10 Best Free Accounting Software Shortlist

Here's my pick of the 10 best software from the 15 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

There are so many different accounting solutions on the market that discovering which ones offer the best free plans or free trials can be tricky. You want to manage your financial transactions and bookkeeping without the need for a significant financial investment but need the right tool that fits your budget. I've got you covered! In this post, I share from my personal experience handling budgets for large companies and being exposed to dozens of different tools and share my picks of the best free accounting software.

What is free accounting software?

Accounting software is a type of tool used to manage a company's accounting and bookkeeping processes. Free options of this type of software allow small businesses and freelancers to access basic bookkeeping functionalities, expense tracking, income recording, invoicing, and financial reporting without the need for a significant financial investment

Generally, free accounting software will have a limit for the total number of transactions, total annual revenues, or the maximum number of users that can use the software. If you go over those limits, they’ll usually make you upgrade to a paid plan or higher service tier.

Overviews Of The 10 Best Free Accounting Software Options

Based on my selection criteria described below, here are the 10 best free accounting software options on the market right now.

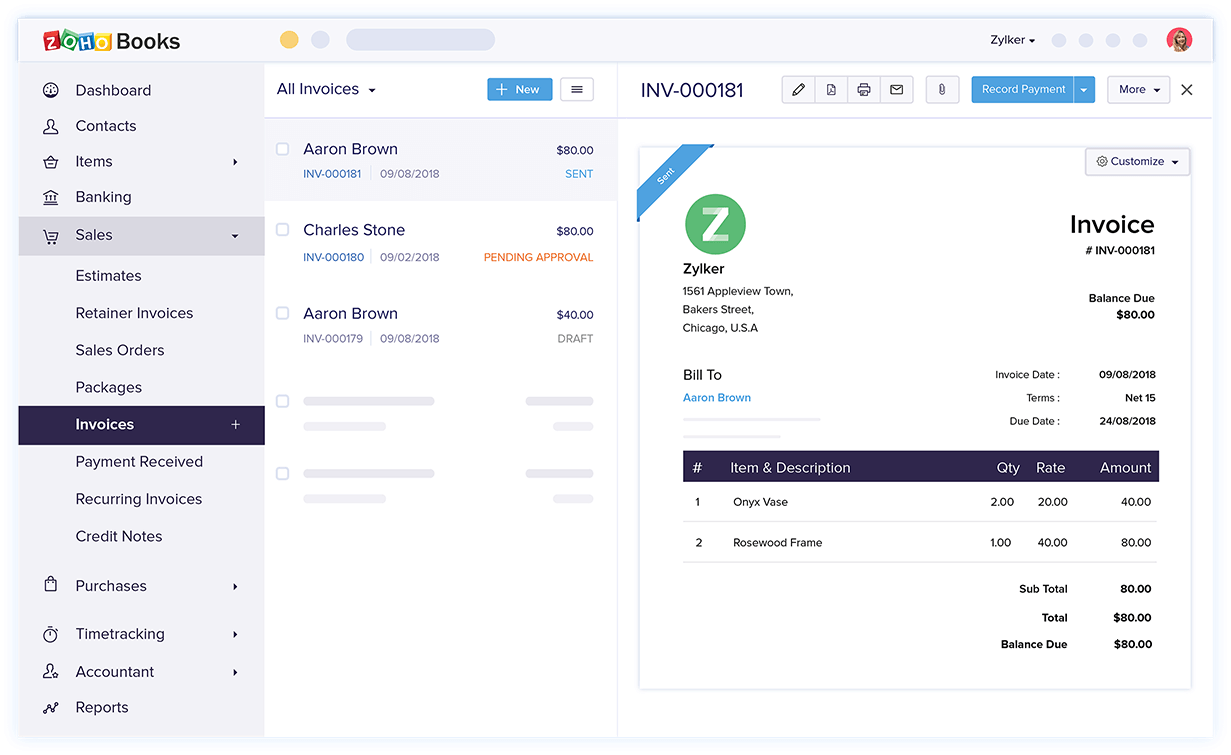

If you’re already a Zoho customer, I’d definitely recommend looking into adding their accounting software to your current setup. Zoho Books can handle everything from expense reporting to automated follow-up on customer accounts.

Why I picked Zoho Books: Zoho Books is a great tool on its own, offering all the essential tools you’d expect from accounting software. It stands out when you combine it with Zoho’s other business services.

Zoho Books Standout Features and Integrations:

Standout Features include integrations with other Zoho business services and third-party payment apps. It also offers easy-to-use invoicing tools that pair with automated follow-up and collections processes. Mileage and expense tracking also help you monitor spending.

Integrations include other Zoho tools, PayPal, Stripe, WePay, and other payment tools.

Pros and cons

Pros:

- Most important features available with free service

- Easy to use

- Test account lets you check out the service before signing up

Cons:

- Works best if you pay for additional services

- Limited support

Striven can handle everything from standard accounting and bookkeeping tasks to communicating with suppliers and monitoring cash flows.

Why I picked Striven: Striven offers an accounting dashboard alongside other valuable business services, letting it serve as a one-stop shop for your company’s software needs.

Striven Standout Features and Integrations:

Standout Features include Striven’s ability to support many kinds of organizations, from businesses to nonprofits to government entities. It also does a good job of generating reports quickly and giving you tools to communicate with customers and vendors from your accounting portal.

Integrations include Gmail, Google Calendar, Microsoft Calendar.

Pros and cons

Pros:

- Strong customer support

- Lots of features

- User friendly

Cons:

- Long setup process

- Limited features for free service

ZipBooks is designed with invoicing at the forefront–it wants to do whatever it takes to help you get paid. The dashboard shows you all of your latest invoice payment stats, and ZipBooks makes it easy to customize your dashboard to display any other financial information you want to see.

Why I picked ZipBooks: ZipBooks is easy to use and lets you send an unlimited number of invoices with its free plan.

ZipBooks Standout Features and Integrations:

Standout Features include the ability to send an unlimited number of invoices without having to pay a fee. You can accept invoice payments using most major payment methods with no additional effort. It also comes with basic reporting tools.

Integrations include Google Drive, Square, PayPal, and major banks.

Pros and cons

Pros:

- Unlimited invoices with free service

- Easily accept payments

- Free service with no limit on business size

Cons:

- Most useful features require a paid subscription

- Limited support

You’ve surely heard you shouldn’t judge a book by its cover. Well, fans of GnuCash would probably tell you not to judge accounting software by its UI.

This one isn’t winning any beauty contests, but it’s what’s on the inside that counts. GnuCash won’t disappoint when it comes to features–everything from the most basic to the most advanced ones are completely free. But, fair warning: be ready for a bit of a learning curve.

Why I picked GnuCash: GnuCash is open source and available entirely for free, making it one of the only accounting tools offering all of its available features for free.

GnuCash Standout Features and Integrations:

Standout Features include a checkbook-style transaction register and statement reconciliation tools. You can also use the app to automate some processes by scheduling transactions.

Integrations are limited.

Pros and cons

Pros:

- Great reporting capability

- Extensive user guides and how-to documentation

- Open-source software that offers all features for free

Cons:

- No professional support

- Steep learning curve

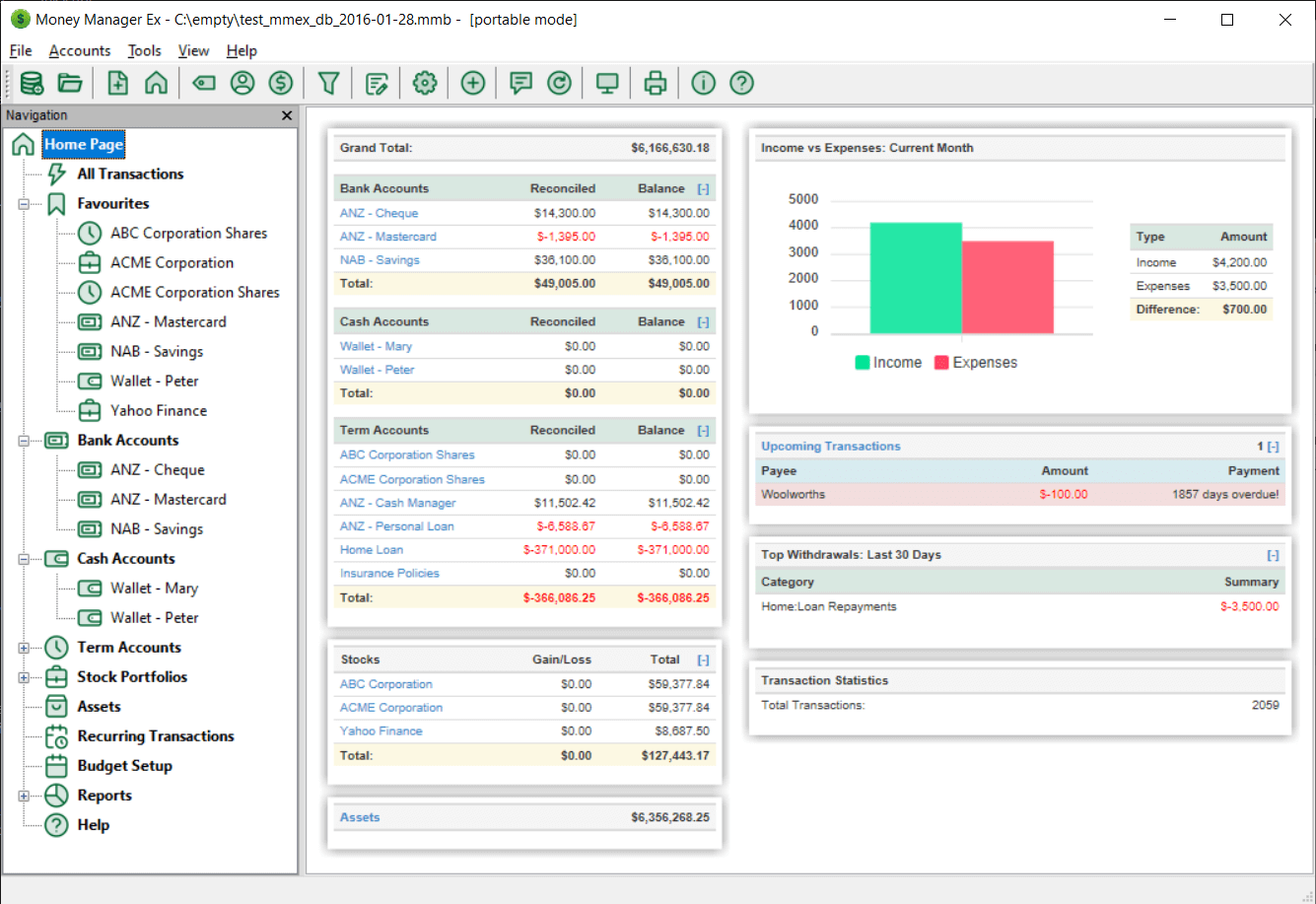

Money Manager EX is aimed more at helping people manage their finances rather than large companies. But nevertheless, it’s a sharp little tool that can handle most of the essential accounting tasks for anyone running a solo construction operation.

Why I picked Money Manager EX: The program is open source and requires more manual data entry, which is good for people who want to take a hands-on approach.

Money Manager Ex Standout Features and Integrations:

Standout Features include Money Manager EX’s strong cash flow tracking, making this tool a great choice for monitoring your company’s performance. Its open-source nature means it’s highly customizable and you can make tweaks to it if you have the expertise to do so.

Integrations: None.

Pros and cons

Pros:

- Multi-currency

- Customizable

- Truly free open-source software

Cons:

- Local installation required, no cloud-based option

- Limited support

Express Accounts’ reporting capabilities can help you quickly generate dozens of different financial reports and analyze your company’s revenues and expenses on a customer-by-customer basis.

Why I picked Express Accounts: Express Accounts is easy to use and generates a huge variety of financial reports that you can use to analyze your company’s situation.

Express Accounts Standout Features and Integrations:

Standout Features include more than 20 essential financial reports that let you quickly get a view of your company’s financial situation. The tool also tracks your sales and accounts receivable, automatically recording orders and invoices to limit the amount of manual bookkeeping you have to do.

In terms of working with customers and suppliers, Express Accounts can generate professional quotes, invoices, and sales orders as well as manage bill payments.

Integrations include other NCH software, such as Inventoria inventory management.

Pros and cons

Pros:

- One lifetime price

- Upgrade price is cheap if your business grows

- Completely free for small companies

Cons:

- Limited integrations

- No free option for larger companies

TurboCASH is an open-source, no-frills option that has all the tools you need for free. If you’re tech-savvy, you can accomplish a lot with this software. However, like most open-source solutions, be ready for a learning curve.

Why I picked TurboCASH: TurboCash may not look as sleek or as simple as other accounting tools, but it offers surprisingly powerful features once you learn to work with it.

TurboCASH Standout Features and Integrations:

Standout Features include its support for multiple accounting standards. You can also use the tool for invoicing and customer tracking. With multi-language support, TurboCASH is an option for almost any company.

Integrations: None.

Pros and cons

Pros:

- Powerful customer tracking and reporting tools

- Multi-language support

- Truly free if you use version 4

Cons:

- Limited support

- Steep learning curve

While it technically isn’t a full-fledged accounting software, TrulySmall Invoices is a great free budgeting tool that makes it easy to create all of your company’s invoices.

Why I picked TrulySmall Invoices: True to its name, TrulySmall Invoices offers basic services that are ideal for a small company that doesn’t need all the bells and whistles.

TrulySmall Invoices Standout Features and Integrations:

Standout Features include the ability to quickly build and track business budgets with receipt scanning tools. The tool also lets you create invoices, generate spending reports, and connect with bank accounts to import data and handle reimbursements for client expenses.

Integrations include the option to connect with external bank accounts.

Pros and cons

Pros:

- Multiple invoice templates

- Start sending invoices without an account

- Easy to use

Cons:

- More invoicing software than accounting software

- Limited customization options in the free tier

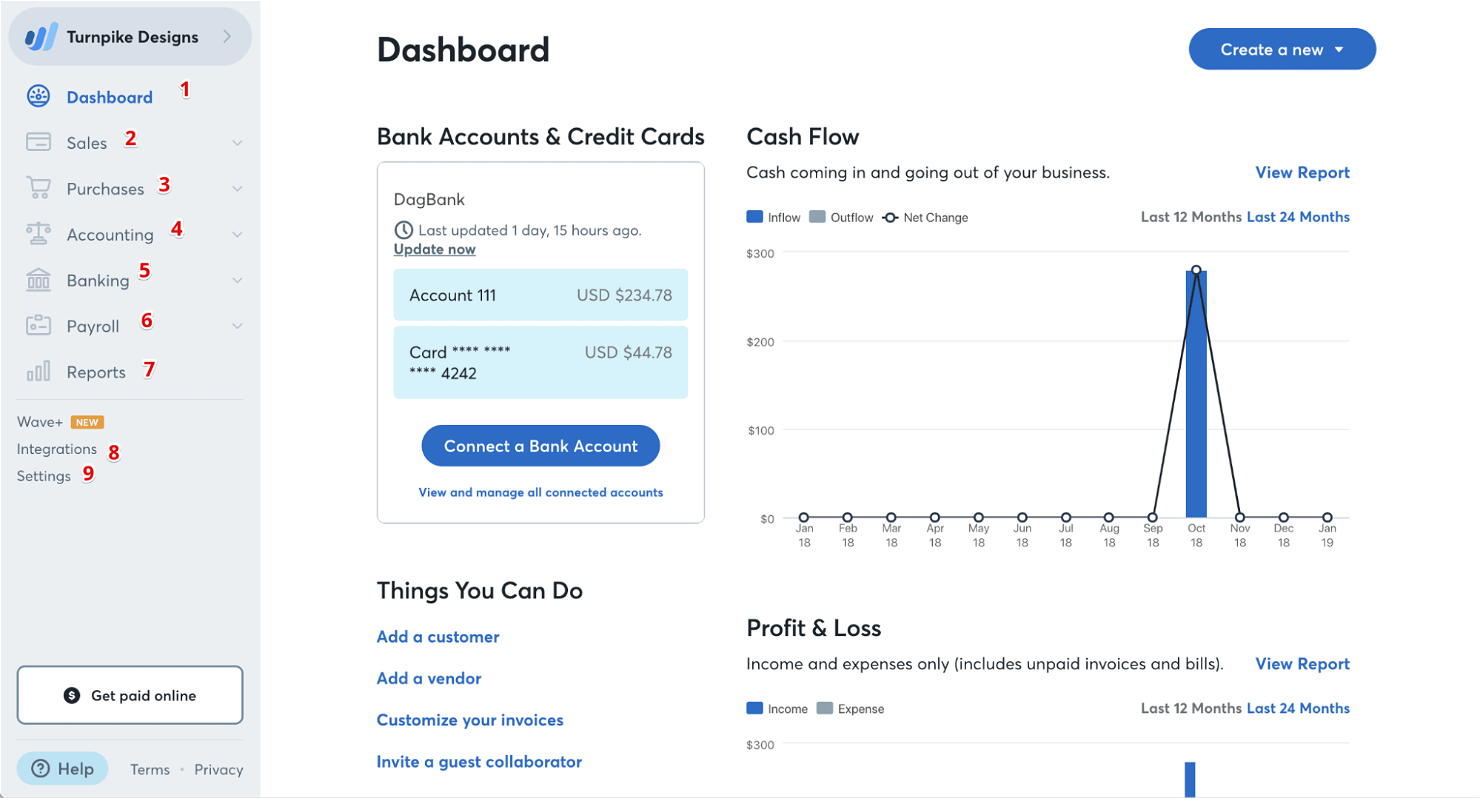

Wave is a great option for anyone who has multiple businesses or those that want to automate processes but don’t have hours to spend setting up accounting software.

Unlike many free software tools on the market, Wave doesn’t impose limits on the number of company bank accounts or credit cards you can add.

Why I picked Wave: Wave is one of the easiest-to-use tools. You can get up and running within a few minutes of making an account.

Wave Standout Features and Integrations:

Standout Features include unlimited connections with bank and credit card accounts make Wave a great way to track revenue and expenses automatically. Once you’ve imported your data, it can quickly build financial reports. It also lets you manage multiple businesses using one account, which makes it easier to keep track of all your companies.

Payment processing, payroll, and personalized bookkeeping services are available through Wave for an additional cost.

Integrations include Google Drive, Stripe, PayPal, and more.

Pros and cons

Pros:

- Additional services such as payroll and automated billing available

- Truly free for accounting

- Easy to use

Cons:

- High fees for some credit card processing

- Free customers can only get chatbot or self-service support

Lendio’s accounting tool, formerly known as Sunrise, is great for invoice automations. For sole proprietors and those who don’t have a dedicated accounting department, Lendio can save you a lot of time and money.

Why I picked Lendio: Lendio offers easy invoicing, includes automations, and has reasonably-priced payment acceptance. Lendio does charge a fee for payment processing (from 2.55% + $0.30 to 3.55% + $0.30 for credit card payments, 0.5% + $0.30 - 1.5% + $0.30 for ACH transactions).

Lendio Standout Features and Integrations:

Standout Features include Lendio’s ability to help automate your invoicing and collection processes, making it easier to get paid for your work. You can also use the tool to make quotes and estimates, track expenses, and generate financial reports.

Integrations: Integrates with Gusto for payroll automation.

Pros and cons

Pros:

- Easy expense tracking

- Reporting tools

- Free service that offers invoice automation

Cons:

- Provides little help with signing up

- Website and support availability are not detailed

| Tools | Price | |

|---|---|---|

| Zoho Books | From $15/user/month (billed annually) | Website |

| Striven | From $10/user/month, (min 5 users). | Website |

| ZipBooks | From $15/user/month | Website |

| GnuCash | Free to use | Website |

| Money Manager EX | Free | Website |

| Express Accounts | Free | Website |

| TurboCASH | Free | Website |

| TrulySmall | From $20 per month | Website |

| WAVE | From $16/user/month | Website |

| Lendio | Free | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareOther Options

Though I’ve given you a list of my favorite free accounting software, everyone’s situation is different.

If you’re not certain that one of the above options is right for you, or if you aren’t looking for a full-fledged accounting software package, here are a few other free tools you might want to consider.

Related Accounting Software Reviews

If these free accounting software options aren't giving you what you need, don't worry. Here are some other, closely related tools that we've tested and evaluated:

- Online Accounting Software Providers

- Small Business Accounting Software

- Nonprofit Accounting Software

- Best Overall Accounting Software

- Financial Reporting Software

- Accounts Payable Software

- ERP Software

Selection Criteria for the Best Free Accounting Software

I looked at all the top free accounting software programs and compared their key features to find the best options for your company.

When comparing software, I focused on the following criteria.

Core Functionality

I began by looking at a number of free accounting tools to find the best ones on the market. To make it on my list, the tools needed to include a few basic functions, including:

- Basic accounting and bookkeeping

- Monitoring and analyzing financial data

- Financial reporting

- Account reconciliation tools

- Tracking revenues and expenses

Key Features

In order to make sure each tool could perform the core tasks described above, I looked for the following capabilities and key features:

- General ledger. This is a place to record all of your company’s financial transactions, including income and expenses.

- Chart of accounts. This lets you monitor each of your company’s different financial accounts.

- Reporting. You want to be able to generate reports that let you see important financial data, such as income and spending over a period, revenue from different clients or activities, or other information.

- Automation & syncing: Accounting software should help you speed up your accounting workflow and synchronize your financial data so it's accessible from anywhere.

Usability

Software is supposed to make your life easier, not harder. While there is, inevitably, a learning curve with any new tool that you adopt, the shallower the learning curve, the better.

Accounting is a very complex subject and many of the people looking for free accounting software are solopreneurs or small business owners who may not have the expertise to do it themselves or the funds to hire a dedicated accountant.

Accounting programs that are intuitive and easier to pick up have an advantage over the competition. Having an extensive knowledge base or how-to articles that introduce the tool and explain how to effectively use it is also important.

Price

Obviously, free accounting software shouldn’t have an upfront or ongoing cost. So I made sure there weren’t any hidden charges or key features locked behind a paywall.

Integrations

Many accounting tools integrate with other popular business programs and tools, like Stripe or PayPal. These integrations can provide huge value. If you can integrate your accounting software with your POS system or the payment processor on your website, you can save a lot of time and effort.

Other services are available from the same provider

If you’re looking for free accounting software, aside from finding an accounting software program that works well, your biggest concern is how much it’s going to cost. However, choosing a software provider that can also help with other aspects of your business (like payroll or HR management) can make things a lot easier.

Many of the companies that offer accounting tools can also help with other aspects of your business. For example, payment acceptance, payroll, and even financial reporting and analysis tools are commonly bundled with or offered alongside bookkeeping software.

I kept these things in mind with my selection, so if you do need other tools for your business, you won’t necessarily need to go very far to find something that works with your accounting software.

Support

Even the best-designed programs can run into issues, and you might need help setting up the program or figuring out the best way to use it. That makes support important.

I considered not only the availability of support but also how you can reach them. For example, being able to email someone to get help is nice, but if you have a complicated issue and need immediate help, being able to get on the phone with someone and have them talk you through an issue is better.

The longer a company’s support hours and the more methods of contact available, the better.

People Also Ask

Below are answers to some of the most common questions about accounting software.

Why would any software company give their product away for free?

Free accounting programs don’t operate as charities out of the goodness of their creators’ hearts. They make money in a few different ways.

One popular way for them to earn money is by charging for payment acceptance. Often, accounting programs that offer invoicing tools will charge a percentage fee when you receive a payment. Additional fees for other services are also common.

Many companies also treat their free accounting service as a trial of sorts, expecting companies to upgrade to one of their premium tiers of service after a short period or as their business grows.

What are the must-haves for accounting software?

All accounting software needs to have some basic tools and features to be suitable for a business.

For example, your program needs to be able to produce a general ledger and chart of accounts for your company. Without those, you can’t use the tool to keep track of your company’s money.

Invoicing tools and accounts payable tracking are also key because without those, you’ll struggle to get paid and to pay your bills on time.

Ideally, the software should be able to generate custom financial reports and offer an easy-to-use dashboard that gives you a quick sense of your company’s financial performance.

What other services should I look for?

Accounting software is designed to help companies manage their finances and keep their books accurate. Many businesses that make accounting software also offer other tools to help with other financial, administrative, and managerial aspects of your company.

For example, it’s relatively common for a company offering accounting software to also offer payment acceptance tools or payroll software. Some offer software that can help you manage your HR or IT processes, too.

Having multiple tools or services from the same provider can help your business save money and reduce the headaches that can come from contracting with multiple businesses for services.

Is free accounting software secure?

When it comes to your personal or business data, it’s understandable that you’d worry about security. The last thing that you want is a nefarious actor or scammer to steal your company’s sensitive financial information.

The good news is that accounting software is generally designed with security in mind. The companies selling it know the importance of protecting your data.

Before you choose an accounting program, do your due diligence. Make sure that the accounting software provider is a reputable company and ask about the security measures it uses.

Also make sure to follow computer security best practices, such as using a complex, unique password for your accounts.

How much does accounting software cost?

Even if you start with a free accounting tool, there may come a time when your company needs to start paying for more fully-featured software. Having an idea of what accounting programs cost can help you plan for when you make that jump.

How much software costs depends on many factors, including the size of your business, how many people need access to the software, and what vendor you get the program from.

On the low end, you can find premium software for $5 to $10 per month. Highly advanced accounting programs for large businesses might cost hundreds of dollars per month.

How do I go about finding the right free accounting software for me?

When you’re looking for free accounting software for your business, you should be looking for a few things.

Start by making a list of your wants and needs for an accounting tool. Almost every program can handle basic tasks like making a chart of accounts or letting you build financial reports. However, each tool offers different additional features.

Figure out what you absolutely must have and what would be nice to have. Look for tools that meet all your needs and try to find the ones that also satisfy a lot of wants.

Obviously, you’ll also be looking at whether the service is free. However, don’t be scared off if the company has a free service with premium upgrades. You might find a time in your company’s growth that you’re ready to level up your bookkeeping software.

Having the option to stick with the same tool and unlock new features means you can avoid the hassle of transitioning to a new tool and learning how to use it.

If you already use business software, such as invoicing tools or payment acceptance tools, keep that in mind while you’re comparing different programs. Try to find one that integrates with the tools you already use.

Conclusion

Accounting software is an important tool for every business, but it’s easy to overspend when you don’t really need to.

The free accounting tools listed above can handle the essentials for your business, and if your company outgrows the free option you choose, you can consider a paid service at that point.

For more corporate finance and accounting insights, sign up for our newsletter to get the latest news and advice from financial leaders.