Benefits of Proper Implementation: Implementing a POS system correctly can boost customer experience, employee productivity, and profits.

Steps to Success: Following the right setup steps—determining your needs, getting your team on-board, selecting your system, setting it up, and testing out it—makes sure you have everything in place.

Once You're Live, You Aren't Done: If you're making big business moves, you should always figure out whether your POS system can keep up.

Don't Become a Cliche: Most implementations that fail, fail for the same reasons. Involve your staff in the process and keep failsafe transaction methods on-hand, in the event your system goes down.

The point-of-sale (POS) implementation process involves everyone from the CEO to your customer.

Getting it wrong impacts the customer experience, employee productivity, company culture, and, in turn, your profits. However, if you get it right, you’ll see improvements in all those areas instead.

In this article, I’ll lay out the steps for successfully implementing a POS system, alongside all the background information you'll need.

Why is POS Implementation Important?

A poorly implemented POS system can lead to reduced employee productivity, poor customer experiences, misplaced documentation, and cybersecurity risks.

Point-of-sale systems consist of the software and hardware businesses use to accept customer payments. It’s the beating heart that keeps your business functioning optimally.

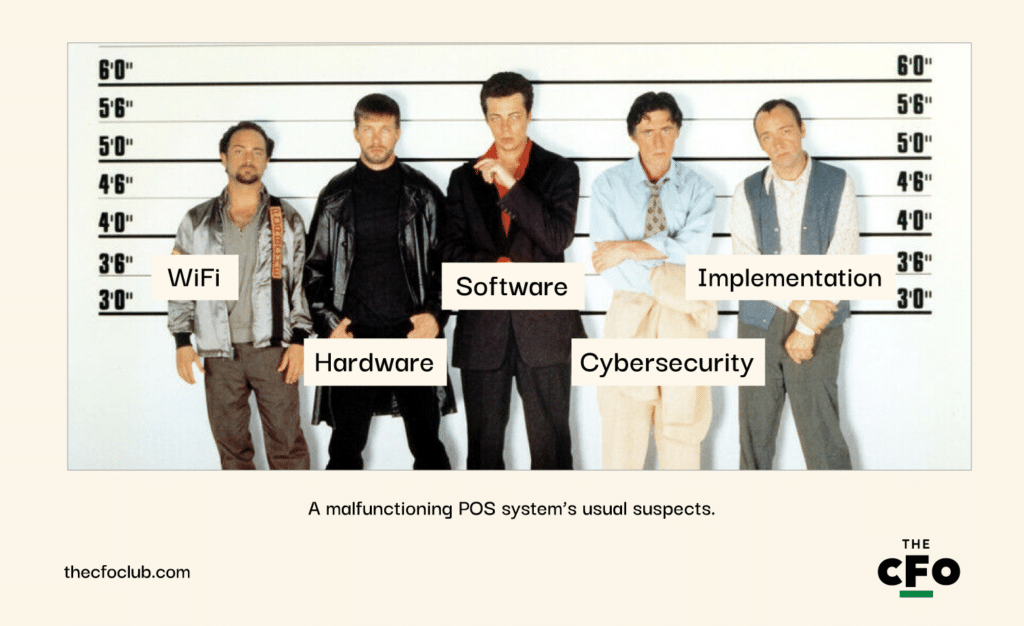

Usually, POS systems malfunction because of poor wifi connectivity, corrupt hardware, outdated cybersecurity, or incompatible software. But a fifth suspect is hiding in the background, creating a foundation for these problems to grow.

I’m talking about poor POS implementation.

A standardized process is the best way to get POS systems running smoothly at all locations, now and going forward. But even with a fool-proof POS implementation plan, you still need to get some people on board.

Our Picks for POS Systems

Since you’re here, I’d imagine you already have a POS system, but in case you don’t, here are some excellent ones The CFO Club’s team has tested and evaluated:

Who’s Involved in POS Implementation?

Implementing a POS isn’t a one-man dance. It’s a group effort that requires support from every level of the business, starting with:

#1: Your Leadership Team

These are the head honchos you need to convince because:

- They decide whether the POS is worth investing in.

- They can help drive adoption among hesitant employees, ensuring a smoother transition.

Most businesses will have multiple leaders calling the shots. I’m talking about Chief Operating Officers, Chief Financial Officers, and other board members. You may also need to involve managers and supervisors to enable employee training.

Primary concerns typically revolve around cost, compatibility, and disruption to daily operations. Address any concerns but also ask for their input. This way they’re involved in the process from the get-go, while you can align your plans with the business owner’s vision.

#2: Your IT Department

POS solutions come with new software, hardware, integrations, and processes. To ensure proper implementation, you need the support of your IT team who knows your existing tech stack inside out.

They can advise you on technical requirements, software compatibility, and integrating the POS with existing systems. This way you can ensure a smooth transition while ensuring your IT team has the information to troubleshoot any issues.

#3: Your Employees

After management, your employees are the next group that you need to get buy-in from. They’re the ones that are going to use the platform daily. Without them onboard, you’ll see reduced productivity and employee satisfaction.

Closer to implementation, start conducting training sessions to educate employees on using the POS. Also, gather feedback from employees on how to improve the system. After all, if they don’t like using it (or don’t use it to its full potential), your POS implementation benefits are going to get chopped in half.

#4: Your POS Provider

While employees and management can guide you from a business perspective, POS providers will guide you on anything product-related.

They understand the software better than anyone else and can help you successfully integrate the POS, offering insights and best practices to avoid mistakes.

When choosing a POS system, ensure the provider has a good reputation for customer support to avoid any payment processing problems in the future.

How To Implement a New POS System

Implementing a POS is kinda like conducting a heist (but without the possibility of jail time).

You’ve identified the best POS system. Now, you have to scout the location, organize your team, and act on your POS implementation plan.

Though POS systems are highly customizable solutions, there are still a few common steps for successful POS implementation:

1. The Scouting: Determine Your Business Needs

You probably jotted these down while choosing a POS system. Use it to guide how you’ll set up the POS.

For example, if you’re a small e-commerce business, you’ll probably need a simple POS software for checkout. But if you’re running a food truck, you’ll need a mobile POS to accept payments on the go. Some factors to consider while determining your POS requirements are:

- Transaction volume

- Current inventory management system

- Number of employees

- Customer experience

- Accounting integration, and

- Hardware requirements

Once you’re clear on requirements, it’s time for probably the toughest step: the buy-in.

2. The Buy-In: Getting Your Team Onboard

Remember the stakeholders? They’re your heist crew, and updating them on project status and expected deadlines is crucial because:

- They’re the ones using the POS. Especially on-floor staff who deal with customers daily. If they’re not onboard or don’t understand the system, you can expect it to impact POS implementation too.

- They understand business nuances better and can offer valuable feedback for more successful implementation. For example, only IT can inform you if the POS will break your tech stack, while management can advise you on the budget.

To ensure everyone is kept in the loop, you can:

- Send out regular email updates,

- Invite stakeholders to test out POS systems,

- Organize weekly update meetings, or

- Provide relevant stakeholders with view-only access to the project management tool.

The choice is yours. However, be available to answer any questions and listen to feedback. This way, your staff will feel involved, making the transition smoother for everyone.

3. The Gear: Finding the Right Hardware

Next, it’s time to find the right hardware for your POS terminal. This could vary depending on your existing services and processes.

For example, pop-up stores may need iPads, tablets, or mobile devices to host your cloud-based, mobile POS software. Meanwhile, retail businesses’ POS systems may need cash drawers, barcode scanners, printers, and self-service terminals.

4. The Plan: Setting up your POS system

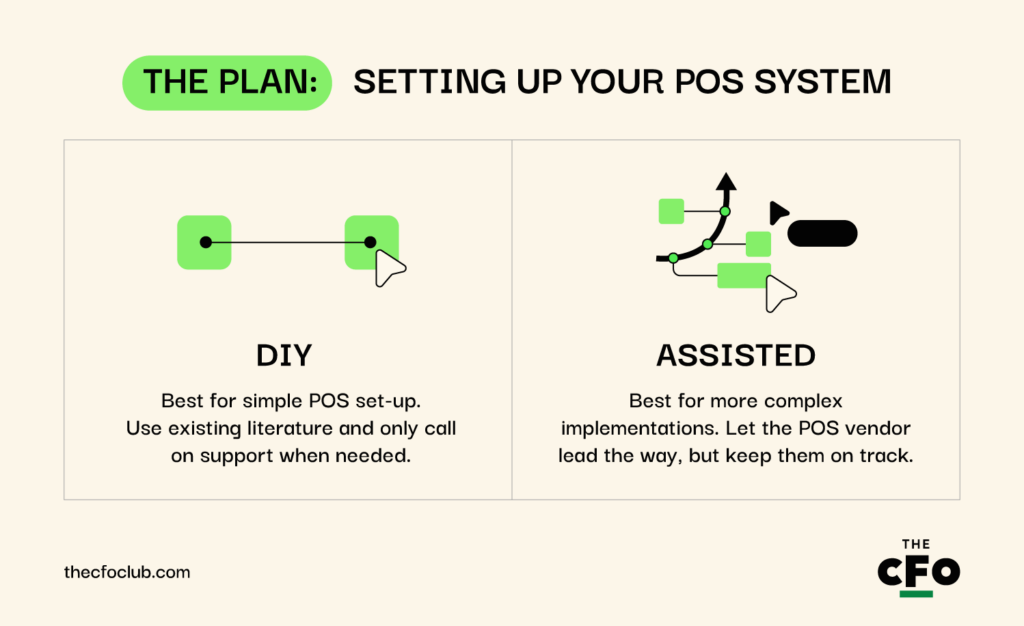

You can choose between two implementation methods:

- The DIY route. This is best for a simple POS setup with a few terminals and products. Tap into tutorials, help articles, and documentation offered by the platform to learn how to do it yourself. You can also contact customer support for assistance.

- The assisted route. If you have a larger catalog or multiple outlets, get the help of your POS vendor. Make sure the POS provider’s customer support is reliable and knowledgeable before committing to avoid frustrating interactions.

Once the implementation method is finalized, the rest is straightforward.

Activate your account

Every POS software has an account activation process. It uses your business details, KYC, and bank account information to validate your business and check if the POS can legally process payments in your location.

Set up your space

This includes setting up the devices like your barcode scanner, card readers, checkout terminals, etc. You can enlist the help of your POS provider to speed up the process.

Upload your catalog

This is the most time-consuming (and important) step in implementing your POS system. In this step, you’ll upload your products, their specifications, variations, prices, offers, and possible discounts. You can save time by uploading these details in bulk, but remember to organize the data in the format the POS software requires.

5. The Trial Run: Testing Out Your POS Software

Testing your POS setup can help identify any issues before launching it to the public. This includes testing the hardware, inventory integration, and payment gateway security.

However, this doesn’t mean everything will work out perfectly. There may still be glitches that need sorting — more on that next!

When To Optimize Your POS System

Having to optimize your POS system is inevitable. But it’s important to do it at the right time, or you’ll find yourself unnecessarily spending resources and disrupting operations.

Here are a few instances when you can consider updating your POS.

When Transaction Fees Start Eating Into Profits

Like death and taxes, transaction fees are an unavoidable cost of running POS software. If you’re not careful, these fees can pile up, slowly chipping away at your profits. Sometimes even third-party fees like payment gateway or merchant service fees may add to the cost.

Ensure you are getting the best deal by regularly checking your current transaction fees and comparing them with competing provider’s terms. Don’t be afraid to switch to a new provider if it makes more financial sense.

When Scaling Your Business

Scaling your business means different things depending on your business type. Like adding more products, opening more stores, or hiring more staff. However, the goal is usually the same: to drive more traffic to your store.

You’ll need a two-pronged approach to scale your POS system optimally:

- Update your POS software. Ensure your POS software specifications can support the expected spike in transaction volume.

- Train your employees. You’ll need to train new employees to use the POS system, including showing them available payment options, applicable discounts and offers, etc.

Completing these two simple steps lets you provide the best customer experience, encouraging return visits and positive reviews.

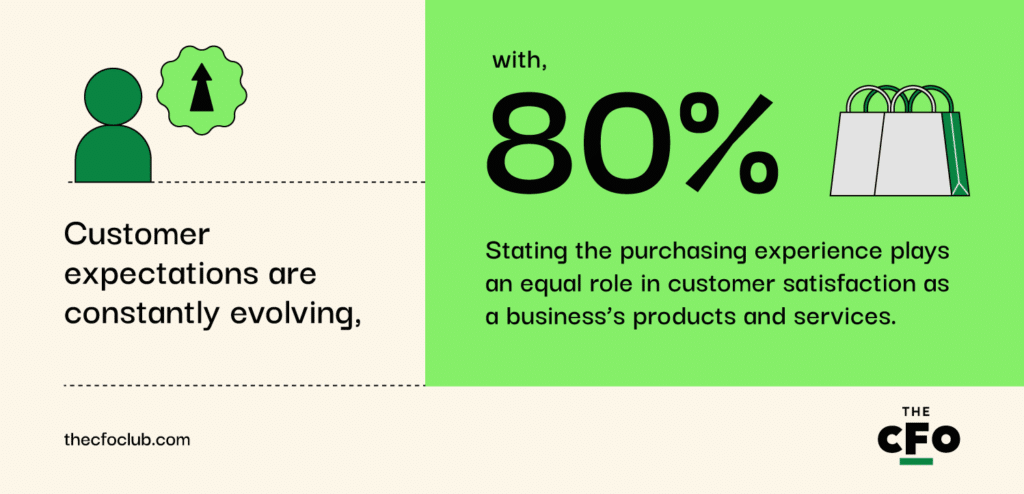

When Your POS Is Out Of Date

Legacy POS systems may not support the latest payment methods, loyalty programs, or other expected features — by lacking these, you risk a poor customer experience that’ll drive your customer to the competition.

To avoid this, keep your POS up to date. And be ready to switch providers if other POS systems can offer a better customer experience.

Tips and Tricks for Successful POS Implementation

If you’re doing this for the first time, here are some tips to ensure a smooth POS implementation.

1. Use a Private Network

POS systems deal with sensitive information like transaction data, customer data, payment details, and more. Hosting your POS on an open network exposes this data to hackers, endangering your customer’s privacy.

To minimize unauthorized access and data loss, consider hosting your POS on a private network. It’ll limit POS access to only devices and users authorized to use the network.

2. Understand Your POS System Thoroughly

It's not just about selecting the right POS, but also taking full advantage of your POS offers.

Does it support coupons? Are there any limits? Take the time to understand these nuances so you can create better business processes and streamline operations.

POS Implementation Mistakes To Avoid

Here are a few key POS implementation mistakes to avoid:

1. Not Involving Frontline Staff In The Integration

I know some of you will have read my section on involving your staff and thought, “Nah, unnecessary”, but it’s a big mistake to consider POS implementation an IT-only job. It’s a company-wide change that needs everyone to be on the same page, especially your frontline staff.

- Involve them in the selection process. Their buy-in is your best chance of getting the system’s full benefit.

- Thoroughly train your staff on the system to avoid mistakes and drops in productivity.

- As they use the system daily, look to your employees to gather feedback for improving the system.

2. Not Having a Backup Plan

Your POS could fail due to bad connectivity, outdated integrations, or malfunctioning hardware. Whatever the reason, a backup plan can help minimize any financial or data losses.

You may need multiple plans for different scenarios. For example, if your inventory integration fails, you may need to send regular updates to the inventory team manually. Or if you can’t accept card transactions, set up alternate payment methods to ensure transactions can continue while you sort out the issue.

Subscribe For More POS Insights

Your POS system connects every aspect of your business workflow. It streamlines your payment workflows, simplifies inventory management, and offers insights into customer preferences.

This is why POS implementation is a company-wide effort, involving everyone from the IT team to your customer-facing employees. However, with more cooks, there are also chances of making mistakes during implementation.

By following the steps outlined in this article – determining requirements, gaining buy-in from stakeholders, setting up hardware, testing, and optimizing over time – businesses can maximize POS benefits while avoiding costly mistakes.

Want to learn more about how POS software can enhance your customer experience? Subscribe to our free newsletter for expert advice, guides, and insights from business leaders shaping the tech industry.