Best Accounting Software With Payroll for Small Businesses Shortlist

Here's my pick of the 10 best software from the 17 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Running a small business is tough enough. Finding an accounting software is easy, but finding an accounting software with payroll for small businesses is another headache on its own.

As a digital software expert, I’ve tested a ton of systems and know how draining the search can be (especially for something so niche). So, I’ve done the work for you.

This list focuses on tools built for small business needs—easy to set up, clear reporting, and stress-free payroll. If you're tired of cobbling things together, these picks will help you find a solution that actually works.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software with payroll for small businesses since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Accounting Software With Payroll for Small Businesses Summary

Software hunting can be a total time suck—I get it. So to help you out, I made this quick cost summary chart with pricing and trial info for my favorite accounting software with payroll for small businesses. Here’s the breakdown:

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for accounts payable automation | Free demo available | Pricing upon request | Website | |

| 2 | Best for comprehensive accounting features | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 3 | Best for customizable accounting tools | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 4 | Best for AI-powered bookkeeping | 30-day free trial | From $8/user/month (billed annually) | Website | |

| 5 | Best for free accounting and payroll | 30-day free trial + free plan available | From $14/user/month | Website | |

| 6 | Best for integrated payroll and HR solutions | Free demo available | From $40/month + $6/user/month | Website | |

| 7 | Best for customizable and integrated financial management | 14-day free trial | From $1.46/month | Website | |

| 8 | Best for simplicity and automation | 14-day free trial | From $20/month | Website | |

| 9 | Best for desktop accounting | 30-day free trial | From $20/user/month | Website | |

| 10 | Best for user-friendly interface | 30-day free trial + free plan available | From $15/month (billed annually) | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounting Software With Payroll for Small Businesses Reviews

If you’re needing more information, here’s a closer look at each of my accounting software with payroll for small businesses options. I’ve broken down the pros and cons, key features, and who each one is best for.

Payouts is a financial automation platform that helps businesses manage vendor payments and accounts payable processes. It offers tools to automate invoice handling, payment approvals, and global payouts.

Why I picked Payouts: Payouts provides intelligent invoice capture using advanced OCR technology, allowing businesses to extract data from various invoice formats, such as PDFs and scanned images. With automatic invoice matching, you can align invoices with purchase orders and receipts, which streamlines the reconciliation process and minimizes discrepancies. The platform also includes customizable approval workflows, enabling businesses to set up approval processes based on specific criteria like amount, vendor, or department.

Standout features & integrations:

Features include a collaborative vendor portal that allows vendors to submit invoices directly, check payment statuses, and access self-service tools. The platform also supports optimized global payments, enabling businesses to pay vendors in multiple currencies and identify early payment discount opportunities automatically.

Integrations include Everflow, CJ Affiliate, Awin, PayPal, Venmo, Payoneer, NetSuite, Priority, Workday, Skrill, and Tune.

Pros and cons

Pros:

- Comprehensive automation of accounts payable processes

- Multiple payout methods

- Supports scaling operations

Cons:

- Potential challenges integrating with existing systems

- May require time to fully customize

Xero is a popular accounting software designed for small businesses, accountants, and bookkeepers, offering an advanced suite of features for efficient financial management.

Why I picked Xero: Xero is a great accounting software for small businesses due to its user-friendly interface and advanced features, such as invoicing, expense tracking, and bank reconciliation. It also offers flexible payroll integration, robust reporting tools, and scalability, making it suitable for growing businesses that need both simplicity and advanced functionality.

Standout features & integrations:

Features include invoicing, expense tracking, bank reconciliation, and payroll management. Xero also offers advanced reporting and analytics, making it easier for businesses to monitor their financial health.

Integrations include Stripe, PayPal, Square, HubSpot, Shopify, Gusto, Bill.com, Expensify, Vend, and WooCommerce.

Pros and cons

Pros:

- Strong integrations

- User-friendly interface

- Comprehensive features

Cons:

- Complex setup process

- Limited mobile app functionality

Zoho Books is an accounting software designed for small businesses. It’s best for customizable accounting tools, offering a range of features that can be tailored to specific business needs.

Why I picked Zoho Books: Zoho Books provides advanced flexibility and customization options, allowing users to tailor their accounting processes to fit their unique workflows and preferences. Additionally, its seamless integrations with other Zoho apps and third-party tools make it highly adaptable, while automation features help streamline everyday financial tasks, saving time and reducing errors.

Standout features & integrations:

Features include strong invoicing, expense tracking, and inventory management, all of which can be customized to suit different business needs.

Integrations include G Suite, Microsoft Office 365, Slack, PayPal, Stripe, Square, Shopify, Zoho CRM, Zoho Projects, and Zapier.

Pros and cons

Pros:

- Multi-language invoicing

- Customized workflows

- Built-in client portal

Cons:

- Lack of fixed asset management

- Restricted offline access

ClearBooks is an accounting software designed for small businesses, offering AI-streamlined bookkeeping, professional invoicing, and flexible online payment options to help businesses get paid sooner.

Why I picked ClearBooks: ClearBooks provides users with a unique AI-powered bookkeeping feature, which sets it apart from other accounting software. This advanced technology significantly reduces the time spent on financial admin tasks, allowing small business owners to focus on growth. Additionally, its cloud-based system ensures accessibility from anywhere, and it integrates with popular banks and payroll systems, providing a seamless financial management experience.

Standout features & integrations:

Features include AI-streamlined bookkeeping, professional invoicing, and flexible online payment options.

Integrations include PayPal, GoCardless, Stripe, Xero, QuickBooks, Sage, FreeAgent, KashFlow, FreshBooks, and Zoho Books.

Pros and cons

Pros:

- Flexible payment options

- Professional invoicing

- AI-powered bookkeeping

Cons:

- No mobile app

- Advanced features may be overwhelming

Wave is a small business software that offers accounting and payroll services. It provides a user-friendly interface and a range of features to help companies manage their finances effectively.

Why I picked Wave: Wave stands out for its free, easy-to-use tools for managing invoices, expenses, and financial reporting. The software’s built-in payroll and invoicing features, combined with the lack of subscription fees for core accounting tools, make it ideal for small businesses with limited budgets.

Standout features & integrations:

Features include invoicing, payments, accounting, and payroll. Wave allows users to create and send professional invoices, accept online payments, and manage their accounting and payroll needs all in one place. The software also offers a smart dashboard that organizes income, expenses, payments, and invoices.

Integrations include PayPal, Shoeboxed, Etsy, Zapier, Google Sheets, Slack, HubSpot, Mailchimp, Stripe, and QuickBooks.

Pros and cons

Pros:

- Comprehensive financial management

- User-friendly interface

- Free accounting tools

Cons:

- Reports customization

- Limited customer support

Gusto is an online, full-service payroll and HR solution offering a variety of products and features to help small businesses manage payroll, benefits, and HR needs. It’s best known for its integrated payroll and HR capabilities, making it an advanced tool for small businesses.

Why I picked Gusto: Gusto excels in integrating payroll and HR functionalities, which is essential for small businesses aiming to streamline operations. The software uniquely combines payroll processing with HR management tools, offering a seamless experience for managing employee benefits, compliance, and payroll in one platform.

Standout features & integrations:

Features include automated payroll processing, employee benefits management, and compliance support. Gusto also offers tools for hiring and onboarding, time tracking, and performance management.

Integrations include QuickBooks, Xero, FreshBooks, Expensify, Hubstaff, Clover, Homebase, When I Work, TSheets, and ZipBooks.

Pros and cons

Pros:

- Employee benefits management

- Automated payroll processing

- Comprehensive HR tools

Cons:

- Setup complexity

- Limited customization options

KashFlow is an accounting software with payroll designed for small businesses, offering customizable and integrated financial management tools. It simplifies complex financial tasks with features like invoicing, expense tracking, and payroll processing, making it an advanced solution for small business owners.

Why I picked KashFlow: KashFlow offers an intuitive interface that simplifies bookkeeping, invoicing, and expense tracking. Its cloud-based platform allows for easy access, and its payroll integration helps small businesses manage employee payments and tax obligations efficiently. Additionally, KashFlow is scalable and highly customizable, making it a flexible option as the business grows.

Standout features & integrations:

Features include VAT returns, invoicing, payments, payroll management, and reporting tools.

Integrations include PayPal, GoCardless, Stripe, Dropbox, Mailchimp, Receipt Bank, Amazon, eBay, Shopify, and WooCommerce.

Pros and cons

Pros:

- Comprehensive payroll features

- VAT compliant

- In-depth reporting

Cons:

- Steep learning curve for new users

- Limited mobile functionality

Kashoo is an accounting software for small businesses, offering automated accounting, simplified invoicing, and easy expense tracking.

Why I picked Kashoo: Kashoo offers a straightforward approach to accounting, standing out in a market filled with complex solutions. Its emphasis on automation and simplicity makes it particularly suitable for small business owners looking to save time and reduce manual accounting tasks. With a user-friendly interface and automated features, even those with minimal accounting knowledge can manage their finances effectively.

Standout features & integrations:

Features include automated income and expense tracking, simplified invoicing, and easy expense tracking and budgeting. Kashoo also offers detailed reporting and customization options, making it a versatile tool for growing businesses.

Integrations include Stripe, PayPal, Square, FreshBooks, QuickBooks, Xero, Gusto, HubSpot, Shopify, and WooCommerce.

Pros and cons

Pros:

- Multi-currency support

- User-friendly interface

- Automated accounting

Cons:

- Limited international support

- Limited advanced features

AccountEdge is a powerful and easy-to-use desktop accounting software for small businesses on Mac or Windows. It excels in desktop accounting with strong on-premise capabilities and optional remote access.

Why I picked AccountEdge: AccountEdge provides a wide-variety of features tailored to small businesses, including sales, invoicing, payroll runs, accounting, and inventory. It stands out for its reliability as a desktop accounting platform, offering both Mac and Windows applications with optional remote cloud access through AccountEdge Connect. This makes it an excellent choice for businesses seeking the security of on-premise software with the flexibility of remote access.

Standout features & integrations:

Features include sales, invoicing, payroll, accounting, and inventory. AccountEdge also offers advanced data management and reporting capabilities.

Integrations include Shopify, BigCommerce, WooCommerce, Square, Stripe, PayPal, Mailchimp, G Suite, Microsoft Office, and Dropbox.

Pros and cons

Pros:

- Optional remote access

- Comprehensive feature set

- Reliable desktop platform

Cons:

- Steep learning curve

- Limited mobile app functionality

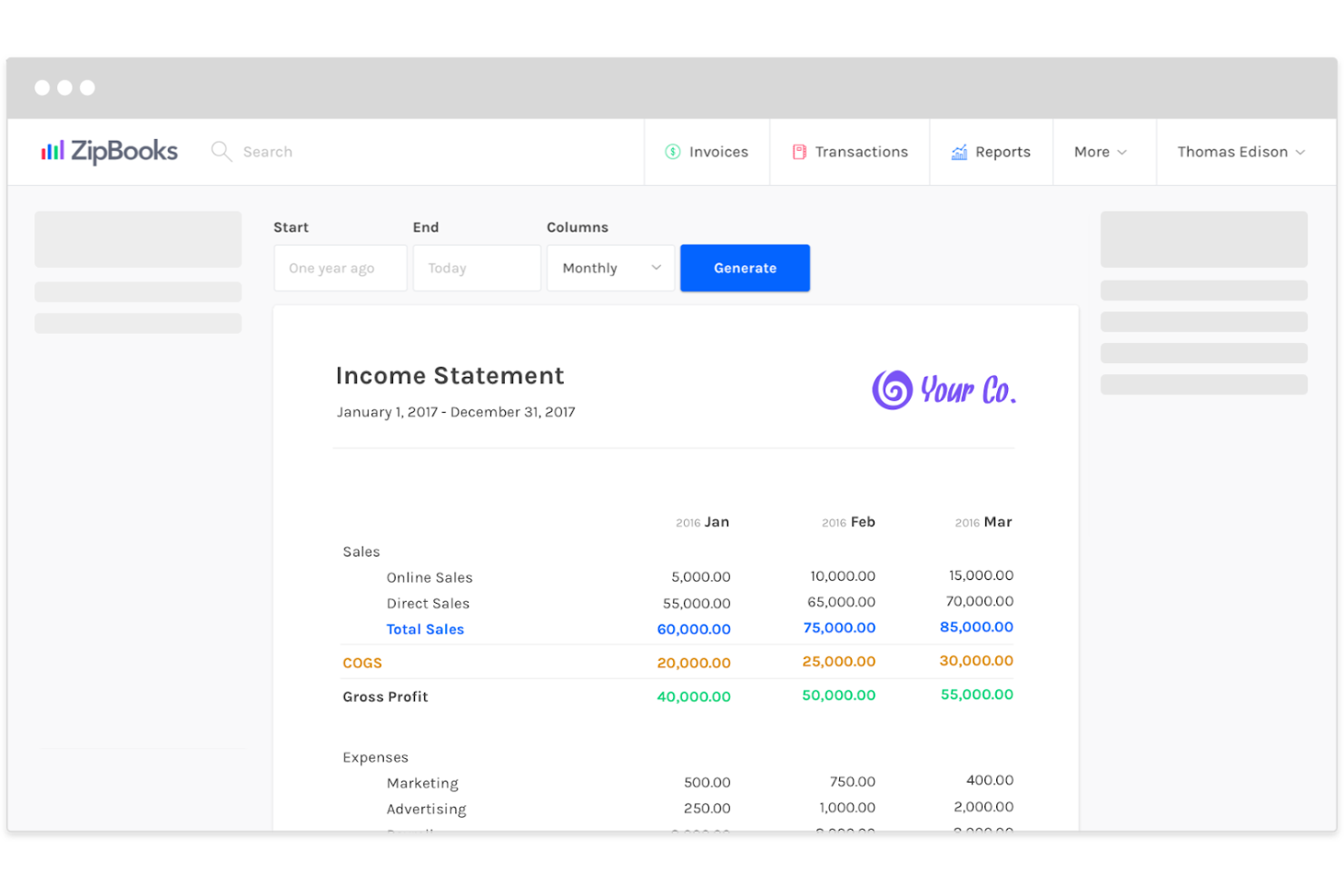

ZipBooks is a free, online accounting software and invoicing platform designed for small businesses. It offers features such as accounting, billing, expense management, and intelligence, enabling users to send professional invoices, track expenses, and access smart insights and reports.

Why I picked ZipBooks: ZipBooks is known for its user-friendly interface, making it accessible even for those without an accounting background. Its simplicity and intuitive design make it an excellent choice for small business owners needing to manage their finances efficiently. The software helps teams streamline bookkeeping tasks, allowing users to focus on growing their business rather than getting bogged down by complex accounting processes.

Standout features & integrations:

Features include one-time and recurring billing, smart expense tracking, and a full suite of reports and insights. ZipBooks also offers auto-categorization and intuitive color-coding to make bookkeeping straightforward.

Integrations include PayPal, Stripe, Square, Gusto, Slack, Google Drive, Google Sheets, Trello, and Asana.

Pros and cons

Pros:

- Smart expense tracking

- Efficient invoicing

- User-friendly interface

Cons:

- Steep learning curve

- Limited advanced features

Other Accounting Software With Payroll for Small Businesses

Here are a few more accounting software with payroll for small businesses that almost made my top 10. They didn’t quite make the final cut, but they’re still solid options and definitely worth a closer look!

- Patriot

For affordability and value

- MYOB Business

For scalable business solutions

- QuickBooks

For integration with other financial tools

- ADP Workforce Now

For comprehensive HR and online payroll features

- Sage Accounting

For scalability for growing businesses

- Unanet

For project-based accounting and payroll

- Odoo

For customization options for various industries

Related Reviews

If you still haven’t found what you’re looking for here, check out these other tools that we’ve tested and evaluated:

Accounting Software With Payroll for Small Businesses Selection Criteria

When you're picking accounting software with payroll for small businesses, it really needs to solve your actual day-to-day problems—not add to them. After testing and digging into these tools myself, here’s what I always look for when deciding if a software’s really worth it:

Core Functionality (25% of Total Weighting Score):

- Payroll processing and tax calculations

- Financial reporting and analytics

- Expense tracking and management

- Invoicing and billing

- Bank transactions and reconciliation

Additional Standout Features (25% of Total Weighting Score):

- Integration with third-party apps

- Mobile app functionality

- Customizable dashboards

- Advanced security features

- AI-driven insights and automation

Usability (10% of Total Weighting Score):

- Intuitive user interface

- Drag-and-drop functionality

- Role-based access control

- Customizable workflows

- Real-time collaboration features

Onboarding (10% of Total Weighting Score):

- Availability of training videos

- Interactive product tours

- Pre-built templates

- Chatbots for instant support

- Webinars for in-depth training

Customer Support (10% of Total Weighting Score):

- 24/7 availability

- Multiple support channels (phone, email, chat)

- Dedicated account managers

- Comprehensive knowledge base

- Fast response times

Value For Money (10% of Total Weighting Score):

- Competitive pricing plans

- Transparent pricing structure

- Free trial availability

- Discounts for annual subscriptions

- Cost-benefit analysis

Customer Reviews (10% of Total Weighting Score):

- Overall satisfaction ratings

- Feedback on ease of use

- Comments on customer support

- Reviews on feature set

- Testimonials on reliability and performance

How to Choose Accounting Software With Payroll for Small Businesses

It’s super easy to get lost in endless feature lists and confusing pricing. To keep things simple while you figure out what’s right for your business, here’s a quick checklist to help you stay on track:

| Factor | What to Consider |

|---|---|

| Scalability | Ensure the software can grow with your business, as you shift from a small company to a midsize organization. Look for options that allow you to add users and features as your needs increase. |

| Integrations | Check if the software integrates with tools you already use, like CRM or inventory management systems, to streamline processes. |

| Customizability | Choose a solution that allows you to tailor reports and dashboards to fit your business needs, ensuring relevant data is at your fingertips. |

| Ease of Use | Opt for user-friendly interfaces that make it simple for you and your team to manage payroll and accounting tasks without extensive training. |

| Budget | Compare pricing plans and ensure there are no hidden fees. Consider the total cost of ownership, including setup and ongoing support. |

| Security Safeguards | Verify that the software provides robust security measures like encryption and two-factor authentication to protect your financial data. |

| Customer Support | Look for solutions offering reliable customer service through various channels, ensuring you get help when needed. |

| Reporting Features | Ensure the software provides comprehensive reporting capabilities, allowing you to easily generate financial statements and payroll summaries. |

Trends in Accounting Software With Payroll for Small Business

I’ve been keeping an eye on trends in accounting software with payroll for small businesses, and a few things really stood out. After digging through tons of product updates, release notes, and announcements, I pulled together the biggest takeaways—and what they might mean going forward.

- Cloud-Based Solutions: Cloud payroll systems are a game changer for small businesses. They’re flexible, easy to scale, and let you manage wages without needing fancy hardware. Plus, when your payroll is connected with your accounting and HR tools, everything flows smoother—less manual entry, fewer mistakes, and more time back in your day.

- Mobile Applications: More business owners are turning to mobile apps to handle HR and payroll on the go. It just makes life easier. Whether you're approving timesheets or running payroll from your phone, it gives you the freedom to work from anywhere—and teams love the convenience too.

- Integrated Systems: Payroll tools that are fully integrated with HR and accounting are on the rise. This is because having everything in one place keeps things simple, streamlines processes, saves time, and helps make sure you’re staying on top of compliance without bouncing between systems.

- Automation and AI: Smart software is getting even smarter. With automation and AI, routine tasks like data entry or reconciling transactions can be handled for you. That means fewer errors and more time to focus on the parts of your business that really need your attention.

- Compliance and Security: Keeping up with tax rules and labor laws is a job on its own—but your payroll software can help with that. The right tool will stay updated for you and keep your data safe, so you can focus on running your business without worrying about compliance headaches or data risks.

What Is Accounting Software With Payroll for Small Businesses?

Accounting software with payroll for small businesses helps manage financial transactions and payroll processes, enabling small business owners and accountants to track income and expenses, generate financial reports, and ensure timely and accurate employee payments.

Typically, this software includes components such as a general ledger, accounts payable, accounts receivable, payroll processing, and tax compliance. These features allow users to maintain precise financial records, automate payroll calculations, and comply with tax regulations efficiently.

Features of Accounting Software With Payroll for Small Businesses

Picking the right accounting software with payroll for small businesses can make your life way easier—saving time, keeping things compliant, and helping everything run smoother. Here are a few key features to keep an eye out for:

- Core Accounting Functions: Core accounting functions include recording transactions, managing the general ledger, and generating financial statements. These are essential for tracking revenue, expenses, and cash flow, ensuring the financial health of your business.

- Payroll Management: Payroll management automates payroll calculations, tax withholdings, and benefits. It ensures timely and accurate payment to employees, which is vital for maintaining employee satisfaction and compliance with tax laws.

- Budgeting and Forecasting: Budgeting and forecasting tools help businesses create financial plans based on historical and real-time data. This feature is important for tracking performance against budgets and making informed financial decisions.

- Billing and Invoicing: Automated billing and invoicing streamline the process of generating invoices and tracking payments. This feature helps maintain cash flow and reduces the time spent on manual billing tasks.

- Project Accounting: Project accounting allows businesses to track revenue and expenses on a project basis. This is particularly useful for businesses that undertake project-based work, ensuring accurate financial tracking and billing.

- Asset Tracking: Asset tracking manages the value and details of long-term and short-term assets. This feature is essential for maintaining accurate records of asset values, depreciation, and inventory levels.

- Reporting and Analytics: Advanced reporting and analytics provide real-time insights into financial performance. Customizable dashboards and reports help businesses monitor key metrics and make data-driven decisions.

- Mobile Support: Mobile support allows access to financial data from anywhere, ensuring that employees can manage workflows on the go. This feature is particularly useful for businesses with remote or mobile workforces.

- Tax Management: Tax management automates complex tax calculations and ensures compliance with local, national, and global tax requirements. This feature reduces the risk of errors and penalties associated with tax filings.

- Integration: Integration with other business applications, such as ERP systems and CRM software, ensures seamless data flow across the organization. This feature enhances efficiency and reduces the likelihood of data-entry errors.

Benefits of Accounting Software With Payroll for Small Businesses

When you're picking accounting software with payroll for small businesses, you want something that makes life easier—not more complicated. Here are some of the biggest perks for small business owners:

- Time Savings: Automating payroll processes reduces the time spent on manual calculations and data entry, allowing business owners to focus on other critical tasks.

- Accuracy: The software minimizes human errors in payroll calculations, ensuring employees are paid correctly and on time, which helps maintain employee satisfaction and compliance with tax regulations.

- Cost Efficiency: By reducing the need for external payroll services or additional staff, businesses can save money and allocate resources more effectively.

- Compliance: The software helps ensure that payroll processes adhere to the latest tax laws and regulations, reducing the risk of costly penalties and audits.

- Data Integration: Seamless integration with other accounting functions provides a holistic view of the business’s financial health, aiding in better decision-making and financial planning.

Costs & Pricing of Accounting Software With Payroll for Small Businesses

Choosing an accounting software with payroll for small businesses? Prices and features can vary a lot. Here’s a quick table to help you compare plan types, average costs, and what you typically get with each.

Plan Comparison Table for Accounting Software With Payroll for Small Businesses

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic invoicing, limited transactions, and community support. |

| Personal Plan | $5-$25/user/month | Basic payroll processing, tax calculation, and email support. |

| Business Plan | $25-$50/user/month | Advanced reporting, multiple user access, priority support, and integrations. |

| Enterprise Plan | Custom pricing | Custom workflows, dedicated account manager, enhanced security, and compliance. |

Accounting Software With Payroll for Small Businesses FAQs

Here are some commonly asked questions about accounting software with payroll for small business:

How do I integrate my accounting software with my payroll system?

Integrating your accounting software with your payroll system typically involves using built-in integration features or third-party connectors. Most modern accounting software solutions offer direct integration with popular payroll services. You will need to follow the specific instructions provided by your software vendor, which usually involves setting up API keys or using pre-built connectors. Ensure that both systems are compatible and that you regularly sync data to avoid discrepancies.

What are the tax compliance features available in accounting software with payroll?

Accounting software with payroll often includes tax compliance features such as automatic tax calculations, electronic tax filing, and updates on tax law changes. These features help ensure that your payroll processes adhere to federal, state, and local tax regulations. Some software also provides alerts for upcoming tax deadlines and generates necessary tax forms like W-2s and 1099s.

How do I handle payroll for remote employees using accounting software?

Handling payroll for remote employees involves ensuring that your accounting software can manage multi-state payroll and comply with varying state tax laws. You will need to set up the correct tax jurisdictions for each remote employee and ensure that your software can handle different state tax withholdings. Additionally, consider using direct deposit features to streamline payments to remote employees.

Is it possible to manage employee benefits through accounting software with payroll?

Yes, many accounting software solutions with payroll capabilities allow you to manage employee benefits. This includes tracking health insurance, retirement plans, and other benefits. You can usually set up benefit plans within the software, assign them to employees, and manage contributions and deductions. Some software also integrates with benefits providers to streamline administration.

How secure is my payroll data in accounting software?

Payroll data security is a critical concern, and most reputable accounting software providers implement robust security measures. These measures typically include data encryption, secure user authentication, regular security audits, and compliance with data protection regulations like GDPR or CCPA. Always ensure that your software provider follows industry best practices for data security and consider additional measures like two-factor authentication.

What support options are available if I encounter issues with payroll in my accounting software?

Support options vary by software provider but typically include online resources like FAQs, user guides, and video tutorials. Many providers also offer customer support through email, phone, or live chat. Some may provide dedicated account managers or premium support plans for more personalized assistance. Check your software’s support section to understand the available options and response times.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.