Best Accounts Payable Automation Software Shortlist

Here’s my shortlist of the best accounts payable automation software:

Our one-on-one guidance will help you find the perfect fit.

Accounts payable automation software is a digital solution that streamlines invoice processing, approval workflows, and payments. Without it, finance teams often end up buried in spreadsheets, chasing down signatures, and scrambling to fix late payments instead of focusing on the big picture.

With a background in financial management and years spent digging into finance tools, I’ve tested more AP software than I can count. The right solution doesn’t just save time. It tightens up controls, boosts team efficiency, and gives leadership the real-time visibility they need to steer the business forward. It turns AP from a messy back-office chore into a smooth and strategic operation.

After plenty of hands-on testing and combing through user feedback, I’ve narrowed down the best accounts payable automation platforms out there. These are the tools that truly help, whether you're growing fast, juggling vendors, or just ready to stop chasing approvals and start gaining control.

Why Trust Our Software Reviews

We’ve been testing and reviewing finance and accounting software since 2023. With backgrounds as financial operators, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent and our software review methodology.

Best Accounts Payable Automation Software Summary

I’ve put together this quick pricing breakdown to help you find the right accounts payable automation software essential for smarter AP decisions.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for AI-powered bill entry & coding | 21-day free trial available | From $99/month | Website | |

| 2 | Best for vendor payouts | Free demo available | Pricing upon request | Website | |

| 3 | Best for all-in-one cash management | Free demo available | From $149/month | Website | |

| 4 | Best for multi-method payment support | 30-day free trial + free plan available | From $15/user/month | Website | |

| 5 | Best for automated approval workflows | Free trial available | From $499/month | Website | |

| 6 | Best for advanced policy controls | Free demo available | From $8/user/month (billed annually) | Website | |

| 7 | Best for rapidly growing businesses | Free trial + free plan available | From $18.50/month + $8/user/month (billed annually) | Website | |

| 8 | Best for small CPG businesses | Free plan available | From $199/month | Website | |

| 9 | Best for automated three-way matching | Free demo available | Pricing upon request | Website | |

| 10 | Best for AI-driven invoice automation | Free demo available | Pricing upon request | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounts Payable Automation Software Reviews

Explore the top accounts payable automation software with my quick, clear reviews. Get insights into features, pros, cons, and integrations, so you can find the tool to help you streamline workflows, cut manual errors, and gain better control over your payables.

MakersHub is an automation platform that helps businesses cut down on manual work across the accounts payable (AP) process. The software uses AI to capture, code, and route invoices for approval, saving time and improving accuracy.

Why I picked MakersHub: I picked MakersHub for its AI-powered bill entry and coding, which can help your team avoid common data entry errors. Instead of manually keying in invoices, MakersHub pulls data directly from documents and codes it automatically. I also liked its structured approval flows—they keep the process moving by routing bills to the right people at the right time. For industries where spend oversight is critical, this kind of control may be especially useful.

Standout features & integrations:

Features include automated payments, industry-specific workflows for contractors and manufacturers, and an accountant certification program that helps teams get up to speed quickly. MakersHub also gathers user feedback to inform product improvements over time.

Integrations include QuickBooks Online and QuickBooks Desktop.

Pros and cons

Pros:

- Integration with QuickBooks

- Multi-layered approval process

- Automation of bills and payments

Cons:

- Certain features are limited to higher-tier plans

- Steep learning curve for new users

Payouts is an accounts payable automation platform tailored to streamline financial processes for businesses in affiliate marketing, influencer platforms, and digital advertising networks. By focusing on automation and efficiency, Payouts simplifies vendor payments, invoicing, and accounts payable workflows.

Why I picked Payouts: Payouts excels in automating complex payment workflows, making it ideal for teams managing high transaction volumes across vendors and partners. Its AP automation capabilities ensure that vendor payments are processed accurately and on time, reducing administrative workload and improving financial transparency. Additionally, the platform's vendor management tools provide centralized oversight for communication, payment tracking, and compliance, helping businesses maintain strong relationships with partners.

Standout features & integrations:

Features include support for multiple payout methods, such as fiat and cryptocurrencies and global accounts that facilitate transactions in local currencies. Overall, these features reduce conversion costs and simplify international payments. The platform also offers advanced invoicing tools that ensure precise and timely billing and advanced AP workflows that minimize errors and delays.

Integrations include PayPal, Venmo, Payoneer, impact.com, CJ Affiliate, Everflow, Zelle, Priority, Tune, System1, and NetSuite.

Pros and cons

Pros:

- Supports scaling operations

- Multiple payout methods

- Comprehensive automation of accounts payable processes

Cons:

- May require time to fully customize

- Potential challenges integrating with existing systems

Centime is a comprehensive cash management and business banking software that provides automation for accounts receivable and accounts payable processes, along with cash flow forecasting and KPI tracking. It helps improve collections effectiveness, reduce past-due payments, and enhance working capital for businesses of all sizes.

Why I picked Centime: Centime is a unique accounts payable automation software because it integrates cash management into a single platform. This integration allows you to automate invoice processing, route approvals, make payments, track performance, and more. The software also allows for instant capture of invoice data using AI, streamlines invoice coding and routing, and integrates with accounting systems, which is crucial for maintaining financial accuracy and compliance with accounting standards.

Standout features & integrations:

Features include accounts payable automation, which streamlines invoice processing and payment planning. The cash flow forecasting tool provides businesses with a 13-week rolling forecast to aid in liquidity planning. Additionally, Centime's working capital credit feature allows companies to access short-term credit lines from leading banks.

Integrations include NetSuite, QuickBooks, and Sage Intacct.

Pros and cons

Pros:

- Monitors key performance indicators, days sales outstanding, and days payables outstanding

- Tracks bills and bill payments in one window

- Combines accounts payable and accounts receivable management with cash flow tracking

Cons:

- Lacks a free trial with actual company data

- May be costly for smaller businesses

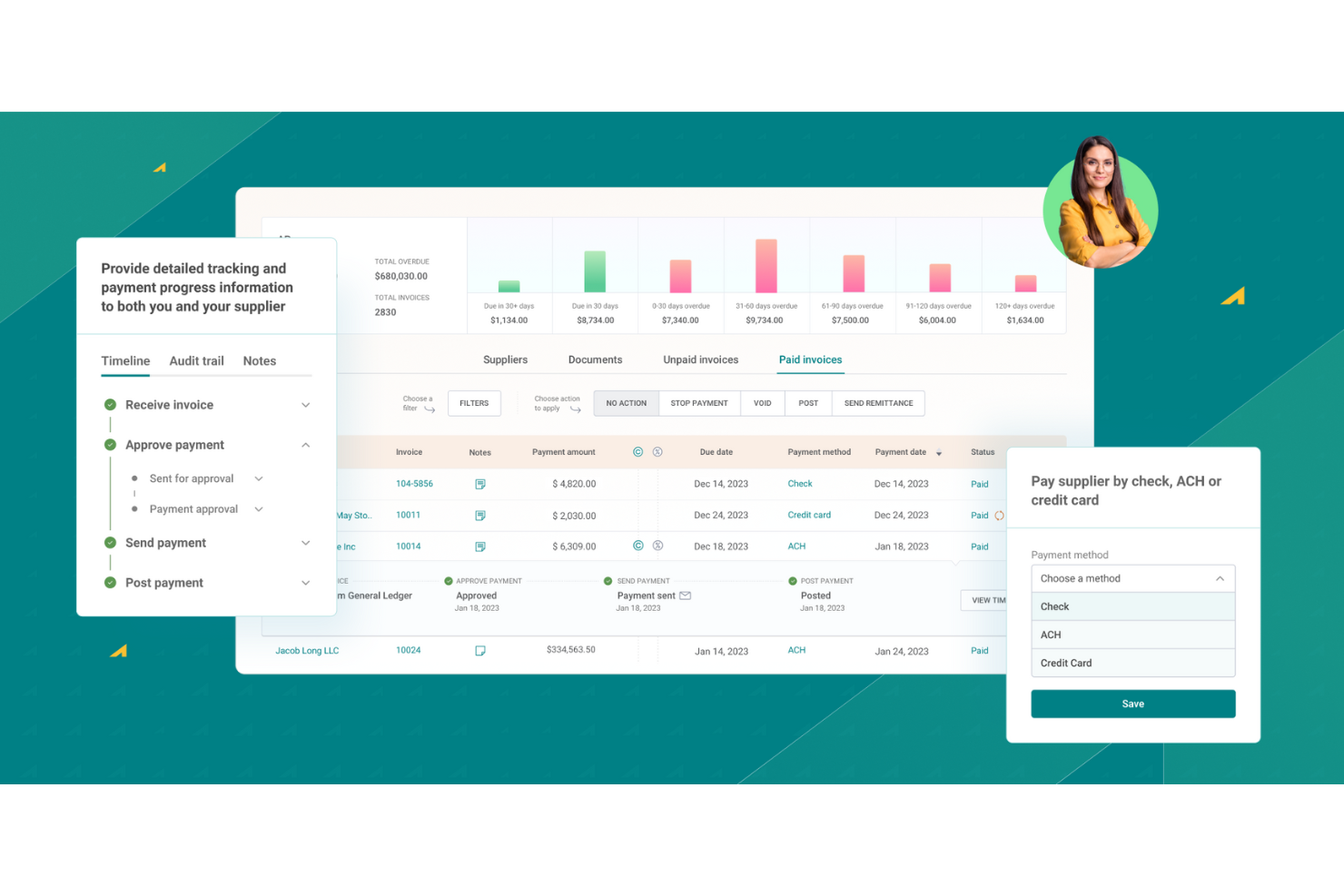

Ramp is a finance automation platform designed to help businesses manage their expenses, payments, and overall financial operations more efficiently.

Why I picked Ramp: I like that it offers AI-driven invoice processing. With optical character recognition (OCR) technology, Ramp automatically captures and digitizes invoice details, reducing the need for manual data entry and minimizing errors. You can also set up multi-level approval processes tailored to your organization's structure, ensuring that all invoices are reviewed and approved by the appropriate team members before payment. Furthermore, Ramp supports multiple payment methods, including ACH, check, card, and international wire transfers, giving you flexibility in managing vendor payments.

Standout features & integrations:

Features include automated two-way and three-way matching, which helps prevent overbilling by cross-referencing invoices with purchase orders and receipts. Additionally, Ramp offers real-time spend insights, providing you with up-to-date information on your company's financial status.

Integrations include NetSuite, Sage, Xero, QuickBooks, Microsoft Dynamics Business Central, Acumatica, Uber, Lyft, Okta, Google, Rippling, and Gmail.

Pros and cons

Pros:

- Automated expense reporting and receipt matching

- Ability to issue multiple virtual cards with customizable controls

- Comprehensive reporting features

Cons:

- Could offer more advanced accounting features

- Potential challenges integrating with less common ERP systems

New Product Updates from Ramp

AI-Powered Policy Agents by Ramp for Real-Time Expense Review and Fraud Detection

Ramp's new AI-powered Policy Agents review expenses in real time to flag fraud and out-of-policy spending, interact with employees, and recommend policy improvements. For more details, visit Ramp Announcements.

Precoro is a cloud-based procurement and accounts payable automation software designed to help businesses streamline their purchasing processes and manage company spending more effectively.

Why I picked Precoro: One standout feature of Precoro is its automated approval workflows. You can set up custom approval routes that align with your company's policies, ensuring that every purchase request and invoice is reviewed and authorized by the appropriate team members. It also offers a three-way matching system that cross-verifies purchase orders, receipts, and invoices to ensure consistency across all documents before any payment is processed.

Standout features & integrations:

Features include comprehensive vendor management, allowing you to store contracts and collaborate with suppliers in one centralized location. The platform also offers budget control capabilities, enabling you to monitor spending across various departments and projects to ensure adherence to financial plans. Additionally, Precoro provides detailed reporting and analytics tools, giving you insights into spending patterns and helping identify opportunities for cost savings.

Integrations include QuickBooks Online, NetSuite, Xero, Amazon Business, Home Depot, Staples Advantage, Grainger, Slack, and Power BI.

Pros and cons

Pros:

- Efficient purchase order creation and tracking

- Robust three-way matching system

- Customizable workflows adapt to various business needs

Cons:

- Mobile app could be improved

- Could offer more native integrations

Rippling Spend is a comprehensive platform designed to help businesses manage and control their spending. It consolidates various financial processes, including expense management, corporate cards, and bill payments, into a single system.

Why I picked Rippling Spend: I like its advanced policy engine, which allows you to create and enforce detailed spending rules. By setting up approval chains with role-based rules and cost checks, you can ensure that all expenses align with your company's policies. This automation reduces the need for manual oversight and minimizes the risk of unauthorized spending. Rippling Spend also lets you reimburse employees in over 100 countries and handle multi-currency payments. The platform even supports cross-currency reconciliation and collects receipts in any language.

Standout features & integrations:

Features include automated workflows that enhance financial processes by integrating with your existing systems. The platform offers real-time visibility into all company spending, allowing you to monitor expenses as they occur and make informed financial decisions promptly. Additionally, Rippling Spend integrates with payroll, enabling automatic reimbursement of employee expenses through their regular paychecks.

Integrations include Slack, Checkr, Google, Zoom, Asana, Salesforce, Microsoft 365, Guideline, GitHub, Jira, Datadog, and Hubspot.

Pros and cons

Pros:

- Efficient automation of HR tasks

- Employee self-service options

- Comprehensive features for various operations

Cons:

- Initial setup can be time-consuming

- Potential learning curve when maximizing the platform's features

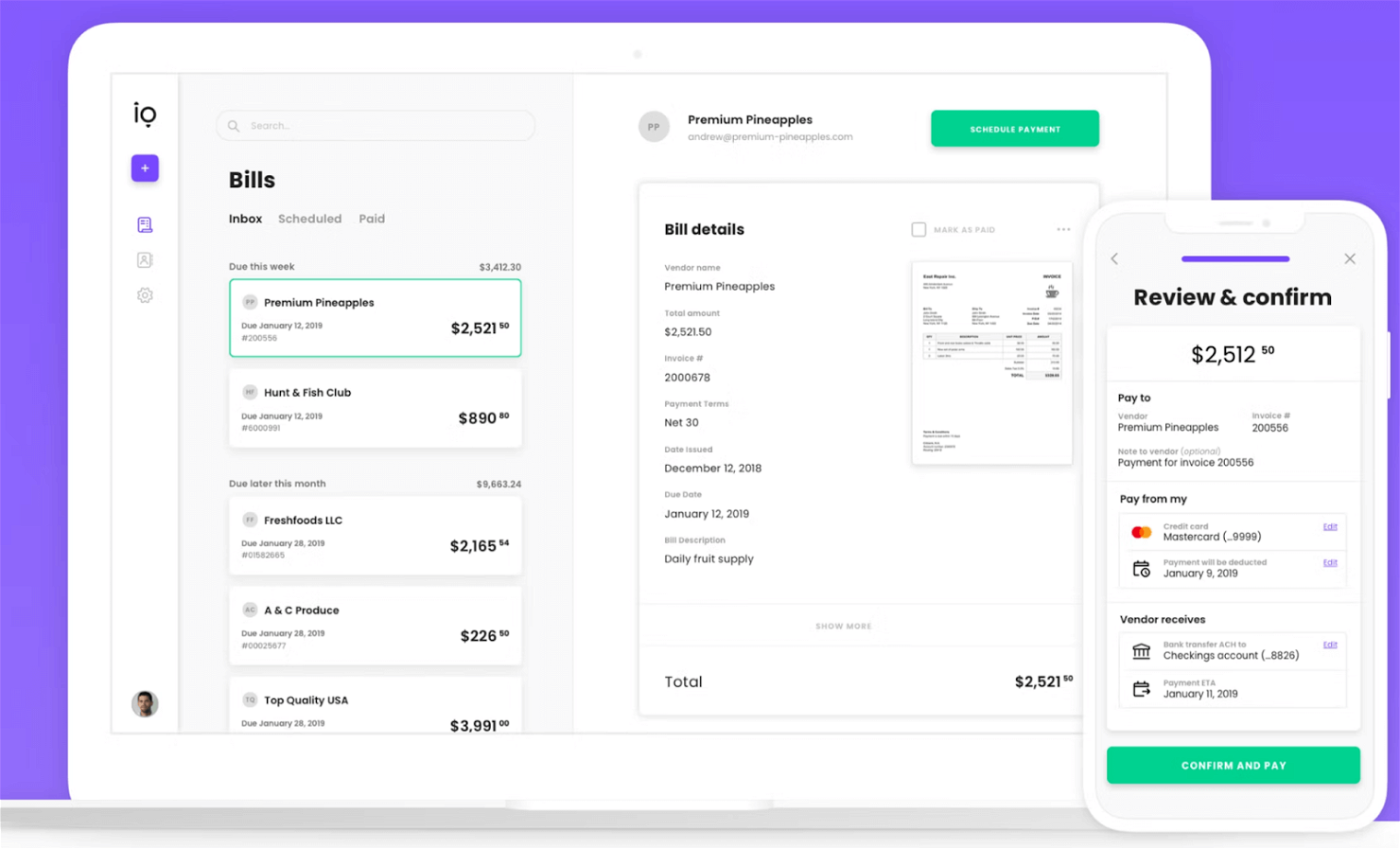

Melio is an online payment platform designed to simplify bill payments for small businesses. It allows you to pay vendors, suppliers, and contractors using bank transfers or credit cards.

Why I picked Melio: Melio is an excellent option for rapidly growing companies that need to keep their costs low and have outgrown basic platforms but aren’t quite ready for enterprise solutions that are too complex. The platform makes it easy to manage your accounts payable by letting you pay bills online, even if your vendors prefer checks. You can choose to pay via bank transfer or credit card, but your vendors get paid the way they want, without any extra hassle for them. It's also simple to schedule payments, helping you avoid late fees and better manage your cash flow. With quick bill syncing, you and your team can keep track of everything in one place.

Standout features & integrations:

Features include 1099 report generation, the ability to create approval workflows in a few clicks, and OCR for invoice data capture. It notably lets businesses pay vendors with credit cards, even if the vendors don’t accept cards. Plus, Melio can grab relevant data from synced accounting software if needed.

Integrations include Amazon Business, FreshBooks, QuickBooks, and Xero. It also integrates with Microsoft Dynamics Business Central.

Pros and cons

Pros:

- Can schedule payments ahead of time

- Can pay vendors with credit cards even if they don’t accept them

- Simple and intuitive interface

Cons:

- No automation features beyond the basics

- Setting up new vendors could be improved

Settle is a product designed to help small CPG businesses manage their payments and cash flow by automating the accounts payable process. It’s geared towards companies that want a simpler way to manage vendor payments, optimize working capital, and gain more control over their financial operations.

Why I picked Settle: Settle gives you tools to schedule and pay bills automatically, allowing you to better manage your outgoing cash flow. The platform lets you choose when and how to pay vendors and even helps you access financing options if you need them. You can also easily track your payment history in one place, which makes managing multiple vendors a lot easier. For businesses that rely on tight cash flow management, Settle offers flexible payment terms to help improve financial stability.

Standout features & integrations:

Features include detailed cash flow forecasting, which helps you predict your financial needs based on upcoming payments. Additionally, it offers customizable approval workflows, ensuring your team can review and approve payments before they’re processed.

Integrations include QuickBooks Online, NetSuite, Shopify, Amazon, Cin7, Google, and Xero.

Pros and cons

Pros:

- Comprehensive financial dashboard

- Automated invoice management

- Inventory management and forecasting

Cons:

- Could offer more customization for specific workflows

- Complex setup

Procurify is a cloud-based procurement and spend management platform designed to help organizations gain real-time visibility and control over their purchasing processes.

Why I picked Procurify: Procurify's accounts payable automation software offers automated data capture using optical character recognition (OCR) technology, which extracts invoice details and reduces manual data entry errors. This automation ensures that invoices are processed quickly and accurately, freeing up your team to focus on more strategic tasks. Another valuable feature is the customizable approval workflows. You can set up approval processes that align with your organization's hierarchy and policies, ensuring compliance with internal controls.

Standout features & integrations:

Features include automated three-way matching that compares invoices with purchase orders and goods received notices to verify accuracy. The software's real-time tracking and notifications also help keep stakeholders informed about invoice statuses. Additionally, its centralized vendor database allows you to streamline vendor management and payment processes with ease.

Integrations include QuickBooks Online, QuickBooks Desktop, NetSuite, Sage Intacct, Microsoft Dynamics 365, API, and PunchOut.

Pros and cons

Pros:

- The mobile app allows for approvals and management on the go

- Offers customizable reporting

- Real-time budget tracking

Cons:

- Editing purchase order requests can be cumbersome

- Could use more advanced analytics features

DOKKA is a digital tool designed to automate accounting processes, specifically focusing on the management and processing of invoices through artificial intelligence (AI). With a user-friendly approach, DOKKA aims to enhance productivity and reduce manual efforts, making it a helpful ally for finance teams.

Why I picked DOKKA: DOKKA excels in AI-driven invoice automation, a key component of its accounts payable automation software. It adeptly processes and categorizes invoices, extracting relevant data with high accuracy. This capability significantly reduces the time and errors associated with manual data entry, ensuring a smooth, automated workflow.

Standout features & integrations:

Features include its intelligent document management system, which uses AI to categorize and file documents automatically. The tool also automates both 2-way and 3-way PO matching, making the matching process more efficient. Additionally, DOKKA features customizable workflows that allow businesses to tailor the software to their specific needs, while its user-friendly interface, designed similarly to popular email apps like Gmail, makes navigation intuitive.

Integrations include NetSuite, SAP Business One, Microsoft Dynamics, Acumatica, Priority, QuickBooks, Xero, and Sage.

Pros and cons

Pros:

- Offers enhanced collaboration features

- Provides customizable workflows

- Highly accurate data extraction

Cons:

- Doesn't offer a free trial

- Price may be too high for small businesses

Other AP Automation Software Options

Here are a few other great options that didn’t quite make the cut for the best AP automation software list but are still worth considering:

- Klippa SpendControl

For multi-currency support

- Xero

For automated cash flow insights

- Airbase

For startups

- Stampli

For collaboration

- BILL

For international payments

- Bonsai

For freelancers

- Tipalti

For global accounts payable automation

- Xledger

For multi-entity financial management

- Quadient AP By Beanworks

For managing multiple locations or divisions

- Basware

For predictive analytics and benchmarking

Related Financial Software

If you still haven't found what you're looking for, check out some other, closely related tools we've tested and evaluated:

- Accounting Software

- Accounts Payable Software

- Expense Report Software

- Expense Tracking Software

- Financial Reporting Software

- ERP Software

- POS Systems

- Billing Software

- Forecasting Software

- Merchant Account Services

Accounts Payable Automation Software Selection Criteria

To choose the best accounts payable automation software, I prioritized what matters to finance leaders: reducing errors and accelerating approvals. I used a structured evaluation framework focused on efficiency, accuracy, and ease of use.

Core Functionality (25% of total weighting score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Automate invoice processing

- Manage approval workflows

- Integrate with ERP systems

- Facilitate payment processing

- Provide analytics and reporting

Additional Standout Features (25% of total weighting score)

To help further narrow down the competition, I also looked for unique features, such as:

- AI-powered fraud detection

- Dynamic workflow automation

- Vendor management portal

- Customizable invoice coding

- Real-time audit trails

Usability (10% of total weighting score)

To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Mobile accessibility

- Customizable dashboards

- Ease of navigation

- Integration with existing tools

Onboarding (10% of total weighting score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Comprehensive documentation

- Onboarding webinars

- Access to chatbots for support

Customer Support (10% of total weighting score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 customer service availability

- Dedicated account managers

- Multi-channel support options

- Response time and resolution rate

- Availability of support forums

Value For Money (10% of total weighting score)

To evaluate the value for money of each platform, I considered the following:

- Transparent pricing models

- Availability of free trials

- Cost vs. feature set

- Discounts for annual subscriptions

- No hidden fees

Customer Reviews (10% of total weighting score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction rating

- Comments on ease of use

- Feedback on customer service

- Reports on system reliability

- Opinions on feature set completeness

How to Choose Accounts Payable Automation Software

Choosing the right software can feel overwhelming with all the lengthy feature lists and confusing pricing plans. To make things easier, here are a few key factors to keep in mind as you navigate the selection process.

| Factor | What to Consider |

|---|---|

| Scalability | Will this software grow with your business? |

| Integrations | Does it integrate with your existing systems (i.e. ERP systems and CRMs)? |

| Customizability | Can you tailor it to fit your specific needs? |

| Ease of Use | Do the people who'll use it find it user-friendly? |

| Budget | Does it fit within your financial constraints? |

| Data Security | Are there measures in place to protect your data? |

| Support | Is there reliable customer support available? |

| Compliance | Does it help you stay compliant with regulations? |

Trends in Accounts Payable Automation Software

Accounts payable automation software is evolving fast. After sorting through the latest releases and feature updates, three clear trends emerged. If you’re looking to cut costs, increase control, and reduce manual errors, keep an eye out for these trends:

- Artificial Intelligence and Machine Learning: These technologies are making AP automation smarter by improving cash flow predictions, boosting fraud detection, and handling complex decisions on their own.

- Hyperautomation: This goes beyond basic automation by combining tools like AI and RPA to automate as many AP processes as possible. The goal? Faster workflows, fewer errors, and better efficiency.

- Advanced Data Analytics: More AP solutions are using analytics to give businesses deeper insights into spending patterns and financial health. NetSuite, for instance, helps companies manage expenses and cash flow with its powerful analytics tools.

- Blockchain Technology: Some vendors are starting to explore blockchain as a way to secure transaction records, reduce fraud risks, and ensure transparency. By creating an unchangeable digital ledger, blockchain could make invoice processing safer and more efficient.

- Fraud Prevention Features: Security is a bigger focus than ever, with automated fraud detection tools becoming a must-have. These algorithms help businesses spot and stop fraudulent activity before it becomes a problem.

What Is Accounts Payable Automation Software?

Accounts payable automation software is a digital tool that automates the processing, approval, and payment of supplier invoices.

It replaces manual AP workflows with features like automated invoice capture, three-way matching, approval routing, and scheduled payments. Designed for accounting teams and CFOs, this software reduces human error, accelerates invoice cycle times, and ensures compliance with internal controls.

By providing real-time visibility into liabilities and cash flow, accounts payable automation software helps finance leaders optimize working capital and scale operations efficiently.

Features of Accounts Payable Automation Software

Whether you’re picking out accounts payable automation software for a small business or larger corporation, here are some key features you’ll want to look for:

- Invoice Management: Streamlines the processing, tracking, and approval of invoices, making it easier to manage large volumes of invoices efficiently.

- Purchase Order Matching: Automatically matches purchase orders with invoices and receipts to ensure accuracy and prevent discrepancies.

- Optical Character Recognition (OCR): OCR pulls data from paper and PDF invoices scanned in or sent via email to do the data entry for you.

- Workflow and Approval Automation: Automates the routing of invoices and payments through predefined approval workflows, reducing manual intervention and speeding up processing times.

- Payment Processing: Facilitates electronic payments to vendors, reducing the need for paper checks and minimizing processing errors.

- Reporting and Analytics: Provides real-time insights and detailed reports on accounts payable activities, helping businesses make informed financial decisions.

- Vendor Management: Maintains detailed records of vendor information and interactions, improving vendor relationships and ensuring compliance with agreed terms.

- Document Management: Allows for the electronic storage and retrieval of documents, reducing paper clutter and enabling quick access to important files.

- Three-Way Matching: Ensures that the invoice, purchase order, and receipt of goods match before processing payment, preventing fraud and errors.

- Batch Processing: Enables the processing of multiple invoices and payments in a single batch, saving time on billing management and reducing administrative workload.

Benefits of Accounts Payable Automation Software

Switching to accounts payable automation software can make a big difference for your team and your business. Here are some key benefits you can expect:

- Increased Visibility: Centralized data and real-time reporting provide better insights into your accounts payable process and overall financial health.

- Time Savings: Automating repetitive tasks like data entry and invoice processing frees up your team's time for more important work.

- Error Reduction: The software minimizes human errors by automatically capturing and matching invoice data with purchase orders.

- Improved Cash Flow Management: Real-time monitoring of invoices and payments helps you better manage your cash flow and forecast future needs.

- Enhanced Compliance: Automation ensures that all invoices are processed according to regulatory requirements, reducing the risk of non-compliance.

- Better Vendor Relationships: Faster and more accurate payment processing keeps vendors happy and may lead to better payment terms or discounts.

- Cost Savings: Reducing manual processes lowers administrative costs and decreases the likelihood of costly errors.

Costs and Pricing of Accounts Payable Automation Software

Accounts payable automation software pricing usually scales by features and team size. Most tools follow a predictable tiered structure. Use my table below to quickly compare common plans, average costs, and key features, so you can budget smartly and choose the right fit for your finance team.

| Plan Type | Average Price (per user, per month) | Common Features |

|---|---|---|

| Free | $0 | Basic invoice processing, limited document storage, email support, and basic reporting. |

| Startup | $20-30 | Invoice processing, document storage, email and chat support, basic integrations, and reporting. |

| Business | $50-70 | Advanced invoice processing, enhanced document storage, multi-user access, advanced integrations, and detailed reporting. |

| Enterprise | $100-150 | Comprehensive invoice processing, unlimited document storage, dedicated support, custom integrations, and advanced analytics. |

Accounts Payable Automation Software FAQs

Got more questions about AP automation or what to keep in mind when looking for a solution? Here are a few common questions and answers:

What are the main benefits of automating AP?

Here’s what AP software can do for your finance department:

- Save time: Your team does far less manual data entry, vendor communications, and so on.

- Cut labor costs: You don’t need to bring on more AP team members as your business grows—the software helps handle increasing payment volume.

- Reduce errors: Automation reduces the chance of errors that manual entry could lead to.

- Data visibility: Financial reports update in real time. You get current data to make decisions, not past data.

What tasks can AP automation solutions handle?

Here’s what AP automation can handle for you:

- Approval and routing of purchase requisitions, POs, and invoices.

- Invoice data capture through OCR and AI.

- Communications with vendors and suppliers.

- Payments, especially recurring payments.

How do you implement AP automation?

To implement AP automation, start by evaluating your current AP processes and identifying your needs. Build a business case to get stakeholder buy-in. Document your requirements and choose an AP automation vendor that fits your needs. Create and execute an implementation plan with clear steps and timelines.

How much time does AP automation save?

AP automation can save significant time by reducing manual tasks. On average, you can expect to save 60% to 80% of the time typically spent on invoice receipt and data capture. This efficiency allows your team to focus on higher-value tasks.

How can RPA and AI be used for accounts payable automation?

RPA (Robotic Process Automation) and AI (Artificial Intelligence) can automate repetitive tasks like invoice processing, data entry, and validation. These technologies make your accounts payable workflow more efficient and accurate, reducing errors and speeding up processing times.

How do you handle exceptions in AP automation?

Handling exceptions in AP automation involves setting up workflows to manage discrepancies like invoice mismatches or missing information. Your team can review and resolve these exceptions manually or use machine learning algorithms to identify and correct common issues over time.

What security measures are in place for AP automation software?

AP automation software typically includes several security measures like data encryption, user access controls, and audit trails. These features help protect your financial data from unauthorized access and ensure compliance with industry standards.

What's Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.