Accounting can feel overwhelming—especially for small business owners, freelancers, or anyone looking to sharpen their financial skills. But the right resources make all the difference. That’s where the best accounting books for small businesses come in.

Over the years, I’ve explored countless titles on Amazon, uncovering guides that break down complex terms, demystify double-entry bookkeeping, and walk you through real-world practices. These finance books helped me make sense of every credit card charge, bank statement, and income report—and even tested my knowledge along the way.

Now, I’m passing along that curated list. Whether you're a beginner or brushing up your skills, these accounting books for small businesses are packed with insights to help you take control of your company's finances.

17 Best Accounting Books for Small Business Owners Shortlist

These are the best small business accounting books I've found, in no particular order. Keep scrolling for write-ups on each one.

- Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports by Thomas Ittelson

- Accounting Made Simple by Mike Piper

- Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine by Mike Michalowicz

- Bookkeeping All-In-One For Dummies by Lita Epstein and John A. Tracy

- LLC QuickStart Guide: The Simplified Beginner's Guide to Limited Liability Companies by ClydeBank Business

- Small Business Finance for the Busy Entrepreneur: Blueprint for Building a Solid, Profitable Business by Sylvia Inks

- How to Read a Financial Report: Wringing Vital Signs Out of the Numbers by John A. Tracy and Tage C. Tracy

- The Accounting Game: Basic Accounting Fresh from the Lemonade Stand by Darrell Mullis and Judith Orloff

- Accounting for Non-Accountants: Financial Accounting Made Simple for Beginners (Basics for Entrepreneurs and Small Business Owners) (Quick Start Your Business) by Wayne Label

- Wiley GAAP 2023: Interpretation and Application of Generally Accepted Accounting Principles (Wiley Regulatory Reporting) by Joanne M. Flood

- CPA Financial Accounting & Reporting Exam Secrets Study Guide: CPA Test Review for the Certified Public Accountant Exam by CPA Exam Secrets Test Prep Team

- Accounting for the Numberphobic: A Survival Guide for Small Business Owners by Dawn Fotopulos

- QuickBooks Online For Dummies (For Dummies (Computer/Tech) by David H. Ringstrom

- The All-in-One Accounting Bible: [10 in 1] Everything You Need to Know From Setting Up Your Accounting System to Detecting Financial Irregularities for Small Business Owners by Ronan Hughes

- Cost Accounting For Dummies (For Dummies (Business & Personal Finance) by Kenneth W. Boyd

- Warren Buffett Accounting Book: Reading Financial Statements for Value Investing by Stig Brodersen and Preston Pysh

- Managerial Accounting For Dummies by Mark P. Holtzman

Overviews of the 17 Best Accounting Books for Small Business Owners

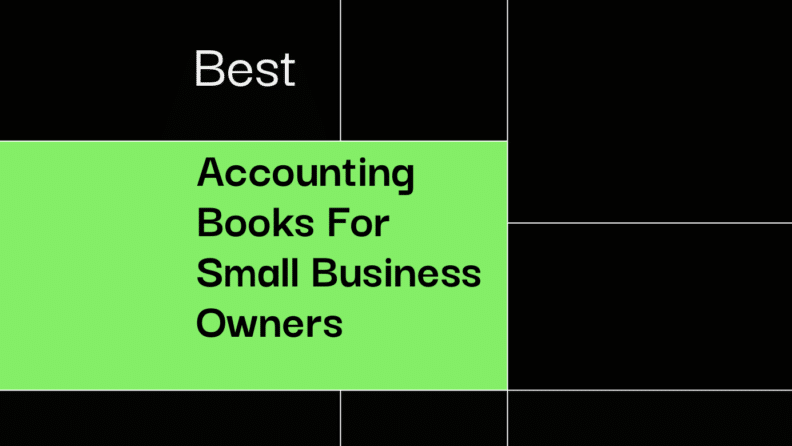

1. Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports by Thomas Ittelson

Summary:

This book simplifies the world of financial statements for those without a financial background. It presents a step-by-step guide to understanding and creating financial reports that are immediately usable for business decision-making.

What You'll Learn:

Readers will acquire a fundamental understanding of the three main financial statements used in business: the balance sheet, income statement, and cash flow statement. This guide elucidates how these statements connect and reflect the financial health of a business.

Why You Should Read It:

For anyone struggling with financial statements, this book turns seemingly intimidating accounting concepts into comprehensible knowledge. It’s a practical tool for small business owners aiming to get a handle on their company’s financial reports without getting bogged down in accounting technicalities.

About The Author:

Thomas Ittelson is a seasoned author and expert in presenting intricate financial concepts simply. For author updates or professional engagements, connect with him on LinkedIn, or know more about him through Mercury Group Press' website.

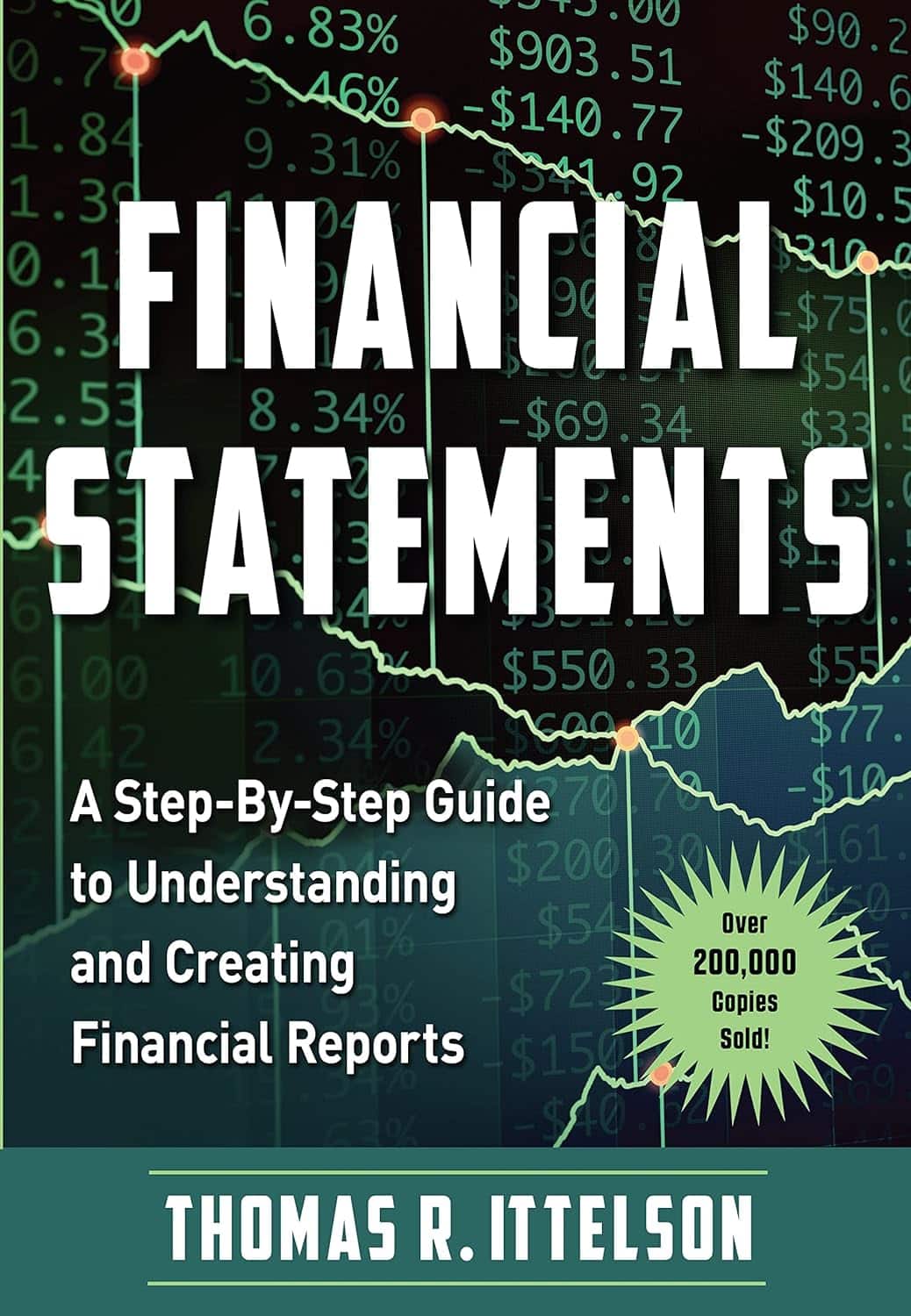

2. Accounting Made Simple by Mike Piper

Summary:

Mike Piper’s book distills the essence of accounting principles into easy-to-grasp concepts with clear examples. It serves as a quick reference and primer for anyone looking to understand accounting without going through extensive textbooks.

What You'll Learn:

The book covers the basics of accounting, breaking down terms and calculations that are fundamental to the practice. With concise explanations, readers will grasp how accounting mechanisms work, from debits and credits to financial statements and accounting for income taxes.

Why You Should Read It:

If you’re in search of a straightforward, jargon-free guide to accounting principles, “Accounting Made Simple” is your go-to resource. Its streamlined approach makes it an invaluable tool for small business owners and anyone interested in learning accounting's essentials.

Quote From The Book:

“Accounting is the language of business, and understanding accounting is the key to understanding business.”

About The Author:

Mike Piper is a CPA and the author of several personal finance books. Stay connected with Mike through his Twitter account, or personal blog.

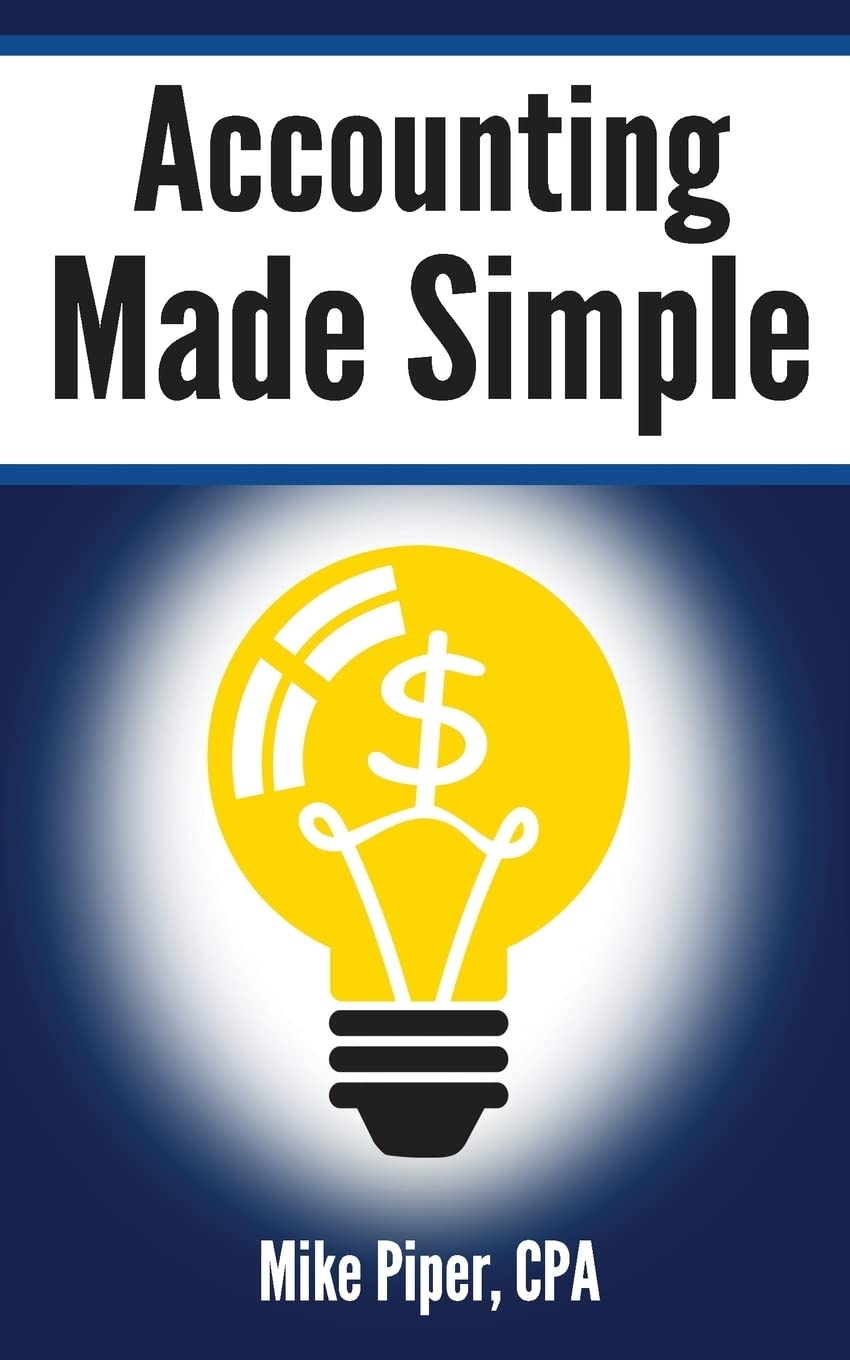

3. Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine by Mike Michalowicz

Summary:

In this transformative guide, Michalowicz presents a counterintuitive financial strategy that supports small business owners in their quest for profitability from their first day of business.

What You'll Learn:

“Profit First” fundamentally shifts your financial management perspective, guiding you to prioritize profits over revenues. You'll learn how to turn your business from a "cash-eating monster" into a sustainable, profitable entity with a robust financial health, through practical steps and real-life business examples.

Why You Should Read It:

With a fresh take on financial strategies, this book is an invaluable resource for entrepreneurs at any business stage. It'll help you forever view your business's finances in a new light, leading to enhanced profitability and financial security.

Quote From The Book:

"Profit is not an event. Profit is a habit.”

About The Author:

Mike Michalowicz is a renowned author, entrepreneur, and lecturer. Engage with him further on LinkedIn, Twitter, or his personal website.

4. Bookkeeping All-In-One For Dummies by Lita Epstein and John A. Tracy

Summary:

This book serves as a comprehensive guide, delivering the skinny on bookkeeping principles and methods in a way that’s easy to understand, regardless of your business's industry or size.

What You'll Learn:

Epstein and Tracy have distilled their extensive knowledge into this all-in-one guide, providing insights into the importance of keeping impeccable financial records. You’ll grasp the ins and outs of financial statements, inventory accounting, and financial planning and control, arming yourself with the tools necessary for sound financial management of your business.

Why You Should Read It:

Whether you’re a seasoned bookkeeper looking to brush up on your skills or a small business owner diving into bookkeeping for the first time, this book offers valuable insights and guidelines that simplify the often daunting world of financial recordkeeping.

About The Authors:

Lita Epstein, who earned her MBA from Emory University’s Goizueta Business School, enjoys helping people develop good financial, investing, and tax planning skills, while John A. Tracy is a professor of accounting, emeritus, at the University of Colorado in Boulder. Engage with Lita on LinkedIn or visit her personal website.

5. LLC QuickStart Guide: The Simplified Beginner's Guide to Limited Liability Companies by ClydeBank Business

Summary:

While not explicitly an accounting book, I threw this one in for business owners unsure of the next legal step, as it touches on the legal implications of your business' tax accounting. ClydeBank Business presents a straightforward and actionable guide to forming and operating a Limited Liability Company (LLC) with ease and efficiency.

What You'll Learn:

The book lays out the process of establishing an LLC, explaining the legalities, operation dynamics, taxation nuances, and benefits of this business structure. It is designed to aid both new and seasoned entrepreneurs in navigating through the complexities of LLCs with simplified and clear instructions.

Why You Should Read It:

If you’re planning to start your own business and considering the LLC structure, this guide is an indispensable resource. It provides all the foundational knowledge you'd need, in a clear, straightforward manner.

Quote From The Book:

"Understanding the unique benefits and limitations of an LLC is critical for business success."

About The Author:

ClydeBank Business is a brand known for producing high-quality educational guides for business professionals and enthusiasts. You can connect with ClydeBank Business through their official LinkedIn or visit their official website for more resources and updates.

6. Small Business Finance for the Busy Entrepreneur: Blueprint for Building a Solid, Profitable Business by Sylvia Inks

Summary:

Sylvia Inks’ guide is a treasure trove of practical advice on small business finance. It’s designed for entrepreneurs juggling various responsibilities while aiming to establish a financially solid and profitable business.

What You'll Learn:

Inks provides a blueprint for business owners to understand and manage their finances effectively. With clear steps and actionable advice, readers will learn to avoid common financial mistakes, save time and money, and ultimately build a business that not only survives but thrives.

Why You Should Read It:

This book is perfect for busy entrepreneurs who need straightforward, easy-to-implement financial strategies. If time is of the essence and you need quick solutions to your business finance challenges, Inks’ guide is an invaluable resource.

Quote From The Book:

“Success does not happen overnight. It’s the small, consistent steps that lead to big results.”

About The Author:

Sylvia Inks is a finance coach and small business expert. Engage with her further on LinkedIn, Twitter, or her website.

7. How to Read a Financial Report: Wringing Vital Signs Out of the Numbers by John A. Tracy and Tage C. Tracy

Summary:

This book, written by the Tracys, demystifies financial reports, providing readers with the skills to analyze and understand the crucial information hidden in these documents.

What You'll Learn:

The authors break down the elements of financial reports into understandable parts, offering insights into how these numbers can guide business decisions. Whether you’re an entrepreneur, manager, or investor, this book illuminates the fundamentals of financial reporting, making the numbers speak to you in clear, actionable terms.

Why You Should Read It:

With a straightforward approach, the book is invaluable for anyone who needs to understand a business’s financial health through its reports. It's a must-read for those who wish to make informed, intelligent decisions based on a company’s financial status.

Quote From The Book:

"Financial reporting is a communications tool and should be designed to communicate useful information as clearly as possible."

About The Authors:

John A. Tracy is a Professor of Accounting, Emeritus, at the University of Colorado at Boulder. He's written over 10+ successful accounting and finance books. Tage C. Tracy has 20+ years of experience in financial consulting at the executive level.

8. The Accounting Game: Basic Accounting Fresh from the Lemonade Stand by Darrell Mullis and Judith Orloff

Summary:

This book offers a unique and engaging approach to learning accounting fundamentals, likening the process to running a lemonade stand, making complex concepts accessible and enjoyable for beginners.

What You'll Learn:

This guide offers a practical understanding of financial accounting basics, including crafting financial statements, tracking transactions, and understanding the importance of cash flow. With each lesson, you gain the confidence and knowledge needed to manage the finances of your small business efficiently.

Why You Should Read It:

Engaging and user-friendly, “The Accounting Game” demystifies the daunting world of financial accounting, making it an ideal read for small business owners and entrepreneurs without a financial background, yet in need of mastering the basics of accounting.

Quote From The Book:

"Understanding the 'language of business' is essential for all future entrepreneurs, and this book makes learning enjoyable and easy."

About The Author:

Darrell Mullis and Judith Orloff have collaborated to make accounting understandable for everyone. Mullis is an entrepreneur and business expert, while Orloff is an accredited author, with over 15+ titles to her name.

9. Accounting for Non-Accountants: Financial Accounting Made Simple for Beginners (Basics for Entrepreneurs and Small Business Owners) (Quick Start Your Business) by Wayne Label

Summary:

Wayne Label’s work is a comprehensive and accessible primer for those who have little to no background in accounting. It breaks down intricate accounting concepts into manageable lessons for beginners, serving as an essential resource for small business owners.

What You'll Learn:

The book introduces readers to the fundamentals of financial accounting in a straightforward manner. You’ll explore essential concepts, practices, and terminology, acquiring the skills to interpret and utilize financial information effectively for business planning and decision-making.

Why You Should Read It:

If accounting seems like a foreign language to you, this book provides a clear and simple translation. It’s designed for ease of understanding, making it a crucial tool for non-accountants who need to familiarize themselves with financial accounting basics quickly and painlessly.

Quote From The Book:

“Mastering the basics of financial accounting has never been easier, making this guide an indispensable tool for business beginners.”

About The Author:

Wayne Label is a seasoned accountant and author, dedicated to making accounting understandable for everyone.

10. Wiley GAAP 2023: Interpretation and Application of Generally Accepted Accounting Principles (Wiley Regulatory Reporting) by Joanne M. Flood

Summary:

Now here's a really fun one. “Wiley GAAP 2023” is a thorough examination and application guide of GAAP (Generally Accepted Accounting Principles). Authored by Joanne M. Flood, it may be dry, but it's an indispensable resource for accounting professionals dealing with detailed financial reporting rules.

What You'll Learn:

The book provides an in-depth analysis and understanding of GAAP, detailing the latest updates and amendments. It serves as both a textbook and a reference guide, with examples, illustrations, and practical advice to help you navigate through GAAP's complex regulations confidently.

Why You Should Read It:

For accounting professionals, understanding GAAP is non-negotiable, and this book is an invaluable asset in mastering it. Whether you’re a student, an accountant, or an entrepreneur needing an in-depth understanding of GAAP, “Wiley GAAP 2023” should be within arm's reach on your bookshelf.

Quote From The Book:

“GAAP is a complex beast; understanding it requires not only theoretical knowledge but also practical insight and experience, all of which are encapsulated in this guide.”

About The Author:

Joanne M. Flood is an expert in accounting principles and a prominent author in the field. To stay updated with her latest works and insights, connect with her on LinkedIn.

11. CPA Financial Accounting & Reporting Exam Secrets Study Guide: CPA Test Review for the Certified Public Accountant Exam by CPA Exam Secrets Test Prep Team

Summary:

Having fun with your business' financials and considering going right into the accounting field? This guide is an invaluable resource for those preparing for the CPA Financial Accounting & Reporting Exam. It demystifies the exam’s challenging content, offering crucial tips, and practice questions to aid in mastering the material needed to pass the test confidently.

What You'll Learn:

The book arms test-takers with essential strategies and secrets to tackle the CPA exam effectively. From understanding and applying financial accounting principles to reporting, you’ll find in-depth reviews of all topics covered in the exam, accompanied by test-taking strategies designed to help you succeed.

Why You Should Read It:

For aspiring CPAs, this study guide is a beacon, illuminating the path to successful exam preparation and completion. It’s a trusted companion that seeks to ease your study process while maximizing your understanding and retention of crucial exam content.

About The Author:

The CPA Exam Secrets Test Prep Team consists of educators and CPA professionals who work tirelessly to provide students with the best tools and strategies to approach the CPA exam.

12. Accounting for the Numberphobic: A Survival Guide for Small Business Owners by Dawn Fotopulos

Summary:

Now let's go in the complete opposite direction from the last book. Dawn Fotopulos provides a lifeline for small business owners who dread dealing with their company's finances. This guide is designed to be a stress reliever, turning the seemingly daunting task of accounting into a manageable and perhaps, even enjoyable process.

What You'll Learn:

Fotopulos’s guide walks you through the fundamentals of small business accounting in easy-to-understand terms. From profit-and-loss statements to balance sheets and cash flow forecasts, this book will empower you with the knowledge required to take control of your business’s financial health.

Why You Should Read It:

If numbers make you nervous, “Accounting for the Numberphobic” is your go-to guide. It's written specifically for small business owners without a financial background, helping them overcome fear and confusion surrounding accounting.

Quote From The Book:

“You don't have to be a numbers person to understand the basics of accounting - you just need the right guide.”

About The Author:

Dawn Fotopulos is an experienced entrepreneur, business coach, and accounting professional dedicated to helping small business owners thrive. Connect with her on LinkedIn, Twitter, or visit her company website for more insights and resources.

13. QuickBooks Online For Dummies by David H. Ringstrom

Summary:

David H. Ringstrom’s guide is an indispensable tool for users looking to get the most out of QuickBooks Online. With expert insight and clear instructions, it simplifies the process of setting up and navigating through QuickBooks Online, helping businesses effectively manage their finances.

What You'll Learn:

This comprehensive guide walks through the functionalities of QuickBooks Online, from the basics of setting up an account, to more advanced features like payroll and taxes. You’ll learn how to invoice customers, pay vendors, manage cash flows, and generate financial reports, making the day-to-day accounting process smoother and more efficient.

Why You Should Read It:

For anyone new to QuickBooks Online or seeking to enhance their skills, this book is a valuable resource. It allows businesses to efficiently track income, expenses, and other financial data, ultimately providing a clearer picture of their financial health.

Quote From The Book:

“Mastering QuickBooks Online is essential for accurate and efficient financial management in your business.”

About The Author:

David H. Ringstrom is a certified public accountant and a recognized expert in the field of accounting software. Connect with him through his LinkedIn, Twitter, or website.

14. The All-in-One Accounting Bible: [10 in 1] Everything You Need to Know From Setting Up Your Accounting System to Detecting Financial Irregularities for Small Business Owners by Ronan Hughes

![The All-in-One Accounting Bible: [10 in 1] Everything You Need to Know From Setting Up Your Accounting System to Detecting Financial Irregularities for Small Business Owners by Ronan Hughes best accounting books for small business owners](https://thecfoclub.com/wp-content/uploads/sites/12/2023/10/image-5.jpeg)

Summary:

Ronan Hughes presents a comprehensive accounting guide tailored for small business owners. This book acts as a compendium of accounting knowledge, providing a well-rounded understanding of various accounting aspects crucial for running a small business successfully.

What You'll Learn:

Hughes covers a broad range of topics, from setting up your accounting system to identifying financial irregularities. Whether you’re learning to create financial statements, handle taxes, or detect fraud, this book offers valuable insights and practical tips to manage your business’s finances effectively.

Why You Should Read It:

As a small business owner, having a solid grasp of accounting principles is vital. Hughes’ guide is designed to be your one-stop reference, providing detailed explanations and practical examples to simplify complex accounting concepts and practices.

Quote From The Book:

“Understanding the ins and outs of accounting is crucial for small business success, and this guide illuminates the path.”

About The Author:

Ronan Hughes is an experienced accountant and author dedicated to assisting small business owners in navigating the complexities of accounting.

15. Cost Accounting For Dummies by Kenneth W. Boyd

Summary:

Another one (even though I don't think you're a dummy)! Kenneth W. Boyd provides a straightforward guide to understanding the fundamental aspects of cost accounting. His book offers invaluable insights and practical advice, breaking down the complex facets of cost accounting into digestible and actionable information.

What You'll Learn:

“Cost Accounting For Dummies” covers various crucial topics, including how to set up a cost accounting system, controlling and budgeting, dealing with variances, and making informed pricing decisions. With Boyd’s guide, you’ll navigate through the world of cost accounting with ease and confidence.

Why You Should Read It:

If you’re looking to grasp the intricacies of cost accounting without getting overwhelmed, this book is the perfect starting point. Whether you are a student, a small business owner, or an aspiring accountant, Boyd’s straightforward and practical approach makes cost accounting accessible to everyone.

Quote From The Book:

“Cost accounting is a valuable tool you use to reduce and eliminate costs in a business.”

About The Author:

Kenneth W. Boyd is a former CPA with over twenty years of accounting experience. Engage further with Kenneth on LinkedIn or visit his company website for additional insights and resources.

16. Warren Buffett Accounting Book: Reading Financial Statements for Value Investing by Stig Brodersen and Preston Pysh

Summary:

In this guide, Brodersen and Pysh illuminate the accounting principles employed by Warren Buffett himself. By dissecting Buffett's unique approach to accounting and investing, they provide readers with invaluable insights into making informed and value-driven investment decisions.

What You'll Learn:

The authors offer a deep dive into understanding financial statements and value investing. Through exploring income statements, balance sheets, and cash flow statements, readers will learn how to analyze and interpret financial data to identify valuable investment opportunities just like Buffett.

Why You Should Read It:

For anyone aspiring to attract value investors like the legendary Warren Buffett, this book is an essential read. It not only demystifies Buffett’s accounting principles but also empowers readers with the knowledge to position their company effectively to attract investors.

Quote From The Book:

“Understanding the accounting aspect is crucial to identifying exceptional businesses.”

About The Authors:

Stig Brodersen and Preston Pysh are both experienced investors and authors, with a passion for educating others about value investing. Engage with Stig on LinkedIn and Twitter, and connect with Preston through LinkedIn and his company website.

17. Managerial Accounting For Dummies by Mark P. Holtzman

Summary:

Mark P. Holtzman's “Managerial Accounting For Dummies” simplifies complex managerial accounting concepts for students, professionals, and small business owners. The book navigates through fundamental aspects of managerial accounting, providing insightful explanations and practical examples.

What You'll Learn:

You'll delve into the core components of managerial accounting, including cost classification, behavior, and management, budgeting processes, performance metrics, and decision-making strategies. Holtzman provides a clear roadmap to understanding how managerial accounting supports strategic planning and organizational control in any business setting.

Why You Should Read It:

This guide is a vital resource for anyone needing a clear and comprehensible overview of managerial accounting principles. Its straightforward approach makes it an excellent reference for students, small business owners, and professionals aiming to grasp and apply managerial accounting tools effectively.

Quote From The Book:

“Managerial accounting is the practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals.”

About The Author:

Mark P. Holtzman, PhD, CPA, is an accomplished author and professor of accounting, bringing years of teaching and writing experience to the table. Engage with Mark on LinkedIn.

Which Best Accounting Books for Small Business Owners Do You Recommend?

Throughout this journey, I've explored the depths of accounting handbooks, catered to the needs of accounting students, and now shed light on the most recommended reads in the realm of accounting for small business owners.

But, as vast as our list is, there's always room for more. Perhaps you've come across a gem that I might have missed. If so, I'd love to hear from you. Share your suggestions and let's continue this journey of financial enlightenment together.

If you'd like to receive actionable advice and tips for running your business, subscribe to The CFO Club's weekly newsletter today.