Best Online Accounting Software Providers Shortlist

Here’s my shortlist of the best online accounting software:

Our one-on-one guidance will help you find the perfect fit.

Time is money, and outdated accounting software could be costing you more than you think. Whether you’re a small business owner, freelancer, accountant, or nonprofit, disjointed tools with slow performance and limited integrations only drain your time, energy, and profits.

As a digital software expert with experience in fintech and business operations, I’ve helped professionals across industries find accounting software that actually works. Throughout my career, I've learned what truly works, and what falls short.

To save you time and frustration, I’ve reviewed the top online accounting software for people who need clarity, control, and flexibility. This guide will help you find a better fit so you can stop troubleshooting and focus on growing your business.

Why Trust Our Reviews

We’ve been testing and reviewing accounting software since 2023. As financial operators ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our accounting software review methodology.

Best Online Accounting Software Summary

Below is my easy-to-use comparison chart which lays out the pricing details for my top online accounting software picks designed for easy scanning.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for setting custom spending policies | 30-day free trial + free plan available | From $15/user/month | Website | |

| 2 | Best for real-time financial insights | 14-day free trial | From $25/month | Website | |

| 3 | Best advanced small business solution | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 4 | Best for service businesses | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 5 | Best for a range of integrations | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 6 | Best for budgeting | Free trial + free plan available | From $15/month (billed annually) | Website | |

| 7 | Best for internal control features | Free demo available | Pricing upon request | Website | |

| 8 | Best for global operations | Free demo available | From $630/year | Website | |

| 9 | Best for service firms | Free demo available | Pricing upon request | Website | |

| 10 | Best for automation | 30-day free trial | From $13.50/month (billed annually) | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Online Accounting Software Reviews

Here’s my carefully selected list of the best online accounting software. Each option is broken down by key features, pros and cons, integrations, and ideal use cases to help you find the right fit with confidence.

Ramp is an online accounting and spend management platform that helps businesses automate financial processes and track expenses in real time. It offers tools for accounts payable, corporate cards, and policy enforcement to simplify financial management.

Why I Picked Ramp: I picked Ramp because it can automate expense reporting, reducing manual tasks for finance teams. You can set custom spending policies to control employee expenses and stay compliant with company guidelines. I also like Ramp’s accounts payable feature, which helps you manage vendor payments quickly and avoid missed deadlines. Its real-time visibility into financial transactions can help you make faster, more informed decisions.

Standout features & integrations:

Features include accounting automation that accelerates month-end closings, real-time financial insights to monitor spending as it happens, and multi-currency support to handle international payments.

Integrations include NetSuite, Sage, Xero, QuickBooks, Microsoft Dynamics Business Central, Acumatica, Uber, Lyft, Okta, Google, Rippling, and Gmail.

Pros and cons

Pros:

- Comprehensive reporting features

- Ability to issue multiple virtual cards with customizable controls

- Automated expense reporting and receipt matching

Cons:

- Mostly focuses on accounts payable and spend management

- Could offer more advanced accounting features

New Product Updates from Ramp

AI-Powered Policy Agents by Ramp for Real-Time Expense Review and Fraud Detection

Ramp's new AI-powered Policy Agents review expenses in real time to flag fraud and out-of-policy spending, interact with employees, and recommend policy improvements. For more details, visit Ramp Announcements.

Puzzle.io is an online accounting software built for startups and small businesses. It combines automation and real-time data to help you manage your finances without the usual complexity.

Why I picked Puzzle.io: One reason I chose Puzzle.io is its real-time financial reporting. Instead of waiting for month-end reports, you get daily drafts of your balance sheet, income statement, and cash flow statement. This lets you make quicker decisions and stay on top of your financial health. The platform also supports both cash and accrual accounting simultaneously, so you don't have to switch systems or juggle spreadsheets.

Standout features & integrations:

Features include automation of complex accounting tasks. It handles revenue recognition, prepaid expenses, fixed assets, and accounts payable/receivable through built-in accrual automation. This means you can manage GAAP-compliant books without needing a full accounting team. The AI also learns from your categorization habits, improving over time to reduce manual work.

Integrations include Stripe, Brex, Ramp, Rippling, and Gusto.

Pros and cons

Pros:

- Real-time dashboards provide immediate financial insights

- AI-powered transaction categorization

- Automated bank reconciliations ensure accuracy

Cons:

- May not be suitable for larger organizations

- Free trial requires users to connect a bank account

New Product Updates from Puzzle.io

Puzzle.io's Automated PDF Statement Loading

Puzzle.io has introduced automated PDF statement loading for Meow, streamlining the reconciliation process by eliminating manual downloads and uploads. For more details, visit Puzzle.io Product Updates.

QuickBooks Online is easy to use, even for people with no accounting experience, and is especially suited to the needs of small business owners and solopreneurs. All plans include a mobile app, user support, and app integration.

Why I picked QuickBooks Online: QuickBooks Online offers an all-in-one solution for managing finances, including invoicing, expense tracking, and payroll. Its user-friendly interface and automation features save time on administrative tasks, allowing business owners to focus on growth. With strong reporting and tax preparation tools, it ensures small businesses stay organized and compliant.

Standout features & integrations:

Features include the ability to automate your financial tasks, which saves time for more strategic activities. You can easily track income and expenses, giving you a clear view of your business's financial health. Additionally, QuickBooks provides customizable reports and dashboards, allowing you to focus on the metrics that matter most to your business.

Integrations include Shopify, PayPal, Square, Amazon, Etsy, Gusto, Stripe, TSheets, Mailchimp, and HubSpot.

Pros and cons

Pros:

- Security

- Integrations

- Breadth and quality of features

Cons:

- Occasional customer support issues

- Issues with transition from QuickBooks Desktop

FreshBooks is an online accounting platform designed for small service businesses. Its invoicing capabilities are a standout feature, allowing users to create professional invoices, track payments, and set up automatic payment reminders.

Why I picked FreshBooks: FreshBooks simplifies invoicing, time tracking, and expense management, making it easy to bill clients accurately and get paid faster. Its project management tools help teams collaborate and track progress, ensuring tasks stay on schedule. Additionally, FreshBooks offers detailed reporting to help service businesses understand their financial performance and make informed decisions.

Standout features & integrations:

Features include customizable invoices that allow you to create professional-looking invoices quickly and set automatic payment reminders for your clients. You can also track your billable hours with an automated time tracking feature, which helps ensure you charge accurately for your work. Plus, FreshBooks offers an easy way to manage your expenses, enabling you to categorize and attach receipts, making tax time a breeze.

Integrations include G Suite, Stripe, Gusto, PayPal, Mailchimp, HubSpot, Trello, Slack, Shopify, and Zoom.

Pros and cons

Pros:

- Reliability and adaptability

- Reporting and dashboards

- Branded and recurrent invoicing features

Cons:

- Mobile app needs improvements

- Occasional lag in automatic payments

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

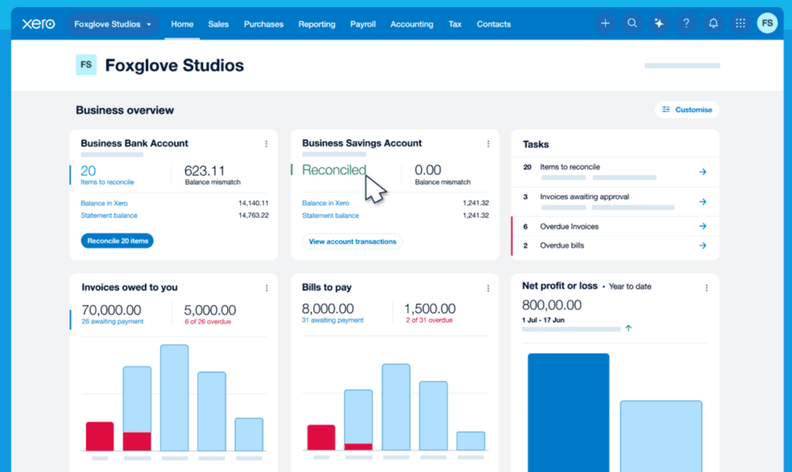

Xero is a global small business platform that offers comprehensive accounting features and is easy to use, even for people without accounting experience. Its mobile app also allows users to access their financial information from anywhere.

Why I picked Xero: Xero connects with over 1,000 third-party apps, allowing businesses to customize their workflows. Whether you need tools for ecommerce, payroll, inventory, or CRM, Xero’s integrations make it easy to sync data across platforms. This flexibility helps businesses streamline operations and adapt the software to their unique needs.

Standout features & integrations:

Features include the ability for you and your team to manage your business's finances with ease using real-time bank feeds. Additionally, you can generate detailed financial reports that offer insights into your business's performance, allowing you to make informed decisions. Finally, Xero offers an intuitive invoicing system that lets you create and send personalized invoices, helping you get paid faster and keep track of outstanding payments.

Integrations include Stripe, PayPal, HubSpot, Mailchimp, Shopify, Square, Gusto, Expensify, Microsoft 365, and Google Workspace.

Pros and cons

Pros:

- Security

- Real-time reporting

- Custom integrations and add-ons

- Intuitive user interface

Cons:

- No phone call support

- Issues with inventory management

New Product Updates from Xero

Xero Reimagined: New Homepage and Navigation Beta

Xero has unveiled its Reimagined beta with a redesigned homepage and improved navigation, featuring real-time financial insights for users. For more information, visit Xero's official site.

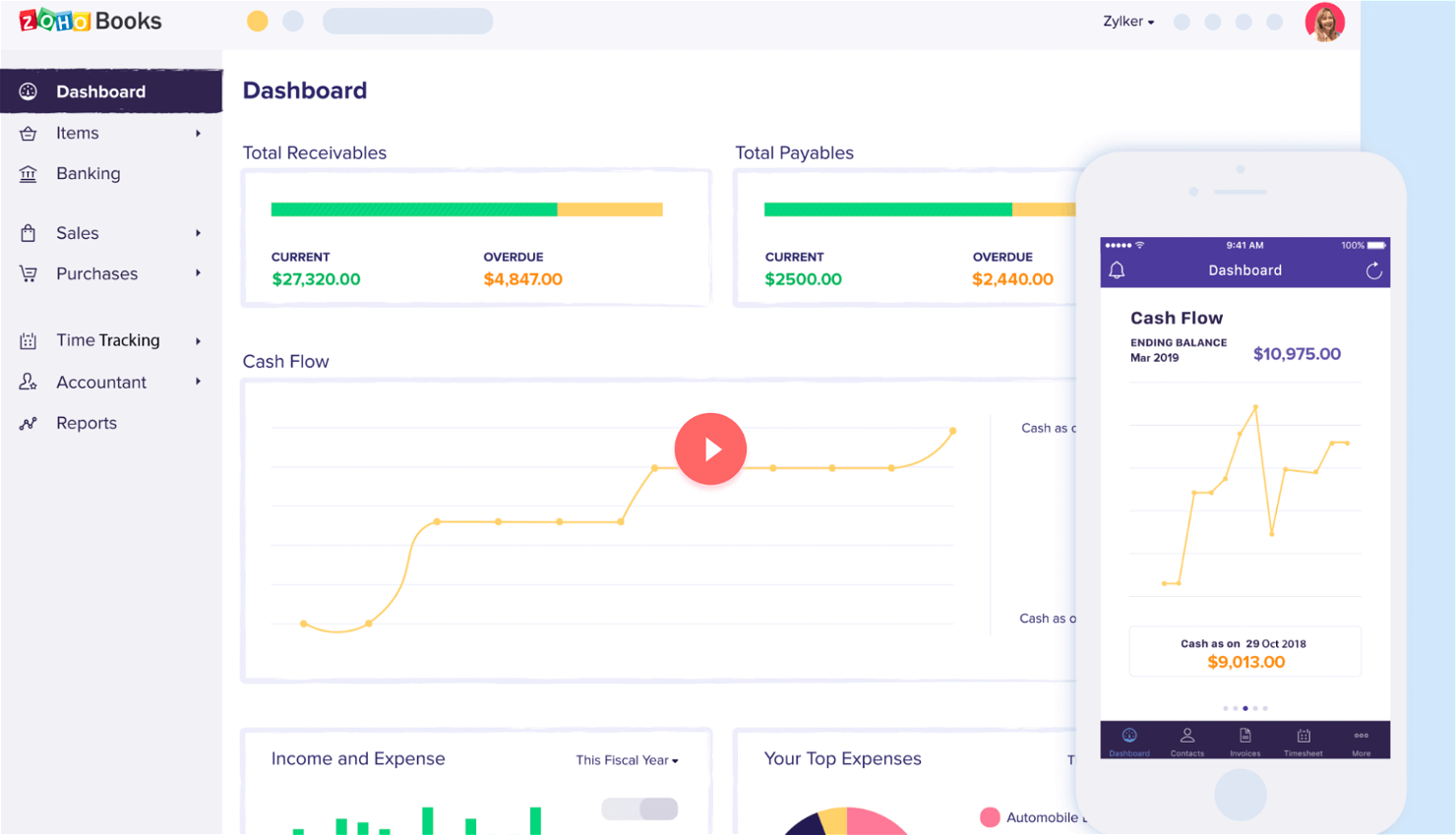

Zoho Books is the online accounting platform for growing businesses today, offering invoicing, expense tracking, inventory management, and financial reporting. Its user-friendly interface and automation features make it easy to use.

Why I picked Zoho Books: Zoho Books provides tools to create, track, and manage budgets for your business in real time. You can set financial goals, monitor expenses, and compare them against actual performance to stay on track. Plus, its intuitive dashboards and customizable reports make it easy to analyze spending patterns and make data-driven financial decisions.

Standout features & integrations:

Features include advanced financial management that allows you to handle invoicing and payroll integration seamlessly. You'll also find the inventory management feature particularly useful, as it synchronizes stock across ecommerce platforms, enabling efficient inventory tracking. Additionally, Zoho Books offers project accounting, which helps you manage budgets, track time, and bill clients accurately, ensuring clear insights into project profitability.

Integrations include Stripe, PayPal, Square, Authorize.Net, 2Checkout, Braintree, Zoho CRM, Zoho Projects, Zoho Analytics, Slack, G Suite, and Zapier.

Pros and cons

Pros:

- Customer support

- Integration with other Zoho products

- Simple external banking feeds

- Clean and clear layout

Cons:

- Inventory feature needs improvement

- Can't customize automated reports

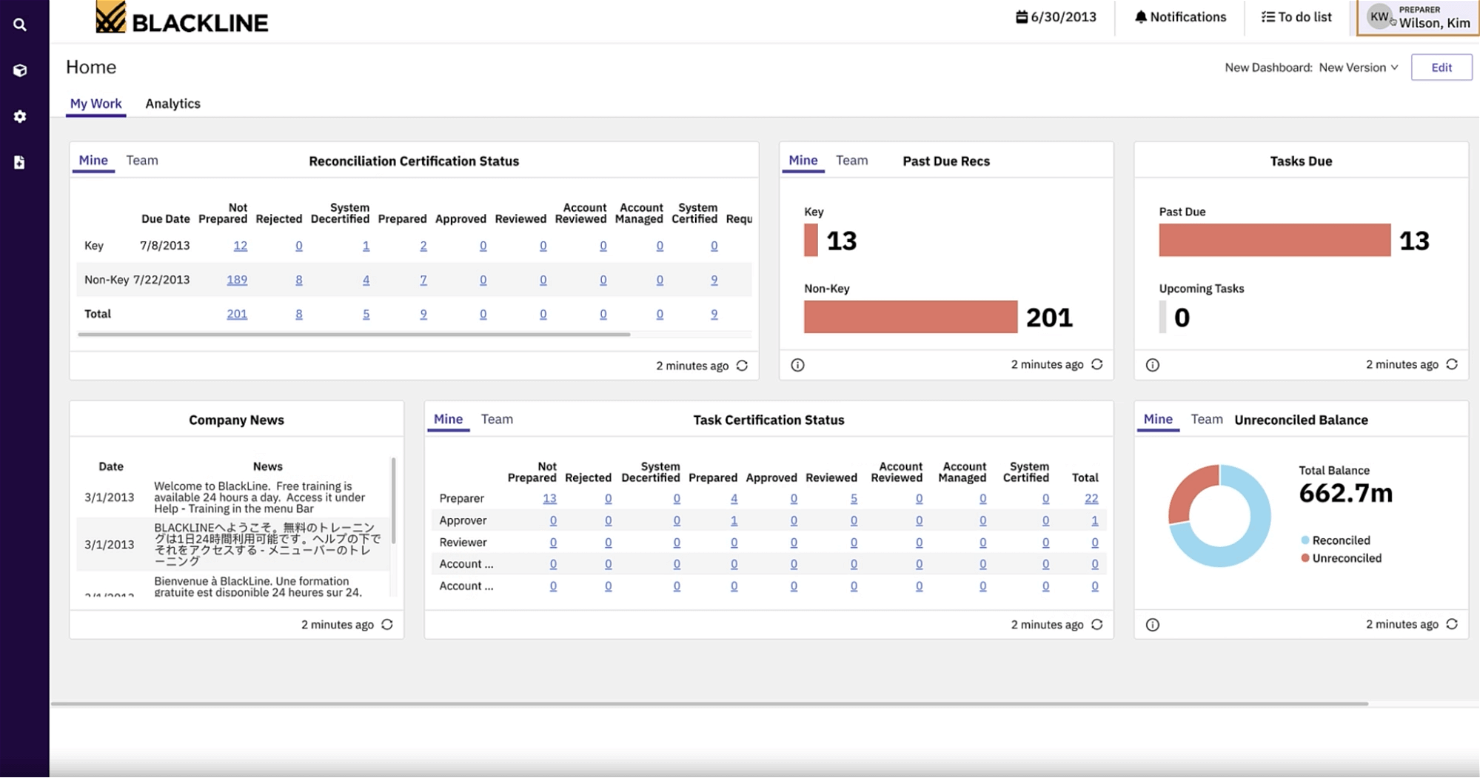

BlackLine is a cloud-based financial accounting software providing account reconciliation, journal entry management, and financial reporting. Its user-friendly platform offers helpful automation features, reducing manual data entry and minimizing errors.

Why I picked BlackLine: BlackLine automates key financial processes like account reconciliation and transaction matching, reducing the risk of errors and ensuring compliance. Its built-in audit trails and real-time dashboards provide transparency, helping teams identify and address discrepancies quickly. Plus, it supports segregation of duties and enforces policy adherence, strengthening overall financial governance.

Standout features & integrations:

Features include automated workflows that let you set up approval processes and assign tasks to your team. You can create and store custom templates to make repetitive tasks faster and easier. The software's real-time reporting also gives you up-to-date insights into your financial close process.

Integrations include SAP, NetSuite, Workday, QuickBooks, Xero, Microsoft Dynamics 365, Salesforce, Coupa, and Kyriba.

Pros and cons

Pros:

- Automation

- Real-time detailed reporting

- Reconciliation dashboard

Cons:

- Some integrations are very technical

TallyPrime is designed for global small and medium companies and prides itself on its simplicity. It offers a suite of accounting features and inventory management tools.

Why I picked TallyPrime: TallyPrime supports multi-currency transactions, making it easy to manage international payments and accounts. Its compliance features cover various tax systems, ensuring businesses meet regulatory requirements across regions. Additionally, TallyPrime’s ability to handle multiple languages and provide consolidated financial reports simplifies managing operations across different countries.

Standout features & integrations:

Features include easy invoice creation, which allows you and your team to generate invoices swiftly without errors. TallyPrime provides flexible inventory management, helping you keep track of stock levels efficiently. Additionally, with over 400 insightful business reports, you can make informed decisions that drive your business forward.

Integrations include WhatsApp, AWS, and support for custom solutions through a developer suite.

Pros and cons

Pros:

- Superb customer support

- Customizable reporting

- User-friendly interface

Cons:

- Limited invoicing template options

BQE CORE is a cloud-based accounting software designed specifically for professional service firms. It offers time and expense tracking, invoicing, project management, and financial reporting.

Why I picked BQE CORE: BQE CORE's automation features reduce administrative workload by streamlining invoicing, expense tracking, and resource allocation. Along with these key features, BQE CORE provides detailed analytics and reporting to help firms optimize profitability and manage projects more effectively.

Standout features & integrations:

Features include time tracking that lets you monitor your team's hours accurately. You can also use project management to keep all your tasks organized in one place. Additionally, the billing feature helps ensure you're invoicing clients promptly and accurately.

Integrations include QuickBooks, Xero, MYOB, Google Workspace, Microsoft Office 365, Dropbox, Evernote, Slack, Asana, and Salesforce.

Pros and cons

Pros:

- Excellent customer support

- Ability to customize invoicing and reporting

- Easy to track processes in one place

Cons:

- Invoice editing not user friendly

- Time-consuming to learn

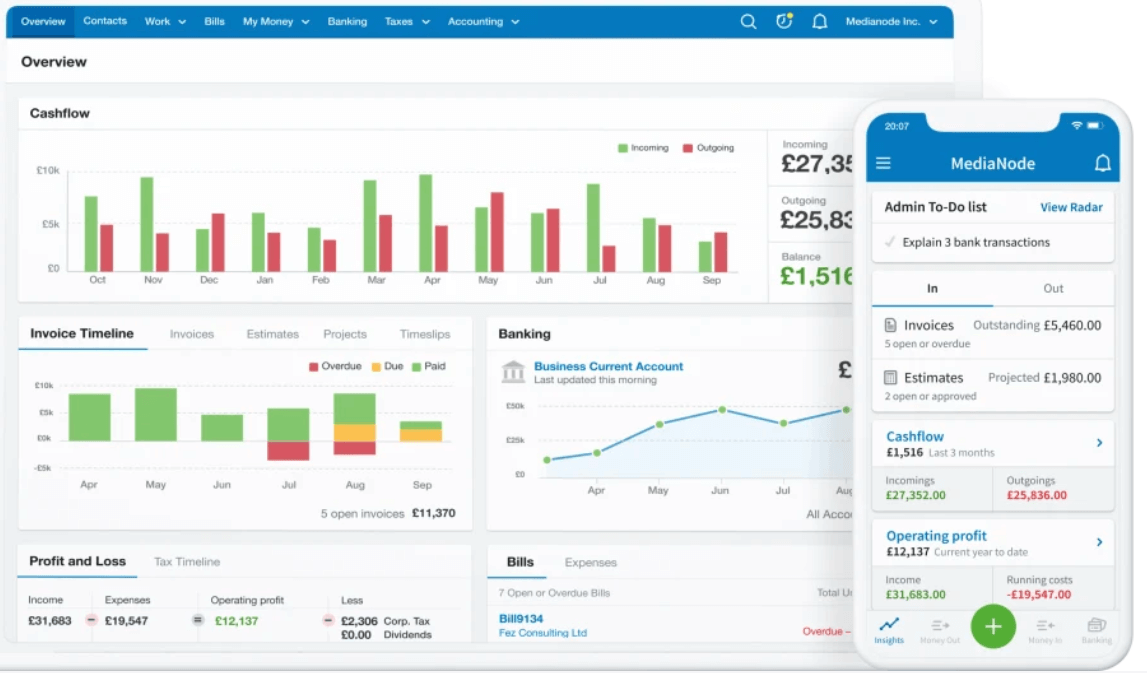

FreeAgent is an award-winning accounting software option for small businesses, freelancers, and contractors. It helps manage day-to-day administrative and accounting processes with ease.

Why I picked FreeAgent: FreeAgent simplifies accounting with easy-to-use tools for invoicing, expense tracking, and tax preparation, tailored to meet the needs of non-accountants. Its cloud-based platform offers seamless integration with banks and real-time insights into financial health, making it efficient for managing finances on the go. Additionally, it supports compliance with tax regulations, including VAT and self-assessment in the UK.

Standout features & integrations:

Features include tools for tracking your time directly within the app, which is great for billing your clients accurately. You can also manage projects by setting budgets and deadlines, helping you stay organized. Plus, automatic bank feeds pull your transactions into the software, so you don’t have to manually enter them.

Integrations include Zapier, PayPal, Stripe, GoCardless, HMRC, TaxJar, Mailchimp, Slack, Dropbox, and Google Workspace.

Pros and cons

Pros:

- One-stop solution for all accounting needs

- Sends reminders

- Intuitive and easy to use

Cons:

- Doesn't scale—strictly for small and micro-businesses

- Mobile app is slightly buggy

Other Online Accounting Software

Here are some additional online accounting software options that didn’t make it onto my shortlist, but are still worth checking out:

- WAVE

Free accounting software

- TrulySmall

For small businesses needing simple financial management

- Aplos

For nonprofits

- Veryfi

For managing time and expenses

- DualEntry

For AI-driven bank matching

- Sage Intacct

For using AI

- Acumatica

For managing financial data

- SAP Business One

For financial forecasting

- Sage 50cloud

For automation and security

- ZarMoney

For flexibility

Online Accounting Software Selection Criteria

To create this list of the best online accounting software for small businesses, startups, and nonprofits, I focused on what matters most: usability, time-saving features, and real-world problem solving. Each option was evaluated using the following framework to ensure it meets everyday needs.

Core Functionality (25% of total score)

To be considered for inclusion in this list, each solution had to fulfill these common use cases:

- Manage accounts payable and receivable

- Track expenses and income

- Generate financial reports and ledgers

- Reconcile bank statements

- Support multiple currencies

Additional Standout Features (25% of total score)

To help further narrow down the competition, I also looked for unique features, such as:

- Automated tax calculations

- Integration with e-commerce platforms

- Customizable dashboards

- Machine learning for predictive insights

- Mobile app functionality

Usability (10% of total score)

To get a sense of the usability of each system, I considered the following:

- Intuitive user interface

- Minimal learning curve

- Customizable interface options

- Accessibility features

- Efficiency in performing tasks

Onboarding (10% of total score)

To evaluate the onboarding experience for each platform, I considered the following:

- Availability of training videos

- Interactive product tours

- Access to webinars and workshops

- Comprehensive user manuals

- 24/7 customer support during onboarding

Customer Support (10% of total score)

To assess each software provider’s customer support services, I considered the following:

- 24/7 live chat support

- Availability of phone support

- Comprehensive FAQ section

- Community forums for peer support

- Dedicated account managers

Value For Money (10% of total score)

To evaluate the value for money of each platform, I considered the following:

- Competitive pricing tiers

- Flexible subscription models

- Free trial availability

- Discounts for annual payments

- Features offered in relation to cost

Customer Reviews (10% of total score)

To get a sense of overall customer satisfaction, I considered the following when reading customer reviews:

- Overall satisfaction ratings

- Feedback on customer support experiences

- User experience with software updates

- Reports of software reliability

- Opinions on pricing fairness

How to Choose Online Accounting Software

Choosing the right accounting software can feel overwhelming with so many features and pricing options to sift through. This simple, practical checklist is designed to help you focus on what truly matters for your business or organization.

| Factor | What to Consider |

|---|---|

| Scalability | Ensure the software can grow with your business, accommodating more transactions and users without a hitch. |

| Integrations | Verify it connects with other tools your team uses, like CRM, ERPs, or payroll, for seamless data flow. Ensure it also can run on your chosen computer software (i.e. Mac or Windows). |

| Customizability | Look for options that let you tailor features and reports to fit your specific accounting needs. |

| Ease of Use | Choose software with an intuitive interface to reduce training time and improve user satisfaction. |

| Budget | Assess total cost, including hidden fees. Make sure it aligns with your financial plan. |

| Security Safeguards | Check for strong data protection measures, such as encryption and regular backups. This is especially important if you work in highly regulated sectors or SaaS companies. |

| Customer Support | Opt for providers that offer reliable support to resolve any issues your team encounters swiftly. |

| Reporting Features | Ensure the software provides detailed and customizable financial reports to aid decision-making. |

Trends in Online Accounting Software

I dug through tons of product updates, press releases, and release logs from online accounting software vendors to spot what’s new and exciting. Here are some of the top trends catching my attention:

- Blockchain Integration: Blockchain technology offers enhanced security and transparency in financial transactions. This is becoming increasingly important for businesses looking to ensure the integrity of their financial data.

- AI-Powered Analytics: Artificial intelligence is being utilized to provide deeper insights into financial data. AI algorithms can now identify trends and anomalies that might be missed by manual analysis, helping businesses make informed decisions.

- Real-Time Financial Monitoring: Businesses are demanding real-time access to their financial data to make quicker decisions. This trend is being addressed by accounting software vendors offering dashboards and tools that provide live updates on cash flow and expenses.

- Enhanced Data Security: With increasing cyber threats, data security is a top priority. As such, advanced encryption methods and secure cloud storage are being adopted to protect sensitive financial information for everyone from startups to highly regulated corporations.

- Customizable Reporting Features: Companies need reporting tools tailored to their specific requirements. Therefore, software vendors, like FreshBooks, are offering more customizable reporting options to cater to diverse business needs, allowing users to generate specific reports that align with their unique business goals.

What is Online Accounting Software?

Online accounting software refers to a web-based tool used to help businesses perform various accounting tasks, such as recording transactions, generating financial reports, and managing invoices, using web browsers or dedicated applications.

Among the features that make these tools special are real-time financial reporting, invoicing, expense tracking, bank reconciliation, and collaboration tools. Overall, these help simplify financial management, improve accuracy, and enhance collaboration among users, regardless of their physical location or size (SMBs or large corporations).

Features of Online Accounting Software

When choosing online accounting software, here are the key features you’ll want to have on your radar:

- Invoicing and Billing: Helps businesses create, send, and manage invoices, ensuring timely payments for accounts payable and receivable, and tracking outstanding balances.

- Expense Tracking: Allows users to record and categorize expenses, making it easier to monitor cash flow and prepare for tax season.

- Financial Reporting: Generates detailed reports like profit and loss statements or balance sheets, aiding in informed decision-making and financial analysis for businesses and agencies.

- Bank Reconciliation: Connects with bank accounts to automatically match transactions, reducing errors and saving time in financial management.

- Multi-Currency Support: Facilitates transactions in various currencies, supporting businesses or self employed professionals that operate internationally or deal with foreign clients (like hotel chains).

- Project Accounting: Enables tracking of revenues and expenses for specific projects, providing insight into project profitability and budget management.

- Inventory Management: Monitors stock levels and automates reordering, helping businesses maintain optimal inventory and avoid stockouts.

- Tax Management: Assists in calculating and filing taxes accurately by keeping track of tax rates and ensuring compliance with regulations.

- Mobile Access: Offers access to accounting tools from mobile devices, allowing users to manage finances on the go.

- Integration Capabilities: Connects with other software like CRM or payroll systems, enhancing overall business operations and data consistency.

Benefits of Online Accounting Software

Switching to online accounting software comes with some awesome perks for both your team and your business. Here’s what you can look forward to:

- Accessibility: Access your financial data from anywhere with an internet connection, which supports remote work and on-the-go decision-making.

- Collaboration: Multiple team members can work on the same financial data simultaneously, improving teamwork, reducing bottlenecks, and streamlining workflows.

- Real-Time Updates: Automatically sync and update financial information, ensuring everyone has the latest data for accurate reporting and analysis.

- Cost Efficiency: Reduce the need for physical storage and hardware, as well as minimize IT maintenance costs, by using cloud services.

- Security: Benefit from advanced security measures like encryption and multi-factor authentication to protect sensitive financial information. This is of value for larger businesses or businesses in compliance-based industries.

- Scalability: Easily adjust your service plan to match the changing needs of your business, whether you're expanding or downsizing.

- Integration: Connect with various business tools like CRM and payroll systems to streamline operations and improve data accuracy across single or multiple companies.

Costs and Pricing of Online Accounting Software

Choosing the right online accounting software is about finding the best value for your needs, whether you're a solo freelancer or managing a growing team. The table below compares common plans, pricing, and essential features to help you make a smart, time-saving decision.

Plan Comparison Table for Online Accounting Software

| Plan Type | Average Price | Common Features |

|---|---|---|

| Free Plan | $0 | Basic invoicing, expense tracking, and limited reporting. |

| Personal Plan | $5-$15/user/month | Invoicing, bank reconciliation, and basic customer support. |

| Business Plan | $20-$50/user/month | Advanced reporting, multi-user access, and inventory management. |

| Enterprise Plan | $100+/user/month | Customizable features, dedicated support, and enhanced security. |

Online Accounting Software FAQs

Here are some common questions and answers about buying online accounting software.

What are the benefits of using online accounting software?

Online accounting software tools can streamline your accounting processes, save time and money, and provide real-time insight into your financial performance. More specifically it:

- Offers access from wherever you are on different devices.

- Often helps you save on costs because you don’t need expensive hardware and installations. You’ll also save on onsite maintenance.

- Enhances collaboration, and many users can access the same data simultaneously.

- Shifts financial data security and costs from you to the online accounting software provider.

- Streamlines operations for project management.

What is the most popular online accounting software provider?

There are different popular options depending on region, industry, and business size. However, QuickBooks Online is the most popular option amongst small and medium businesses globally, with over 7 million customers.

Which software is easiest to use?

Which online accounting software tool users consider most intuitive depends on how versed the user is in accounting and their business needs. FreshBooks has earned high marks, however.

How do I migrate my data from my current accounting software to a new online accounting software?

Migrating data from your current accounting software to a new online platform can be a complex process, but most online accounting software providers offer detailed guides and support to help you through it. Typically, the process involves exporting your data from the old system in a compatible format (such as CSV or Excel), and then importing it into the new system. Some providers also offer migration services where their team will handle the entire process for you. It’s crucial to back up your data before starting the migration to prevent any loss of information.

Can online accounting software integrate with other business tools and applications?

Yes, most online accounting software can integrate with a variety of other business tools and applications. Common integrations include CRM systems, e-commerce platforms, payroll services, and payment gateways. These integrations help streamline your business processes by ensuring that data flows seamlessly between different systems, reducing the need for manual data entry and minimizing errors. Check the software’s integration capabilities and supported applications before making a decision.

What security measures are in place to protect my financial data in online accounting software?

Online accounting software providers implement several security measures to protect your financial data. These typically include data encryption, secure socket layer (SSL) technology, two-factor authentication (2FA), and regular security audits. Additionally, reputable providers often have compliance certifications such as SOC 2, ISO 27001, and GDPR, which indicate that they adhere to stringent data protection standards. Always review the security features and certifications of the software to ensure your data is well-protected.

What's Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter.