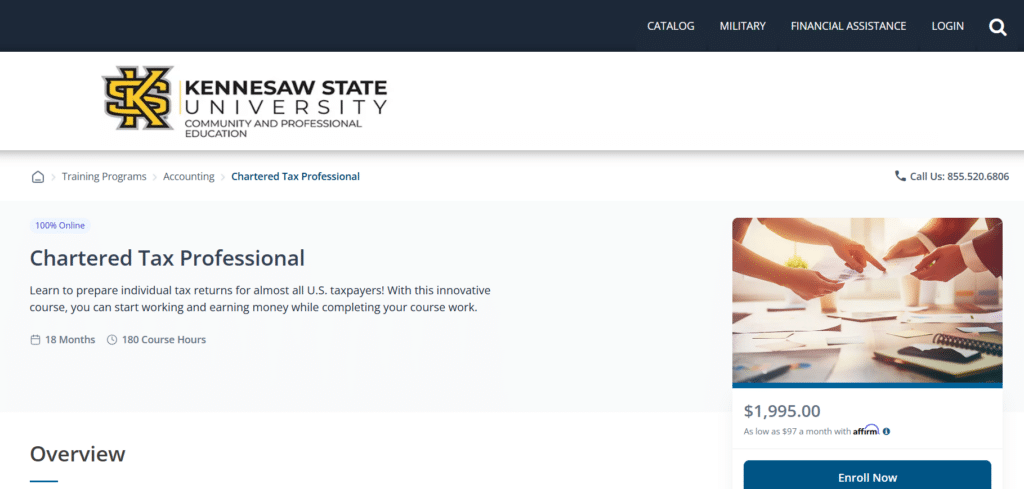

5. Chartered Tax Professional (Kennesaw State University)

This course covers the basics needed to start earning after the first two modules. It focuses on building communication skills and a professional vocabulary for the accounting field. By the end, students will be ready to prepare taxes for different clients and have the knowledge to pass the IRS Enrolled Agent exam.

- Who It’s For: Individuals seeking comprehensive tax knowledge

- Topics Covered:

- Individual tax preparation

- Business tax preparation

- Advanced tax topics

- Conducting professional tax client interviews

- Practicing as a qualified tax professional

- Understanding the ethical duties of tax professionals

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 18 months

- Hours Of Instruction: 180 hours

- Eligibility Requirements:

- High school diploma or equivalent

- Strong numerical skills, interpersonal communication

- Ability to interpret tax laws

- Must complete a comprehensive tax course

- Register with the IRS for a PTIN

- Start preparing tax returns as a tax preparer

- Price: $1,995

- Take The Course: Kennesaw State University

6. Tax Preparation (Dallas College)

This course teaches students how to file individual federal tax returns and is for those wanting practical experience in tax filing. Participants will gain important hands-on skills for success in the field. The training covers basic IRS rules and practical knowledge for filing taxes.

- Who It’s For: Beginners seeking entry-level tax preparation skills

- Topics Covered:

- Federal tax return preparation

- Common tax forms

- Taxpayer rights

- Intermediate tax preparation

- Online, In-Person, or Both?: Both

- Exam Required?: No

- Eligibility Requirements: None

- Take The Course: Dallas College

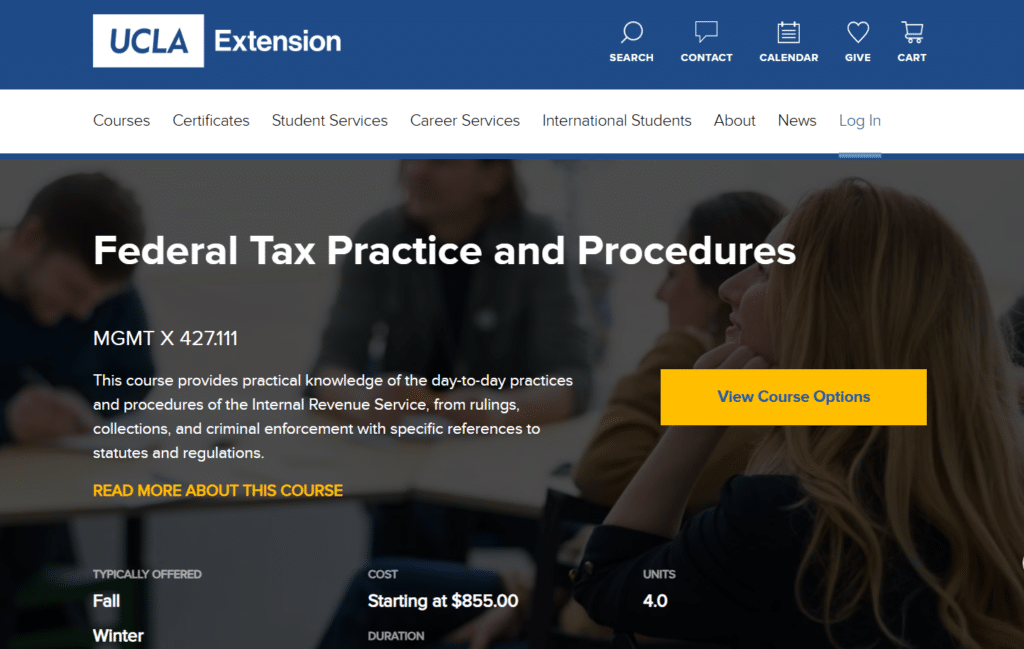

7. Federal Tax Practice and Procedures (UCLA Extension)

This course provides a clear overview of federal tax practices. Students will learn about the daily operations of the Internal Revenue Service, including enforcement actions and regulations. It also covers the civil side of tax practice, helping participants interact effectively with the IRS for themselves or their clients.

- Who It’s For: Tax professionals seeking to enhance their procedural knowledge

- Topics Covered:

- Tax compliance

- IRS procedures

- Taxpayer audits

- IRS record access authority

- Explore the civil aspects of tax practice

- The administrative structure of the IRS

- Taxpayer’s ethical duties

- Tax deficiency litigation and collection

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 11 weeks

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: From $855

- Take The Course: UCLA Extension

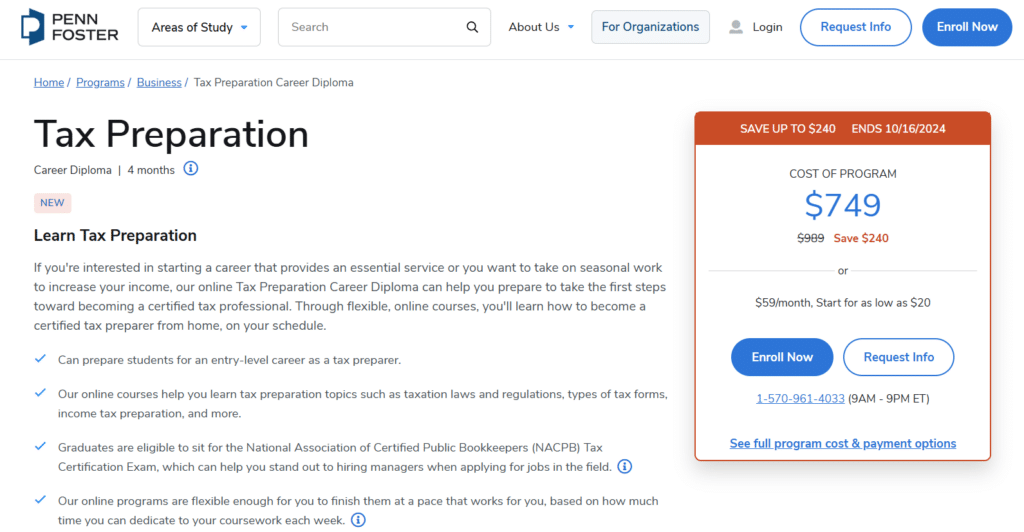

8. Tax Preparation (Penn Foster)

This course provides foundational skills for individuals looking to enter the tax preparation field. Graduates can enhance their resumes and stand out to hiring managers by earning a tax preparation certification. The curriculum focuses on the essentials of preparing federal tax returns for individuals and small businesses.

- Who It’s For: Those looking to start a career in tax preparation

- Topics Covered:

- Tax laws and regulations

- Income reporting

- Deductions and credits

- Types of tax forms

- Calculate gross income and identify its components

- List common itemized deductions

- Apply capital gains and losses to property sales

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 4 months to 11 months

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $989 (or $59/month)

- Take The Course: Penn Foster

9. Basic Income Tax Preparation (Portland Community College)

This course covers the essentials of preparing individual tax returns according to Oregon’s tax laws. It meets the requirements for becoming a licensed income tax preparer in Oregon. Participants will also learn about VITA (Volunteer Income Tax Assistance) certification and volunteer opportunities with CASH (Creating Assets, Savings and Hope) Oregon.

- Who It’s For: Individuals new to tax preparation

- Topics Covered:

- Tax form completion

- Filing status

- Credits and deductions

- Utilizing knowledge of the IRS tax code

- Recognize and implement applicable exclusions

- Recognize and use savings from depreciation

- Calculate tax owed on individual returns

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 10 weeks

- Hours Of Instruction: 80 hours

- Eligibility Requirements: None

- Price: $1,125

- Take The Course: Portland Community College

10. Small Business I Income Tax Preparation Course (CPA Training Center)

This course covers tax preparation for small businesses and expands understanding of the tax issues different business types face. Completing this course will enable participants to prepare specific tax forms for pass-through entities, improving job prospects.

- Who It’s For: Tax professionals focusing on small business taxation

- Topics Covered:

- Business tax returns

- Entity selection

- Tax planning strategies

- Employment taxes

- Income and expenses

- Business property

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $459

- Take The Course: CPA Training Center

11. Personal Income Tax Course (Softron)

This course teaches the basics of preparing personal income taxes. It covers important topics like tax implications for residents and non-residents, as well as new immigrants. Participants will also learn about various credits and benefits, including the climate action incentive credit and the Ontario Trillium benefit.

- Who It’s For: Individuals looking to specialize in personal tax preparation

- Topics Covered:

- Personal tax filing

- Tax credits

- Income reporting

- Pension splitting

- Foreign pension

- Tuition amount

- Charitable donations

- Alimony and child support

- Online, In-Person, or Both?: Online

- Exam Required?: No

- Duration: 5-16 weeks

- Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $295

- Take The Course: Softron

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.