Best Free Accounting Software Shortlist

Here’s my shortlist of the best free accounting software:

Our one-on-one guidance will help you find the perfect fit.

The best free accounting software helps startups and small businesses manage finances effectively without monthly fees, simplifying bookkeeping, invoicing, and expense tracking right from the start.

Reliable accounting software minimizes manual entry, reduces errors, and accelerates tasks like account reconciliation and financial reporting. Choosing the right free accounting tool means fewer missed payments, accurate records, and more time to focus on strategically growing your business.

Why Trust Our Software Reviews

We've tested and reviewed accounting software since 2023 to simplify managing business finances. As finance professionals, we understand the challenge of selecting the right tool.

Through rigorous research and testing over 2,000 tools, we've created 1,000+ in-depth software reviews. Learn how we stay transparent & our accounting software review methodology.

Best Free Accounting Software Summary

Quickly compare pricing for my top free accounting software below. Some tools are completely free, others offer free trials so you can test features before committing.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for expense tracking | 30-day free trial + free plan available | From $15/user/month | Website | |

| 2 | Best for AI-driven insights | 14-day free trial | From $25/month | Website | |

| 3 | Best for businesses using other Zoho services | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 4 | Best for a range of features | 7-day free trial | From $35/user/month (min 5 users) | Website | |

| 5 | Best for very small businesses/freelancers | 14-day free trial | From $9/month | Website | |

| 6 | Best for sole proprietors | Not available | Free to use | Website | |

| 7 | Best for power users | Not available | Free to use | Website | |

| 8 | Best for invoicing | 30-day free trial + free plan available | From $15/month (billed annually) | Website | |

| 9 | Best for small teams | Not available | Free to use | Website | |

| 10 | Best for remote and virtual teams | Not available | Free to use | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Free Accounting Software Reviews

Explore the best free accounting software in my in-depth reviews. I’ve broken down key features, pros and cons, integrations, and top use cases to help you find the right fit fast.

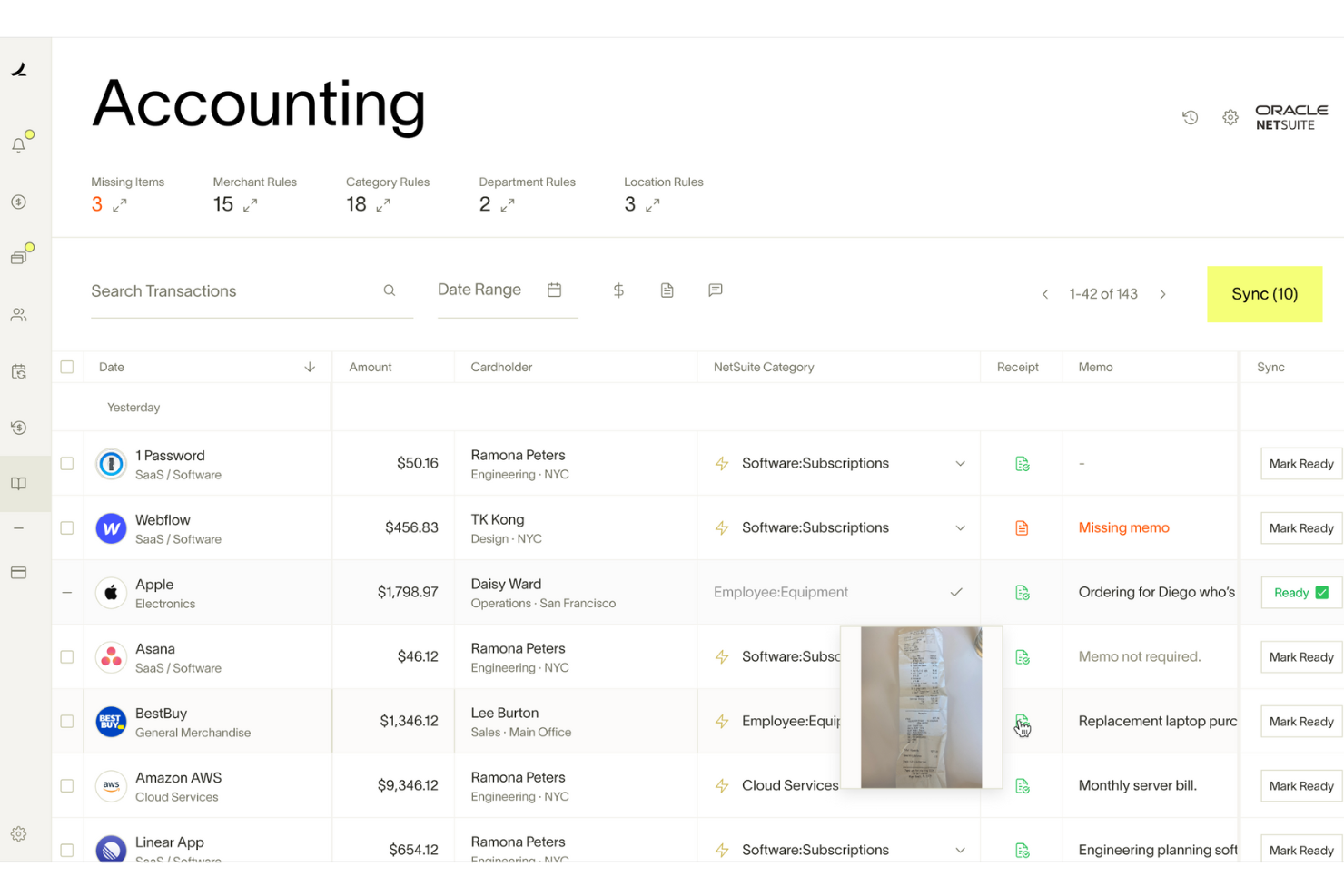

Ramp is a corporate expense management platform that combines physical and virtual company cards with built-in financial controls.

Why I picked Ramp: Ramp offers real-time expense recognition by texting you right after a card swipe, prompting you to upload the receipt via SMS or the app. That means you don’t have to chase paper, and it reduces missing or mismatched receipts. The platform also allows flexible control over spending limits on each virtual or physical card, so you can set monthly, per-transaction, and merchant-specific caps to prevent off-policy charges.

Standout features & integrations:

Features include machine‑learning‑based receipt matching and categorization that automatically pairs receipt images with transactions and tags expenses based on set rules. It also offers bill pay support where you can email or upload vendor invoices, set approval workflows, and pay bills via ACH, check, or card.

Integrations include NetSuite, Sage Intacct, QuickBooks, Microsoft Dynamics Business Central, Acumatica, Workday Financial Management, Uber, Lyft, Amazon Business, TravelPerk, ADP Workforce Now, and Gusto.

What's Free? Ramp includes a free plan for smaller teams looking for basic functions to simplify finances.

Pros and cons

Pros:

- Automated expense reporting and receipt matching

- Ability to issue multiple virtual cards with customizable controls

- Combined AR, AP, and expense management in one system

Cons:

- Mobile app has fewer features than desktop version

- Could offer more advanced accounting features

New Product Updates from Ramp

Vendor Approval Workflows in Ramp

Ramp's new vendor approval workflows allow teams or managers to review new vendors, ensuring compliance with procurement policies and preventing unauthorized entries. For more details, visit Ramp Announcements.

Puzzle.io is a modern accounting software designed to help startups and small businesses manage their finances. It automates many traditional accounting tasks, providing real-time financial insights without the need for extensive manual input.

Why I picked Puzzle.io: One of the reasons I picked Puzzle.io is because of its automated bookkeeping feature. This functionality ensures accuracy in financial management, allowing you to focus on other aspects of your business. The AI-driven insights provided by the software also help you make informed decisions without having to manually sift through data.

Standout features & integrations:

Features include variance analysis, which helps you track unexpected expenses and manage your budget more effectively. The built-in accrual automation also enhances the process of managing financial policies, ensuring consistency across your reports.

Integrations include Stripe, Brex, Ramp, Rippling, and Gusto.

What's Free? Puzzle.io offers a free accounting basics plan that includes cash books and accrual books as well as basic automation like profit & loss, balance sheets, categorization, accrual policies, and revenue recognition.

Pros and cons

Pros:

- Real-time dashboards provide immediate financial insights

- AI-powered transaction categorization

- Automated bank reconciliations ensure accuracy

Cons:

- Free trial requires users to connect a bank account

- May not be suitable for very large enterprises

New Product Updates from Puzzle.io

Puzzle.io's Automated PDF Statement Loading

Puzzle.io has introduced automated PDF statement loading for Meow, streamlining the reconciliation process by eliminating manual downloads and uploads. For more details, visit Puzzle.io Product Updates.

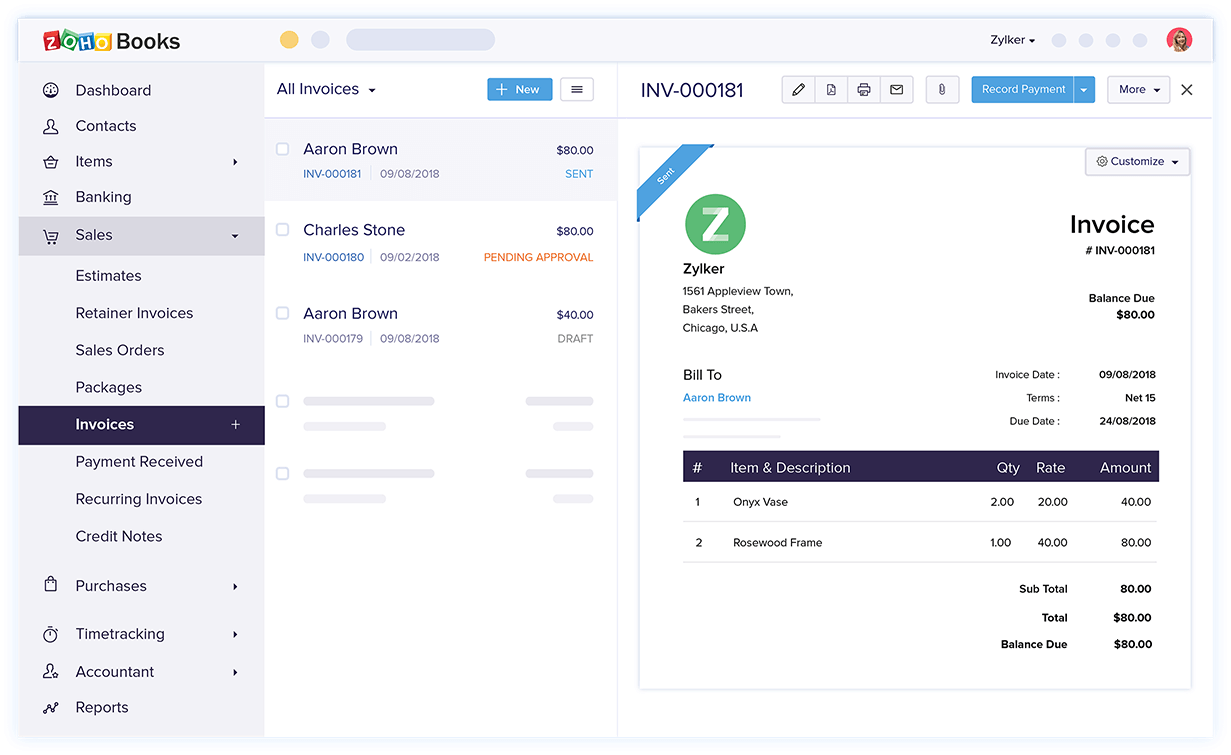

If you’re already a Zoho customer, I’d definitely recommend looking into adding their accounting software to your current setup. Zoho Books can handle everything from expense reporting to automated follow-up on customer accounts.

Why I picked Zoho Books: Zoho Books offers seamless integration within the Zoho ecosystem, creating a unified platform for managing everything from sales and CRM to inventory and invoicing. This tight integration reduces the need for manual data entry, improves workflow efficiency, and provides real-time financial insights across departments.

Standout features & integrations:

Features include the ability to create and send professional invoices with just a few clicks, making your billing process efficient and straightforward. You can also track expenses and time, ensuring your team stays on top of all financial activities without missing a beat.

Integrations include Zoho CRM, PayPal, Stripe, Google Drive, Dropbox, Office 365, Slack, G Suite, Mailchimp, and Zendesk.

What's Free? Zoho Books offers a free-forever plan for businesses with revenue below a certain threshold, allowing one user and one accountant. While it provides essential accounting features, integrations with other applications might be limited in the free version.

Pros and cons

Pros:

- Most important features available with free service

- Easy to use

- Test account lets you check out the service before signing up

Cons:

- Works best if you pay for additional services

- Limited support

Striven can handle everything from standard accounting and bookkeeping tasks to communicating with suppliers and monitoring cash flows.

Why I picked Striven: Striven offers an accounting dashboard alongside other valuable business services, letting it serve as a one-stop shop for your company’s software needs. It provides real-time data and transparency across business functions, supporting both organization and growth. The software's user-friendly interface and strong support also make it easier for your team to modernize processes and manage data effectively.

Standout features & integrations:

Features include accounting tools that allow you to handle financial reporting and payroll management with ease. Your team can manage projects efficiently with tools for planning, budgeting, and collaboration. The software also offers inventory management, helping you keep track of stock levels and purchase orders effectively.

Integrations include API Settings, Authorize.net, Email Relay, Google Calendar, Microsoft Calendar, ShipStation, Shopify, Square, Stripe, Striven For Gmail, and Twilio.

What's Free? Striven offers a limited-time free trial, allowing you to test its features without an immediate financial commitment. During this trial, you can access the full range of features, but you'll need to upgrade to continue using the software beyond the trial period.

Pros and cons

Pros:

- Strong customer support

- Lots of features

- User friendly

Cons:

- Long setup process

- Limited features for free service

While it technically isn’t a full-fledged accounting software, TrulySmall Invoices is a great free budgeting tool that makes it easy to create all of your company’s invoices.

Why I picked TrulySmall Invoices: True to its name, TrulySmall Invoices offers basic services that are ideal for a small company that doesn’t need all the bells and whistles. The software stands out with its ability to sync bank transactions, support digital payments, and handle multi-currency transactions. It also offers receipt scanning and transaction categorization, which can simplify tax preparation.

Standout features & integrations:

Features include the ability to generate and send invoices quickly, helping you maintain efficient cash flow. The software also offers automatic expense tracking, which simplifies managing your business expenses. Additionally, TrulySmall provides detailed reporting features, allowing you to gain insights into your finances effortlessly.

Integrations include QuickBooks, Xero, Stripe, PayPal, Shopify, Square, WooCommerce, FreshBooks, Sage, and Zoho.

What's Free? TrulySmall offers a free trial period, allowing users to explore its features without providing credit card information. Each business requires a separate subscription to keep financial data organized, but there are no hidden fees involved.

Pros and cons

Pros:

- Multiple invoice templates

- Start sending invoices without an account

- Easy to use

Cons:

- More invoicing software than accounting software

- Limited customization options in the free tier

Lendio’s accounting tool, formerly known as Sunrise, is great for invoice automations. For sole proprietors and those who don’t have a dedicated accounting department, Lendio can save you a lot of time and money.

Why I picked Lendio: Lendio offers easy invoicing, includes automations, and has reasonably-priced payment acceptance. However, the software does charge a fee for payment processing (from 2.55% + $0.30 to 3.55% + $0.30 for credit card payments, 0.5% + $0.30 - 1.5% + $0.30 for ACH transactions).

Standout features & integrations:

Features include access to a wide variety of loan options tailored to your business needs. You can easily compare different lenders to find the best terms and rates. The platform also provides a simple online application process, saving you and your team valuable time.

Integrations include QuickBooks, Xero, FreshBooks, Stripe, Square, PayPal, Shopify, Amazon, and eBay.

What's Free? Lendio provides free access to its marketplace for comparing financing options. You can explore different loan products and use tools like loan calculators without any cost, but actual loan applications will depend on the terms of the lenders.

Pros and cons

Pros:

- Easy expense tracking

- Reporting tools

- Free service that offers invoice automation

Cons:

- Provides little help with signing up

- Website and support availability are not detailed

TurboCASH is an open-source, no-frills option that has all the tools you need for free. If you’re tech-savvy, you can accomplish a lot with this software. However, like most open-source solutions, be ready for a learning curve.

Why I picked TurboCASH: TurboCash may not look as sleek or as simple as other accounting tools, but it offers surprisingly powerful features once you learn to work with it. You can manage your general ledger, invoicing, and stock without any cost, which is ideal for small businesses and startups. TurboCASH also allows you to operate remotely and customize the software to fit your specific business model.

Standout features & integrations:

Features include invoicing that makes it easy for you to create detailed customer invoices. The general ledger feature allows you and your team to track every financial transaction effectively. You can also manage sales tax and VAT calculations, helping ensure compliance with tax regulations.

Integrations include QuickBooks, Xero, FreshBooks, Zoho Books, Sage, Tally, MYOB, Wave, Kashoo, and NetSuite.

What's Free? TurboCASH offers a free-forever plan with no limitations on the number of users or features, encouraging community collaboration and open-source development.

Pros and cons

Pros:

- Powerful customer tracking and reporting tools

- Multi-language support

- Truly free if you use version 4

Cons:

- Limited support

- Steep learning curve

ZipBooks is a cloud-based tool designed to simplify financial management for a wide range of users. It's tailored especially for small businesses and freelancers, providing solutions that cover time tracking, expense management, and accounts receivable automation.

Why I picked ZipBooks: ZipBooks offers a unique combination of features that cater to small-scale financial needs without additional costs. You can track time, manage expenses, and automate accounts receivable, all while enjoying seamless bank reconciliation and multi-currency support. Additionally, ZipBooks provides dedicated customer support and allows unlimited users, which is often not seen in other free accounting solutions.

Standout features & integrations:

Features include simple invoicing tools that let you customize and send invoices quickly. You can track expenses effortlessly, giving you a clear view of your spending. It also provides smart insights to help you and your team make better financial decisions.

Integrations include PayPal, Square, Stripe, Gusto, Plaid, Slack, QuickBooks, Google Drive, Trello, and Asana.

What's Free? ZipBooks offers a free-forever plan with essential features for small businesses and freelancers. This plan includes unlimited invoicing, time tracking, and basic reporting, with no user limitations.

Pros and cons

Pros:

- Unlimited invoices with free service

- Easily accept payments

- Free service with no limit on business size

Cons:

- Most useful features require a paid subscription

- Limited support

GnuCash won’t disappoint when it comes to features–everything from the most basic to the most advanced ones are completely free. But, fair warning: be ready for a bit of a learning curve.

Why I picked GnuCash: GnuCash is open source and includes features such as double-entry accounting and a checkbook-style register for transaction management for no cost. It offers advanced capabilities such as stock tracking and multi-currency handling, aligning with its focus on detailed financial management. The software also supports importing data from other financial applications, enhancing its flexibility and usability for various financial tasks.

Standout features & integrations:

Features include the ability to handle double-entry accounting, ensuring your transactions balance correctly by impacting two accounts. You can also manage your transactions with a checkbook-style register, which provides a straightforward interface for entering and viewing financial activities.

Integrations include the ability to import financial data from QIF and OFX files, support for the German HBCI protocol for banking transactions, and it works on Windows, MacOS, and Linux platforms.

What's Free? GnuCash is a free accounting software available for personal and business use, with no trial limitations. It supports an unlimited number of users and offers extensive documentation and community support.

Pros and cons

Pros:

- Great reporting capability

- Extensive user guides and how-to documentation

- Open-source software that offers all features for free

Cons:

- No professional support

- Steep learning curve

Brightbook is an online accounting tool, tailored for users who need straightforward bookkeeping assistance. It caters to those managing finances without extensive accounting knowledge. This product provides real-time financial tracking, unlimited invoicing, and tools for logging bills and payments.

Why I picked Brightbook: Brightbook lets you manage your accounts without any hidden costs. You can create unlimited invoices and track payments, providing an advanced view of your financial activities. The ability to access the platform from any internet-connected device ensures you can manage your finances on the go, maintaining control over your cash flow effortlessly.

Standout features & integrations:

Features include on-the-go invoicing and payments, which allow you to create and send invoices from anywhere using the mobile app. The software's bank reconciliation is simplified by automatically updating transactions when you connect your bank accounts.

Integrations include PayPal, Google Drive, Dropbox, Microsoft Excel, Xero, QuickBooks, Slack, Shopify, Stripe, and Payoneer.

What's Free? Brightbook offers a free-forever plan with no hidden fees. There are no limitations on the number of users, but some advanced features might require a small fee.

Pros and cons

Pros:

- Unlimited invoices

- No user cap

- Quick sign up

- Incredibly simple interface

Cons:

- No integrations

- Limited support

Other Free Accounting Software

Here are some additional free accounting software options that didn’t make it onto my shortlist, but are still worth checking out:

- WAVE

For automations

- Money Manager EX

For simple projects

- Express Accounts

For financial reporting

- Akaunting

For payroll

- Google Sheets

Free spreadsheet software for financial analysis and forecasting

- Odoo ERP

Free business management software

- Fiverr Workspace

Free accounting tool for freelancers

Related Reviews

- Online Accounting Software Providers

- Small Business Accounting Software

- Nonprofit Accounting Software

- Best Overall Accounting Software

- Financial Reporting Software

- Accounts Payable Software

- ERP Software

Free Accounting Software Selection Criteria

I chose the best free accounting software by focusing on what matters most: no surprise paywalls, no rigid customization limits. Each tool was evaluated using a clear, objective framework to ensure transparency and usability.

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage financial transactions

- Generate invoices

- Track expenses

- Produce financial reports

- Handle payroll processing

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Multi-currency support

- Integration with ecommerce platforms

- Mobile app availability

- Automated tax calculations

- Customizable invoice templates

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Ease of navigation

- Intuitive interface

- Learning curve for new users

- Customization of dashboards

- Availability of user guides

- Ease of integration

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Presence of interactive product tours

- Access to templates for setup

- Support from chatbots for quick questions

- Offering of webinars for in-depth learning

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- Availability of live chat support

- Response time to queries

- Availability of a knowledge base

- Access to email support

- Community forums for peer assistance

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Comparison of features with paid versions

- Transparency in pricing

- Cost-effectiveness for small businesses

- Flexibility in upgrading plans

- Inclusion of essential features in the free version

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Critical feedback on limitations

- Overall satisfaction ratings

- Frequency of updates and improvements

- User feedback on reliability

- Praise for customer support

How to Choose Free Accounting Software

Endless features and confusing pricing tiers can make choosing free accounting software overwhelming. To make the process easier, here’s a simple checklist to help you find the right solution with confidence:

| Factor | What to Consider |

|---|---|

| Scalability | Ensure the software can grow with your business. Look for solutions that support expanding user numbers and transaction volumes. |

| Integrations | Check if it connects with your existing tools like CRM or ERPs to streamline workflows and prevent data silos. |

| Customizability | Determine if you can tailor the software to meet your specific needs, such as custom reports or invoicing templates, to better fit your business processes. |

| Ease of Use | Consider the learning curve for your team. User-friendly interfaces and comprehensive support materials reduce training time and increase productivity. |

| Budget | While it's free, assess any potential hidden costs such as paid add-ons, transaction fees, or premium support options that might impact your budget. |

| Security Safeguards | Make sure the software offers strong security features like data encryption and regular backups to protect your financial information. |

Trends in Free Accounting Software

During my search into free accounting software, I reviewed product updates, press releases, and release logs from top vendors. Here’s what stood out:

- AI-Driven Insights: AI capabilities are being used to offer predictive insights and financial forecasting, helping users make informed decisions. Wave, for example, uses AI to generate reports that assist businesses in understanding their cash flow patterns.

- Blockchain for Transparency: Some vendors are exploring blockchain technology to enhance transaction transparency and security. This technology is particularly useful for users who need verifiable audit trails without third-party involvement.

- Customizable Dashboards: Users now have the option to customize their dashboards to display only the most relevant information, tailoring the interface to individual or business needs.

- Focus on Data Privacy: With rising concerns over data security, free accounting software is prioritizing user data privacy by implementing stronger encryption and privacy settings.

- Enhanced Collaboration Tools: Collaborative features are being integrated, enabling multiple users to work on financial documents simultaneously. This is ideal for small teams needing to manage finances together.

What is Free Accounting Software?

Free accounting software is a digital tool designed to help small businesses manage financial tasks like bookkeeping, invoicing, and expense tracking at no cost.

It is primarily used by startups and small enterprises aiming to streamline financial management without added expenses. By eliminating fees, it helps businesses maintain accurate financial records, easily generate reports, and manage cash flow effectively while minimizing manual work and potential errors.

Features of Free Accounting Software

Choosing free accounting software? Here’s what to look for in a reliable, no-cost solution:

- Basic Invoicing: Allows users to create and send invoices, making it easier to manage billing and track payments.

- Expense Tracking: Enables the monitoring and categorization of expenses, providing insights into spending patterns and helping with budgeting. This is especially helpful when it comes to purchase orders.

- Financial Reporting: Offers essential reports such as profit and loss statements, balance sheets, ledgers, and cash flow statements, aiding in financial analysis and decision-making.

- Bank Reconciliation: Facilitates the matching of bank transactions with accounting records, ensuring accuracy in financial data and reducing errors.

- Multi-Currency Support: Supports transactions in various currencies, which is crucial for businesses dealing with international clients or suppliers.

- Mobile Access: Provides the ability to access accounting data on mobile devices, offering flexibility and enabling work on-the-go.

- User Access Controls: Allows the assignment of different user roles and permissions, ensuring data security and proper access management.

- Integration Capabilities: Supports integration with other software systems, enhancing the software’s functionality and streamlining workflows.

- Automated Backups: Ensures data safety by regularly backing up accounting information, protecting against data loss.

- Customer Support: Offers support options, such as tutorials or help centers, to assist users in navigating the software and resolving issues.

Benefits of Free Accounting Software

Using free accounting software in your business can unlock real advantages for you and your team. Here’s what you can expect:

- Cost Savings: Free accounting software eliminates the need for expensive subscriptions, allowing you to allocate funds to other business needs.

- Expense Tracking: You can easily keep tabs on business expenses, helping to manage cash flow with built-in tracking features.

- Invoicing: The software often includes invoicing capabilities, making it simple to bill clients and manage incoming payments.

- Financial Reporting: Generate financial reports quickly, giving you insights into your business's performance without additional cost.

- Tax Preparation: With features for organizing tax-related documents, you can streamline your tax filing process and reduce stress during tax season.

- Data Organization: The software helps organize your financial data, making it easier to find and interpret when needed.

- Accessibility: Many free accounting tools offer cloud-based access, so you can manage finances from anywhere with an internet connection.

- Streamline Workflows: Free accounting software can also help streamline company workflows, freeing up time to focus on more important tasks.

Costs and Pricing of Free Accounting Software

Choosing free accounting software isn’t just about avoiding costs: it’s about knowing exactly what you’re getting. Some tools restrict features, users, or support.

I created this table to highlight the key plan details, possible costs, and what you can realistically expect from free accounting software:

Plan Comparison Table for Free Accounting Software

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic invoicing, expense tracking, and limited reporting. |

| Personal Plan | $5-$25/user/month | Basic invoicing, expense tracking, time tracking, and basic reporting. |

| Business Plan | $25-$50/user/month | Invoicing, expense tracking, time tracking, project management, and advanced reporting. |

| Enterprise Plan | Custom Pricing | All business features, multi-currency support, advanced analytics, and dedicated support. |

Free Accounting Software FAQs

Below are answers to some of the most common questions about free accounting software.

Why would any software company give their product away for free?

Free accounting programs don’t operate as charities out of the goodness of their creators’ hearts. They make money in a few different ways.

One popular way for them to earn money is by charging for payment acceptance. Often, accounting programs that offer invoicing tools will charge a percentage fee when you receive a payment. Additional fees for other services are also common.

Many companies also treat their free accounting service as a trial of sorts, expecting companies to upgrade to one of their premium tiers of service after a short period or as their business grows.

What are the must-haves for accounting software?

All accounting software needs to have some basic tools and features to be suitable for a business.

For example, your program needs to be able to produce a general ledger and chart of accounts for your company. Without those, you can’t use the tool to keep track of your company’s money.

Invoicing tools and accounts payable tracking are also key because without those, you’ll struggle to get paid and to pay your bills on time.

Ideally, the software should be able to generate custom financial reports and offer an easy-to-use dashboard that gives you a quick sense of your company’s financial performance.

What other services should I look for?

Accounting software is designed to help companies manage their finances and keep their books accurate. Many businesses that make accounting software also offer other tools to help with other financial, administrative, and managerial aspects of your company.

For example, it’s relatively common for a company offering accounting software to also offer payment acceptance tools or payroll software. Some offer software that can help you manage your HR or IT processes, too.

Having multiple tools or services from the same provider can help your business save money and reduce the headaches that can come from contracting with multiple businesses for services.

Is free accounting software secure?

When it comes to your personal or business data, it’s understandable that you’d worry about security. The last thing that you want is a nefarious actor or scammer to steal your company’s sensitive financial information.

The good news is that accounting software is generally designed with security in mind. The companies selling it know the importance of protecting your data.

Before you choose an accounting program, do your due diligence. Make sure that the accounting software provider is a reputable company and ask about the security measures it uses.

Also make sure to follow computer security best practices, such as using a complex, unique password for your accounts.

How much does accounting software cost?

Even if you start with a free accounting tool, there may come a time when your company needs to start paying for more fully-featured software. Having an idea of what accounting programs cost can help you plan for when you make that jump.

How much software costs depends on many factors, including the size of your business, how many people need access to the software, and what vendor you get the program from.

On the low end, you can find premium software for $5 to $10 per month. Highly advanced accounting programs for large businesses might cost hundreds of dollars per month.

How do I go about finding the right free accounting software for me?

When you’re looking for free accounting software for your business, you should be looking for a few things.

Start by making a list of your wants and needs for an accounting tool. Almost every program can handle basic tasks like making a chart of accounts or letting you build financial reports. However, each tool offers different additional features.

Figure out what you absolutely must have and what would be nice to have. Look for tools that meet all your needs and try to find the ones that also satisfy a lot of wants.

Obviously, you’ll also be looking at whether the service is free. However, don’t be scared off if the company has a free service with premium upgrades. You might find a time in your company’s growth that you’re ready to level up your bookkeeping software.

Having the option to stick with the same tool and unlock new features means you can avoid the hassle of transitioning to a new tool and learning how to use it.

If you already use business software, such as invoicing tools or payment acceptance tools, keep that in mind while you’re comparing different programs. Try to find one that integrates with the tools you already use.

What's Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.