Best Forecasting Software Providers Shortlist

Here's my pick of the 10 best software from the 20 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Forecasting software refers to digital tools that help businesses predict future outcomes by analyzing historical data and identifying trends. From projecting sales and revenue to planning demand and managing inventory, these platforms support more strategic, data-driven decision-making across finance and operations.

I’ve spent the last few years writing about digital tools for finance teams, working closely with FP&A professionals who live and breathe forecasting. When your forecasts shape high-stakes decisions, you need tools that are accurate, agile, and built for real business needs. But with so many tools on the market, it’s tough to know which ones truly meet the needs of modern finance teams.

That’s why I drew on my experience in digital software to identify the top forecasting software available today. This list includes a mix: some designed specifically for forecasting, others part of broader CPM or ERP systems. After hours of testing and research, these are the tools that can help ease the stress of financial planning.

Why Trust Our Financial Software Reviews

We have been testing and reviewing forecasting software since 2023. As a collection of software analysts and experienced financial operators, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases—including over 150 forecasting software solutions—and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our forecasting software review methodology.

Best Forecasting Software Summary

Pressed for time? Skip the deep dive. Here’s a quick comparison of my top forecasting software picks. It includes pricing, standout features, and links.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for cash flow forecasting | Free demo available | Pricing upon request | Website | |

| 2 | Best for cross-departmental forecasting | Free demo available | Pricing upon request | Website | |

| 3 | Best for Excel-powered financial forecasting | Free demo + product tour available | Pricing upon request | Website | |

| 4 | Best for resource-based revenue forecasting | Freemium plan | $13/user/month | Website | |

| 5 | Best for real-time finance insights | 30-day free trial + free plan available | From $15/user/month | Website | |

| 6 | Best for agency profitability forecasts | 14-day free trial | From $9/month (billed annually) | Website | |

| 7 | Best for expense forecasting | Free demo available | From $8/user/month (billed annually) | Website | |

| 8 | Best for forecasting project profitability | Free trial available | From $9/user/month (billed annually) | Website | |

| 9 | Best for AI-driven financial forecasting | Free demo available | Pricing upon request | Website | |

| 10 | Best spreadsheet-native forecasting tool | 14-day free trial | Pricing upon request | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Forecasting Software Reviews

I rounded up the best forecasting software with financial analysts in mind. Each one is reviewed for what really matters: accuracy, efficiency, and making your reporting process smoother.

Payouts is a global payment automation platform designed to help businesses manage and distribute payments across over 150 countries.

Why I picked Payouts: I picked Payouts because it includes dedicated cash flow forecasting and optimization tools built to help you plan financial resources more accurately. These tools give your team real-time insights into payouts, upcoming liabilities, and available cash, so you can create better forecasts without guesswork. By automatically tracking and reporting on every transaction through its integrated banking dashboard, Payouts lets you spot patterns, predict future cash needs, and make smarter financial decisions before issues arise.

Payouts Standout Features and Integrations:

Standout features include smart AP automation that simplifies the accounts payable process. Additionally, the global accounts feature allows businesses to manage local currency transactions worldwide, giving teams better control and predictability over international payment forecasting.

Integrations include PayPal, Venmo, Payoneer, impact.com, CJ Affiliate, Everflow, Zelle, Priority, Tune, System1, and NetSuite.

Pros and cons

Pros:

- Strong multi-currency support for forecasting needs

- Easy automation of complex payout workflows

- Supports scaling operations

Cons:

- May not integrate with all existing systems

- May require time to fully customize

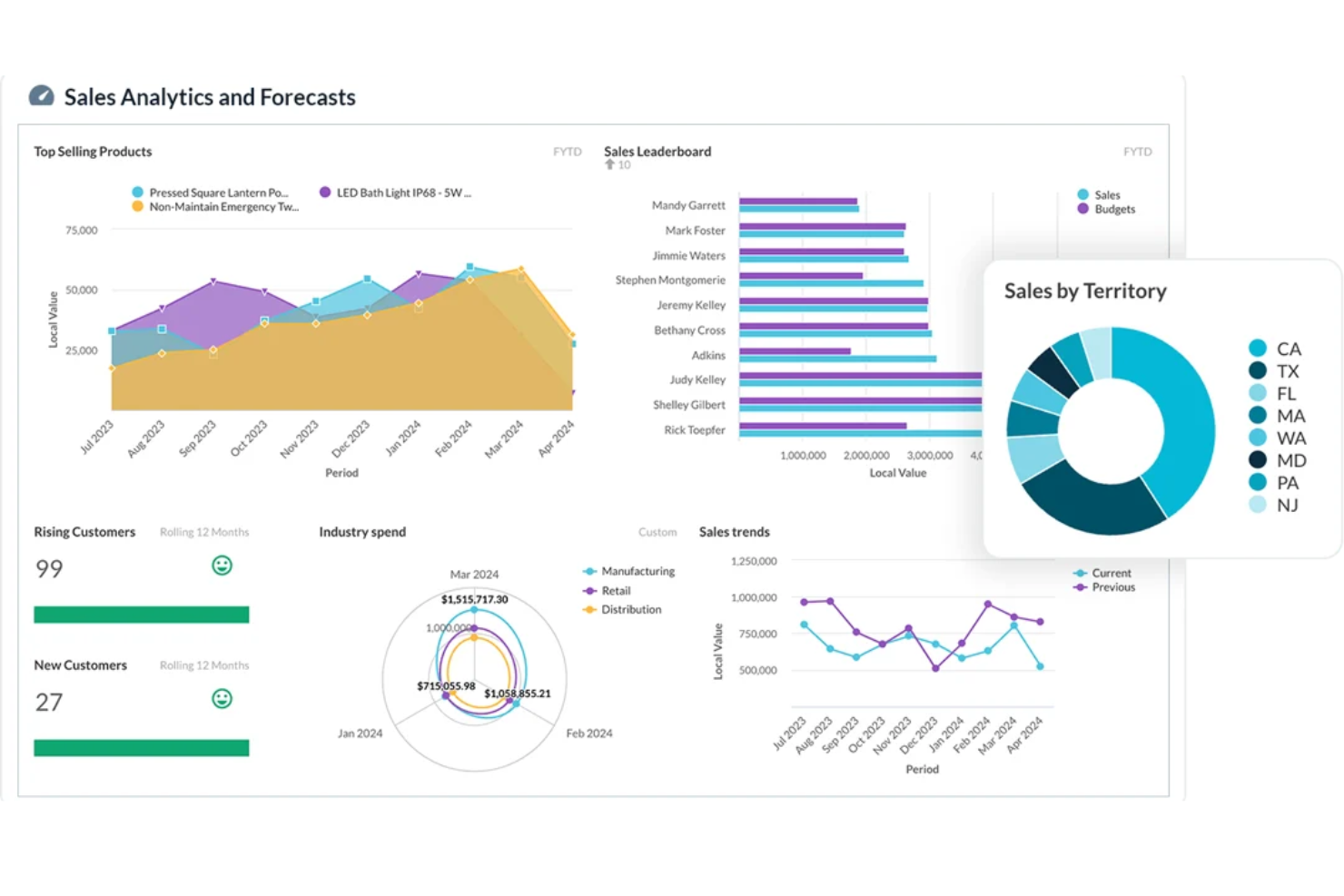

Phocas is a business intelligence and financial analysis platform that helps organizations make data-driven decisions. It provides tools for data analytics, visualization, and reporting.

Why I picked Phocas: I like that Phocas has the ability to consolidate data across various departments and business functions, providing a more holistic view of current performance and trends for the future. Users can create specialized plans across sales, HR, and operations, with customizable forecasting reports and scenario modeling tools available to help visualize future revenue, prepare for customer demand, and model pricing strategies.

Phocas Standout Features and Integrations:

Standout features include customizable dashboards, CRM functionalities, rebate visibility, collaborative workflows, privacy compliance, and security controls.

I also like its Phocas AI feature, which allows less technical users to access data and reports by typing in a question and receiving a tailored response.

Integrations include Merlin, Microsoft, SYSPRO, Retail Express, Epicor, IFS, Sage, Accolent, Datafile, MYOB, Enapps, Kerridge, SAP, Sympac, Netsuite, Oracle, QAD, MAM Software, Jonas Metals Software, Acumatica, Xero, Khaos Control, and more.

Pros and cons

Pros:

- AI feature for quick insights

- Customizable dashboards and reports

- Forecasting functions for different departments

Cons:

- Access to lots of data can be overwhelming

- May take time to fully learn the software

Vena is an Excel-based platform for forecasting, budgeting, and financial reporting and analysis.

Why I picked Vena: I like that Vena builds on Excel's inherent capabilities, offering a dynamic integration that allows for sophisticated data modeling, analysis, and collaboration without abandoning the Excel environment that finance professionals are accustomed to.

Vena Standout Features and Integrations:

Standout features include flexible modeling, scenario analysis, automated data consolidation, intelligent dashboards, self-service analytics, customizable workflows, collaborative features, and an AI-powered planning assistant.

Integrations include Oracle, SAP, NetSuite, Sage Intacct, Salesforce, QuickBooks, Microsoft Dynamics 365 Business Central, Dropbox, OneDrive, SFTP, and SharePoint. You can also build custom integrations with Vena API.

Pros and cons

Pros:

- Sophisticated financial models and scenarios

- Familiar Microsoft Excel interface

- Usually quick to implement

Cons:

- No mobile app

- Mac compatibility issues

New Product Updates from Vena

Vena's Copilot for Teams and CPM for Dynamics 365 on AppSource

Vena announced the release of Vena Copilot for Microsoft Teams and Vena CPM for Microsoft Dynamics 365 Business Central in Microsoft AppSource, enhancing financial planning and reporting capabilities directly within Microsoft applications. For more details, visit Vena Solutions Newsroom.

VOGSY is a versatile CRM and ERP platform designed to support global project teams. It's tailored to manage people, projects, and finances across multiple countries and currencies, providing a unified solution for international business operations.

Why I Picked VOGSY: I chose VOGSY for its robust revenue forecasting, which uses resource planning to project financial outcomes with accuracy—eliminating guesswork from budgeting. This is especially valuable for planning future projects and setting realistic financial goals. VOGSY also consolidates revenue, cost, and margin data across regions, giving you a comprehensive view of financial performance. Integrated billing schedules ensure timely invoicing and cash flow tracking, making it easier to manage budgets and maintain financial stability. Together, these features provide a solid foundation for strategic, data-driven financial planning.

VOGSY Standout Features and Integrations:

Features include the ability to create a single source of truth with speed and ease, which helps in aligning all project-related data and financials. VOGSY also offers the capability to manage documents through Drive integrations, ensuring that important files are easy to access and share. Lastly, the platform shows revenue opportunities and their impact on capacity without manual rework, saving you time and effort in financial forecasting.

Integrations include QuickBooks, Deltek, Xero, Sage, Certinia, Oracle Netsuite, Exact, PHC-GO, Tally, Wave, ABSS, and Omie.

Pros and cons

Pros:

- Real-time global financial overview

- Fast setup and onboarding

- Robust resource planning tools

Cons:

- Limited mobile functionality

- Basic customization options feel restrictive

Ramp is a spend management platform that helps businesses automate accounts payable, track expenses, and manage corporate cards—all in one place. It offers real-time financial data and approval controls, making it useful for teams that want better visibility into their spending as it happens.

Why I Picked Ramp: I picked Ramp as a forecasting option because it gives you up-to-the-minute transaction data and flexible approval workflows that can help keep your forecasts on track. Its automation features take care of routine financial tasks, which can free up your team to focus on analyzing spend patterns and updating forecasts quickly. I also like that Ramp supports fast ERP integration and multi-currency transactions, making it a helpful option for businesses with global operations.

Standout Features & Integrations

Features include automatic invoice processing with optical character recognition (OCR), customizable approval workflows, no-fee vendor payments by card, check, ACH, or wire, and real-time ERP syncing. Ramp also offers corporate cards with built-in spend controls and multi-currency payment capabilities.

Integrations include NetSuite, Sage, Xero, QuickBooks, Microsoft Dynamics Business Central, Acumatica, Uber, Lyft, Okta, Google, Rippling, and Gmail.

Pros and cons

Pros:

- Automated expense reporting and receipt matching

- Ability to issue multiple virtual cards with customizable controls

- Comprehensive reporting features

Cons:

- Could offer more advanced accounting features

- Mostly focuses on accounts payable and spend management

New Product Updates from Ramp

Vendor Approval Workflows in Ramp

Ramp's new vendor approval workflows allow teams or managers to review new vendors, ensuring compliance with procurement policies and preventing unauthorized entries. For more details, visit Ramp Announcements.

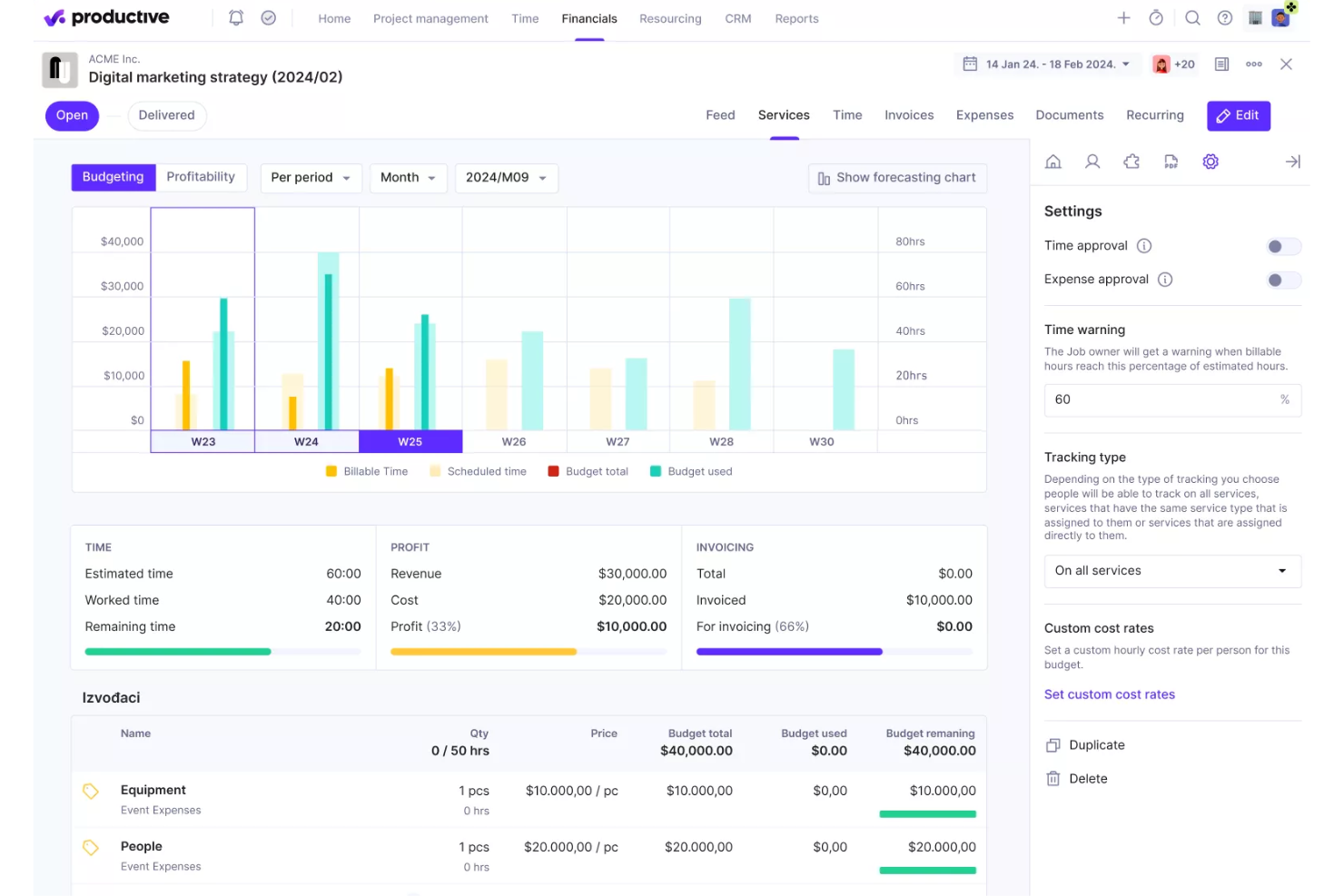

Productive is an all-in-one agency management system designed to assist businesses in managing their operations, projects, and financials.

Why I picked Productive: Productive allows users to create detailed forecasts by leveraging real-time data from multiple sources within the platform. The forecasting tool is integrated with budgeting and profitability modules, enabling users to predict financial outcomes with accuracy. Additionally, the workload feature helps manage resource allocation by forecasting team availability and workload.

Productive Standout Features and Integrations:

Standout features include advanced automation, time off management, project management, Gantt charts, sales CRM, workload management, invoicing, revenue recognition, purchase orders, AI features, customizable reporting, budgeting templates, and permission sets.

Integrations include Jira, Slack, QuickBooks, Xero, Google Calendar, Zapier, Rippling, Sage, BambooHR, and HubSpot.

Pros and cons

Pros:

- Good reporting and resource management capabilities

- Consolidates multiple functions into one platform

- Ability to track project profitability

Cons:

- Could benefit from more integrations

- Initial setup can be time-consuming

Rippling Spend is a comprehensive spend management solution designed to centralize and control all aspects of company expenditures.

Why I picked Rippling Spend: Rippling Spend offers an analytics-driven approach to expense planning. It provides real-time financial reporting and spend analytics, allowing your team to predict future costs based on historical data and current spending trends. Customizable dashboards also provide insights into department-level and company-wide expenses, making it easy to identify trends, anticipate financial risks, and adjust spending plans accordingly.

Rippling Spend Standout Features and Integrations:

Standout features include hiring scenarios, headcount planning, real-time budget tracking, AI-driven anomaly detection, automated expense categorization, role-based spending controls, predictive analytics, vendor payment automation, and transaction audit trails.

Integrations include Slack, Google, Zoom, Salesforce, Microsoft 365, Asana, Carta, PayPal, 1Password, Yubikey, Checkr, and Guideline.

Pros and cons

Pros:

- Automated spend tracking

- Strong analytics and reporting tools

- Real-time financial visibility

Cons:

- Some users find approval workflows complex

- Limited customization in forecasting reports

Bonsai Agency Software is a business management platform tailored for a range of industries, including creative and digital agencies, consultancies, and professional service providers.

Why I picked Bonsai Agency Software: It’s especially helpful for tracking project-related expenses and revenue. You can easily monitor your team’s billable hours and compare them against project budgets to ensure you’re not overspending. Bonsai also offers detailed reports that give you insight into how much profit you’re making on each project, making it easier to plan your future work.

Bonsai Agency Software Standout Features and Integrations:

Standout features include CRM, task management, billing and invoicing, contracts, proposals, file sharing, bookkeeping, customizable templates, and robust reporting and analytics.

Integrations include Slack, QuickBooks Online, Gmail, Google Calendar, Calendly, ClickUp, Trello, Google Drive, Google Sheets, Xero, and HubSpot.

Pros and cons

Pros:

- Scheduling and resourcing features

- Automated workflows

- Integrated client management

Cons:

- Lack of customization options

- Lacks advanced forecasting features

DualEntry is an AI-native ERP platform designed to help finance teams manage complex accounting, reporting, and compliance tasks. It brings together financial planning, revenue management, and real-time analytics in one system.

Why I picked DualEntry: It offers real-time, AI-driven forecasting tools that use actual performance data to generate up-to-date projections. The platform supports driver-based forecasting, allowing you to model revenue based on specific business drivers. This approach helps create accurate sales forecasts by integrating data from finance, sales, and service teams. Additionally, DualEntry's scenario and variance analysis tools let you compare forecasts with actual bank transactions, identify discrepancies, and adjust forecasts using both real-time and historical data.

DualEntry Standout Features and Integrations:

Standout features include automated cash positioning, which provides real-time visibility into your cash position by entity, region, and currency. This helps in making informed decisions quickly without waiting for end-of-day reports. DualEntry's inventory management system also uses advanced algorithms to forecast sales accurately, even in volatile markets, ensuring your inventory aligns with actual demand.

Integrations include BambooHR, Bill.com, Brex, Deel, Google SSO, Gusto, HubSpot, Ramp, Rippling, Salesforce, Stripe Billing, and Stripe Invoicing.

Pros and cons

Pros:

- AI-generated explanations and variance detection

- Automated cash positioning provides up-to-the-minute cash positions across entities

- Automated revenue recognition with predictive insights

Cons:

- Initial data migration could be complex depending on existing systems

- No option to try the system before buying

LiveFlow is a flexible financial reporting and forecasting tool that’s spreadsheet native, running right on top of popular applications, including Excel and Google Sheets.

Why I picked LiveFlow: I selected LiveFlow mostly for its spreadsheet-native design. It’s very easy to use and lets you turn your existing spreadsheets into live, scalable financial planning and analysis (FP&A) tools.

LiveFlow Standout Features and Integrations:

Standout features include custom dashboards that can automatically update with real-time data, plus in-sheet communication and collaboration features.

I also like that its budget vs. actual functionality is completely automated and always pulls the most recent data. You get access to a huge template library, too.

Integrations include Google Sheets, Microsoft Excel, Xero, and QuickBooks.

Pros and cons

Pros:

- Versatile platform with tons of pre-built templates

- Solid automation features

- Great cash flow forecasting

Cons:

- Limited integrations

Other Forecasting Software Options

If you didn’t quite find the right tool for your organization, these alternative forecasting software providers might be worth a look:

- Anaplan

CPM software with forecasting

- Workday Adaptive Planning

For advanced forecasting features

- SAP Analytics Cloud

For business intelligence tools

- LivePlan

For startups

- Cube

For ease of use

- Zoho Finance Plus

Financial software suite with forecasting

- Pigment

For collaboration

- Mosaic Tech

For real-time data integration

- Jirav

Forecasting software with simple integrations

- Salesforce Sales Cloud

For sales forecasting

Related Financial Software

If these forecasting tools didn't have the functionality you need, check out these other financially-focused business tools, that we've tested and evaluated:

- Accounting Software

- POS Systems

- Billing Software

- Financial Reporting Software

- Payroll Services

- Merchant Account Services

- Inventory Management Software

- Expense Report Software

Selection Criteria for the best Forecasting Tools

When looking at forecasting software, I focused on one thing: can it deliver accurate, useful forecasts with less effort? I tested and vetted each tool against the following set of criteria:

Core Forecasting Software Functionality - 25% of total weighting score

- Consolidating data from multiple sources

- Generating accurate financial forecasts

- Creating and comparing multiple scenarios

- Automating routine forecasting tasks

- Collaborating across different departments

Additional Standout Features - 25% of total weighting score

- Machine learning algorithms that improve forecast accuracy over time

- Real-time integration with ERP and CRM systems

- Scenario planning with advanced simulation capabilities

- Intuitive and customizable dashboards tailored to specific business needs

- Predictive modeling that leverages historical data trends

Usability - 10% of total weighting score

- Intuitive user interface that is easy to navigate

- Clear, visually appealing dashboard layouts

- Simple data input methods and streamlined workflows

- Drag-and-drop functionality for creating reports and scenarios

- Easy-to-access help and documentation within the platform

Onboarding - 10% of total weighting score

- Comprehensive training videos and tutorials

- Interactive product tours and guided onboarding sessions

- Availability of templates for quick setup

- Chatbots and live support for real-time assistance

- Webinars and ongoing training opportunities for users

Customer Support - 10% of total weighting score

- 24/7 customer support availability

- Multiple support channels (phone, email, chat)

- Responsive and knowledgeable support team

- Detailed and accessible knowledge base

- Community forums for peer-to-peer support

Value For Money - 10% of total weighting score

- Competitive pricing compared to similar tools

- Transparent pricing structures without hidden fees

- Various pricing tiers to fit different business sizes and needs

- Discounts for long-term commitments or bundled services

- Free trials or money-back guarantees to ensure satisfaction

Customer Reviews - 10% of total weighting score

- High overall satisfaction ratings from users

- Consistent positive feedback on core features

- Testimonials highlighting ease of use and effectiveness

- Reviews that mention reliable customer support

- Recognition for delivering good value for the cost

How to Choose Forecasting Software

I’ve explained why each forecasting software made the list, but choosing the right one is up to you. As you compare options, keep these key points in mind:

| Factor | What to Consider |

|---|---|

| Scalability | Changing software is an administrative headache; thus, the forecasting tool you choose should be able to grow and change in step with your business. If you're a fast-growing startup, put more emphasis here. If you're an established multinational, perhaps scalability is less important. |

| Integrations | If you're getting a standalone tool, it has to integrate with your existing systems, like your ERP software or accounting platforms, to work properly. Clarify what tools are staying, what you can replace, and how it all connects together. |

| Use Case | Be clear on the analytical capabilities you want to unlock, like predictive modeling and scenario planning. While all these forecasting tools will analyze past trends to predict future outcomes, some businesses will need advanced analytics to, say, help deal with market volatility, while others won't. Be clear on the camp you fall into. |

| Number of Users | Who's going to be interacting with the software most? What's their level of digital fluency? These questions are going to help you understand how many licenses you'll need and just how complex the front-end can be before you get diminishing returns. |

| Company Fit | Consider each tool you shortlist alongside your workflows and delivery methodology. Evaluate what's currently working well, as well as the areas that are causing issues that need to be addressed. Then, see if they'd work together. Remember, every business is different — don’t assume that a tool will work for you just because it's popular. |

Trends in Forecasting Software

I reviewed dozens of product updates, press releases, and change logs from leading forecasting software vendors. These are the trends worth watching:

Advanced Analytics and AI Integration

- Machine Learning and Predictive Modeling: Many forecasting tools are now incorporating advanced machine learning algorithms to enhance predictive accuracy. These models learn from historical data and improve over time, making your tools work better for you the longer you're using them. This, coupled with the best statistical analysis software, can go a long way for financial reporting and data collection.

- Real-Time Data Processing: The ability to process and analyze data in real-time has become a key feature. This allows businesses to make immediate decisions based on the latest financial data, improving responsiveness and strategic planning.

Enhanced User Experience

- Intuitive User Interfaces: User interfaces have become more user-friendly, with drag-and-drop functionalities and customizable dashboards. This trend reduces the learning curve and increases user adoption, enabling finance teams to leverage the software's full capabilities more quickly.

- Collaboration Tools: Modern forecasting software includes advanced collaboration features, such as real-time editing and sharing, which facilitate better communication across departments. This improves alignment and ensures that all stakeholders are informed and involved in the financial planning process.

Comprehensive Integration

- Seamless ERP and CRM Integration: There is a growing emphasis on the seamless integration of forecasting tools with ERP and CRM systems. This ensures a unified data environment, reducing the manual effort required to consolidate information from disparate sources. Unsurprising, considering the usefulness of forecasting tools relies on this data.

Advanced Scenario Planning

- Scenario Simulation and Analysis: Tools are increasingly offering robust scenario planning capabilities, allowing businesses to model and compare multiple financial scenarios. This helps in better preparing for uncertainties and making informed strategic decisions.

Automation and Efficiency

- Automated Forecasting Processes: Automation features are becoming more sophisticated, reducing the manual effort required for data entry and analysis. This increases efficiency and allows finance professionals to focus on higher-value tasks, like making decisions based on that data.

What is Forecasting Software?

Forecasting software is a digital tool that helps businesses predict future trends, demand, and outcomes using historical data and analytics. These platforms are essential for planning in finance, inventory, workforce, and operations, especially in industries where anticipating change is critical.

From simple statistical models to advanced AI-powered projections, forecasting tools reduce guesswork and support more confident, data-driven decisions.

Key Features of Forecasting Tools

The best forecasting software goes beyond reporting: it sharpens accuracy, streamlines workflows, and strengthens strategic decisions. Key features to look for include:

- Data Integration: The software should seamlessly integrate with various data sources, ensuring a comprehensive view of financial information, which is crucial for accurate forecasting.

- Advanced Analytics: The inclusion of sophisticated analytics tools helps in generating more precise forecasts, allowing for better planning and resource allocation.

- Scenario Planning: The ability to model different scenarios helps prepare for potential challenges and opportunities, enabling more agile and informed decision-making.

- Automated Data Processing: Automation reduces the time and effort required for manual data entry, minimizes errors, and increases efficiency in the financial planning process.

- Predictive Modeling: Predictive models use historical data and machine learning to forecast future trends, enhancing the accuracy and reliability of financial projections.

- Budget Consolidation: Software should be able to consolidate budget, forecasting, and planning data into actionable information to be shared with internal teams. Most organizations typically consolidate on an annual basis, but greater insight can potentially be gained by using software to consolidate and prepare reports more efficiently — and more frequently.

- Variance Reports: Budgeting is a primary function of forecasting software, but the best tools also allow users to create variance reports. These compare budgets/projections to actual figures, which makes it easier to identify soft spots in forecasting and tweak future operations to better match budgeted figures.

- Machine Learning Integration: Incorporating machine learning algorithms enhances the tool's ability to learn from historical data and improve forecast accuracy over time, providing more reliable and actionable insights.

- Sales Forecasting & Production Scheduling: Software should be able to forecast sales estimates based on factors such as seasonal demand, pricing shifts, and historical trends. Additionally, it should have tools to help teams schedule production based on forecasted demand.

- Custom reporting: Forecasting tools should be able to export findings into user-friendly reports, which can be shared with internal (and potentially external) stakeholders. Ideally, reports should be intuitive and understandable for those without direct experience with the producing software solution.

Benefits of Forecasting Tools

Forecasting tools do more than simply tell you an outcome. By moving away from the spreadsheets and choosing a software solution, you can enjoy:

- Enhanced Accuracy: Using advanced algorithms and data integration, forecasting software improves the precision of financial projections, enabling businesses to make more informed decisions and reduce risks.

- Efficiency Gains: Automation of data processing and report generation saves time and reduces manual errors, allowing finance teams to focus on strategic analysis rather than repetitive tasks.

- Improved Strategic Planning: Scenario planning and predictive modeling provide insights into potential future outcomes, helping businesses prepare for various possibilities and make proactive adjustments.

- Better Collaboration: Integration with cloud services and collaboration tools ensures that all stakeholders have access to up-to-date information, fostering better communication and alignment across departments.

- Scalability and Flexibility: Forecasting software can scale with the growth of the business, accommodating increasing data volumes and complexity without compromising performance, ensuring continued relevance and utility.

Costs & Pricing for Forecasting Software

I included vendor-specific pricing above but, seeing as how much each tool's features can vary from the next, I wanted to put together a general pricing table for forecasting software, based on company size.

Here's a breakdown of the typical plan options and their pricing:

Plan Comparison Table for Forecasting Tools

| Plan Type | Average Price (/user/month) | Common Features | Best For | Integration Frequency |

|---|---|---|---|---|

| Free | $0 | - Basic forecasting tools - Limited data integration - Basic reporting capabilities | Startups and small businesses | Some standalone (intro plans), but often integrated into larger tools |

| Basic | $50 | - Standard forecasting models - Basic analytics - Integration with key data sources | Small to mid-sized businesses | Most often standalone |

| Professional | $150 | - Advanced analytics - Customizable dashboards - Scenario planning - Cloud integration | Growing businesses | Frequently integrated |

| Enterprise | $500+ | Full suite of advanced features - Machine learning - Real-time data processing - Dedicated support | Large enterprises | Most often integrated |

While changing software can be a real pain, changing tiers isn't as big of a deal. Businesses commonly change forecasting tool tiers as their needs evolve due to growth, increased data complexity, or the requirement for advanced features like machine learning and predictive modeling.

Transitions often occur during annual reviews, after significant growth phases, or when new ERP or CRM systems are implemented, which may have their own forecasting functionality.

What are the Different Types of Forecasting Software?

Forecasting software can take a few different forms. The primary categories are outlined below.

- Budgeting and forecasting software: Focuses on financial details, covering revenue estimates, operating expense planning, and financial budgeting. Basic features in this realm may be included in accounting platforms, but many organizations could benefit from dedicated financial forecasting software.

- Sales forecasting software: Focuses on the sales side of things and typically has more features for analyzing the effects of different marketing strategies (discounts, bundling, etc.). Sales forecasting tools are helpful in giving sales teams more accurate targets while also helping supply chain and production managers plan inventory levels and production targets accordingly.

- Demand forecasting software: Focuses on the demand side of the equation, helping businesses optimize inventory levels, plan for shifts in seasonal demand, and track consumer trends and buyer behavior.

- Capacity and workforce forecasting software: Focuses on labor, production capacity, and workflow planning while integrating projected demand and sales data. It’s useful for HR and executive teams to ensure their workforce can keep up with forecasted sales.

- Enterprise resource planning (ERP) software: Offers a versatile feature set to centralize most or all of your operating and planning efforts. ERP platforms are the most expensive of the lot but also the most flexible in how they can be deployed and used.

Some software tools combine multiple focus areas, while others are dedicated to a specific feature set. The best forecasting tool for your team depends on your specific needs—as well as the size of the business, the industry, and other variables.

Forecasting Software FAQs

Below you’ll find my answers to some common questions people have about forecasting software.

What features should I prioritize when choosing forecasting software for my finance team?

Prioritize intuitive dashboards, customizable reporting, and driver-based modeling so you can tailor forecasts to your business needs. Look for tools with strong version control, automated data imports, and seamless ERP or accounting integrations.

Additionally features, such as scenario planning and real-time collaboration can help your team test assumptions together, while audit trails ensure data integrity. Choosing financial forecasting software with automated alerts and permission controls also streamlines workflows and keeps sensitive information secure.

Can forecasting tools integrate with ERP or accounting software?

Yes, many cash forecasting software offer out-of-the-box integrations or APIs for connecting with ERP and accounting systems. This lets you import financial data automatically, saving hours of manual entry and minimizing errors.

With real-time syncing, your forecasts always reflect the latest transactions and balances. Integrations also simplify audit trails and support stronger collaboration across teams. Before choosing a tool, confirm it supports your specific ERP or accounting platform for a smooth setup.

What are the most common challenges when implementing forecasting software?

Common challenges for implementing demand forecasting software include data migration issues, training users, and integrating software. Teams often face resistance when changing established processes. Budget considerations and managing multiple user permissions can also further complicate onboarding.

To overcome these hurdles, involve stakeholders early, run pilot implementations, and lean on vendor support and documentation. Additionally, setting realistic timelines and goals helps ensure a smoother transition and greater long-term adoption success.

Does Excel have a forecasting tool?

Yes, Excel includes built-in forecasting functions like Forecast Sheet, regression, and time series analysis. These are helpful for one-off or straightforward projections and work well for small datasets.

However, keep in mind that Excel lacks automated data connections, version control, and advanced scenario planning, which most finance teams need. Many teams start with Excel but move to specialized forecasting software for better automation, collaboration, and error reduction.

How do scenario planning and ‘what-if’ analysis work in forecasting software?

Forecasting software lets you create different scenarios by changing inputs like sales, expenses, or market conditions. You can instantly compare best-case, worst-case, and base-case projections to see their financial impacts.

‘What-if’ analysis makes it easy to test the effects of changes in real time, supporting better risk management. This helps your team prepare for uncertainties, set contingency plans, and communicate potential outcomes with clear, data-driven visuals.

How does forecasting software assist finance teams?

Forecasting software streamlines budgeting, eliminates manual errors, and centralizes financial data. Your team can quickly build models, run multiple scenarios, and generate reports in real time. This efficiency frees analysts from repetitive tasks, allowing focus on valuable insights and strategic planning.

Collaborative features and audit trails ensure everyone’s on the same page. Ultimately, these tools enhance accuracy, transparency, and speed, so you deliver more timely, actionable forecasts to leadership.

What's Next?

To keep up to date with the latest trends in financial technology, subscribe to our free newsletter.