In this review, I’m going to share my analysis and evaluation from hands-on experience with FreshBooks. But first, if you’re just beginning your search for the best accounting software, check out my picks of the best accounting software listicle.

You probably already know FreshBooks is among the most popular accounting software out there, but you need to better understand what’s good and not so good about it. This in-depth FreshBooks review will walk you through the pros and cons, features, and functionality to help guide you to better understand its capabilities and suitability for your scenario.

Summary: FreshBooks

FreshBooks is a cloud-based accounting software designed to simplify financial management for small businesses. Freelancers, consultants, and small business owners often use FreshBooks to track expenses, manage invoices, and handle basic bookkeeping. It helps businesses by providing an accessible platform for invoicing, time tracking, and expense management.

FreshBooks addresses common pain points like manual invoicing, tracking billable hours, and managing expenses. Its best features are its user-friendly interface, time-tracking tools, and automated invoicing capabilities.

FreshBooks Pros

- User-Friendly Design: FreshBooks offers an intuitive interface that makes it easy for users without accounting expertise to manage finances.

- Invoicing Automation: The software automates recurring invoices and payment reminders, reducing the manual effort required for billing.

- Time Tracking Integration: FreshBooks allows users to track billable hours directly within the platform, making it easier to invoice billable clients accurately.

FreshBooks Cons

- Limited Reporting: FreshBooks provides fewer advanced reporting options compared to other accounting software, limiting deeper financial analysis.

- Lack of Inventory Management: The software does not offer built-in inventory tracking, which can be a disadvantage for businesses that need this feature.

- Scalability Concerns: FreshBooks may not meet the needs of larger businesses with more complex accounting requirements.

FreshBooks Expert Opinion

In my opinion, FreshBooks excels as an easy-to-use accounting platform for freelancers and small business owners, but it falls short for larger companies or those with complex financial needs. Its standout features, like automated invoicing and integrated time tracking, make it a great option for service-based businesses that need simple billing and expense management.

On the other hand, FreshBooks lacks advanced reporting and inventory management, which can be limiting for businesses looking for more advanced financial insights. Overall, the software is most well-suited for those just starting with an accounting solution or looking for a user-friendly option. However, if you require more scalability or advanced features, competitors like QuickBooks or Xero may offer better choices.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different business finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Are You A Good Fit For FreshBooks?

Who Would Be a Good Fit for FreshBooks?

FreshBooks is a good fit for freelancers, consultants, and small service-based businesses that need simple invoicing, expense tracking, and time management. It works well for users who prefer an intuitive interface and don’t need complex accounting tools.

Who Would Be a Bad Fit for FreshBooks?

FreshBooks is not suitable for larger businesses or companies with complex accounting needs. It lacks features like advanced reporting, detailed inventory tracking, and strong financial forecasting, which are essential for more intricate operations. Companies looking for scalability and more customization should consider other alternatives like QuickBooks or Xero.

Best Use Cases for FreshBooks

- Freelancers: FreshBooks simplifies invoicing, expense tracking, and client management for those working independently.

- Consultants: It helps consultants track billable hours and generate professional invoices with minimal effort.

- Small Service Businesses: FreshBooks is great for small businesses like marketing or design agencies that need straightforward accounting tools.

- Remote Teams: The cloud-based system supports easy collaboration, making it ideal for teams working from different locations.

- Startups: FreshBooks provides an easy-to-learn platform for startups that need basic accounting without the complexity of larger systems.

- Sole Proprietors: It offers a simple solution for sole proprietors who need to keep their finances organized without hiring an accountant.

Worst Use Cases for FreshBooks

- Manufacturing Companies: FreshBooks lacks inventory management, making it a poor choice for businesses that rely on detailed stock tracking.

- Large Enterprises: The software doesn’t scale well for large organizations with complex accounting needs or multiple departments.

- Retail Businesses: FreshBooks doesn’t support point-of-sale or advanced inventory tracking, which is essential for retail operations.

- Nonprofits: It doesn’t offer specific features like donor tracking or grant management that nonprofits often require.

- Finance Departments: FreshBooks lacks advanced reporting and financial forecasting features, making it insufficient for larger finance teams.

- Project-Heavy Firms: Companies with complex project management needs may find FreshBooks’ project-tracking capabilities too basic for their requirements.

FreshBooks Evaluation Summary

- Core Functionality: ⭐⭐⭐⭐

- Standout Features: ⭐⭐⭐⭐

- Ease of Use: ⭐⭐⭐⭐⭐

- Onboarding: ⭐⭐⭐⭐

- Customer Support: ⭐⭐⭐⭐

- Integrations: ⭐⭐⭐⭐

- Customer Reviews: ⭐⭐⭐⭐

- Value for Money: ⭐⭐⭐⭐

Review Methodology

We’re a team of software experts who obsess about the features and functionality of different platforms. We know how critical—yet difficult and confusing—software selection can be. We test and score software to find the best solutions, whatever the use case maybe.

Using our objective, data-driven testing methodology, we’ve tested 300+ software. We dedicate ourselves to being objective in fully and fairly testing software, to get beyond the marketing fluff and truly understand the platform.

We’ve developed robust testing scenarios to use the software in the same way you will. We leverage our own first-hand, practical experience with the tools, complemented by interviews with additional users, experts, and software vendors.

How We Test & Score Accounting Software

We’ve spent years building, refining, and improving our software testing and scoring system for accounting software. The rubric is designed to capture the nuances of software selection, and what makes accounting software effective, focusing on critical aspects of the decision-making process.

Below, you can see exactly how our testing and scoring work across eight criteria. It allows us to provide an unbiased evaluation of the software based on core functionality, standout features, ease of use, onboarding, customer support, integrations, customer reviews, and value for money.

Core Functionality (20% of final scoring)

For accounting software, the core functionality we test and evaluate are:

- Invoicing: The ability to easily create, send, and track invoices for customers.

- Expense Tracking: A system for recording, categorizing, and managing business needs and expenses.

- Bank Reconciliation: Tools to reconcile bank transactions with accounting records.

- Financial Reporting: Generation of essential reports like profit and loss statements and balance sheets.

- Tax Management: Features to calculate, file, and track payments during tax time.

- Payment Processing: Integration of payment gateways to accept payments directly from invoices.

Standout Features (20% of final scoring)

We evaluate uncommon, standout features that go above and beyond the core functionality defined and typically found in accounting software. A high score reflects specialized or unique features that make the product faster, more efficient, or offer additional value to the user.

Ease of Use (10% of final scoring)

We consider how quick and easy it is to execute the tasks defined in the core functionality using the accounting software. High scoring software is well designed, intuitive to use, offers mobile apps, provides templates, and makes relatively complex tasks seem simple.

Onboarding (10% of final scoring)

We know how important rapid team adoption is for a new platform, so we evaluate how easy it is to learn and use the accounting software with minimal training. We evaluate how quickly a team member can get set up and start using the software with no experience. High-scoring software indicates little or no support is required.

Customer Support (10% of final scoring)

We review how quick and easy it is to get unstuck and find help by phone, live chat, or knowledge base. Accounting software that provides real-time support scores best, while chatbots score worst.

Integrations (10% of final scoring)

We evaluate how easy it is to integrate with other tools typically found in the tech stack to expand the functionality and utility of the software. Accounting software offering plentiful native integrations, third-party connections, and API access to build custom integrations score best.

Customer Reviews (10% of final scoring)

Beyond our own testing and evaluation, we consider the net promoter score from current and past customers. We review their likelihood, given the option, to choose the accounting software again for the core functionality. A high scoring software reflects a high net promoter score from current or past customers.

Value for Money (10% of final scoring)

Lastly, in consideration of all the other criteria, we review the average price of entry-level plans against the core features and consider the value of the other evaluation criteria. Software that delivers more, for less, will score higher.

Through this comprehensive approach, I aim to identify accounting software that not only meets but exceeds expectations, ensuring teams have the tools they need to succeed.

FreshBooks Review

Core Accounting Software Functionality

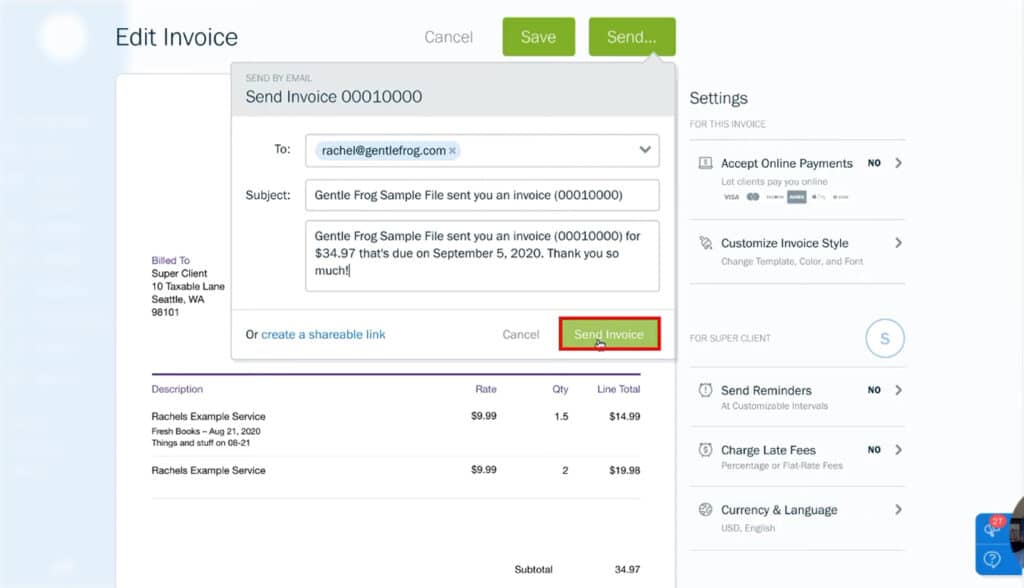

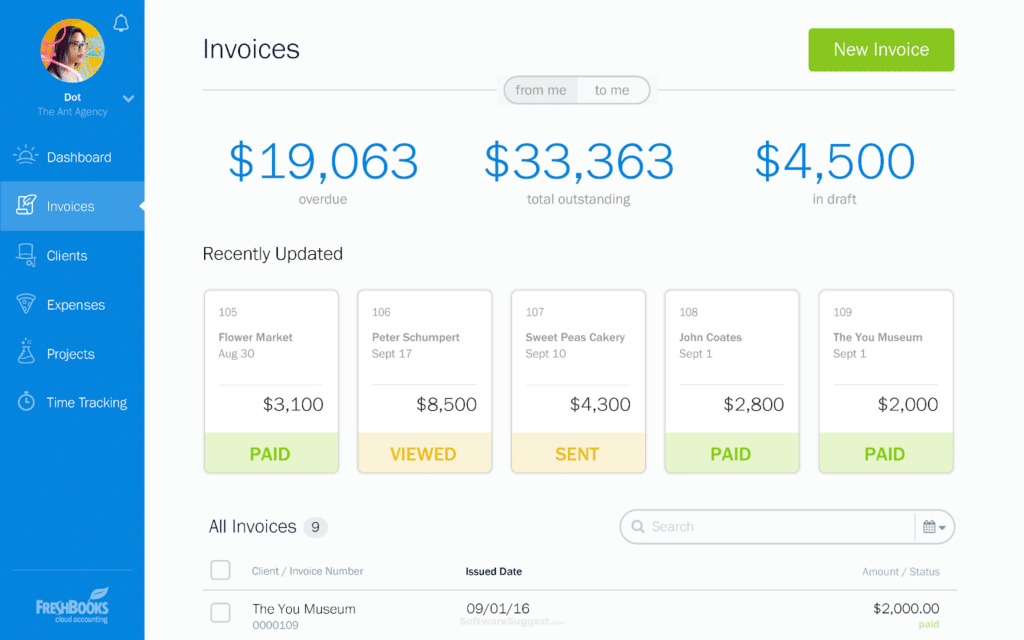

Invoicing: FreshBooks offers customizable invoicing, allowing users to create and send professional invoices to clients. It tracks invoice status, sends automated reminders, and provides options for recurring billing.

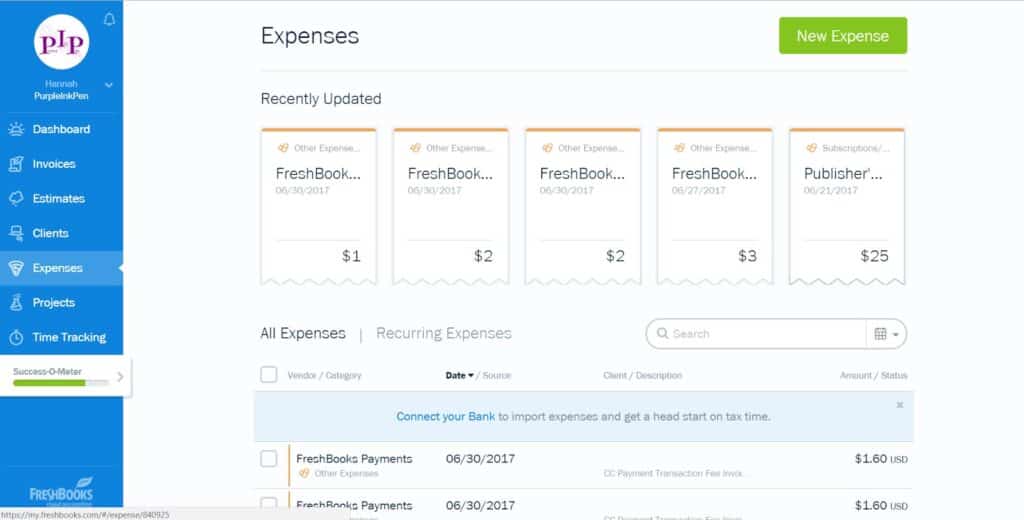

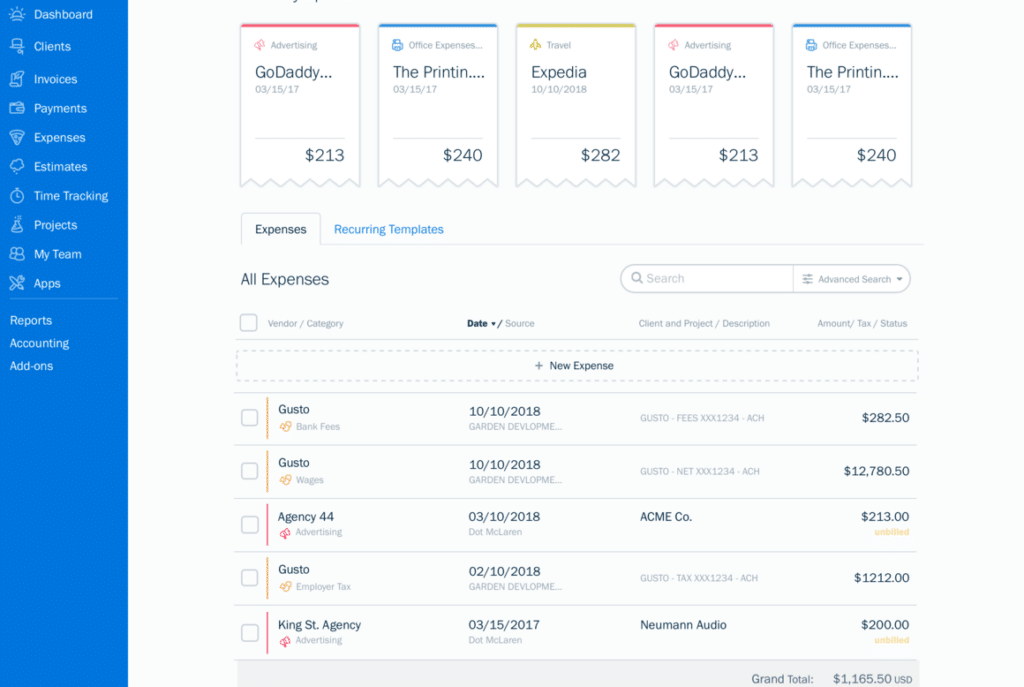

Expense Tracking: FreshBooks simplifies logging expenses by allowing users to upload receipts or connect bank accounts for automatic tracking. Expenses are automatically categorized, making it easier to manage financial records, which is especially useful during tax season.

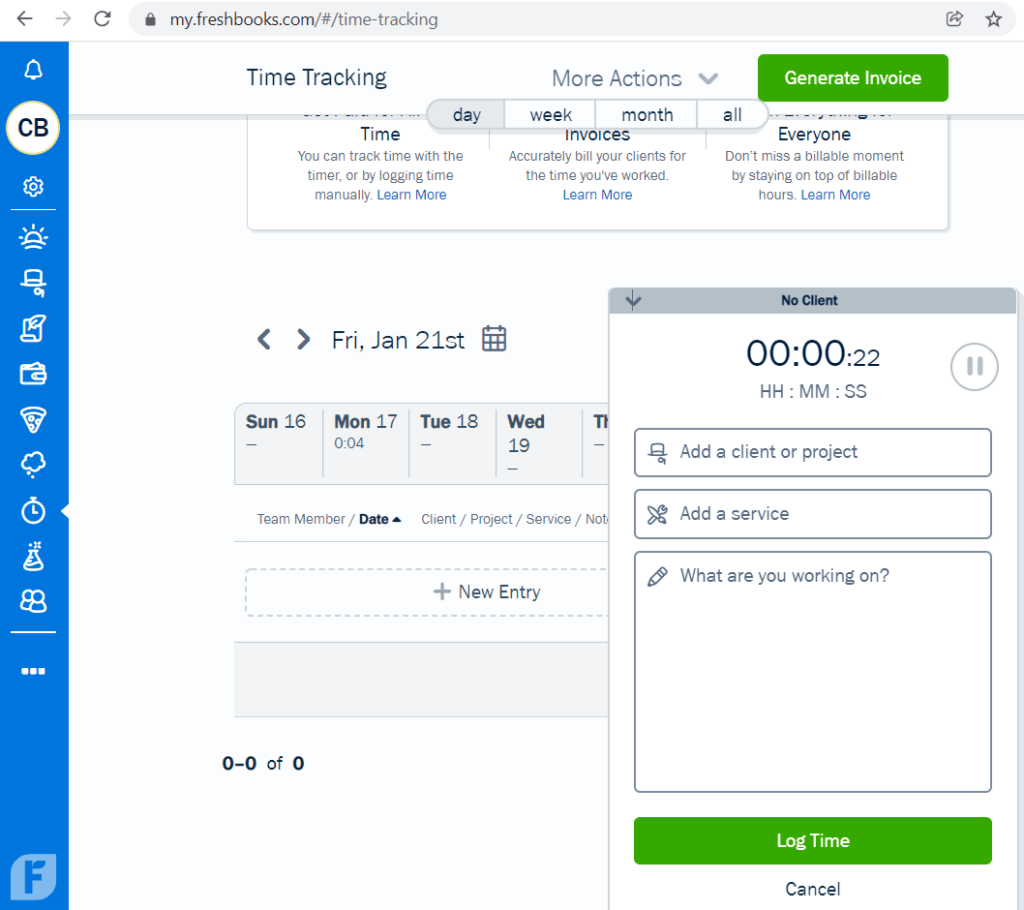

Time Tracking: Users can track billable hours directly in FreshBooks and assign them to specific clients or projects. This feature integrates smoothly with invoicing, allowing users to automatically add tracked time to invoices, making it easy to charge clients for time worked.

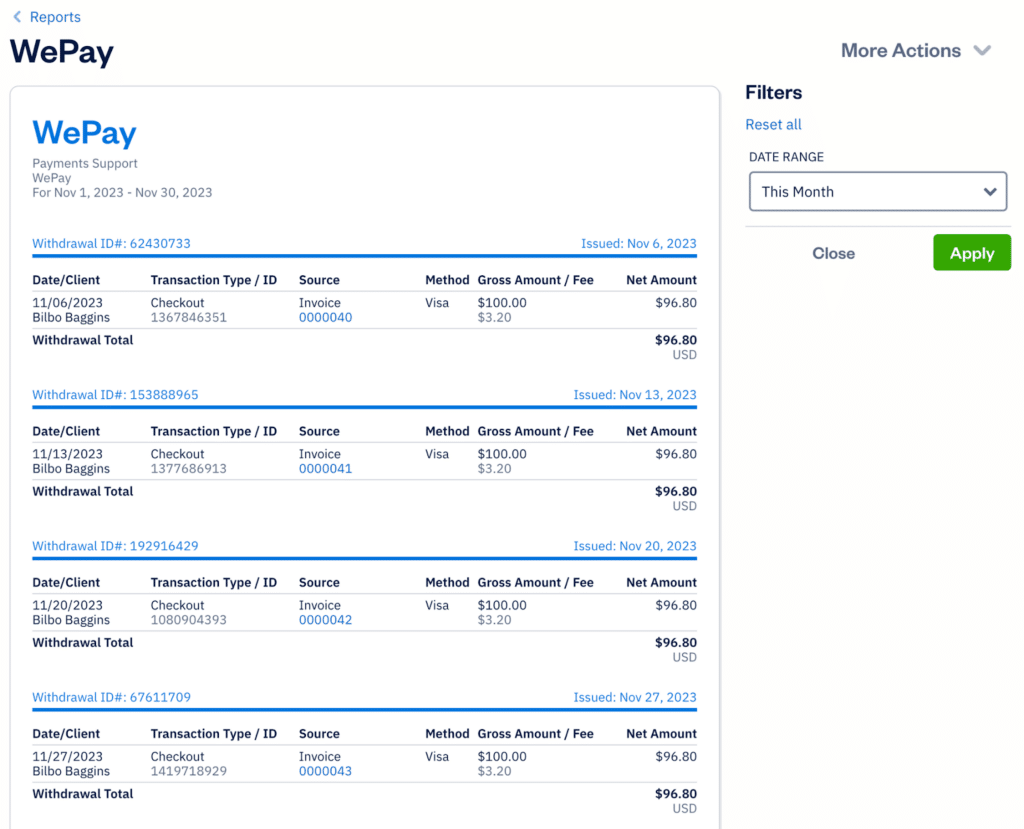

Payments: FreshBooks provides a built-in payment processing system that allows clients to pay invoices directly online. It supports multiple payment methods, including credit card payments and ACH transfers, helping businesses get paid faster.

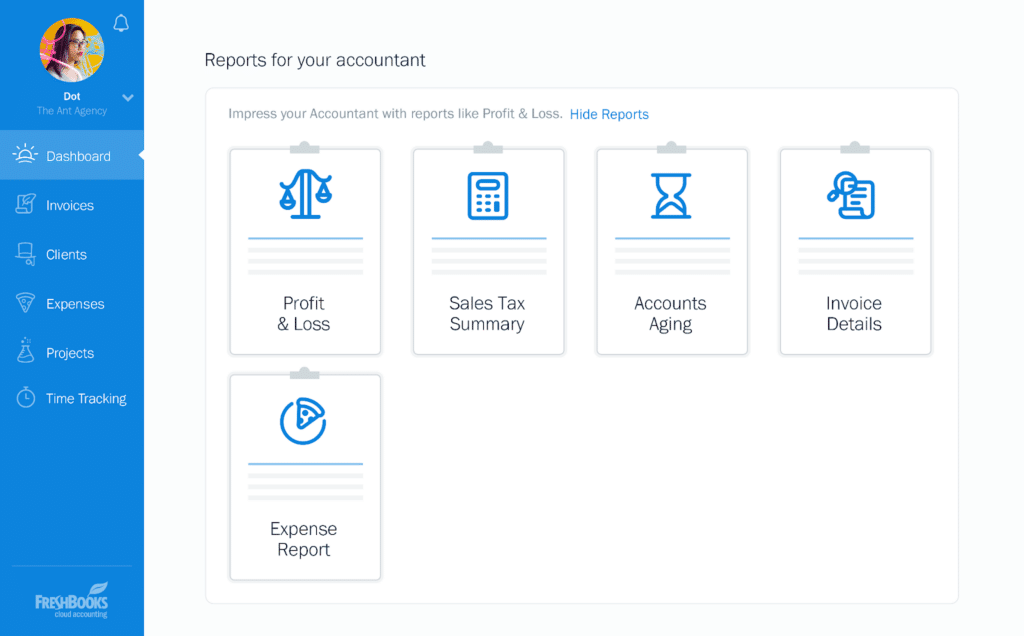

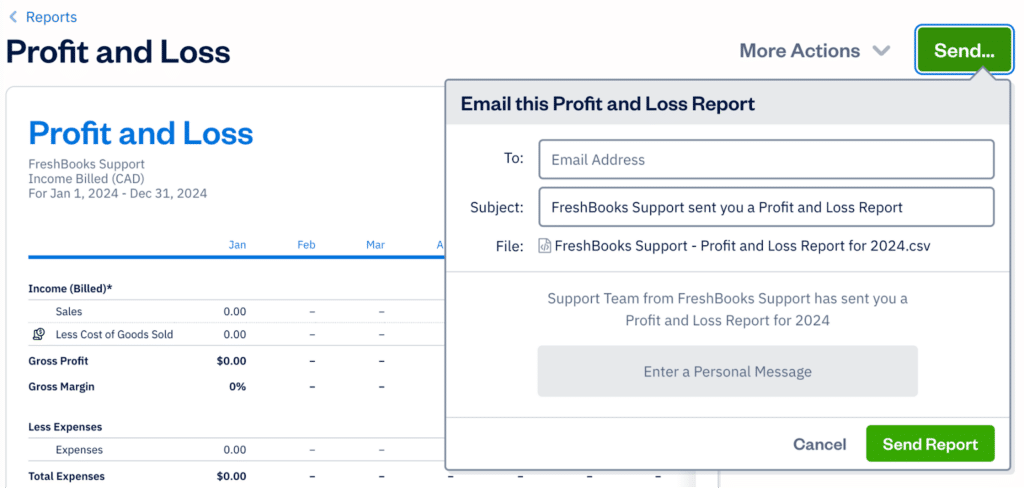

Reporting: FreshBooks provides financial reports, including profit and loss statements and expense reports, which offer a clear overview of business finances. While these reports cover essential financial metrics, more advanced reporting options may be somewhat limited compared to other accounting tools.

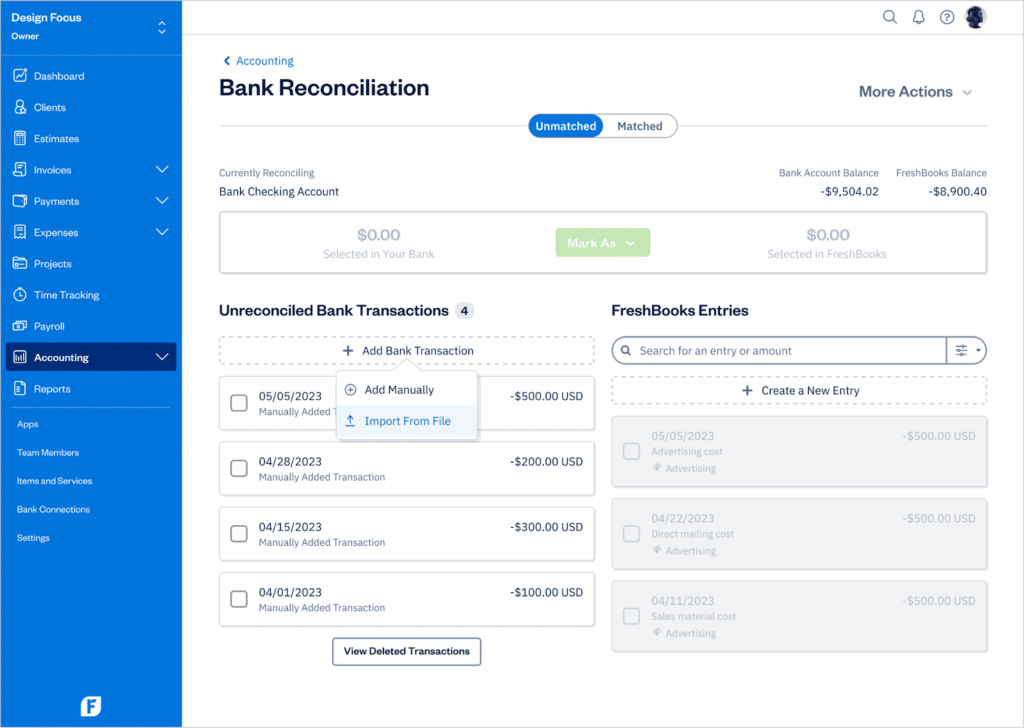

Bank Reconciliation: Users can connect their accounts payable to FreshBooks to automatically import transactions, simplifying the process of tracking expenses. This feature helps match financial records with bank transfers and statements for more accurate bookkeeping.

FreshBooks Standout Features

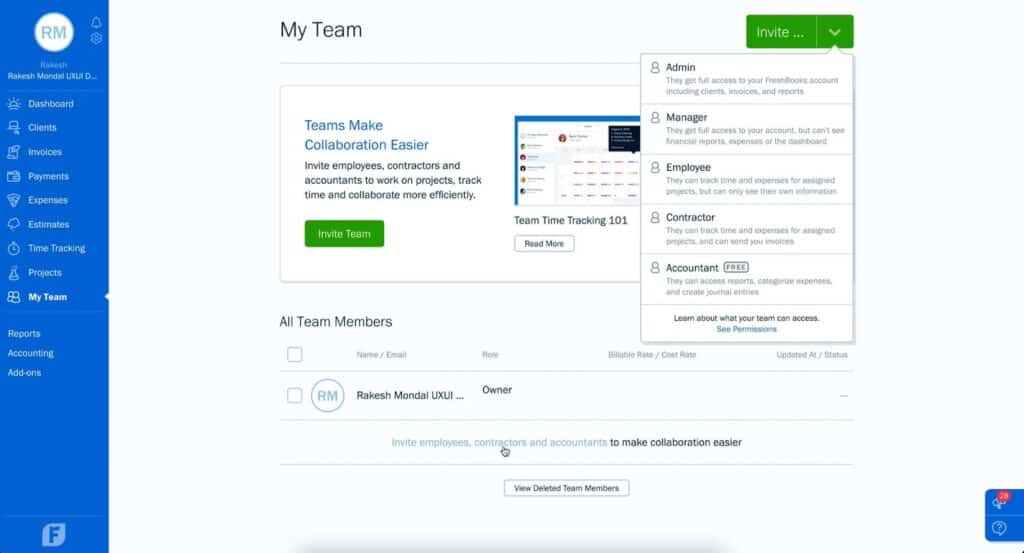

Project Collaboration: FreshBooks provides tools for managing client projects, including the ability to invite collaborators, share files, and track progress. This feature is especially beneficial for service-based businesses handling multi-phase projects.

Client Portal: FreshBooks offers a client portal where clients can view their invoices and make payments. This feature aims to enhance the client experience by providing a centralized location for financial transactions and updates.

Ease of Use

FreshBooks is one of the easiest accounting software platforms I’ve tested. Its intuitive design, clean interface, and straightforward workflows make it simple for users with little to no accounting experience to navigate.

Compared to more complex platforms like QuickBooks, FreshBooks is clearly geared toward users who need a simple and efficient tool to manage their finances without getting bogged down in complicated features.

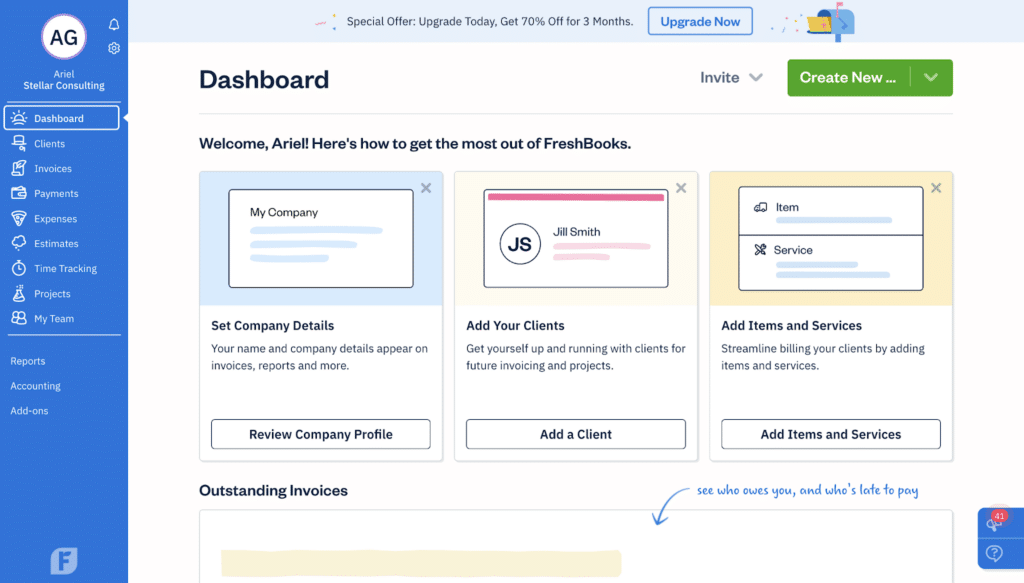

Onboarding

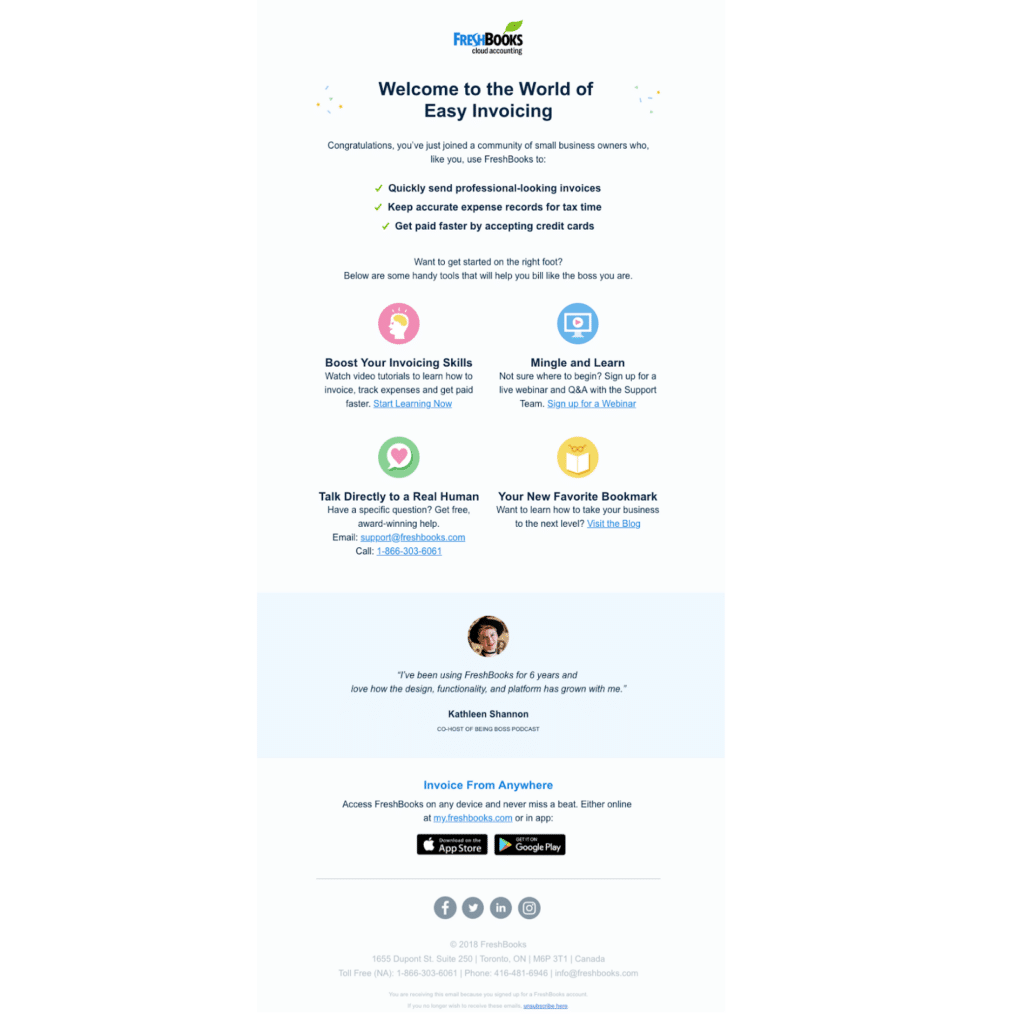

FreshBooks offers a smooth onboarding process to help new users get started quickly. The software provides email support and an advanced knowledge base filled with how-to guides and FAQs.

Along with an easy onboarding system, FreshBooks also offers an intuitive design and user-friendly navigation, requiring minimal time to learn the core features. This makes it a strong option for businesses looking to minimize onboarding time and streamline their accounting processes.

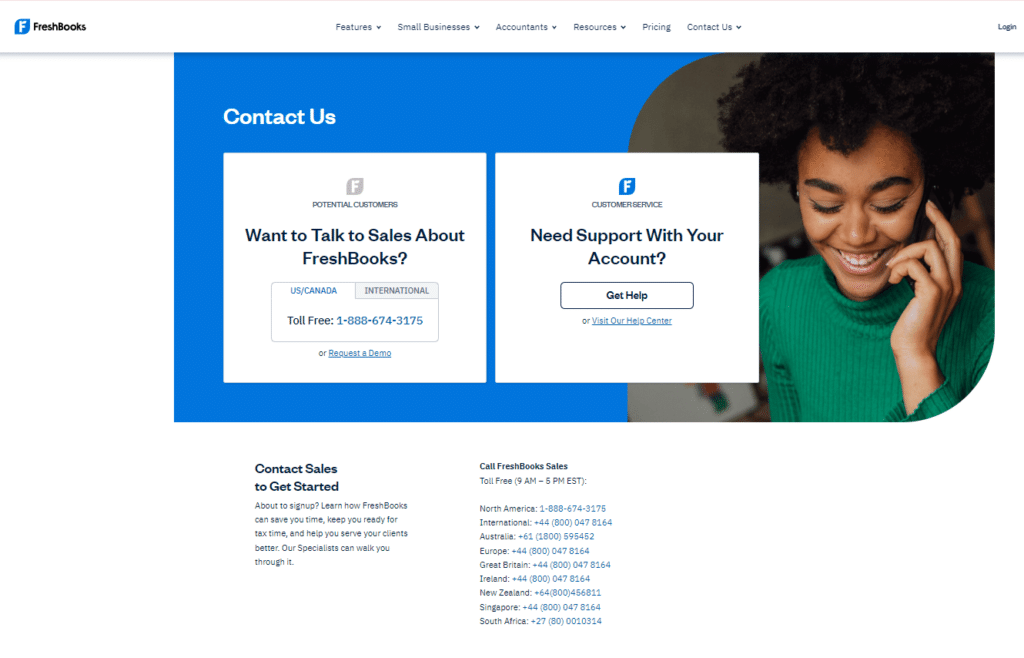

Customer Support

FreshBooks offers support via email and phone. There’s also a detailed knowledge base and FAQ section on their website. The software keeps users informed with regular product updates and allows for customer feedback through their support channels.

Integrations

FreshBooks integrates natively with Stripe, PayPal, Gusto, Shopify, Zapier, Slack, Mailchimp, Trello, Asana, and HubSpot.

FreshBooks also offers additional options through an API for custom integrations and supports further automation through Zapier. Users can access an app marketplace to explore other third-party integrations that expand the software’s functionality.

Value for Money

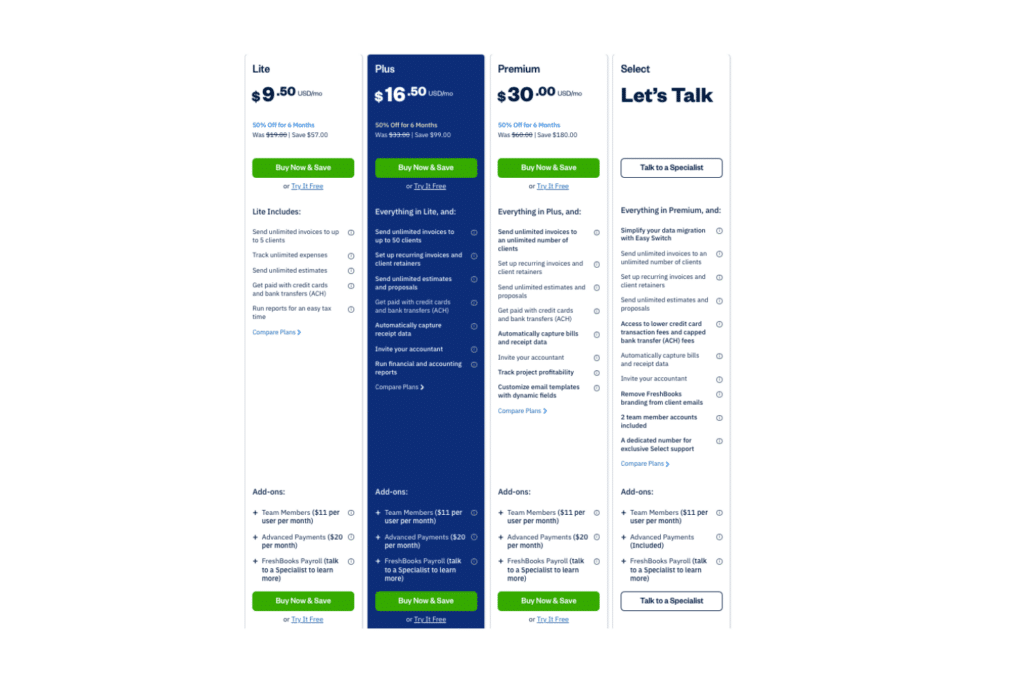

FreshBooks is generally priced in the mid-range compared to other accounting software. It offers multiple pricing plans that cater to different business sizes, from freelancers to businesses with a larger client base. While it isn’t the cheapest option available, the features provided, especially in the higher-tier plans, can justify the cost for businesses that need more functionality and client capacity.

Here’s a look at the pricing plan options for FreshBooks:

- Lite Plan: $9.50/month (up to 5 clients). Includes unlimited expense tracking, unlimited estimates, and easy tax filing.

- Plus Plan: $16.50/month (up to 50 clients). Include everything in the Lite Plan, plus unlimited invoices up to 50 clients, recurring invoices and client retainers, automatic receipt capture, and unlimited proposals.

- Premium Plan: $30/month (unlimited clients). Includes everything in the Plus Plan, plus unlimited invoices to unlimited client amount, customizable email templates, and project tracking.

- Select Plan: Custom pricing for advanced needs. Includes everything in the Premium Plan, plus access to lower credit card transaction fees, the ability to remove FreshBooks branding from client emails, 2 team member accounts, and dedicated support.

Each plan also includes optional add-ons like team members ($11/user/month) and advanced payments ($20/month). FreshBooks Payroll is also available as an additional service by consulting a specialist.

Product Specifications

| Feature | FreshBooks Availability |

| Invoicing | ✅ |

| Expense tracking | ✅ |

| Bank reconciliation | ✅ |

| Financial reporting | ✅ |

| Tax management | ✅ |

| Payment processing | ✅ |

| Multi-currency support | ✅ |

| Time tracking | ✅ |

| Inventory management | ❌ |

| Advanced financial forecasting | ❌ |

| Project profitability tracking | ✅ |

| Mobile app | ✅ |

| Recurring billing | ✅ |

| Client portal | ✅ |

| Payroll integration | ✅ |

| Offline access | ❌ |

| Vendor management | ✅ |

| Purchase orders | ❌ |

| Customizable templates | ✅ |

| Custom user permissions | ✅ |

| Multi-company support | ❌ |

| Automatic tax filing | ❌ |

| Advanced reporting features | ❌ |

| ACH payments | ✅ |

| Automated payment reminders | ✅ |

FreshBooks Alternatives

If you’re looking for alternative accounting software options to FreshBooks, here are a few worth checking out:

- QuickBooks: Offers more advanced reporting features and inventory management, making it ideal for larger businesses with complex accounting needs.

- Xero: Known for its scalability and multi-currency support, Xero is a great option for growing businesses and those with international operations.

- Wave: A free accounting tool with basic features, Wave is best suited for freelancers or very small businesses looking for no-cost accounting software.

- Zoho Books: Provides strong automation capabilities and integrates well with the rest of Zoho’s ecosystem, making it a good choice for companies already using Zoho products.

FreshBooks Frequently Asked Questions

What is FreshBooks?

FreshBooks is a cloud-based accounting software designed for small businesses, freelancers, and self-employed professionals. It helps users manage invoicing, track expenses, handle time tracking, and process payments. FreshBooks is known for its intuitive interface, making it accessible to users without a strong accounting background.

Is there a mobile app for FreshBooks?

Yes, FreshBooks offers a mobile app for both iOS and Android devices. The app allows users to create and send invoices, track time, manage expenses, and view financial reports. It’s designed to provide flexibility, letting users manage their accounting reports on the go.

Is FreshBooks HIPAA compliant?

No, FreshBooks is not HIPAA compliant. This means that businesses handling protected health information (PHI) should look for other accounting tools designed to meet HIPAA requirements. FreshBooks is more suited for general small businesses, freelancers, and service-based companies that do not manage sensitive health data.

Is FreshBooks SOC 2 compliant?

Yes, FreshBooks is SOC 2 compliant, which means it meets the standards for managing customer data based on security, availability, and confidentiality. This certification ensures that FreshBooks implements rigorous data protection controls to safeguard user information.

Is FreshBooks secure?

FreshBooks takes security seriously and implements multiple layers of protection, including 256-bit SSL encryption for data transmission. User data is stored in secure data centers with monitoring and firewalls to prevent unauthorized access. FreshBooks also offers two-factor authentication to enhance login security.

Is FreshBooks FedRAMP certified?

No, FreshBooks is not FedRAMP certified. This certification is typically required for cloud service providers working with federal agencies in the United States. If your organization needs to comply with FedRAMP, you will need to consider alternatives designed for government use.

Is FreshBooks GDPR compliant?

Yes, FreshBooks is GDPR compliant, which means it adheres to the data protection regulations required by the European Union. FreshBooks offers tools for users to manage data privacy settings and provides transparency on how customer data is processed and stored. Users can also request data deletion to ensure compliance.

Is FreshBooks secure for financial transactions?

FreshBooks provides a secure platform for financial transactions by encrypting payment data and adhering to industry-standard security practices. It supports integration with secure payment gateways like Stripe and PayPal, ensuring that client payments are processed safely. FreshBooks also keeps transaction history for easy tracking and auditing.

FreshBooks Company Overview & History

FreshBooks is a cloud-based accounting software that focuses on invoicing, retainers, expense tracking, and time management tools, targeting small businesses, freelancers, and self-employed professionals. The company is headquartered in Toronto, Canada and reports having a global user base across 160+ countries.

FreshBooks is known for its user-friendly interface and customer-centric approach. It emphasizes providing excellent customer support, reflected in its high support approval ratings. The company caters to a global client base, including agencies, consultants, and creative professionals.

With over 30 million users in more than 160 countries, it is widely used by freelancers, solopreneurs, and small to medium-sized businesses. FreshBooks is privately held, and detailed financial information such as revenue, valuation, or stock details is not publicly available.

FreshBooks Major Milestones

- 2003: FreshBooks was founded by Mike McDerment after he became frustrated with existing invoicing software.

- 2004: The first version of FreshBooks was officially launched.

- 2017: FreshBooks completed a rebranding and significant product update, launching its redesigned platform.

- 2021: FreshBooks raised $80.75 million in Series E funding, boosting its valuation to over $1 billion.

- 2022: FreshBooks continued expanding globally, entering new markets across Europe and Asia.

Want to learn more about FreshBooks? Check out their site for additional information.

From $15/month

30-day free trial

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.