Best Nonprofit Accounting Software Shortlist

Here are my top 10 nonprofit accounting software selections:

Our one-on-one guidance will help you find the perfect fit.

Nonprofit accounting software is built to help mission-driven organizations manage fund accounting, track donations and grants, and stay compliant with IRS requirements like Form 990. Unlike general accounting tools, it lets you separate income and expenses by fund, donor, or grant so you can report with clarity and maintain the trust of your board and funders.

As a digital software expert with a focus on financial management tools, I’ve spent years analyzing platforms that help teams stay compliant, efficient, and audit-ready. While I haven’t worked inside a nonprofit, I understand the unique pressure to stretch limited resources, coordinate across locations, and meet strict reporting standards without the luxury of time or IT support.

That’s why I did the research for you, spending hours testing platforms and analyzing real user reviews. This list highlights the best nonprofit accounting software that support compliance, streamline operations, and give your team the confidence to focus on your mission.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software since 2023. As financial operators ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our accounting software review methodology.

Best Nonprofit Accounting Software Summary

Here’s a handy comparison chart with pricing details for my top nonprofit accounting software picks—making it easier for you to find the perfect fit for your budget and needs!

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for automation | 14-day free trial | From $25/month | Website | |

| 2 | Best for handling complex transactions | Free demo available | Pricing upon request | Website | |

| 3 | Best for basic expense tracking | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 4 | Best for customization | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 5 | Best for nonprofits using other services from Zoho | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 6 | Best for financial task automation | Free demo | Pricing upon request | Website | |

| 7 | Best for donor management | 15-day free trial | From $59.25/month | Website | |

| 8 | Best for church leaders | Free demo available | From $29 per month | Website | |

| 9 | Best for range of features | Not available | Pricing upon request | Website | |

| 10 | Best for unlimited invoicing | 30-day free trial + free plan available | From $15/month (billed annually) | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Nonprofit Accounting Software Reviews

Take a look at my handpicked list of the best nonprofit accounting software, complete with all the details you need. I’ve broken down the key features, pros and cons, integrations, and best use cases for each tool, so you can easily find the perfect fit for your nonprofit. Let’s dive in!

Puzzle.io is an accounting platform designed to help startups and small businesses manage their finances with greater accuracy and less manual effort.

Why I picked Puzzle.io: One of the main reasons I chose Puzzle.io for nonprofit accounting is its ability to handle both cash and accrual accounting simultaneously. This dual capability is essential for nonprofits that need to report on a cash basis for internal purposes while maintaining accrual records for compliance and reporting. Puzzle.io automates this process, reducing the need for manual adjustments and ensuring consistency across financial statements.

Standout features and integrations:

Features include automated revenue recognition, which is particularly beneficial for nonprofits managing grants or donations that span multiple periods. It also offers a variance analysis tool, enabling users to set thresholds and receive alerts when actual figures deviate from expected values.

Integrations include Stripe, Brex, Ramp, Rippling, and Gusto.

Pros and cons

Pros:

- Automated bank reconciliations ensure accuracy

- AI-powered transaction categorization

- Real-time dashboards provide immediate financial insights

Cons:

- Free trial requires users to connect a bank account

- May not be suitable for larger organizations

New Product Updates from Puzzle.io

Puzzle.io's Automated PDF Statement Loading

Puzzle.io has introduced automated PDF statement loading for Meow, streamlining the reconciliation process by eliminating manual downloads and uploads. For more details, visit Puzzle.io Product Updates.

DualEntry is an AI-native enterprise accounting platform built to help finance teams handle high transaction volumes without increasing headcount.

Why I picked DualEntry: For nonprofits, I like that DualEntry has automation features that reduce manual data entry. For example, its AI-powered OCR reads and logs bills, invoices, and purchase orders directly into the system. The platform also offers automatic bank matching, creating and matching transactions for quick reconciliation. It even supports multi-currency transactions and offers automatic categorizations and suggestions based on set rules. This ensures that complex transactions, like multiple funding sources and grants, are accurately routed and categorized.

Standout features and integrations:

Features include AI-driven insights that provide fast analysis and cost-cutting proposals, helping your team make informed financial decisions. Additionally, the platform's Copilot feature offers tailored recommendations for handling transactions, ensuring accuracy and compliance.

Integrations include BambooHR, Bill.com, Brex, Deel, Google SSO, Gusto, HubSpot, Ramp, Rippling, Salesforce, Stripe Billing, and Stripe Invoicing.

Pros and cons

Pros:

- Advanced AI features help with complex accounting tasks

- Supports multi-entity and multi-currency operations

- Automated revenue recognition ensures compliance with standards

Cons:

- No option to try the system before buying

- Customization options require careful setup

FreshBooks is a cloud-based accounting software designed for small businesses and self-employed professionals, offering features such as invoicing, expense tracking, and time tracking.

Why I picked FreshBooks: With its user-friendly interface and automation capabilities, FreshBooks helps users manage their finances efficiently without the need for extensive accounting knowledge. The platform is known for its intuitive design, mobile accessibility, and robust reporting, making it a valuable solution for businesses looking to streamline their accounting processes and focus on growth.

Standout features and integrations:

Features include tracking restricted funds to ensure you don’t spend your nonprofit’s donations improperly. It also offers services like expense tracking, reporting tools, and time tracking to help manage your nonprofit. You can also use its invoicing tools and payment acceptance service to get paid if you provide work or a service for someone else.

Integrations include HubSpot, Gusto, Fundbox, and Zapier.

Pros and cons

Pros:

- Track restricted funds

- Long trial period

- Low cost

Cons:

- Monthly fee for each additional user

- Fewer features aimed specifically at nonprofits

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

Xero is a cloud-based accounting software designed for small and medium-sized businesses, providing tools for invoicing, expense tracking, and financial reporting.

Why I picked Xero: Xero offers real-time financial tracking and cloud-based accessibility, enabling nonprofits to manage finances efficiently from anywhere. With its fund tracking and customizable reporting features, you can easily allocate resources effectively and maintain transparency with stakeholders. Similarly, Xero integrates with various donor management and fundraising tools, providing an advanced solution for nonprofit financial management.

Standout features and integrations:

Features include the ability to build custom reports to track the exact financial data that you need or to generate forecasts. Xero also offers key financial services like payment acceptance and the ability to connect to external banks. Plus, you can use it for payroll services and file storage if you want more functionality.

Integrations include third-party banks, Gusto Payroll, Shopify, Microsoft Outlook, Stripe, Mailchimp, and more.

Pros and cons

Pros:

- File storage for receipts, customer data, etc.

- No limit to the number of users on one account

- Reporting tools

Cons:

- Some services, like payroll, come at an additional charge

- Many features require an advanced subscription

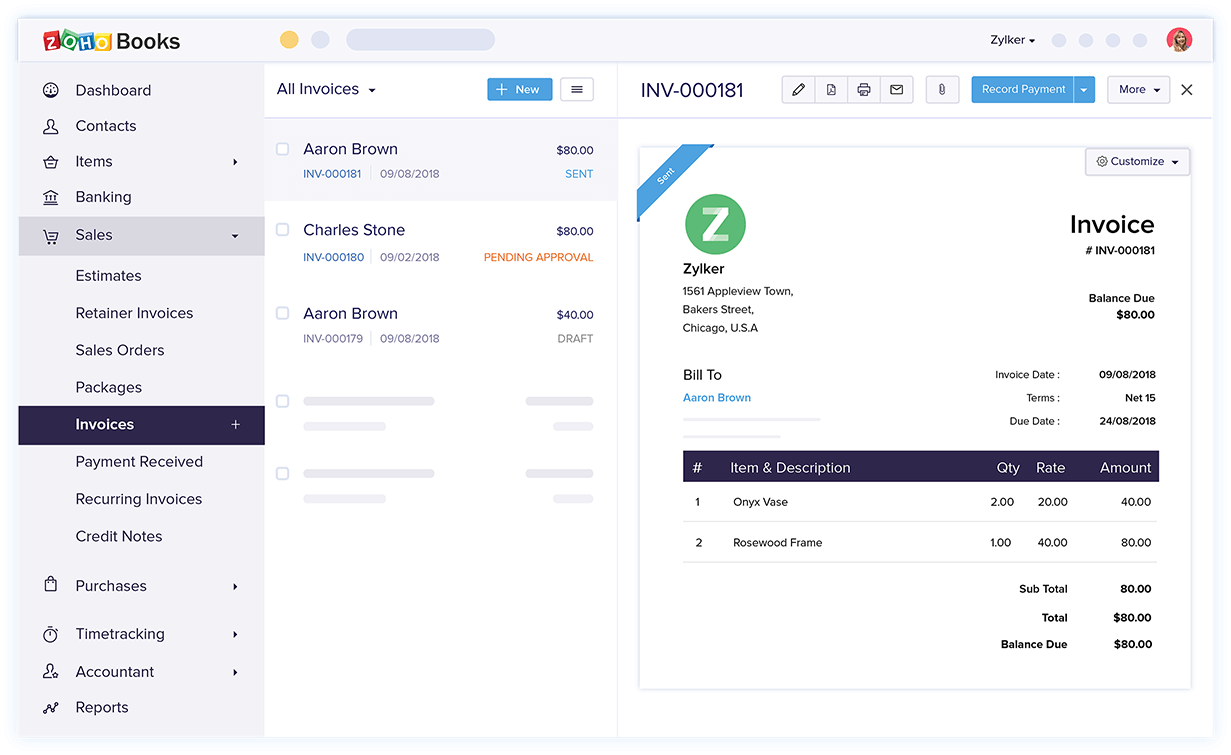

Zoho Books is an online accounting software designed for small businesses, providing features such as invoicing, expense tracking, and financial reporting.

Why I picked Zoho Books: Zoho Books seamlessly integrates with Zoho’s ecosystem, including Zoho CRM, Zoho Desk, and Zoho Projects. This integration enables nonprofits to manage finances, donor relationships, and operational workflows within a unified platform. Additionally, its automation features simplify recurring transactions and reporting, allowing nonprofits to focus more on their mission and less on administrative tasks.

Standout features and integrations:

Features include detailed fund tracking and financial reporting, enabling nonprofits to maintain transparency and accountability in managing their finances. The software also offers automated workflows and recurring transaction features to save time, helping nonprofits focus on their mission rather than manual accounting processes.

Integrations include other Zoho tools, along with PayPal, Stripe, and WePay.

Pros and cons

Pros:

- Free for organizations with annual revenues less than $50,000

- Easy automated workflows

- Highly intuitive and easy to use with no experience

Cons:

- Few customization options

- Limited support

Xledger is a cloud-based financial software that provides comprehensive solutions for finance, HR, and payroll management, aimed at streamlining business processes for organizations. It's designed to support various industries, including nonprofits, and is particularly noted for its real-time financial reporting, analytics capabilities, and scalability.

Why I picked Xledger: Xledger's automation accounting and financial tasks address the specific challenges faced by nonprofits, like limited resources. As a cloud-based system, Xledger allows nonprofit staff and volunteers to access financial data and tools from any location and on any device, with access to real-time insights to enhance transparency and accountability and build donor trust.

Xledger Standout features and integrations:

Features include automated fund accounting tailored for nonprofits, providing real-time financial insights and streamlined reporting. Its cloud-based platform also ensures secure access and scalability, facilitating efficient financial management for organizations of all sizes. Additionally, Xledger’s integrated budgeting and expense tracking features enable nonprofits to maintain financial transparency and compliance with ease.

Integrations include Salesforce, Microsoft Dynamics CRM, Magento, GoldFinch, Harvest, JPMorgan Chase Bank, and Chase Credit Card.

Pros and cons

Pros:

- Donor management tools

- Real-time reporting

- Automation of day-to-day operations

Cons:

- Limited customization options

- Learning curve for new users

Aplos is an accounting software specifically designed for nonprofit organizations, offering comprehensive financial management tools to help nonprofits track donations, manage grants, and maintain compliance.

Why I picked Aplos: Aplos empowers nonprofits to streamline their financial processes and demonstrate transparency to stakeholders. The platform offers built-in tools designed specifically for nonprofits, such as donor profiles, contribution tracking, and fundraising campaign management. Its donation tracking also integrates seamlessly with fund accounting, ensuring contributions are allocated correctly and transparently.

Standout features and integrations:

Features include CRM tools that let you create donor profiles, track your communication and relationship history with them, make tailored appeals for donations, and track the pledges donors offer. The service also comes with true fund accounting that allows nonprofits to easily track and report financials by designated funds, ensuring transparency and compliance.

Integrations include Gusto, WePay, Church Community Builder, Bloomerang, PayPal, Sage Payroll, and more.

Pros and cons

Pros:

- Many integrations

- Intuitive and easy to use without sacrificing functionality

- Donor management tools

Cons:

- Some basic services require higher level of subscription

- High price

Realm is a mobile database and synchronization platform designed to help developers build real-time, collaborative applications.

Why I picked Realm: Realm streamlines administrative tasks, enhances congregant engagement, and facilitates effective communication, enabling church leaders to focus more on ministry. The software integrates seamlessly with giving tools, enabling automatic posting of contributions into the general ledger, which streamlines financial processes and reduces manual data entry. It also offers fund accounting capabilities, allowing users to manage finances by fund, ensuring transparency and compliance with accounting standards.

Standout features and integrations:

Features include Realm’s app for pastors and congregants to help people stay connected to their church, register for events, volunteer, and donate, making this a uniquely helpful tool for churches. On the financial side, it offers financial dashboards, donor tracking and management, and donation acceptance tools.

Integrations include Constant Contact, Go Method, Nelco, and Verified First.

Pros and cons

Pros:

- Easy to use

- Donor management and tracking capabilities

- Designed specifically for churches and worship organizations

Cons:

- Not applicable to all nonprofits

- Opaque pricing

- Limited features

Serenic Navigator is an integrated cloud-based enterprise resource planning (ERP) solution designed for nonprofit organizations and government agencies.

Why I picked Serenic Navigator: Serenic Navigator offers advanced financial management, grant management, and budgeting tools tailored to the unique needs of nonprofit organizations. Its integration with Microsoft Dynamics 365 Business Central enhances usability and ensures seamless data flow across platforms. Additionally, Serenic Navigator provides advanced reporting and compliance tracking features, enabling nonprofits to maintain transparency and adhere to regulatory standards effectively.

Standout features and integrations:

Features include precise tracking and management of multiple funds to ensure financial transparency. Its advanced fund accounting capabilities allow nonprofits to manage multiple funds with ease. Plus, the software offers built-in compliance tracking to ensure adherence to regulatory standards, enhancing organizational credibility.

Integrations include Sylogist’s other services, including IT management, web portals, and business apps.

Pros and cons

Pros:

- Financial tracking and budgeting tools

- Wide variety of add-on services

- Designed specifically for nonprofits

Cons:

- Works best if you buy multiple services, not just accounting

- Pricing is not transparent

ZipBooks is an accounting software tailored to meet the unique needs of nonprofits, providing robust financial management tools to help organizations track donations, grants, and expenses effectively.

Why I picked ZipBooks: ZipBooks enables nonprofits to maintain accurate financial records and demonstrate transparency to stakeholders. The platform is known for its user-friendly interface, cloud-based accessibility, and affordability, making it a valuable solution for nonprofits seeking to manage their finances efficiently and focus on their mission.

Standout features and integrations:

Features include unlimited invoicing, enabling nonprofits to efficiently manage donor contributions and fundraising efforts. Its expense tracking and categorization features help organizations monitor spending and maintain financial transparency. Additionally, ZipBooks provides real-time financial reporting, allowing nonprofits to generate up-to-date balance sheets and income statements for informed decision-making.

Integrations include Google Drive, Square, PayPal, Zoho Flow, Gusto, Slack, and Asana.

Pros and cons

Pros:

- Easy payment acceptance

- Higher levels of service are low cost

- Free service is suitable for many smaller nonprofits

Cons:

- Few integrations

- Limited support

Other Nonprofit Accounting Software

If you don’t feel any options on my list are the right fit for your organization, here are a few other nonprofit accounting tools to consider:

- Quicken

For individually-run nonprofits

- WAVE

For ease of use

- Sage Intacct

For global nonprofits

- QuickBooks Online

For tracking cash flow by project

- UncommonGood

For fundraising

- NonprofitCore

For donor outreach

- AccuFund

For government agencies

Nonprofit Accounting Software Selection Criteria

When picking the best nonprofit accounting software for this list, I focused on what really matters, like staying on budget and making financial reporting as stress-free as possible. To keep things fair and organized, I used this evaluation framework:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage fund accounting

- Handle donation tracking

- Create financial statements

- Track grants and restricted funds

- Generate expense reports

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Integrate with donor management systems

- Provide mobile accessibility

- Offer advanced budgeting tools

- Include automated compliance checks

- Support multi-currency transactions

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Offer intuitive navigation

- Provide a clean interface

- Include customizable dashboards

- Minimize complexity of features

- Ensure quick access to key functions

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Offer comprehensive training videos

- Provide step-by-step product tours

- Include templates for quick setup

- Offer live webinars for guidance

- Ensure availability of chat support

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- Offer 24/7 support availability

- Provide multiple support channels

- Include a comprehensive knowledge base

- Ensure quick response times

- Provide personalized support options

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Offer competitive pricing

- Provide transparent pricing models

- Include essential features in basic plans

- Offer scalable pricing options

- Ensure cost-effectiveness for nonprofits

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Discuss overall satisfaction with features

- Highlight ease of use

- Mention reliability and stability

- Praise customer support quality

- Note the software’s adaptability

How to Choose Nonprofit Accounting Software

Sorting through endless features and confusing pricing plans can feel like a headache. To keep things simple and help you stay on track, here’s a handy checklist of key factors to consider when choosing the right software for you!

| Factor | What to Consider |

|---|---|

| Scalability | Ensure the software can grow with your organization, handling more users and transactions without a hitch as your needs expand. |

| Integrations | Check for compatibility with existing tools your team uses, like CRMs, ERPs, or donor management systems, to streamline data flow and reduce manual entry. |

| Customizability | Look for software that allows you to tailor reports and dashboards to fit your specific nonprofit requirements and financial reporting standards. |

| Ease of Use | Choose a solution your team can learn quickly, minimizing training time and maximizing productivity with an intuitive interface and helpful resources. |

| Budget | Consider both upfront costs and ongoing fees, ensuring it aligns with your financial constraints without sacrificing essential features. |

| Security Safeguards | Prioritize software with robust data protection measures, such as encryption and regular backups, to keep sensitive donor and financial data safe. |

| Reporting | Opt for tools that offer comprehensive financial reporting capabilities tailored for nonprofits, including grant tracking and fund accounting. |

| Support | Assess the availability of customer support services, ensuring your team has reliable assistance when navigating technical challenges or questions. |

Trends in Nonprofit Accounting Software

I’ve combed through tons of product updates, press releases, and release logs from nonprofit accounting software vendors, so you don’t have to! Here are some of the biggest trends catching my eye:

- Automated Financial Reporting: Automation is highly valued among nonprofits for providing real-time data access and better donation tracking. It allows anyone, from SMBs and large organizations, to streamline their reporting processes, making financial management more efficient.

- AI and Machine Learning: These technologies are becoming crucial in financial management for nonprofits. They help in tracking metrics, consolidating data, and providing better insights into financial health, allowing for more informed decision-making.

- Data Analytics: There's a growing emphasis on using data analytics to evaluate financial performance. Nonprofits are breaking down financial data into metrics like donor retention and fundraising efficiency to enhance decision-making.

- Cloud Computing: This technology is increasingly adopted for its ability to improve collaboration by allowing remote data access, reduce costs, and enhance data security. It supports multiple users accessing accounting information from anywhere.

- Digital Media Engagement: Nonprofits are utilizing digital media, including social media and storytelling, to engage donors more effectively. This trend helps in increasing their online presence and attracting more support through visual and narrative content.

What is Nonprofit Accounting Software?

Nonprofit accounting software is a financial management system designed to help nonprofits track donations, manage grants, and stay audit-ready with fund accounting.

It supports the unique needs of nonprofit organizations by separating restricted and unrestricted funds, generating donor reports, and ensuring compliance with IRS and GAAP requirements. Ideal for charities, churches, and foundations, nonprofit accounting software streamlines financial operations and improves transparency for boards, auditors, and stakeholders.

Features of Nonprofit Accounting Software

When choosing nonprofit accounting software, here are the must-have features to look for:

- Fund Accounting: Allows organizations to track and manage multiple funds or grants across services, ensuring financial accountability and compliance with donor restrictions.

- Budget Management: Enables the creation and monitoring of budgets to ensure that the organization stays within its financial limits and meets its financial goals.

- Donation Tracking: Facilitates the tracking of donations and pledges, ensuring accurate reporting and acknowledgment to donors.

- Grant Management: Supports the management and reporting of grants, helping organizations comply with grantor requirements and track funding sources.

- Financial Reporting: Provides tools for generating standard and custom financial reports, aiding in transparency and informed decision-making.

- Compliance Features: Ensures adherence to regulatory requirements specific to nonprofits, reducing the risk of penalties and fines.

- Integration Capabilities: Enables seamless connectivity with other systems and applications, such as CRM or payroll software, to streamline operations.

- User Access Controls: Allows for the assignment of different access levels to users, ensuring data security and integrity.

- Multi-Currency Support: Facilitates transactions and reporting in different currencies, beneficial for organizations dealing with international donations or operations.

- Audit Trail: Maintains a record of all financial transactions and changes, providing transparency and aiding in audits.

- Project Management: Helps streamline workflows and balance your budget.

Benefits of Nonprofit Accounting Software

Bringing in the right nonprofit accounting software can be a total game-changer for your team and organization. Here’s what you can look forward to:

- Improved Financial Accuracy: Automation features reduce the risk of human errors in financial records, ensuring more accurate reporting.

- Time Savings: Automated processes and integrations with other tools save time on manual data entry and reconciliations. This is especially beneficial if you have several nonprofit organizations.

- Better Financial Insights: Real-time reporting and analytics tools provide valuable insights into financial health and donor contributions.

- Enhanced Compliance: Built-in compliance checks help ensure adherence to regulatory requirements specific to nonprofits.

- Efficient Fundraising Management: Tools for tracking donations and generating donor reports make managing fundraising activities easier.

- Budget Tracking: Features for budget creation and monitoring help keep finances aligned with organizational goals.

- Donor Relationship Management: Integration with CRM systems allows for better communication and relationship building with donors. This is beneficial for all nonprofits, but even moreso if you're a startup.

Costs and Pricing of Nonprofit Accounting Software

Finding the right nonprofit accounting software starts with clarity. Features, user limits, and add-ons can shift the price quickly. Use the table below to compare plans, average costs, and what each option actually delivers:

Plan Comparison Table for Nonprofit Accounting Software

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic accounting, limited user access, and essential reporting. |

| Personal Plan | $10-$30/user/month | Customizable dashboards, user support, and basic integrations. |

| Business Plan | $50-$100/user/month | Advanced reporting, multi-user access, custom integrations, and enhanced security. |

| Enterprise Plan | Custom pricing | Full feature set, dedicated support, unlimited users, and advanced customization. |

Nonprofit Accounting Software FAQS

Here are some answers to common questions about nonprofit accounting software:

How does nonprofit accounting software handle restricted funds?

Nonprofit accounting software is designed to help you track and manage restricted funds efficiently. These tools allow you to set up specific accounts for different types of restricted funds, making it easy to ensure that these funds are used according to donor specifications. Your team can generate reports that show the allocation and usage of restricted funds, ensuring transparency and compliance with donor requirements.

Can nonprofit accounting software integrate with donor management systems?

Yes, many nonprofit accounting software solutions offer integration capabilities with donor management systems. This integration allows you to sync donor data and financial transactions across platforms, providing a comprehensive view of your organization’s finances. By integrating these systems, you can streamline your financial processes and maintain accurate records without manual data entry.

Is it possible to automate grant tracking with nonprofit accounting software?

Nonprofit accounting software often includes features for automating grant tracking. You can set up automated alerts for grant application deadlines and reporting requirements, ensuring that your team stays on top of crucial tasks. Additionally, the software can help you track grant expenditures and generate reports needed for grant compliance, saving you time and reducing the risk of errors.

Can we customize the chart of accounts in nonprofit accounting software?

Yes, most nonprofit accounting software allows you to customize the chart of accounts to fit your organization’s specific needs. You can create new accounts, modify existing ones, and organize them in a way that reflects your financial structure. This flexibility helps you align your accounting practices with your operational goals and reporting requirements.

Is accounting software secure?

Whenever you’re working with important data, such as financial information or donor contact info, it’s important to consider security. You don’t want malicious actors to steal financial or personal information.Before deciding on a software provider, check to make sure that the vendor is reputable and that it uses proper security measures. Also, be sure to take some steps of your own, such as using a unique, complex password.

What's Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.