Best Accounting Software for Mac Shortlist

Here's my pick of the 10 best software from the 17 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Finding a good accounting software for Mac can be a headache. A lot of options are built for Windows first, leaving Mac users with clunky or outdated tools.

As a financial controller, I understand the need for more accurate reports, easy bank syncing, and time-saving automation. I also get that starting the searching for your next accounting software can be another challenge within itself.

That’s why I tested and reviewed these accounting software for Mac options to help you make the right choice. Based on my experience in financial operations and management, I’ve selected tools that are reliable, efficient, and designed to keep your accounting workflow smooth.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our accounting software for mac review methodology.

Best Accounting Software for Mac Summary

Here’s a quick cost breakdown of the best accounting software for Mac, so you know what to expect before committing. Whether you need a budget-friendly option or a full-featured solution, this summary makes it easy to compare prices.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for AI-native ledger automation | 14-day free trial | From $25/month | Website | |

| 2 | Best for user-friendly invoicing and time tracking | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 3 | Best for cloud-based bookkeeping | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 4 | Best for advanced data management and reporting | 30-day free trial | From $20/month | Website | |

| 5 | Best for comprehensive financial management | 60-day free trial | From $17.50/user/month (billed annually) | Website | |

| 6 | Best for cloud-based bookkeeping | 30-day free trial + free plan available | From $15/month (billed annually) | Website | |

| 7 | Best for automated income and expense tracking | 14-day free trial | From $20/month | Website | |

| 8 | Best for basic accounting needs | Not available | From $5.99/user/month | Website | |

| 9 | Best for free accounting tools | Free plan available | From $0/month | Website | |

| 10 | Best for comprehensive ERP integration | Free demo available | Pricing upon request | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounting Software for Mac Reviews

I’ve put together a deep dive into the best accounting software for Mac, covering what each one does well (and where it falls short). Below, I’ll walk you through the features, pros and cons, and the best fit for each tool.

Puzzle.io is a modern accounting software designed for startups and small businesses. It offers real-time financial reporting and automation to help you manage your finances.

Why I Picked Puzzle.io:

I like its AI-native ledger, which enhances accuracy and saves time by automating bookkeeping tasks. This means you can focus on growing your business rather than getting bogged down with manual data entry. Additionally, Puzzle.io offers real-time cash flow insights, allowing you to make informed financial decisions quickly. This is crucial for maintaining the financial health of your business.

Standout Features & Integrations:

Features include automated bookkeeping, real-time cash flow tracking, tax-ready financial statements, AI-driven insights, customizable financial reports, multi-basis accounting, expense monitoring, prepaid expense management, fixed asset tracking, and accounts payable and receivable management.

Integrations include Stripe, Brex, Ramp, Rippling, and Gusto.

Pros and cons

Pros:

- Automated bank reconciliations ensure accuracy

- AI-powered transaction categorization

- Real-time dashboards provide immediate financial insights

Cons:

- Free trial requires users to connect a bank account

- May not be suitable for very large enterprises

New Product Updates from Puzzle.io

Puzzle.io's Automated PDF Statement Loading

Puzzle.io has introduced automated PDF statement loading for Meow, streamlining the reconciliation process by eliminating manual downloads and uploads. For more details, visit Puzzle.io Product Updates.

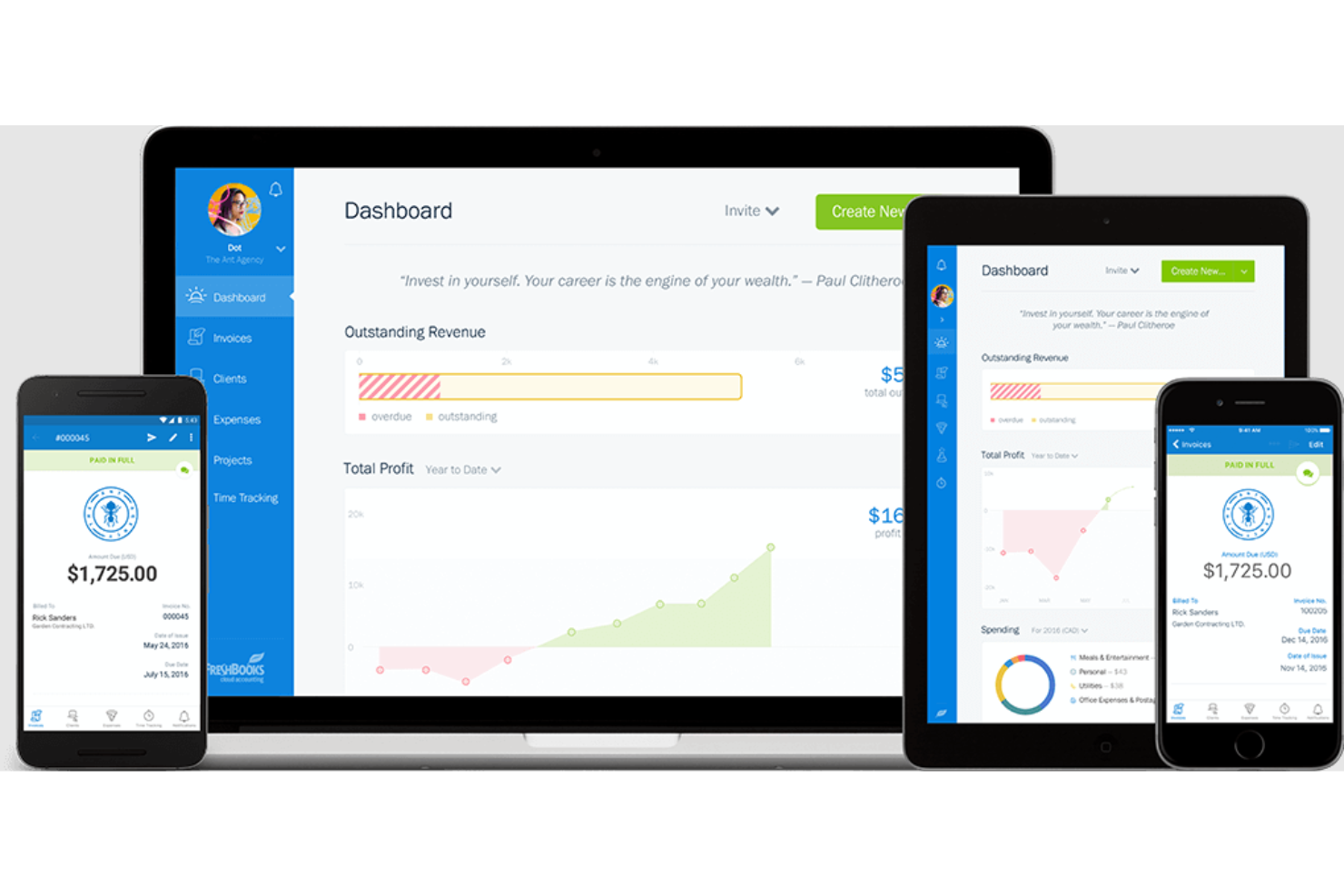

FreshBooks is a comprehensive small business accounting software for Mac that offers a variety of features. It is best for user-friendly invoicing and time tracking due to its intuitive interface and robust features that simplify these tasks.

Why I Picked FreshBooks:

I chose FreshBooks for its exceptional ease of use and powerful invoicing capabilities. Compared to other accounting software, FreshBooks stands out with its user-friendly design and efficient time-tracking tools. I believe it is the best for user-friendly invoicing and time tracking because it allows users to create professional invoices quickly and accurately log billable hours.

Standout Features & Integrations:

Features include professional invoicing, automated time tracking, and comprehensive expense management.

Integrations include Google Workspace, Shopify, Stripe, PayPal, Mailchimp, Slack, HubSpot, Trello, Zapier, and Asana.

Pros and cons

Pros:

- Automated time tracking

- Robust invoicing

- Easy to use

Cons:

- Higher cost for additional users

- Limited advanced features

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

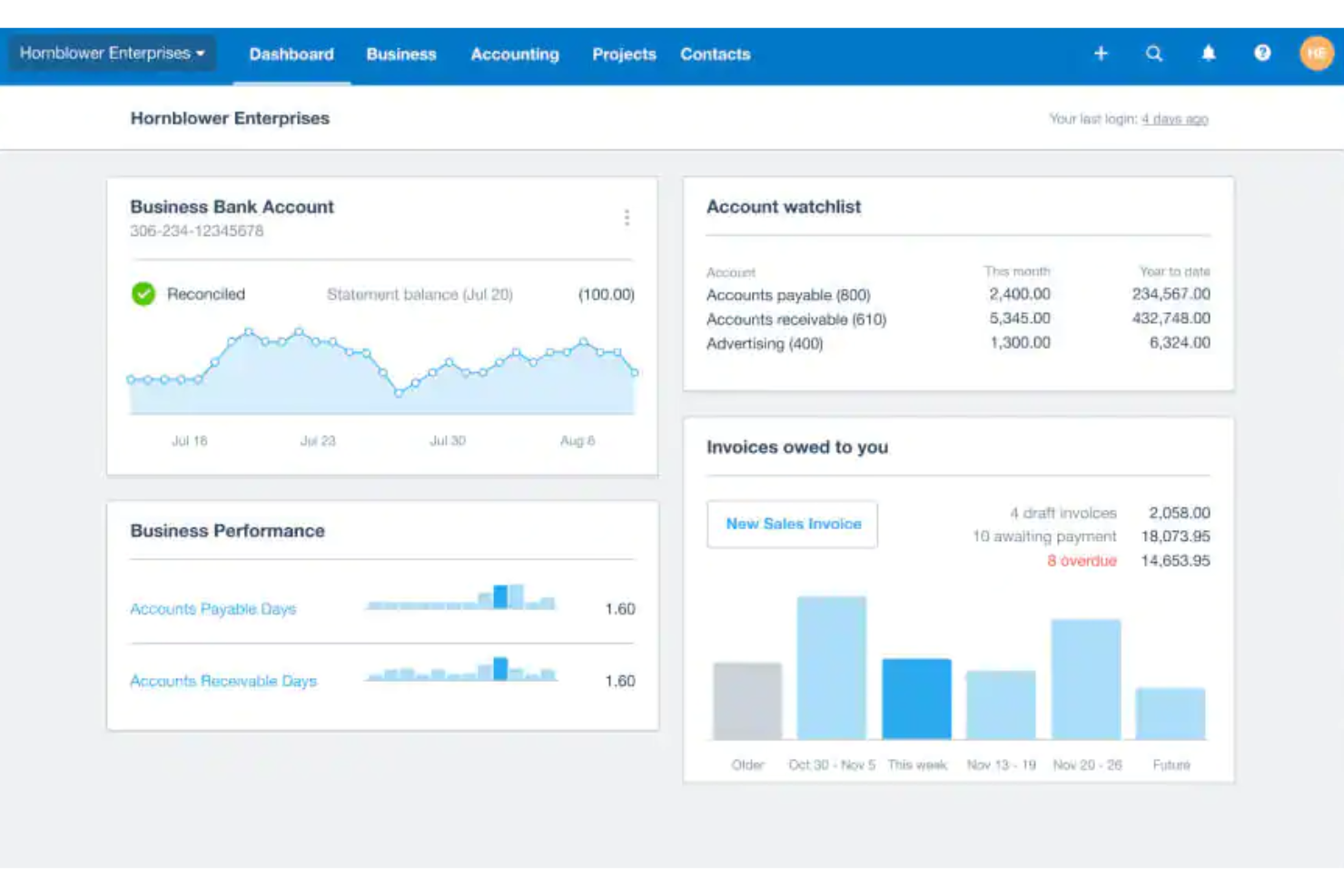

Xero is a cloud-based accounting software designed for small businesses. It automates bookkeeping tasks and keeps financial records organized.

Why I Picked Xero:

I chose Xero for its robust cloud-based bookkeeping capabilities, which make it stand out from other accounting software for Mac. Its ability to automate various accounting tasks and provide real-time financial data makes it the best for cloud-based bookkeeping.

Standout Features & Integrations:

Features include automated invoicing, bank transaction reconciliation, and real-time financial data updates.

Integrations include Stripe, PayPal, Square, Shopify, HubSpot, Gusto, Vend, GoCardless, Expensify, and Bill.com.

Pros and cons

Pros:

- Mobile app

- Real-time financial data

- Automated invoicing

Cons:

- Learning curve for new users

- Limited offline access

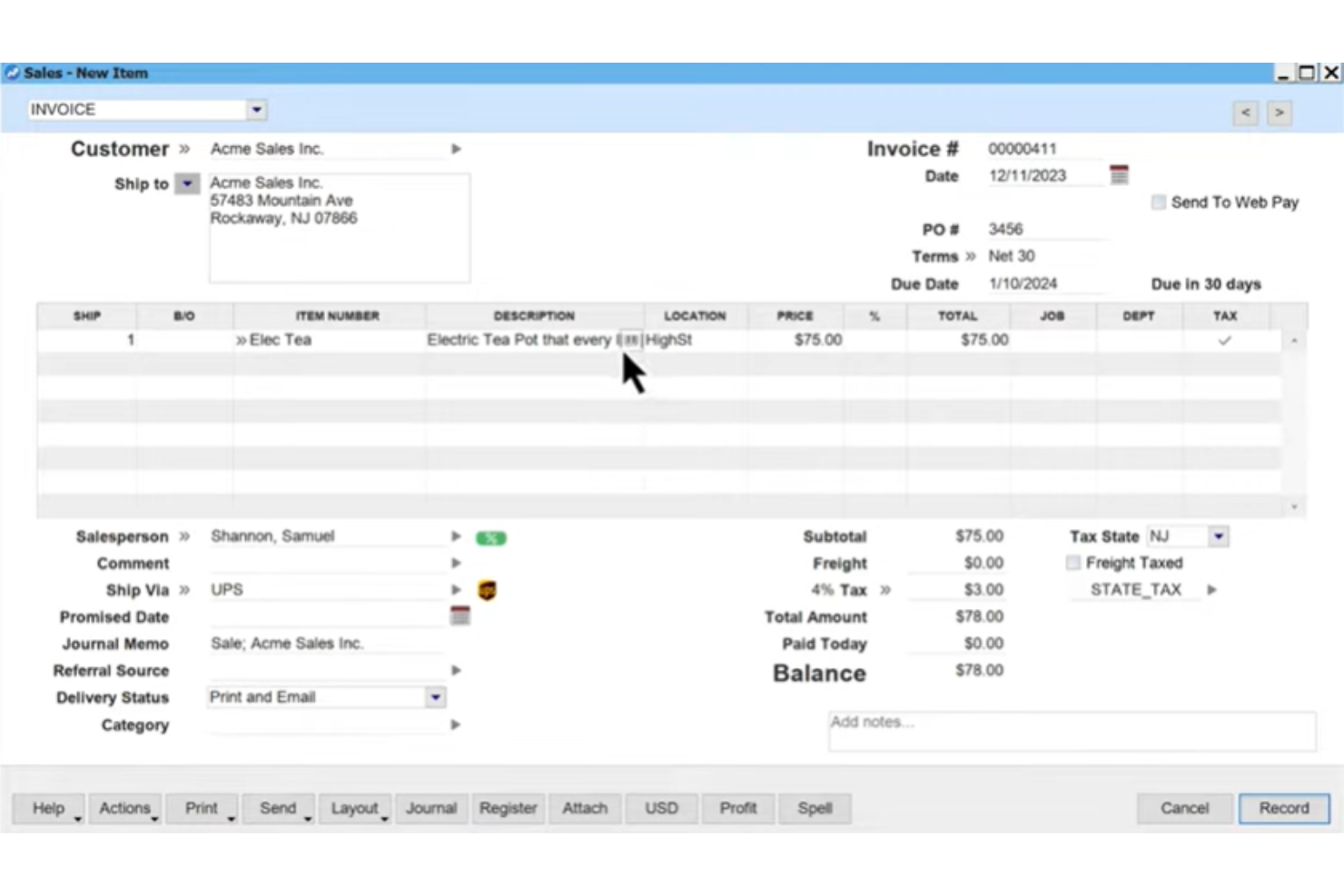

AccountEdge is a powerful and easy-to-use desktop accounting software for small businesses on Mac or Windows.

Why I Picked AccountEdge:

I chose AccountEdge for its extensive suite of features tailored to small businesses. Its advanced data management and reporting capabilities set it apart from other accounting software, providing detailed financial insights crucial for business decisions.

Standout Features & Integrations:

Features include invoicing, payroll management, and detailed inventory tracking. AccountEdge also offers advanced data management tools, allowing for easy data import/export and integration with PowerBI for enhanced analytics.

Integrations include Shopify, BigCommerce, WooCommerce, PayPal, Stripe, Square, Gusto, Avalara, Microsoft Excel, and PowerBI.

Pros and cons

Pros:

- Reliable desktop application

- Advanced reporting tools

- Comprehensive feature set

Cons:

- Limited mobile access

- Higher learning curve

QuickBooks Online for Mac is a comprehensive accounting software designed to manage various financial tasks for Mac users.

Why I Picked QuickBooks Online for Mac:

I chose QuickBooks Online for Mac because it offers a robust set of features that cater to the diverse financial management needs of businesses. Its compatibility with multiple devices, including Mac, ensures that users can manage their finances easily across platforms.

Standout Features & Integrations:

Features include automated expense tracking, customizable invoices, and real-time financial reporting.

Integrations include PayPal, Shopify, Square, Stripe, TSheets, HubSpot, Salesforce, Bill.com, Expensify, and Gusto.

Pros and cons

Pros:

- Real-time reporting

- Multi-device compatibility

- Comprehensive features

Cons:

- Learning curve

- Higher cost

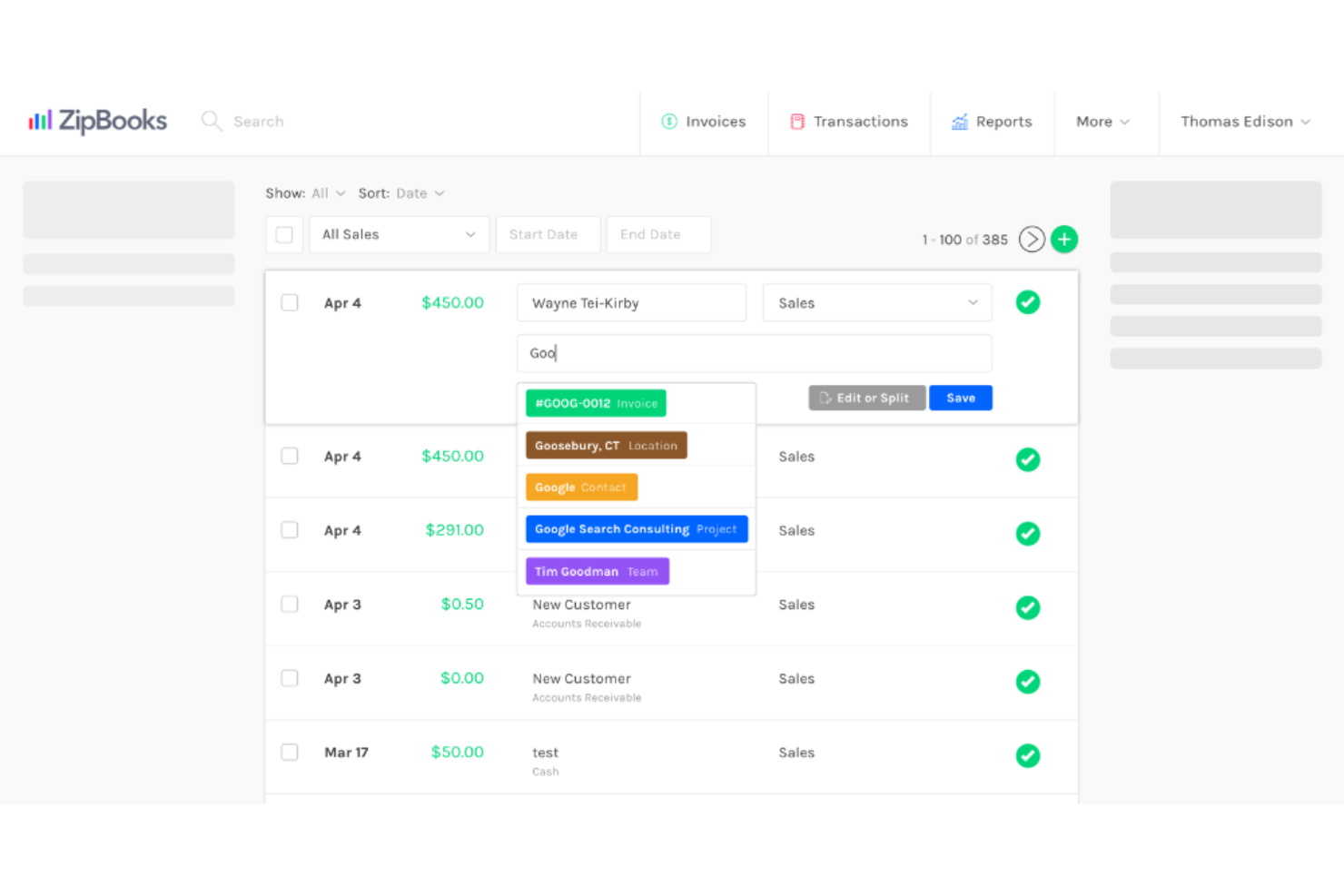

ZipBooks is a Mac-friendly accounting software that provides a complete solution for billing, expense management, and intelligence features.

Why I Picked ZipBooks:

I chose ZipBooks for its exceptional user interface, which stands out among other accounting software for Mac. The design is clean and intuitive, making it easy for users to manage their finances. I believe ZipBooks is best for those who prioritize a visually appealing, modernized, and user-friendly experience.

Standout Features & Integrations:

Features include accounting solutions, professional invoicing, automated expense tracking, and detailed reporting. ZipBooks also offers mobile accounting, team management, and time tracking.

Integrations include Stripe, PayPal, WePay, Square, Google Drive, Slack, Trello, Asana, QuickBooks, and Xero.

Pros and cons

Pros:

- Easy to use

- Comprehensive accounting features

- Clean, intuitive interface

Cons:

- No phone support

- Limited advanced features

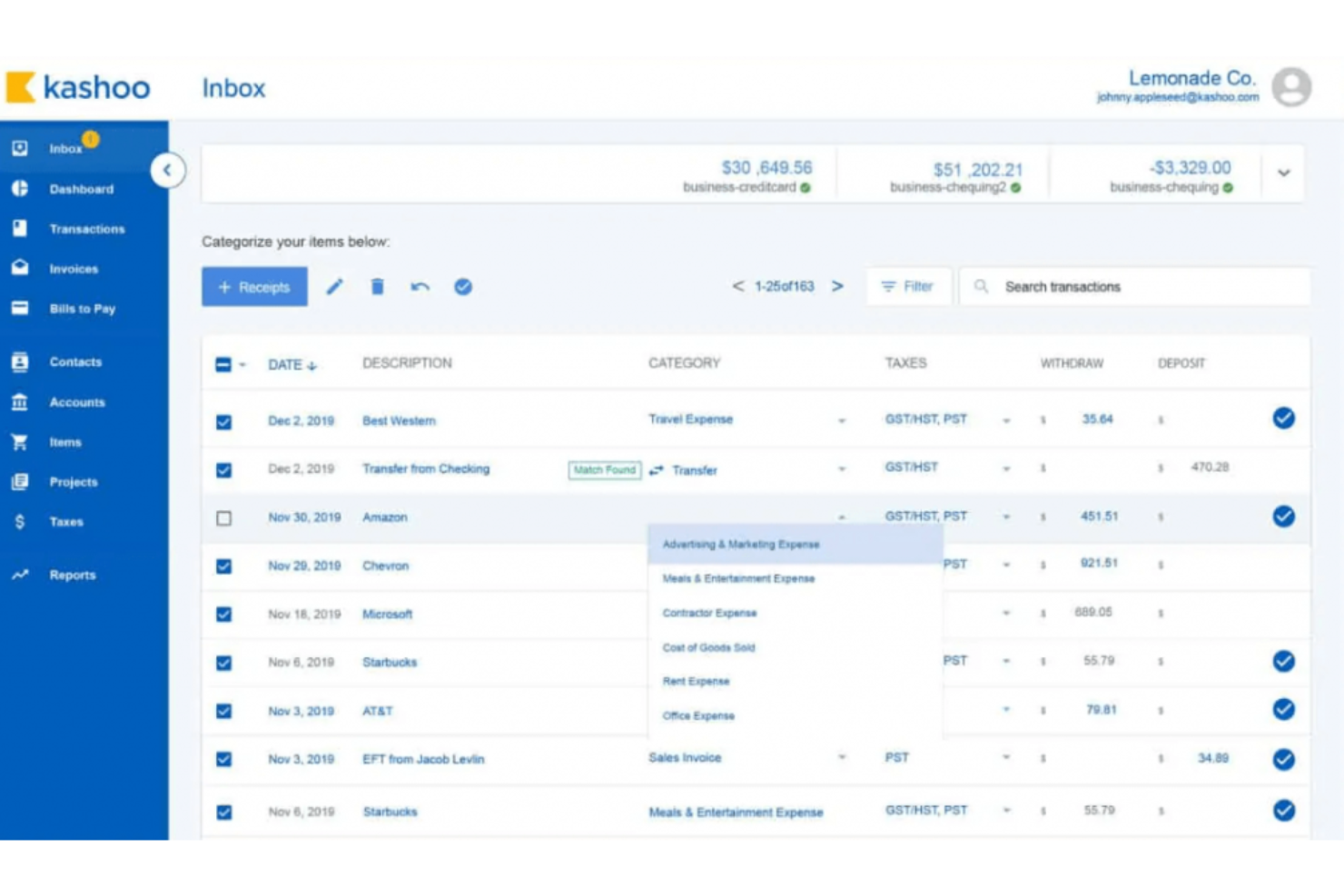

Kashoo is a simple accounting solution designed for small business owners and accountants. Kashoo is best for automated income and expense tracking because it connects directly to your bank, categorizes transactions, and updates your financial records automatically.

Why I Picked Kashoo:

I chose Kashoo for this list because it offers a straightforward, automated approach to accounting that is ideal for small business owners who need to save time. Its ability to connect directly to bank accounts and automate transaction categorization sets it apart from other accounting software for Mac. I believe Kashoo is best for automated income and expense tracking due to its robust automation features that minimize manual data entry.

Standout Features & Integrations:

Features include automated bookkeeping, simplified invoicing, and easy expense tracking. The software also offers customizable invoicing and detailed financial reporting.

Integrations include Stripe, PayPal, Square, FreshBooks, QuickBooks, Xero, Gusto, Shopify, WooCommerce, and Zapier.

Pros and cons

Pros:

- Customizable invoicing

- User-friendly interface

- Automated transaction categorization

Cons:

- No free plan

- Limited advanced features

Small Business Accounting is a straightforward tool designed to meet basic accounting needs for small businesses. It offers essential features to manage finances without overwhelming users with complexity.

Why I Picked Small Business Accounting:

I chose Small Business Accounting for its simplicity and focus on core accounting functions, which makes it ideal for small business owners who need to manage their finances without getting bogged down by overly complex features. Its user-friendly interface and essential tools make it stand out from other accounting software that may offer more features but at the cost of usability.

Standout Features & Integrations:

Features include basic invoicing, expense tracking, and financial reporting.

Integrations include Excel, iCloud, Google Drive, Dropbox, QuickBooks, FreshBooks, Xero, PayPal, Stripe, and Square.

Pros and cons

Pros:

- Affordable pricing

- Essential accounting tools

- User-friendly interface

Cons:

- Customer support less responsive

- Limited advanced features

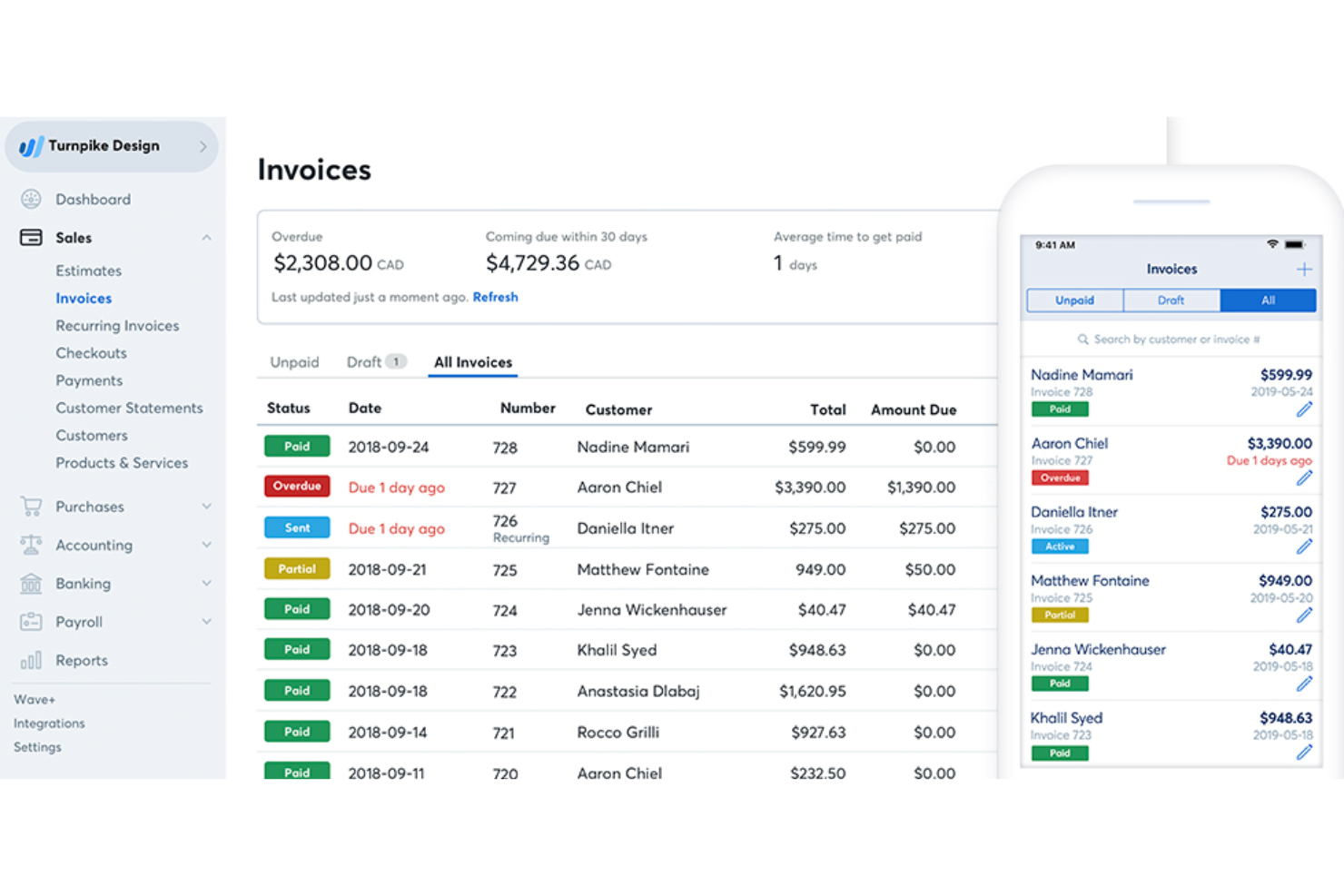

Wave Accounting is a free accounting software for small businesses that offers a range of financial management tools. It provides essential accounting features at no cost, making it an ideal choice for small businesses and freelancers.

Why I Picked Wave Accounting:

I chose Wave Accounting for the list because it stands out as a cost-effective solution for small business owners who need robust accounting tools without the financial burden. I believe Wave is best for free accounting tools because it provides comprehensive financial management capabilities at no cost, making it accessible to businesses with limited budgets.

Standout Features & Integrations:

Features include customizable invoicing, online payment options, and a user-friendly dashboard. The software also offers mobile receipts and payroll services, ensuring that all financial aspects are covered.

Integrations include PayPal, Stripe, Shoeboxed, Etsy, Zapier, Google Sheets, Slack, HubSpot, Mailchimp, and QuickBooks.

Pros and cons

Pros:

- Comprehensive features

- User-friendly interface

- Free accounting tools

Cons:

- No advanced reporting

- Limited customer support

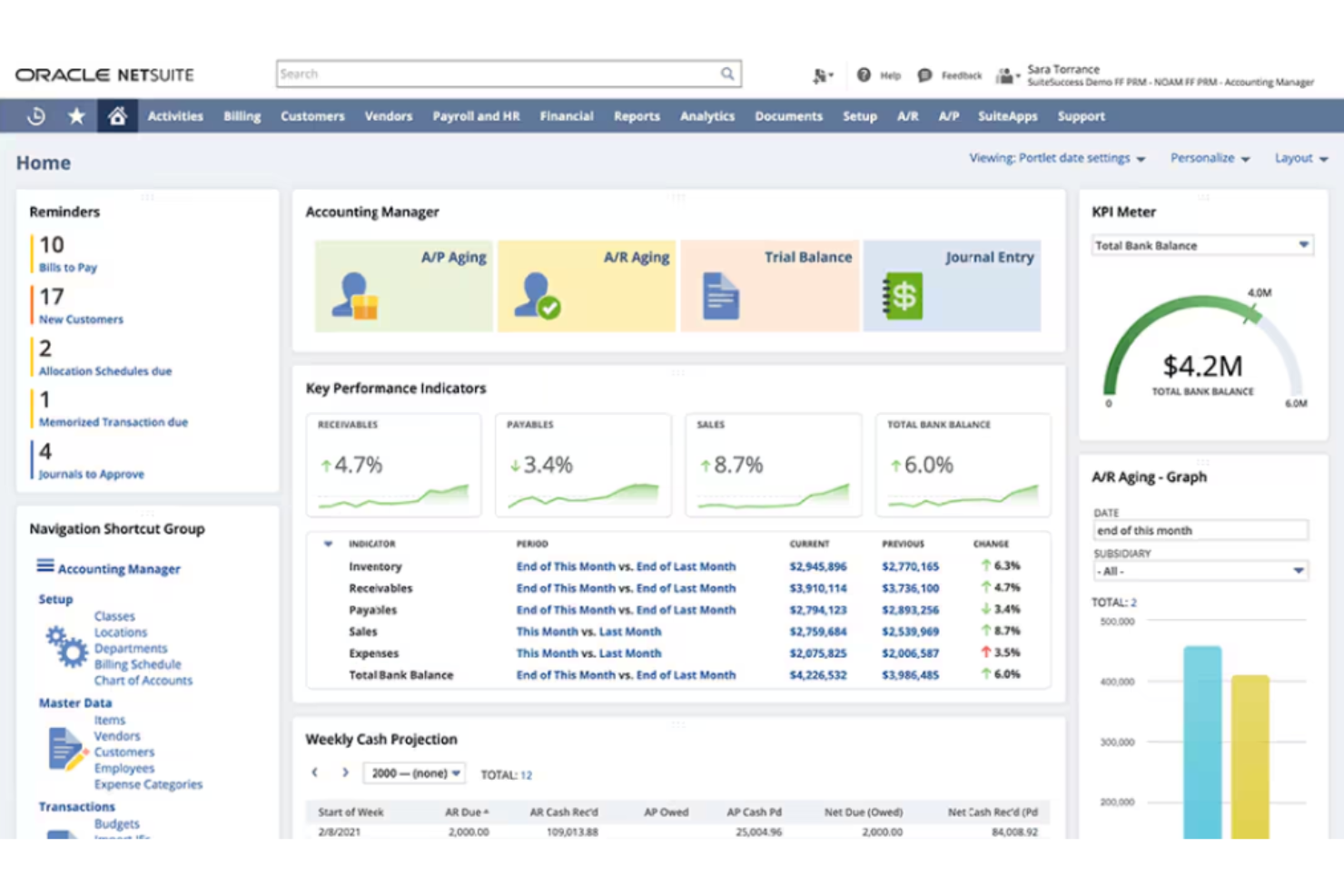

NetSuite is a cloud-based accounting software that offers a full suite of financial management tools. It provides a unified platform that integrates accounting with other business processes.

Why I Picked NetSuite:

I chose NetSuite for its robust ERP integration capabilities, which set it apart from other accounting software for Mac. NetSuite's ability to easily integrate accounting with inventory, order management, HR, and customer management makes it a standout choice. This comprehensive integration is ideal for businesses looking to streamline operations and improve efficiency.

Standout Features & Integrations:

Features include real-time financial data access, automated accounts payable and receivable, and compliance with multiple regulatory requirements. NetSuite also offers advanced cash management and tax management capabilities.

Integrations include Salesforce, Shopify, PayPal, Expensify, Avalara, Bill.com, Concur, Adaptive Insights, Coupa, and Docusign.

Pros and cons

Pros:

- Automated processes

- Real-time financial data

- Comprehensive ERP integration

Cons:

- Complex setup

- Expensive

Other Accounting Software For Mac

Below is a list of additional accounting software for Mac that I shortlisted, but did not make it to the top list. Definitely worth checking them out.

- Sage for Mac

For Apple device integration

- DualEntry

For complex accounting tasks

- Melio

For bill payment solutions

- KashFlow

For small business accounting features

- Zoho Books

For integration with other Zoho apps

- Neat

For receipt tracking and organization

- Quicken

For personal finance management

Accounting Software for Mac Selection Criteria

When picking the best accounting software for Mac, I focused on what actually makes a difference—easy setup, must-have features, and common frustrations like bank syncing and automation. Here’s the simple framework I used to keep things fair and helpful:

Core Functionality - 25% of Total Weighting Score

- Invoicing

- Expense tracking

- Financial reporting

- Bank reconciliation

- Payroll management

Additional Standout Features - 25% of Total Weighting Score

- Seamless integration with third-party apps

- Mobile app functionality

- Advanced analytics and reporting

- Customizable dashboards

- Automation of repetitive tasks

Usability - 10% of Total Weighting Score

- Intuitive user interface

- Easy navigation

- Minimal learning curve

- Drag-and-drop functionality

- Customizable workflows

Onboarding: 10% of Total Weighting Score

- Availability of training videos

- Interactive product tours

- Chatbots for instant help

- Webinars for in-depth training

- Pre-built templates for quick setup

Customer Support: 10% of Total Weighting Score

- 24/7 availability

- Multiple support channels (phone, email, chat)

- Knowledgeable support staff

- Quick response times

- Comprehensive help center

Value For Money - 10% of Total Weighting Score

- Competitive pricing

- Transparent pricing structure

- Free trial availability

- Flexible subscription plans

- Discounts for long-term commitments

Customer Reviews - 10% of Total Weighting Score

- Overall satisfaction ratings

- Feedback on ease of use

- Comments on customer support quality

- Reviews on feature effectiveness

- User testimonials on value for money

How To Choose Accounting Software for Mac

All those feature lists and pricing plans can get pretty overwhelming. To keep things simple, here’s a quick checklist to help you focus on what really matters.

| Factor | What to Consider |

|---|---|

| Scalability | Make sure the software can handle your growing business. Look for features that support more users, transactions, and data without slowing down. |

| Integrations | Check if it connects with your banking apps, tax software, and other business tools. Seamless integration saves time and reduces manual work. |

| Customizability | See if you can tailor reports, dashboards, and workflows to fit your needs. A flexible tool helps you focus on what matters most. |

| Ease of Use | Look for an intuitive design that’s easy to navigate. You shouldn’t need hours of training just to get started. |

| Budget | Compare pricing plans to find the best value. Make sure you get essential features without overspending. |

| Security | Ensure the software protects your financial data. Look for encryption, backups, and compliance with security standards. |

| Reporting | Choose a tool with clear, customizable reports. Good reporting helps you track finances, spot trends, and make smart decisions. |

| Customer Support | Reliable support is a must. Look for responsive help via chat, email, or phone in case you run into issues. |

Trends for Accounting Software for Mac

I’ve dug through tons of product updates, press releases, and release logs from different accounting software for Mac. Here are some key trends that caught my eye:

- Cloud-Based Accounting: Cloud technology is becoming a cornerstone of modern accounting practices. It offers secure, accessible data storage and real-time financial insights from anywhere. This trend is important as it eliminates the need for expensive on-premises servers and IT staff, making it suitable for firms of all sizes.

- AI and Automation: AI-powered tools are automating repetitive tasks like data entry and bookkeeping. This allows accountants to focus on higher-level analysis and strategic planning. The rise of AI is significant because it improves accuracy and efficiency, freeing up time for more valuable tasks.

- Data Analytics: The ability to collect, analyze, and interpret vast amounts of data is revolutionizing accounting. Data analytics helps uncover hidden patterns and generate data-driven insights. This trend is crucial as it allows for proactive tax planning and improved decision-making.

- Robotic Process Automation (RPA): RPA uses software robots to automate routine accounting tasks. These bots can categorize data, generate reports, and ensure compliance with tax regulations. RPA is interesting because it streamlines workflows and minimizes errors, allowing accountants to focus on strategic work.

- Blockchain Technology: Blockchain offers a secure, immutable record of financial transactions. It enhances transparency and auditability and can automate tax calculations and payments through smart contracts. This trend is important as it reduces errors and increases efficiency in financial processes.

What Is Accounting Software for Mac?

Accounting software for Mac is a tool designed to help businesses manage their financial transactions, track expenses, and generate financial reports. Small business owners, accountants, and financial managers commonly use it to streamline their accounting processes and ensure accurate financial record-keeping.

The components of accounting software for Mac computers typically include modules for invoicing, expense tracking, payroll management, and financial reporting. These features allow users to automate routine tasks, maintain compliance with financial regulations, and gain insights into their financial performance.

Features of Accounting Software for Mac

The right accounting software for your Mac can make managing finances so much easier. With the right features, you can save time, avoid mistakes, and keep everything running smoothly. Here are the top features to look for!

- Mac Compatibility: Ensure the software is fully compatible with macOS to avoid any functionality issues. This ensures easy integration and optimal performance on your Mac device.

- Cloud-Based Storage: Cloud-based solutions allow you to access your financial data from anywhere, providing flexibility and ensuring your data is backed up and secure.

- Invoicing and Billing: Look for software that offers robust invoicing and billing capabilities. This feature helps you manage your cash flow by tracking payments and sending automated reminders to clients.

- Expense Tracking: Effective expense tracking is crucial for managing your business's finances. The software should allow you to categorize and monitor expenses easily, helping you stay on top of your budget.

- Reporting Tools: Comprehensive reporting tools are essential for analyzing your financial performance. Look for software that offers customizable reports to gain insights into your business's financial health.

- Integration Capabilities: The ability to integrate with other business tools, such as CRM systems, payroll services, and e-commerce platforms, project management tools, can streamline your operations and improve efficiency.

- User-Friendly Interface: A user-friendly interface is important, especially if you or your team are not accounting experts. The software should be easy to navigate and use, reducing the learning curve.

- Security Features: Robust security features, such as data encryption and secure access controls, are essential to protect your sensitive financial information from breaches and unauthorized access.

- Mobile Access: Mobile access allows you to manage your finances on the go. Look for software that offers a mobile app compatible with iOS devices, enabling you to handle accounting tasks from your iPhone or iPad.

- Scalability: As your business grows, your accounting needs will evolve. Choose software that can scale with your business, offering advanced features and additional user support as needed.

Selecting the right accounting software for your Mac involves considering various features that align with your business needs. By investing in the right software, you can streamline your operations, gain valuable insights, and focus on growing your business.

Benefits Of Accounting Software for Mac

Using accounting software for Mac can make managing finances way easier and more accurate, whether you're handling personal or business accounts. Here are five key benefits that can save you time and keep your books in order.

- Easy Integration with Apple Ecosystem: Accounting software for Mac integrates smoothly with other Apple products and services, such as iCloud, Calendar, and Contacts. This integration allows users to synchronize their financial data across multiple devices, enhancing productivity and ensuring that all financial information is up-to-date and easily accessible.

- Enhanced Security Features: Mac-compatible accounting software often meets Apple's stringent security standards, offering robust protection for sensitive financial data. Features such as data encryption, secure credential tokenization, and automatic backups help safeguard against data breaches and ensure the confidentiality and integrity of financial information.

- User-Friendly Interface: The design principles of macOS are reflected in the user interfaces of Mac-compatible accounting software, making them intuitive and easy to navigate. This user-friendly experience reduces the learning curve for new users and allows businesses to manage their finances more efficiently without requiring extensive training.

- Automation of Financial Tasks: Many accounting software solutions for Mac offer automation features that streamline various financial tasks, such as invoicing, payroll processing, and bank reconciliation. By automating these routine tasks, businesses can reduce manual errors, save time, and focus on more strategic activities that drive growth.

- Scalability and Customization: Accounting software for Mac is often scalable, catering to the needs of small businesses, freelancers, and large enterprises alike. These solutions offer customizable features and pricing plans that can grow with the business, ensuring that the software remains relevant and effective as the organization expands.

Costs And Pricing Of Accounting Software for Mac

Picking the right accounting software for Mac means knowing what you’re paying for. Prices can vary based on features, user limits, and integrations. Check out the table below for a quick breakdown of common plans, costs, and what’s included.

Plan Comparison Table for Accounting Software for Mac

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic invoicing, expense tracking, and limited reports. |

| Personal Plan | $10-$30/month | Bank connections, automated categorization, and customizable reports. |

| Business Plan | $50-$100/month | Advanced reporting, multi-user access, and tax preparation tools. |

| Enterprise Plan | $150-$300/month | Full feature set, priority support, and integrations with other business tools. |

Accounting Software for Mac FAQs

Can I integrate my Mac accounting software with other business tools?

Yes, most accounting software for Mac offers integrations with various business tools. For example, QuickBooks Online integrates with payment processors like PayPal and Square, while Xero connects with CRM systems like HubSpot. These integrations help streamline your business operations by syncing data across platforms.

Is it possible to migrate data from Windows-based accounting software to Mac?

Yes, migrating data from Windows-based accounting software to Mac is generally possible. Most software providers offer detailed guides or support services to assist with the migration process. For instance, QuickBooks provides a step-by-step guide to transfer data from QuickBooks Desktop (Windows) to QuickBooks Online, which is accessible on Mac.

How secure is my financial data on Mac accounting software?

Security is a top priority for accounting software providers. Most platforms use advanced encryption methods to protect your data. Additionally, they offer features like two-factor authentication and regular security updates to ensure your financial information remains secure.

Can I access my accounting software on multiple devices?

Yes, most modern accounting software solutions offer cloud-based access, allowing you to log in from multiple devices, including your Mac, iPhone, or iPad. This flexibility ensures you can manage your finances on the go, without being tied to a single device.

Are there any Mac-specific features in accounting software?

While most accounting software is designed to be platform-agnostic, some do offer Mac-specific features. For example, QuickBooks Online has a Mac app that provides a more native experience, including keyboard shortcuts and better integration with macOS features like Spotlight search.

What kind of customer support can I expect for Mac accounting software?

Customer support varies by provider, but most offer comprehensive support options, including live chat, email, and phone support. Additionally, many platforms have extensive online resources such as FAQs, video tutorials, and community forums to help you troubleshoot issues.

Is it necessary to have accounting knowledge to use these software solutions?

While having some accounting knowledge can be beneficial, most accounting software for Mac is designed to be user-friendly, even for those without a background in accounting. They often include tutorials, guides, and customer support to help you navigate the software effectively.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.