Best Accounting Software Shortlist

Here’s my shortlist of the best accounting software for small to mid-sized businesses:

Our one-on-one guidance will help you find the perfect fit.

Accounting software is a digital tool that helps businesses manage and automate financial processes like invoicing, payroll, tax filing, and reporting.

For small and mid-sized companies, startups, and nonprofits, the right solution can save hours each week, lower operating costs, and improve financial visibility. But finding a platform that truly delivers, without unnecessary complexity or hidden costs, can be a challenge in today’s crowded marketplace.

As a digital software expert with 6+ years in small business fintech, I’ve helped CFOs and finance teams evaluate and implement solutions that actually meet their needs. I’ve seen how the wrong software creates more problems than it solves, and how the right one can transform how a business operates, scales, and reports.

That’s why I personally tested and compared the leading tools. After hours of in-depth research, I found the best accounting software solutions designed to streamline operations, support long-term growth, and help you keep your finances on solid ground.

Why Trust Our Software Reviews

We've been testing and reviewing accounting software since 2023, on a mission to make it easier to manage business finances. As financial operators ourselves, we know how critical (and difficult) it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our accounting software review methodology.

Best Accounting Software Summary

I put together this quick pricing chart of my top accounting software picks. Compare what each one costs to find a good fit for your business, whether you’re just starting out or growing fast.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for automated expense management | 30-day free trial + free plan available | From $15/user/month | Website | |

| 2 | Best for service-based businesses | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 3 | Best for cash flow insights | 14-day free trial | From $25/month | Website | |

| 4 | Best for small businesses | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 5 | Best for fast-growing businesses | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 6 | Best for comprehensive invoicing and billing | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 7 | Best for mid-sized businesses | Free demo available | Pricing upon request | Website | |

| 8 | Best for multi-entity financial management | Free demo | Pricing upon request | Website | |

| 9 | Best for nonprofits | 30-day free trial + free plan available | From $15/month (billed annually) | Website | |

| 10 | Best for real-time financial insights | Free trial available | Pricing upon request | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Accounting Software Reviews

If you’re searching for the best accounting software, I’ve broken down each one by features, pros and cons, and use cases. This quick guide makes it easy to compare tools at a glance.

Ramp is a finance automation platform that offers corporate cards, expense management, bill payments, and accounting automation to help businesses manage their finances more efficiently.

Why I picked Ramp: Ramp's accounting automation features are designed to save your team time and reduce errors. By collecting, coding, and categorizing receipts automatically, Ramp ensures that each transaction is accurately documented, helping you close your books faster. Additionally, Ramp's AI-driven system provides intelligent transaction suggestions based on historical data, simplifying the categorization process and enhancing accuracy.

Standout features & integrations:

Features include automated approval workflows that allow you to set up custom rules for expense approvals, ensuring compliance with company policies without manual intervention. Real-time spend tracking provides immediate visibility into expenses, enabling proactive financial management. Customizable reporting tools let you generate detailed financial reports tailored to your business needs, offering deeper insights into spending patterns.

Integrations include NetSuite, Sage, Xero, QuickBooks, Microsoft Dynamics Business Central, Acumatica, Uber, Lyft, Okta, Google, Rippling, and Gmail.

Pros and cons

Pros:

- Comprehensive reporting features

- Ability to issue multiple virtual cards with customizable controls

- Automated expense reporting and receipt matching

Cons:

- Mostly focuses on accounts payable and spend management

- Could offer more advanced accounting features

New Product Updates from Ramp

Vendor Approval Workflows in Ramp

Ramp's new vendor approval workflows allow teams or managers to review new vendors, ensuring compliance with procurement policies and preventing unauthorized entries. For more details, visit Ramp Announcements.

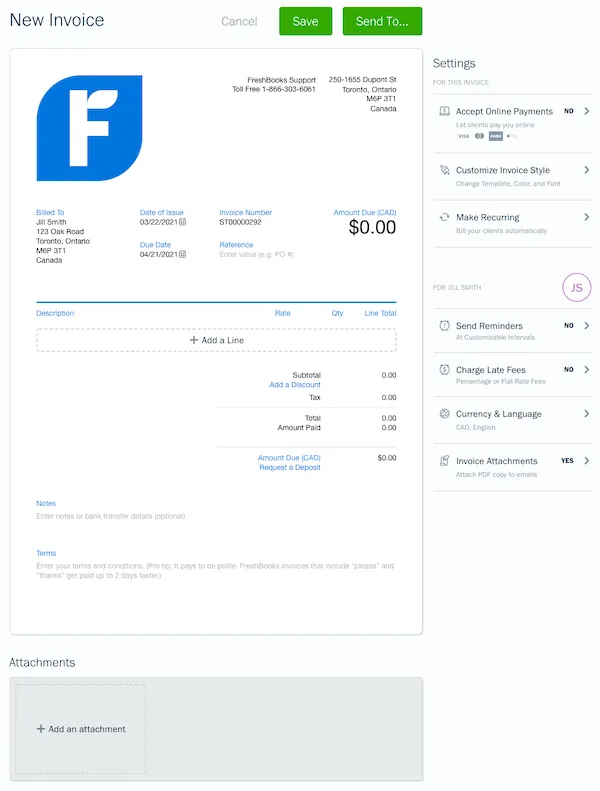

FreshBooks is a cloud-based accounting software platform for freelancers and small service-based businesses. It supports several features service businesses need (proposals, estimates, time tracking) and sells some functions as add-ons.

Why I picked FreshBooks: FreshBooks is a top choice for small service businesses, like freelancers or digital marketing agencies, thanks to its billing and invoicing emphasis. Not to mention its affordability and other features like client management and time tracking. Additionally, FreshBooks’s bookkeeping side is easy enough to learn on your own—perfect for small service businesses that may not have an accountant.

Standout features & integrations:

Features include invoicing that lets you customize and track your billing, expense tracking to keep all your receipts and spending in one place, and time tracking to help you bill clients accurately. You can also use project management tools to collaborate with your team or clients directly within the platform. Plus, its reporting options give you a clear view of your finances with easy-to-read summaries and details.

Integrations include Shopify, Stripe, Gusto, HubSpot, Square, Trello, Zoom, Asana, Google Drive, and PayPal.

Pros and cons

Pros:

- Several features for managing projects and clients

- Easy to learn

- High degree of invoice customization

Cons:

- No inventory management

- Limited mobile app

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

Puzzle.io is an accounting software designed specifically for startups and small businesses. It offers a suite of features that simplify bookkeeping and enhance financial decision-making.

Why I picked Puzzle.io: I picked Puzzle.io because it provides automated bookkeeping with high accuracy, saving you time and reducing errors in your financial records. The platform also gives you real-time cash flow insights, allowing for informed decisions based on up-to-date financial data. Additionally, Puzzle.io supports both cash and accrual accounting methods, making it versatile for different business needs.

Standout features & integrations:

Features include customizable automation, which lets you tailor the software to fit your specific accounting policies. The continuous accuracy checks through AI ensure that your financial statements are always reliable, giving you peace of mind. Plus, with features like variance analysis, you can quickly identify any unexpected expenses that might impact your budget.

Integrations include Stripe, Brex, Ramp, Rippling, and Gusto.

Pros and cons

Pros:

- Real-time dashboards provide immediate financial insights

- AI-powered transaction categorization

- Automated bank reconciliations ensure accuracy

Cons:

- Free trial requires users to connect a bank account

- May not be suitable for larger organizations

New Product Updates from Puzzle.io

Puzzle.io's Automated PDF Statement Loading

Puzzle.io has introduced automated PDF statement loading for Meow, streamlining the reconciliation process by eliminating manual downloads and uploads. For more details, visit Puzzle.io Product Updates.

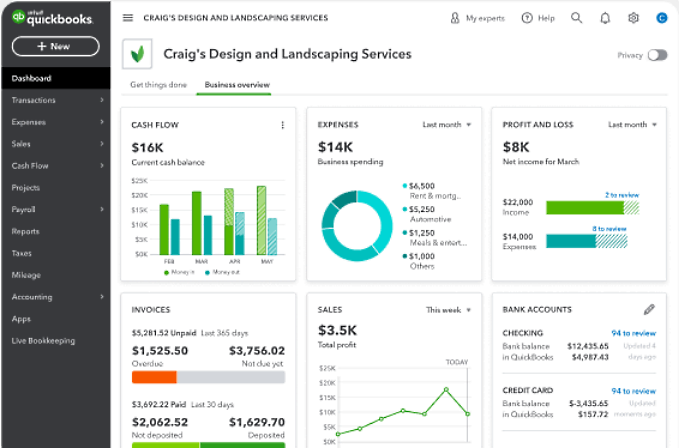

QuickBooks is an accounting software platform for smaller businesses across nearly every industry. This platform supports most core bookkeeping and accounting functions, while users can purchase other functions, such as payroll, as add-ons.

Why I Picked QuickBooks: QuickBooks continues to be the most widely used accounting software among small business owners. It’s easy to set up and use—you can probably do it without professional implementation, although they can help you if you need it. Plus, QuickBooks has several plans. You can start small and upgrade to higher plans as your budget and needs grow, or even hire a remote bookkeeper through the software if needed.

Standout features & integrations:

Features include the ability to manage your finances with tools that let you track income and expenses, automate tasks like invoicing and payments, and generate insightful financial reports. You can also benefit from the user-friendly dashboard that offers a clear view of your business's financial health at a glance. Additionally, QuickBooks provides mobile access, so you can stay connected to your finances wherever you are.

Integrations include PayPal, Shopify, Square, TSheets, HubSpot, Expensify, Stripe, Mailchimp, Bill.com, and Salesforce.

Pros and cons

Pros:

- Automated bank reconciliation features

- Easy to learn and use

- Offers both cloud-based and desktop solutions

Cons:

- Pricier than industry peers

- Must upgrade to add users

Xero is a cloud-based accounting software designed for small businesses. It's popular for its user-friendly interface and scalability, catering to self-employed individuals and growing enterprises.

Why I picked Xero: Xero's small business accounting software scales seamlessly with increasing financial complexities, offering a cloud-based infrastructure that adapts to dynamic operational needs. Its intuitive interface and automation streamline financial management, enabling businesses to focus on growth without being bogged down by manual processes.

Standout features & integrations:

Features include online invoicing that helps you manage and automate invoicing tasks from any device. Your team can also access data from over 21,000 banks, facilitating easier bank reconciliation processes. Additionally, expense management is simplified, offering a way to handle claims and reimbursements efficiently.

Integrations include HubSpot, Shopify, Squarespace, Mailchimp, PayPal, Stripe, Gusto, Microsoft 365, Google Workspace, and Square.

Pros and cons

Pros:

- Real-time collaboration

- Unlimited users allowed

- Strong payment features

- Clean and simple UI

Cons:

- Limited customizations

- Multi-currency not available on all plans

Zoho Books is a strong accounting software designed to cater to small and medium-sized enterprises by providing a comprehensive suite of financial management tools. This cloud-based platform facilitates diverse functions such as invoicing, expense tracking, inventory management, and customizable financial reporting.

Why I picked Zoho Books: Zoho Books simplifies the entire invoicing and billing process, allowing you to manage everything from creation to payment in one place. It’s designed to handle various billing needs, making it easy to tailor invoices and manage recurring payments efficiently. This ensures you can focus on your business without worrying about tracking payments or following up manually.

Standout features & integrations:

Features include expense tracking to help you categorize and monitor your business spending. You can also automate recurring invoices and payment reminders to save time and keep cash flow steady. Plus, the client portal makes it easy for your customers to view and pay their invoices directly.

Integrations include Zoho CRM, Zoho Projects, Zoho Inventory, Stripe, PayPal, Square, Slack, G Suite, Office 365, and Shopify.

Pros and cons

Pros:

- Customizable invoices

- Facilitates transactions in various currencies

- Automates various accounting processes

Cons:

- Mobile version lacks features on the desktop version

- May not be ideal for larger enterprises

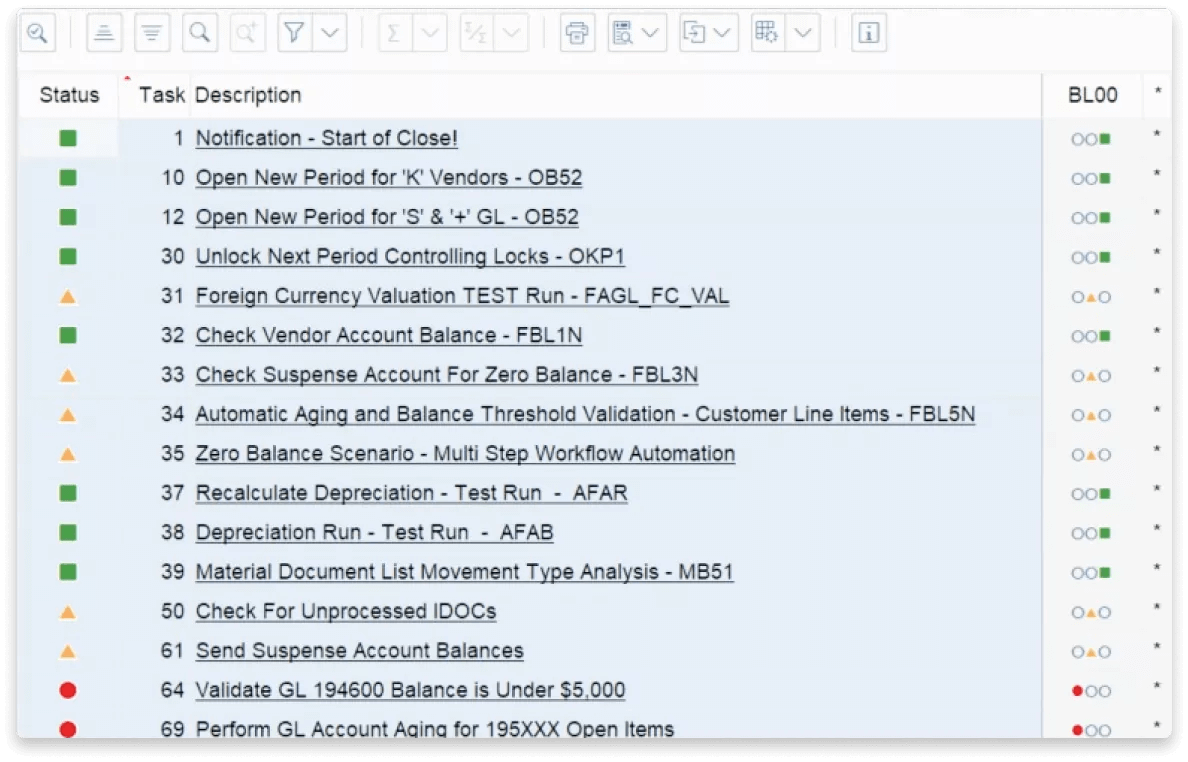

BlackLine is a cloud-based accounting and financial automation platform streamlining the entire financial close process. This platform can automate accounts receivable and financial closing and supports intercompany accounting management.

Why I picked BlackLine: BlackLine is not an advanced piece of accounting software—it aims to streamline and modernize the financial close, one of accounting’s largest tasks for mid-sized to larger businesses. As such, BlackLine can complement your general ledger accounting software and take a lot of weight off your accounting and finance teams. Overall, it's definitely a worthwhile feature for companies that are already using SAP because BlackLine’s SAP integration unlocks BlackLine’s prized Smart Close feature.

Standout features & integrations:

Features include account reconciliation to help you match transactions and keep your books accurate. You can also use task management to track your financial close processes and assign responsibilities to your team. Additionally, the journal entry automation saves you time by eliminating manual data entry and reducing errors.

Integrations include SAP, Workday, NetSuite, Sage, QuickBooks, Xero, Microsoft Dynamics, Coupa, and Adaptive Insights.

Pros and cons

Pros:

- Offers several intercompany accounting management features

- Automates most of the accounts receivable process

- Accelerates and improves the financial close process

Cons:

- Very little accounts payable automation

- Only handles accounting and finance tasks

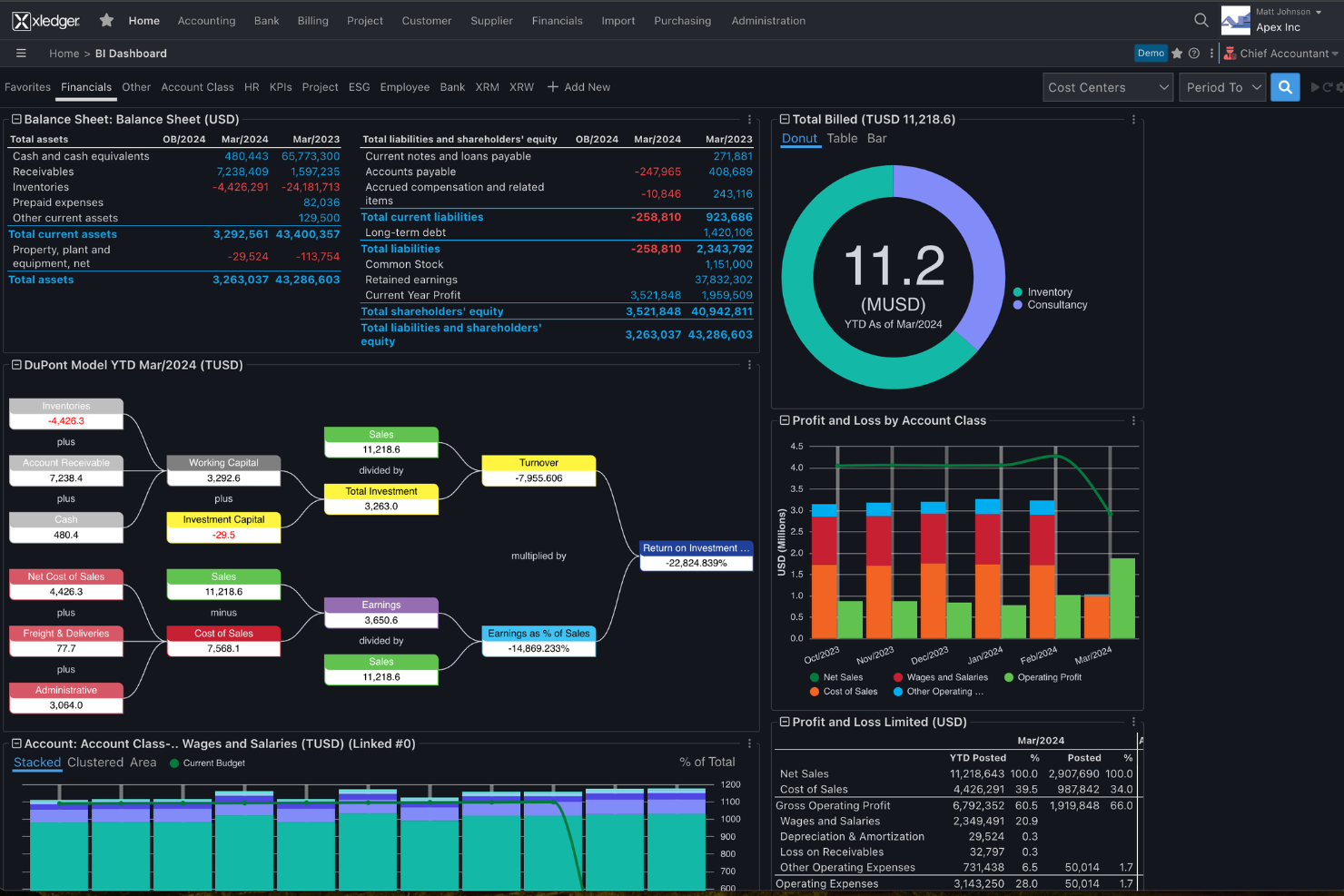

Xledger provides a strong cloud-based solution primarily designed for businesses looking to streamline their financial management processes. This platform is tailored for organizations that require powerful automation, real-time data access, and scalability to adapt to growing and changing business needs.

Why I picked Xledger: As accounting software, Xledger excels in delivering extensive automation for financial operations, reducing the need for manual entry and minimizing errors. It supports complex financial management requirements with features like multi-entity consolidation, real-time reporting, and advanced budgeting tools. The software is particularly noted for its strong compliance features and the ability to handle various currencies and tax regulations, making it suitable for global businesses.

Standout features & integrations:

Features include simplified recurring billing that automates repetitive invoicing tasks, saving you time and minimizing errors. You can choose flexible delivery options, sending invoices via email as PDFs or through traditional mail. For multi-entity corporations, Xledger automatically generates accounts payable entries for invoicing between entities, ensuring accuracy and efficiency.

Integrations include Salesforce, Microsoft Dynamics CRM, GoldFinch, JPMorgan Chase, Wells Fargo, Bank of America, and other major banks.

Pros and cons

Pros:

- High degree of automation for financial processes

- Comprehensive multi-entity and multi-currency support

- Real-time financial reporting and analytics

Cons:

- Potentially high cost for smaller businesses

- Slight learning curve for new users

ZipBooks offers a free version specifically for nonprofits with unlimited bookkeeping, invoicing, and donor management features.

Why I picked ZipBooks: ZipBooks provides tools tailored to managing donations and tracking expenses in a straightforward way. Its user-friendly design helps nonprofits stay organized while focusing on their mission rather than administrative tasks. This makes it easier to manage finances and demonstrate accountability to donors and stakeholders.

Standout features & integrations:

Features include smart categorization that helps you organize your expenses without much effort. You can track your time and link it directly to your projects for accurate billing. Plus, the built-in reporting tools let you quickly see how your business is doing and where you can improve.

Integrations include PayPal, Stripe, Square, Gusto, Slack, Google Drive, Google Sheets, QuickBooks, Zapier, and Shopify.

Pros and cons

Pros:

- Mobile app allows you to request and receive donations on the go

- Free plan available

- Customized for nonprofits

Cons:

- No phone support

- Limited features compared to those of paid plans from ZipBooks

Sage Intacct is a versatile project accounting tool beneficial for a wide range of industries and business sizes, particularly those with project-centric operations. It's highly useful for mid-sized to large enterprises in sectors such as construction, consulting, engineering, software development, hospitality, healthcare, and real estate development.

Why I picked Sage Intacct: Sage Intacct provides real-time financial insights through customizable reports and dashboards, which can be tailored to the specific needs of a business. This level of customization and real-time data availability aids in more informed decision-making and strategic planning. Additionally, Sage Intacct supports multi-entity and multi-currency management, making it ideal for businesses with complex financial structures and international operations.

Standout features & integrations:

Features include intelligent general ledgers to simplify your accounting processes by automating entries and providing real-time insights. Additionally, its advanced dashboards and reporting tools offer over 150 pre-built reports, allowing your team to customize and analyze data effectively.

Integrations include Salesforce, ADP, Bill.com, Avalara, Expensify, Stripe, Square, Shopify, Nexonia, and MineralTree.

Pros and cons

Pros:

- Extensive configurations and automation features

- Cloud deployment

- Shared chart of accounts

Cons:

- May not be ideal for smaller businesses

- Extensive features may come with a learning curve

Other Accounting Software

Here are a few more accounting software options that didn’t quite make my shortlist, but are still definitely worth a look!

- Patriot Accounting

For flexible accounting methods

- Kashoo

For automated bookkeeping

- WAVE

For freelancers

- DualEntry

For enterprise accounting

- InvoiceBerry

For beginning freelancers

- ZarMoney

For all-in-one services

- OneUp Accounting

For automatic processing

- Neat

For receipt and document management

- Aplos

For churches and non-profits

- TrulySmall

For simplistic accounting

How to Choose Accounting Software

I know how overwhelming it feels to choose small business accounting software with all the features and price points out there. To simplify things, here’s a quick checklist that’ll help you stay focused and find the right fit for your business.

| Factor | What to Consider |

|---|---|

| Scalability | Will the software grow with your business? Ensure it can handle an increase in data and users over time, especially if it's a small business accounting software. |

| Integrations | Does it integrate with tools your team already uses, like CRM or payroll systems, to streamline workflows? Does it connect with your chosen software (i.e. Mac or Windows)? |

| Customizability | Can you tailor the software to fit your specific accounting needs and reporting requirements? |

| Ease of Use | Is the interface intuitive for your team, reducing training time and user error? |

| Budget | Does the software fit within your financial constraints without hidden fees? |

| Security Safeguards | How does the software protect sensitive financial data and ensure compliance with regulations? |

| Customer Support | Is there reliable support available when you need help with issues or questions? |

| Reporting Features | Are the reporting tools robust enough to provide the insights your business requires? |

Costs and Pricing of Accounting Software

If you’re shopping for accounting software, I get it: costs can stack up fast. I’ve broken down key features, average pricing, and plan types so you can compare your options easily. Whether you're freelancing or scaling a team, this quick overview helps you find the right fit without overpaying.

Plan Comparison Table for Accounting Software

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic invoicing, expense tracking, and limited reports. |

| Personal Plan | $10-$25/user/month | Invoicing, expense tracking, basic reporting, and limited customer support. |

| Business Plan | $25-$75/user/month | Advanced reporting, multi-user access, project tracking, and integrations. |

| Enterprise Plan | $75-$150/user/month | Customizable dashboards, advanced analytics, dedicated support, and security features. |

Accounting Software Selection Criteria

I picked the top accounting software by focusing on what actually matters: simple setup, lower cost, smooth integrations, and features like invoicing or tax help. I also used a consistent review system to easily compare options:

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage invoices and billing

- Track expenses and income

- Generate financial reports

- Handle payroll processing

- Support tax preparation

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Mobile access for managing finances on the go

- Integration with third-party applications

- AI-driven financial insights

- Customizable dashboards and reports

- Multi-currency support for international businesses

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Ease of navigation between features

- Availability of templates for common tasks

- Responsiveness of customer support within the interface

- Customization options for different user roles

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos and tutorials

- Interactive product tours for new users

- Access to dedicated onboarding specialists

- Availability of migration tools for data import

- Comprehensive user guides and documentation

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- Availability of 24/7 support channels

- Response time for customer inquiries

- Access to a comprehensive knowledge base

- Availability of live chat support

- User feedback on support experiences

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Comparison of pricing plans with competitors

- Assessment of feature offerings at each pricing tier

- Availability of discounts for annual subscriptions

- Evaluation of free vs. paid plan limitations

- Overall satisfaction with pricing transparency

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- User feedback on software reliability

- Satisfaction with feature set and updates

- Comments on ease of use and learning curve

- Reports on customer support efficacy

- Overall value for money feedback

Trends in Accounting Software

During my search, I dug deep into the latest accounting software updates, including press releases, product changes, release notes. Here are some of the top trends I noticed that I think you should keep an eye on when comparing the best small business accounting software:

- AI-Powered Insights: Many accounting software solutions are now incorporating AI to provide predictive analytics and insights. This helps businesses forecast financial trends and make informed decisions.

- Blockchain for Security: As security becomes a priority, some vendors are exploring blockchain technology to safeguard financial data. This ensures that transactions are transparent and tamper-proof, which is particularly beneficial for businesses managing sensitive information (i.e. healthcare or legal firms dealing with trusts).

- Customizable Dashboards: Most vendors now offer features like customizable dashboards, which allow users to tailor their view to focus on valuable metrics. This could be extremely beneficial for freelancers, who need to organize projects and prioritize due dates.

- Subscription-Based Billing Management: With the rise of subscription models, many accounting tools are adding features to manage recurring billing and subscriptions. This is crucial for businesses that rely on subscription services for steady revenue.

- Real-Time Collaboration: Features enabling real-time collaboration are gaining traction. These allow multiple users to work on financial data simultaneously, improving teamwork and efficiency.

What is Accounting Software?

Accounting software is a digital tool that helps individuals and businesses manage financial transactions, track income and expenses, and generate financial reports.

This software streamlines processes like invoicing, payroll, tax filing, and budgeting, reducing the need for manual bookkeeping. It’s widely used by freelancers, small businesses, and accountants to improve accuracy, save time, and maintain compliance. Popular examples include QuickBooks, Xero, and FreshBooks, with each offering varying features to suit different business needs.

Features of Accounting Software

If you're comparing accounting software, make sure it includes essentials like invoicing, expense tracking, and tax filing. Here are some other key features you should look for to help you streamline processes and aid in business growth:

- General Ledger Management: Helps in maintaining a comprehensive record of all financial transactions, providing a clear financial overview of the business.

- Accounts Payable and Receivable: Allows businesses to efficiently manage incoming and outgoing payments, ensuring smooth cash flow.

- Financial Reporting: Aids in generating detailed financial reports which are essential for strategic planning and close and consolidation processes.

- Bank Reconciliation: Helps in matching the company's financial records with bank statements, ensuring accuracy in financial data.

- Budgeting and Forecasting: Provides tools for planning future financial needs and tracking financial performance against the budget.

- Tax Management: Assists in preparing and filing taxes, which helps in staying compliant with tax regulations.

- Inventory Management: Allows businesses to monitor and manage stock levels, ensuring they meet demand without overstocking.

- Payroll Processing: Automates the calculation and processing of employee wages, saving time and reducing errors for everyone from SMBs to enterprises.

- Expense Tracking: Helps in recording and categorizing business expenses, facilitating better expense management and control for all industries, from service-based to corporations.

- Invoicing and Billing: Streamlines the creation and management of invoices, aiding in timely billing and payment collection.

Benefits of Accounting Software

Bringing accounting software into your business comes with a ton of perks for both your team and your bottom line. Here are a few benefits you’ll love:

- Time Savings: Automates repetitive tasks like invoicing and payroll, freeing up time for other important business activities while streamlining workflows.

- Accuracy: Reduces human errors with automatic calculations and data entry, ensuring financial records are precise. This helps streamline finances, especially for larger businesses.

- Financial Insights: Generates real-time reports and analytics to help make informed business decisions. This is great for any business model, including agencies.

- Tax Compliance: Simplifies tax processes with integrated tax features that ensure compliance with regulations. This is ideal for all business sizes, but especially startups.

- Cash Flow Management: Tracks income and expenses in real-time to better manage your cash flow and financial health.

- Expense Tracking: Easily categorizes and tracks expenses, helping you to maintain a clear view of where money is going. This is most beneficial for businesses in trades, such as oil and gas industries.

- Scalability: Adapts to business growth with features that support increasing volumes of transactions and data. This can be especially beneficial for SMBs or those in media-related industries.

Accounting Software FAQs

Here are answers to a few FAQs about accounting software:

Do I need accounting software for my small business?

How to switch accounting software?

Can you add users as your business grows?

How secure is your financial data with accounting software?

Is there any free accounting software?

What integrations should I look for in accounting software for small or mid-sized businesses?

Can accounting software support multi-entity or multi-currency operations?

What's Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.