Best Accounting Software For Large Business Shortlist

Here's my pick of the 10 best software from the 19 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Running large-scale finances on outdated systems is a constant drag. Reports take too long, errors slip through, and your team wastes hours on manual fixes. You’ve probably looked for better accounting software for large businesses, but with so many options that sound the same, it’s hard to know what will actually work at scale.

As a digital software expert, I’ve seen which tools break under pressure and which ones actually support complex operations. I know the value of real-time reporting, solid consolidation features, and automation that cuts your month-end in half. That hands-on experience helps me spot what matters—and what doesn’t.

I tested and reviewed each tool on this list with day-to-day financial management in mind. These picks are built to handle volume, complexity, and fast-moving teams. If you’re looking for a smarter way to run finance, this list will point you in the right direction.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software for large businesses since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our review methodology.

The Best Accounting Software For Large Business: Comparison Chart

Comparing tools isn’t fun, and looking at costs can be exhausting. To help speed up the process, I summarized all the pricing and trial information you’ll need for my top accounting software for large businesses. Check it out.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for financial management | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 2 | Best for generative AI and automation | Free trial available | From $180/user/month | Website | |

| 3 | Best for AI-powered continuous accounting | Not available | From $10/user/month | Website | |

| 4 | Best for integrated financial management | Free demo available | Pricing upon request | Website | |

| 5 | Best for advanced financial and supply management | Not available | Pricing upon request | Website | |

| 6 | Best for customer satisfaction rating | Free demo available | From $1,800/month (billed annually) | Website | |

| 7 | Best for comprehensive workforce management | Free demo available. | Pricing upon request | Website | |

| 8 | Best for compliance and risk management | Free demo available | Pricing upon request | Website | |

| 9 | Best for industry-specific solutions | Not available | Pricing upon request | Website | |

| 10 | Best for easy app integrations | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounting Software For Large Business Reviews

In this section, I’ll take you through a closer look at each accounting software made for large businesses. I’ll break down the pros and cons, key features, and when each tool makes the most sense—so you can see what fits best for your team and how you work.

Zoho Books offers a wide range of features to manage finances, automate business workflows, and collaborate across departments.

Why I Picked Zoho Books: I chose Zoho Books for its robust set of features that cater to the comprehensive financial management needs of large businesses. Its ability to automate workflows and provide real-time financial insights makes it stand out.

Standout Features & Integrations:

Features include automated bank feeds, multi-currency support, project accounting, and detailed financial reporting.

Integrations include Zoho CRM, Zoho Projects, PayPal, Stripe, G Suite, Office 365, Slack, Zapier, Avalara, and Twilio.

Pros and cons

Pros:

- Automated workflows

- Multi-currency support

- Comprehensive financial tools

Cons:

- Steeper learning curve

- Limited third-party integrations

Microsoft Dynamics 365 Finance leverages generative AI and automation to optimize financial processes and enhance decision-making.

Why I Picked Microsoft Dynamics 365 Finance: I chose Microsoft Dynamics 365 Finance excels in automating complex financial tasks, making it ideal for large businesses that require robust financial management capabilities. Its ability to integrate AI-driven insights into financial operations makes it the best choice for businesses looking to enhance efficiency and accuracy.

Standout Features & Integrations:

Features include financial planning and analysis, accounting and financial close, tax management, and cash management.

Integrations include Microsoft 365, Power BI, Azure, LinkedIn, Adobe Sign, DocuSign, Salesforce, SAP, Oracle, and ServiceNow.

Pros and cons

Pros:

- Robust integration options

- Comprehensive financial management

- Advanced AI capabilities

Cons:

- Complex setup

- High cost

Sage is a cloud-based financial management platform designed to streamline accounting processes for growing businesses.

Why I Picked Sage: I chose Sage for its advanced AI-powered continuous accounting features, which set it apart from other accounting software. This tool excels in automating time-consuming accounting tasks, allowing businesses to focus on strategic growth. Its AI and machine learning capabilities make it the best choice for continuous accounting, providing real-time insights and anomaly detection.

Standout Features & Integrations:

Features include AI-powered general ledger, multi-entity and multi-currency management, and real-time reporting and dashboards.

Integrations include Salesforce, ADP, Bill.com, Expensify, Stripe, Avalara, Gusto, PayPal, Shopify, and Square.

Pros and cons

Pros:

- Multi-entity management

- Real-time insights

- AI-powered automation

Cons:

- Implementation time

- Pricing not transparent

NetSuite Accounting combines core financial functions with compliance management, enhancing business performance and financial close efficiency.

Why I Picked NetSuite Accounting: I chose NetSuite Accounting for its comprehensive suite of integrated financial management tools. Unlike other software, it offers a unified platform that integrates with various business functions, making it ideal for large enterprises. Its ability to automate and streamline complex financial processes sets it apart, ensuring efficient and accurate financial management.

Standout Features & Integrations:

Features include general ledger, accounts receivable, accounts payable, tax management, fixed assets management, cash management, and payment management.

Integrations include Salesforce, Shopify, Magento, PayPal, Stripe, Expensify, Bill.com, Avalara, ADP, and Concur.

Pros and cons

Pros:

- Strong compliance features

- Real-time data visibility

- Comprehensive financial management

Cons:

- Complex implementation

- Pricing not transparent

Infor CloudSuite Financials is a modern, cloud-based ERP financial and accounting software designed for large businesses.

Why I Picked Infor CloudSuite Financials: I chose Infor CloudSuite Financials for its robust integration of financial and supply management functionalities, which stands out among other accounting software for large businesses. Its ability to provide deep industry-specific functionality and eliminate the need for customizations makes it particularly suitable for advanced financial and supply management.

Standout Features & Integrations:

Features include a next-gen global ledger that supports unlimited financial calendars, ledgers, and dimension strings.

Integrations include GTreasury, Salesforce, SAP, Oracle, Microsoft Dynamics, Workday, QuickBooks, NetSuite, Sage, and Epicor.

Pros and cons

Pros:

- Industry-specific functionality

- Advanced supply chain integration

- Comprehensive financial management

Cons:

- Complex setup process

- Pricing not publicly available

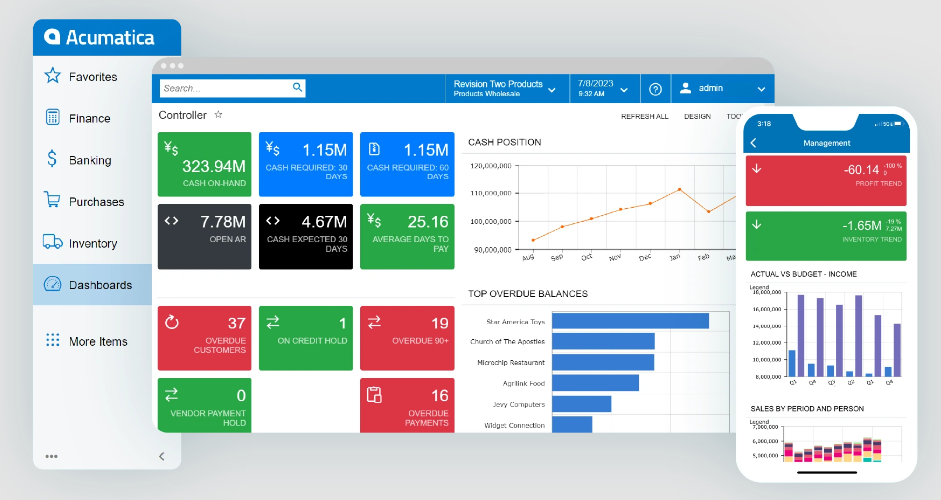

Acumatica is a cloud-based ERP business management system that offers a wide range of products and solutions for large businesses.

Why I Picked Acumatica: I chose Acumatica for this list because it stands out with its exceptional customer satisfaction ratings, which are the highest in the industry. This is a testament to its user-centric design and robust feature set. I believe Acumatica is best for customer satisfaction due to its flexible deployment options, transparent pricing, and the ability to scale with business needs without hidden fees.

Standout Features & Integrations:

Features include a full suite of accounting functions, real-time business insights, and automation across multiple workflows.

Integrations include Amazon, BigCommerce, Shopify, Microsoft Dynamics 365, QuickBooks, NetSuite, Sage Intacct, Salesforce, HubSpot, and PayPal.

Pros and cons

Pros:

- Transparent pricing

- Flexible deployment options

- High customer satisfaction

Cons:

- Complex initial setup

- Limited offline capabilities

Workday Financial Management is a comprehensive enterprise accounting and finance software designed for large businesses. Offering integrated solutions that streamline both financial and human resources operations.

Why I Picked Workday Financial Management: I chose Workday Financial Management for its robust integration of financial and workforce management capabilities. Unlike other accounting software, Workday excels in providing a unified platform that combines financial management with human capital management, making it ideal for large businesses that require comprehensive workforce management. Its AI-driven automation and real-time insights further distinguish it from competitors.

Standout Features & Integrations:

Features include AI-driven automation for accounting processes, real-time financial consolidation, and multidimensional analysis.

Integrations include Salesforce, Microsoft Office 365, Slack, ServiceNow, ADP, SAP, Oracle, Google Workspace, Coupa, and DocuSign.

Pros and cons

Pros:

- Real-time insights

- AI-driven automation

- Unified platform

Cons:

- Complex setup

- Pricing not transparent

SAP S/4HANA Finance excels in compliance and risk management, ensuring businesses meet regulatory requirements and manage risks effectively.

Why I Picked SAP S/4HANA Finance: I chose SAP S/4HANA Finance for its robust compliance and risk management capabilities. This tool stands out due to its advanced features that automate and manage risks, controls, identities, cyber threats, and international trade across the enterprise. I believe it is the best for compliance and risk management because it integrates embedded analytics and artificial intelligence to provide a comprehensive solution.

Standout Features & Integrations:

Features include advanced financial closing, group reporting, and governance, risk, and compliance (GRC) management.

Integrations include SAP Ariba, SAP Concur, SAP SuccessFactors, SAP Fieldglass, Microsoft Office 365, Salesforce, Amazon Web Services (AWS), Google Cloud Platform (GCP), IBM Watson, and Oracle.

Pros and cons

Pros:

- Integrated analytics

- Comprehensive risk management

- Advanced compliance features

Cons:

- High cost

- Complex setup

Epicor ERP is designed for large businesses, offering solutions for automotive, building supply, distribution, manufacturing, and retail.

Why I Picked Epicor ERP: I chose Epicor ERP for the list because it stands out with its solutions, which are tailored to meet the unique needs of various sectors. This specialization makes it different from other accounting software that often takes a more generic approach. I believe Epicor ERP is best for industry-specific solutions because it offers tailored functionalities and tools that address the distinct challenges and requirements of different industries.

Standout Features & Integrations:

Features include advanced data management and integration capabilities, digital commerce tools, and a comprehensive suite of business products.

Integrations include Salesforce, Microsoft Dynamics, Oracle, SAP, QuickBooks, Shopify, Magento, Amazon, eBay, and PayPal.

Pros and cons

Pros:

- Strong integration capabilities

- Comprehensive feature set

- Industry-specific solutions

Cons:

- Complex setup process

- Pricing not transparent

Xero is a leading accounting software designed for large businesses. It offers a range of features and pricing plans tailored to different business types.

Why I Picked Xero: I chose Xero for this list because its ability to easily connect with a wide array of apps makes it ideal for businesses looking to streamline their accounting processes. Due to its extensive app marketplace and ease of connecting with other business tools, Xero is best for app integrations.

Standout Features & Integrations:

Features include invoicing, expense tracking, bank reconciliation, and financial reporting.

Integrations include Stripe, PayPal, Square, Shopify, HubSpot, Gusto, Bill.com, Expensify, Vend, and Deputy.

Pros and cons

Pros:

- Strong financial reporting

- User-friendly interface

- Extensive app marketplace

Cons:

- Higher cost for premium features

- Limited customer support options

Other Accounting Software For Large Business

Below is a list of additional accounting software for large businesses that I shortlisted, but did not make it to the top list. Worth checking them out.Business accounting software automates financial management tasks. It enhances accuracy, saves time, and provides real-time financial insights. This software solves major pain points like manual errors, time-consuming processes, and lack of financial visibility.

- QuickBooks Online

For live expert assistance

- BlackLine

For good financial close management

- Odoo Accounting

For good integration with other business apps

- Ramco ERP Finance

For good cloud-based financial management

- Priority Software

For good ERP financial management

- Unit4 Financials

For good financial planning and analysis

- Coupa

For good spend management solutions

- Kashoo

For good simplicity in bookkeeping

- Certinia

For good project accounting capabilities

Accounting Software For Large Business Selection Criteria

Picking the right accounting software for a large business really comes down to finding tools that actually fit your needs and can handle the complexity. I’ve spent time testing and digging into these platforms myself, so I can share what features really make a difference—and which ones you can skip.

Core Functionality: 25% of Total Weighting Score

- General Ledger Management

- Accounts Payable and Receivable

- Financial Reporting and Analysis

- Budgeting and Forecasting

- Tax Management

Additional Standout Features: 25% of Total Weighting Score

- Advanced Analytics and Reporting

- Automation Capabilities

- Integration with Other Systems

- Scalability

- Customizability

Usability: 10% of Total Weighting Score

- Intuitive Interface

- Navigation

- Customization

- Performance

Onboarding: 10% of Total Weighting Score

- Training Videos

- Templates

- Interactive Product Tours

- Chatbots and Webinars

Customer Support: 10% of Total Weighting Score

- 24/7 Support

- Multiple Support Channels

- Knowledge Base

- Response Time

Value For Money: 10% of Total Weighting Score

- Pricing Plans

- Feature-to-Cost Ratio

- Scalability

- Trial Periods

Customer Reviews: 10% of Total Weighting Score

- User Satisfaction

- Feedback on Features

- Support Experience

- Overall Value

How To Choose Accounting Software For Large Business

As you go through the process of choosing the right software for your team, here are a few things to keep in mind:

- Scalability: Large businesses often experience growth and changes in their operations. For this reason, it is crucial to choose accounting software that can scale with your business. Scalability ensures that the software can handle increased transaction volumes, additional users, and more complex financial processes as your business expands. For example, a retail chain expanding its number of stores will need software that can manage a higher volume of sales transactions and inventory data without compromising performance.

- Integration Capabilities: Large businesses typically use multiple software systems for various functions such as Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Project Management (PM), and Human Resources (HR). The chosen accounting software should seamlessly integrate with these existing systems to ensure a unified and efficient workflow. For instance, integrating accounting software with a CRM system can automate the process of generating invoices from sales data, reducing manual entry and errors.

- Compliance and Security: Compliance with accounting standards and data security are paramount for large businesses. The software should support compliance with relevant financial regulations and standards such as GAAP or IFRS. Additionally, it should offer robust security features to protect sensitive financial data from breaches and unauthorized access. For example, a multinational corporation will need software that can handle multi-currency transactions and comply with international tax laws while ensuring data security through encryption and access controls.

- Customization and Industry-Specific Features: Large businesses often have unique requirements based on their industry. The accounting software should offer customization options and industry-specific features to meet these needs. For example, a manufacturing company may require software with advanced inventory management and cost accounting features, while a service-based business might need robust project accounting and time-tracking capabilities.

- User Support and Training: Implementing new accounting software in a large business in any space can be complex, and adequate support and training are essential for a smooth transition. The software provider should offer comprehensive support services, including training sessions, user manuals, and customer support to assist your team in effectively using the software. For instance, a B2B enterprise with a global presence will benefit from 24/7 customer support and training programs tailored to different user roles within the organization.

Trends For Accounting Software For Large Business

Accounting software for large businesses is changing fast—and for the better. Here are a few trends worth keeping an eye on.

- AI and Machine Learning Integration: AI and machine learning are being integrated into accounting software. These technologies help automate repetitive tasks and improve accuracy. This trend is important for reducing human error and increasing efficiency.

- Blockchain for Enhanced Security: Blockchain technology is being used to enhance security in accounting software. It provides a tamper-proof ledger of transactions. This is crucial for maintaining data integrity and preventing fraud.

- Cloud-Based Solutions: Cloud-based accounting software is becoming more prevalent. It allows for real-time access to financial data from anywhere. This trend is significant for improving collaboration and flexibility.

- Advanced Analytics and Reporting: Advanced analytics and reporting features are being incorporated into accounting software. These tools provide deeper insights into financial data. This is valuable for making informed business decisions.

- Mobile Accessibility: Mobile accessibility is a growing trend in accounting software. It enables users to manage finances on the go. This is important for maintaining productivity and responsiveness.

What Is Accounting Software For Large Business?

Accounting software for large businesses is a comprehensive tool designed to manage and streamline the financial operations of large enterprises. A large business accounting system is used by finance departments, accountants, and financial managers to handle high volumes of transactions, ensure compliance with regulatory standards, and provide real-time financial insights.

Sometimes also called enterprise accounting software, an accounting platform for large businesses is essential for managing complex financial processes, including general ledger, accounts receivable, accounts payable, and financial reporting, enabling large businesses to maintain financial accuracy and efficiency.

Features Of Accounting Software For Large Business

Picking the right accounting software for large businesses isn’t just a nice-to-have—it’s key to keeping complex finances running smoothly.

The right software makes all of that easier. It can help your team stay accurate, move faster, and get clearer insights without all the manual work. Here are the top features to look for when choosing accounting software for large businesses.

- Core Accounting: All accounting needs, including recording and categorizing transactions, managing the general ledger, payment processing, and generating financial statements. These functions are essential for tracking revenue, expenses, and cash flow, which are critical for the financial health of any large business.

- Payroll Management: Integrated payroll management software automates payroll calculations, including gross and net pay, payroll tax withholdings, and benefits. This feature is crucial for businesses with large workforces to ensure accurate and timely payroll processing.

- Budgeting and Forecasting: This feature allows businesses to use historical and real-time data to create budgets and forecasts. It helps managers project future business performance and track actual performance against the budget, enabling better financial planning and decision-making.

- Billing and Invoicing: This feature accelerates cash flow by automating invoicing and collection processes. It includes generating invoices, managing credit terms, and improving payment collection with automated alerts and multiple payment methods.

- Project Accounting: This feature is essential for businesses that undertake project-based work. It automates the allocation and tracking of project revenue and expenses, enabling companies to monitor progress against key project milestones and invoice customers accordingly.

- Asset Tracking: This module helps track the value and details of fixed assets over their useful lifespan. It automates depreciation calculations and maintains records of each asset’s value, inventory level, condition, and cost.

- Reporting and Analytics: Advanced reporting and analytics tools provide detailed insights into the company’s financial health. Customizable dashboards and real-time analytics help financial teams monitor key metrics and make data-driven decisions.

- Mobile Support: Cloud-based accounting software with mobile support allows staff to access information anytime, anywhere. A mobile app is particularly useful for employees who need to manage workflows while on the move.

- Tax Management: This feature automates complex tax calculations by local, national, and global requirements. It ensures that businesses pay and collect the appropriate taxes and maintain detailed records for compliance purposes.

- Integration with Other Systems: Integration with other business applications, such as an ERP system and CRM systems, ensures that financial data is synchronized across the organization. This reduces data-entry errors and provides a holistic view of the business.

Benefits Of Accounting Software For Large Business

When you're running finance for a large organization, you need tools that actually keep up. The right accounting software can make a big difference—helping your team move faster, cut down on errors, and get the insights you need to make smarter decisions. Here are five key benefits worth knowing about:

- Enhanced Accuracy: Using accounting software reduces the risk of human error in financial calculations and data entry, ensuring that financial records are precise and reliable.

- Time Efficiency: Automated processes in accounting software save significant time by handling repetitive tasks such as invoicing, payroll, and reconciliations, allowing staff to focus on more strategic activities.

- Improved Financial Reporting: Accounting software provides comprehensive and customizable financial reports, enabling businesses to gain deeper insights into their financial health and make informed decisions.

- Regulatory Compliance: The software helps ensure that the business complies with financial regulations and standards by automatically updating tax codes and generating necessary compliance reports. This is especially valuable for businesses in healthcare.

- Scalability: As a business grows, accounting software can easily scale to accommodate increased transaction volumes and more complex financial operations, supporting the business's expansion without disruption.

Adopting accounting software can transform the financial management of large businesses, leading to greater efficiency, accuracy, and strategic insight. By leveraging these tools, organizations can better navigate the complexities of their financial operations and drive sustained growth.

Costs And Pricing Of Accounting Software For Large Business

This section provides an estimate of average accounting software plans and costs for large businesses.

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic invoicing, expense tracking, limited users, ad-supported, basic reporting |

| Personal Plan | $15-$20 per month | Enhanced invoicing, multiple users, basic inventory management, basic payroll |

| Business Plan | $70-$175 per month | Advanced invoicing, multi-user support, comprehensive inventory management, payroll, tax management, financial reporting, integrations with other business tools |

| Enterprise Plan | $350+ per month | Customizable features, unlimited users, advanced financial management, inventory and order management, HR operations, advanced analytics, dedicated support, multi-currency and multi-language support, compliance tools |

Accounting Software For Large Business FAQs

How can accounting software help large businesses manage complex financial operations?

Accounting software for large businesses is designed to handle complex financial operations by automating and streamlining various accounting tasks. These systems can manage high volumes of transactions, support multi-currency operations, and integrate with other enterprise systems like CRM and ERP.

They provide advanced features such as automated invoicing, tax management, payroll processing, and comprehensive financial reporting. By automating routine tasks, accounting software frees up time for finance teams to focus on strategic planning and analysis, thereby improving overall efficiency and accuracy.

How does accounting software ensure compliance with global tax regulations?

Accounting software for large businesses often includes features to handle complex tax calculations and ensure compliance with global tax regulations. These systems can automatically calculate VAT, GST, and other taxes based on the location of the transaction. They also provide tools for tax planning and optimization, helping businesses identify tax-saving opportunities. Additionally, the software can generate detailed tax reports and set reminders for important tax deadlines to avoid penalties. By keeping up with changes in tax laws, accounting software ensures that businesses remain compliant across different jurisdictions.

How can accounting software improve financial reporting and analysis for large businesses?

Accounting software enhances financial reporting and analysis by providing real-time access to financial data and offering a wide range of pre-built and customizable reports. These systems can generate balance sheets, income statements, cash flow statements, and other critical financial documents with just a few clicks.

Advanced data visualization tools help businesses analyze historical trends and make informed decisions. By automating the reporting process, accounting software reduces the risk of errors and ensures that financial information is accurate and up-to-date.

How does accounting software handle multi-currency transactions for global businesses?

Accounting software designed for large, global businesses typically includes multi-currency support to handle transactions in different currencies. The software can automatically convert currencies based on real-time exchange rates and manage multiple bank accounts in various currencies.

It also ensures compliance with international accounting standards and provides detailed reports on foreign currency transactions. This capability is essential for businesses operating in multiple countries, as it simplifies financial management and reduces the risk of errors in currency conversion.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.