Most companies’ biggest expense is payroll.

First, you need people to make things happen. Then, you need payroll professionals to pay those first people. Then, you need other people in human resources and management to evaluate those people. It’s a lot of layers and, unfortunately, the efficiency of your labor costs feels like it can fluctuate by the day.

Naturally, you’re going to want to make sure you’re only paying as much as you need to; not bloating your organization or holding onto underperformers.

Unless you’re me, apparently.

My Experience Forecasting Payroll

I’ve spent countless hours gathering historical information from my own business in order to forecast future labor costs using Excel. After all, sitting cash is often wasted cash, but I needed to ensure I was keeping enough cash on hand for payroll tasks.

Spent hours… and got it wrong.

I ended up hiring too many staff without enough to do. I had to retroactively right-size the business, damaging relationships with a few great hires along the way.

Great operator, right?

Unfortunately, my story is all too common for those in charge of payroll, whether they're coming from a financial background or not. After all, the approach to labor forecasting is pretty rudimentary, leading to human errors and a huge delta between forecasted and actual payroll expenses.

How AI Can Streamline Payroll Forecasting

Nowadays, the delta I mentioned can be minimized pretty easily with AI-based predictive analytics.

Instead of running through data sets on your own or, shudder, making decisions based on a linear percentage growth model, artificial intelligence algorithms can tell you what you should be expecting in future payroll costs. This optimization is especially beneficial during a hyper-growth period.

The best part? Automation and machine learning aren’t going to take your job (or the jobs of your valued employees); it’s going to enhance each person’s ability to make accurate, informed decisions.

After all, R2D2 wasn't the one in charge of flying the ship... but he sure did help it run smoothly.

There are a few areas specifically within payroll for AI to tackle first. These include:

Accurate Classification of Employees

Have you ever had a disgruntled employee grill you about their tax withholdings? Or worse, ever released funds to an employee that you later needed to recover due to validation errors?

With AI technology, you can classify employees’ payroll deductions faster and more accurately. Plus, robotic process automation and chatbots can answer payroll questions, freeing you from these (often) time-consuming tasks.

Compliance

Anyone in finance knows this consideration all too well - make a mistake with peoples’ payslips and you’re likely to face a lawsuit, or worse, the IRS.

AI can easily be trained on payroll regulations for a specific:

- Type of company

- Industry

- Geographic region

And, really, any other global payroll regulations to ensure you’re always handling your payroll operations correctly and compliantly.

Constant Data Management

If the world were perfect, you’d be able to employ a full-time team of analysts to look through internal payroll data - including labor costs - and determine areas for optimization. Well, news flash: thanks to integrations from payroll services, AI is your team of analysts.

Onboarding & Offboarding

Imagine this: you upload some forms, click a button, and a new hire is (correctly) set up in your payroll system via robotic process automation. Sounds dreamy, right?

Luckily, this is just around the corner.

Employee Experience

The fewer mistakes you make - such as poor data entry, or hiring too many people and having to rightsize after the fact - the more your employees are going to trust you.

This is going to have a cascading effect: better employee experience; improved word-of-mouth references by staff; better talent flowing into your ecosystem.

Predictive Analytics in Payroll Systems

Predictive analytics in the realm of payroll leverages machine learning models to make forecasts based on historical and real-time data. These models are not simple equations but rather dynamically adaptive systems that learn from each data point they process. Here’s how it goes down:

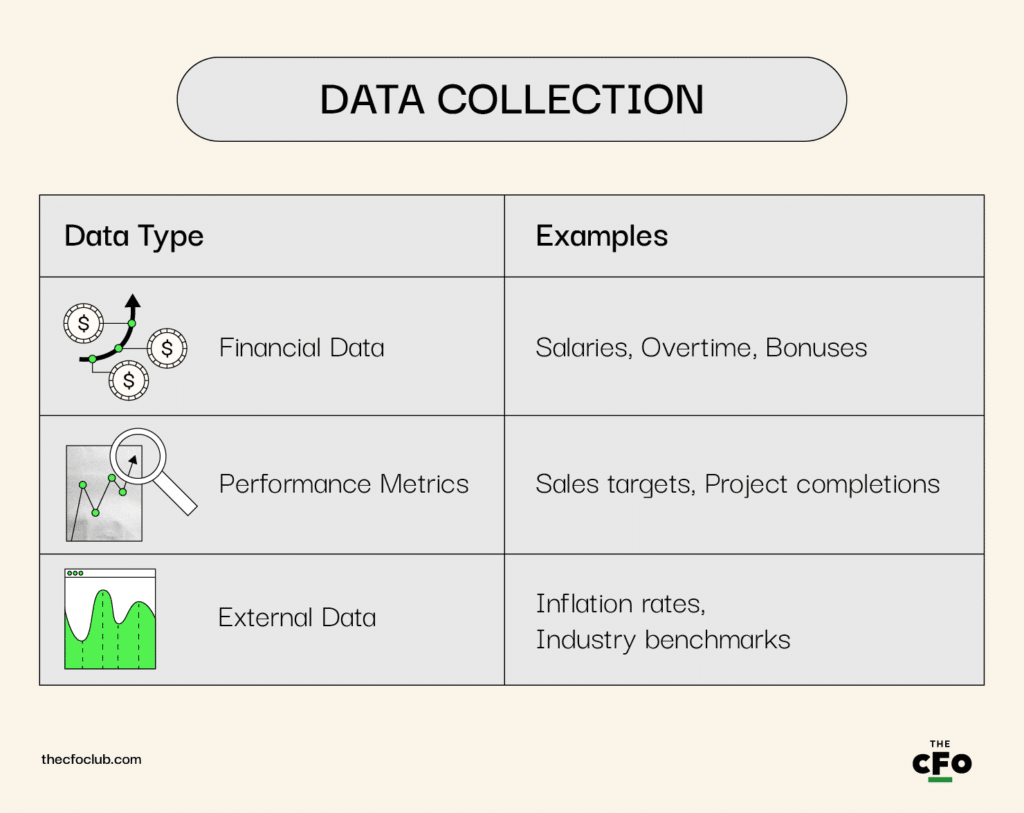

1. Data Collection

The initial phase is all about gathering data. This includes information about salaries, overtime, bonuses, taxes, and other deductions. Essentially, any variable that would impact your payroll. But predictive analytics takes it a step further. It also looks at less obvious factors, such as employee performance metrics, company-wide KPIs, and even seasonality patterns that might impact labor costs.

2. Data Analysis

Once the data is collected, algorithms analyze it to recognize patterns and correlations. For example, the model might identify a trend where payroll costs increase during Q4 due to holiday bonuses or overtime work.

3. Model Training

The machine learning model is "trained" using this historical data. During this phase, the model learns how various factors have traditionally impacted payroll. It uses this training to make forecasts.

4. Validation

Before the model can be trusted, it must be validated using a separate data set. This step ensures the model's predictions are accurate and not the result of overfitting to the training data.

5. Real-Time Updates

What sets predictive analytics apart is its ability to update its forecasts in real-time. As new data becomes available, the model adapts, allowing it to make increasingly accurate predictions within updated conditions.

6. Forecast Generation

Finally, the model produces forecasts. These can range from the expected monthly payroll expenditure to the optimum number of hires needed for a particular period. It's like having a financial analyst who works 24/7, continually ingesting new data and refining its forecasts.

7. Decision Support

Beyond simply providing reports, predictive analytics tools often include features that aid decision-making, such as confidence intervals for their predictions. These can be critical in helping CFOs make informed choices.

By using predictive analytics in payroll, you're not just automating a task. You're transforming it into a strategic function that can offer actionable insights, optimize your workforce, and reduce costs. The predictive capabilities allow you to anticipate changes, rather than just react to them, putting you a step ahead in your financial planning.

AI’s Current Wins Within Payroll Functions

Already, companies are reporting significant gains through the deployment of AI in payroll solutions.

Classification and Compliance

Companies like ADP and Gusto have incorporated AI to assist in classifying employees correctly, thus ensuring tax and legal compliance.

| Vendor | Classification Accuracy | Compliance Features |

| ADP | 98% | Federal & State Laws |

| Gusto | 97% | Federal & State Laws |

Data-Driven Decision Making

AI's ability to analyze large sets of data has made it a critical tool in compensation strategy, helping companies match compensation to performance metrics effectively.

Cost Savings

Companies report up to a 20% reduction in labor costs through optimal staffing recommendations and timely compliance checks, thanks to AI.

The Future of AI in Payroll

Looking ahead, we're stepping into a world where AI won't just be an accessory but a core component of payroll systems, eliminating human error and inefficiencies altogether.

Fully Automated Payroll

It's not pie-in-the-sky; in the near future, AI should be able to manage the entire payroll process, from data collection to fund disbursement. It will be programmed to align closely with your compensation strategy, making real-time adjustments based on a myriad of internal and external factors.

Real-Time Audits

AI will continuously audit your payroll system to ensure that every cent is accounted for, instantly flagging discrepancies for human review.

Imagine that: being able to step away from timesheets and focus instead on your role as a Strategic CFO.

Employee Experience

The era of one-size-fits-all is over. AI will allow for highly personalized compensation and benefits packages, designed to attract and retain the best talent.

- Build your compensation strategy as a guiding manifesto.

- Train AI on your strategy.

- Allow the AI to brainstorm ideas that will win over candidates, using your compensation strategy & real-time market information as inputs.

- Make the final decision on what ideas you'd like to action.

Get Ahead of the Curve

When it comes to future-proofing your payroll, AI isn’t just a "nice to have," it’s increasingly becoming a "need to have." So, if you're still relying on manual data entry and not yet leveraging use cases for AI in your payroll department, it's time for strategic decisions to be made… and quickly.

If you want to get more expert tips (and confessions) for running an efficient finance team in a tech company, subscribe to The CFO Club’s newsletter today.