Wave is an accounting software that offers a straightforward pricing structure without multiple tiers. Financial operators use Wave Accounting to manage their accounting needs efficiently. Wave Accounting's pricing structure is lower cost compared to its competitors and offers good value. This guide covers everything you need to know about Wave Accounting pricing, plans, and costs to make an informed purchase decision with confidence.

How Much Does Wave Accounting Cost?

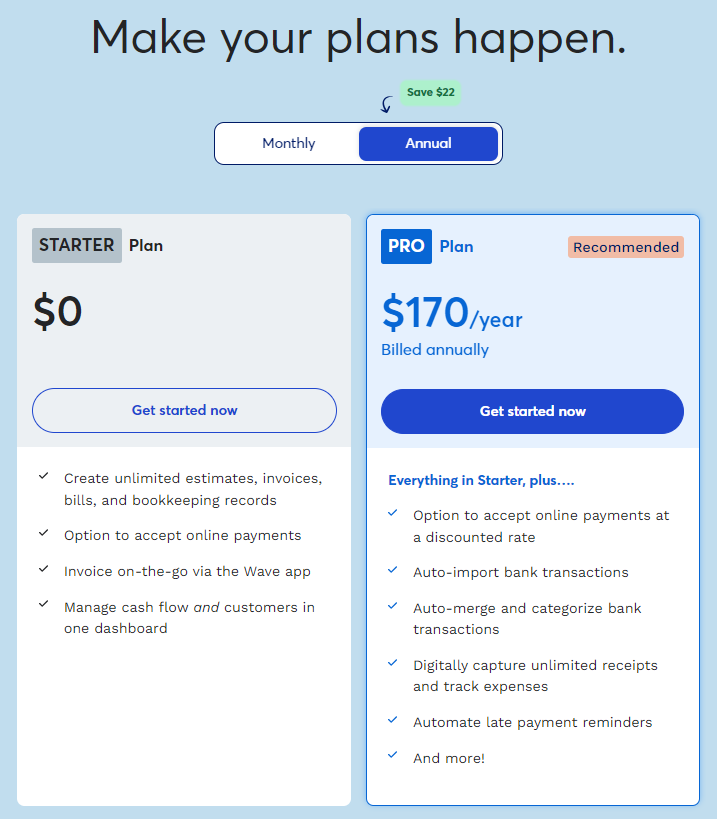

Wave Accounting offers both free and monthly fee plans. The free accounting plan includes basic features suitable for freelancers and small businesses. For more advanced needs, such as additional users and automated transaction imports, Wave Accounting offers a paid plan priced at $16/business/month or $170/business/year.

Wave Accounting Plans & Pricing Tiers

Here's an overview of the available Wave Accounting plans:

| Plan Type | Price | What’s Included? |

| Starter Plan | $0/business/month | Basic accounting tools, invoicing, receipt scanning, expense tracking, Income tracking, reports, add users, and a mobile app |

| Pro Plan | $16/business/month | All Starter features, plus auto-import bank transactions, auto-merge and categorize transactions, digitally capture receipts, add additional users, priority support, customizable invoices, unlimited users, and recurring billing |

Let’s break down the available Wave Accounting plans a bit further:

Wave Accounting Starter Plan

The Starter Plan is ideal for small businesses, freelancers, and entrepreneurs seeking basic financial tools. It’s designed for industries such as retail, consulting, and creative services. This plan includes accounting, invoicing, and receipt scanning features. It's best suited for users who need simple financial management. Limitations include no payroll or payment processing, and access to additional features requires upgrading.

Wave Accounting Pro Plan

The Pro Plan is suited for growing businesses that require more advanced financial features. It’s ideal for companies in industries like professional services and mid-sized retail. This plan offers full accounting, invoicing, receipt scanning, and advanced payroll management. It's best suited for businesses with more complex financial needs. Limitations include higher fees for additional payroll services and payment processing.

Wave Accounting Pricing vs. Competitors

Wave Accounting is generally considered affordable compared to other accounting software. It offers a Starter Plan that includes essential key features like invoicing, accounting, and receipt scanning. Competitors like QuickBooks and Xero have higher starting prices and often lock advanced features and integrations behind more expensive plans. On the other hand, Wave provides strong security safeguards across all its plans.

Comparison Chart: Wave Accounting vs. Alternatives

Wondering how Wave Accounting pricing compares to other accounting software? Here’s a comparison chart that breaks down the costs of other accounting software side-by-side:

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for automated expense management | 30-day free trial + free plan available | From $15/user/month | Website | |

| 2 | Best for service-based businesses | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 3 | Best for cash flow insights | 14-day free trial | From $25/month | Website | |

| 4 | Best for enterprise accounting | Free demo available | Pricing upon request | Website | |

| 5 | Best for small businesses | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 6 | Best for fast-growing businesses | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 7 | Best for comprehensive invoicing and billing | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 8 | Best for mid-sized businesses | Free demo available | Pricing upon request | Website | |

| 9 | Best for multi-entity financial management | Free demo | Pricing upon request | Website | |

| 10 | Best for freelancers | Free plan available | From $16/user/month | Website |

Alternatives to Wave Accounting

Wave Accounting is a solid accounting software, but there are plenty of other options out there. Depending on your use case, budget, team size, and other factors, you might consider shopping around for a solution that’s better suited to your needs. If you’re looking for alternative accounting software options to Wave Accounting, here are a few worth checking out:

Our one-on-one guidance will help you find the perfect fit.

How to Choose the Right Wave Accounting Plan

When deciding which Wave Accounting plan to go with, you’ll want to consider the added value and potential drawbacks that come with each option. Scrolling through long lists of features can quickly lead to confusion and uncertainty, so here are a few factors to keep in mind as you evaluate and assess your choices:

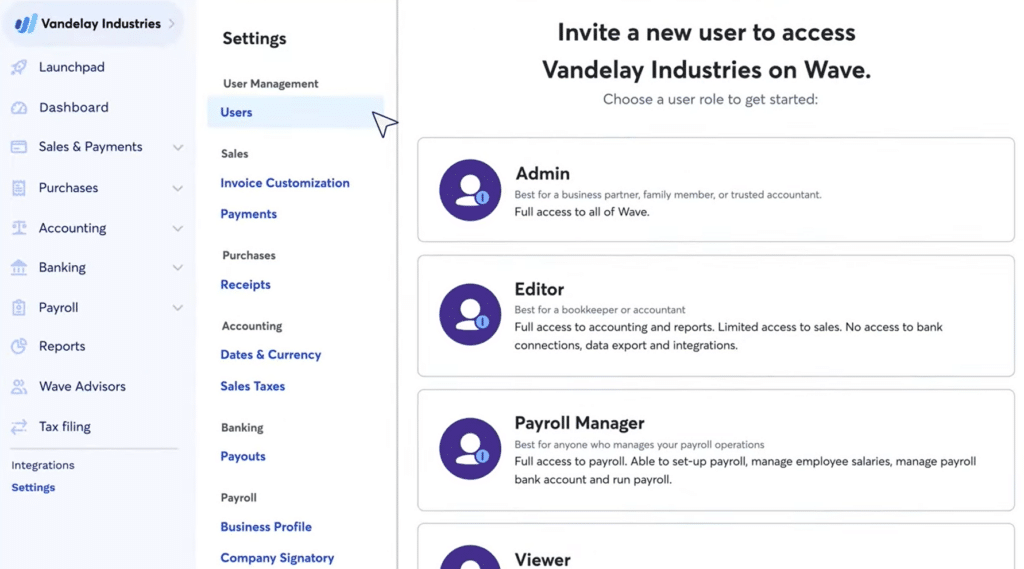

Wave Accounting Scalability and Team Size

Evaluating Wave Accounting's scalability is vital for your team’s size and growth trajectory.

Wave Accounting offers a free Starter Plan, ideal for freelancers and small teams needing basic accounting features. For growing businesses, the Pro Plan, at $16/business/month, includes advanced features like priority support and transaction fee discounts.

Medium-sized teams handling multiple transactions may also benefit from these enhanced services, ensuring efficient financial management as they expand. Larger teams with extensive payroll needs might consider the Pro Plan with add-on features offered by Wave Accounting, such as unlimited receipts, payroll, and bookkeeping.

Industry-Specific Wave Accounting Features

Along with scalability, teams should also consider each plan’s individual features.

Wave Accounting offers features tailored to various industries, enhancing team productivity. For instance, contractors generally benefit from the professional invoice templates and automated payment reminders. On the other hand, legal firms can explore Wave Accounting’s customization features for different law practices, while restaurants can use it for expense tracking and payroll management.

Wave Accounting's core features are available across all plans, ensuring accessibility regardless of subscription level. However, more advanced features, such as message templates and auto-import are only available through the Pro Plan.

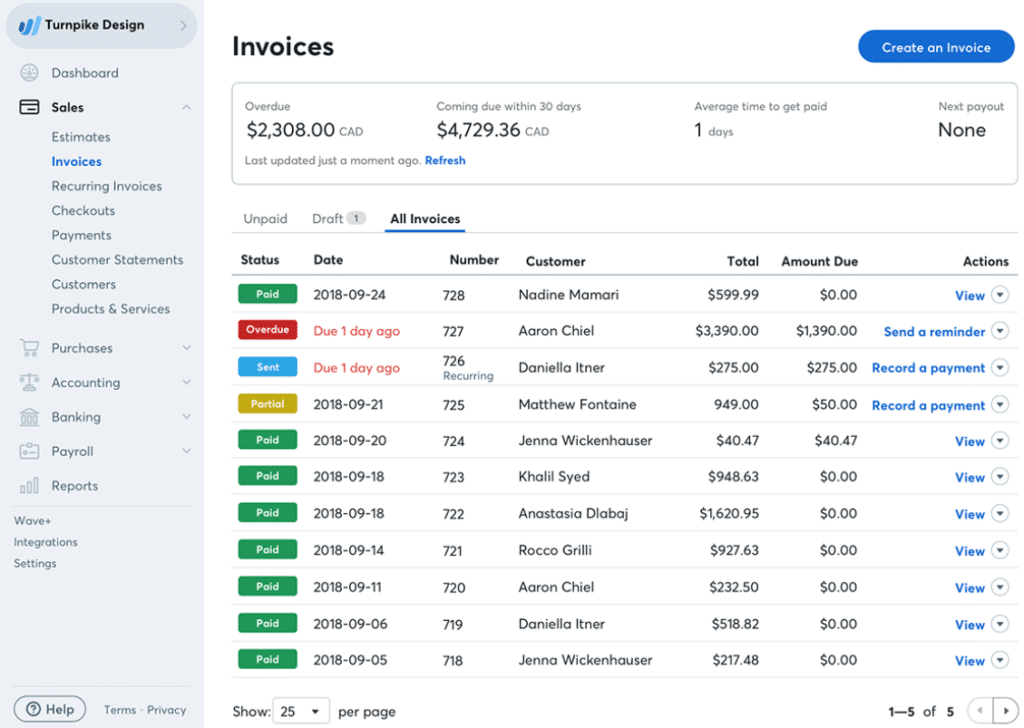

Wave Accounting Integration Capabilities

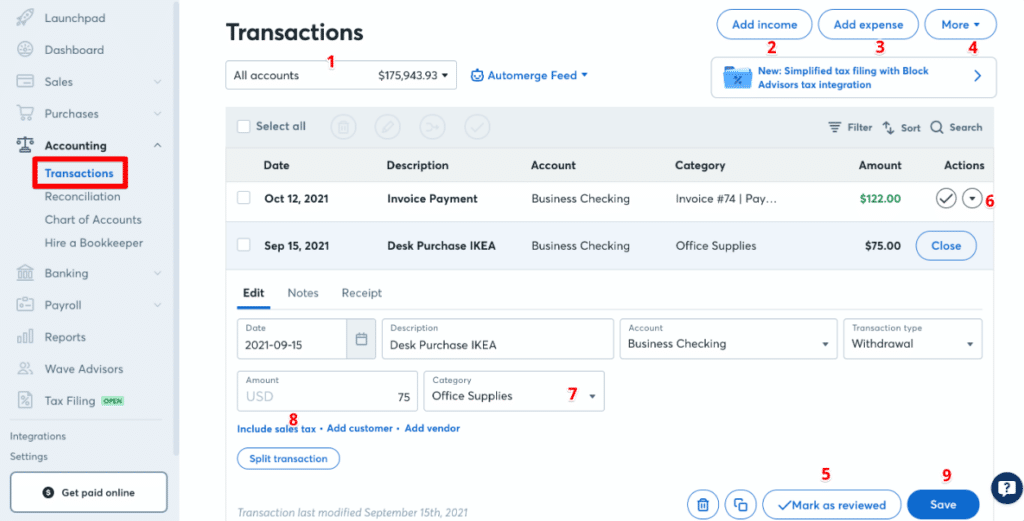

Connecting your accounting software to your existing tech stack is vital for easy operations and efficient data management.

Wave Accounting offers native integrations with various apps and services, including Google Drive, PayPal, and Stripe. Additionally, Wave Accounting can be connected to over 6000 apps through Zapier, enabling further automation and integration possibilities. For custom solutions, Wave Accounting provides an API, allowing your team to build tailored integrations that meet specific business needs.

Wave Accounting Security Safeguards

Users need to consider the safety and security features included with different Wave Accounting plans to protect their financial data.

Wave Accounting secures your data with up to 256-bit TLS encryption, similar to online banking and shopping standards. Data is stored on secure servers with strict controls. Wave Accounting also offers multi-factor authentication for an extra layer of security. These features are consistent across all Wave Accounting plans, ensuring that your financial information remains protected regardless of the plan you choose.

Wave Accounting Pricing FAQs

Here are answers to a few common questions about Wave Accounting’s pricing:

What additional costs should I anticipate with Wave Accounting?

While Wave Accounting offers many of its core features for free, there are additional costs you may encounter:

- Credit Card Processing Fees: 2.9% + $0.60 per transaction for Visa, Mastercard, and Discover, and 3.4% + $0.60 per transaction for American Express.

- Bank Payment (ACH) Fees: 1% per transaction with a $1 minimum fee.

- Wave Payroll: $40 monthly base fee, plus $6 per active employee or independent contractor paid per month.

Are there any discounts or promotions available for Wave Accounting?

Wave Accounting provides a few opportunities for discounts and promotions:

- Referral Program: Users can share a 20% discount with friends through a trackable code, and in return, they earn a free month of access to certain Wave services.

- Discounted Rates for Online Payments: Users have the option to accept online payments at a discounted rate for the first 10 transactions in a month.

How often does Wave Accounting change its pricing structure?

Wave Accounting does not frequently change its pricing structure. The pricing for its core services has remained stable over recent years. The specifics of the last change or frequency of changes are not publicly detailed on the website, suggesting infrequent adjustments.

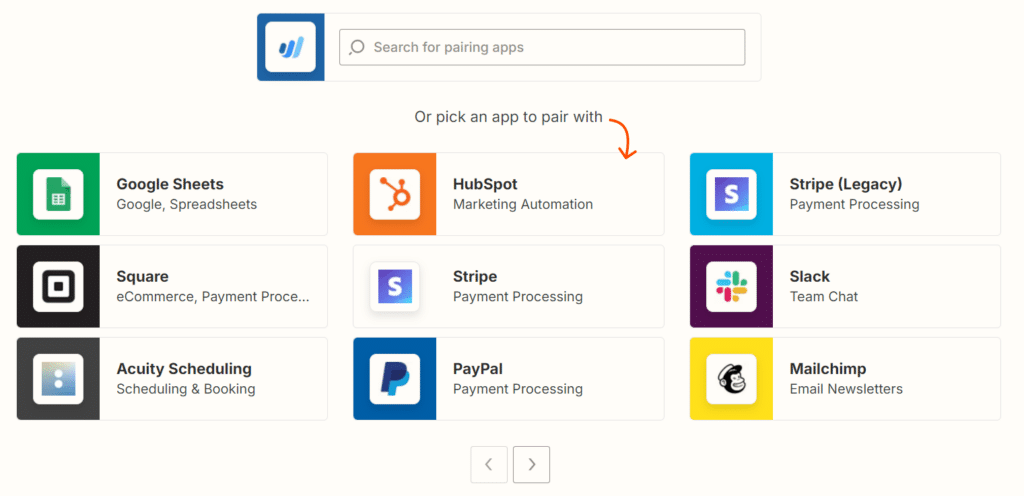

Are there any fees for using Wave Accounting's invoicing and accounting software?

No, Wave Accounting’s invoicing and accounting software is free to use. Users can create, send, and edit recurring invoices without incurring any charges.

What is the cost of Wave Accounting’s advisory services?

Wave Advisors offers personalized bookkeeping support and coaching for small business owners. The pricing for these services is not specified on the main pricing page, and interested users are encouraged to contact Wave Accounting directly for detailed information.

Can I access all features of Wave Accounting for free?

Most of Wave Accounting’s essential features, including accounting, invoicing, and receipt scanning, are available for free. However, certain advanced services like payroll and payment processing come with additional fees.

Is Wave Accounting Good Value?

In my opinion, Wave Accounting offers impressive value for freelancers, small business owners, and startups looking for a free version of an accounting software solution. Its intuitive interface, coupled with strong functionality like invoicing features, expense tracking, and receipt scanning, makes it a standout option. The software integrates smoothly with major banks, allowing for effortless transaction imports.

While it lacks the advanced features found in its premium software, its free pricing model compensates for this, making it particularly appealing for those with limited budgets. Industries that operate on a smaller scale or individuals who need straightforward accounting without the need for extensive email support will benefit the most from Wave Accounting.

Verdict: Wave Accounting provides excellent value for small-scale users seeking a cost-effective accounting solution.

Want to learn more about Wave? Check out their site for additional information.

From $0/month

Free plan available

Need expert help selecting the right Accounting Software?

We’ve joined up with Crozdesk.com to give all our readers (yes, you!) access to Crozdesk’s software advisors. Just use the form below to share your needs, and they will contact you at no cost or commitment. You will then be matched and connected to a shortlist of vendors that best fit your company, and you can access exclusive software discounts!

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.