Top SaaS businesses have a gross margin of 80% to 90%. If your gross margin is considerably lower, take a closer look at your Cost of Goods Sold (COGS) and compare it with your competitor’s. But make sure you look at both GAAP and non-GAAP COGS.

The COGS in the income statement are GAAP COGS. Non-GAAP COGS appear outside the income statement, usually as an adjustment to GAAP COGS.

Learning the difference between GAAP and non-GAAP COGS helps us understand the logic behind the reconciliation between these two numbers.

In this guide, I help distinguish between GAAP and non-GAAP COGS and the relevance of both types.

What is GAAP?

GAAP (Generally Accepted Accounting Principles) are a set of principles that every public company in the US must follow.

GAAP standardizes financial reporting with its uniform rules and formats, making financial statements easier to analyze and compare.

However, there are instances where GAAP reporting fails to accurately depict the company’s operating performance.

For example, suppose you recently hired more support staff because you expect a sharp increase in demand over the second half of the year. Your COGS increase significantly because of this decision, causing the gross margin to shrink.

The shrinking gross margin may be a red flag for investors. But that’s where non-GAAP COGS can help.

What is Non-GAAP?

Non-GAAP measures are calculated by adjusting the figures on the income statement, cash flow statement, and balance sheet to show accurate financial performance.

These figures generally exclude one-off or non-cash expenses such as costs related to acquisitions and restructuring, impairment of intangible assets, and depreciation of fixed assets.

Non-GAAP reporting isn’t a statutory requirement. However, many large companies make non-GAAP adjustments to GAAP numbers.

Examples of non-GAAP items include free cash flow, net debt, and non-GAAP earnings figures like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and adjusted Earnings-per-Share (EPS).

How to Calculate GAAP COGS for SaaS

GAAP doesn’t prescribe a specific method to calculate COGS for SaaS businesses. However, the standard practice for service businesses is to calculate the COS (cost of sales).

COS is conceptually the same as COGS. To determine whether you should include an expense in COS, ask yourself: Would the service stop or deteriorate quickly without this expense?

Here’s what a SaaS company’s COGS would generally include:

- Employee expenses directly attributable to running the production environment (this could be the cost of DevOps or infrastructure team)

- The employee cost of customer support and retention-focused customer success functions (not account management)

- Any other employee expenses directly related to rendering the service

- Hosting (such as AWS or Azure)

- Third-party software or data you use to deliver your service

- Professional services costs as per the relevant accounting standards

The expenses are added to COGS using accrual basis accounting.

Also, this list is inclusive. You may need to add more costs, depending on your business setup.

For example, if you own the servers you use to deliver your SaaS, the COS should include the depreciation on these assets.

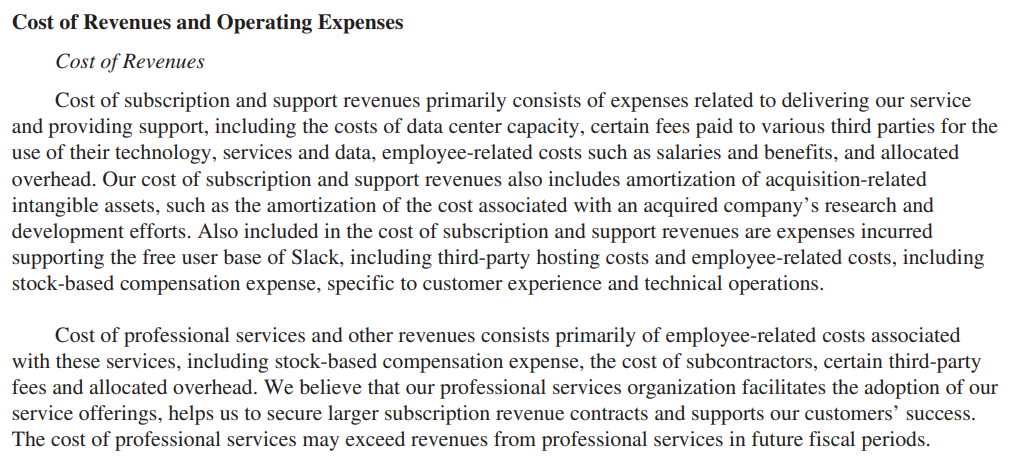

Here’s an excerpt from Salesforce’s annual report explaining what’s included in their GAAP COGS (referred to as cost of revenue):

Why There’s a Difference

The FASB (Financial Accounting Standards Board) and SEC (Securities and Exchange Commission) are responsible for issuing, amending, and enforcing GAAP.

The primary objective of GAAP is to ensure accuracy and consistency in financial reporting.

GAAP principles and rules are an excellent way to communicate financial information to stakeholders.

However, you need more flexibility for analysis or showing stakeholders the actual company performance. For example, you can include sales commissions in COGS to better understand how much each sale contributes towards covering your fixed costs.

Non-GAAP measures are a valuable analysis tool. However, stakeholders should use prudence to determine the validity of non-GAAP results on a case-by-case basis.

The reason? Non-GAAP numbers can sometimes be misleading, especially when analyzing companies using other accounting standards like IFRS (International Financial Reporting Standards).

Why it Matters

Understanding the differences in how GAAP and non-GAAP COGS are computed enables you to reconcile these differences.

The ability to dismantle the costs baked into the GAAP COGS to compute non-COGS for analysis is a valuable skill for any SaaS CFO.

While public companies are required to use GAAP for financial reporting, they might choose to use non-GAAP COGS to show more accurate performance results.

Non-GAAP COGS include costs directly associated with delivering the service (such as sales commissions) that aren’t included in GAAP COGS.

This enables stakeholders and investors to understand the company’s profitability and cost structure more accurately.

Companies frequently use non-GAAP measures to improve optimism among investors.

In fact, 77% of companies in the Dow Jones Industrial Average reported non-GAAP EPS (earnings per share). Even Amazon uses non-GAAP measures in its financial statements:

So if you’re a SaaS CFO analyzing a competitor’s 10K, understanding the non-GAAP measures can help improve your analysis.

Key Differences

Below are the key differences between GAAP and non-GAAP COGS.

Things to Include

GAAP requires that COGS include costs directly related to the production of goods or the rendering of services.

The SaaS COGS computation is slightly different. Costs like customer support team salaries, which are generally excluded from COGS, are included in SaaS COGS.

Non-GAAP SaaS COGS are more flexible. You can include any cost you think is directly related to rendering the service or exclude one-off and non-cash expenses.

Examples include sales commissions or product development costs; for example, including sales commission in COGS gives you a clearer idea of your SaaS business’s gross margin after accounting for direct variable costs like sales commission.

Non-GAAP COGS is also an excellent way to show stakeholders a breakdown of the cost structure and gross profit. It allows stakeholders to assess product viability and identify cost levers that can help improve the gross margin.

Purpose

The FASB and SEC require public companies to use GAAP for financial reporting. GAAP ensures that the computation of COGS is uniform and easily understandable by investors and other stakeholders.

Small companies aren’t required to follow GAAP, though it’s still recommended that you follow GAAP because your lenders and creditors might want to see GAAP-compliant financial statements.

Lenders might add a debt covenant when issuing a loan, requiring you to follow GAAP. That’s why most US companies follow GAAP.

You may add non-GAAP COGS to the financial statements to offer investors more information or insights. They’re also a great tool for analyzing your cost structure and identifying ways to improve your gross margin.

Flexibility

Since non-GAAP financial measures aren’t standardized, they offer more flexibility. You can choose to include costs that most accurately reflect your COGS.

On the other hand, GAAP measures are standardized. You can’t include a cost in COGS that, according to GAAP, must be treated as an operating expense.

Sure, non-GAAP measures offer more opportunity for window dressing. But the SEC doesn’t like companies being too aggressive with their non-GAAP figures.

“When evaluating what is a normal, operating expense, the staff considers the nature and effect of the non-GAAP adjustment and how it relates to the company’s operations, revenue-generating activities, business strategy, industry, and regulatory environment.”

-SEC

Overly aggressive non-GAAP figures or lack of non-GAAP disclosures can be a costly mistake. The SEC fined DXC Technology Company (DXC) $8 million for misleading disclosures and a lack of adequate disclosure controls about non-GAAP measures.

The idea is to use non-GAAP measures to provide a clearer picture of the company’s actual financial position; not mislead investors with overly optimistic figures.

Comparability

Since GAAP figures are calculated using a standard procedure, they’re comparable across time and companies.

For example, all SaaS companies include the cost of hosting in COGS but exclude sales commissions.

This uniformity makes GAAP COGS comparable. That’s why lenders and investors will never only rely on non-GAAP numbers.

Non-GAAP COGS can include a variety of other costs, including sales commissions, advertising expenses, and the salaries of the account management team.

Companies have the freedom to choose what they want to include in their non-GAAP COGS. This lack of uniformity makes non-GAAP measures incomparable.

Collectively Painting a Picture

GAAP and non-GAAP COGS are equally important figures. The key is to know their differences and when to focus on which figure. GAAP COGS offer uniformity and make the COGS of different companies comparable. Non-GAAP COGS help reconcile the differences between operational reality and GAAP COGS.

Want more accounting and finance articles for SaaS CFOs? Subscribe to The CFO Club’s newsletter and receive weekly articles on accounting and finance.