If you want to learn how to manage your books without signing up for a 4-year degree, these accounting courses are for you. I've included summaries of who each course is for, what they teach, and why I've chosen them.

Quick Vibe Check

Before you go sign up for a course, I want to make sure you aren’t just needing a little extra help.

If you’re a business owner or manager who needs to clean up your books — but doesn’t really care about being an accounting whiz — use accounting software instead. Seriously, it’ll save you time, money, and let’s be real: you wouldn’t complete courses you don’t care about, anyway.

Here are the best accounting tools on the market:

Best Accounting Courses Shortlist

Here's a shortlist of the best accounting courses in 2025:

- Learn Accounting for Free (AccountingCoach)

- Financial Accounting Fundamentals (University of Virginia)

- Financial Accounting Basics (Alison)

- Accounting Principles I (CPA Credits)

- Accounting Ethics (LinkedIn Learning)

- Financial Accounting (Harvard Business School Online)

- Financial Accounting (Massachusetts Institute of Technology)

- Financial Accounting (Association of Chartered Certified Accountants)

- Accounting Crash Course (Wall Street Prep)

- Accounting Fundamentals (Corporate Finance Institute)

- Financial Accounting (Southern New Hampshire University)

- Principles of Financial Accounting (IESE Business School)

- Intermediate Financial Accounting I (CPA Credits)

Find more details about each course below.

Overview of the Best Accounting Courses

1. Learn Accounting for Free (AccountingCoach)

This course provides a foundational understanding of accounting, covering essential concepts needed to grasp basic accounting practices. It includes detailed explanations of financial statements, accounting equations, and the mechanics of debits and credits.

- Who It’s For: Beginners seeking a foundational understanding of accounting and accounting software

- Topics Covered:

- Understanding financial statements

- Basics of bookkeeping and accounting principles

- Payroll and bank reconciliation processes

- Managing accounts receivable and payable

- Business tax concepts

- Online, In-Person, or Both? Online

- Exam Required? No

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price:

- Free (limited)

- Pro: $99 (One-time fee, lifetime access)

- Pro Plus: $159 (One-time fee, lifetime access) (Certificates of Achievement)

- Take The Course: AccountingCoach

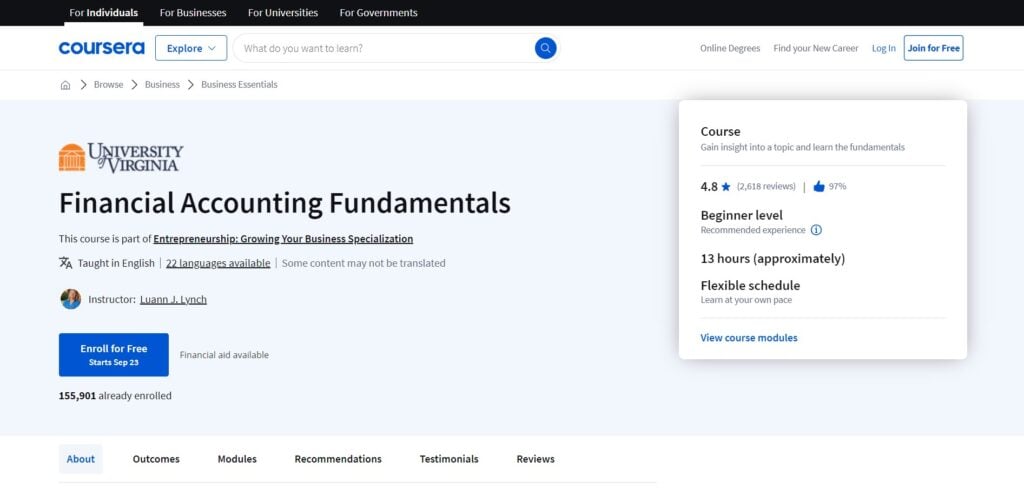

2. Financial Accounting Fundamentals (University of Virginia)

This course teaches the basics of financial accounting. Participants learn how to interpret financial statements, analyze business performance, and use accounting information for decision-making.

- Who It’s For: Individuals new to financial accounting

- Topics Covered:

- Analyzing income statements and balance sheets

- Understanding cash flow statements

- Applying accounting principles to business scenarios

- Interpreting financial ratios

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 13 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free

- Take The Course: Coursera

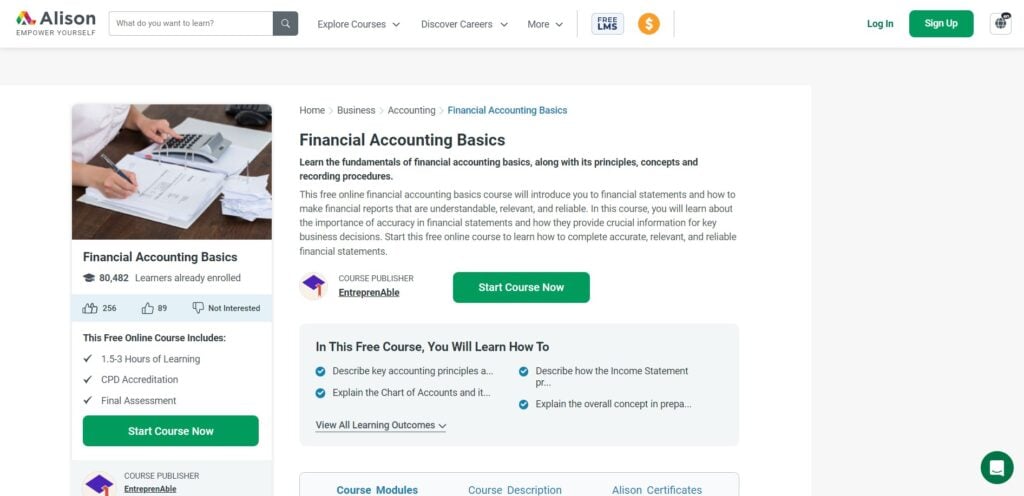

3. Financial Accounting Basics (Alison)

This course covers fundamental accounting principles, focusing on recording financial transactions and understanding financial statements. The course helps learners grasp key accounting concepts essential for managing finances in business using technology.

- Who It’s For: Students, small business owners, and beginners seeking foundational accounting skills.

- Topics Covered:

- Recording and classifying financial transactions

- Understanding the double-entry system

- Preparing income statements and balance sheets

- Analyzing financial reports

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 1.5 - 3 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free

- Take The Course: Alison

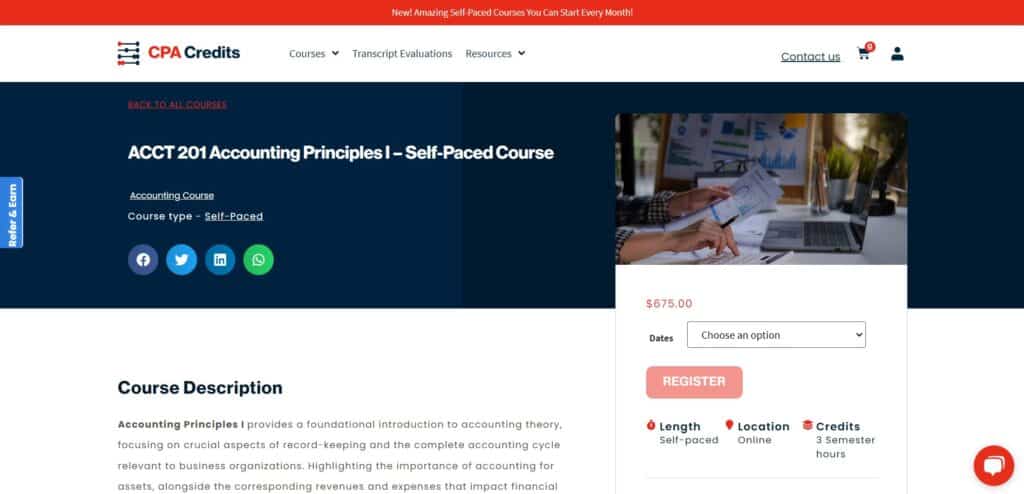

4. ACCT 201 Accounting Principles I (CPA Credits)

This course introduces fundamental accounting concepts, including the accounting cycle, financial statement preparation, and applying accounting principles in business decision-making. It is designed to build a solid foundation in accounting for further studies or professional practice.

- Who It’s For: Students and professionals beginning their accounting education.

- Topics Covered:

- The accounting cycle and double-entry bookkeeping

- Preparing and analyzing financial statements

- Understanding accrual accounting

- Internal controls and cash management

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 3 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $675.00

- Take The Course: CPA Credits

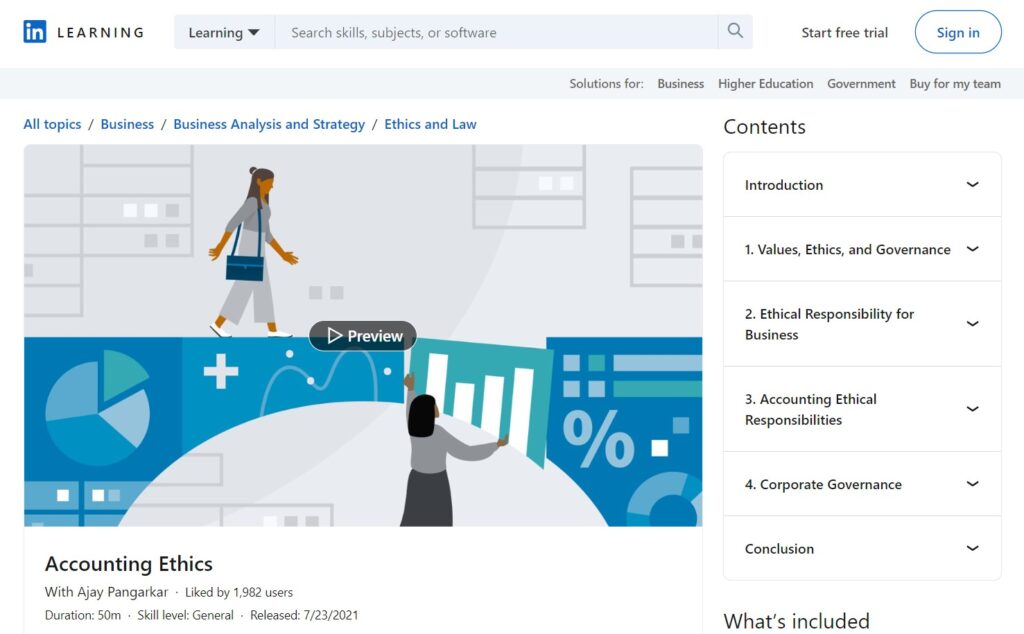

5. Accounting Ethics (LinkedIn Learning)

This course focuses on the ethical standards and principles that guide accounting professionals. It covers ethical decision-making, integrity in financial reporting, budgeting, auditing, and navigating ethical dilemmas in accounting.

- Who It’s For: Accounting professionals and students

- Topics Covered:

- Ethical standards in accounting practices

- Recognizing and resolving ethical dilemmas

- The role of integrity and objectivity in financial reporting

- Understanding professional codes of conduct

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 50 minutes

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free 1 month

- Take The Course: LinkedIn Learning

6. Financial Accounting (Harvard Business School Online)

The course teaches participants how to interpret financial data, make informed business decisions, and understand the impact of accounting on company performance. This accounting program covers essential accounting principles with real-world applications.

- Who It’s For: Business professionals, aspiring managers, and entrepreneurs

- Topics Covered:

- Fundamentals of financial statement analysis

- Revenue recognition and cash flow analysis

- Adjusting entries and financial reporting

- Analyzing profitability and business health

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 8 weeks

- How Many Hours Of Instruction: 6 to 8 hours per week

- Eligibility Requirements: None

- Price: $1,850

- Take The Course: HBS Online

7. MITx: Financial Accounting (Massachusetts Institute of Technology)

This course teaches essential accounting skills for analyzing financial statements and making data-driven decisions. It focuses on key accounting concepts, financial statement preparation, and evaluating company performance using accounting data.

- Who It’s For: Students and professionals wanting an in-depth understanding of financial accounting

- Topics Covered:

- Understanding financial statements and accounting principles

- Analyzing income statements, balance sheets, and cash flow

- Revenue recognition and expense matching

- Applying accounting data for business decision-making

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 12 weeks

- How Many Hours Of Instruction: 10 - 14 hours per week

- Eligibility Requirements: None

- Price:

- Free

- $549 (with certificate)

- Take The Course: edX

8. ACCA: Financial Accounting (Association of Chartered Certified Accountants)

Offered by the Association of Chartered Certified Accountants, this course provides an in-depth understanding of financial accounting principles, focusing on preparing financial statements and analyzing business transactions. The course is structured to help learners gain the skills required for the ACCA qualification.

- Who It’s For: Aspiring accountants and ACCA students

- Topics Covered:

- Understanding double-entry accounting systems

- Preparing trial balances and financial statements

- Analyzing and interpreting financial data

- Applying accounting principles to real-world scenarios

- Online, In-Person, or Both? Online

- Exam Required? Yes

- Duration: 12 weeks

- How Many Hours Of Instruction: 5 - 8 hours per week

- Eligibility Requirements: None

- Price:

- Free

- $119 (with certificate)

- Take The Course: edX

9. Accounting Crash Course (Wall Street Prep)

The course provides a comprehensive introduction to accounting fundamentals, tailored for finance professionals. The accounting classes emphasize financial statement construction, analysis, and the accounting principles critical for economic modeling.

- Who It’s For: Professionals needing a quick overview of accounting

- Topics Covered:

- Creating and analyzing balance sheets, income statements, and cash flow statements

- Understanding accrual accounting and adjusting entries

- Financial forecasting techniques

- Reconciling and interpreting financial data

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 7 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $39

- Take The Course: Wall Street Prep

10. Accounting Fundamentals (Corporate Finance Institute)

This course teaches essential accounting skills, focusing on financial statement analysis, accounting principles, and the impact of financial data on business decisions. It is designed to provide a strong foundation for those working in corporate finance.

- Who It’s For: Finance professionals, analysts, and beginners looking to build accounting skills.

- Topics Covered:

- Financial records

- Preparing balance sheets, income statements, and cash flow statements

- Understanding the accounting cycle and financial analysis

- Applying accounting principles to business decisions

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 5 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price:

- $497 per year (All Access Self-Study)

- $847 per year (Premium Access Full-Immersion)

- Take The Course: Corporate Finance Institute

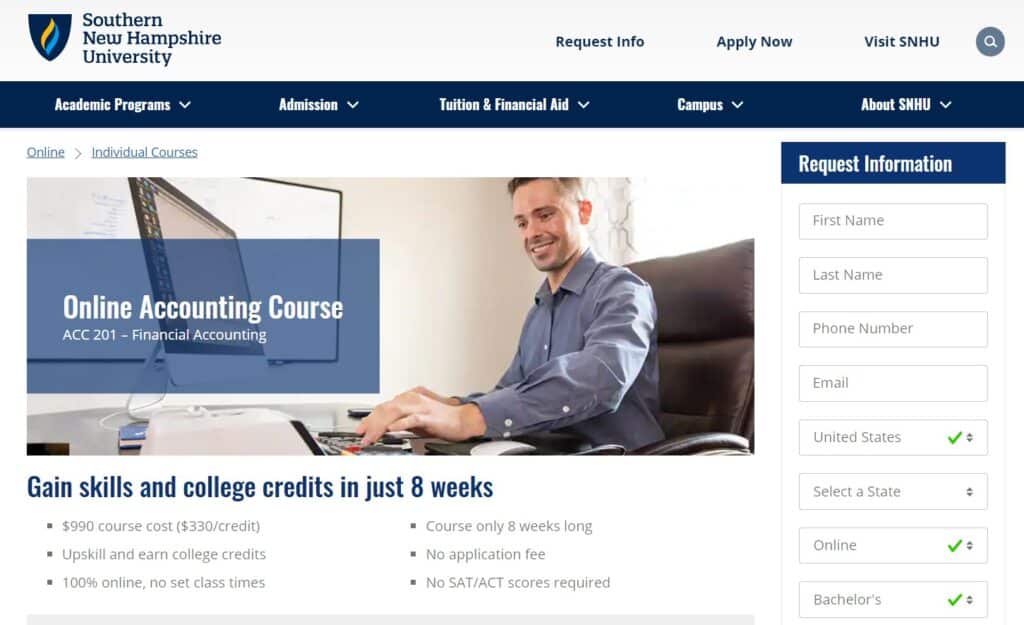

11. ACC 201 – Financial Accounting (Southern New Hampshire University)

This course provides an in-depth understanding of accounting principles, focusing on analyzing financial statements and using accounting data for decision-making. The course covers the essential skills needed to manage financial information in a business setting.

- Who It’s For: Students, aspiring accountants, and business professionals.

- Topics Covered:

- Recording financial transactions

- Preparing and interpreting income statements and balance sheets

- Analyzing cash flow statements

- Understanding the impact of accounting on business decisions

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 8 weeks

- Eligibility Requirements: None

- Price: $990

- Take The Course: SNHU

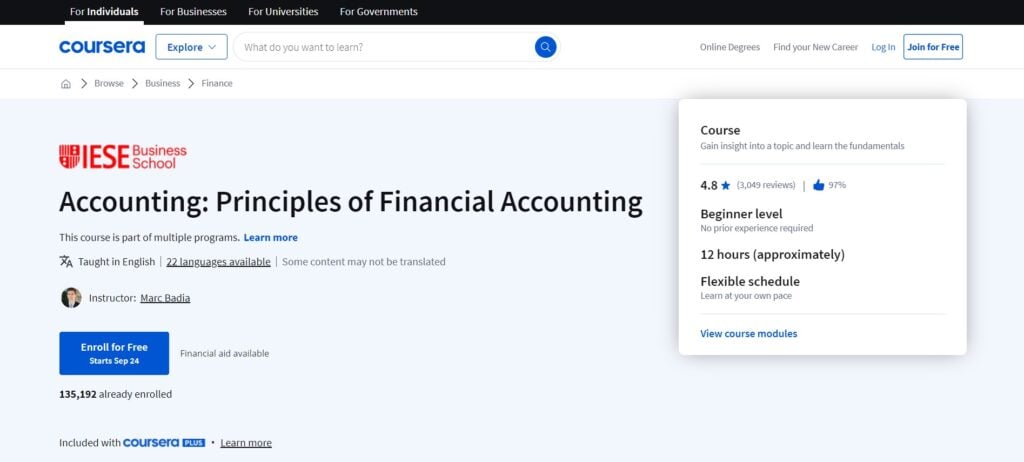

12. Accounting: Principles of Financial Accounting (IESE Business School)

This University of Illinois course on Coursera introduces the basics of financial accounting. It covers how to prepare and analyze financial statements, understand accounting principles, and use financial data to make business decisions.

- Who It’s For: Students, business professionals, and anyone new to business financial accounting.

- Topics Covered:

- Preparing and analyzing balance sheets and income statements

- Understanding the accrual accounting process

- Evaluating business performance using financial ratios

- Applying accounting principles to real-world scenarios

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 12 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: Free

- Take The Course: Coursera

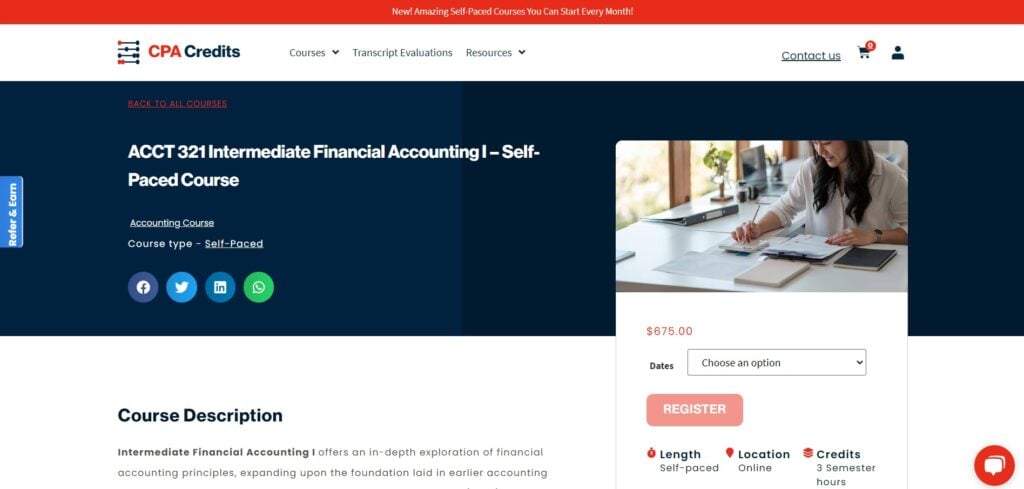

13. ACCT 321 Intermediate Financial Accounting I (CPA Credits)

This course delves into intermediate-level financial accounting. It covers more complex accounting topics and principles. Students will explore the key organizations responsible for establishing financial reporting policies and gain a strong understanding of the components that form the foundation of the conceptual framework for financial reporting, which is essential for interpreting and implementing accounting standards.

- Who It’s For: Students and professionals advancing their accounting knowledge.

- Topics Covered:

- Detailed revenue recognition methods

- Inventory costing techniques and valuation

- Accounting for long-term liabilities

- Financial statement analysis for decision-making

- Online, In-Person, or Both? Online

- Exam Required? No

- Duration: 3 hours

- How Many Hours Of Instruction: Self-paced

- Eligibility Requirements: None

- Price: $675.00

- Take The Course: CPA Credits

What’s Next

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.