Best Accounting Software For The Self-Employed Shortlist

Here's my pick of the 10 best software from the 18 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Running your own business is already a juggling act—you don’t need outdated accounting software making things harder. But even if you're in the market for a new accounting software for self employed professionals, it can be daunting (and time consuming) trying to find the perfect fit.

As a financial controller, I’ve helped countless business owners streamline their finances. I know what works, what doesn’t, and how the right software can save you time and money. You don’t need a complicated system—just one that’s reliable, easy to use, and built for self employed pros like you.

I tested and reviewed the best options to help you find your next solution. Whether you need simple invoicing or full financial management, this list will guide you to the best accounting software for self employed professionals. Let’s find the right tool for you!

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Accounting Software for the Self-Employed Summary

When looking for new software, starting with the price can make things easier—then you can weigh the pros and cons. To help you out, I’ve put together a quick rundown of the pricing and trial options for my top picks.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for client project accounting | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 2 | Best for simplifying accounting with intuitive features | 30-day free trial | From $13.50/month (billed annually) | Website | |

| 3 | Best for AI-driven financial management | Not available | Pricing upon request | Website | |

| 4 | Best for desktop accounting with remote access | 30-day free trial | From $20/user/month | Website | |

| 5 | Best for free and simple bookkeeping | Not available | Free to use | Website | |

| 6 | Best for automated expense tracking | 30-day free trial + free plan available | From $15/month (billed annually) | Website | |

| 7 | Best for automated income and expense tracking | 14-day free trial | From $20/month | Website | |

| 8 | Best for integrated invoicing and contracts | Free plan available | From $18/user/month (billed annually) | Website | |

| 9 | Best for customizable accounting solutions | Not available | From $15/user/month (billed annually) + $10 base fee per month | Website | |

| 10 | Best for free accounting features | Free plan available | From $14/user/month | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounting Software For The Self-Employed Reviews

Let’s dive into the best accounting software for self employed professionals! I’ve broken down the pros and cons of each tool, highlighted key features, and explained who they’re best for—so you can find the perfect fit for your business.

FreshBooks is cloud-based accounting software built for small business owners and freelancers. It helps you manage your finances by organizing invoices, tracking expenses, and handling payments in one place.

Why I picked FreshBooks: FreshBooks offers features that cater specifically to the needs of self-employed individuals. The software includes tools like estimates, proposals, and project tracking, allowing you to manage client work from start to finish. Time tracking is integrated, so you can log billable hours directly into projects and convert them into invoices with ease. This setup helps you stay on top of your workload and ensures accurate billing for your services.

Standout features & integrations:

Features include a customizable chart of accounts, which lets you tailor your financial tracking to match your business structure. The software's bank reconciliation feature automatically matches your bank transactions with your recorded expenses, ensuring accuracy and saving you time. FreshBooks also offers a receipt scanner that uses optical character recognition (OCR) to capture and log expense details.

Integrations include Gusto, HubSpot, Square, FundBox, Google Sheets, PayPal, Mailchimp, WooCommerce, Airtable, Stripe, and Expensify.

Pros and cons

Pros:

- Good mobile app for on-the-go access

- Time and expense tracking

- Customizable invoices and estimates improve professionalism

Cons:

- Accounts payable is limited to higher-tier plans

- Lacks features for tax filing

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

FreeAgent simplifies accounting for self-employed individuals with intuitive features for managing finances, invoicing, expenses, and taxes. Its user-friendly platform also offers real-time financial insights and customizable reports, enabling users to make informed business decisions with ease.

Why I picked FreeAgent: FreeAgent has an exceptional ability to simplify accounting tasks through its intuitive interface. It offers a range of features specifically tailored for self-employed individuals, including automated banking integrations and advanced tax preparation tools. These features, mixed with the software’s focus on ease of use and efficiency, makes it a top choice for those without extensive accounting knowledge.

Standout features & integrations:

Features include invoicing, expense management, cash flow monitoring, tax forecasting, and integration with Amazon for online sellers. FreeAgent also offers a mobile app for managing finances on the go and a dashboard that provides an overview of business performance.

Integrations include Amazon, PayPal, Stripe, GoCardless, Tyl by NatWest, Mettle, Royal Bank of Scotland, Ulster Bank, NatWest, and HMRC.

Pros and cons

Pros:

- Automated banking features

- Comprehensive quarterly tax preparation

- Intuitive user interface

Cons:

- No advanced reporting

- Primarily UK-focused

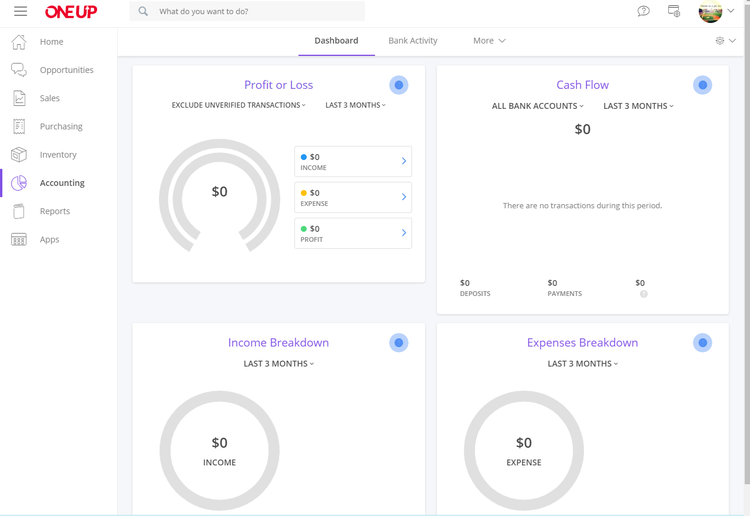

OneUp is accounting software that offers AI categorization, financial performance tracking, cash flow forecasting, invoicing, and bill payment. It integrates with banking portals and provides customizable features.

Why I picked OneUp: OneUp is known for its advanced AI-driven financial management capabilities, which set it apart from other accounting software for the self-employed. Recognized for its accuracy, OneUp's AI technology automates many accounting tasks, making it ideal for efficient and reliable financial management.

Standout features & integrations:

Features include AI categorization of transactions, financial performance tracking, cash flow forecasting, invoicing, and bill payment.

Integrations include Google Workspace, QuickBooks, PayPal, Square, Stripe, Shopify, WooCommerce, Xero, FreshBooks, and Zoho Books.

Pros and cons

Pros:

- Mobile and desktop access

- Daily cash flow updates

- AI-driven categorization

Cons:

- Mobile apps may not offer all desktop features

- Limited customization

AccountEdge is an advanced desktop accounting app, available for Mac, iOS, and Windows. It offers invoicing, expense tracking, banking, payroll, inventory, and contact management.

Why I picked AccountEdge: AccountEdge stands out as a strong desktop accounting solution that also offers remote access through its AccountEdge Connect add-on. This combination of on-premise reliability and cloud flexibility makes it unique among accounting software options. Additionally, it allows for customization and scalability, making it adaptable to the unique needs of a small business or freelancer.

Standout features & integrations:

Features include invoicing, expense tracking, payroll management, and advanced inventory control. AccountEdge also offers detailed financial reporting and data management tools, making it a versatile choice for small businesses.

Integrations include Shopify, Etsy, eBay, WooCommerce, BigCommerce, Squarespace, Square, Amazon, and PowerBI.

Pros and cons

Pros:

- Comprehensive feature set

- Remote access option

- Advanced data management

Cons:

- Multi-user capabilities may require additional setup

- Limited mobile app functionality

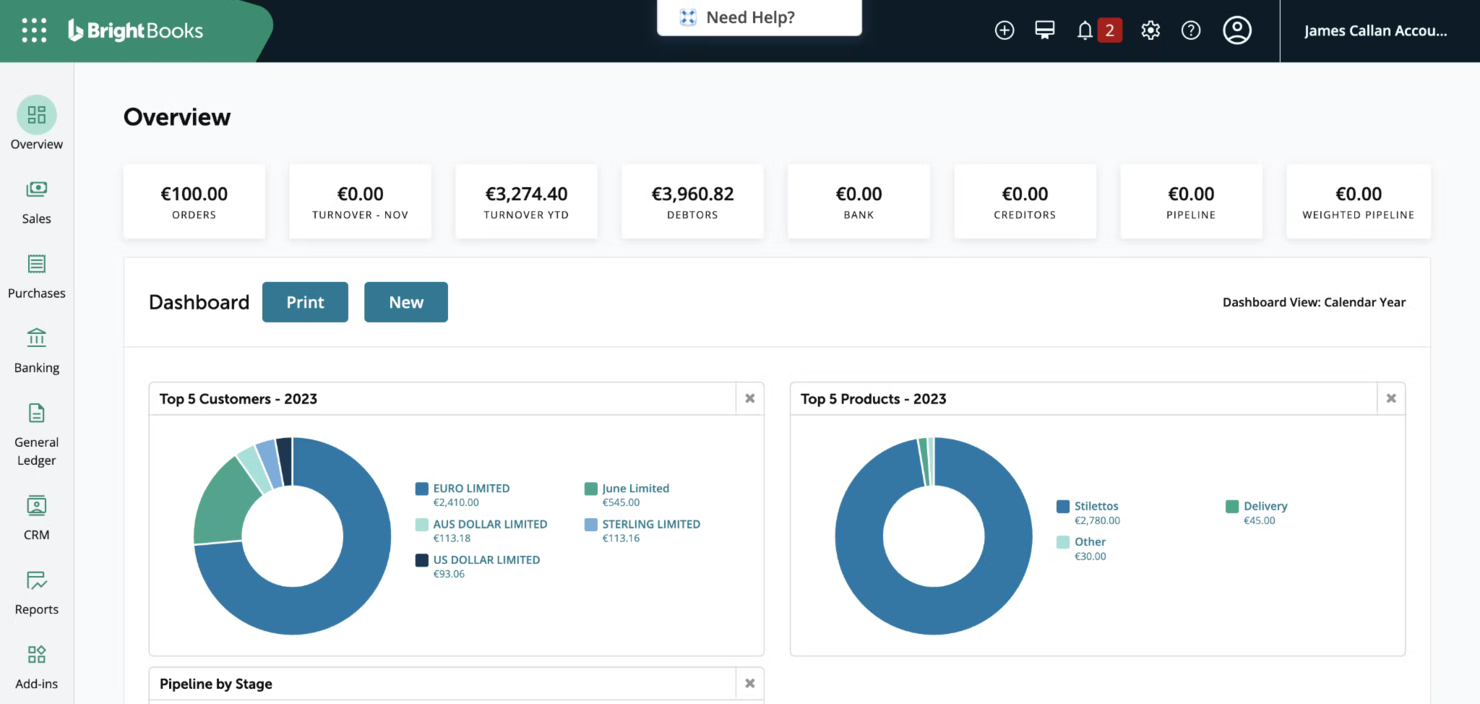

Brightbooks is a user-friendly accounting software tailored for self-employed individuals, offering a streamlined solution for managing financial tasks. It helps users maintain clarity and control over their business finances with ease.

Why I picked Brightbook: Brightbook stands out as a completely free accounting solution that simplifies bookkeeping for self-employed individuals. Unlike other tools with hidden costs or complex features, Brightbook offers a user-friendly interface with essential functionalities at no charge. This makes it especially suitable for those needing basic accounting without the financial burden.

Standout features & integrations:

Features include invoicing, instant financial insights, banking integration, secure data storage, multi-currency support, and bill and expense management. Users can also create and send professional invoices, track cash flow, and manage multiple companies and users from a single account.

Integrations include PayPal, Stripe, Square, Slack, Google Workspace, Dropbox, Zapier, Bank Feeds, Shopify, and QuickBooks.

Pros and cons

Pros:

- User-friendly

- Unlimited invoices

- No hidden fees

Cons:

- May not be suitable for rapidly growing businesses

- Lacks double-entry accounting

ZipBooks is an intuitive accounting and bookkeeping software for self-employed individuals, providing an efficient way to manage their financial activities. It simplifies the complexities of accounting, helping users stay organized and focused on their business.

Why I picked ZipBooks: ZipBooks is noted for its stellar automated expense tracking feature, which simplifies managing and categorizing expenses. This tool also excels with its user-friendly interface and intelligent automation, reducing the time spent on manual bookkeeping tasks. Lastly, it offers essential features like invoicing, expense tracking, and financial reporting in a simple, intuitive platform, making it ideal for freelancers and small business owners who need to manage their finances efficiently without a steep learning curve.

Standout features & integrations:

Features include automated expense tracking, smart categorization, and a full suite of financial reports. ZipBooks also offers invoicing, time tracking, and project management tools.

Integrations include Slack, Gusto, PayPal, Square, Google Drive, Asana, Trello, QuickBooks, and Stripe.

Pros and cons

Pros:

- Comprehensive financial reports

- User-friendly interface

- Automated expense tracking

Cons:

- Steep learning curve

- No phone support

Kashoo is a user-friendly accounting software designed for small business owners, accountants, and bookkeepers. It excels in automated income and expense tracking, making it ideal for streamlining financial management.

Why I picked Kashoo: Kashoo offers advanced automation features that simplify income and expense tracking. Unlike other accounting software, it excels at automating redundant tasks, allowing users to focus on their business rather than bookkeeping. This efficiency makes it especially useful for self-employed individuals needing reliable financial management.

Standout features & integrations:

Features include automated bookkeeping, simplified invoicing, and easy expense tracking. Kashoo also allows users to connect their bank accounts, automatically categorizing transactions and generating real-time financial reports.

Integrations include Stripe, PayPal, Square, FreshBooks, QuickBooks, Xero, Gusto, Shopify, WooCommerce, and BigCommerce.

Pros and cons

Pros:

- Simplified invoicing

- Easy expense tracking

- Automated bookkeeping

Cons:

- May not be suitable for rapidly growing businesses

- Limited customization

Fiverr Workspace is a platform designed to help self-employed individuals manage their businesses more efficiently. It offers integrated invoicing and contracts, making it ideal for freelancers and small business owners.

Why I picked Fiverr Workspace: Fiverr Workspace is known for its advanced suite of tools that streamline business operations from proposals to payments. Its ability to integrate invoicing and contracts on one platform sets it apart from other accounting software. This integration simplifies client management and ensures that all business transactions are well-documented and legally binding.

Standout features & integrations:

Features include customizable and automated invoicing, smart proposals that generate contracts, and automated time tracking and task management.

Integrations include Slack, PayPal, Stripe, Google Drive, Dropbox, QuickBooks, Xero, Trello, Asana, and Zapier.

Pros and cons

Pros:

- Customizable invoices

- Automated time tracking

- Integrated invoicing and contracts

Cons:

- Initial setup and learning may be time-consuming

- Moderate learning curve

CustomBooks™ is a customizable cloud-based accounting software designed for self-employed individuals and small businesses. It excels in providing customizable accounting solutions, allowing users to tailor the software to their specific business needs, offering both flexibility and scalability.

Why I picked CustomBooks™: CustomBooks™ provides users with strong customization options, making it a highly adaptable software for most businesses. Additionally, its ability to combine essential accounting features with inventory management, project tracking, and time tracking all in one platform make it convenient for all types of freelancers and small business owners.

Standout features & integrations:

Features include advanced inventory management, cloud banking, and advanced sales and purchase management.

Integrations include Shopify, Etsy, eBay, WooCommerce, BigCommerce, Squarespace, Square, Amazon, ShipStation, and Bill.com.

Pros and cons

Pros:

- Excellent support

- Advanced inventory management

- Unlimited users

Cons:

- Some advanced customizations may require technical expertise

- Higher starting price

Wave is a free accounting software designed for self-employed individuals, offering free accounting features that make it an attractive option for budget-conscious users. Its user-friendly interface and advanced tools for invoicing, expense tracking, and financial reporting simplify financial management for small business owners

Why I picked Wave: Wave is known for its advanced free accounting features, which stand out in a market where most tools require a subscription. It offers users the ability to handle essential tasks like invoicing, expense tracking, and receipt scanning without requiring advanced accounting knowledge. Additionally, the software’s open integration with personal and business accounts allows for seamless financial management, making it a practical choice for freelancers and small business owners.

Standout features & integrations:

Features include invoicing, payments, mobile receipts, banking, payroll, and access to advisors.

Integrations include PayPal, Etsy, Shoeboxed, Zapier, Google Sheets, Slack, HubSpot, Mailchimp, Stripe, and QuickBooks.

Pros and cons

Pros:

- Secure platform

- User-friendly interface

- Easy-to-access accounting features

Cons:

- Limited multi-currency functionality

- Limited advanced features

Other Accounting Software For The Self-Employed

Below is a list of additional accounting software for the self-employed that I shortlisted. While they didn’t make the top 10, they’re still valuable and worth further research.

- Collective

For comprehensive business management

- Xero

For real-time financial insights

- QuickBooks

For comprehensive financial management

- Planful

For financial planning and analysis

- Zoho Books

For integrated business solutions

- Plooto

For automated payments

- SparkReceipt

For receipt management

- Quicken

For personal finance tracking

Related Reviews

If you still haven’t found what you’re looking for here, check out these other tools that we’ve tested and evaluated:

Accounting Software For The Self-Employed Selection Criteria

When choosing accounting software for self employed professionals, it needs to actually solve your problems—not create new ones. After testing and researching these tools myself, here are the key things I look for when evaluating accounting software:

Core Functionality (25% of total weighting score):

- Recurring Invoicing and Billing

- Expense Tracking

- Tax Preparation and Tax Deductions

- Financial Reporting

- Bank Reconciliation

- Online Accounting

Additional Standout Features (25% of total weighting score):

- Automation

- Mobile Access

- Integration Capabilities

- Customizable Dashboards

- AI and Machine Learning

- Online Payments

- Track Time

Usability (10% of total weighting score):

- Intuitive Interface

- Customization Options

- Performance

- Accessibility

- Interactive Elements (i.e. drag-and-drop)

Onboarding (10% of total weighting score):

- Training Videos

- Templates

- Interactive Product Tours

- Chatbots and Webinars

- Easy Data Migration

Customer Support (10% of total weighting score):

- Availability

- Responsiveness

- Knowledge Base

- Community Forums

- Dedicated Account Managers or Support Teams

Value For Money (10% of total weighting score):

- Pricing Plans

- Feature-to-Cost Ratio

- Free Trials

- Discounts and Offers

- Clear Pricing Structure

Customer Reviews (10% of total weighting score):

- User Satisfaction

- Feature Ratings

- Support Feedback

- Ease of Use

- Frequent Updates and Improvements

How To Choose Accounting Software For The Self-Employed

It’s easy to feel overwhelmed by endless features and confusing pricing plans. To keep things simple as you choose between accounting software for self employed individuals, here’s a handy checklist to help you stay on track:

| Factor | What to Consider |

|---|---|

| Scalability | Ensure the software can grow with your business. Look for options that accommodate increasing transaction volumes (i.e. going from self-based to a startup) and additional features as your needs evolve. |

| Integrations | Verify that the software integrates smoothly with other tools you use, like payment processors and tax software, to streamline your workflow and avoid data silos. |

| Customizability | Choose software that lets you tailor reports and dashboards to your specific business needs, giving you the flexibility to focus on what matters most to you. |

| Ease of Use | Opt for intuitive interfaces that save you time and reduce the learning curve, enabling you to manage your finances efficiently without extensive training. |

| Budget | Find a solution that fits your budget without hidden costs. Compare pricing plans to ensure you’re getting the features you need at a price you can afford. |

| Security Safeguards | Prioritize software with robust security measures, such as encryption and two-factor authentication, to protect your sensitive financial data from breaches. |

Trends In Accounting Software For The Self-Employed

I’ve been keeping a close eye on accounting software for self-employed professionals, and a few trends keep popping up. After digging through product updates, press releases, and release logs, I’ve pulled together the key insights—and what they could mean for the future. Let’s break it down!

- Cloud-Based Accounting: Cloud-based accounting software is becoming essential, offering secure, real-time access to financial data from anywhere. It facilitates remote work and collaboration while reducing the need for expensive on-premises servers and IT staff, making it ideal for self-employed individuals.

- Automation and AI: Automation and AI are revolutionizing repetitive tasks like data entry, bookkeeping, and reconciliation. These automatic technologies free up time for self-employed accountants to focus on higher-level analysis and strategic planning.

- Data Analytics: The ability to collect, analyze, and interpret large amounts of data is transforming accounting. Data analytics helps self-employed accountants uncover patterns, identify trends, and generate insights, which is essential for proactive tax planning, risk management, and better decision-making.

- Blockchain Technology: Blockchain offers a secure and transparent way to manage financial transactions. For self-employed accountants, blockchain enhances record-keeping and auditing by providing immutable transaction records. This increases trust and reduces fraud risk.

- Remote Work and Virtual Collaboration: The shift to remote work is supported by cloud-based accounting software and virtual collaboration tools. These technologies allow self-employed accountants to work flexibly and maintain productivity, opening opportunities to access a global talent pool and improve work-life balance.

What Is Accounting Software For The Self-Employed?

Accounting software for the self-employed helps solo business owners manage financial transactions, track expenses, and generate invoices. Freelancers, consultants, and small business owners use this software to maintain accurate financial records and ensure tax compliance.

The primary components include expense tracking, invoicing, and financial reporting. These features enable users to monitor income and expenses, create and send invoices, and generate reports for tax purposes.

Features Of Accounting Software For The Self-Employed

Picking the right accounting software for self employed professionals makes managing your finances go a lot smoother. Here are the key features to look for when choosing the best software for you.

- Invoicing: Invoicing is a fundamental feature that allows you to bill clients for your services. It is essential for maintaining cash flow and ensuring timely payments.

- Expense Tracking: Expense tracking helps you monitor your business expenses, making it easier to manage your budget and prepare for tax season.

- Tax Preparation: Tax preparation features can simplify the process of filing taxes by organizing your financial data and calculating tax liabilities.

- Mileage Tracking: Mileage tracking is useful for those who use their personal vehicle for business purposes. It helps in accurately recording and claiming mileage deductions.

- Time Tracking: Time tracking allows you to log hours spent on various projects, which is particularly useful for billing clients accurately and managing your time effectively.

- Bank Reconciliation: Bank reconciliation features help you match your accounting records with your bank statements, ensuring that your financial data is accurate and up-to-date.

- Mobile Accessibility: Mobile accessibility allows you to manage your finances on the go, providing flexibility and convenience.

- Client Management: Client management features help you keep track of client information, communications, and billing, ensuring that you maintain good relationships with your clients.

- Customizable Reports: Customizable reports provide insights into your financial performance, helping you make informed business decisions.

- Integration with Other Tools: Integration with other tools, such as payment processors and project management software, can streamline your workflow and improve efficiency.

Benefits Of Accounting Software For The Self-Employed

When choosing accounting software for self employed professionals, it’s all about finding something that makes your life easier. Here’s how the right software can make a big difference for your business:

- Time Efficiency: Accounting software automates many financial tasks, allowing users to focus on their core business activities rather than spending hours on manual bookkeeping.

- Accuracy: By reducing the risk of human error, accounting software ensures that financial records are precise, which is important for making informed business decisions and maintaining compliance with tax regulations.

- Financial Insights: These tools provide detailed financial reports and analytics, helping users to understand their financial health and make strategic decisions to grow their business.

- Expense Tracking: Accounting software allows for easy tracking of expenses, ensuring that all costs are recorded and categorized correctly, which simplifies budgeting and tax preparation.

- Invoicing and Payments: The software streamlines the invoicing process, making it easy to send professional invoices and track payments, thereby improving cash flow management.

Costs & Pricing Of Accounting Software For The Self-Employed

Choosing the right accounting software for self employed individuals means knowing what you’re paying for. Prices can vary a lot depending on the features and support you need, so it’s important to pick a plan that fits your business. To make things easier, here’s a breakdown of common plan types, their average costs, and what you can expect to get with each one.

Plan Comparison Table for Accounting Software for the Self-Employed

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic invoicing, expense tracking, receipt capture, and limited customer support |

| Personal Plan | $15-$20/month | Enhanced invoicing, time tracking, tax estimation, basic reporting, and a mobile app |

| Business Plan | $20-$30/month | Advanced reporting, project management, bank integration, and automated reminders |

| Enterprise Plan | $30-$50/month | Comprehensive analytics, multi-user access, payroll integration, and custom reports |

Accounting Software For The Self Employed FAQs

Here are some commonly asked questions about accounting software for the self employed:

Can accounting software help with tax compliance?

Yes, many accounting software options for self-employed individuals come with features designed to assist with tax compliance. These features include automated tax calculations, generation of tax reports, and reminders for tax deadlines. Some software even offers integration with tax filing services, making it easier to submit your returns accurately and on time.

Is it possible to migrate my existing financial data to new accounting software?

migrate your existing financial data. This process typically involves exporting data from your current system and importing it into the new software. It’s important to follow the software provider’s guidelines to ensure a smooth transition and to verify the accuracy of the migrated data.

How secure is my financial data in accounting software?

Security is a top priority for reputable accounting software for self-employed individuals. Look for software that offers robust security measures such as data encryption, two-factor authentication, and regular security updates. Additionally, ensure that the software complies with relevant data protection regulations to safeguard your financial information.

What kind of customer support can I expect from accounting software providers?

Customer support varies by provider, but most offer multiple channels such as email, phone, and live chat. Some providers also offer extensive online resources, including tutorials, FAQs, and community forums. It’s important to choose a provider with a support system that meets your needs, especially if you anticipate requiring assistance during setup or while using the software.

How do I handle invoicing and payments with accounting software?

Accounting software for self-employed individuals typically includes features for creating and sending invoices, tracking payments, and managing accounts receivable. Some software also integrates with payment gateways, allowing clients to pay invoices online. This can help streamline your billing process and improve cash flow management.

Can accounting software generate financial reports?

Yes, one of the key benefits of accounting software for self-employed individuals is its ability to generate a variety of financial reports. These reports can include profit and loss statements, balance sheets, cash flow statements, and more. Having access to these reports can provide valuable insights into your business’s financial health and aid in decision-making.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.