Best Financial ERP Software Shortlist

Here’s my pick of the 10 best software from the 27 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

Choosing the right financial ERP software can be challenging with so many options available. You need a tool to manage finances, streamline operations, and improve decision-making. A good financial ERP integrates financial processes into a single system, reduces errors, saves time, and provides real-time insights, addressing issues like data silos, manual errors, and inefficient processes.

Based on my experience with various financial management tools, my team of software analysts and I can help you find the best fit. This guide will help you navigate through the top financial ERP software options, comparing features, pros and cons, and pricing. We aim to equip you with the knowledge to select the best tool that fits your organization’s needs and supports your financial goals.

Why Trust Our Software Reviews

We’ve been testing and reviewing ERP software since 2023. As financial operators ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our ERP software review methodology.

Best Financial ERP Software Summary

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for full financial management and analytics | Free demo available | From $180/user/month | Website | |

| 2 | Best for multichannel retail operations | Free demo available | Pricing available upon request | Website | |

| 3 | Best for unifying finance and HR on one platform | Free demo available | Pricing upon request | Website | |

| 4 | Best for preconfigured ERP solutions | Free demo available | Pricing upon request | Website | |

| 5 | Best for service-centric ERP solutions | Not available | Pricing upon request | Website | |

| 6 | Best for accountant-built financial ERP | Free demo available | Pricing upon request | Website | |

| 7 | Best for detailed financial management features | Not available | Pricing upon request | Website | |

| 8 | Best for professional services automation | Free demo available | Pricing upon request | Website | |

| 9 | Best for cloud-based manufacturing ERP | Not available | Pricing upon request | Website | |

| 10 | Best for industry-specific solutions | 30-day free trial | From $0.75/unit/month (600 units and 3-month contract minimum) | Website |

-

LiveFlow

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Float Financial

Visit Website -

Vena

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Financial ERP Software Reviews

Here is my detailed analysis of the top financial ERP software, highlighting their strengths and limitations. Each review provides in-depth insights into their features and the best use cases for each tool.

Best for full financial management and analytics

Microsoft Dynamics 365 offers detailed financial management, advanced analytics, and smooth integration with other Microsoft products to optimize business operations.

Why I picked Microsoft Dynamics 365: I chose Microsoft Dynamics 365 for its seamless integration with Microsoft products, which sets it apart from other financial ERP software. This integration ensures a unified experience across different Microsoft applications, enhancing productivity and ease of use.

Standout Features & Integrations:

Features include detailed financial management, supply chain management, and customer service capabilities. The software also offers advanced analytics and AI for actionable insights.

Integrations include Microsoft Office 365, Microsoft Azure, Power BI, Power Apps, Power Automate, LinkedIn, Outlook, SharePoint, OneDrive, and Teams.

Pros and cons

Pros:

- Advanced analytics

- Integrates with the Microsoft ecosystem

- Integrated financial management

Cons:

- Slight learning curve

- Higher cost

Brightpearl is a retail operating system designed for multichannel ecommerce businesses. It excels in streamlining operations, boosting efficiency, and helping businesses stay ahead in a fast-changing retail landscape.

Why I picked Brightpearl: I chose Brightpearl for its capabilities in managing multichannel retail operations. Its automation features save time and reduce errors, making it ideal for businesses operating across multiple sales channels. Brightpearl's integration with various ecommerce platforms and advanced inventory planning tools make it a great choice for multichannel retail operations.

Standout Features & Integrations:

Features include advanced inventory planning and an automation engine that handles complex order fulfillment and multi-location inventory management. Brightpearl also offers retail analytics and business intelligence tools to help businesses make informed decisions.

Integrations include Shopify, Amazon, BigCommerce, Magento, eBay, QuickBooks, Lightspeed, Shipstation, Dotdigital, and Xero.

Pros and cons

Pros:

- Detailed retail analytics

- Advanced inventory planning

- Automated operational features

Cons:

- Limited customization options for specific business needs

- May require extensive setup

Workday is an enterprise management cloud solution that unifies finance and HR on one platform. It provides a smooth integration that aims to help operational efficiency and decision-making.

Why I picked Workday: I chose Workday for its modern integration of finance and HR functionalities into a single platform. This integration can help simplify data management and enhance real-time decision-making. Workday's continuous innovation and AI-driven insights are also great assets for unifying financial and human resources operations.

Standout Features & Integrations:

Features include financial management, spend management, payroll, human capital management, workforce management, talent management, analytics & reporting, and workforce planning. These features can help businesses manage costs and enable smarter financial decisions.

Integrations include Salesforce, Microsoft Azure, Google Cloud, Slack, ServiceNow, ADP, SAP, Oracle, IBM, and Amazon Web Services.

Pros and cons

Pros:

- Continuous innovation

- Real-time insights

- Unified finance and HR platform

Cons:

- Custom reporting can be complex and time-consuming to set up

- Pricing not publicly available

Infor is an ERP solution designed to manage business operations, including finance, human resources, and supply chain. It excels in industry-specific cloud solutions with tailored functionalities for various industries.

Why I picked Infor: I chose Infor for its industry-specific preconfigured solutions, which set it apart from other financial ERP software. Its cloud-based solutions are tailored to meet the unique challenges of various sectors, providing preconfigured solutions that address unique industry needs. It stands out for its deep industry expertise and ability to deliver customized, ready-to-use ERP systems that minimize implementation time.

Standout Features & Integrations:

Features include real-time data analysis, automation of complex business processes, and a wide array of financial management tools. These features enable businesses to make data-driven decisions and organize operations efficiently.

Integrations include Amazon Web Services (AWS), Salesforce, Microsoft Azure, IBM, Oracle, Google Cloud, SAP, Workday, Tableau, and Slack.

Pros and cons

Pros:

- Detailed financial tools

- Real-time data analysis

- Industry-specific solutions

Cons:

- Customization can be limited depending on specific industry needs

- Slightly complex setup

Ramco ERP is a financial-focused ERP software designed to optimize operations across various industries. It is best known for its service-centric ERP solutions, ideal for businesses focused on services.

Why I picked Ramco ERP: I chose Ramco ERP for its service-centric capabilities, which set it apart from other financial ERP software. Its focus on industries like staffing, professional services, and facility management make it a unique solution for those industries. Ramco ERP is best for service-centric ERP solutions due to its extensive features tailored for service-oriented businesses, ensuring efficient management and operational excellence.

Standout Features & Integrations:

Features include full financial management covering payables, receivables, fixed assets, general accounting, and costing. The software also offers real-time ledger and sub-ledger reconciliations, multi-location, multi-country, and multi-currency support, and compliance with financial and regulatory standards.

Integrations include Salesforce, Microsoft Dynamics 365, Oracle, SAP, QuickBooks, Xero, Zoho, FreshBooks, Sage, and Tally.

Pros and cons

Pros:

- Multi-currency support

- Real-time reconciliations

- Full financial management features

Cons:

- Complex setup process

- Pricing not transparent

Multiview ERP is a cloud-based accounting software designed for various industries, offering features such as budgeting, forecasting, materials management, and month-end processes. It is best for accountant-built financial ERP due to its design by accountants, ensuring it meets real-world financial needs.

Why I picked Multiview ERP: I chose Multiview ERP for its unique approach of being built by accountants, ensuring it meets the practical needs of financial professionals. This makes it stand out from other financial ERP software by offering features directly relevant to accounting practices. It also integrates real-world financial knowledge into its design, making it highly effective for financial management.

Standout Features & Integrations:

Features include dynamic reporting capabilities, advanced financial insights, and scalability to meet diverse user needs. Multiview ERP promotes transitioning from manual to automated accounting processes and offers resources such as articles, videos, webinars, and a blog.

Integrations include Cerner, Avalara, Ancora, QuickBooks, Salesforce, Microsoft Dynamics 365, SAP, Oracle, Sage, and NetSuite.

Pros and cons

Pros:

- Scalable solution

- Dynamic reporting capabilities

- Advanced financial insights

Cons:

- Integration challenges with certain third-party applications

- Limited mobile access

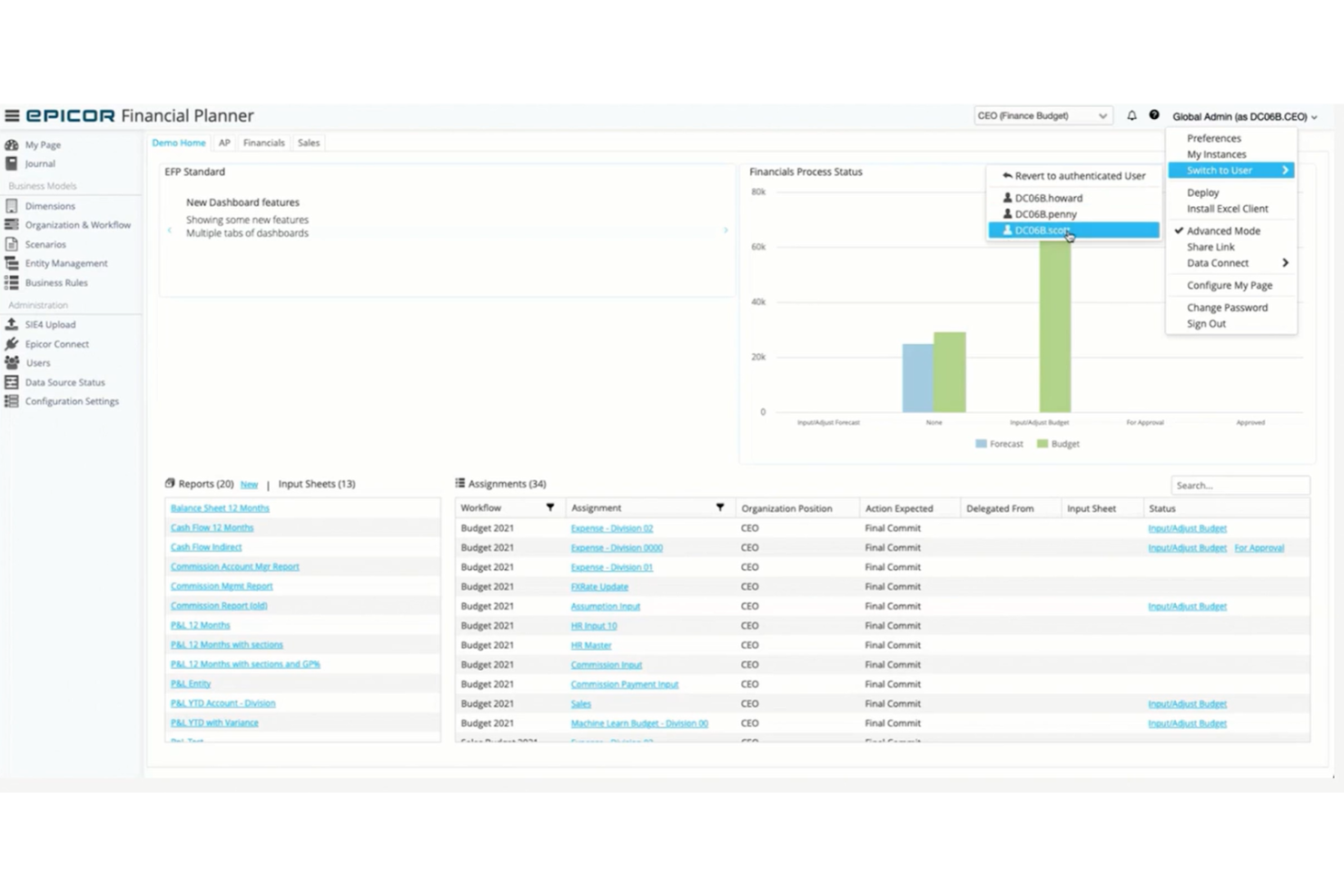

Epicor Financial Management is an ERP software solution designed to meet the financial needs of various industries, offering robust financial management features.

Why I picked Epicor Financial Management:I chose Epicor Financial Management for its extensive range of financial management capabilities that cater to diverse industry needs. The software stands out due to its flexibility, scalability, and integration with other essential business modules. I believe it is best for detailed financial management features because it provides advanced tools for budgeting, forecasting, cash flow management, and compliance, making it a top choice for businesses looking to hone in on their financial operations.

Standout Features & Integrations:

Features include customizable data queries, live dashboards, and reports, as well as enhanced KPI and data visualization. The system supports machine learning for budget planning and offers mobile applications for improved workforce efficiency. Additionally, it provides a strategic financial overview for managing multiple sites and companies.

Integrations include Microsoft Teams, Avalara, Workato, Salesforce, Oracle, SAP, QuickBooks, ADP, PayPal, and Stripe.

Pros and cons

Pros:

- AI-powered applications

- Scalable and flexible

- Variety of financial tools

Cons:

- Customization options can be limited for specific needs

- Pricing not transparent

Certinia is a cloud-based PSA and ERP software on the Salesforce platform, designed to improve cash flow, project profitability, and employee utilization. It is ideal for professional services automation, offering tools to manage project profitability, resource utilization, and customer satisfaction within the Salesforce ecosystem.

Why I picked Certinia: I chose Certinia for its professional services automation capabilities and deep integration with Salesforce. This integration allows collaboration across business functions, making it unique compared to other financial ERP software. Certinia excels in professional services automation with real-time project tracking, resource management, and billing solutions, essential for maintaining project profitability and customer satisfaction.

Standout Features & Integrations:

Features include project profitability tracking, resource management, and full-featured billing solutions, helping businesses manage projects efficiently and stay on time and within budget while ensuring customer satisfaction.

Integrations include Salesforce, Slack, Microsoft Teams, Google Workspace, Jira, Concur, Docusign, QuickBooks, Xero, and HubSpot.

Pros and cons

Pros:

- Thoughtful billing solutions

- Real-time project tracking

- Deep Salesforce integration

Cons:

- Limited to Salesforce ecosystem

- Pricing not transparent

Plex Systems ERP is a cloud-based manufacturing ERP providing niche solutions for manufacturers. It excels in cloud-based manufacturing ERP with real-time visibility and control over the entire production lifecycle.

Why I picked Plex Systems ERP: I chose Plex Systems ERP for its integration of ERP and MES functionalities, tailored specifically for manufacturing industries. This specialization sets it apart from other financial ERP software. Plex Systems ERP is ideal for cloud-based manufacturing, offering real-time insights and control to ensure unified operations from the shop floor to the top floor.

Standout Features & Integrations:

Features include real-time production lifecycle visibility, detailed financial management, and full traceability and operations monitoring. These features ensure that manufacturers can maintain quality, mitigate risks, and protect their brand reputation.

Integrations include Salesforce, QuickBooks, Microsoft Dynamics 365, SAP, Oracle, NetSuite, ADP, Paychex, Avalara, and Shopify.

Pros and cons

Pros:

- Full traceability

- Detailed financial management

- Real-time production insights

Cons:

- May require extensive setup

- Pricing not transparent

SAP S/4HANA is an ERP solution designed for diverse business needs, from mission-critical operations to business model innovation. It excels in providing tailored, industry-specific ERP capabilities, helping businesses drive innovation and unlock efficiencies.

Why I picked SAP S/4HANA: I chose SAP S/4HANA for its industry-specific solutions, which is great for businesses needing tailored ERP systems. Its integration of AI and analytics helps businesses create innovation and efficiency. SAP S/4HANA is best for those needing industry-specific solutions due to its proven business processes and intelligent automation adaptable to various industry requirements.

Standout Features & Integrations:

Features include AI and analytics capabilities, intelligent automation, and industry best practices. These features help businesses drive innovation, improve operational efficiency, and adapt to changing market conditions.

Integrations include Microsoft Office 365, Salesforce, Google Workspace, Amazon Web Services (AWS), Microsoft Azure, IBM Cloud, Oracle Cloud, ServiceNow, Slack, and Dropbox.

Pros and cons

Pros:

- Proven business processes

- AI and analytics capabilities

- Industry-specific solutions

Cons:

- Slight learning curve

- Complex implementation

Other Financial ERP Software

Below is a list of additional financial ERP software that we shortlisted, but did not make it to the top list. Definitely worth checking them out.

- QAD

For adaptive manufacturing and supply chain solutions

- Deskera

For all-in-one business management

- DualEntry

For direct CPA support

- Oracle ERP

For comprehensive financial management

- TallyPrime

For small business accounting

- Sage Intacct

For real-time financial insights

- Cin7 Core

For inventory management integration

- ERPNext

For open-source financial management

- Exact Globe

For international financial management

- SAP ERP

For large-scale enterprise solutions

- Abas ERP

For mid-sized manufacturing companies

- Genius ERP

For custom manufacturing operations

- SYSPRO

For manufacturing and distribution sectors

- IFS

For asset management and service industries

- Odoo ERP

For modular and customizable solutions

- Acumatica Cloud ERP

For flexible deployment options

- Priority ERP

For user-friendly interface

Selection Criteria For Financial ERP Software

Selecting financial ERP software involves evaluating its functionality and suitability for specific use cases crucial to the buyer. The criteria address the needs and pain points of the software buyer, ensuring effective use for financial management, reporting, and compliance. Key features typically include core financial management, advanced analytics, integration capabilities, scalability, and user-friendly interfaces.

Core Functionality (25% of Total Weighting Score):

- General Ledger Management

- Accounts Payable and Receivable

- Financial Reporting and Analytics

- Budgeting and Forecasting

- Compliance and Audit Management

Additional Standout Features (25% of Total Weighting Score):

- Integration with third-party applications

- Advanced AI-driven analytics

- Customizable dashboards and reports

- Mobile accessibility

- Real-time data processing

Usability (10% of Total Weighting Score):

- Intuitive user interface with minimal learning curve

- Customizable workflows and processes

- Drag-and-drop functionality for ease of use

- Clear and concise navigation menus

- Responsive design for various devices

Onboarding (10% of Total Weighting Score):

- Availability of comprehensive training videos and tutorials

- Interactive product tours and walkthroughs

- Pre-built templates for quick setup

- Access to chatbots and live support during onboarding

- Regular webinars and training sessions

Customer Support (10% of Total Weighting Score):

- 24/7 customer support availability

- Multiple support channels (phone, email, chat)

- Dedicated account managers

- Fast response times and resolution rates

- Access to a knowledge base and community forums

Value For Money (10% of Total Weighting Score):

- Competitive pricing models

- Transparent pricing with no hidden fees

- Flexible subscription plans

- Discounts for long-term commitments

- ROI and cost-benefit analysis

Customer Reviews (10% of Total Weighting Score):

- Overall satisfaction ratings

- Feedback on ease of use and functionality

- Comments on customer support experiences

- Reviews on the software's reliability and performance

- Testimonials on the software's impact on business operations

How to Choose Financial ERP Software

As you work through your own unique software selection process, keep the following points in mind:

- Identify Business Requirements: Before selecting a financial ERP, understand your business's specific needs by reviewing current processes and identifying areas for improvement. For example, if you manage multiple subsidiaries or foreign currency transactions, choose an ERP that supports these features. Some tools, for instance, may offer extensive support for international business requirements, including multiple languages and currencies, which could be advantageous for global operations.

- Evaluate Integration Capabilities: An ERP system should integrate well with your existing and future software, ensuring all business processes are connected and providing a single source of truth for financial data. For example, if you use specific AP or AR platforms, ensure the ERP can integrate with these systems to avoid manual data entry and errors. Many leading ERPs offer robust APIs and pre-built integrations with popular business and banking applications, saving time and reducing complexity during implementation.

- Consider Scalability and Flexibility: Your ERP should meet current needs and scale with your business as it grows, supporting additional users, subsidiaries, and new processes without a complete overhaul. For example, you may want to consider a cloud-based ERP solution that will allow for easy scalability and may be ideal for businesses planning significant growth or expansion into new markets.

- Assess Vendor Reputation and Support: The reputation of the ERP vendor and the quality of their support services are also a good indication of overall user experience. Choose vendors with a proven industry track record and positive reviews ( or poor experiences that were addressed and rectified.) Consider the level of support offered, including implementation assistance, training, and ongoing technical support.

- Determine Total Cost of Ownership: The cost of an ERP system includes more than the initial purchase price. It encompasses implementation, training, customization, and ongoing maintenance. Understanding all these costs helps to avoid budget overruns. For instance, cloud-based ERPs often have lower upfront costs compared to on-premises solutions, but you must consider subscription fees and potential costs for additional modules or users. Some vendors also offer free ERP software to help small businesses and startups with initial costs, but they may come with fees for add-on services.

Trends For Financial ERP Software

Here are some trends in financial ERP software and their potential impact on the business finance industry.

- AI and Machine Learning Integration: AI and machine learning are being integrated into financial ERP systems. These technologies help automate routine tasks and provide predictive analytics. This trend is important for improving decision-making and efficiency.

- Cloud-Based Solutions: Cloud-based ERP solutions are becoming more prevalent. Cloud ERP benefits include scalability and remote access, which are crucial for modern businesses and firms, like property management or real estate. This trend is interesting due to its impact on operational flexibility.

- Enhanced Data Security: Data security features are being significantly improved in ERP systems. With increasing cyber threats, enhanced security measures are essential. This trend will likely become a growing standard for protecting sensitive financial information.

- Real-Time Analytics: Real-time analytics capabilities are being embedded into ERP software. This allows businesses to make quicker, data-driven decisions when it comes to financial services. The immediacy of insights makes this trend particularly valuable.

- Mobile Accessibility: ERP systems are increasingly accessible via mobile devices. This supports on-the-go management and real-time updates. For example, Microsoft Dynamics offers mobile access to streamline operations.

What Is Financial ERP Software?

Financial ERP software integrates various financial processes within an organization into a single system. It is used by finance professionals, accountants, and business managers to manage transactions, reporting during consolidation and close processes, and compliance efficiently.

The primary components include general ledger, accounts payable, accounts receivable, fixed assets, and financial reporting modules. These components provide a unified view of the organization's financial health, unify operations, and ensure accurate data management.

Features of Financial ERP Software

When selecting financial ERP software, it's helpful to identify specific features that best support your business's financial management needs. Financial ERP systems integrate various financial processes into a single platform, enhancing efficiency, accuracy, and strategic decision-making. Below are the key features we have highlighted for you to look for in financial ERP software.

- Integration Capabilities: Integration with other business modules such as inventory management, human resources, and supply chain can help minimize workflow disruption and bottlenecks. This ensures data can flow across departments, reducing manual data entry and errors, and providing a holistic view of the organization's financial health.

- Scalability: The software should be scalable to accommodate business growth. Whether you're a small startup or a large enterprise, the ERP system should handle increasing data volumes, user numbers, and transaction complexities without compromising performance.

- Regulatory Compliance and Security: Compliance with financial regulations is a constant challenge, especially in healthcare and retail. The ERP system should have built-in compliance features to ensure adherence to local and international standards. Diligent security measures, including data encryption, role-based access controls, and audit trails, are recommended to safeguard sensitive financial information.

- User-Friendly Interface: A user-friendly interface ensures that your team can navigate the system efficiently, reducing the learning curve and increasing productivity. The software should be accessible from multiple devices and platforms, allowing users to perform financial tasks remotely.

- Automation: Automation of routine tasks such as data entry, invoice processing, and reconciliation enhances efficiency and accuracy. Automation minimizes the risk of human error, contributing to more reliable financial data, which can be used during consolidation and close processes.

- Real-Time Data Updates: Real-time data is crucial for making informed decisions. The ERP system should provide real-time updates, ensuring that financial data is accurate and up-to-date. This empowers businesses to respond promptly to changing market conditions.

- Detailed Financial Reporting: The ability to generate comprehensive financial reports, from balance sheets to income statements, is a great way to minimize administrative tasks, synchronize data, and reduce the risk of manual errors. Advanced analytics tools should enable businesses to gain valuable insights into their financial performance, facilitating strategic decision-making.

- Accounts Payable and Receivable Management: Managing outgoing and incoming payments efficiently is vital. The ERP system should automate the invoicing and payment collection processes, improving cash flow management and reducing the risk of errors.

- Budgeting and Forecasting: Effective budgeting and forecasting tools are helpful for financial planning. The ERP system should support the creation of detailed budgets and forecasts, helping businesses plan for the future and allocate resources effectively.

- Risk Management: The ERP system should include tools for identifying, assessing, and mitigating financial risks. This feature helps businesses proactively manage risks, devise strategies to minimize their impact, and make informed decisions.

Benefits of Financial ERP Software

Financial ERP software integrates various financial processes within an organization into a single system. This integration supports operations, improves accuracy, and provides valuable insights for better decision-making. Below are five main benefits of financial ERP software for users and organizations.

- Improved Efficiency and Productivity: By automating routine financial tasks such as accounts payable, receivable, and general ledger accounting, financial ERP software frees up staff time for more strategic activities like financial analysis, thereby enhancing overall productivity.

- Enhanced Decision-Making: Real-time access to financial data gives managers a clearer picture of financial performance, allowing them to make more informed decisions quickly and accurately.

- Cost Savings: Improving financial management through ERP can lead to cost savings in areas like inventory management and procurement, making operations more cost-effective and reducing unnecessary expenditures.

- Data Consistency and Accuracy: Centralized data management ensures that information is consistent across the organization, eliminating discrepancies that arise from using multiple standalone applications and reducing errors in financial records.

- Regulatory Compliance: Automated compliance features help companies adhere to financial regulations by providing a centralized repository of financial data and automating reporting, which is often required for governance and tax reporting.

Investing in financial ERP software significantly enhances the efficiency and effectiveness of financial management within an organization. By integrating various financial processes into a single system, it streamlines operations and provides valuable insights for strategic decision-making

Costs And Pricing of Financial ERP Software

Selecting financial ERP software requires an understanding of the various pricing models and plans available. This software can significantly enhance financial management processes, but costs vary based on features and organization size. Financial ERP software generally offers several pricing plans, from free basic options to advanced enterprise solutions. The table below summarizes common plans, their average prices, and typical features.

Plan Comparison Table for Financial ERP Software

| Plan Type | Average Price | Common Features |

| Free Plan | $0 | Basic financial management, limited users, and basic reporting |

| Personal Plan | $1,740 - $4,620/month | Financial management, basic CRM, limited customization, and basic support |

| Business Plan | $4,620 - $5,160/month | Advanced financial management, CRM, HR management, inventory management, and support |

| Enterprise Plan | $9,330/month | Full financial management, CRM, HR, SCM, advanced analytics, and dedicated support |

Each plan caters to different organization sizes, budgets, and specific financial needs. Free plans are ideal for smaller businesses with basic requirements, while personal, business, and enterprise plans provide advanced features for larger organizations. Evaluate the features of each plan to ensure they align with your business requirements.

Financial ERP Software FAQs

Here are some of the commonly asked questions about financial ERP software:

How does financial ERP software handle multi-currency transactions?

Financial ERP software manages multi-currency transactions, allowing businesses to conduct transactions in various currencies with automatic real-time exchange rate conversions. This is particularly beneficial for companies operating in multiple countries, ensuring accurate financial reporting and compliance with local regulations. The software includes functionalities for currency revaluation, translation, and consolidation, essential for maintaining accurate financial records and generating consolidated financial statements.

Can financial ERP software integrate with existing financial systems?

Financial ERP software integrates with existing financial systems and other business applications through APIs or connectors, facilitating data exchange and ensuring smooth information flow across platforms. This reduces manual data entry and minimizes errors. Integration capabilities are crucial for businesses maintaining a unified financial management system while using specialized tools for specific functions.

What are the common challenges faced during the implementation of financial ERP software?

Implementing financial ERP software presents challenges such as data migration, customization complexities, and user adoption. Data migration, transferring data from legacy systems to the new ERP, can be time-consuming and error-prone if not managed properly. Customization complexities arise when tailoring the ERP to specific business processes, increasing implementation time and costs. User adoption is critical, as employees may resist changes to their workflows. Effective change management strategies, including comprehensive training and clear communication, are essential to overcome these challenges.

How does financial ERP software support compliance and regulatory requirements?

Financial ERP software supports compliance and regulatory requirements with robust reporting, audit trails, and data security measures. It generates accurate reports for industry standards and government regulations, maintains audit trails to track financial data changes, and ensures transparency and accountability. Additionally, it implements stringent data security protocols to protect sensitive information from unauthorized access and breaches, helping businesses meet regulations like GDPR, HIPAA, and SOX.

How can financial ERP software improve financial reporting and analysis?

Financial ERP software enhances reporting and analysis by centralizing data and providing real-time insights. It consolidates data from various departments, enabling comprehensive financial reporting. Advanced analytics tools allow users to generate customized reports, perform trend analysis, and create financial forecasts. Real-time access ensures decision-makers have up-to-date information for informed decisions. Additionally, the software automates reporting processes, reducing the time and effort needed to produce accurate financial statements.

What role does financial ERP software play in budgeting and forecasting?

Financial ERP software aids budgeting and forecasting by providing tools to create, manage, and analyze budgets. It allows businesses to set financial goals, allocate resources, and track performance. The software supports methods like zero-based budgeting, rolling forecasts, and scenario planning. Its forecasting capabilities enable predictions of future financial performance based on historical data and market trends. By integrating these processes, financial ERP software helps businesses make proactive financial decisions and adjust strategies to achieve their objectives.

How does financial ERP software handle financial consolidation for multi-entity organizations?

Financial ERP software simplifies consolidation for multi-entity organizations by automating the combination of financial data from multiple subsidiaries. It supports intercompany transactions, eliminating manual reconciliation and ensuring accurate consolidated financial statements. The software provides tools for currency translation, minority interest calculations, and elimination of intercompany transactions, ensuring compliance with IFRS and GAAP. By streamlining consolidation, financial ERP software enables timely, accurate consolidated reports, facilitating better financial oversight and decision-making.

Other ERP Software Options

If you still haven’t found what you’re looking for here, check out these other ERP solutions that we’ve tested and evaluated:

- Project-Based ERP Software

- Supply Chain Management ERP Software

- ERP for Midsize Companies

- ERP Software For Small Manufacturers

- ERP Software for the Metal Industry

- ERP Software For The Printing Industry

- Retail ERP Software

- Discrete Manufacturing ERP Software

- Real Estate ERP Software

- ERP Software For Engineering Companies

- Government ERP Software

- ERP Systems For Custom Manufacturing

- Chemical ERP Software

- Distribution ERP Software

- ERP for the Service Industry

- Construction ERP

- Oil and Gas ERP Software

- Aerospace ERP Software

- ERP Alternatives

- ERP For Nonprofits

- Automotive ERP Software

- ERP Software for Small Businesses

- ERP For Furniture Manufacturing

- ERP Software for the Food and Beverage Industry

- Hospital ERP Software

- ERP For The Apparel Industry

- Cloud ERP Software

- Field Service ERP Software

- Education ERP

- ERP Payroll Software

- ERP For Professional Services

- Job Shop ERP Software

- Food Manufacturing ERP Software

- Process Manufacturing ERP Software

- Manufacturing ERP Software

- ERP Accounting Software

What’s Next?

Ready to compound your abilities as a finance professional? Subscribe to our free newsletter for expert advice, guides, and insights from finance leaders shaping the tech industry.