Best Accounting Software For Accountants Shortlist

Here's my pick of the 10 best software from the 24 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Outdated accounting software for accountants makes your job harder than it should be. Slow reports, endless data entry, and clunky interfaces turn simple tasks into headaches. Instead of helping, your software adds to the chaos, eating up time you don’t have.

As a digital software expert, I’ve seen it all—the good, the bad, and the painfully outdated. I know what actually makes a difference in your daily work and what just gets in the way. My goal? To help you find a tool that works for your specific business needs.

I tested and reviewed these tools with that in mind. Whether you need automation, better reporting, or smoother integrations, there’s something here to make your life easier. Let’s find your next accounting software for accountants.

Why Trust Our Software Reviews

We’ve been testing and reviewing accounting software for accountants since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our review methodology.

Best Accounting Software For Accountants Summary

Budget matters when choosing the right accounting software for accountants, and finding a tool that balances cost with features can be tricky. To save you time, I’ve broken down the pricing details so you can quickly compare options and find the best fit for your needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for real-time error detection | 14-day free trial | From $25/month | Website | |

| 2 | Best for freelancers and small businesses | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 3 | Best for seamless app integrations | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 4 | Best for PCAOB compliance tools | Free demo available | Pricing upon request | Website | |

| 5 | Best for live expert assistance | Free demo available | From $3.80/month | Website | |

| 6 | Best for comprehensive business management | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 7 | Best for dedicated bookkeeping services | Free trial available | From $249/month (billed annually) | Website | |

| 8 | Best for inventory management | 14-day free trial | From $20/month | Website | |

| 9 | Best for free and unlimited accounting | Not available | From $59/user/month | Website | |

| 10 | Best for smart insights and reports | 30-day free trial + free plan available | From $15/month (billed annually) | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounting Software For Accountants Reviews

Choosing the right accounting software can make your job easier, but with so many options, it’s tough to know which one truly delivers. Below, I’ve outlined each of my top accounting software for accountants picks, highlighting the pros and cons, pricing, and more to help you find a reliable tool that fits your needs.

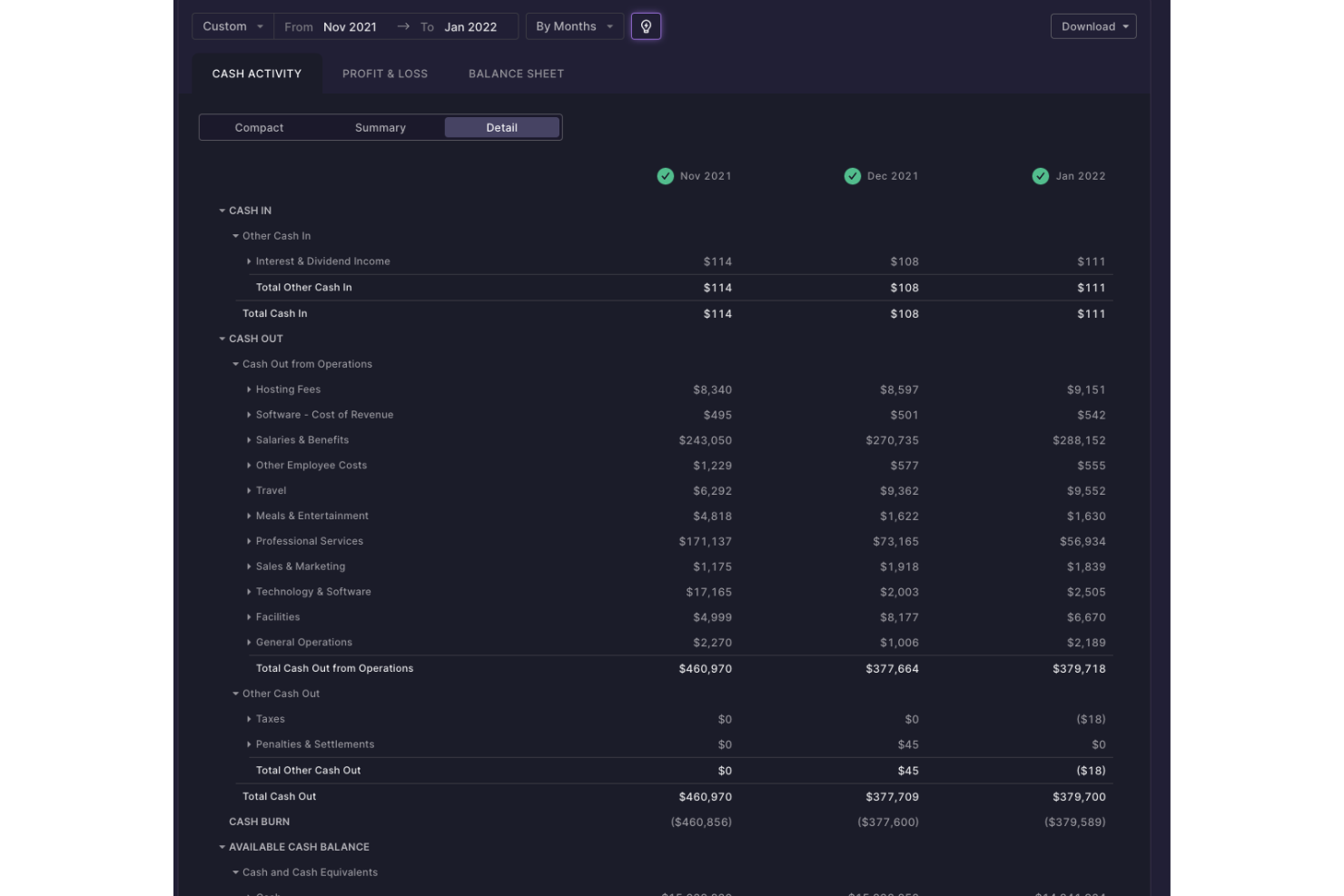

Puzzle.io is an AI-native accounting platform built for startups and small businesses that need help managing bookkeeping, financial reporting, and compliance work. It offers a full accounting system while also giving accountants tools to automate categorization, monitor accuracy, and reduce manual oversight.

Why I Picked Puzzle.io: I picked Puzzle.io because of how its continuous accuracy monitoring works. The software applies machine learning to detect potential errors across reconciliations, financial statements, and categorization rules. Instead of waiting for period-end reviews, you get visibility into possible issues as they happen. This can reduce time spent on error correction and catch anomalies earlier in the close cycle. It also supports both accrual and cash accounting simultaneously, which gives you flexibility to handle different client needs or business models without managing duplicate records.

Standout Features & Integrations:

Features include variance analysis with customizable thresholds to surface unexpected transactions, built-in accrual automation that handles revenue recognition without needing spreadsheets, and an onboarding flow that can help you migrate legacy books while retaining financial history. Puzzle.io also includes an advisor network that can connect you with external bookkeepers if needed.

Integrations include Mercury, Ramp, Brex, Every, Meow, Rippling, Gusto, Deel, Central, Stripe, Bill.com, Runway, and Causal.

Pros and cons

Pros:

- Automates revenue recognition and expense categorization

- AI improves categorization accuracy over time

- Supports both cash and accrual accounting

Cons:

- Free trial requires users to connect a bank account

- Limited customization for complex workflows

New Product Updates from Puzzle.io

Puzzle.io's Automated PDF Statement Loading

Puzzle.io has introduced automated PDF statement loading for Meow, streamlining the reconciliation process by eliminating manual downloads and uploads. For more details, visit Puzzle.io Product Updates.

FreshBooks is a cloud-based accounting software tailored for freelancers and small businesses, offering easy invoicing, expense tracking, and time management.

Why I Picked FreshBooks: I chose FreshBooks for its simplicity and focus on the needs of freelancers and small businesses. Its user-friendly design and specialized features like time tracking and project management make it a standout choice for solo entrepreneurs and small teams looking for a straightforward accounting solution.

Standout Features & Integrations:

Features include customizable invoicing, expense tracking, time tracking, and project management. FreshBooks also offers mobile apps for iOS and Android, allowing users to manage their finances on the go.

Integrations include G Suite, PayPal, Stripe, Gusto, Shopify, Trello, Slack, HubSpot, Zapier, and Mailchimp.

Pros and cons

Pros:

- Strong invoicing and time tracking tools

- Designed for freelancers and small teams

- Simple and intuitive interface

Cons:

- Some features lack customization options

- Higher cost for additional users

- Limited reporting capabilities

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

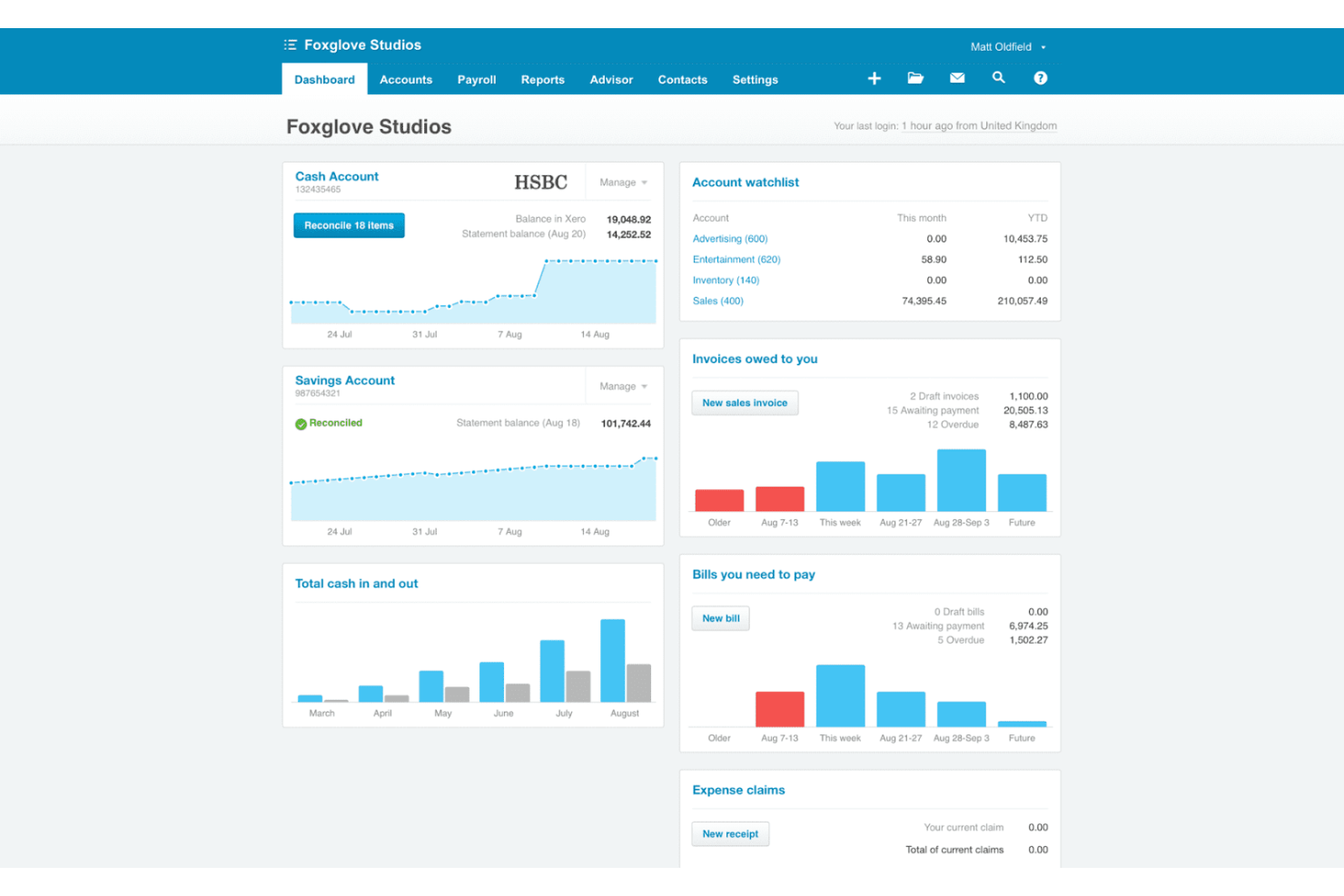

Xero is an accounting software platform that offers cloud-based accounting for small and medium-sized businesses with a strong focus on integrations.

Why I Picked Xero: I chose Xero because of its robust ecosystem of app integrations, which makes it a versatile option for businesses with varied needs. Its consistent integration with a wide range of third-party tools allows for a tailored accounting experience, which is uncommon among many accounting solutions.

Standout Features & Integrations:

Features include real-time bank reconciliation, invoicing, inventory management, and multi-currency accounting. Xero also offers a mobile app for managing finances on the go.

Integrations include PayPal, Stripe, HubSpot, Gusto, Expensify, Shopify, Square, Bill.com, Salesforce, and Zapier.

Pros and cons

Pros:

- User-friendly interface

- Real-time financial data syncing

- Extensive app integration options

Cons:

- Steeper learning curve for beginners

- Higher pricing for advanced features

- Limited customer support

DualEntry is an AI-native ERP accounting software built for mid-market businesses that have outgrown entry-level systems. It focuses on automating accounting tasks and improving financial accuracy with real-time AI insights.

Why I Picked DualEntry: I picked DualEntry because it automates complex accounting processes like revenue recognition and bank matching, helping you reduce manual work and stay audit-ready. The AI-powered audit trails and PCAOB compliance tools make it easier to maintain accurate records. It also supports multi-entity consolidation and real-time financial reporting, which is a huge plus for growing businesses.

Standout Features & Integrations:

Features include automated revenue recognition, AI-powered audit trails, and customizable approval workflows.

Integrations include BambooHR, Bill.com, Brex, Deel, Google SSO, Gusto, HubSpot, Ramp, Rippling, Salesforce, Stripe Billing, and Stripe Invoicing.

Pros and cons

Pros:

- Automated revenue recognition ensures compliance with standards

- Supports multi-entity and multi-currency operations

- Advanced AI features help with complex accounting tasks

Cons:

- As an ERP, it may offer more features than needed for simpler accounting needs

- Customization options require careful setup

QuickBooks is a comprehensive accounting software designed for small to medium-sized businesses, offering robust financial management tools.

Why I Picked QuickBooks: I chose QuickBooks for its extensive feature set and live expert assistance, which stands out among other accounting tools. Its combination of powerful financial tracking and the ability to consult with professionals makes it a unique option for businesses that need both tools and guidance.

Standout Features & Integrations:

Features include customizable financial reports, automated expense tracking, invoicing, and payroll management. QuickBooks also offers a mobile app for on-the-go access to financial data.

Integrations include PayPal, Shopify, Square, Stripe, Gusto, TSheets, Amazon, Bill.com, HubSpot, and Salesforce.

Pros and cons

Pros:

- Strong integration capabilities

- Extensive financial reporting tools

- Live expert assistance available

Cons:

- Learning curve for new users

- Limited customization for reports

- Higher price point

Zoho Books is a cloud-based accounting software that provides a complete business management solution, including invoicing, expense tracking, and financial reporting.

Why I Picked Zoho Books: I chose Zoho Books because of its extensive suite of tools that go beyond basic accounting, making it a strong choice for businesses looking for a comprehensive management solution. The integration with other Zoho applications and its ability to manage multiple aspects of business operations in one platform sets it apart from other accounting software.

Standout Features & Integrations:

Features include automated bank feeds, invoicing, project management, inventory management, and tax compliance. Zoho Books also provides a client portal for easy communication and document sharing with clients.

Integrations include Zoho CRM, Zoho Projects, Zoho Inventory, PayPal, Stripe, G Suite, Office 365, Slack, Zapier, and Dropbox.

Pros and cons

Pros:

- Customizable workflows

- Strong integration with other Zoho apps

- Comprehensive suite of business management tools

Cons:

- Higher cost for advanced features

- Limited third-party integrations outside Zoho

- Learning curve for new users

Bench is a bookkeeping service that pairs you with a dedicated bookkeeper to manage your financial records and provide monthly reports.

Why I Picked Bench: I chose Bench for its dedicated bookkeeping services, which sets it apart from traditional accounting software. Unlike other tools that require you to do the bookkeeping yourself, Bench provides personalized support, making it ideal for businesses that prefer to outsource their financial management.

Standout Features & Integrations:

Features include monthly financial statements, real-time expense tracking, and tax-ready financials. Bench also offers a user-friendly platform where you can easily communicate with your dedicated bookkeeper and track your financial health.

Integrations include Stripe, PayPal, Square, Shopify, Gusto, QuickBooks, FreshBooks, Xero, HubSpot, and Amazon.

Pros and cons

Pros:

- Easy communication with bookkeepers

- Monthly financial statements provided

- Dedicated bookkeeping service

Cons:

- No real-time customization options

- Limited to U.S.-based businesses

- Higher cost than DIY software

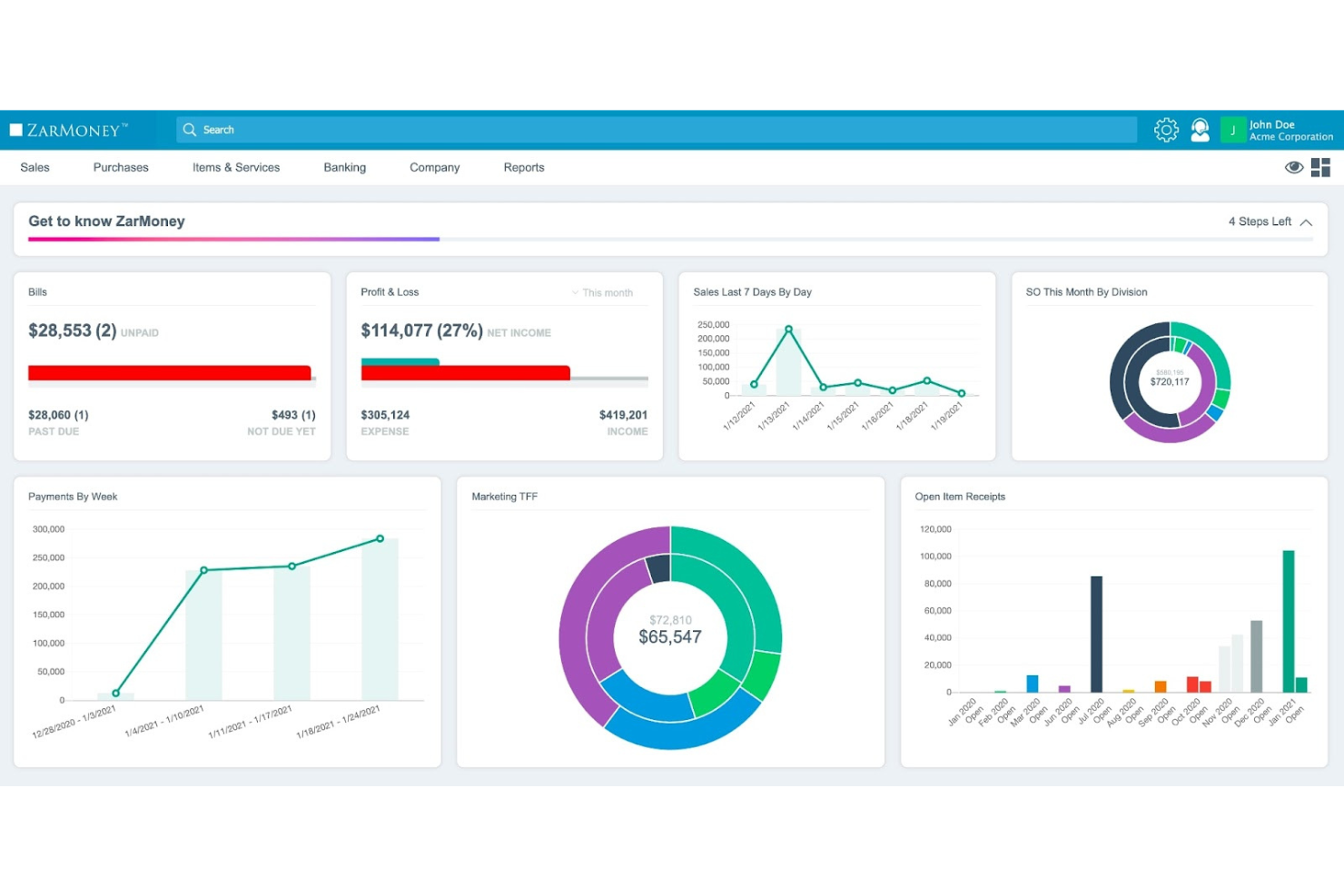

ZarMoney is an online accounting software that excels in inventory management, offering comprehensive tools for tracking and managing stock levels.

Why I Picked ZarMoney: I chose ZarMoney for its robust inventory management features, which are particularly beneficial for businesses that need to keep tight control over their stock. Its ability to integrate inventory management seamlessly with accounting functions makes it stand out from other accounting software options, especially for businesses with extensive product catalogs.

Standout Features & Integrations:

Features include real-time inventory tracking, automated stock alerts, multi-warehouse management, and detailed reporting on stock levels and inventory valuation. ZarMoney also supports vendor management and purchase order creation directly from the software.

Integrations include PayPal, Stripe, Square, Shopify, Zapier, Google Workspace, QuickBooks, Mailchimp, Gusto, and Expensify.

Pros and cons

Pros:

- Affordable pricing for small businesses

- Real-time stock tracking and alerts

- Strong inventory management features

Cons:

- Customer support may have response delays

- Not ideal for very large enterprises

- Limited advanced accounting features

Manager.io is a comprehensive accounting software that offers free and unlimited access to its full suite of accounting features.

Why I Picked Manager.io: I chose Manager.io because it offers a complete accounting solution at no cost, making it a standout option for small business owners or individuals needing a robust yet free accounting tool. Its unlimited features without hidden costs are unique compared to other free accounting software.

Standout Features & Integrations:

Features include double-entry accounting, invoicing, expense tracking, and payroll management. Manager.io also provides comprehensive financial reporting and multi-currency support, which are valuable for businesses operating internationally.

Integrations include Zapier, PayPal, Stripe, Square, WooCommerce, Shopify, Google Sheets, QuickBooks, Xero, and FreshBooks.

Pros and cons

Pros:

- Multi-currency and payroll support

- Unlimited accounting features

- Completely free for the desktop version

Cons:

- User interface may feel outdated

- Desktop version lacks cloud accessibility

- Limited integrations with third-party apps

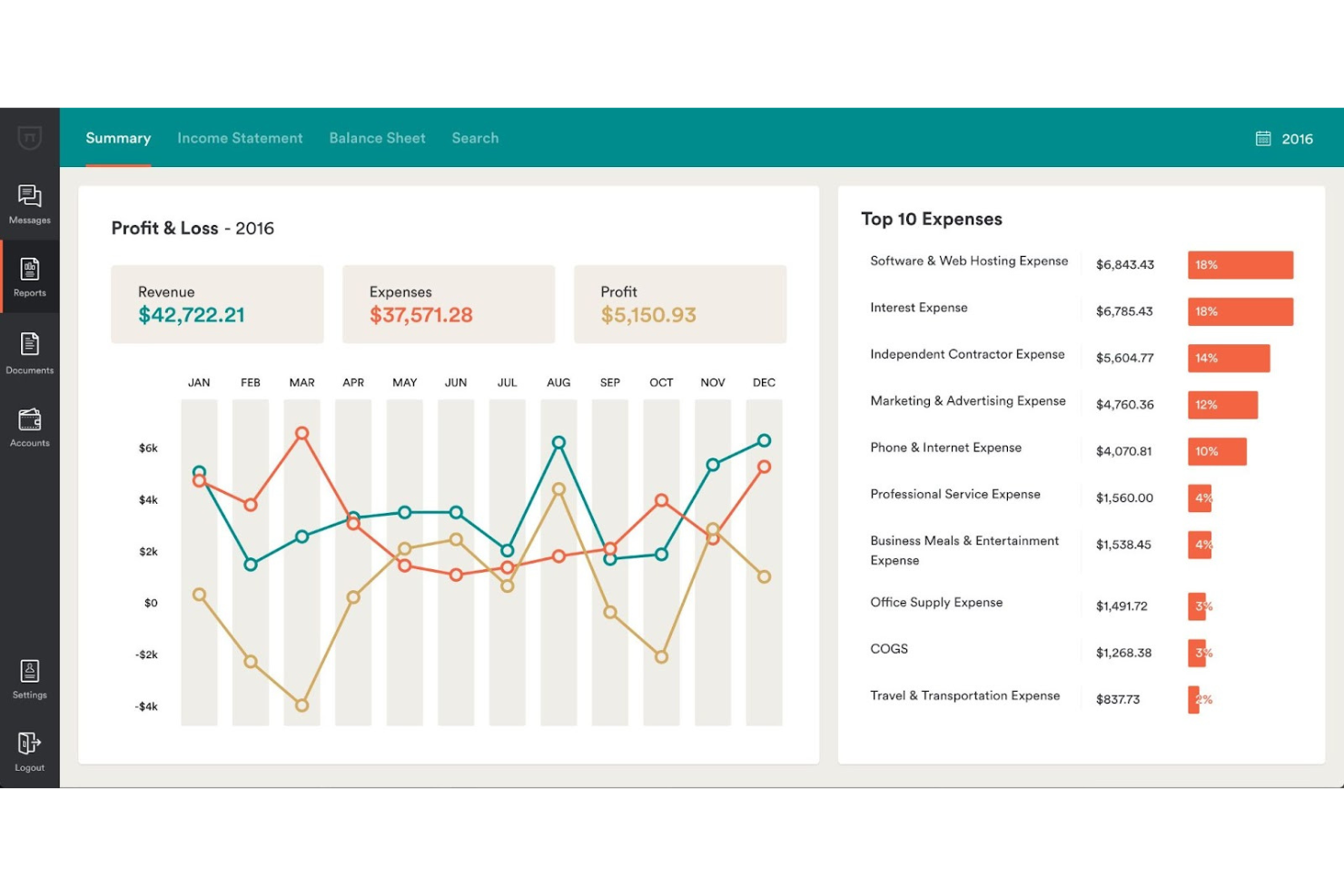

ZipBooks is an online accounting software offering smart insights and detailed reports, designed to help businesses make informed financial decisions.

Why I Picked ZipBooks: I chose ZipBooks for its ability to provide intelligent insights and comprehensive reports, which are crucial for businesses that need to monitor their financial performance closely. Its unique emphasis on smart recommendations and easy-to-read reports sets it apart from other accounting tools.

Standout Features & Integrations:

Features include smart tagging for transactions, real-time financial reporting, and automated invoicing. ZipBooks also provides a business health score, helping users quickly assess their financial standing.

Integrations include PayPal, Square, Stripe, Gusto, Slack, Zapier, Google Workspace, QuickBooks, Xero, and FreshBooks.

Pros and cons

Pros:

- Affordable pricing for small businesses

- Real-time business health score

- Smart financial insights and reports

Cons:

- Customer support response can vary

- Fewer integrations than competitors

- Limited advanced features

Other Accounting Software For Accountants

Below is a list of additional accounting software for accountants that we shortlisted, but did not make it to the top list. Definitely worth checking them out.

- Acumatica

For multi-entity accounting

- MYOB

For scalable business solutions

- AccountEdge

For advanced data management

- Wave

For free accounting features

- Kashoo

For automated accounting

- Clear Books

For cloud-based accounting

- FreeAgent

For freelancer and small business support

- Busy Accounting Software

For inventory management tools

- SlickAccount

For cash flow management

- Bill.com

For accounts payable automation

- LessAccounting

For good simplicity and ease of use

- Intapp

Compliance and risk management

- Sage Software Suite

For good scalability for growing businesses

- ProSeries

For tax preparation features

Accounting Software For Accountants Selection Criteria

When choosing accounting software for accountants, focus on how well it fits your workflow. You need a tool that’s precise, reliable, and built for real accounting tasks. These criteria highlight what matters most—functionality, efficiency, and the ability to handle complex financial work.

Core Functionality - 25% of total weighting score:

- Accurate financial reporting and analysis

- Automated invoicing and billing

- Expense tracking and management

- Payroll processing

- Tax preparation and filing

Additional Standout Features - 25% of total weighting score:

- Integration with third-party tools for expanded functionality

- AI-driven financial insights and automation

- Industry-specific accounting modules (e.g., construction, healthcare)

- Multi-currency and multi-entity support

- Real-time collaboration features for team-based accounting

Usability - 10% of total weighting score:

- Intuitive navigation and clean interface design

- Efficient workflow automation to reduce manual tasks

- Customizable dashboards and reporting tools

- Role-based access with easy configuration

- Mobile accessibility for on-the-go financial management

Onboarding - 10% of total weighting score:

- Availability of step-by-step tutorials and training videos

- Interactive product tours to guide new users

- Pre-built templates for quick setup

- Migration tools to import data from previous systems

- Access to live webinars and Q&A sessions for real-time learning

Customer Support - 10% of total weighting score:

- 24/7 availability of support channels (phone, email, chat)

- Dedicated account managers for personalized support

- Comprehensive knowledge base and FAQs

- Access to community forums and user groups

- Fast response times and issue resolution

Value for Money - 10% of total weighting score:

- Transparent pricing with no hidden fees

- Tiered pricing models to suit different business sizes

- Free trials or demo versions to test the software

- Discounts for long-term contracts or annual billing

- Feature-rich packages that justify the cost

Customer Reviews - 10% of total weighting score:

- High ratings for reliability and performance

- Positive feedback on customer service and support

- Consistency in delivering promised features

- Recognition for innovation and user satisfaction

- Common themes in customer feedback on usability and functionality

How To Choose Accounting Software for Accountants

Sorting through endless features and pricing can be overwhelming. This checklist will help you stay focused on what really matters when it comes to choosing an accounting software for accountants.

| Factor | What to Consider |

|---|---|

| Scalability | Ensure the software can grow with your practice. Look for features that support additional users and clients without significant cost increases. |

| Integrations | Check compatibility with other tools you use, like CRM systems or payroll software, to streamline your workflows and reduce manual data entry. |

| Customizability | Choose software that allows you to tailor features and reports to fit your accounting practices and client needs. |

| Ease of Use | Opt for intuitive interfaces that require minimal training, allowing your team to quickly adapt and maintain productivity. |

| Budget | Consider not just the initial cost but ongoing fees and any additional charges for extra features or users. Make sure it fits within your budget. |

| Security Safeguards | Prioritize software with robust security measures, such as encryption and two-factor authentication, to protect sensitive financial data. |

| Reporting Features | Look for comprehensive reporting tools that provide insights into financial health, helping you make informed decisions for your clients. |

| Customer Support | Reliable support can be crucial when issues arise. Assess the availability and quality of customer service, including response times and support channels. |

Trends In Accounting Software For Accountants

I dug through tons of product updates, press releases, and release logs from accounting software vendors. Here are the top trends on my radar:

- AI-Driven Analytics: AI is being increasingly integrated to provide predictive analytics and insights, helping accountants make data-driven decisions. Xero and QuickBooks are leading the way by offering AI tools that analyze financial data to forecast trends and identify anomalies.

- Blockchain Integration: Some accounting software are exploring blockchain for enhanced security and transparency in financial transactions. Vendors like Oracle are experimenting with blockchain to create immutable records, which can be especially useful for audits.

- Real-Time Collaboration Tools: More platforms are incorporating features that allow multiple users to work on financial data simultaneously. FreshBooks, an online accounting software, has rolled out real-time collaboration features that enable accountants and clients to interact within the software, improving communication and efficiency.

- Cloud-Based Solutions: The shift to cloud-based platforms continues to grow as businesses seek flexibility and accessibility. Sage Intacct offers extensive cloud solutions, allowing accountants to access financial data from anywhere, supporting remote work trends. This is especially beneficial if you work for a company with international locations.

- Customizable Reporting: There is a growing demand for customizable and dynamic reporting tools. Zoho Books provides advanced reporting features that allow users to create tailored financial reports to meet specific business needs, offering a more personalized experience.

What Is Accounting Software For Accountants?

Accounting software for accountants is a specialized tool designed to manage and streamline financial processes such as bookkeeping, invoicing, payroll, and tax preparation.

An accounting system is used by accounting services and firms to ensure accurate financial record-keeping, compliance with regulations, and efficient financial reporting. This software is essential for accountants in large businesses who need to handle complex financial data, automate routine tasks, and generate detailed reports for clients or internal business use.

Features Of Accounting Software For Accountants

When reviewing SaaS accounting software for accountants, I look for features that truly help with financial management and reporting. Here are the must-haves I consider:

- General Ledger Management: Centralizes financial data for accurate tracking of all transactions.

- Accounts Payable and Receivable: Manages incoming and outgoing payments efficiently.

- Payroll Processing: Automates salary calculations, tax deductions, and employee payments.

- Tax Compliance: Ensures adherence to local, state, and federal tax regulations.

- Financial Reporting: Generates detailed reports for financial analysis and decision-making.

- Bank Reconciliation: Matches transactions with bank statements for accuracy.

- Expense Tracking: Monitors and categorizes business expenses automatically.

- Inventory Management: Tracks inventory levels and integrates with accounting records.

- Multi-Currency Support: Handles transactions in different currencies with real-time conversion.

- Audit Trails: Provides a detailed log of all financial activities for accountability. This is especially beneficial if you're an accountant managing trust accounts.

Benefits Of Accounting Software For Accountants

Accounting software helps accountants and businesses work smarter by simplifying finances and improving accuracy. Here are the top benefits for you:

- Increased Efficiency: Automates routine financial tasks, saving time and reducing the likelihood of manual errors. This is extremely valuable if you work for a multi company organization, and need a solution to manage finances across several locations.

- Improved Accuracy: Provides precise calculations and consistent data, which helps avoid costly mistakes in financial records.

- Better Financial Insights: Generates detailed reports and analytics, enabling more informed decision-making based on real-time financial data.

- Enhanced Compliance: Keeps up with regulatory changes and ensures that financial practices adhere to local, state, and federal laws. This becomes increasingly more complex for midsize businesses to larger corporations.

- Scalability: Supports growing businesses by handling more complex financial transactions and increasing data volume without compromising performance.

Costs And Pricing Of Accounting Software For Accountants

Knowing how much accounting software costs (and what you’re actually paying for) is key to finding the right fit for your business. Prices can vary based on features, user access, and the kind of support you get. To make things easier, I’ve broken down the common pricing plans so you can pick the one that works best for your needs and budget.

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic invoicing, expense tracking, limited reporting, single-user support |

| Basic Plan | $10-$25/user/month | Invoicing, accounts payable/receivable, basic reporting, email support |

| Standard Plan | $30-$50/user/month | Payroll processing, advanced reporting, multi-user access, integrations |

| Premium Plan | $60-$100/user/month | Multi-currency support, inventory management, comprehensive reporting, priority support |

| Enterprise Plan | $150+/user/month | Custom features, unlimited users, dedicated account manager, full API access |

Accounting Software for Accountants FAQs

Is cloud-based accounting software secure?

Yes, reputable cloud-based accounting software uses encryption and other security measures to protect your data. Regular backups and updates ensure data safety and compliance with industry standards. Always verify the security features of the software provider and use strong, unique passwords.

Can accounting software handle multiple currencies?

Many accounting software options offer multi-currency support, which is crucial for businesses dealing with international transactions. This feature automatically converts and tracks transactions in various currencies. Ensure that the software you choose supports the currencies you frequently use.

What is the difference between invoicing and accounting software?

Invoicing software focuses primarily on creating and managing invoices. Accounting software, on the other hand, offers a broader range of financial management tools, including invoicing, expense tracking, payroll, and financial reporting. Accounting software provides a more comprehensive solution for managing business finances.

Can I integrate accounting software with other business tools?

Yes, most accounting software integrates with various other tools like CRM systems, eCommerce platforms, and payment gateways. These integrations streamline workflows and reduce manual data entry. Check for specific integrations that match your existing business tools.

Is it difficult to migrate from one accounting software to another?

Migration can be challenging but many accounting software providers offer tools and support to make the transition smoother. Before switching, back up your data and ensure that the new software can import your existing data formats. Consider professional help for complex migrations.

How often should I update my accounting software?

Regular updates are crucial to keep your software secure and compliant with the latest financial regulations. Most cloud-based software updates automatically, ensuring you have the latest features and security patches. If using desktop software, check for updates regularly and install them as needed.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.