Knowing how to adjust vacation accrual is critical; even though US workers want the option of paid time off (PTO), many don’t use up their vacation days.

In a 2023 survey by the Pew Research Center, 62% of employees said PTO was extremely important to them, making it one of the most sought-after employee benefits. However, 46% of these employees don’t use up all of their PTO.

In this article, I explain the step-by-step process of adjusting vacation accrual. I also explain how raises and sabbaticals impact accrued vacation pay.

Accounting For Accrued Vacation

Employees can use vacation time for vacations, sick leave, or other reasons, based on the vacation policy. But when employees don’t use their vacation time, they become eligible to receive a payment for that time. That’s why accrued vacation appears on your balance sheet until it's paid.

According to ASC 710, employers must accrue a liability for future absences (the accounting term for vacation not yet used) if the following conditions are met:

- The employee has already rendered the services necessary to earn compensation for future absences.

- The obligation relates to the rights that vest or accumulate. The vested rights must continue even if an employee terminates—the rights must not be contingent on future service. Put simply, the employer must not have a use it or lose it policy, and the accrued vacation pay must carry over to subsequent years.

- Payment of the compensation must be probable.

- The amount can be reasonably estimated.

The amount due to employees for unused vacation appears as a liability on your balance sheet until paid. The amount also appears on your income statement as an expense in the period during which it became due.

Once paid, the liability disappears from the balance sheet, and the accrued vacation amount appears in the cash flow statement as a cash outflow.

Of course, there are cases where you won’t have to pay for accrued vacation. For example, you won’t have to accrue vacation pay if you have a use it or lose it policy.

Use It or Lose It Policy

A use-it or lose-it policy requires employees to forfeit unused vacation time after a predetermined date.

Suppose Fred, one of your employees, has 30 hours of accrued vacation time. Your use it or lose it policy can require Fred to use up these 30 hours by the end of the first quarter of the following calendar year or forfeit the vacation time.

But there’s a catch: Not all companies can have a use it or lose it policy.

State laws dictate whether you can take away vacation time from an employee once they have earned it.

For example, businesses in Nebraska can’t change their vacation policy to take away vacation time from employees after they have rendered the services to earn vacation time. This means Nabraskan businesses can’t have a use it or lose it policy.

When To Record A Vacation Entry In Accrual Accounting

Most businesses record leave accruals once per calendar year. Other common time frames to record unused vacation leaves are once per fiscal year or on the employee’s hire date. Payments are recorded when you make them.

The two types of entries you’ll need to pass for every employee with accrued vacation time are:

- Entry to make the vacation pay amount due

- Entry to record the payment

How To Calculate Accrued Vacation

Before you pass a journal entry, you’ll need to calculate the accrued vacation amount for each employee who has unused vacation days.

Here’s the formula to calculate accrued vacation:

Accrued vacation = (Accrued vacation time in hours x Employee’s hourly rate)

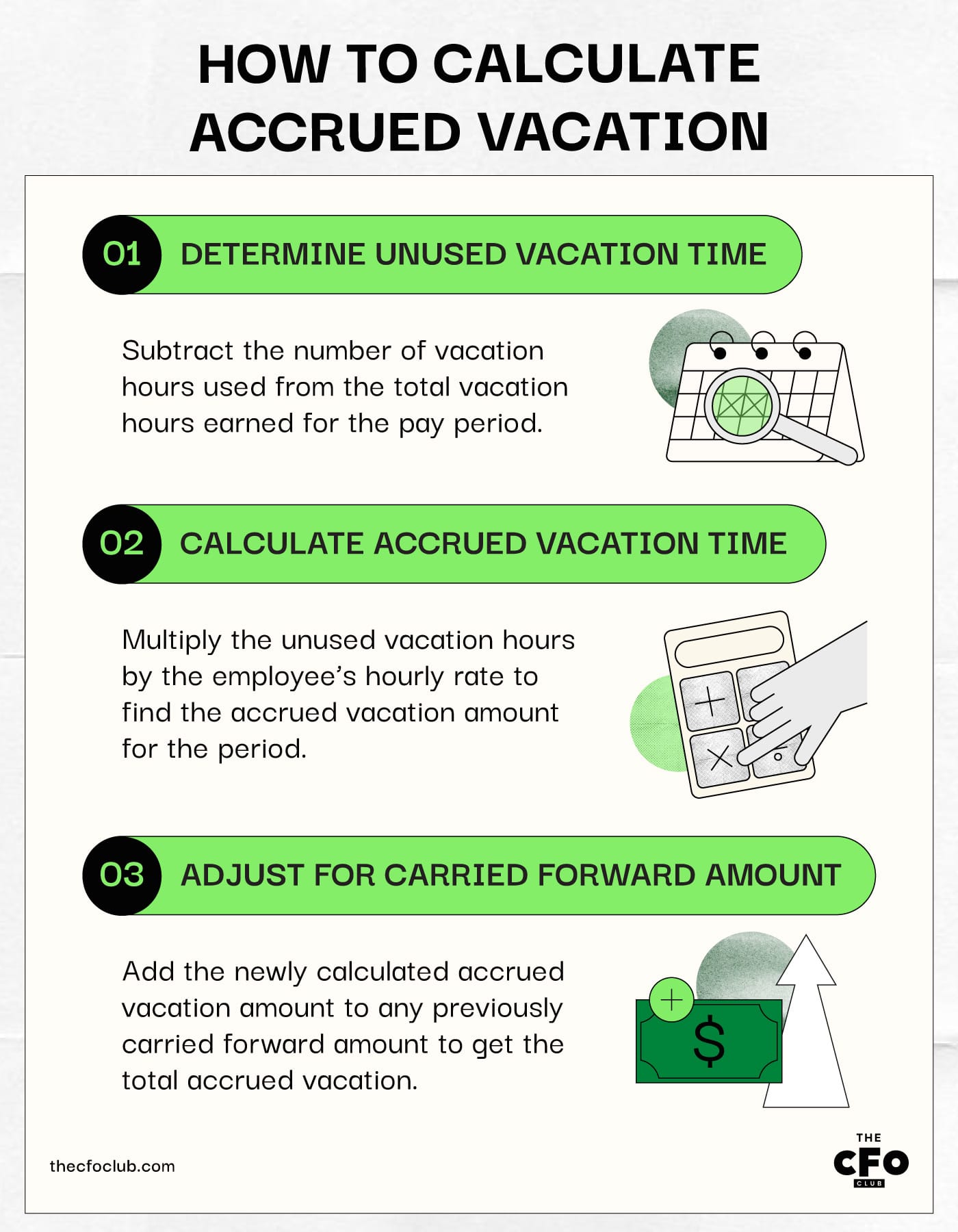

Follow this step-by-step process to collect the required information and calculate accrued vacation:

- Determine the unused vacation time for the previous pay period by subtracting the number of vacation hours used from the total number of vacation hours earned for that period.

- Multiply the number of hours of accrued vacation time by the employee’s total hourly rate.

- Add this amount to the accrued vacation amount carried forward from the previous periods.

Most Common Software Tools for Accrued Vacation

The two software tools commonly used to calculate and record accrued vacation are payroll and accounting software solutions.

Payroll software helps calculate earned vacation time during a specific accounting period. Alternatively, you can request your payroll service provider to share employee vacation time data for a specific period.

Once you have the data needed to calculate accrued vacation, use accounting software to record journal entries. Your accounting software will automatically update the income statement, balance sheet, and cash flow.

Top accounting software solutions offer built-in features for vacation accrual. Once you input the leave balance, accrual rate, and the employee’s hourly rate, the software automatically updates vacation accrual balances.

Example of Adjusting Vacation Accrual

Suppose John Smith has already earned 40 hours of accrued vacation time. According to your vacation policy, John Smith receives five hours of vacation time per month, for a total of 60 hours per year.

During the previous accounting period, John Smith used 40 hours of vacation time. At the end of the accounting period, John Smith will have 60 hours of accrued vacation time left, calculated like this:

[40 hours of accrued vacation time + (60 hours of vacation time for the previous year - 40 hours of used vacation time)] = 60 hours

John Smith earns $30 per hour.

Here’s what John Smith’s accrued vacation will be at the end of the accounting period:

60 hours x $30 per hour = $1,800

Note that $1,800 should be the balance of John Smith’s accrued vacation account, not the incremental amount to be used in the journal entry. The amount in the entry should be:

($1,800 - Closing balance of the account for the previous accounting period)

Since John Smith had 40 hours of accrued vacation time, the closing balance for the previous accounting period can be calculated as:

(40 hours x $30 per hour) = $1,200

The amount in the journal entry would be:

($1,800 - $1,200) = $600

Relevant Journal Entries

Now that you know the calculations required for recording accrued vacation journal entries, let’s use the same examples to see what journal entries to pass.

Adding More Vacation Accrual

The incremental amount in our example is $600. Put simply, John Smith has $600 worth of additional unused vacation time, carried over from the previous year.

Here’s what the journal entry will look like:

| Account | Debit | Credit | Notes |

|---|---|---|---|

| Vacation Expense | $600 | - | Recording accrued vacation time as an expense. This figure appears in the income statement. |

| Vacation Payable | - | $600 | Recording accrued vacation liability. This figure appears on the balance sheet until the employee uses vacation time or the amount is paid. |

Vacation Being Used by Employees

Suppose John Smith wants to use 50 hours of vacation time at the beginning of the next fiscal year. He currently has 60 hours of accrued vacation time.

When John Smith uses 50 hours of vacation time, you create the following journal entry to adjust the vacation accrual amount:

| Account | Debit | Credit | Notes |

|---|---|---|---|

| Vacation Payable | $600 | - | Reducing the balance of payables. |

| Cash | - | $600 | Reducing the cash balance by the amount of accrued vacation paid to the employee. |

How Raises Impact Accrued Vacation Pay

Raises increase your accrued vacation liability.

Vacation pay is calculated using an employee’s most recent pay rate. When you raise an employee’s pay, you must add the incremental amount of vacation pay to the accrued vacation liability.

For example, suppose John Smith has 60 hours of accrued vacation time. His hourly rate increases from $30 to $35.

His accrued vacation amount will increase by $300 (60 hours x $5 per hour) after the raise. Here’s the journal entry to adjust the vacation accrual:

| Account | Debit | Credit | Notes |

|---|---|---|---|

| Vacation Expense | $300 | - | Increasing the vacation expense |

| Vacation Payable | - | $300 | Increasing the accrued vacation liability |

Sabbaticals and their Impact

EITF Abstract 06-02 addresses the confusion around accounting for sabbatical leave. According to the abstract:

- Sabbatical leave is not accrued when it’s for research or public service that enhances the employer’s reputation or otherwise benefits the employer. The employee is essentially performing services for the company, for which they’re being compensated.

- Sabbatical leave is accrued when the sabbatical is unrestricted time off and granted as compensation for services rendered previously.

Can The Accrued Vacation Time Or Dollars Be Negative?

Yes, the accrued vacation time or dollars for a specific employee can be negative.

Negative leave balances occur when employers pay more vacation dollars or allow employees to take more vacation time than they have earned.

The accrued vacation balance will eventually turn positive as vacation hours continue to accrue.

Adjusting Vacation Accrual Made Easy

Adjusting vacation accrual is simple once you understand how to calculate incremental accrual and journal entries. In most cases, you’ll only need to make two entries: adding unused vacation time and paying employees for using vacation time.

To receive weekly articles on topics that help SaaS CFOs manage a finance team in a tech company efficiently, subscribe to The CFO newsletter.