Corporate finance is overwhelming without the right guidance, no matter who you are. If you’re diving in, these issues probably sound familiar:

- Grappling with cash flow forecasting and finding it tough to plan for growth confidently.

- Navigating capital structure decisions without a clear understanding of risk and return.

- Trying to optimize financial performance but getting stuck in the weeds of data.

These challenges often arise because corporate finance covers a broad scope of business, requiring both strategic vision and analytical skills. The right corporate finance courses can bridge that gap, giving you the skills to make smarter financial decisions.

I’ve gathered a list of top courses to help you master corporate finance essentials, from capital budgeting, to emerging fintech and financial analysis. Here’s what each course offers and why it’s a valuable resource.

Best Corporate Finance Courses Shortlist

There's a variety of corporate finance courses here, but these are the most useful, across the board:

- Corporate Finance Fundamentals (CFI)

- Introduction to Corporate Finance (University of Pennsylvania)

- Corporate Finance Foundations (LinkedIn Learning)

- Corporate Finance & Valuation Methods (NYIF)

- ColumbiaX: Introduction to Corporate Finance (Columbia University)

- Excel for Corporate Finance Professionals (LinkedIn Learning)

- Basics of Corporate Finance (Alpha Academy)

- The Corporate Finance Course (365 Careers)

- Corporate Finance I: Measuring and Promoting Value Creation (University of Illinois Urbana-Champaign)

- Corporate Finance: Robust Financial Modeling (LinkedIn Learning)

- Fundamentals of Corporate Finance and Valuation (Wharton Academy)

- Financial Modeling and Forecasting Financial Statements (LinkedIn Learning)

- Corporate Finance: Financial Analysis and Decision-Making (Robert Bob Steele)

- Corporate Finance: A Beginner’s Guide (University of Padova)

- Reading Corporate Financial Statements (LinkedIn Learning)

- Fundamentals of Corporate Finance (Sentinel|9)

- Advanced Corporate Finance (NYU Stern Executive Education)

- Corporate Finance: Strategies for Creating Shareholder Value (Studyportals)

- Corporate Finance Program (Mays Business School)

Details about each course are below.

Overview of the Best Corporate Finance Courses

1. Corporate Finance Fundamentals (CFI)

This course introduces fundamental concepts in corporate finance, focusing on important areas such as financing strategies and capital markets. Participants will explore key topics, including deal structuring and the various stages of business lifecycles. This curriculum provides a solid understanding of the principles that drive financial decision-making in corporate settings.

- Who It’s For: Individuals pursuing careers in investment banking, equity research, private equity, corporate finance, and accounting

- Topics Covered:

- Capital raising process

- Debt and equity securities

- Valuation multiples

- Mergers and acquisitions

- Dividends and return of capital

- Financial planning & analysis (FP&A)

- Determining the key players

- Terminal value

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 2 hours and 30 minutes

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements:

- PC or Mac

- Microsoft Office Suite 2016 or the latest version

- Stable internet connection

- Price:

- Self-study: $497 per year (all access)

- Full-immersion: $847 per year (premium access)

- Take The Course: Corporate Finance Institute

2. Introduction to Corporate Finance (University of Pennsylvania)

This online course consists of four modules that cover essential finance concepts, including budgeting and free cash flow. Each module features video lectures, readings, and quizzes to enhance the learning experience. It briefly introduces finance fundamentals, focusing on practical applications in personal finance, corporate decision-making, and financial intermediation.

- Who It’s For: Beginners and finance professionals seeking a fundamental understanding

- Topics Covered:

- Time value of money

- Risk-return tradeoff

- Cost of capital

- Discounted cash flow (DCF) analysis

- Asset valuation

- Internal rate of return

- Hurdle rate

- Retirement savings

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 7 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Enroll for free (financial aid available)

- Take The Course: Coursera

3. Corporate Finance Foundations (LinkedIn Learning)

This course introduces basic corporate finance concepts and how they affect a company's performance. It explains the role of risk in decision-making and covers the capital asset pricing model (CAPM). Students will learn how different financial choices impact business strategy and valuation.

- Who It’s For: Beginners in corporate finance, executives, managers, and accountants

- Topics Covered:

- Financial decision impacts

- Risk management

- Diversification

- Financing options

- Cash flow and operations

- Use of equity or debt financing

- Grasping securities markets

- Capital budgeting

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 1 hour and 25 minutes

- How Many Hours Of Instruction: 1 hour and 25 minutes

- Eligibility Requirements: None

- Price: Free for a month

- Take The Course: LinkedIn Learning

4. Corporate Finance & Valuation Methods (New York Institute and Finance)

This course is designed to help improve career opportunities in finance by covering important topics related to financial decision-making. Participants will learn key principles that influence a company's capital structure. The program includes several courses and ends with an exam to earn a professional certificate.

- Who It’s For: Professionals aiming to advance in corporate finance

- Topics Covered:

- Financial Mathematics

- Capital budgeting

- Cost of capital

- Discounted cash flow (DCF) methodologies

- Option pricing

- Corporate funding strategies

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 5 months

- How Many Hours Of Instruction: 1-2 hours per week

- Eligibility Requirements: None

- Price: $1,549

- Take The Course: edX

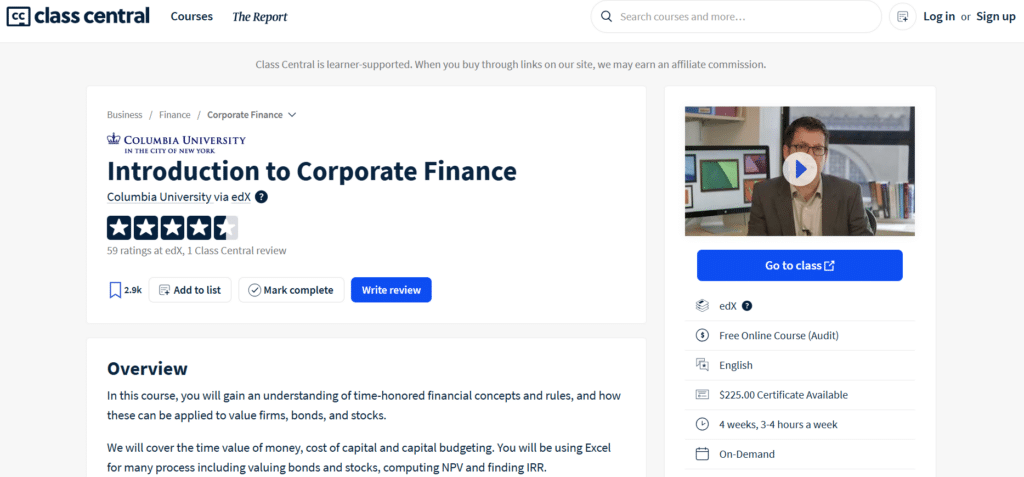

5. ColumbiaX: Introduction to Corporate Finance (Columbia University)

This course covers important corporate finance topics and includes hands-on Excel applications for processes like computing NPV and finding IRR. Led by a well-respected instructor, you will learn essential financial principles and how to apply them to evaluate companies and investments in today's fast-paced financial environment.

- Who It’s For: Beginners in finance and aspiring market leaders

- Topics Covered:

- Time value of money

- Cost of capital

- Capital budgeting

- Internal rate of return

- Bonds and stocks

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 4 weeks

- How Many Hours Of Instruction: 3-4 hours per week

- Eligibility Requirements: None

- Price:

- Without certificate: Free

- With certificate: $225.00

- Take The Course: Class Central

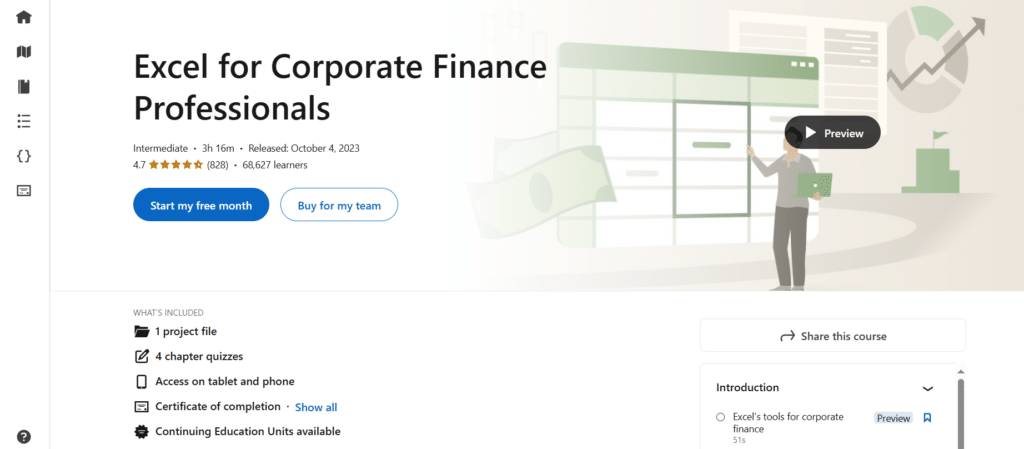

6. Excel for Corporate Finance Professionals (LinkedIn Learning)

This course focuses on using Excel for essential corporate finance and financial planning. Participants will learn to apply Excel for capital investment selection and determining the firm's cost of capital. The course includes practical exercises and downloadable files to reinforce key concepts and facilitate hands-on learning.

- Who It’s For: Corporate finance professionals looking to improve their Excel skills

- Topics Covered:

- Financial modeling in Excel

- Analyzing financial statements

- Forecasting and scenario analysis

- Data visualization and reporting in Excel

- Critical tasks in corporate finance

- Project selection

- WACC and capital structure

- Operational budgeting

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 3 hours and 16 minutes

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free for a month

- Take The Course: LinkedIn Learning

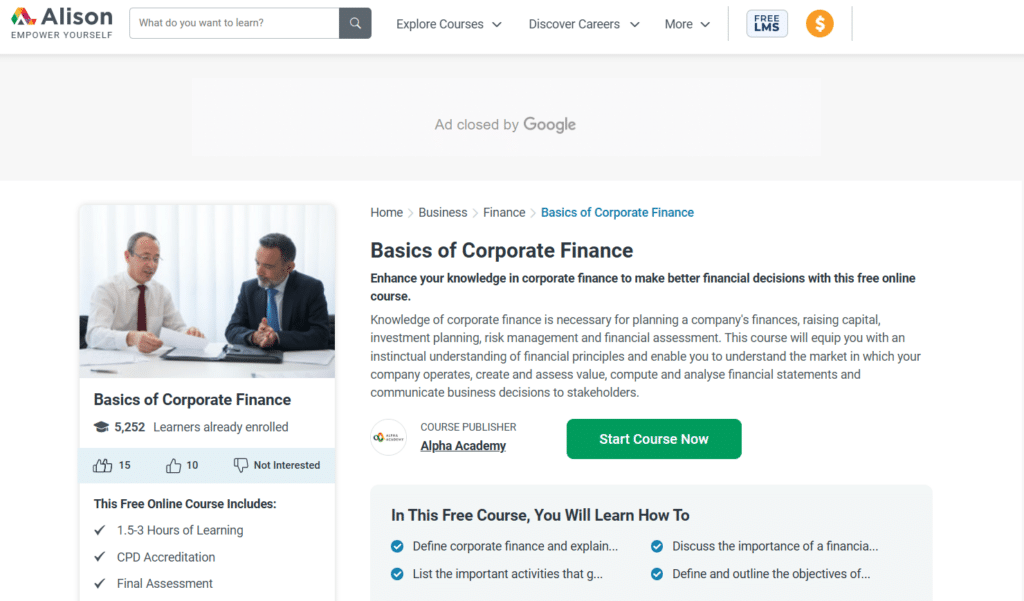

7. Basics of Corporate Finance (Alpha Academy)

This free course provides a solid introduction to corporate finance, focusing on maximizing organizational value through strategic resource management. It covers key techniques for evaluating investments and optimizing capital structure, which are crucial for making sound financial decisions. By the end, participants will have a clearer understanding of the principles and practices essential for a successful career in corporate finance.

- Who It’s For: Individuals new to corporate finance

- Topics Covered:

- Financial management fundamentals

- Capital budgeting

- Investment appraisal techniques

- Financing options

- Utilize Google Analytics

- Financial risk management

- Investment planning and objectives

- Financial analysis

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 1 hour and 30 minutes to 3 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free

- Take The Course: Alison

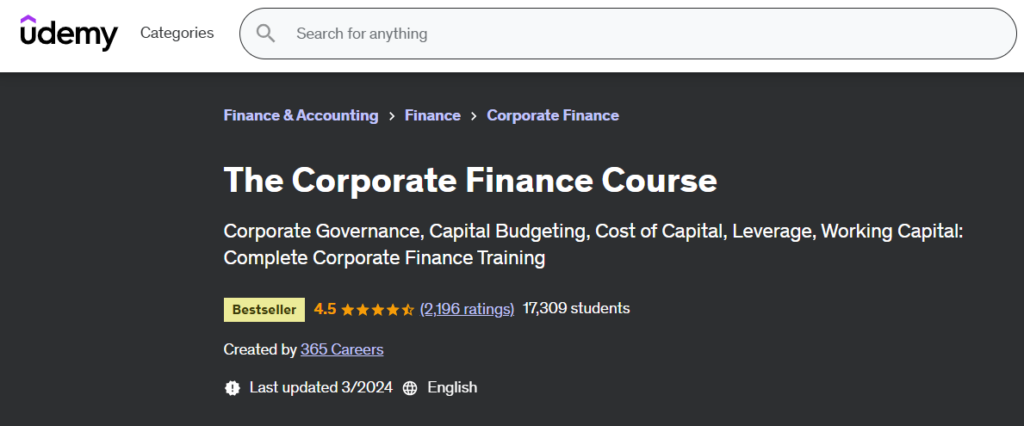

8. The Corporate Finance Course (365 Careers)

This course offers an in-depth exploration of corporate finance, emphasizing practical applications through interactive lessons and engaging animations. It provides real-world scenarios and challenges to ensure learners grasp complex financial concepts.

- Who It’s For: Finance professionals, students interested in corporate finance, aspiring private equity analysts, entrepreneurs, investment bankers, and financial advisors

- Topics Covered:

- Corporate finance fundamentals

- Financial decision-making

- Capital structure management

- Valuation techniques

- Measures of Leverage

- Corporate Governance and ESG

- Utilizing financial calculator

- Formula sheet

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 6 hours and 30 minutes

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $119.99

- Take The Course: Udemy

9. Corporate Finance I: Measuring and Promoting Value Creation (University of Illinois Urbana-Champaign)

This course explores how businesses can generate and assess value, focusing on essential financial principles. Participants will learn to manage liquidity needs and make informed investment decisions. With a strong emphasis on practical applications, the training aims to enhance understanding of corporate finance and prepare for real-world challenges.

- Who It’s For: Individuals seeking an introduction to value creation in corporate finance

- Topics Covered:

- Measuring financial success

- Value creation strategies

- Capital budgeting techniques

- Financial statement analysis

- Mergers and Acquisitions

- Corporation’s objectives

- Financial planning

- Performance evaluation

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 24 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free (with optional paid certificate program)

- Take The Course: Coursera

10. Corporate Finance: Robust Financial Modeling (LinkedIn Learning)

This course focuses on developing strong financial modeling skills essential for sound decision-making in corporate finance. Learners will explore techniques for analyzing different outcomes and preparing for various business scenarios, and they will be equipped to create effective financial representations and confidently present their findings.

- Who It’s For: Finance professionals focused on financial modeling

- Topics Covered:

- Building robust financial models

- Sensitivity analysis

- Scenario planning

- Forecasting and reporting

- Designing a financial model

- Quality assurance

- Finalizing and presenting a model

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 44 minutes and 4 seconds

- How Many Hours Of Instruction: 44 minutes and 4 seconds

- Eligibility Requirements: None

- Price: Free for a month

- Take The Course: LinkedIn Learning

11. Fundamentals of Corporate Finance and Valuation (Wharton Academy)

This course provides an in-depth exploration of corporate finance, focusing on key financial principles and decision-making. Students will engage with a case-driven curriculum, allowing them to apply these concepts in practical scenarios. It’s tailored to enhance their understanding of how businesses finance operations and generate value.

- Who It’s For: Finance professionals, executives, entrepreneurs and finance career seekers

- Topics Covered:

- Corporate finance principles

- Valuation methods

- Capital market fundamentals

- Financial statement analysis

- Financial modeling

- Capital structure and risks

- Inflation and interest rates

- Mergers and Acquisitions

- Online, In-Person, or Both? In-Person

- Exam Required? Yes

- Duration: 60 hours

- How Many Hours Of Instruction: 8 hours per day

- Eligibility Requirements:

- Current undergraduate student or recent graduate

- An English proficiency: TOEFL 100+ or IELTS Band 7+. Alternatively, Duolingo (minimum 130), PSAT, SAT, or ACT scores can be submitted

- Strong quantitative abilities

- Price: $7,599 (includes accommodations and meals)

- Take The Course: Wharton Academy

12. Financial Modeling and Forecasting Financial Statements (LinkedIn Learning)

This course focuses on creating effective financial models and forecasting key financial statements to help users predict company performance. It guides participants through analyzing past data to understand fluctuations and apply that knowledge to future projections. By engaging with real business cases, participants will learn the critical role of accurate forecasts in shaping strategic financial decisions.

- Who It’s For: Finance professionals interested in financial forecasting

- Topics Covered:

- Building financial models

- Forecasting income statements and balance sheets

- Sensitivity analysis

- Scenario planning

- Users of forecasted financial statements

- Accurate sales forecast

- Causes of financial statement changes

- Creating a forecasted cash flow statement

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 1 hour and 53 minutes

- How Many Hours Of Instruction: 1 hour and 53 minutes

- Eligibility Requirements: None

- Price: Free for a month

- Take The Course: LinkedIn Learning

13. Corporate Finance: Financial Analysis and Decision-Making (Robert Bob Steele)

This course helps participants learn how to evaluate investments using different financial measures. It explores funding options, like equity and debt, and how they affect a company’s financial health. It also covers international finance challenges and includes hands-on activities to strengthen their understanding.

- Who It’s For: Business professionals, finance students, accounting professionals, business managers, financial analysts, and students pursuing an accounting degree

- Topics Covered:

- Financial analysis techniques

- Corporate decision-making

- Risk management

- Capital structure and valuation

- Applying financial ratios

- Evaluating solvency

- Apply forecasting and budgeting methods

- Use time value of money principles

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 163 hours and 30 minutes

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements:

- Basic understanding of mathematics and algebra

- Proficiency in Excel

- Spreadsheet software for financial calculations

- Price: $79.99

- Take The Course: Udemy

14. Corporate Finance: A Beginner’s Guide (University of Padova)

This course thoroughly introduces corporate finance, covering key principles and essential concepts. Participants will learn practical skills to assess investment opportunities. It also looks at different funding options and how they affect a company's value, helping them make better financial decisions.

- Who It’s For: Beginners and non-finance professionals, graduate students, students pursuing accounting degrees, and individuals seeking fundamental knowledge in corporate finance

- Topics Covered:

- Introduction to corporate finance

- Investment appraisal

- Financial decision-making

- Capital budgeting

- Discount rates

- Financial analysis

- Risk and return models

- Capital structure

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 5 weeks

- How Many Hours Of Instruction: 8 hours per week

- Eligibility Requirements: None

- Price: $349.99 per year (unlimited subscription)

- Take The Course: FutureLearn

15. Reading Corporate Financial Statements (LinkedIn Learning)

This course explores how to analyze corporate financial statements, focusing on common layouts and data points to interpret a company's financial status. It guides learners through understanding financial statement structures and using this information for decision-making.

- Who It’s For: Professionals who need to understand financial reports

- Topics Covered:

- Reading balance sheets

- Income statements and cash flow statements

- Financial ratios

- Decision-making based on financial data

- Stockholders’ equity preparation

- Common layouts

- Data points

- Organization

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 1 hour and 8 minutes

- How Many Hours Of Instruction: 1 hour and 8 minutes

- Eligibility Requirements: None

- Price: Free for a month

- Take The Course: LinkedIn Learning

16. Fundamentals of Corporate Finance (Sentinel|9)

This course offers a solid introduction to the essential aspects of managing company finances and making strategic choices. Participants will develop hands-on skills for assessing budgets and funding strategies through practical examples. Additionally, they’ll learn how to evaluate a company's worth and apply forecasting techniques to enhance planning and minimize decision-making risks.

- Who It’s For: Individuals interested in understanding corporate finance fundamentals, business managers, and professionals looking to advance in their careers

- Topics Covered:

- Corporate finance principles

- Financial decision-making

- Capital budgeting

- Financing options

- Corporate finance and ratio analysis

- Company and stock valuations

- Options valuation and trading analysis

- Finance and free market economies

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 4 weeks

- How Many Hours Of Instruction: 3 hours per week

- Eligibility Requirements: None

- Price: $79 per premium course (join for more info)

- Take The Course: FutureLearn

17. Advanced Corporate Finance (NYU Stern Executive Education)

This course focuses on advanced financial strategies to enhance company value and shareholder returns. It covers important theories like the Modigliani-Miller Theorem and examines how debt influences company valuation and risk. Participants will engage in discussions and practical exercises, and it’s recommended to complete a basic corporate finance course beforehand.

- Who It’s For: Senior executives and finance professionals

- Topics Covered:

- Capital structure optimization

- Risk management

- Valuation techniques

- Corporate financial strategies

- Financial leverage

- Adjusted present value method

- Cost of capital fallacy

- Leveraged recapitalization

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 3 days

- How Many Hours Of Instruction: 4 hours and 30 minutes per day

- Eligibility Requirements:

- Individuals with over 5 years of professional experience

- Individuals seeking to enhance their financial literacy

- Price: $3,800.00

- Take The Course: NYU Stern Executive Education

18. Corporate Finance: Strategies for Creating Shareholder Value (Studyportals)

This program provides practical insights into making informed investment decisions and understanding the impact of financing strategies on profits. Through lectures, case studies, and group work, participants apply their knowledge to real scenarios, evaluating strategic choices and prioritizing investment options for better shareholder outcomes.

- Who It’s For: Professionals interested in enhancing shareholder value, executives, managers, consultants, commercial bankers, and investment bankers

- Topics Covered:

- Financial analysis

- Capital investment strategies

- Corporate governance

- Value creation techniques

- Financing decisions

- Evaluation of investments

- Corporate financial strategies

- Interaction of investment and financing

- Online, In-Person, or Both? In-Person

- Exam Required? Yes

- Duration: 6 days

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $10,450

- Take The Course: Studyportals

19. Corporate Finance Program (Mays Business School)

This program helps students prepare for various career options by requiring them to complete courses in finance, accounting, and data analysis. These classes are designed to ensure students are ready for different roles in the finance field.

- Who It’s For: Undergraduate students pursuing finance and accounting careers

- Topics Covered:

- Financial management

- Capital markets

- Corporate finance principles

- Practical finance applications

- Success factors in corporate finance

- Financial modeling

- Valuation

- Final statement analysis

- Online, In-Person, or Both? In-Person

- Exam Required? No

- How Many Hours Of Instruction: 16 credit hours

- Eligibility Requirements:

- Essay: articulating the interest in obtaining the CFP

- Resume in Mays format

- Finance students and PPA enrollees

- Take The Course: Mays Business School

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.