There are a lot of software options to forecast cash flow but, for many, figuring out how to do it manually is the preferred method to start with. For that reason, I wanted to create a comprehensive guide to help you create accurate cash flow projections for your business.

What Are Cash Flow Projections?

Cash flow projections help financial practitioners and business operators estimate the amount of cash that will flow in and out of a business over a specified period. The goal is to properly anticipate the potential cash balance, shortages, or surpluses, so that you can maintain a healthy, positive cash flow while growing the business.

These projections are typically looking at monthly, quarterly, or annual periods to help identify when:

- Additional funding is needed

- Cash outflows exceed inflows

- Excess cash is available

Depending on the complexity of your customer relationships and payment terms, you'll either build your forecasted cash flow model in a spreadsheet or opt for a software-based approach.

Why Are Cash Flow Projections Important for Your Business?

Starting and running a few of my own businesses over the past ten years, with limited budgets, has come with its share of challenges. Fortunately, my experience with cash flow projection and cash flow management in other businesses has served me well—likely making all the difference between failure and success in my own ventures.

I’ve learned that cash flow projection is vital for business planning, identifying cash shortfalls, managing working capital, securing financing, and optimizing business performance.

1. Planning for the Future

Financial planning includes finding ways to improve cash flow, which involves cash flow projections that allow you to anticipate your financial needs.

By understanding when cash inflows and outflows are expected, you can make informed decisions about investments, expansions, or cost-cutting measures.

2. Proactive Risk Management

By projecting your cash flow, you can identify periods where your cash inflows may not be sufficient to cover your outflows. This allows you to take proactive steps to bridge the gap, such as securing financing or adjusting your expenses.

3. Managing Working Capital

Cash flow projections help you manage your working capital effectively. You can determine the optimal inventory level, negotiate favorable payment terms and pricing with suppliers, and ensure you have enough cash available in bank accounts or other sources to meet your day-to-day operational needs.

4. Securing Financing

If you're seeking financing from investors or banks, they’ll want to see that you have a clear understanding of your cash flow and that you can generate enough cash to repay any debts or generate returns on your investment.

5. Monitoring Business Performance

When it comes to monitoring your business's financial performance, creating cash flow projections acts as a benchmark. By comparing your actual cash flow against your projected cash flow, you can identify any discrepancies and take corrective action if needed.

What You Need for Accurate Projections

Gathering all the necessary information is important before you can create cash flow projections. This includes both historical financial data and future estimates.

Here are the key pieces of information you'll need:

1. Historical Financial Data

Start by collecting your past financial statements, such as income statements, balance sheets, and cash flow statements. These will provide insights into your past revenue, expenses, the different cash flow types, and cash flow patterns.

2. Sales and Revenue Estimates

Forecasting your future sales and revenue is necessary for creating accurate cash flow projections. Remember, past performance isn’t always an indicator of what the future will look like, so consider factors such as market trends, customer behavior, seasonal variations, and any upcoming business activities or events that may impact your sales. This also holds true for expenditures.

3. Expense Estimates

As with revenue, estimating and billing your expenses is essential. Categorize your expenses into fixed costs (e.g., rent, salaries) and variable expenses(e.g., raw materials, daily, weekly, monthly, or periodic operational expenses). Be as detailed as possible to ensure accuracy.

4. Accounts Receivable and Accounts Payable

Take into account any outstanding invoices that are yet to be paid by your customers (aka accounts receivable) or any pending bills or invoices that you need to pay (aka accounts payable).

5. Cash Reserves and Credit Lines

Consider your available cash reserves, existing lines of credit, room on credit cards, or loans you can tap into if needed. These will act as a safety net and help you navigate unexpected financial challenges.

Once you have gathered this information, you're ready to start creating your cash flow projections.

Who’s Involved in Creating Projections?

Creating cash flow projections isn’t a solitary task. Key stakeholders should be involved to ensure accuracy and gain different perspectives. Here are some individuals who should be involved in the process.

1. Business Owners

If you’re the CFO, you have a deep understanding of the business's financials… but you still need the owner to get involved. Small business owners know what they expect in terms of performance and goals and must be kept in the loop.

Your combined input is crucial in estimating future sales, expenses, and cash flows, due to any upcoming business changes or material developments.

2. Financial Advisors

If you work closely with any external financial advisors, you should bring them in here. They see numerous businesses just like yours, so their expertise can be invaluable in creating accurate cash flow projections.

They can provide guidance on estimating revenue and expenses as they relate to banking policy, rate changes, and other financing factors to ensure that your projections align with accounting principles.

3. Sales and Marketing Leaders

Your sales and marketing teams are on the front lines, interacting with customers and driving revenue. If you don’t have a massive backlog of data to review, consider involving them in this process.

They can provide valuable insights into market trends, customer behavior, and upcoming promotions or campaigns that may impact sales.

4. Operations and Production Leaders

Similarly, if information is still a bit fractured in your business, you’ll want to bring this team in.

Operation and production leaders have an in-depth understanding of upcoming changes or projects that may require additional funding. Including them in the process ensures that all expenses are accounted for, and the projections are realistic.

How To Create Cash Flow Projections

I’ve used this step-by-step guide many times and found it simplified the cash flow projection process.

Step 1: Choose Your Preferred Tool

Assuming you’re still wanting to avoid using accounting software—even the stuff built for small businesses, you can create cash flow projections using an Excel spreadsheet, Google sheets, or a similar web application.

The choice of tool depends on your comfort level and the complexity of your financials.

Step 2: Set the Time Period

Decide on the appropriate time period for your cash flow projections. Depending on your business activities or model, you could choose to divide it into weekly, monthly, quarterly, or periodic periods.

Weekly and monthly projections are the most common for small businesses.

Step 3: Estimate Revenue

Start by estimating your revenue for each period. Consider historical sales data, market trends, customer behavior, and any upcoming events or promotions.

Be realistic but err on the conservative side in your estimates, and factor in potential fluctuations.

Step 4: Categorize Expenses

- Categorize your expenses into fixed costs (e.g., rent, salaries) and variable costs (e.g., raw materials, advertising, and marketing expenses).

- Assign each expense category a specific amount for each period.

- Consult the relevant stakeholders for each category to ensure you’re capturing realistic costs.

Step 5: Factor in Timing

Being realistic with your timing is one of the most important things to consider in this forecasting process.

Take into account the timing of your revenue and expenses. Some revenue may be received immediately, while others may have longer payment terms. Similarly, expenses may be due upfront or spread out over time.

In my experience, many small businesses are overly optimistic about when revenues will come in and choose to pay bills too late, impacting supplier and vendor relationships and favorable payment terms.

Step 6: Consider Seasonality

If your business experiences seasonal fluctuations, adjust your cash flow projections accordingly. Identify high and low activity periods and ensure your projections account for these variations.

Seasonality is another often overlooked factor that creates unrealistic cash flow projections and leads to cash crunches.

Step 7: Account for Accounts Receivable and Payable

Factor in any outstanding invoices that are yet to be paid by your customers (accounts receivable) and any pending bills or invoices that you need to pay (accounts payable).

Step 8: Include Cash Reserves and Credit Lines

Take into account your current cash reserves and any existing lines of credit that you can tap into if needed. These will act as a safety net, ensuring that you have a buffer in case things hit the fan.

Step 9: Model Other Scenarios

While it's impossible to predict everything (I’m looking at you, pandemic), it's important to consider potential circumstances that may impact your cash flow. This could include changes in market conditions, regulatory changes, or unexpected expenses.

Build a buffer and assumptions into your projections that account for uncertainties.

Step 10: Review and Refine

It’s important to analyze your cash flow statement, create your cash flow projections, and review each of them carefully—on your own and with others. Look for any inconsistencies, errors, or unrealistic assumptions and, most importantly, make adjustments as needed when you find them.

Remember, cash flow projections are not set in stone. They should be regularly reviewed and updated as your business and financial situation evolves. By monitoring your actual cash flow against your projections, you can make adjustments and fine-tune your forecasts for greater accuracy.

When to Create Cash Flow Projections

Cash flow projections should be created at regular intervals to minimize the chances of being caught off guard by your financials; however, I know that there are a million things you should be doing regularly.

Here’s when you absolutely need to create these projections.

At the Start of a New Business

If you're starting a new business, you have nothing to fall back on in case things don’t pan out the way you expect. Cash flow projections help solidify the most realistic scenario for you, and identify potential challenges early on.

If You’re Seeking Financing

Whether you're applying for a loan or seeking investors, cash flow projections are a crucial component of your pitch. Lenders and investors want to see that you have a clear understanding of your cash flow and can generate enough cash to pay them back on time.

If You’re Expanding

If there are plans to expand the business, cash flow projections can help you determine its financial viability.

They allow you to assess the impact of expansion on your cash flow and, if needed, identify additional financing needs in the short and long term.

Before Making Major Financial Decisions

If you’re about to propose, it’s a good idea to be sure you’re ready first. Why should business be any different?

Whenever major financial decisions are being considered, such as purchasing assets, entering into contracts, or launching new products or services, assessing the impact on cash flow is important to help you make informed decisions.

Cash Flow Projection Example

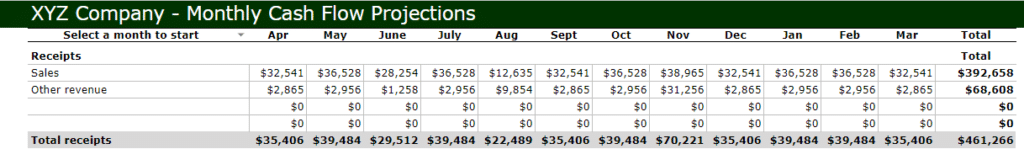

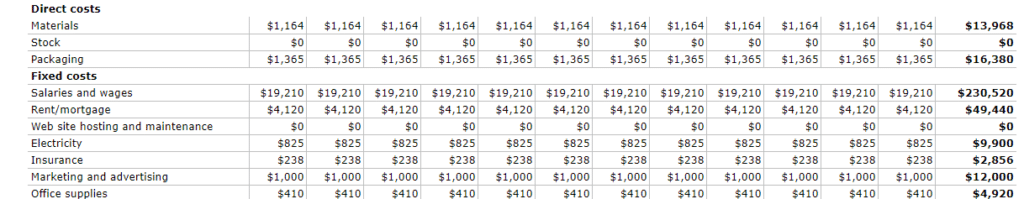

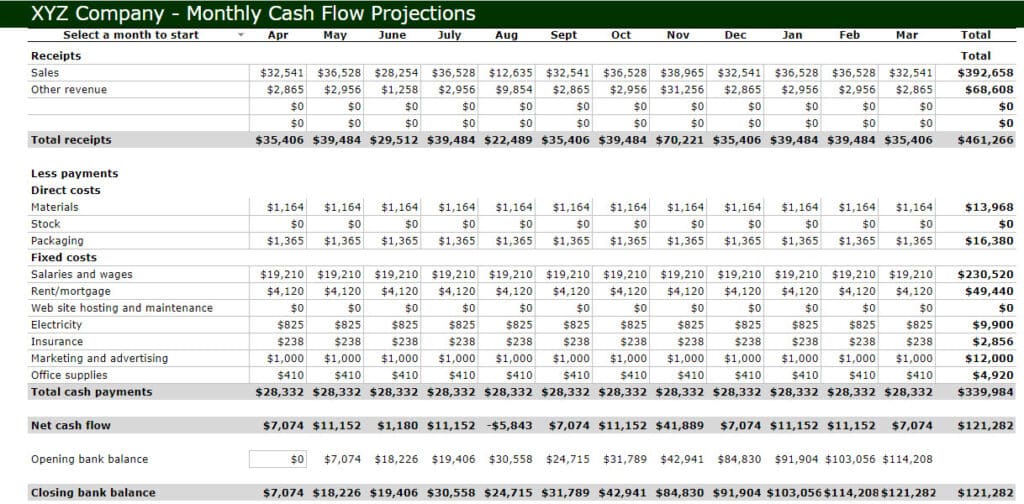

To help you visualize how cash flow projections are created, here’s an example of a basic monthly cash flow projection for a small business:

3 Biggest Mistakes To Avoid

You should avoid some common mistakes throughout the cash flow projection process.

Overestimating Revenue

We’re all tempted to be overly optimistic when estimating revenue. However, it's important to be realistic and base your projections on historical data, business and market trends, and reliable information, as you aren’t doing yourself any favors with the optimism here.

Factor in customers who are late payers and, at the very least, build in the assumption that a percentage of revenue may not materialize on time (or at all). This ensures you have a bit of a buffer, just in case cash inflows are not as you’d hoped.

Underestimating Expenses

Similarly, underestimating expenses can lead to cash flow shortages. Be thorough when categorizing your expenses and consider all potential costs, including hidden or one-time expenses.

Just as you’ve built in a buffer on revenues, build in an assumption that you’ll see some unexpected one-off costs or price increases, to save yourself unwanted surprises.

Ignoring Seasonality

If your business experiences seasonal fluctuations, failing to account for this can become a bigger problem than you might imagine. This is where it makes sense to get feedback from other stakeholders, who might have insight into costs you haven’t yet considered. Oftentimes, they have industry-specific knowledge about season or period costs and revenue cycles.

Subscribe for More Cash Flow Insights

Having the knowledge and tools necessary to create realistic cash flow projections without relying on expensive software helps you demonstrate to stakeholders that you have what it takes to make this thing work.

Ready to compound your abilities as a finance leader? Subscribe to our newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.