Best Financial Management Software Shortlist

Here’s a look at my top financial management software picks:

Our one-on-one guidance will help you find the perfect fit.

Financial management software is a digital solution designed to help businesses streamline, organize, and track their financial operations, from budgeting and forecasting to invoicing and reporting. Whether you're juggling cash flow, chasing invoices, or trying to make sense of your books, the right software brings clarity and control to your finances.

As a digital software expert, I’ve seen (and know) firsthand how overwhelming it can be to choose a financial tool that actually fits. Maybe you’ve tried software that was too complex, too limited, or just didn’t scale as your business grew. I get it. You need something that saves time, not something that adds more to your plate.

That’s why I’ve spent several hours testing platforms and analyzing user feedback to find tools that actually solve the problems you face daily. If you're tired of manual spreadsheets, worried about accuracy, or just need a clearer view of your financial health, these financial management solutions are built to make your job easier, and your business stronger.

Why Trust Our Software Reviews

We’ve been testing and reviewing finance and accounting software since 2023. As CFOs ourselves, we know how critical and difficult it is to make the right decision when selecting software. We invest in deep research to help our audience make better software purchasing decisions.

We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our software review methodology.

Best Financial Management Software Summary

Looking for the fastest way to pick a financial management software? Below, I’ve created a cost summary chart to help you find a solution quickly and efficiently.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for live expert assistance | Free demo available | From $3.80/month | Website | |

| 2 | Best for business and personal financial management | 30-day free trial | From $8.90/month (billed annually) | Website | |

| 3 | Best for comprehensive budgeting | 14-day free trial | From $25/user/month | Website | |

| 4 | Best for discounted pricing | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 5 | Best for multi-entity management | Free demo available | Pricing upon request | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Financial Management Software Reviews

Below are my detailed summaries of the best financial management software that made it onto my shortlist. My reviews offer a detailed look at the key features, pros & cons, integrations, and ideal use cases of each tool to help you find the best one for you.

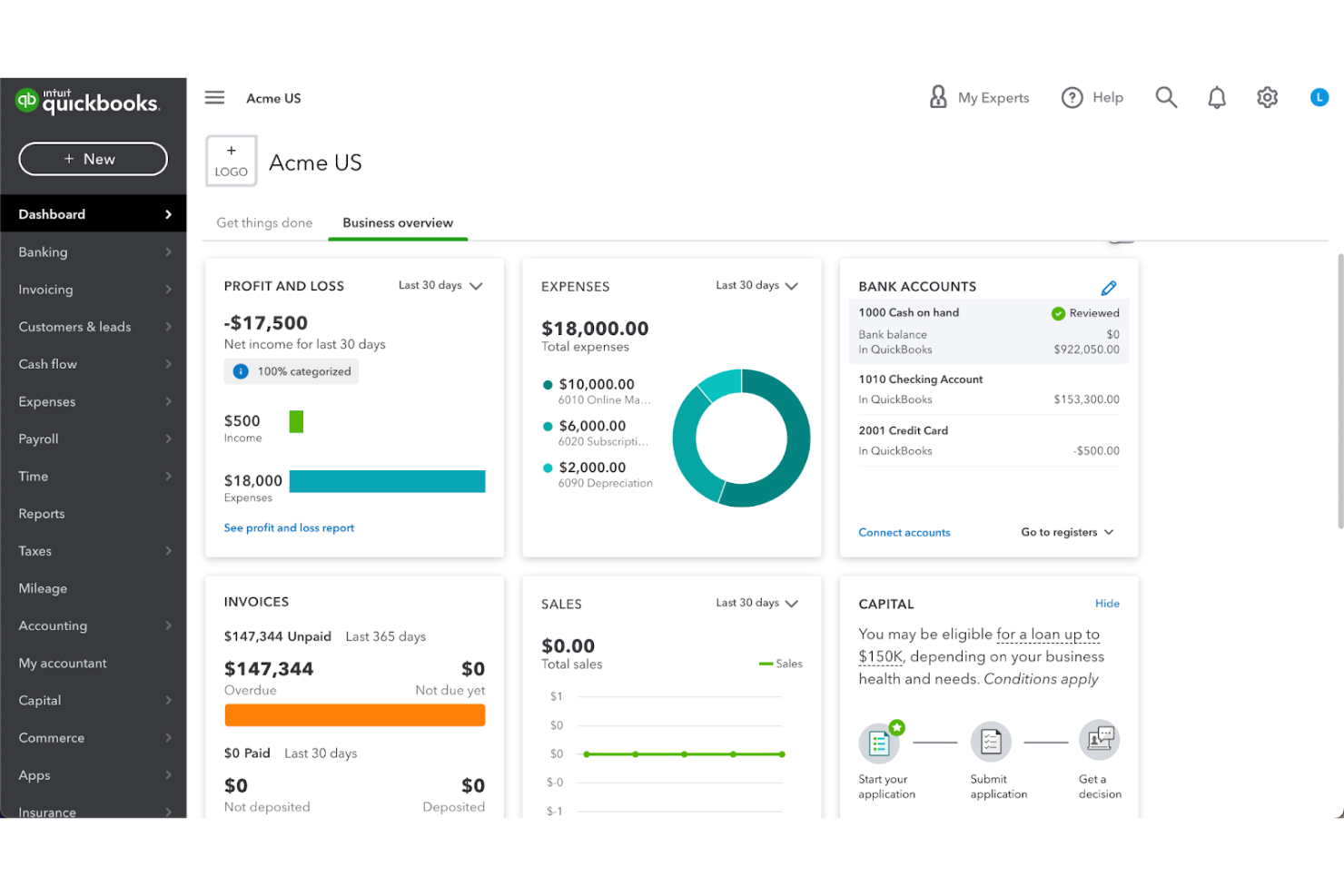

QuickBooks is a financial management software tailored for small to medium-sized businesses. It supports key business functions like bookkeeping, invoicing, payroll, expense tracking, and tax preparation.

Why I picked QuickBooks: The platform’s live expert assistance helps you get set up quickly and provides ongoing bookkeeping guidance. Once you’re up and running, software offers automated bookkeeping to reduce manual entry, receipt capture for expense tracking, and mileage tracking for business travel. You can also create customizable estimates and manage your invoices directly through the platform.

Standout Features & Integrations:

Features include automated bookkeeping, receipt capture, mileage tracking, and customizable estimates. You can manage payroll, handle expense tracking, and even get live expert assistance for setup and bookkeeping guidance.

Integrations include TurboTax, Shopify, PayPal, Square, Amazon, Etsy, Stripe, WooCommerce, eBay, and BigCommerce.

Pros and cons

Pros:

- Customizable estimates

- Receipt capture and mileage tracking

- Automated bookkeeping

Cons:

- Learning curve for new users

- Limited reporting capabilities

Quicken offers a suite of financial management tools tailored for personal and small business use, focusing on budgeting, investment tracking, and debt management. It’s a good solution for those seeking wealth management solutions for both their personal and business needs.

Why I picked Quicken: Quicken's range of products includes budgeting software, investment tracking, and bill management. You can set custom savings goals and track your spending in real-time using Quicken Simplifi, which comes alongside the business product. The software also provides tax-related transaction tracking and account reconciliation tools. For small business owners who want to consolidate their financial data, it’s a good option.

Standout Features & Integrations:

Features include budgeting tools, investment tracking, and bill management. You can set custom savings goals and track spending in real-time. It also offers tax-related transaction tracking and account reconciliation tools.

Integrations include Dropbox, PayPal, and Zillow.

Pros and cons

Pros:

- Detailed investment tracking

- Tax-related transaction tracking

- Real-time spending tracking

Cons:

- Requires setup assistance

- Limited mobile app features

CRM Creatio is a no-code customer relationship management platform designed to help businesses manage customer interactions and automate processes across marketing, sales, and service.

Why I picked CRM Creatio: It offers an extension, Financial Management for Creatio, that has comprehensive budgeting capabilities. You can create, manage, and analyze budgets with detailed expense categorization, monitor budget performance in real time, and utilize historical data to forecast future financial needs. The extension also allows for both automatic and manual addition of financial records, categorization of transactions, and meticulous tracking of operational expenses and revenue streams.

Standout Features & Integrations:

Features include real-time balance updates, which let you view the current status of all linked bank accounts, ensuring you're always informed about your cash position. Additionally, the advanced analytics dashboard offers customizable tools to monitor profit and loss, cash flow forecasts, receivables and payables, and customer balances.

Integrations include Accelo, Act!, ActiveCampaign, Acumatica, Adobe Analytics, Asana, Microsoft Exchange, Excel, Mailchimp, HubSpot Marketing Hub, Google Calendar, and Tableau.

Pros and cons

Pros:

- A scalable solution for various business processes

- Extensive customization options

- No-code platform for non-technical users

Cons:

- Configuring the platform can be time-consuming

- Learning curve for new users

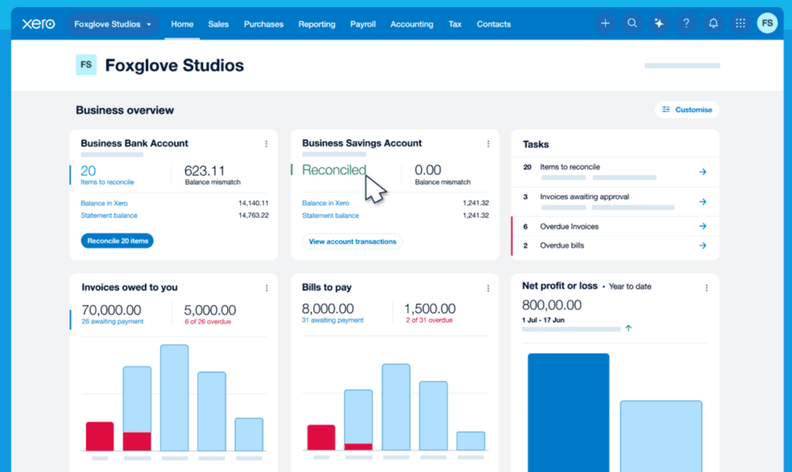

Xero is a cloud-based accounting software designed for small businesses, accountants, and bookkeepers. It offers features like invoicing, expense tracking, and payroll management, consolidating multiple aspects of your money management in a single place.

Why I picked Xero: New users can benefit from significant discounts when they sign up for this system, with prices as low as $0.75/month for the first 6 months. You can connect to over 21,000 global banks for automated reconciliation between your bank accounts. Xero also includes expense management tools and integrates payroll with Gusto.

Standout Features & Integrations:

Features include online invoicing, bank connections, expense management, and payroll integration. You can also track projects, manage purchase orders, and generate financial reports. Xero supports multi-currency accounting for global businesses.

Integrations include Hubdoc, Avalara, Stripe, PayPal, Gusto, Square, Shopify, Bill.com, Expensify, and Google Sheets.

Pros and cons

Pros:

- iOS and Android mobile apps

- Strong integration with Gusto

- Multi-currency support

Cons:

- Discounted prices only for first 6 months

- Limited invoices on basic plan

New Product Updates from Xero

Xero Reimagined: New Homepage and Navigation Beta

Xero has unveiled its Reimagined beta with a redesigned homepage and improved navigation, featuring real-time financial insights for users. For more information, visit Xero's official site.

Sage Intacct is a cloud-based accounting and financial management software tailored for midsize businesses. It provides comprehensive features such as core financials, advanced reporting, project accounting, and payroll management, all designed to enhance productivity and support growth.

Why I picked Sage Intacct: Sage Intacct helps you manage your financial accounts across business entities, streamline payroll, and generate advanced reports. The platform's integration with various business tools ensures efficient data flow and portfolio management. Its emphasis on automation and AI simplifies accounting processes and boosts productivity. With tools for HR and payroll management, Sage Intacct saves your team time and reduces manual data entry.

Standout Features & Integrations:

Features include multi-dimensional reporting, dynamic allocations, and advanced financial consolidation. The platform also provides intuitive budgeting tools and comprehensive payroll solutions. Additionally, Sage Intacct offers project accounting functionalities.

Integrations include Salesforce, ADP, Expensify, Bill.com, Stripe, Avalara, TSheets, Gusto, HubSpot, and Paychex.

Pros and cons

Pros:

- Multi-dimensional reporting

- Comprehensive training resources

- Advanced financial consolidation

Cons:

- Requires technical knowledge

- Complex implementation

Other Financial Management Software

Here are some additional financial management software options that didn’t make it onto my shortlist, but are still worth checking out:

- Acumatica

For industry-specific ERP solutions

- Mosaic

For quick FP&A implementation

- Workday Financial Management

For AI-driven financial insights

Financial Management Software Selection Criteria

I kept real CFO challenges in mind when picking the best financial management software for this list—focusing on what actually matters to you. To keep things fair and structured, I also used this simple framework for my evaluations:

Core Functionality (25% of total weighting score)

- Manage budgets and expenses

- Track income and revenue

- Generate financial reports

- Handle invoicing and billing

- Monitor cash flow

Additional Standout Features (25% of total weighting score)

- Pre-filled timesheets

- Side-by-side reporting

- Tentative allocations for scenario planning

- Granular control over budgets by project phase

- AI chatbots for quick task management

- Workflow management

Usability (10% of total weighting score)

- Intuitive navigation and interface

- Easy access to frequently used features

- Context menus for quick actions

- Customizable templates for repetitive tasks

- Drag-and-drop simplicity for scheduling

Onboarding (10% of total weighting score)

- Availability of training videos and webinars

- Interactive product tours

- Quick start guides for new users

- Chatbots to assist during the onboarding process

- Templates to simplify initial setup

Customer Support (10% of total weighting score)

- Availability of live chat and email support

- AI chatbots that can escalate to human agents

- Knowledge base with FAQs and guides

- Screen annotation tools for reporting issues

- Dedicated customer success managers

Value For Money (10% of total weighting score)

- Competitive pricing against similar tools

- Availability of different plans to suit various business sizes

- Inclusion of essential features in lower-tier plans

- Flexible add-ons and extensions

- Discounts for annual payments

Customer Reviews (10% of total weighting score)

- Overall customer satisfaction ratings

- Specific mentions of ease of use and interface design

- Feedback on customer support responsiveness

- Positive comments on the learning curve and user experience

- Value for money perception compared to competitors

How To Choose Financial Management Software

It’s easy to get bogged down in long feature lists and complex pricing structures. To help you stay focused as you work through your unique software selection process, here’s a checklist of factors to keep in mind:

| Factor | What to Consider |

| Scalability | Will the software grow with your business? |

| Integrations | Does it integrate with your existing tools (ERPs, CRMs, etc)? |

| Customizability | Can you tailor it to fit your specific needs? |

| Ease of Use | Is it user-friendly for you and your team? |

| Budget | Does it fit within your financial constraints? |

| Security Safeguards | Are there robust security measures in place? |

| Support | What kind of customer support is available? |

| Reporting | Does it provide the reports you need? |

Trends In Financial Management Software

I’ve dug through tons of product updates, press releases, and release logs from various financial management software vendors, so you don’t have to! Here are some of the coolest trends catching my attention:

- Micro-Budgeting: More tools offer granular control over budgets, breaking them down by project phases or tasks. This helps empower businesses to manage spending more precisely. For example, Float allows setting and monitoring budgets at the task level.

- Scenario Planning: This deluxe feature helps businesses prepare for potential changes by simulating different financial outcomes. Tools like Parallax enable tentative project allocations to assess their impact on resources and budgets.

- Pre-Filled Timesheets: To save time, some software now automatically populates spreadsheets with assigned tasks and planned hours. For example, Float’s pre-filled timesheets help users quickly log their time, making time tracking and contract management less cumbersome.

- Real-Time Dashboards: Real-time data visualization is becoming standard, allowing businesses to make informed decisions quickly. Smartsheet offers real-time dashboards that integrate with major applications, providing up-to-date insights. This is beneficial, especially during the consolidation and close processes for multi company organizations.

- Comprehensive Financial Graphs: Detailed financial graphs within projects help track progress and profitability. Parallax, for instance, includes graphs in each project’s overview to show the current and projected financial trajectory.

What Is Financial Management Software?

Financial management software is a tool that helps businesses manage income, expenses, and financial reporting in one place. It’s used to automate tasks like budgeting, invoicing, payroll, and cash flow tracking to save time and reduce errors.

Companies rely on it to improve financial visibility, ensure compliance, and make smarter spending decisions. Ideal for startups to large enterprises, this software reduces manual work, minimizes errors, and offers real-time visibility into financial health.

Features Of Financial Management Software

When selecting financial management software, keep an eye out for the following key features:

- Micro-Budgets: Provides granular control over budgets by allowing you to break down the budget by project phase, enhancing control over spending. This can be very beneficial for zero based budgeting methods.

- Pre-Filled Timesheets: Automatically populate tasks and planned hours, reducing the time needed to log work hours.

- Project Financials: Manages rate cards, budgets, invoices, and even payments, offering comprehensive financial oversight for projects.

- Time and Expense Tracking: Facilitates the submission of timesheets and tracking of expenses, aiding in accurate project costing.

- Resource Management: Includes settings for creating time-off policies, work groups, and assigning custom permissions, ensuring efficient resource allocation.

- Comprehensive Reporting: Offers strong reporting features that help keep projects on track and within budget by providing detailed financial insights. This is also helpful when it comes to creating financial statements.

- Milestone Tracking: Enables the monitoring of project milestones, ensuring timely progress and completion of financial goals.

- Risk Management Capabilities: Assesses and manages potential financial risks, helping to maintain project stability and budget adherence. This is beneficial for all businesses, especially loan-based institutions.

- Customizable Views: Allows for the customization of views such as Gantt charts and Kanban boards, enhancing financial planning and workflow visualization.

- Integration with Other Tools: Integrates with tools like Slack, Google Drive, and Dropbox, facilitating smooth data flow and collaboration.

Benefits Of Financial Management Software

Bringing in the right financial management software can be a game-changer for your team and your business. Here are some big wins you can expect:

- Improved Accuracy: Automation in budgeting apps reduces manual data entry errors, ensuring your financial records are precise.

- Time Savings: Features like automated invoicing and expense tracking cut down on time-consuming tasks.

- Enhanced Reporting: Real-time financial dashboards and customizable reports offer clear insights into your business's financial health.

- Better Compliance: The software helps you adhere to financial regulations by automatically updating tax rates and generating required reports.

- Budget Management: Real-time budget tracking and forecasting tools help you stay on top of your financial goals.

- Cash Flow Management: Tools for monitoring accounts receivable and payable ensure you maintain healthy cash flow and avoid debts.

- Scalability: As your business grows, the software can handle increased transaction volumes and more complex financial services.

Costs And Pricing Of Financial Management Software

Choosing the right financial management software isn’t just about features—it’s also about finding a pricing plan that fits your needs. Costs can vary depending on team size, add-ons, and the bells and whistles you want.

To make things easier, here’s a quick breakdown of common plans, their average prices, and what you get with each one:

Plan Comparison Table for Financial Management Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0/user/month | Basic accounting, limited reports, and community support. |

| Personal Plan | $5-$25/user/month | Advanced accounting, budgeting tools, basic customer support, and integrations. |

| Business Plan | $25-$75/user/month | Comprehensive accounting, invoicing, advanced reporting, and multi-user access. |

| Enterprise Plan | $75-$150/user/month | Customizable accounting, dedicated support, enhanced security, and advanced analytics. |

Financial Management Software FAQs

Here are some answers to common questions about financial management software:

Is financial management software cloud-based?

Yes, most leading financial management software solutions offer cloud-based options. Cloud financial management software allows you to:

- Access your data from anywhere

- Collaborate with your team

- Stay up-to-date with software improvements and security patches

Many vendors now focus on cloud-first products for reliability and convenience.

Does financial management software integrate with management information systems?

Yes, most business financial management software can integrate with your management information systems. This is done typically with APIs or built-in connectors. It helps streamline data sharing, reduces manual entry, and cuts down on errors.

It’s a good idea to confirm with vendors that their product supports the systems your team already uses, so you avoid workflow bottlenecks down the line.

Will financial management software support financial auditing?

Yes, top financial performance management software keep detailed logs and audit trails for every transaction. This helps you meet compliance standards and speeds up audits.

Look for software that lets you control access, generate audit reports, and see user activity, so you maintain transparency and stay ready for reviews or regulatory checks.

What system support is available for financial management software?

Most reputable vendors offer 24/7 customer support, onboarding help, and a resource library. Some provide chat, phone, or dedicated account managers.

If you’re running a small team or moving financial data often, prioritize software with live support channels and responsive service SLAs to limit downtime.

How can I migrate my data to new financial management software?

Migrating data usually involves exporting your files from your old system, then importing them into the new software using migration tools or vendor-assisted services.

Always back up your data first. Check if your vendor offers white-glove onboarding or templates to make the transition smoother, especially for complex historical records.

What security features should I expect from financial management software?

You should expect role-based access, multi-factor authentication, data encryption (in transit and at rest), and regular security audits. Choose a system that’s compliant with industry standards like SOC 2 or ISO 27001. If you handle sensitive or regulated financial data, ask for details about the vendor’s security certifications.

How do financial management tools help with cash flow management?

Financial management software can do the following:

- Automates tracking incoming and outgoing funds

- Generates real-time cash flow statements

- Issues alerts for low balances or overdue invoices.

Some platforms forecast cash flow based on trends in your historical data, so you can plan for funding gaps or investment opportunities in advance.

Can financial management software handle multi-entity or multi-currency operations?

Yes, many robust platforms support managing multiple entities, subsidiaries, or departments under a single account. They can also process transactions in different currencies and automate currency conversion. If your business operates internationally or through several branches, confirm that the software supports consolidation and reporting across entities.

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.